Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I have been keeping an eye on the Vaughn Bowen insider trading court case. Even though it is a side issue to the UWL buisness, I could see it having a pretty negative impact on sentiment and short/medium term share price. It doesn't really inspire confidence when a director goes to criminal court!

The good news though is that the committal hearing is now set for 5 days from the 28th November 2022 and I am fairly confident that the Morrison bid for $5 /share will get over the line before this date. Its really just a matter of whether $5 is the final price or whether we have a new bidder emerge or Vocus come back again. https://asic.gov.au/about-asic/news-centre/find-a-media-release/2021-releases/21-245mr-melbourne-man-charged-with-insider-trading/

Another trading halt, another suitor this time offering up $5 in what at first glance can only be good for shareholders.

The bidder this time is Connect Consortium which is made up of Macquarie Infrastructure and Real Assets Holdings Pty Limited (“MIRA Holdings”), an entity within Macquarie Asset Management's Real Assets division (“MAM Real Assets”), and Public Sector Pension Investment Board (“PSP Investments”).

Watch this space.

Uniti share price spiked by 10% today due to media speculation that Macquarie Asset Management and PSP Investments have made a $5 a share bid for Uniti Group. Now in a trading halt, watch this space.

https://www.afr.com/street-talk/macquarie-psp-bid-5-for-uniti-group-20220323-p5a787

Uniti confirmed a $4.50 per share bid from Morrison & Co. - I personally hope it doesnt go through, I think Uniti is a great investment going forward for years.

Uniti entered into exclusive discussions with HRL Morrison & Co after the fund manager lobbed an indicative $4.50 a share bid at the company. They said the discussions were non-binding, preliminary, highly conditional and uncertain as to an outcome. The company said there was no certainty the indicative proposal would result in an offer to Uniti shareholders.

Uniti group are in a trading halt until Thursday 17th March. The trading halt is due to media speculation, specifically The Australia posting an article today saying UWL are in exclusive talks with a buyer who has put an offer between $4 - $5 per share.

UWL is up roughly 17% today before the trading halt. Uniti did announce on the 24th January that it had received approaches from more than one party indicating an acquisition.

Today (15th march) is when the insider trading allegations against Vaughan Bowen are before the court. I wonder if the 15% spike on opening price is due to people in the court room knowing what is going on. I am not sure what the legal priocess is but this is a committal hearing that was previouslyly postponed from Feb. Timing seems awfully coincidental if unrelated.

It also looks like they have run out of powder for there share buyback no shares have been bought back since the 6/3 - they bought back a total of 8,845,794 shares at prices between $2.99-3.48, Worth a total of $28,915,090.18. Based on todays opening price jump ($3.80, although slid back to $3.60 at trading halt) and what looks to be a momentum shift in supply/demand a pretty savvy buyback program overall.

Uniti Group gone into a trading halt this morning. There is takeover speculation again, but I doubt that management would accept anything below $4, as management mentioned last year that they thought the business was undervalued around $4.

A good sign of confidence that the shares are now undervalued when management start there buyback program after sitting on it for the last 3 months. Official start date was the15th November, blue line shows share price during the period when no shares were purchased. They made a comment in the results call that they didn't want to start it during the immediate period before they released their results (21-2) and that they were having a capital allocation meeting to decide on how to spend their cash. It looks like they currently see more immediate value in a share buyback than potential acquisitions. I expect this buyback will continue whiloe the price is below $3.75

- shares bought to date

- 1.1M (22/2/22)

- 1.5M (23/2/22)

A pretty outstanding set of results. Good organic growth and the addition of opticom has made them a much bigger and better buisness than a year ago. They have delivered on everything they said they would do last year and the commentary from the investor briefing was very positive. Despite this the market hated this result and sold it down by 12% after a similiar sell off yesterday. Its now trading around 3.26 down from $4 last week. Maybe market was expecting more immediate growth? To me its a pretty crazy reaction to a vertically integrated telecomunications infrastructure buisness that is profitable, has low maintenance costs on its long life infrastructure and has great cashflow generating capabilities. It wasn't cheap last week but I think it is becoming cheap now given the growth runway this buisness still has.

The only miss was a delay in construction revenue which has been delayed due to the covid shutdowns in Q2, they made it clear that this revenue has just been deferred not lost. Comentary around outlook was positive and they expect to meet full year guidance (145M EBITA - 70M for H1), but didn't want to go on record to exceed the current full year record, but my reading was as they are very happy with the way the buisness is running and the amount of revenue contracted into the future.

91% of their revenue is now recurring. In the call they did a very good job of explaining there competitive advantage around owning their own fibre network, the multiple revenue options this generates and how they are able to capitalise on this and how they still have a ways to go on extracting the full value out of there networks. The mentioned the high demand for high speed internet and how they are robust to inflationary environment and expect to pass along costs if inflation starts to impact. Currently not much inflation in there buisness but they can see some signs of it coming.

Not much talk about capital management, but they did say they have identified several opportunities (only in Australia) that they are exploring that would be valuable assests to there buisness but nothing material yet to be disclosed. It suggests to me that a buyback will probably not happen if they get keen on an aquisition. If they buy something it can be funded from cash reserves and debt (they paid 40M down t. They are meeting this week to discuss capital allocation. No plans to pay a dividend. No detail around any buyers for the company and I think this annoucement was more to support the shareprice than any real activity.

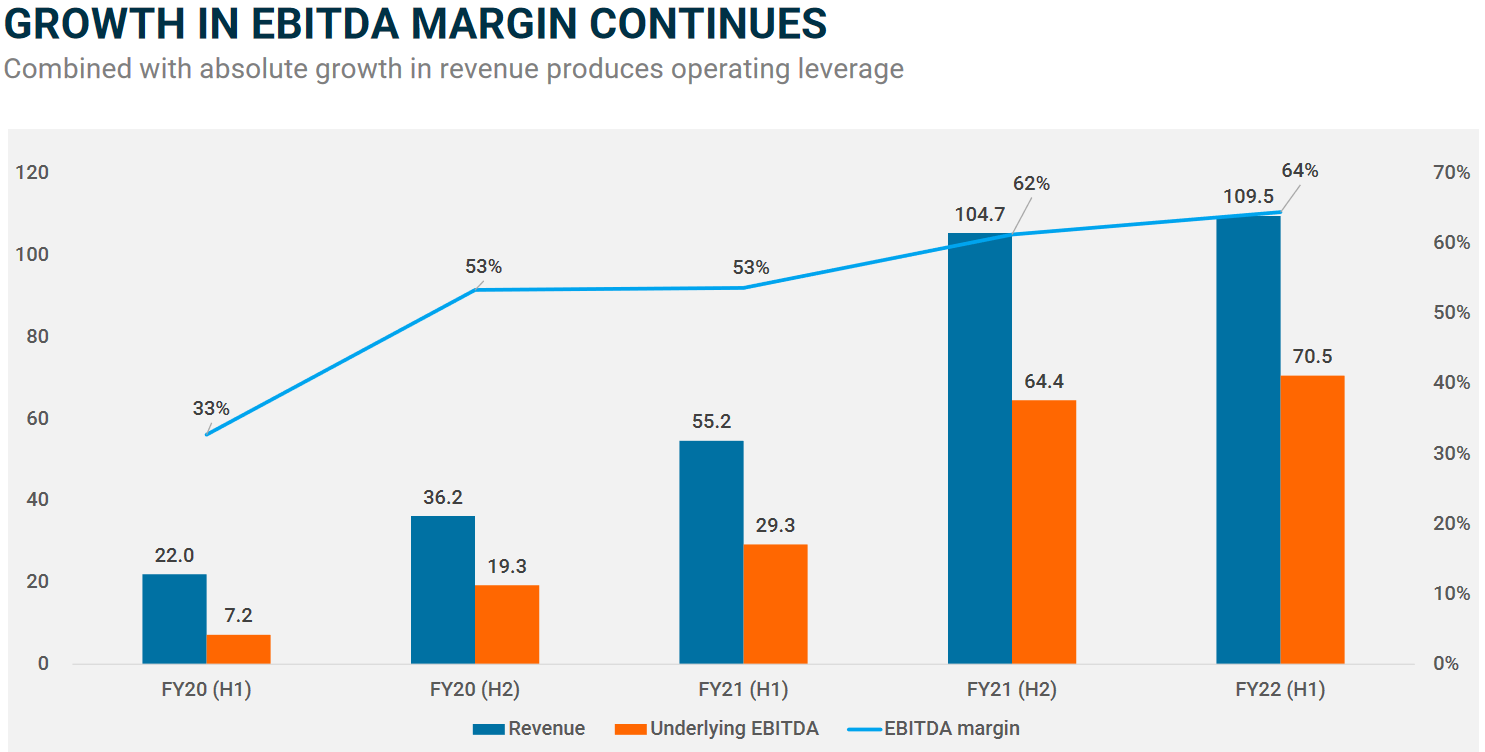

I think this graph from the report gives a pretty clear story on how front end revenue gets converted into cashflow.

24-Jan-2022: How do you stop a share price slide in a falling market? This is how:

24 January 2022: Uniti Group Limited (UWL or Company) refers to its announcement to market on 27 October 2021, and subsequently on 17 November 2021, that the Company proposes to undertake an on-market share buyback subject to prevailing share price, market conditions and alternate uses of capital.

In the interests of ensuring that the market is fully informed prior to commencing the share buyback, the Company notes it has received approaches from more than one party indicating potential interest in an acquisition of the Company, which as of this time, do not include detail as to timing, price or conditions. Therefore, the Company notes that there is no guarantee that such approaches will result in any substantive proposal(s) emerging.

Authorised for release by the Board of Directors.

- ENDS -

Disclosure: I hold UWL shares IRL and here. UWL are up by almost 8% this morning on the back of this M&A talk confirmation. Nice to see some green in my portfolio today.

26-Feb-2021: Uniti (UWL) is a roll-up, meaning they are a growth-via-aquisition company that is buying up small telcos and bits of large telcos (they recently acquired assets from Telstra) and growing fast as a result. The two guys at the helm of UWL are Michael Simmons and Vaughan Bowen, and they grew M2 Telecommunications up from nothing to a $1.8 billion company when it was taken over by Vocus (VOC) in 2015. Simmons and Bowen then ran Vocus for a while also. They have both since moved on from VOC and are now running UWL, and trying to replicate the success they had with M2. I am always wary of roll-ups. I have consistently warned that they all unravel at some point, whether it be child care centres, vet clinics, telcos, even dental practises. Eventually they run out of cheap private companies to buy in their sector, or cheap public companies to takeover, and they begin to overpay. The whole process works by arbitraging the difference between the multiple that people are preapred to pay for a private company, and the higher multiple that can be achieved if you roll that private company into an existing public company. As long as you maintain price discipline - and do NOT overpay, it works very well. Until you run out of assets to buy at attractive multiples. Uniti are still in that successful growth stage currently, hence I'm on board (I own UWL shares) and I've posted a number of Straws on them here. I'm happy to enjoy the ride until it takes a nasty turn. I'm watching what they pay and the market's reaction to each acquisition announcement. It is usually clear when they are peaking, and you can afford to wait for them to drop a little before jumping off. However, once they turn pear-shaped, don't hang in there thinking that it will all come good again. Cash in your chips and enjoy your winnings. That's why guys like Simmons and Bowen always move on and start up another company from scratch once their companies become mature or too big. Sometimes they just takeover a small company that someone else has built up from scratch (like Uniti Wireless Ltd - UWL) and use that as their new starting point. My 12-month PT for UWL (so by the end of Feb 2022) is $2.47. I think they can get there, but if they do not, I'll probably have already moved on.

17-June-2021: One of the best looking charts I've seen this year. They took out my $2.47 price target and just kept on going. I still hold UWL. I'm raising my PT by +50% to $3.71 based on momentum and potential. Both are very positive. Good company. Management have a good prior track record of building up similar companies in the Telco space. And they are carving out a niche and competing directly with the NBN. And killing it! (In a good way)

17-Dec-2021: Update: Uniti Group (UWL) keep popping up on the Marcus Padley daily ("Marcus Today" newsletter) 12-month high (SP) list, and they're making all-time highs every week lately, including again today with an intra-day high of $4.62, and they closed just one cent short of that, at $4.61. They've gone way past where I thought fair value was, but I've decided not to sell any more for a while in RL, as that's been one of my biggest mistakes over the past decade or three, not letting my winners run - enough. I tend to keep trimming them as they rise, which makes sense from a risk management POV, but certainly limits the upside (gains). I'm raising my PT (not a valuation, just a price target) now to $4.85, because I think that $5 level might provide some resistance, and they might take a few practice runs before pushing through that $5 level with conviction, if they manage to do that. I still like UWL, and they are one of the largest positions in one of my real life portfolios. I'm not buying more up here, the air is way too thin, but I'm not going to sell any for a while either. Let's see just how high they can go!

Go you good thing!!

I’m attempting to build the negative case for UWL, any insights would be appreciated, it’s a bit thin!

· Stock on issue has increased with acquisitions and options (Buyback could temper this?)

· Long term Debt 261.9m, Cash 57.3m

· Management: Vaughn and co are excellent storytellers and it appears “everyone” has bought into the story.

· Potential growth impacts if greenfield housing developments slow down or get delayed. (But yeah, who knows what happens next with the housing market and the "politics" of the housing market will probably keep it propped up.)

· Vaughn Bowen, insider trading allegations in relation to Optus share sales in 2019 may rear its head again.

· Renumeration: Performance bonuses 50% payable on short term incentives, 50% long term.

I admit it is easy to counter these points and build a bull case for UWL, however it is useful to look at the other side of the trade. Held RL

* Financials via Tikr

UWL announced that they are doing a buyback this morning. Shows that they are confident about their cashflow and see the current share price as undervalued. This is great to know taking into account the number of acquisitions they have done over the last two years. Very few companies have locked in growth almost doubling earning over the next 5 years. A long term hold for me in my personal portfolio.

The Uniti share price got smashed by 20% in one day last week only to recover this week. This was over director Vaughan Bowen being accused of insider trading in Vocus and his court hearing will be due in November. This is not related to the performance of the Uniti business in anyway, but could have the effect of changing sentiment towards managment if it gets a lot of media attention. It will be interesting to see if the share price takes another dive if Vaugan is sentenced for up to 15 years jail per charge of which there are two. If there is another leg down in the share price I would consider it a buying opportunity.

Uniti group has been hit with some controversy, with a director Vaughn Bowen being accused of insider trading from when he was involved with Vocus communications several years ago. In response Uniti's share price has had a sharp setback setting around 10% down from recent highs. This is a well managed business and this setback looks temporary and is a good opportunity to grab a bargain while mr market is worried about a problem that won't have a direct impact on the business. This business has been in takeover mode for the last 2yrs and has now consolidated into a high cash generating entity that still has a long growth runway.

Good report from UWL today showing fantastic organic growth in just 6 month. All metrics were heading in the right direction but I particularly like the fact organic growth is now well and truly kicking in with an increase in contracted premises of 24% or 48000.

Earnings above consensus. FY21 EBITDA(u) $93.7M (pcp $26.5M)

June 2021 exit run-rate EBITDA(u) of $133.4M, ~15% increase on December 2020

Record revenue, earnings and free cash-flow generation

Free Cash Flow at 68% of EBITDA(u) for the full year

Contracted FTTP ‘order book’ expands by 24% to >250,000 in 6 months to 30 June 2021, net of ~16,000 premises connected

Net Leverage reduced to ~1.5X June 2021 exit run-rate EBITDA(u) from 2.2X at December 2020

Uniti Group to report on the 24th of August. I am expecting them to provide a lot more detail on the locked in growth they have going forward. Dont be surprised if the share price runs up between now and then in antisipation of this news.

I came across this article which gives a great overview of the business -

https://www.raskmedia.com.au/2021/06/29/uniti-group-asxuwl-is-more-than-just-a-telco-heres-why/

Uniti Groups share price up today. Money being paid out to Vocus share holders today and they will be looking for a new home for their funds and UWL is an obvious choice. Looking forward to their update in August. Also a good article in the Financial Review today see below.

https://www.afr.com/street-talk/uniti-group-out-to-prove-m-and-a-credentials-20201019-p566ef

After the massive run up in share price, the bull case for UWL is still very much in tact. Click below to get great insights into the business with its CEO Mick Simmons. Next stop could be the ASX 100 after entering the ASX 200 recently.

Vocus has been taken over and money will be paid out to those shareholders in the next few days. You would think that money would be looking for a new home and UWL seems to be an obvious choice being in the same sector. This could provide more support to the share price.

This article which is a bit out of date but still very relavant shows the shareholder value created by the $UWL team when they ran TPG and M2 Group. History seems to repeating itself. Management are a key focus for me when investing and I regard the $UWL team very highly.

Game changing acquisition positions Uniti, our Stock of the Week, for share price growth

By Trevor Hoey. Published at Jun 19, 2020, in Stock of the Week

It was just this week that analysts at Bell Potter ran the ruler across diversified telecommunications company Uniti Group (ASX:UWL), making earnings upgrades and increasing their price target to $2.25 following the $532 million acquisition of Opticomm, a transaction that will drive substantial growth in the near to medium-term.

Bell Potter’s price target implies share price upside of 32% relative to Thursday’s closing price of $1.70

Uniti’s share price traded strongly during late-April and throughout May to hit a high of $1.72, but when the Dow plunged more than 1800 points last week it retraced to $1.54.

While the share price recovery that occurred this week can be in part attributed to a recovery in equities markets, it was the game changing acquisition that should be the focus when assessing the company’s growth profile, scope for further expansion and underlying valuation.

As a backdrop, Opticomm is one of the largest private providers of telecommunications infrastructure networks in Australia, and the group is expected to generate revenues of $70 million in fiscal 2020.

Importantly, it is a high margin business, underlined by EBITDA projections of $38.7 million in fiscal 2020.

Highlighting the potential earnings boost that Opticomm provides, Uniti’s pro forma post-acquisition EBITDA is $86.7 million.

One of the other key benefits of Opticomm is the earnings predictability that it brings to the group because of the significant proportion of recurring revenue.

Vocus, TPG, M2 team at the helm

Management estimates that the acquisition will be immediately earnings per share accretive to the tune of 23% with increasing incremental growth to occur as synergies are realised.

However, it is one thing to make projections regarding anticipated synergies, but another to actually realise these expectations in the form of increased revenues and earnings.

The good news for Uniti is that the company already has established a track record of successfully integrating acquisitions, but arguably of more importance, it has high profile executives including managing director Michael Simmons who has taken other ASX listed telcos down this path before.

Simmons has nearly 40 years of experience in the media and telecommunications industry as a CEO, Director or CFO over this period.

He was the founding chief executive of TPG Telecom (formerly SP Telemedia Limited/NBN Enterprises Pty Ltd), a non-Executive Director of M2 Telecommunications Limited, managing director of Terria (the industry bid to build NBNCo) and chief executive of Vocus Group.

TPG, M2 and Vocus all delivered outstanding shareholder returns on the back of growth by acquisitions.

The following chart shows the outstanding share price performance of TPG Telecom (ASX:TPM) that was largely attributed to the substantial earnings growth that stemmed from acquisitions during the period.

As M2 acquired approximately 20 companies over the course of 15 years, it transitioned from a mere minnow to a group valued at about $1.3 billion, and another Uniti executive in Vaughan Bowen played an active role in the process.

Bowen has held various directorships over the past 10 years, was the founder of M2 Group Limited, previously chairman of Vocus Group Limited and is currently the chairman of the Telco Together Foundation.

While M2 was acquired by Vocus, the following historical share price chart shows its strong acquisition led performance between 2006 and 2016 with the last leg up being its response to the Vocus takeover.

Bowen joined Uniti Group Limited in the role of Executive Director in March 2019 to lead the company's mergers and acquisitions activities.

Before examining the operational benefits of the Opticomm transaction, it is worth noting the performance of the broader S&P/ASX 200 Communication Services index (XTJ) throughout the recent period of volatility.

With communications services being of an essential nature, the sector has historically been a defensive area to park your money.

This is still the case, as evidenced by the following chart (as at 16/06/20 - date Opticomm acquisition announced), which shows the degree of outperformance by the XTJ (blue line) over the last six months, but more importantly the significantly shallower trough at the bottom of the downturn demonstrates the sector’s resilience and stability.

Opticomm has dominant positions in niche markets

Opticomm is a designer, builder, owner and operator of wholesale open access telecommunications infrastructure networks.

The group is a national provider of fibre-to-the-premises telecommunications networks to new residential, commercial and retail developments.

It has a particularly strong competitive position in greenfield sites, and management has made good progress in targeting markets such as retirement living and community precincts.

With growing demand for high-speed Internet connectivity, the company’s products and services should be highly sought after, and there is a legislative requirement for fixed line fibre telecommunications infrastructure to be made available in new housing developments, effectively providing regulatory support.

While we already emphasised the importance of Opticomm’s business model in terms of earnings visibility from its established businesses, it is also worth noting the growth transparency that is evident when considering that it has a current combined order book of nearly 190,000 contracted lots for future delivery.

Opticomm has 39 retail service providers on its network, as well as long-term relationships with developers.

The company’s success in expanding its presence, particularly on the eastern seaboard is demonstrated below.

Get our newsletter with an exclusive article straight to your inbox

Thursday 10th June 2021: https://www.ausbiz.com.au/media/the-call-thursday-10-june-?videoId=11113

That's a link to a "The Call" episode (from Ausbiz) featuring Ben Clark from TMS Capital and "friend-of-the-Strawman.com-site" Carl Capolingua from Think Markets, and they both like Uniti Group (UWL), and consider it a buy, even at these elevated levels, so it's gone into "The Call" portfolio.

The UWL coverage starts at the 38 minute mark.

[I hold UWL shares.]

The Uniti share price has increased over 140% in just over 6 months, from $1.16 in November 2020 to a close of $2.79 today. Is Uniti approaching upper value?

@Chalky posted a credible bull case for Uniti as a significant fibre network competitor to the NBN with sustained organic growth in Multi Dwelling Units (MDU) developments and brownfield.

According to Simply Wall Street data earnings are forecast to grow 54.6% per year to $72 million in 2023 (Consensus of 4 analysts. See chart) One analysts thinks it is feasible for earnings to reach $70 million by 2022, and with full integration of Opticomm and Velocity, earnings could reach $100 million by 2024.

How long can Uniti sustain this high rate of growth? Assuming earnings growth can be maintained at over 20% for several years, a future PE of 20 sounds very reasonable. So what could Uniti be worth in 2023 and 2024?

E (2023) = $72 million = 72/434 = 16.6c/share. Value (2023) = PE x E = 20 x 16.6 = $3.32.

E(2024) = $100 million = 100/434 = 23 c/share. Value (2024) = PE x E = 20 x 23 = $4.60

With potential value of $3.32 in 2023 and $4.60 in 2024, I guess Uniti is a 'keeper' for now.

Disc: Hold shares

$UWL market cap $1.6B (share price $2.42), 2021 revenue run rate $200m, EBITDA run rate $116m. Management have contracted connections which will double revenue in 5 years at a minimum, without management doing anything and at a 70% margin. EBITDA to increase by 2.2 times.

Upside to revenues include the likelihood that users will upgrade to faster higher priced plans to meet the demand for higher speeds needed to stream videos games etc

Further upside to growth will come from $UWL's functional separation approval, allowing them to be the first super fast broadband network to be a wholesale and retail provider opening up another large market for them.

Having been a shareholder of $ALU for a number of years and seeing the market price in their 5 year targets to some extent, due to managements consistent performance, I can see the same happening with UWL.

$UWL is likely to be a takeover target, but I hope it doesn't happen too early as there is a lot of growth to play out. If there is an offer it would need to be at much higher levels due to the certainty of future growth and profitability over the next 5 years.

Based on current multiples and on the most base case I would value $UWL at $6, working on a 15x EBITDA multiple in 5 years, a lot of upside to the current price of $2.44 today. Disclosure - I own and it has been my largest holding for the last 18 months.

- Record Results Across the Group. Significant Organic Fibre Growth Locked-In.

- Record H1 FY21 Revenue, EBITDA(u) and Free Cash Flow, Group-wide organic growth - Run-rate EBITDA(u) and Free Cash Flow @ $116M and $72M respectively (as at Dec 20)

- 86% of Run-rate EBITDA at Dec 20 generated by Uniti Wholesale & Infrastructure (W&I), approximately $100m

- Consolidated Run-rate Revenue now 88% recurring in nature, dominated by W&I

- 75% of >200,000 contracted fibre premises going “live” within 5 years, doubling W&I active services

- Uniti’s continued growth enhanced by digital app evolution, a strengthening property market, growing demand for speed and data, near-infinite fibre technology capacity & anticipated retail price inflation

- DISC: I hold

27-Jan-2021: Final Appendix 4C and Operational Update

Plus: 22-Jan-2021: Results of Share Purchase Plan Offer

OPERATIONAL UPDATE & FINAL APPENDIX 4C (Q2-FY21)

Operating Cash Flow up 53% on prior quarter. Free Cash Flow up 64% on prior quarter.

Highlights:

- Record Net Operating Cash Flow of $16.1M, up 53% on prior quarter (Q1-FY21)

- 544% increase in Net Operating Cash Flow vs prior corresponding period (Q2-FY20)

- Record Free Cash Flow in Q2 of $11.3M, up 64% on prior quarter (Q1-FY21)

- Free Cash Flow represents 70% of Net Operating Cashflow, after all capex

- Key financial performance metrics for first half of FY21 above forecast levels

- Materially above-forecast growth in net new FTTP activations in the quarter

- Completed OptiComm, HarbourISP and Telstra Velocity® acquisitions in the quarter

- OptiComm (owned for 1 month of Q2-FY21), HarbourISP (owned for 2 months of Q2- FY21), Telstra Velocity® assets (owned for 1 week of Q2-FY21)

- Integration of recent acquisitions on or ahead of schedule

- $45M in cash reserves. Net debt ~2.2 times proforma FY21 EBITDA $116M @ 31/12/20

- Net leverage reduced to ~2 times proforma FY21 EBITDA, following receipt of $20M from the upsized SPP completed on 20 Jan 2021

- This is Uniti’s final Appendix 4C, having filed the required 8 quarterly 4C’s since IPO

Also - UWL's recent SPP to raise an additional $10m (on top of the larger institutional placement to fund the Telstra Velocity® & South Brisbane Exchange acquisition) closed over-subscribed by more than seven times the initially announced SPP Offer amount of $10M. Despite upsizing the offer to $20m, all eligible applications were scaled back to just 28.3% of what they applied for. For instance, I applied for $10K worth of shares (you could apply for anywhere from $1K to $30K), and I got $2,833.50 worth of shares (1,889 UWL shares @ $1.50 each) and a $7,166.50 refund. Plenty of support there from retail shareholders! Mind you, the $1.50 offer price looked pretty good when the shares traded during the offer period at over $1.70 for the most part, and got up to $1.97 last Wednesday (20-Jan-2021) with an intra-day high of $2.05 the following day (21-Jan-2021). They closed today at $1.885.

[I hold UWL shares. It's the same management team (Vaughan Bowen and Michael Simmons) that built up M2 Telecommunications Group until it merged with Vocus, and then led Vocus Group (VOC) for a while as well. Many - including myself - believe that they are well on their way to repeating the magic once again with Uniti.]

About Uniti Group: Uniti Group (ASX: UWL) is a diversified provider of telecommunications services, with ‘three pillars’ of strategic growth; Wholesale & Infrastructure (W&I), Consumer & Business (C&B), formerly Consumer & Business Enablement (CBE) and Specialty Services. Uniti Group listed on the Australian Securities Exchange in February 2019 and has a stated strategy of becoming a market-leading constructor, owner and vertically integrated operator of privileged fibre infrastructure, and a provider of value-added telecommunications services in identified profitable niche markets. In the time since its listing, Uniti has made a number of acquisitions, each aligned to the three pillars stated above. Notably, since mid-2019 Uniti has consolidated the majority of the ‘challenger’ participants in the greenfield fibre broadband networks market, to make the Uniti W&I business today the definitive challenger in greenfield markets. At the core of Uniti Group is a commitment to deliver high quality, high speed telecommunications networks and associated services to its customers, in order to produce strong and growing annuity earnings and, in turn, exceptional long term returns to its shareholders.

About Michael Simmons (UWL'ce CEO & MD): Michael has more than 40 years' industry experience. Prior to joining Uniti, Michael held chief executive roles at Vocus Group, TPG Telecom (previously SPTelemedia Group) and TERRiA as well as other roles within those businesses prior to being appointed chief executive. Michael has also had board and advisory roles within the telco and media sectors, a four and-a-half-year advisory role with AAPT prior to its acquisition by TPG Telecom, and a 8 year term as a non-executive director of M2 Group Limited, which merged with Vocus Group Limited in 2016. Shortly after joining the Vocus board, Michael stepped away as a Director to take on an executive role as Chief Executive of the Enterprise, Wholesale & Government business unit and subsequently interim CEO of Vocus Group. In October 2018, he moved across to UWL (as CEO & MD), which was then called Uniti Wireless Ltd (hence the UWL ticker code).

About Vaughan Bowen (Executive Director): Vaughan is a highly successful business builder, M&A practitioner & philanthropist. As founder of ASX100 telecommunications company M2 Group (which became part of Vocus Group, following a merger in 2016), Vaughan took M2 from start-up to a business valued at greater than $2B, with more than 3,000 team members, nearly 1 million customer services across Australia & New Zealand and owner of household names including Dodo, iPrimus and Commander. During the M2 journey, Vaughan led the identification, vendor negotiation and acquisition of more than 30 companies. In 2012 Vaughan founded, seeded and continues to serve as Chairman of the Telco Together Foundation (“TTF”), the Australian telco industry’s only united charitable entity, endorsed by the federal government’s Department of Communications. In only a few years, TTF has raised several million dollars for various disadvantaged communities and implemented national programs for the benefit of the not-for-profit sector as a whole, including carrier-unified text message giving.

Operating Cash Flow up 53% on prior quarter. Free Cash Flow up 64% on prior quarter.

- Record Net Operating Cash Flow of $16.1M, up 53% on prior quarter (Q1-FY21)

- 544% increase in Net Operating Cash Flow vs prior corresponding period (Q2-FY20)

- Record Free Cash Flow in Q2 of $11.3M, up 64% on prior quarter (Q1-FY21)

- Free Cash Flow represents 70% of Net Operating Cashflow, after all capex - Key financial performance metrics for first half of FY21 above forecast levels

- Materially above-forecast growth in net new FTTP activations in the quarter

- Completed OptiComm, HarbourISP and Telstra Velocity® acquisitions in the quarter

- OptiComm (owned for 1 month of Q2-FY21), HarbourISP (owned for 2 months of Q2- FY21), Telstra Velocity® assets (owned for 1 week of Q2-FY21)

- Integration of recent acquisitions on or ahead of schedule

- $45M in cash reserves. Net debt ~2.2 times proforma FY21 EBITDA $116M @ 31/12/20 - Net leverage reduced to ~2 times proforma FY21 EBITDA, following receipt of $20M from the upsized SPP completed on 20 Jan 2021

- This is Uniti’s final Appendix 4C, having filed the required 8 quarterly 4C’s since IPO

Sorry about previous postcould some let me know ho to edit a straw

Disc: I hold

16-Dec-2020: UWL: Uniti acquires Telstra Velocity Assets plus Investor Presentation - Telstra Velocity acquisition

UNITI ACQUIRES TELSTRA VELOCITY® & SOUTH BRISBANE EXCHANGE ASSETS

Adds ~50,000 Active FTTP Services. Telstra to become a RSP of Uniti. Highly Accretive.

- Telstra Velocity® & South Brisbane Exchange is Australia’s second largest private FTTP network

- ~ 68,000 premises passed, ~ 65,000 FTTP connected premises, ~50,000 active premises

- Telstra to become a RSP on Uniti’s national FTTP network (including OptiComm)

- Purchase Price of $140M, $85M payable on completion, $55M deferred with $20M payable over 3 years and $35M on completion of migration of the assets and services, with an ability to adjust the total purchase price subject to the size of the customer base at the time of migration

- Uniti commits to $70M spend for a 10-year term with Telstra Wholesale for essential backhaul, duct and exchange access to support delivery of services following customer migration being completed

- Forecast annual EBITDA contribution to Uniti of $21M, commencing from early January 2021 and potentially increasing post migration of assets and services

- ~13% EPS accretive(*) and increases FY21 pro forma EBITDA by more than 20%(**) to $116M

- Acquisition funded by mix of debt, underwritten equity placement and share purchase plan

- Uniti’s net debt to FY21 pro forma EBITDA(***) ~2.3 times ratio at completion

16 December 2020: Uniti Group Limited (ASX:UWL) (Uniti) is pleased to announce that it has entered into a binding agreement to acquire certain fibre-to-the-premises (FTTP) assets owned by Telstra Corporation Ltd (ASX:TLS, Telstra) deployed to provide high speed broadband to the Telstra Velocity® estates and South Brisbane Exchange regions (Velocity). Telstra will become a Retail Service Provider (RSP) of the Uniti FTTP business (including the Velocity network), which recently adopted the OptiComm branding (following Uniti's acquisition of OptiComm Ltd).

Detail is provided below regarding Velocity, Uniti’s strategic rationale, transaction specifics and funding.

About Telstra Velocity®

Velocity is Telstra’s optical fibre network that uses FTTP technology to deliver high speed broadband, phone and pay phone, subscription TV and free-to-air services amounting to approximately 55,000 services, across 128 residential housing estates in all mainland Australian states as well as the South Brisbane Exchange region (a region previously serviced by Telstra copper before the sale of the exchange) currently serviced by FTTP networks. Approximately 68,000 premises are passed with the Velocity FTTP network in these estates and regions and Velocity is the sole FTTP network in the vast majority of these estates. Approximately 50,000 superfast broadband carriage services are active today.

Why Velocity / Strategic Rationale

Scale and reach: The Velocity assets will add considerable additional scale and national reach to Uniti’s Wholesale & Infrastructure (Uniti W&I) FTTP network, increasing active premises by approximately 40% to over 170,000 and further strengthening Uniti W&I’s position as the definitive challenger in the FTTP greenfield housing markets, encompassing broad-acre estates and multi-dwelling unit (MDU) developments.

Highly accretive: The acquisition of the Velocity assets is highly synergistic and is forecast to be materially earnings accretive for Uniti, delivering an increase in Earnings Per Share (EPS) of ~13% (excluding the impact of the SPP), with annual incremental EBITDA contribution expected to be not less than $21M effective from completion of the acquisition, a greater than 20% increase in Pro forma FY21 EBITDA to $116M.

The sole in-area FTTP network: Velocity is the sole FTTP network provider in the vast majority of the estates it services. Acquisition of the Velocity assets will see Uniti W&I be the primary wholesale provider of fixed network superfast broadband services in these estates, which is expected to deliver long term annuity revenue and earnings.

Enhanced retail competition: More than 40 RSPs on Uniti W&I’s wholesale network will have the opportunity to compete for the supply of superfast broadband services to residential customers in the Velocity estates with the transition to Uniti’s ownership and wholesale services, delivering enhanced competition to the market as Telstra was previously the dominant RSP to Velocity estates. There will be a managed transition process designed to minimise customer disruption. End user customers will be able to transition to the Uniti RSP of their choice, including Uniti-owned RSPs (operated under a functional separation undertaking with the ACCC).

Telstra as a RSP: Uniti W&I will welcome Telstra, for the first time, as a RSP on its national FTTP network in areas, where Telstra is able to utilise the RSP arrangements. Having Australia’s largest and most recognised retail telecommunications provider join its expanding RSP community provides Uniti W&I with an enhanced ability to compete for business from greenfield property developers, certain of which regard having Telstra as a RSP an important factor when choosing a FTTP network builder / operator.

--- click on the links at the top for the rest of this announcement - including Transaction Specifics - and the associated company presentation ---

[I hold UWL shares.]

Notes:

- (*) Accretion excludes impact of SPP. Based on management unaudited financials, FY21 EPS accretion as if the acquisition was effective on 1 July 2020 and presented pre-integration costs, transaction costs and acquisition related amortisation.

- (**) Uniti’s pro forma FY21 EBITDA of $95 million excluding noncash share based remuneration costs comprised of $86 million pro forma EBITDA for Uniti including OptiComm, $3 million for Harbour ISP and $6 million of run-rate cost synergies expected to be achieved from the OptiComm acquisition as at 30 June 2021 (out of a total of $10 million).

- (***) Pro forma net debt of approximately $271 million, reflective of current net debt of $226 million plus additional net debt of $45 million ($50 million in new debt less $5 million in cash to balance sheet) to partially fund the upfront consideration. Pro forma FY21 EBITDA of $116 million, comprised of Uniti’s pro forma FY21 EBITDA of $95 million excluding non-cash share based remuneration costs plus c. $21 million EBITDA contribution from Telstra Velocity. Approximately 2.8x net leverage including deferred consideration of $55 million.

22-Oct-2020: Uniti's Functional Separation Undertaking Accepted [by ACCC]

ACCC ACCEPTS UNITI’S FUNCTIONAL SEPARATION UNDERTAKING

Uniti’s Retail Broadband Services Now Available on All Uniti-Owned Networks

- Uniti’s Functional Separation Undertaking accepted by ACCC, following public review process

- Uniti is the first superfast broadband network owner to be able to operate as both a wholesale and retail provider, under new separation rules introduced in August 2020

- Provides opportunity to actively promote Uniti retail broadband services on Uniti-owned networks, to deepen network penetration and expand Average Revenue Per User

- Enables strategic acquisition opportunities to be pursued in retail service provider market

- Enhances Uniti’s competitiveness in winning FTTP network construction opportunities within its Wholesale & Infrastructure business unit

--- click on link above for the full announcement ---

[I hold UWL shares.]

30-July-2020: In this LivewireMarkets Buy-Hold-Sell segment, Vishal Teckchandani discusses CCX (City Chic Collective), TPW (Temple & Webster) and UWL (Uniti Group, formerly Uniti Wireless Group) with Tobias Yao from Wilsons (Wilson Asset Management Group) and Arden Jennings from Ausbill.

Tobias and Arden both rate CCX, TPW and UWL as BUYS, and Arden said that both UWL and CCX were high conviction positions for Ausbill, with CCX in both their Ausbil Small Cap Fund and their Ausbill Microcap Fund. However, both WAM Funds (Wilsons) and Ausbill clearly hold all 3 companies in their respective funds.

Tobias also likes IFM (Infomedia) and Arden likes LIC (Lifestyle Communities).

Warning: Vishal's puns could elicit the odd groan...