Ansell has just updated its FY23 guidance and issued FY24 guidance.Good news and bad news.

ASX Announcement

Good news: FY23 EPS to be in the range US$1.17-1.18, within previously guided $1.10-1.20 - in fact towards the upper end.

Bad news:

Guidance for statutory EPS for FY24 is US$0.57-0.77, compared with the current consensus of US$1.22.

The downgrade is due to several exceptional items, including investments in cost reduction planned for the the year. The Adjust EPS guidance without the exceptional items is US$0.92-1.12, still well below the current consensus.

Clearly, $ANN - which is generally consider a well-run industrial with category leading products, is struggling having been hit by post-pandemic softness in its healthcare division, supply chain issues, write-offs in Russia, cost inflation and not - potentially, a slowdown.

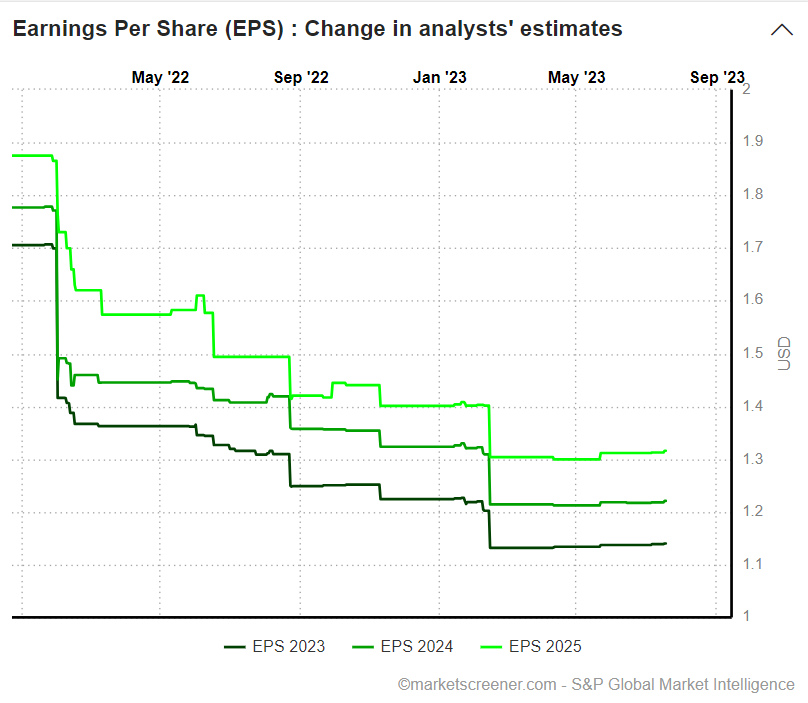

The picture of evolving EPS consensus - not yet updated for today - does not make pleasant viewing.

It will be interesting to see the SP response.

Disc: Not held, but previously held in RL.