Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Xprecia Prime receives FDA approval. SP up +60% at peak. Now to see how they can convert this to revenue.

UBI CEO John Sharman said, “Approval to sell Xprecia Prime in the USA is a historic moment for UBI. It represents more than 10 years of research & development work and many millions of dollars of investment.”

Mr Sharman said, “This is the first time the FDA have granted a CLIA Waiver by Application to any coagulation device, and it is testament to the performance of Xprecia Prime. The number of PT/INR tests performed in clinics is the largest part of the USA market so to have won unrestricted access to all clinics and hospitals across the USA is a major achievement.”

Mr Sharman said, “There are more than 6 million patients who take warfarin (coumadin) in the USA and more than 140 million PT/INR test strips are sold each year.

This FDA approval represents the first opportunity in UBI’s history to access the lucrative (and fully reimbursed) USA market. Our expectation is Xprecia Prime will qualify under the existing reimbursement codes used by Medicare, Medicaid and USA Health insurers. UBI has a pipeline of sales and distribution contracts already in negotiation and now that we have FDA approval we expect to conclude some, if not all of these contracts, win market share and generate substantial revenue for the company.

Held in RL and SM

Results Investor presentation and a CR announced. Good news is the increase in Sentia sales and the reduction in expenses and therefore losses. Not so good news is a 40% dilution, $12.5M Cap raise at a historically cheap price of 15c when they have $10M in the bank. Suggests that they are not expecting a profit in the next 18+ months? Viburnum possibly increases its 26% stake by underwriting the raise and receives a 5% fee in options or 6% in cash.

Language has changed for Xprecia Prime FDA "Current US FDA 510k submission under review with feedback expected Q1 2024." in the annual report "assuming there are no further queries, an FDA decision is expected during Q1 2024;" are they being conservative is a further delay expected? One of the uses for CR is stated as "Ongoing costs associated with the approval of Xprecia Prime in the USA" positive that "Large European and USA deals in negotiation." Xprecia Prime still has to be the biggest potential for increasing revenue significantly in the short term but dependent on FDA approval.

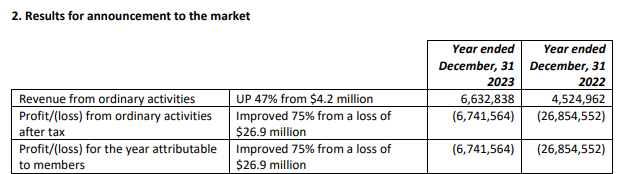

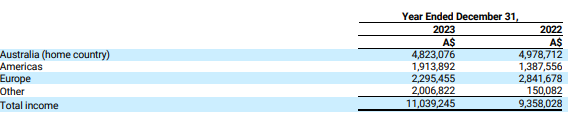

Highlights Year-on-year (2023 v 2022)

Key developments during 2023 include:

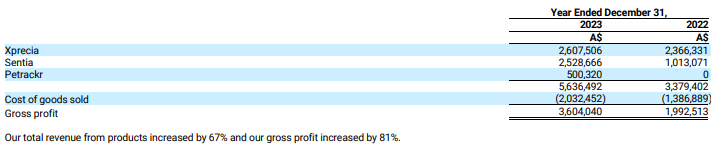

Revenue from the sale of products increased 67% to $5.64m

Total revenue increased 47% to A$6.63 million

Gross profit increased 100% to A$4.28 million

Operating costs decreased as follows:

R&D expenses declined by 60% to A$4.97 million

Total operating expenses declined by 43% to A$20.97 million

Net loss after tax and impairment of intangible assets improved by A$20.11 million

Revenue from coagulation testing products grew 10% but was negatively impacted by the “aggressive selling of stock” by Siemens as a result of its rights to sell Xprecia products ending formally on March 31, 2023.

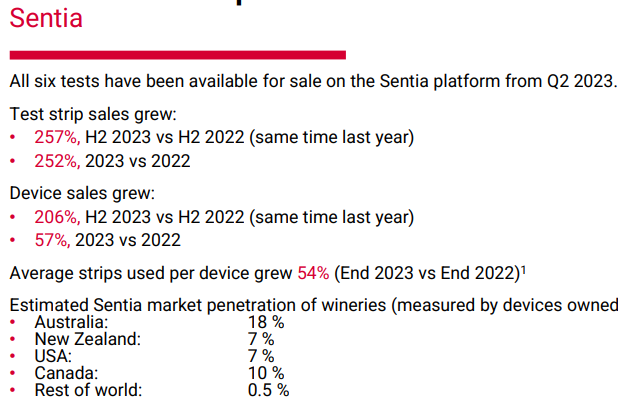

Revenue from wine testing products increased by 150%. During 2022, our revenues from wine testing products were primarily from the sale of Sentia analyzers, Free SO2 and Malic Acid test strips. During 2023, we began generating revenues from the sale of the following additional test products – Fructose, Glucose, Acetic Acid and Titratable Acidity.

Petrackr, launched in May 2023, generated revenue of A$500,320.

Universal Biosensors, Inc (ASX: UBI) ("UBI") advises that it intends to raise approximately $12.5m of capital.

The capital will be used to support UBI’s: • working capital requirement (to support the expected inventory build and growth in sales); • ongoing product development; • operating losses in the shorter term; and • Ongoing costs associated with the approval of Xprecia Prime in the USA

An underwritten pro rata non-renounceable entitlement offer of new CHESS Depository Interests over fully paid shares of common stock of UBI to raise approximately A$10 million at a proposed ratio of 1 New CDI for every 2.55 existing CDIs held and a non-underwritten placement of New CDIs to institutional and sophisticated investors to raise up to A$2.5 million

New CDIs will be issued at a price of A$0.15 per New CDI participants in the Placement and Entitlement Offer shall receive one attaching Option for every New CDI issued, at an exercise price of A$0.20. The Options will vest upon issue, expire 3 years from the date of issue, be exercisable in multiple tranches and each entitle the option holder to 1 CDI upon exercise

UBI has received a binding commitment from existing shareholder Viburnum Funds (Viburnum Funds holds a beneficial interest and voting power over approximately 26% of our shares.)to fully underwrite the Entitlement Offer. Viburnum is an associate of Mr. Craig Coleman (the Non-Executive Director of UBI who is also the Executive Chairman of Viburnum and a substantial shareholder in Viburnum). Viburnum shall have the right to require the Entitlement Offer to be repriced in the event that the trading price of UBI CDI's falls below A$0.10 per existing CDI for any three consecutive days prior to the securityholder meeting (see below). In the event the parties are unable to agree the repriced amount, Viburnum shall be entitled to terminate the underwriting agreement. Viburnum will receive 13,849,567 options, as its underwriting fee , equal in value to 5.0% of the underwritten amount of A$10 million. The Underwriter Options will be issued on the same terms as the Options issued to investors under the Entitlement Offer. If the Underwriter Options are not issued, including where securityholder approval is not obtained for the issue of Underwriter Options, UBI shall pay Viburnum an underwriting fee equal to 6% of the underwritten amount in cash, at the time of issue of CDIs under the Entitlement Offer.

Technology update

Lead & Heavy Metals detection UBI’s has identified a significant market opportunity in detecting heavy metals and other impurities in water. The opportunity uses UBI’s existing infrastructure and technology and is low cost. UBI is completing proof of concept for Lead and Copper sensors

Admittedly these financials are a lag to the last announcement of the first $1M month but at $1.6M total for the quarter and a burn of $5.15M albeit including $1.8M non recurring and $1.2M on inventory the revenue was below expectation and the SP took a hit down around 20%. No detail on progress of various products.

The Company spent $1.8m during the period on non-recurring capital items and product development, including costs relating to the FDA application for Xprecia Prime. The Company also spent $1.2m on inventory relating to new products launched in markets around the world.

Sales for H2 2023 were up 55% on H1 2023

Repost from a forum response to@PinchOfSalt with his comments at the end.

UBI has quite a lot of detailed analyst coverage which all got the share price wrong but gives a good overview of the company. Bell Potter the latest with a valuation of $0.38 Hold in January 23 down from $0.60 Buy

SP has been hammered on the back of delayed FDA approval of Xprecia Prime and slow uptake of the Sentia platform globally compared to AU. Roughly 5% ROW compared to 17%AU.

Margins for the the main platforms are Sentia 71% on TAM of $900M, Xprecia 66% on TAM of $1Bn, Petrackr 49% on TAM of $260M.

R&d spend had been big at appx 16% of revenue in 22, 8% in 23 and 6+% for 24. The unanswered question is whether they will pursue cash flow or continue to chase further development of the cancer, fertility, heavy metals testing which could take a lot of funds.

The big opportunity appears to be the US market for Xprecia Prime as there was a big hangover in sales of the old system as the deal with Siemens came to an end in 23.

Some interesting thoughts on HC on Prime revenue in India

"Just for reference the retail list price for a Xprecia Prime handset in India is Rupees 65,000 (A$ 1,150) and a Pack of 100 Strips is Rupees 22,500 (A$ 4 per strip). If we use the order earlier this year in Italy as a usage benchmark that was for 100 units and 130,000 strips over 24 months (65,000 per year). At a similar usage rate the India sales from this order would result in 330,000 strip sales per year. That is a retail value of A$ 1,320,000 in strip sales from this order alone"

Another post looking at cashflow.

"In regards the reference to $1.4m of sales a month for breakeven, I can't get the maths on that to work. I think the breakeven sales figure is much higher at $2.7m per month.

Showing my working in case anyone can spot an error.

From the six months to June 2023 report

- Annualised operating expenses of $21.4m (10.7 x 2)

- Gross margins of 65%

- Thus sales required to breakeven on opex = $32.9m (21.4 / 0.65)

- Monthly sales for breakeven $2.7m (32.9 / 12)

The December sales result was good but I still expect around $3m of cash burn in the December quarter."

Sentia widely regarded as market leading in ease of use and now with a suite of available tests should gain traction.

Petrackr has better accuracy and lower cost than most competitors.

Xprecia has about 2000 devices in market. Not sure how many they can deliver per year. Siemens had 5000+ installed on old platform.

Capacity to manufacture 70M tests per year.

So in conclusion answering questions arising from the latest update.

1. Cash flow positive? Probably not yet but with US Xprecia approval in 24 should be coming as long as r&d spend is kept tight.

2. Is the $1M repeatable? Yes but likely to be lumpy at this early stage with stocking orders for devices and strips before recurring strip revenue becomes steady.

3. Earlier broker reports had revenue forecasts for 24 @ ~$40M but Bell Potter Jan 23. @$16M at a current MC of $47M you would have to think there is danger of a take over before the good times appear. Top 20 holders own 64%

From @PinchOfSalt

"I don't think TAM means much but your other points are good. High margin, growing sales, decreasing R&D.

But they need to more than double revenue to $2.7M p/m to break-even.

With cash and cash equivalents at $16.6M in the last 4C (Sept '23) they've got till the end of 24 at current cash burn rates ($3M / qtr) before needing a CR. If they can continue to increase revenue during '24 then they've got longer. Seems to be a path to profitability (or at least break even) if they can open up some new markets."

Hope this helps and feel free to comment Strawpeople.

Disc: 8% holding in SM down 17% and a small holding in RL.

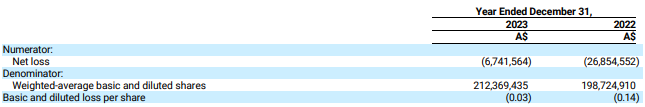

Very rough forward estimate. Simply wall st gives an industry average (hard to do with this sort of company) price to sales of 4.3 vs UBI current price of 9. If they can generate sales in 24 of $16M that would give a valuation of $69M and with 212M shares on issue that equates to $0.32 per share. It has got to this price a couple of times in the last Year. Revenue of $40M as previously forecast in older broker reports would give $0.81 per share. Revenue back in 2016 $19M, 2017 $25M, 2018 $69M before dropping to $7M in 2019. ATH was Nov 21 at $1.04. Potential to rerate with FDA approval and US Sales?

Things turning the corner for UBI? Xprecia Prime sales starting to build and FDA decision in Q1. Update lacking in detail and is this just a lumps sales month or a trend?

Sales orders in December are forecast to exceed $1,000,000 (unaudited estimate).

• UBI has received its largest order for Xprecia Prime devices from India. The order is for 520 devices, which are to be delivered in December.

• UBI submitted its full response to the FDA’s “Request for Additional Information” on 23 November. Assuming there are no further queries, an FDA decision re the approval of Xprecia Prime for sale in the USA is expected during Q1 2024.“

December is forecast to be UBI’s biggest revenue month ever and is the first time we expect to record $1,000,000 from selling our products directly to customers (excluding Siemens). Six of UBI’s new products have been in the market for approximately 6 months and sales growth during H2 2023 has been strong (compared with H1 2023). We now have 11 revenue generating products in market and we are starting to build sales momentum.”

Cash burning, fast growing (off a small base) UBI gained > 25% on Friday on no official news.

They were up > 30% intraday which made me wonder if they had confirmed their ability to cross the cash burning chasm to the promised land but ... then I saw this 5 min drive time puff piece:

https://omny.fm/shows/money-news/john-sharman-ceo-of-universal-biosensors

CEO John Sharman on the radio with a bunch of softball questions (sales pitch dressed up as news?). No new info here but no doubt a lot of first time listeners and probably a lot of 'at market' orders in an illiquid stock.

It likely sounds like a no brainer if you don't know the business and it's cashflow concerns.

That said, if they can make it through before the cash runs out, it is still cheap today.

Disc: Held

Expanding Xprecia Prime sales into India has not helped the SP which is back down to near June lows.

Universal Biosensors, Inc. (ASX: UBI) is pleased to announce it has received approval from the Indian Central Drugs Standard Control Organisation (CDSCO) for the sale of Xprecia Prime, with the first order received from UBI’s distributor for the region.

This first order is in the process of being delivered and will see first sales into the market in Q3 CY23.

Mr John Sharman, CEO of UBI said; “We have been working on the approval of Xprecia Prime in India for more than 12 months, and we are delighted with this significant step forward. Whilst this first order is not material in value (under $100,000), India is a powerful and emerging market, and we are excited for the opportunities Xprecia Prime represents to disrupt this market.”

Petrackr gaining traction with 5 more distributors signed up and an improved revenue forecast.

Universal Biosensors signs five more Petrackr distribution deals

We now have 8 distribution deals in total and received purchase orders of $480,000 in the first two months since launch. First year sales value from these 8 deals is expected to exceed $4 million with sales growth expected in the following years.

Mr John Sharman, CEO of UBI said; “We are confident that “Petrackr” provides customers with a better alternative in terms of price, accuracy, latest technology, user mobile application and overall performance compared to the current products available in the market.”

UBI CEO's address making some bold statements at the AGM. Let's see them follow through.

"UBI believes that it can achieve operating cash break even on a monthly basis towards the end of calendar 2023 and then ongoing throughout 2024."

Petrackr

Global launch May 2023. Superior features and performance compared to market leader.

4 distribution agreements have been signed. • First orders expected to be $0.33m. • First full years sales expected to be $2.25m.

Another 10 transactions are being negotiated • First orders are expected to be $1m. • First full year sales expected to be $4m

Next gen manufacturing line will accelerate the development of UBI’s new technology platform. Validation to be completed in June 23 Project is $0.70m below budget.

Specifically it will allow UBI to design and manufacture: • 2 and 3 electrode strips in unique configurations.

• 3 electrode strips using aptamer based technology to detect and measure a range of targets previously not achievable with the legacy technology.

• 3 electrode Lubricin based strips to detect and measure a range of targets previously not achievable with the legacy technology.

Sentia wine testing new test Titratable Acidity. US growing well but Europe seems less positive. Maybe more reluctant to change from standard practice? Positive statement about financial opportunity. Increased uptake should lead to a steady revenue stream from the consumable strips. If they can do the same thing with the animal diabetes product should start to see good revenue flows in coming quarters.

Mr John Sharman, CEO of UBI said; “The launch of our Titratable Acidity test means we now have the six most important tests undertaken by winemakers available on the Sentia platform. Current testing for Titratable Acidity relies on traditional enzymatic tests using expensive machinery and time consuming processes or simple “colour changes” on enzymatic paper strips. Sentia represents a compelling alternative for winemakers to buy when compared with this and other more expensive, time-consuming and often less accurate laboratory equipment and chemistries currently in use.”

Mr Sharman said; “ In-market sales for Q123 v Q122 grew at 188% with 165 devices sold into wineries and over 65,000 strips sold. In Australia we estimate 16% of the market is using Sentia and our business in the USA is growing strongly. We estimate we have 5% of the USA winemaking market using Sentia and our ambition is to have 8-10% of that market by the end of this year. Sales in Europe are growing from a small base.”

Mr Sharman said; “The feedback we have received about the market opportunity for Sentia has been strong and we believe Sentia represents a significant financial opportunity for the company.”

Next Sentia wine test with 2 more coming in next 2 months. First batch of previous fructose sensors sold out quickly.

Universal Biosensors has launched its Acetic Acid biosensor test, the 5th test now available on the Sentia wine testing platform.

Acetic acid is tested continuously throughout the year and is of particular importance for red wine ageing in barrels. The timing of the launch is ideal for the upcoming fermentation and maturation period for wineries in the northern hemisphere. High levels of Acetic acid in wine are considered a highly undesirable fault and therefore monitoring is extremely important.

We have two more Sentia products in development being a Titratable Acidity test and our next generation Free SO2 test, which will be a significant enhancement for the very good Free SO2 product already in market. Both products are scheduled for launch within the next two months.”

Mr Sharman said; “Sentia now has 5 tests on the platform which makes it a more compelling alternative

It should also provide momentum in terms of device sales during 2023. We hope that Acetic Acid will be as well received as our Fructose biosensor, where the first batch of sensors sold out within a few weeks.”

Look forward to seeing the next set of results and the revenue from Xprecia Prime. UBI makes first sales of next generation Xprecia Prime in Europe

Mr John Sharman, CEO of UBI said; “This is a significant achievement for UBI and something we have been anticipating for many months. It represents the beginning of our new coagulation business based around our next generation Xprecia Prime platform.”

Mr Sharman said; “Looking forward, the Siemens relationship ends in March, our own distribution network is growing and our new Xprecia Prime device looks very promising in terms of sales. The supply chain issues appear behind us, our USA based clinical trial is complete and we are well positioned to submit our 510K application to have Xprecia Prime approved for sale in the USA. We are looking forward to a much better sales performance from our coagulation business during 2023.”

A good update today with some more details following the results presentation. @Chagsy points still hold on cash burn but some targets to see whether UBI can meet in Sentia and animal testing. Update on cancer testing and Covid / fertility testing. Plenty of news to come in H2 22 and H1 23

For the 9 months ending 30 September 2022, “In Market” Device sales are estimated to grow at an average of 24% per quarter. For the 9 months ending 30 September 2022, “In Market” Strip sales are estimated to grow at an average of 41% per quarter. Average Selling Price per strip has increased 21% between H1 2021 and H1 2022.

Three more products are expected to be released over the coming months (Q4 2022 / Q1 2023) • Fructose – our reworked chemistry is working well, and the strip is now in stability trials. • Titratable Acidity – the chemistry is working well, and the strip is now in stability trials. • Acetic Acid - the chemistry is working well, and the strip is now in stability trials. We now have 20 distribution agreements in place covering 25 countries.

Xprecia Prime USA clinical studies progressing well with 308 patients of the FDA’s required 360 enrolled. UBI now have 27 distribution agreements in place covering 19 countries. Sales in 2023 are expected to benefit from the finalization of the Siemens hand over and the launch of Xpreica Prime.

Animal Blood Glucose Biosensor Update 60 prototype devices are to be delivered to UBI in October. Contact has been made with 45+ potential distributors globally. 10 companies in advanced discussions (ie. NDA, Term Sheet) covering: • United States (4x) including one global player, • United Kingdom (2x), • Europe, • Australia, • China, • Finland. Sales expected to commence H1 2023.

It’s estimated 1.25m animals have diabetes globally of which: • 552,000 animals are in the US: 300,000 dogs (1 in 300 have diabetes). 252,000 cats (1 in 230 have diabetes). Estimated global market size $239m in 2022. Market is growing at a CAGR of 11.35% and projected to be $414m in 2027. 138 million test strips estimated in 2022 (62 million in the US). Projected number of test strips per animal with diabetes is 112 p.a.

Supply chain issues delayed the delivery of a key raw material (Lubricin) by several months which in turn delayed our second development trial using Victorian Cancer Biobank blood samples. New Lubricin arrived at UBI during the last week of August. UBI’s second development trial, (Victorian Cancer Biobank trial), is expected to report results before the end of 2022.

Work on our aptamer based COVID-19 biosensor platform is progressing. Our first pilot clinical study, testing live COVID-19 virus, will begin during Q4 2022. The work performed on the aptamer based COVID-19 biosensor platform is all transferrable to our fertility hormone monitoring tests and will fast track this development (on the same platform). The three aptamers for estradiol, progesterone and luteinizing hormone have been developed and are at the UBI facility. Initial testing has been performed and the results look promising. Full proof of concept work will begin in Q4 2022.

Disc: hold in SM and RL

This is clearly a risky investment given the distinct lack of profitability. Despite that, I have a small holding, the thesis primarily based on the Human and animal testing sticking to its knitting, but a huge uptake from the wine segment "Sentia". It seems to solve a significant problem, or pain point, for wine producers and as such I am disappointed to see barely any traction in sales.

From the announcement:

Sales increased marginally over the period but:

21% direct sales growth quarter on quarter (Q1 2022 : Q2 2022).

21% increase in Average Selling Price per strip between H1 2021 and H1 2022.

So the eye is naturally drawn to those red increases, but the important bit is the "sales increased marginally" ie no evidence of traction. This may be because of a lumpy order book....but I was hoping for more. Yes, they will generate higher margins through their direct sales channel, but it may be more important to just ramp up sales through distributors and achieve FCF+ve.

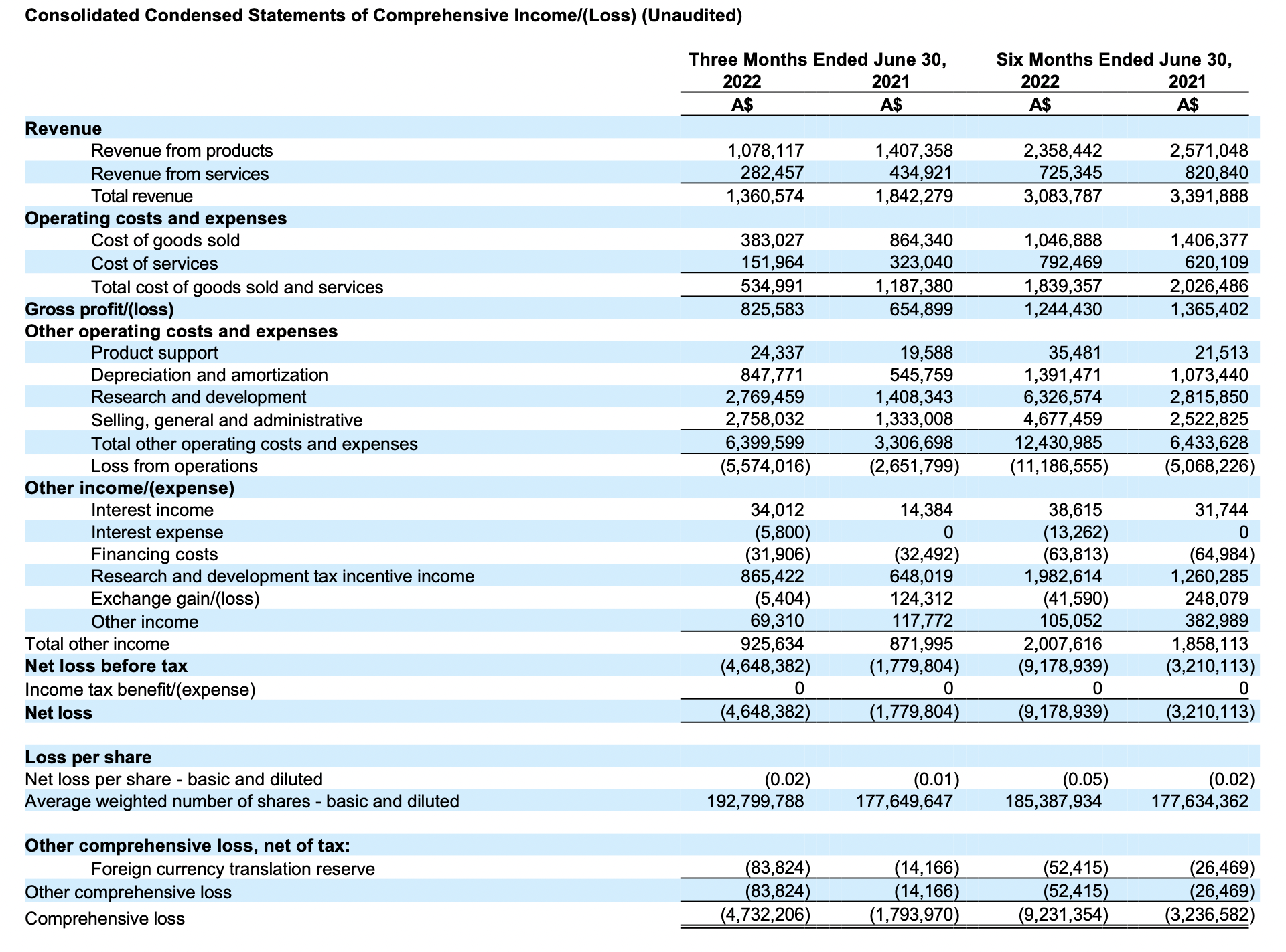

Looking at the PnL:

revenue was down 10%

losses up 186% at 9 million.

The 6/12 comprehensive loss tripled vs same period last year:

It's not clear to me how much of this is non-recurring. Presumable some of the $6mill research is one off, but not all of it. That still leaves a shade under $5mill in general and administrative.

So, they really are going to have to turn this around pretty fast if they are not going to come back to institutions/shareholders for some more funds. They sound confident, but if there is no evidence of traction in next quarterly I'll be cutting my losses.

Held IRL

Hot off the press 39min ago.... shares jumping

ENTERED GLOBAL EXCLUSIVE LICENSE AGREEMENT WITH IQ SCIENCE FOR COMMERCIALISATION OF A SARS-COV-2 N-PROTEIN DETECTION TEST