Welcome to the inaugural Strawman Classic; Australia’s biggest prize-money investing contest.

Test your stock picking and portfolio management skills against some of Australia’s best private investors. With $100,000 in play money, you can buy and sell any ASX listed stock that is trading above 2c, and trade as many times as you like. Whoever has the highest returns at the end of the competition period will not only score some major bragging rights, but also $10,000 cash in a ThinkMarkets trading account!

Aside from building some great investing experience (risk free), you’ll be able to follow the trades and portfolios of the top ranked performers. Best of all, the Strawman Classic is FREE to play — so make sure to register before entry is closed!

We’ll also be tracking the progress of the competition in a weekly segment on AusBiz, highlighting leading investors and top ranking stocks. Make sure you create your free AusBiz account so you don’t miss a thing.

And if $8 trades sound good, we’d also encourage you to support our sponsor by opening up a ThinkMarkets trading account, and take advantage of their super cool trading app.

How to register

To enter the Strawman Classic you must first create your free Strawman profile, then go to www.strawman.com/classic to register for the competition.

Entry closes at 11:59pm AEDT on October 18, 2020.

Competition dates

October 5th, 2020 — Registrations open

October 19th, 2020 — The competition commences with registration closed from this date.

December 11th, 2020 — Competition end date. Performance returns will be locked after the close of trade on this date.

How it works

Strawman members each start with $100,000 in play money, which can be used to build a virtual portfolio based on real world stocks and prices. You can buy any ASX listed share, provided there is sufficient real-world volume traded, and shares are trading at 2c or greater, with trades processed at the closing prices for that day.

Please note, if you already have an active Strawman portfolio, its performance will be tracked separately for the competition. Because we track performance using a total portfolio percentage return, previous returns and portfolio value will not impact your competition performance.

Note that cash earns a 0% rate of return and we factor in dividends and other corporate actions to return calculations.

Trades will only be executed if price and volume conditions are met. Specifically, the next available closing price must meet the price limit conditions of the order and there must be an equivalent amount of real-world volume traded on the ASX that day.

EG. If only $5,000 worth of a given share is traded on a particular day, that is all you will be able to trade. The rest of your order will remain outstanding until it can be fulfilled with sufficient volume at (or better than) your specified price

You can track your rank and the competition leaderboard at www.strawman.com/classic

How to buy and sell shares on Strawman

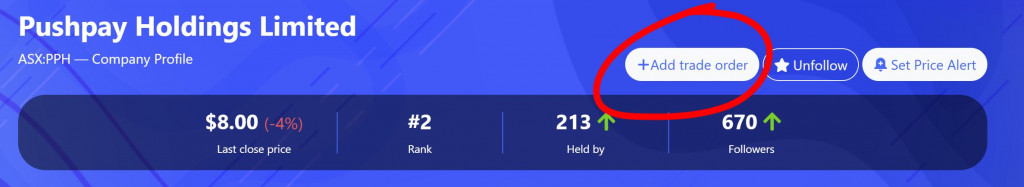

To place a trade, open up the order pad from the relevant company page, or by clicking the Add Content button at the top of every page.

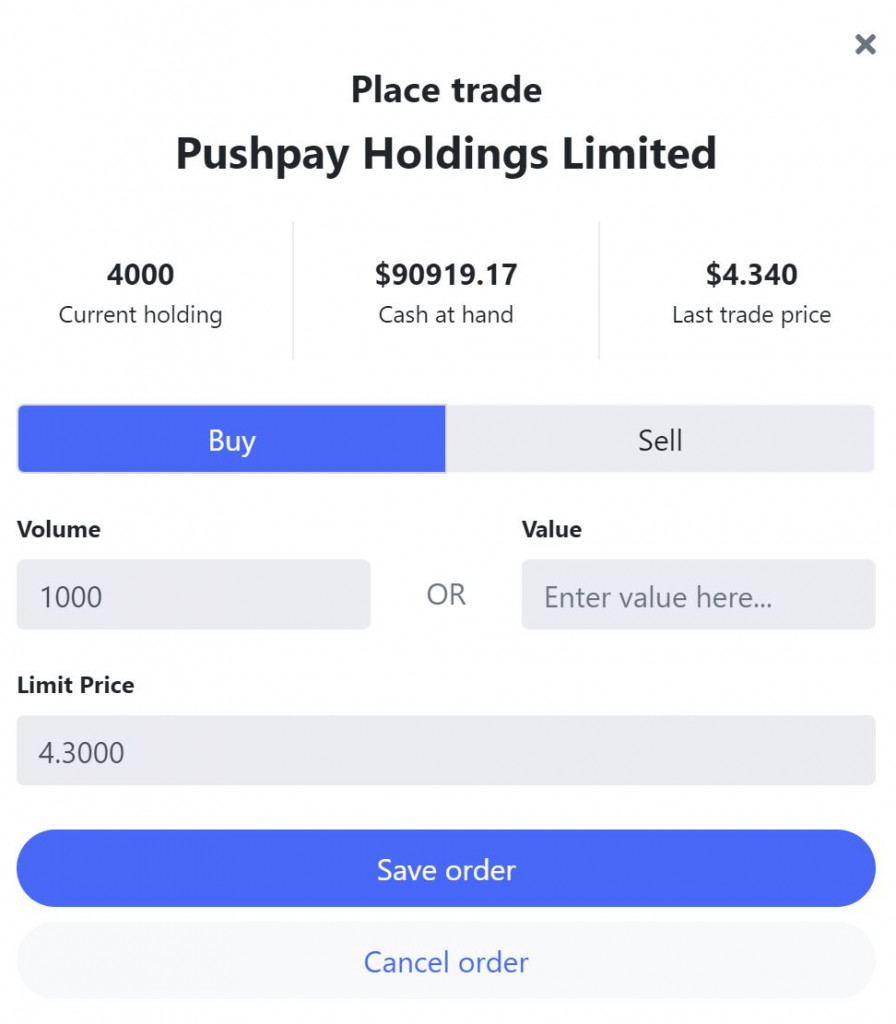

When you place a trade you can set the size of your order by specifying the exact number of shares or a dollar value. If you set a dollar value, the system will purchase as close to this amount as possible given your nominated order price.

You must also set a ‘limit price‘. In the case of a buy trade, this is the maximum price you are prepared to pay per share. If you are selling, this is the minimum share price you are prepared to accept. Of course, if the market offers a better price, that’s what the system will use to complete the trade.

Note that you cannot initiate a position that represents more than 20% of your total portfolio value (including cash). However, a share can represent a higher weighting if its market value subsequently increases. This helps ensure that total portfolio performance is not overly dependent on just a few stocks.

Once placed, orders are marked as pending and will settle at the next available closing price. Pending orders will automatically expire after one week if they cannot be completed, and can be edited or cancelled at anytime by visiting your profile page.

The order pad will display the “cash” you have available to buy shares. This will also include the value of any outstanding sell orders. If there is insufficient cash available after all eligible sell orders have been completed, any outstanding buy orders will remain as pending. The system will execute pending buy trades in the order they were placed.

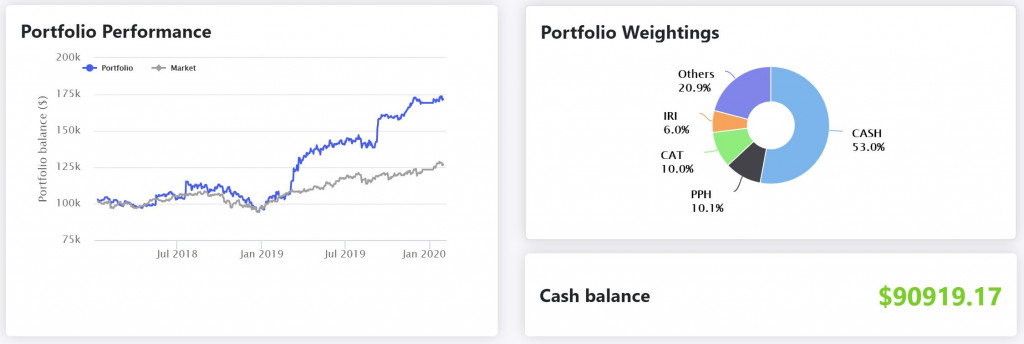

On your Profile page, your virtual portfolio will be compared against the Vanguard Australian Shares Index ETF (ASX:VAS). This provides a practical benchmark to measure your performance against, and is a close approximation of the S&P/ASX 300 index. $100,000 is invested into this ETF the day your first trade is completed.

In all cases, dividends are automatically reinvested and factored into return calculations.

The competition will have a dedicated Leaderboard that is specific to the competition period. You can track your progress and see all member rankings here.

Go to your Profile page to view and manage your portfolio.

F.A.Q’s

Can you short sell?

No. Strawman is presently a “long only” trading game.

Do you account for liquidity?

In order for a trade to be completed on Strawman, the relevant company must have recorded at least one trade at the same price and day on the ASX. As such, you can’t buy or sell stocks that are suspended, and it may take some time to fill orders on infrequently traded shares.

Is there a set number of trades you can make?

You can buy and sell to your heart’s desire — so long as you have sufficient cash, and a buy order doesn’t breach the 20% cap on position sizes.

However, because we don’t have intra-day prices, you cannot ‘day trade’. That is, you can’t buy and sell the same stock on the same day.

How is performance measured?

The performance of individual shares is listed in your portfolio (on your profile page). This is a money weighted total return figure that factors in the value of all trades since the position was initiated. Dividends are reinvested and returns are annualised if the position is held for more than 12 months.

The performance of your entire portfolio is based on its dollar value, and includes the value of any cash. Cash earns a 0% return, so be mindful of how you weight this in your portfolio. (A high cash balance will give you a relative out-performance in a falling market, but will likely drag your total average return lower over time.)

Need more help?

If ever you get stuck, or just have a comment or suggestion, you can email support at admin@strawman.com.

Entry is subject to our Terms & Conditions.

Our Partners

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2020 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211