Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

(FBG) improved proposal of US$225 million (~A$333 million1

Shareholders will vote on the FBG Transaction at the Extraordinary General Meeting this Friday, 30 June 2023, as improved by the above-stated amendment

FBG bid ( $225M )will pay the bail- out / exit from the USA portion of the business

PBH not a good foray into the USA market. Lots of betting competition in this market.

16th June 2023: . (DraftKings) to acquire the US Business for a headline purchase price of US$195 million in cash, on a debt-free and cash-free basis with no financing condition (the DraftKings Proposal).

Looks a good deal enables PBH to bail -out with $195M .. Netting not aware of the debt number though.....

PBH Debt to Equity is in bad shape.

Has been a rampaging market darling in 2020... Had the capital, Capitulated over there in the USA.

Earnings By Region:

By Region Revenue ($M) Profit ($M)

Australia 195. 247.69

Canada 0.17 -15.64

Ireland 2.40 N/A

USA 98.67 -197.45

Chart 5yr:

Market cap: $418Mill ( still a decent market cap )

Mercifully, I jettisoned $PBH earlier this year and it is no longer even on my watch list. However, sometimes out of curiosity, I look at how the stocks on my "EXITS" list are travelling.

$PBH grew revenues and betting volumes strongly, and is going ganbusters in igaming. But ...in order to grow 1H revenue 28% from $139.1m in the PCP to $178.1m, it burned $136m in cash.

Just think about that: $136m cash burned to add $39m in revenue, in a highly competitve market. What's more, $103m of the cash burn was operating cash outflow.

The "good news", it that there is still $387m of cash on the pile awaiting incineration.

I'm not the sharpest analyst, but I just don't get it.

Disc. Not Held

With reporting season behind us, before prioritising and embarking on the next phase of research on current holdings and watchlist, I do a quick review of holdings on my “Exited Watchlist” (see end of this straw for an explanation.)

Today its Pointsbet ($PBH).

My investment timeline: Entry Thesis and Exit Thesis

Fascinated by the opportunity to follow a new and rapidly developing market, enabled by legislative changes in the USA, I took an initial position in $PBH in Feb 2020. The thesis was: having developed and acquired its own tech, and built a leading position in Australia, it would form key partnerships and leverage them to move quickly in targeted US States as these opened up for online sports betting. The blue sky in the thesis was i-gaming.

Sometimes we just get plain lucky, and later that year, $PBH became a 3-4 bagger off the back of the transformational, strategic partnership deal with NBC, whereupon I sold down, paid the tax, and retained a position equal to my original holding (1.5%). While it is tempting to "let winners run" I considered PBH super high risk, because there was no solid analysis or basis to the investment thesis. Accordingly, my portfolio "rules" required me to reduce my holding.

In addition to the headline metrics of revenue growth, net-win and competitive positioning as new states opened up, there were two key metrics to monitor:

- Marketing spend, as a proportion of cash receipts

- Market share

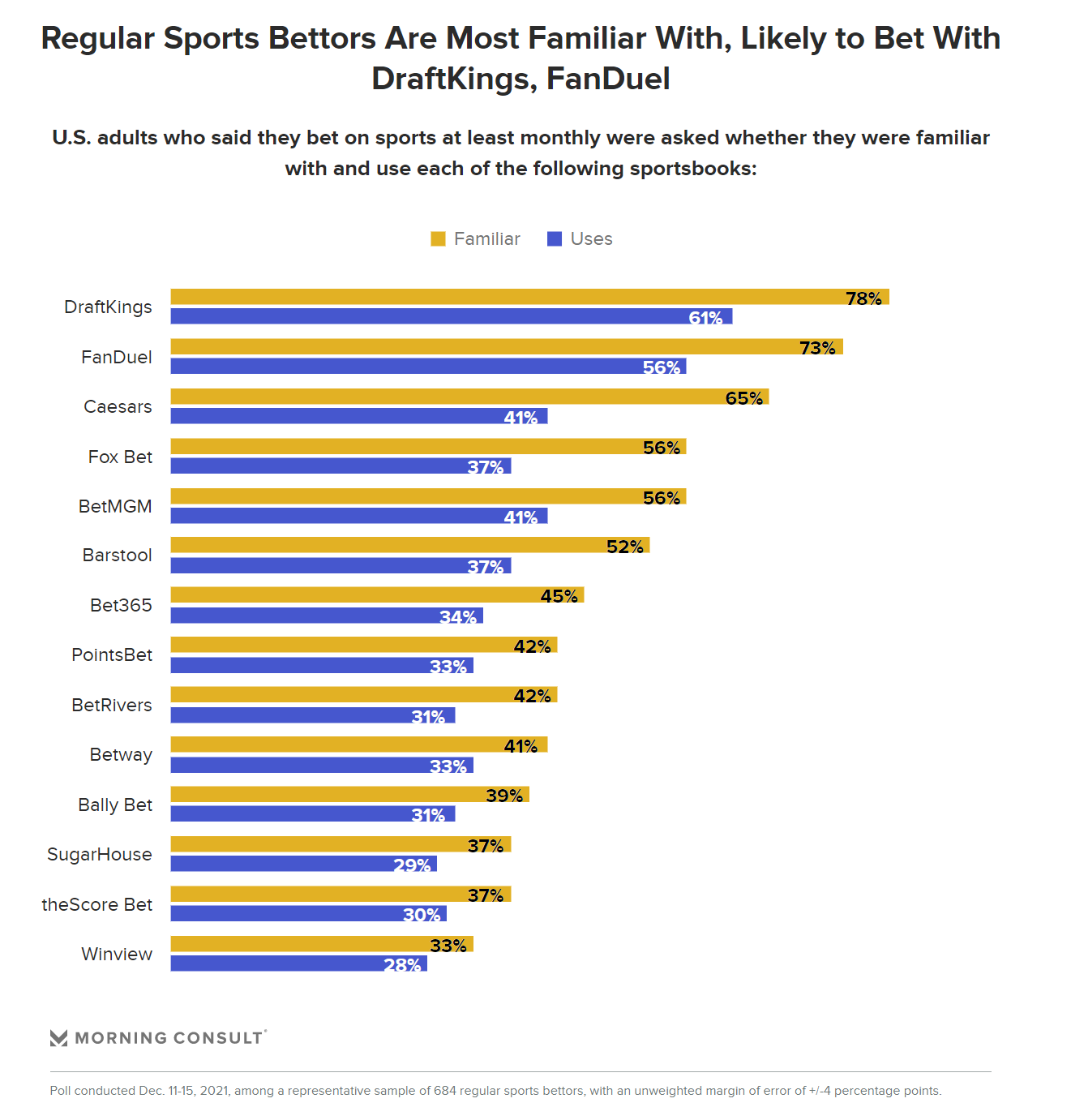

In April 2022, I exited my initial stake (having rode all the way up and all the way back down), having concluded that marketing spend was unsustainable given high competitive intensity in the sports betting industry. This article from January 2022 (and from which I extracted the following indicative market share (awareness/use) analysis was illustrative of the industry analysis I monitored. The hypothesis being that industry returns would be low, eventually leading to rationalisation/consolidation (or players just running out of cash and exiting). Importantly, $PBH was not positioned as one of the top 2 or 3 who might reasonably be expected to survive.

So, reviewing the latest results, what have I learned?

- It was a great year with Net-Win up 48% (Group) and 122% (US)

- EBITDA loss increased to ($243.6m) from ($156.1m)

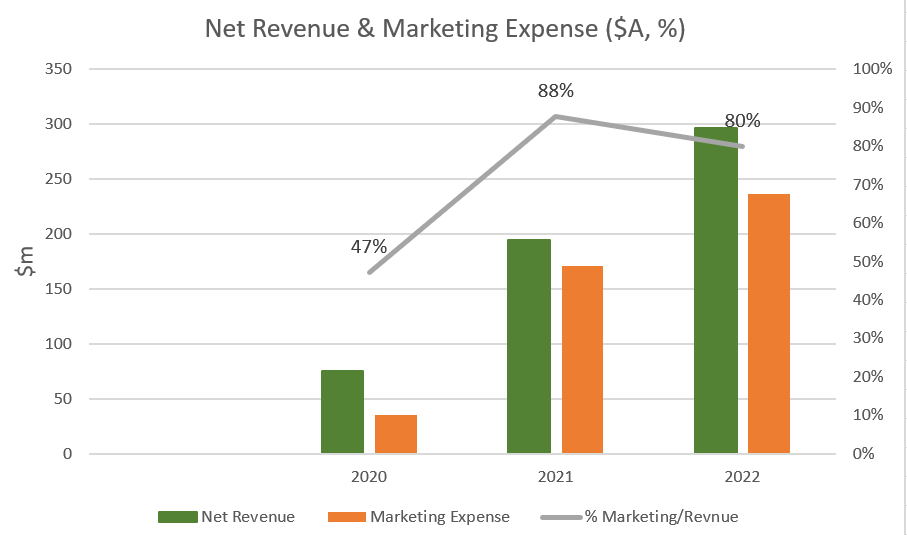

- This was driven by marketing expense increasing to $236.8m from $170.7m

Importantly, the increase in marketing spend of +$66.1m from FY21 to FY22 drove an increase of only $34m in Gross profit (from $87.6m to $121.6m).

The graph below shows the sales and marketing spend compared with revenue. As a proportion of revenue, this fell slightly from 88% to 80%. While this is a positive change, I remain concerned about the sustainability of the spend, in the context that FCF was ($291m) in FY22 from ($197m) in FY21. The closing cash position of $520m means within that a year or two more capital will be required, unless there is a fundamental shift in market dynamics. I can't see what will drive that shift.

Now you might argue that this marketing spend is an investment in market share and brand. However, given the competitive market structure, I can equally argue that the value of that investment will be short-lived and competed away. I might be wrong, as I am not an expert in gaming market competitive dynamics. (It is not clear to me that the state by state market share gains are being sustained, but that's a level of analysis we are not getting into today.)

As for the blue-sky part of the thesis, i-gaming appears to be doing well. Net-Win jumped from $1.5m to $20.4m, contributing almost 7% of the Group Net-Win. I will continue to monitor this progress.

Conclusion

I am happy with my exit decision earlier this year. I don’t see the case to re-enter, as the “exit thesis” is playing out. $PBH and the sports betting industry in USA more generally is not for me because industry structure and conduct is unattractive.

This is not invesment advice. This is a record of my personal investment diary.

What is the "Exited Watch List"?

Just as a decision to invest can be mistaken or changed by events over the passage of time, so too the decision to exit an investment. I maintain a list, built over 5-6 years of investing in ASX stocks that I have previously held, and continue to monitor.

Note: not held in the list are resource stocks - the one class of equities in which I will periodically "trade" over a 3 to 24 months time horizon. That's for another day.

Exited Watchlist:

A2M, AD8, APX, BTH, BVS, BWX, CAT, CGS, DTC, DUB, ELO, EOL, HSN, KGN, LVT, NAN, NOU(FNP), NTO, NWL, PBH, PPH, RBL, RFF, SKO, ST1, VHT, WEB, WSP

Disc: Not held in RL or SM

Red Flag

I nopticed in the latest quarterly that both PBH’s managed security provider and media and tech adviser are owned and/or run by PBH board members. In my view it’s a bad look that companies closely affiliated with PBH directors are being paid by PBH for services. IMHO no matter how much they say the Directors are at 'arms length' it's a clear conflict of interest and should never have been allowed.

Specifically, Executive Director Manjit Singh is the founder, owner and director of PBH’s managed security company, DruvStar. DruvStar was paid $0.4M in Q2.

Non Executive Direct Kosha Gada is the CEO and MD of PBH’s media and tech adviser Recastled. Recastled was paid $0.1M in Q2.

Who starts a 4C with a 20 slide PowerPoint unless you are trying to influence a message.

Net loss of $50M in the quarter. Ran through 100M cash, with 65M on sales and marketing/ US business development. The $560M cash balance will be threatened soon.

These costs are baked in too with committed marketing spend with NBC of US$393M in progressively increasing amounts over the 5-year partnership that commenced last year.

Understand this is a run for market share in the US, the problem will be if they cannot get to the required real estate.

A small update from Pointsbet today:-

PBH also note that following authorisation from the New York State Gaming Commission (NYSGC), Poinstbet New York has commenced pre-registeration of New York residents.

It is anticipated that Pointsbet will launch sportsbook operations in New York by the end of January 2022, following receipt of the required final approvals from the NYSGC.

This is a massive market opportunity for Pointsbet. New York state has approx. 20mill population.

PointsBet launches operations in US state of Virginia

PointsBet has launched mobile and sports betting in the US state of Virginia, marking the eighth American state in which the Melbourne-based company now operates. Virginia is the 12th most populous US state with over 8.5m population.

The company also operates in New Jersey, Iowa, Indiana, Illinois, Colorado, Michigan, and West Virginia.

Management said - “As the official, exclusive sports betting partner of NBC Sports, PointsBet will also utilise the media giant’s premium television and digital assets to promote the PointsBet brand in the state of Virginia across its local sports communities,”.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02467448-3A583877?access_token=83ff96335c2d45a094df02a206a39ff4

In September, New Jersey became the first U.S. state to generate more than $1 billion in sports betting in a single month by taking in $1.01 billion in wagers in September, according to PlayNJ, which tracks gaming developments in the state.

Eric Ramsey, an analyst for the PlayUSA.com Network, which includes PlayNJ.com said "The relentless growth in online sports betting and casino gaming continues to lift the entire industry."

According to official reporting released on Monday 18th October, New Jersey's online and retail sportsbooks attracted $1.01 billion in September, breaking the state and U.S. record of $996.3 million that New Jersey set in December 2020. September's volume was up 35.1% from the $748.6 million generated in September 2020, up 52.1% from $664.7 million in August.

This is excellent news for Pointsbet as it shows the continuing growth in online sports betting in the US and the massive market potential there as more and more states open up to online sports betting. The "rising tide lifts all boats" as they say.

Another capital raising for Pointsbet. I expect this to be a frequent occurence as the US opens more states to sportsbetting and PBH will keep tapping the market to fund the expansion. Which isnt a problem if the growth is there and they arent burning cash without the returns. See announcement below:-

PointsBet Announces Capital Raising to Strengthen its Balance Sheet for Long Term Success

Melbourne, Australia, 29 July 2021 - PointsBet Holdings Limited (ASX:PBH) ("PointsBet" or the "Company") today announces an underwritten capital raising of approximately A$400 million comprising:

• a fully underwritten 1 for 9 accelerated pro rata renounceable entitlement offer, with retail rights trading to raise approximately A$184.9 million at A$8.00 per share (the "Entitlement Offer Price") (the "Entitlement Offer"); and

• a fully underwritten institutional placement to raise A$215.1 million ("Placement")1. The Placement price will be at a fixed price of A$10.00 per share (the "Placement Price"),

(together, the "Capital Raising").

Purpose of the Capital Raising

Consistent with its objective of consolidating and expanding upon its strong position in the rapidly expanding US sports betting and iGaming market, PointsBet is undertaking this Capital Raising to provide funding to support:

· North American marketing and client acquisition;

· Technology and product development (sports betting and iGaming); US market access and government licensing fees;

· Continued investment in talent and scale of operations; and Balance sheet flexibility.

PointsBet's Managing Director and Group CEO, Sam Swanell, said: "Since inception, PointsBet's Board and management have been working to establish and consolidate the key building blocks that have put us in the strong position we are today to pursue the expansion of the North American sports betting and iGaming opportunity.

"Today, in addition to our profitable Australian business, we have live operations in 6 US States with iGaming live in two of these states. By December 2022 we plan to be live in at least 19 North American states or provinces. The North American sports betting and

iGaming market could be a US$54bn revenue opportunity by 2033 and our strategy is to continue to invest to become a top 5 player in this market, targeting a 10% market share in all key North American jurisdictions. The Capital Raising will position PointsBet to execute this strategy."

Details of the Capital Raising Placement

The Placement will raise approximately A$215.1 million. The Placement is being undertaken utilising the Company's existing Placement capacity under Listing Rule 7.1.

The Placement will be conducted at the fixed price of A$10.00 per New Share, representing a discount of 11.4% to the A$11.29 closing price of PointsBet on ASX on Wednesday, 28 July 2021.

Allocations under the Placement will be determined on behalf of PointsBet by an independent sub-committee of its Board in consultation with the Joint Lead Managers and financial adviser.

It is intended that eligible shareholders, who bid for up to their 'pro-rata' share of new shares under the Placement, at the final price, will be allocated their full bid, on a best endeavours basis. For the remaining shares under the Placement, the Company will seek to prioritise allocations to existing shareholders and then introduce new shareholders, in each case based on factors including likelihood of long-term support, the strategic alignment of the investor, support to date and the size and timeliness of bids into the book.

Entitlement Offer

Eligible shareholders under the Entitlement Offer will be able to subscribe for 1 New Share for every 9 shares held ("Entitlements") at 7:00pm (AEST) on Wednesday, 4 August 2021 ("Record Date") at the Entitlement Offer Price.

The Entitlement Offer Price represents a 26.5% discount to the theoretical ex entitlement price (TERP - including New Shares issued via the Placement) of A$10.882 based on the A$11.29 closing price of PointsBet on ASX on Wednesday, 28 July 2021.

The Entitlement Offer comprises:

• an Institutional Entitlement Offer: Eligible institutional shareholders will be entitled to participate in the Institutional Entitlement Offer which will take place from Friday, 30 July 2021 to Saturday, 31 July 2021. Eligible institutional shareholders can choose to take up all, part or none of their Entitlements. Entitlements that eligible institutional shareholders do not take up by the close of the Institutional Entitlement Offer, and Entitlements that would otherwise have been offered to ineligible institutional shareholders, will be sold through an institutional shortfall bookbuild that will open on Monday, 2 August 2021 and any proceeds in excess of the Entitlement Offer Price will be paid to the relevant PointsBet shareholders (net of any withholding tax and expenses).

• a Retail Entitlement Offer: Eligible retail shareholders in Australia and New Zealand will be entitled to participate in the Retail Entitlement Offer at the same price as the Institutional Entitlement Offer (A$8.00 per New Share). Eligible retail shareholders have a number of options under the Retail Entitlement Offer:

- elect to take up all or part of their Entitlements by the Retail Entitlement Offer closing date of 5:00pm (AEST) on Friday, 20 August 2021;

- sell their Entitlements, including on ASX, between Wednesday, 4 August 2021 and Friday, 13 August 2021; or

- do nothing and let their Entitlements be offered for sale through a retail shortfall bookbuild process on Wednesday, 25 August 2021 managed by the Joint Lead Managers with any proceeds in excess of the Entitlement Offer Price paid to the relevant PointsBet shareholders (net of any withholding tax and expenses).

Entitlements that would otherwise be offered to ineligible retail shareholders will be sold through a retail shortfall bookbuild on Wednesday, 25 August 2021 and any proceeds in excess of the Entitlement Offer Price will be paid to the relevant PointsBet shareholders (net of any withholding tax and expenses).

PointsBet Chairman, Brett Paton, has indicated that he will be participating in the Entitlement Offer for approximately A$6.0 million of his eligible Entitlements.

PointsBet Secures Sports Betting and iGaming Market Access in Pennsylvania and Mississippi

26 March 2021 - Melbourne, Australia - PointsBet Holdings Limited (ASX: PBH) (the “Company”) today announced that its wholly owned subsidiary, PointsBet USA Inc. (“PointsBet”), and Penn National Gaming Inc. (NASDAQ: PENN) (“PNG”) have agreed to extend the Online Gaming Services Framework Agreement dated 31 July 2019 (the “Agreement”) to provide PointsBet with online sports betting and iGaming market access in Pennsylvania and Mississippi (the “Additional States”), subject to enabling legislation (in Mississippi) and licensure in each of those States. Pennsylvania currently permits online sports betting and iGaming (the "Transaction").

As part of the Transaction, PointsBet has agreed to release PNG and Penn Interactive Ventures, LLC ("PIV") and their respective affiliates from the disposal restrictions contained in Section 6.4(a) of the subscription agreement entered between, among others, the Company, PointsBet, PNG and PIV dated 31 July 2019 (details of which were disclosed to ASX on 1 August 2019) ("Subscription Agreement") in respect of the securities which were acquired by PIV under the Subscription Agreement. Such restrictions were due to expire on 1 August 2021. All other equity restrictions in the Subscription Agreement remain unchanged.

Key features of the expanded partnership

- The term of the Market Access Agreement for each Additional State is twenty (20) years from the date the PointsBet branded service is first offered to PointsBet players in the applicable State.

- The agreement expands PointsBet’s United States sports betting footprint to 14 States (subject to the passing of enabling legislation and licensure as relevant).

- PointsBet will be responsible for all licensing and approval costs in connection with launching and operating the PointsBet services (including, those associated with the licensed operator obtaining and maintaining the applicable B2C Operating Licenses required for PointsBet to operate the services in each Additional State).

- PointsBet will pay PNG a portion of the Net Gaming Revenues derived from each Additional State.

DISC: I hold

PointsBet and National Hockey League Announce Multi-Year Sports Betting & Marketing Partnership

10 February 2021 - Melbourne, Australia - PointsBet Holdings Limited (ASX: PBH) (the Company) today announced a multi-year strategic partnership with the National Hockey League (NHL), naming PointsBet an “Official Sports Betting Partner of the NHL”....

The agreement between PointsBet and the NHL spans across both the United States and Australia. As part of the partnership, PointsBet receives rights to use NHL marks and logos, as well as a variety of NHL sponsorship and promotional opportunities for its brand across various linear, digital, and social media assets.

Notably, the deal also provides PointsBet the ability to integrate content into live NHL game broadcasts across NHL media partners, including NBC Sports, NBC Sports Regional Networks, Altitude TV, and other potential future linear alignments.

Disc: I hold

Q2 FY21 Update

~ Group Net Win of A$44.6m up 148% on PCP

~ Record Net Win in Australia of A$49.8m, up 240% on PCP ? 13.5% online handle market share in New Jersey(1) for the quarter

~ 14.7% market share in Illinois by online handle and 3.6% by total online bet count(2)

~ 4.2% online handle market share in Indiana(3) for the quarter

~ Active Clients(3) in the US up 222% on the PCP and up 71% since 30 September 2020

~ Launched operations in Colorado in November

~ 428k bets processed on Melbourne Cup Day

Appendix 4C, Quarterly Activities Report and Trading Update ~ Attached

Q2 FY21 INVESTOR PRESENTATION & TRADING UPDATE ~

https://cdn-api.markitdigital.com/apiman-gateway/CommSec/commsec-node-api/1.0/event/document/1410-02334837-76EH14J6VNT5P436MCFPQJV9TE/pdf?access_token=GjxZwrvpQlACfwF2WiBKZkpeP605

PointsBet Appoints Shaquille O’Neal as Australian Brand Ambassador ~

https://wcsecure.weblink.com.au/pdf/PBH/02333167.pdf

PointsBet Appoints Paige Spiranac as Brand Ambassador ~

https://wcsecure.weblink.com.au/pdf/PBH/02333629.pdf

Disc: I Hold

PointsBet Obtains Approval to Go Live with Online Sports Betting in Michigan

21 January, 2021 - Melbourne, Australia - PointsBet Holdings Limited (ASX: PBH) today announced its wholly owned subsidiary PointsBet Michigan LLC (the “Company”) has been authorised by the Michigan Gaming Control Board (MGCB) to commence online sport betting operations on Friday, 22 January 2021 at 12 noon (US EST time). Michigan will become the sixth operational US state for PointsBet, following successful launches in New Jersey, Iowa, Indiana, Illinois, and Colorado.

Michigan will also see the inaugural launch of PointsBet’s iGaming product in H2 FY21 following receipt of the necessary MGCB approvals

DISC~ I hold