Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Kip McGrath reported 1st half 2024 result today.

Main issue as i see it is ongoing investment in the business. It increased revenue by $2.5m but increased employee expense by $2.6m.

This increase in employee expense increase probably coming from corporate centers ( management flagged recent corporate center acquisitions incurred additional cost of $250,000.

It seems like it lost the Abu Dhabi schools' contract after AGM i.e lost $510,000 profit and it is the probably the reason why it subtly downgraded the full year outlook

From "Expect FY24 full year NPAT to exceed prior year" at the time of AGM in November to now " FY24 full-year profit is expected to align with the prior year result"

The market has lost patience and I am not sure how long current shareholders can keep faith in management.

Bag holder.

Here is an interesting chart.

KME is increasing its Revenue/Share but in the last 5 years, it has also invested heavily in corporate rollout / online shift / US expansion. Hence, increased Revenue/Share hasn't been contributing to an increase in earnings/share in the last 5 years. Hopefully, We are at the end of this investment cycle.

This morning KME published the AGM presentation as a generic announcement.

It did have Q1 FY24 updates and FY24 guidance - I am not sure why it wasn't a price-sensitive announcement.

Q1 FY24 Highlights

- Revenue grew by 20%

- Student numbers up 4%

- Lesson numbers up 5%

- Tutorfly revenue 0.433m for Q1 ( up from 0.068m)

- New opportunities in California, Maryland, and NJ

- Contracted services reached 3m for FY24 ( up from 2.6m at the end of FY23)

- Established partnerships with 14 school districts ( up from 11 at the end of FY23)

- Expanded presence to 10 states ( up from 7 at the end of FY23)

- 7% increase in Customer Lifetime value

- fee increases

- increasing tutoring weeks per year

- Corporate Center

- Increase 6 corporate centers in first quarter

- Total 35 corporate Quartner ( up from 29 at the end of FY23)

- US Expansion

- New US center to open by March 2024 in Frisco, Texas

- Investments Continue

- Buying back Corporate Center + US expansion will impact half-year results

There was no option to join AGM online so no idea what was discussed.

It seems like the company is increasing revenue and growing but also increasing investment at the same pace - It comes down to, do you have trust in the Management that the investment it is doing is effective or burning cash.

Don't think issue is of alignment - as Storm has significant personal wealth tied to the business...so questions just come down to his skill and ego etc. -- Your guess is as good as mine -- Revenue is growing so hopefully at some stage he will stop investment and cash will flow... or AI will eat its business ??

I like the progress KME is making so will keep on holding..

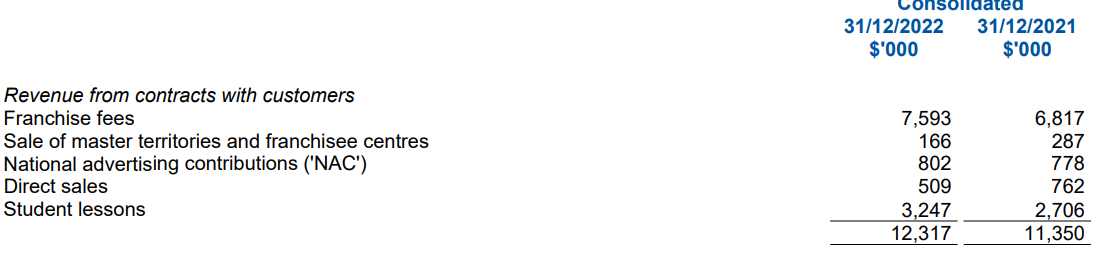

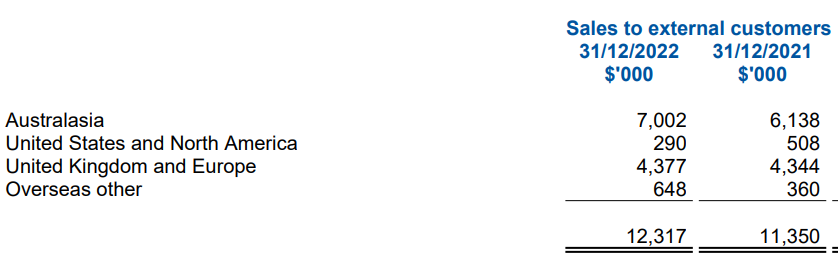

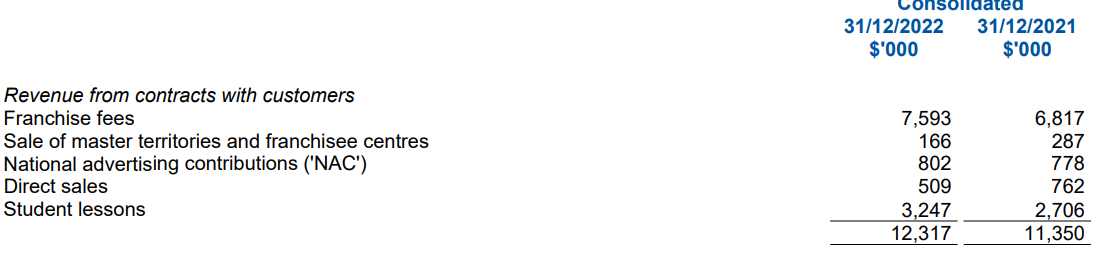

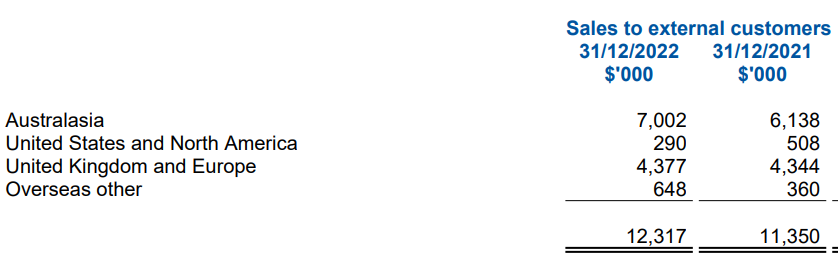

Kip McGrath released its FY23 report and the following are the graphs,

Revenue:

Customer Receipts:

Expense:

Operating Cash

No. of Shares

Geographic info ( USA is dragging the performance)

Revenue breakdown

Franchise fees are increasing because the Silver franchise is getting converted to Gold. Overall Student lessons are bringing higher revenue. ( at the end of the day that's the most important matric to see )

Some encouraging traction for Tutorfly

Corporate Center

Yes, Tutorfly is a drag but its a relatively small part of the business. The Franchise Network and Corporate Center are going in right direction. Hopefully based on the comments from the Annual Report, Tutorfly will come good in FY24. Overall happy with the result.

At a first look I'm happy with this update due to the huge investment in tutorfly disguising that profit figure, though I'm disappointed at the franchise fee revenue figures. Stripping out tutorfly I get an adjusted NPAT of ~ 2.55m.

Based on the previous update, I had thought the kip results were in line with my base case assumptions (I've reincluded these below - wondering if I must have deleted them or something). I'm having a rethink of whether I should be on my base case at the moment.

- Most metrics have improved on last year generally.

- The revenue figures for the franchise fees were not stronger than the first half, which I was hoping for. The increase in revenue from the first half was mostly to do with the higher corporate incoming (inc. tutorfly) in the second half.

- Tutorfly revenue of 1.2million, with loss of 0.9 million, BUT 2.6 million contracted work secured in FY24. This is nice, but I wouldn’t necessarily expect it to show next half due to American holidays.

- Stripping tutorfly out, I have an NPAT of 2.55 mil. This has Kip on an adjusted PE of ~ 12.2.

- Recovery in UK pound may be a hidden hand helping. 1.71 aud per UKP compared to 1.98 now. My guesstimate is around a 600k increase in revenue - theoretically this should also impact UK expenses.

- Software depreciation continues to be high. Effectively a cost.

- New sales of franchises remain slow.

- Now 29 corporate centres. This is up from 24 Corporate centres last year. (With ~ 20% increase in total corporate centre revenue exc. tutorfly by my count)

- Decreased marketing spend of -2967 compared to -3543 this year might have increased profit.

- Franchise support (merchandise?) has increased a lot. This might indicate investment.

OLD NOTES

Base Case assumptions:

Starting 1.8m annual npat stripping tutorfly out.

Growth of 4% compounded + 200k per year (Compounded after added)

This generates a value of 42m after 30 years.

Bull Case assumptions:

Starting 2.8m annual npat stripping tutorfly out.

6% growth + 400k fixed growth (corporate) per year

This generates a value of 73m after 30 years.

Taking the average of these two results we get a value of 115/2 = 57.5m

There are 56 519 331 shares on issue, so this gives a target price of $1.017

Monthly Newsletter_July_2023_Digital_230712_093419.pdf

Page 13 : Australasian Emerging Companies Fund comments

Not bad. 200k, 50k, and 100k worth of shares purchased yesterday, which is a total value of ~$150-175k.

Curious that the directors chose to coordinate buying, not sure how to interpret that.

The trading update seems in line with my base case assumptions, so I'm updating my valuation to that.

I'm disappointed, but was probably just too optimistic.

I'm curious as to how the tutorfly revenue is going. Counterintuitively, if it has been bad, this might indicate a strong result for the rest of the business.

They also say they've been investing, but I think that's an easy thing to say.

FY26 Revenue = 36m

FY26 NPAT = 4m

PE Ratio = 20

Market Cap = 80m

Shares on issue at FY26 = 61m

Share Price (FY26) = $1.32 discount it to FY24 $1.07

KME updated the market this morning with following are lower range of updates

Rev : 26.9m

EBITDA : 6.4m

NPAT : 1.7m

Now at Share price of 0.42 --KME's market cap is ~24m

That means currently it sits on PE of ~14

If you expect KME to grow and increase its market share from investment in the last 3 years, then it looks pretty cheap at this price.

If you expect KME services will be redundant through AI innovation then probably its value is zero. ( as everyone will use AI tutor and no one wants to use KME service)

My opinion is that AI innovation will add value to existing tutoring services as opposed to replacing it and as it stands today KME's online competitors like BYJU or CLUEY are not sure they would be around 2 years from now.

Nice article explaining current state.

https://www.edweek.org/technology/what-chatgpt-could-mean-for-tutoring/2023/05

Based on the reading it seems to me that tutors work will be assisted by AI. Tutor won't be replaced by AI completely but it will reduce lot of admin work for tutors and allow them to focus on main goal i.e students progress. and my thinking is that is good for KME as it will increase efficiency and ideally reduce operating expenses.

Now not every company will be able to create their own AI powered system so i expect some technology company bringing platform to provide that service to tutoring centers. It would be interesting to see how it pans out.

Tutorfly's performance was a major drag on Kip McGrath's performance in 1H FY23. with promising words about 2nd half in report.

Seems like the new revenue stream: drop-in tutoring" is working (https://www.dropintutor.com/)

https://gmcs.org/2023/01/free-on-line-tutoring/

KME Reported its FY23 report and the share price has gone downhill ( i.e no change after the result as it was going downhill before the result as well)

It seems that the market didn't like that NPAT has gone 29% down or it didn't like that revenue only increased by 9.2%.

Yes, the result wasn't great but to my eyes, It wasn't bad at all compared to what I was expecting or fearing that inflation will seriously hamper its tuition numbers.

Some of the bright spots in the results for me

- The corporate business continues to scale and has achieved profitability for the first time

- May be market didn't like the cashflow shown but the underlying net cash flow from operations was $3.1M

- Cash flow from operations this half was affected by $2.3M in outflows to franchisees

- Revenue from Franchise fees and Student lessons are trending in the right direction

- Revenue performance was hampered by UK/Europe and the USA. Now I have noticed the trend that most of the reported companies had issues gaining growth momentum in UK/Europe in this period and for USA, KME is saying that there were some delays with Tutorfly Director comments as below:

- " We have contracts in place for the second half to see revenue return to last year’s levels for the full year and are now working with 4 school districts up from 1. We have also developed a new revenue stream for ‘drop-in tutoring.’ Currently, in use at one school district, a click button provides an instant help feature. We believe this new service for drop-in tutoring provides an exciting new business opportunity more widely throughout all operations"

So in nutshell, Yes company didn't had a great half but I think it has been punished way more than it should ( in my opinion - anyway) probably illiquid nature has to do with it. Hopefully, the same illiquidity will at some point act in shareholder's favor - I shall wait for such time.

Turning into a bit of a serial disappointer unfortunately.

The market saw this kind of tepid result coming months ago, with the price at 52-week lows well before the report came out.

Safe to safe this half did not meet expectations. It looks like Tutorfly is losing quite a bit as they supposedly invest for growth. I imagine this will not be looked on favourably by the market - at least KME has already fallen a lot. Not sure whether there will be something more positive in the investment presentation yet to be released but there has been a lot of investment and not much to show for it.

Currently a lot is resting on the second half - Storm and KME would be testing a lot of people's patience.

22/11/22 Presentation to AGM 22 November 2022

Not much new from KME in their AGM update, a general update that revenue growth is "performing well" but noted with US expansion 1H/2H skew will be larger moving forward.

The update on the US/Tutorfly expansion was the most interesting, management saying that FY23 to date has already contracted as much work FY22 with 8 months remaining and now a preferred supplier in Alabama and Texas. I was initially sceptical on the US expansion which also used a different business model than KME traditionally uses (outsourced tutors). However the ability to sell into government contracts has greatly de-risked the expansion and it seems it could be material to FY23 numbers.

Increased government contracted work was a theme for the more established geographies as well with management calling out their ability to tutor at scale as a main reason why. While it may be a sugar hit for KME, I suspect governments funding to close the Covid caused learning gap will stay around for a few years.

Looks to be a fair amount of consistent volume (compared to history - still illiquid) going through KME over the last few weeks. Wonder who is buying and who is selling.

Research report from CZZ updated - 221121_KME.pdf (mcusercontent.com)

BUY (TP=$1.85) KME for multiple upsides to our forecasts and US optionality Trading on 12x FY23 P/E and forecast to grow NPAT/NPATA at a 30/25% CAGR b/w FY23–27, we consider KME to be significantly undervalued. Our Target Price of $1.85 is based on a DCF (10% CoE and 3% TVGR) and reflects conservative corporate centre unit economics, SSSG, and silver to gold conversions.

As KME did their AGM only face-to-face and not provided online options ( I don't really know what was said in AGM)

I actually requested if they can provide an online AGM for someone like myself who is not Sydney based to attend - the response that came back was along the line of " KME is a small company and the cost for the hybrid meeting are prohibitive"

Well, I like the cost-conscious view but setting up a hybrid meeting isn't that difficult nowadays - in my opinion, but anyway...

There were some mixed comments on the presentation

- KME expects a skew towards the second half ( First half trading is seasonally lower) - In my mind, this is a nice way of saying that the first half will be soft

- Tutorfly is scoring goals it seems - ( FY23 YTD contracted work is currently equal to the total for FY22, with 8 months remaining to secure additional work)

- Middle east growth is picking momentum ( 4000 students/week up from 2500 students/week)

- Corporate centers growth is intact ( 2700 students per week up 20% from June 2022)

Seems like the franchise is probably suffering in an unfavorable macro environment. but KME will sustain reasonable growth because of Tutorfly, the corporate center, middle east

Overall, I am not too concerned about it.

Had to tweak the cost base in my KME model, the business has frontloaded more employee costs than I expected to service the growth of the corporate centres expected to come through. There is some concern that 2H corporate revenue was flat on 1H but the run-rate exiting FY22 is strong and momentum suggests strong growth into FY23.

On rough numbers KME should do around $5m NPAT, 20x is $1.80. Based on commentary there is probably upside to these numbers, but best to be conservative after I got a little ahead of myself last time...

Nice to see Tutorfly already profitable.

With all the pieces falling into place FY23 looks like the year for KME.

Simple valuation of about A$90m based on 53m shares on issue.

Summary

I think there is limited downside risk in KME at current prices aside from any irrational market sentiment against which the company is pretty well protected. Backed up by recent director, KMP purchases.

Growth potential in revenue and margins with US expansion and transition to online. This could deliver a good return in terms of share price.

What I like

Owners name on the door, family run business. Good insider ownership in a long standing business. To me this minimizes risk around corporate governance and practices.

Growth plans in the US via tutorfly as foot in the door. Growth globally by purchasing back franchises. I think franchising is becoming less relevant this century due to vastly improved communications and online meaning you can run multiple businesses all over the world from one place more easily.

Directors and KMP recently buying on market ~$1/share

What I don't like

Tutoring should be a competitive industry. Not ever likely to create super high margins. While KME have brand name and some IP I have capped EBITDA margins at 30%. ie. not expecting a 10 bagger.

Bit harsh to put this under don't like.......balance sheet is ok but not super strong (19m net equity, 21m of intangibles). No real borrowings, 8m in cash at HY22 but this is mostly offset by final payments for tutorfly and owings to franchisees. I normally like to see more buffer and an acquisition or black swan type event could see them raising capital. Some people might just consider this a fit or lean balance sheet.

Model Assumptions (~A$90m value)

Simple DCF model, only for indication of value.

Revenue growth of 20% initially, reducing this decade and a terminal revenue of A$72m in 2030. This represents a risked view for me and has to be organic.

EBITDA margins growing from 20% upto 30% - fairly conservative

NPAT margins ending at about 15% - generous, I should form a stronger view on capital requirements, R&D and therefore depreciation.

Discount rate 10% - I know this is standard but I would say conservative, but reflects higher inflation and interest rates in the next 0-5 years.

No further dilution of share count - this is generous.

Note. Instead of DCF, in terms of a price target, I'd go with about 100m mkt cap, ~$1.90 per share, in the next couple of years based on $5m NPAT and 20x PE (moderate growth company in interest rate world of ~4%).

KME has provided guidance so the following is what I am expecting

Things I want to know in FY22 reports

- How Corporate centers are performing? What level of margin can be expected and when we will see effect on bottom line?

- How blended tutoring is working? Online tutoring percentage? further technology investment required?

- Tutorfly progress? What's the plan for the near and medium term for tutorfly?

There has been a further significant director purchase in the last month or so.

Cluey also posted quite a strong quarterly yesterday, which makes me think that demand for tutoring is very high at the moment. Given this, the director buying, and the scuttlebutt I've heard on here I'm thinking they might post a strong quarterly.

- edit - Apparently there aren't quarterlies for companies that make a profit (with some additions)! whoops - I was thinking there might be a short term trade here before their quarterly drops and as a disclosure I have bought some more shares. (I might be wrong, I'm not much of a trader =/ )

A substantial purchase by Storm here.

Valuation $1.27

Base Case Assumption at this year AGM Revenue Tracking 21% than previous year (FY22 Revenue ~$23.1M) I worked on achieving Revenue of $28.1M in FY26. (Seems others maybe forecasting higher amounts?, am I Missing something). Achieving EPS in FY26 of $0.082 apply PE 25 discount back I get $1.27.

One of the online learning platforms Cluey released its half-yearly result today.

Revenue has increased significantly from the previous period but I am not sure if the model is going to survive longer.

The way I read it, They had to spend 4.5m in marketing to get 15.7m revenue.

15.7m revenue required 7.2m cost to generate 8.5m gross profit

To increase gross profit, they increased their marketing 15 times, Admin roughly 10 times, and employee expense 10 times.

Most of the employee expense is also the cost of sales for this business as without tutors there is no classes. [ so in fact gross margin would be very less if you factor that also in]

Article on the tailwinds. Not sure of the applicability for Australian market but likely to be relevant.

https://www.economist.com/international/the-pandemic-will-spur-the-worldwide-growth-of-private-tutoring/21805216

KME reported a 221% increase in online lessons to 654000 (over 295000 in FY2020). That averages out at 54500 month / 12576 week. This is substantially more than the last update stated (560000 year / 46666 month / 10769 week).

It looks like there has been another large increase in online lessons. Perhaps the increase is linked to a return to lockdowns. Maybe a general realisation that online lessons are a new normal, and a return to pre-covid norms is less likely.

Face to face lessons consistant at 1440000 year.

Held IRL

The online lessons part of the business looks to have prompted the recent share price spike. The half year report stated, “KME delivered 290,000 online lessons for the half, an increase of 800% with gross revenue at the student level of $16.1M, compared to $1.7M in the previous half year”.

KME reported the following relating to online lessons...

On 23/9/2020, KME announced 46000 online lessons per month vs 3200 for the same period last year). This is when the share price started to spike. By my calculations: 46000*12 = 552,000 lessons per year AND 552000/52 = 10,615 weekly).

This was confirmed on 17/11/2020 as 11,000 average weekly online lessons (since March 2020 lockdown), compared to CY 2019 with 450 average weekly online lessons. My calculations: 11000*52 = 572000 per year AND 572000/12 = 47,666 per month).

The half yearly report and accounts, on 23/2/2020, showed 290,000 online lessons for the half. My calculations: (290,000*2)/12 = 48333 per month AND (290,000*2)/52 = 11153 weekly.

The investor update on 1/3/2020 shows 280,000 online lessons for the half. My calculations: 280000*2 = 560,000 per year AND 560,000/12 = 46666 per month AND 10769 weekly.

I feel like I’m back at school trying to complete a maths test.

Announcements titled “company update” and “letter to shareholders” were not a general update on the company, or a general letter to shareholders, but related to center acquisitions.

KME's financial reporting over the above period appears randomly labeled, fragmented, and inconsistent. I really hope the lessons they provide to students are easier to follow than their financial reporting.

It looks like the increase in online lessons is being maintained but after the first large jump (reported in september), there has been little further acceleration over 6 months. In fact the most recent numbers indicate a small decline (unless they used the wrong number in the report - or are not entirely sure of the exact number). Perhaps there is a small decline (in online lessons) due to some students preferring face to face while not in lockdown.

I own a small holding - in real life.

Hi Alpha18, not sure how to directly respond to your straw. I think the slide recently is mainly due to the lockdown as the centre's will be shut again (they can do online of course) but there will be some lost revenue. It's illiquid so doesn't take much in the way of selling to push the price down.

Market not reacting to great news?

The market didn’t bat an eyelid from the announcement on the 18th of June stating that Kip is one of four providers selected by the NSW government for its $337 million COVID intensive learning program.

We’re less than 1 month away from their reporting on their yearly result and my gut tells me the news will be good.

The business is currently undergoing a shift in their business model from the historical franchisee face-to-face tutor lessons. There are two key shifts occurring, both of which will drive increased revenue and profits for KME in the future:

A shift to a hybrid online and face-to-face tutoring model. KME launched their proprietary Kip Online system four years ago but traction was slow as parents were wary of the quality of online learning (especially as KME price face-to-face and online lessons the same at ~$63). Pre-Covid about 1.4% of lessons were online, but lockdowns accelerated the shift with 42% of lessons now online in the latest update. Speaking with management, they expect more students to transition back to face-to-face when it is safe to do so, and target between 20-40% online penetration over time.

A shift to a blended franchisee and corporate-owned centre network. KME has strategically identified that certain centres in highly populated areas are more profitable if they are run by the corporate office rather than a franchisee. Management are approaching these franchisees and offering a guaranteed buyer for their franchise at a fixed valuation, preferably a mix of cash and shares. This has the added benefit that salaried tutors in corporate centres can service students online who fall outside of a KME centre catchment. Like online penetration, management are hoping to achieve a corporate/franchisee balance of 20-40% over time.

KME is a leading provider of tutoring services to K-12 students, primarily in Maths and English. The business was founded by Kip McGrath in 1976 and has expanded from one tutoring centre in Maitland to 524 centres in 11 countries largely through a franchise business model. It is currently managed by Kip’s son Storm, with the father and son duo still owning ~30% of the business between them.

The core business model is charging franchisees a percentage of revenue which is collected per student, per lesson. KME offers two levels of franchise fees, Silver and Gold. Silver franchisees pay 10% of their revenue and receive access to the KME brand, learning materials and basic administration support. Gold franchisees pay 20% of their revenue and in return outsource more back office functions to KME such as accounting, human resources and marketing which frees time to focus on students and on average Gold franchisees generate more lessons and revenue than Silver franchisees.

In a few paragraphs, I expect KME can sharply grow lessons over the next few years with pent up demand as parents look to ensure their children have not fallen behind in their learning with the disruptions from Covid.

As online lessons maintain their penetration between 20-40%, more franchisees shift to Gold status as they become more confident in the future.

A conservative and aligned management team continue to make strategic purchases of franchisee centres and grow the corporate network over time, which also allows for further penetration of online lessons into new regions previously not serviced with more salaried tutors available.

Finally, margins should grow strongly on increased revenue from higher margin sources and general scale over fixed corporate costs. With large investment in Kip Online brought forward by Covid and an expanded executive team now in place, this should happen quickly.