Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Bapcor has raised $180m through an institutional placement, issuing 40.9m new shares at $4.40.

This was done at a 8.5% discount to the most recent closing price, which isn't too bad (although it represents a ~32% discount to the pre-COVID market price).

The company is also hoping to raise a further $30m through a Share Purchase Plan (SPP) to eligible shareholders, at the same offer price (or better if the market price falls between now and the SPP close date). That will result in the issue of a further ~6.8m shares.

In total, BAP will have approximately 332m shares on issue.

The raise is primarily to reduce the comapny's net debt, and ensure there is sufficient liquidity available thorugh the COVD-19 disruption. After the raise, Bapcor expects to have at least $231m in cash, or $261m if the SPP is fully subscribed. That comapres to total borrowings of $441m.

Put another way, the net debt to EBITDA ratio wiull drop to 1.3x

At the same time, Bapcir provided a trading update which shows that business has held up remarkeably well through to the end of March, although the NZ business suffered more than others due to stricter lockdown measures. Safe to assume that April will see the full impacts of lockdowns, and it wont be pretty.

Nevertheless, the business is now well positioned to weather the storm and there is no change to its 5 year strategy.

I will lower my valuation due to the increased number of shares on issue.

ASX announcement here

The Australian again today - https://www.theaustralian.com.au/business/dataroom/bapcor-assembles-its-takeover-defence/news-story/edab4e6a7d71ceed47efff7ef57c7d46?utm_source=TheAustralian&utm_medium=Email&utm_campaign=Editorial&utm_content=AM_BIZREV_Newsletter&net_sub_uid=AM_BIZREV_Newsletter

Not much new in this other than rumour about BAP appointing takeover defence (the rumour is UBS) and investors being divided on the appointment of Noel Meehan as CEO. Given the timing of things, it does seem like the Board moved a little more quickly on his confirmation than I might have expected.

SP down 21% since November when the Board accelerated the retirement of CEO Darryl Abotomey to his immediate dismissal.

Refer my straw from yesterday for wider report on Investor Day.

I start with today’s SP of $6.68 and forward PE of 16.2. Assuming average annual earnings growth of 7% (pre-cost savings), then add 50% of the targeted EBIT benefit by FY25, at a PE of 17, I get FY25 SP of $9.29, which discounts back 2.5 years at 10% to $7.32.

If they deliver the full target benefits of $100m EBIT, then today’s value per share is $8.55 or if PE expands to 20, then it would be $10.06.

Target SP is equal weighted average of 4 scenarios.

- Downside: $6:20

- Market: $6.88

- Base: $7.32

- Upside Better Than Before: $10.06

Weighted Average=$7.62

$BAP announced FY23 results. While I haven't held for some time, I am interested to follow how they are tracking as it provides a good lens on retail (mix of discretionary/non-discretionary), supply chains and inflation impacts. Market appeared to be expecting worse with SP up 7% at time of writing.

Their Highlights

Record revenue of $2.0b, up 9.7%, with growth across all segments

- Pro-Forma NPAT of $125.3m, with 2H23 Pro-Forma NPAT of $63.3M higher than 1H23 of $62.0M and in line with guidance

- Record full year dividend of 22.0 cents per share, fully franked, with a payout ratio of 59.6%, including a final dividend of 11.5 cents per share

- Operating margins lifted in all Trade and Wholesale segments in 2H23 versus 1H23, while Retail faced some headwinds due to macro-economic factors

- Year on year temporary margin compression due to input cost inflation, capability build and higher interest costs • Continued resilience of Bapcor’s diversified business model demonstrated throughout FY23

- Ongoing focus on capital efficiency with ~$50M like for like reduction in inventory leading to significantly improved cash conversion of 145.4% in 2H23

- Distribution Centre Queensland achieved practical completion in 2H23

- Continued network expansion and growth in proportion of own brand sales across all segments

- Better than Before transformation program in execution phase and on track to deliver initial benefits in FY24

My Analysis

I find it helpful to look at how the P&L elements are tracking with %yoy comparisons.

While they have succeeded in passing on increased COGS by price increases matching 10% yoy, rising expenses across the board have outstripped the benefits of higher volumes.

As a result, while %GM is flat at 46.7% (yay), %OM has fallen from 10.7% to 8.8% and NPAT from 6.8% to 5.3%, driving an NPAT decline of 15.4%.

This is yet another example of the negative operating leverage of retail. In this case on the top line, we all know the automotive story. With leadtimes for new cars still 6m to 2yrs, this has provided a tailwind for $BAP, as more work has been required on the existing fleet. However, the increase in expenses is a suprise to me (I confess to no longer following $BAP closely, so I am not saying it hasn't been flagged or wasn't clear at 1H).

Not sure what is included in "Other expenses", but they are in the middle of a transformation program and there is a $20m cash charge in the cashflow statement (OK, OK,... no pile-on about consultants please), with result due to show through in FY24.

Valuation: with eps at 31.36cps, $BAP is on a p/e/ of 22x,... which means the market expects a return to earnings growth some time soon.

Final dividend holding flat at 11.5 cps, giving a total of 22cps up from 21.5cps. Divideny yield is 3.20% for the FY, which grosses up to 4.6%,

Key Takeaway: Top line follows sector macro; expenses = ouch. Overall: meh.

Disc: No longer held. Happy with that decision

This article in the AFR talks to BAP.ASX having a 39% staff turnover. Woah. Thats gotta impact day to day operations.

I enjoy a good bit of confirmation bias.

Disc: no longer held.

An AFR article is reporting that CEO Darrly Abotomey will revieve no additional termination benefits, after shareholders voted down the golden handshake at the AGM with only 47% supporting the termination agreement details.

I can't help but wonder if the shareholder body has significantly changed since Darrly departed. I think his history and actions would have been worth the payout, even if he wasn't the future, he got them to the place they are today.

My stance has not changed, all the red flags remain, and I no longer hold.

Bit of a curate’s egg from BAP.

headline numbers appear ok, given the disruption to supply lines and the COVID related lockdowns that would have impacted retail sales.

Revenue increased across all segments which shows superb resilience. EPS was marginally increased. They have increased the dividend.

However, the increase in inventory has lowered ROIC and cash conversion. Combined with the higher pay out, debt has consequently jumped by $100m.

I am concerned this looks like a company trying to maintain its attractiveness as a yield stock by increasing debt to keep a high dividend. This may not be entirely fair given much of these issues should resolve with the normalisation of supply chains and the retail environment.

I have a 5% holding in Super. I will be holding to see if these trends revert.

Disc: held reasonably strongly in my SMSF

Gaurav Sodhi at Intelligent Investor wrote a pretty blunt piece yesterday communicating their decision to advise a sell on BAP and that they were ceasing coverage. The pointy end of the piece here...

"Bapcor’s business is progressing nicely and – on a price-earnings ratio of 20 with a decent yield and solid balance sheet – the valuation of the company appears reasonable. Yet tussles between board and management, departures of senior executives, and public feuds are not what we want to see.

If you hold Bapcor, we suggest you SELL and watch how things progress from the sidelines. We’ll keep an eye on the business and might wade back in, but we don’t intend to provide additional coverage until we're confident in the board and management. For now, we’re CEASING COVERAGE to focus on better opportunities."

BAP is one of my longest holdings, a business I knew well and was totally confident in. I have only ever added to my holding. After Darryl Abotomey left so abruptly I was nervous, things looked to have stabilised a little but all the signals are pointing the wrong way for me and I've just submitted my first sell order with a tinge of sadness.

BAP closed the day down almost 8% after the release of their H1 results today (and presumably the turmoil going on).

Management quite positive and declared an increased interim fully franked dividend of $0.10 (to keep investors happy and onside one presumes if they're about to fight takeover offers)

Lots of comparison back to FY20 as the comparisons back to FY21 don't look great on profitability despite the nearly 2% growth in revenues. Lots of costs associated with COVID and transition to their new Melbourne Distribution Centre. Some highlights:

CEO: “The team delivered an increase in revenue of 1.9% and proforma NPAT of $61M, a testament to the resilience of the business. Compared to FY20, a year that had the benefit of stimulus-induced demand, the current half year delivered a 28% increase in revenue and 33% increase in pro forma NPAT."

Compared to FY21 though that's a pro forma NPAT decrease of 13.7% and I suspect that's what has earned a kick in the pants from the market

"In FY22, Bapcor continues to aim to deliver pro forma earnings at least at the level of FY21. H2 FY22 is expected to be stronger than the second half of FY21, subject to no further material COVID- 19 impacts."

Bapcor says that the impact of COVID-19 has not been as severe as expected, and that demand has been stronger than anticipated as restrictions ease -- particularly in the Australian Retail and Trade segments.

Autobarn was quite amazing really, with sales up 45% in May & June! Although there was a 3% dip in April, FY sales from this business will be 8% higher.

Trade sales are expected to be up 5% for the FY

NZ operations, Specialist Wholesale and Thai operations were the hardest hit, but to what extend they didnt say.

Bapcor has speculated that the increase in sales was "stimulus induced". They warned investors to expect demand to moderate once Government stimulus stops.

Bapcor has reinstated guidance, telling investors to expect between $84-88m in NPAT for FY20. Prior to COVID, they were telling investors to expect mid- to single-digit gains in FY19 NPAT, which came in at $94m

Read the announcement here

BAP Investor Day Report (Edited to include two more broker updates)

I attended the Bapcor Investor Day yesterday. It was a good opportunity to hear from each of the Executive team members and to find out about the plans for the transformation program: “Better Than Before”. (Refer to earlier straws on here expressing dismay that CEO Noel has succumbed to bringing in a certain management consultancy!)

I’ll not try to summarise everything from the day, other than some of the key takeaways for me, as a long-term holder of $BAP in RL. (2.2%). The presentation pack is quite self-explanatory.

The good news is that there is nothing radical or whacky in the transformation program, although the target is very ambitious. $BAP has grown in part by bolting acquired auto-parts businesses onto the historical Burson core. If I could characterise the transformation in my own words, it is simply to drive operational efficiency through improved procurement and logistics, and more consistent pricing, enabled by investment in systems and digitialisation, customer relations (loyalty program), and culture/capability development of the team.

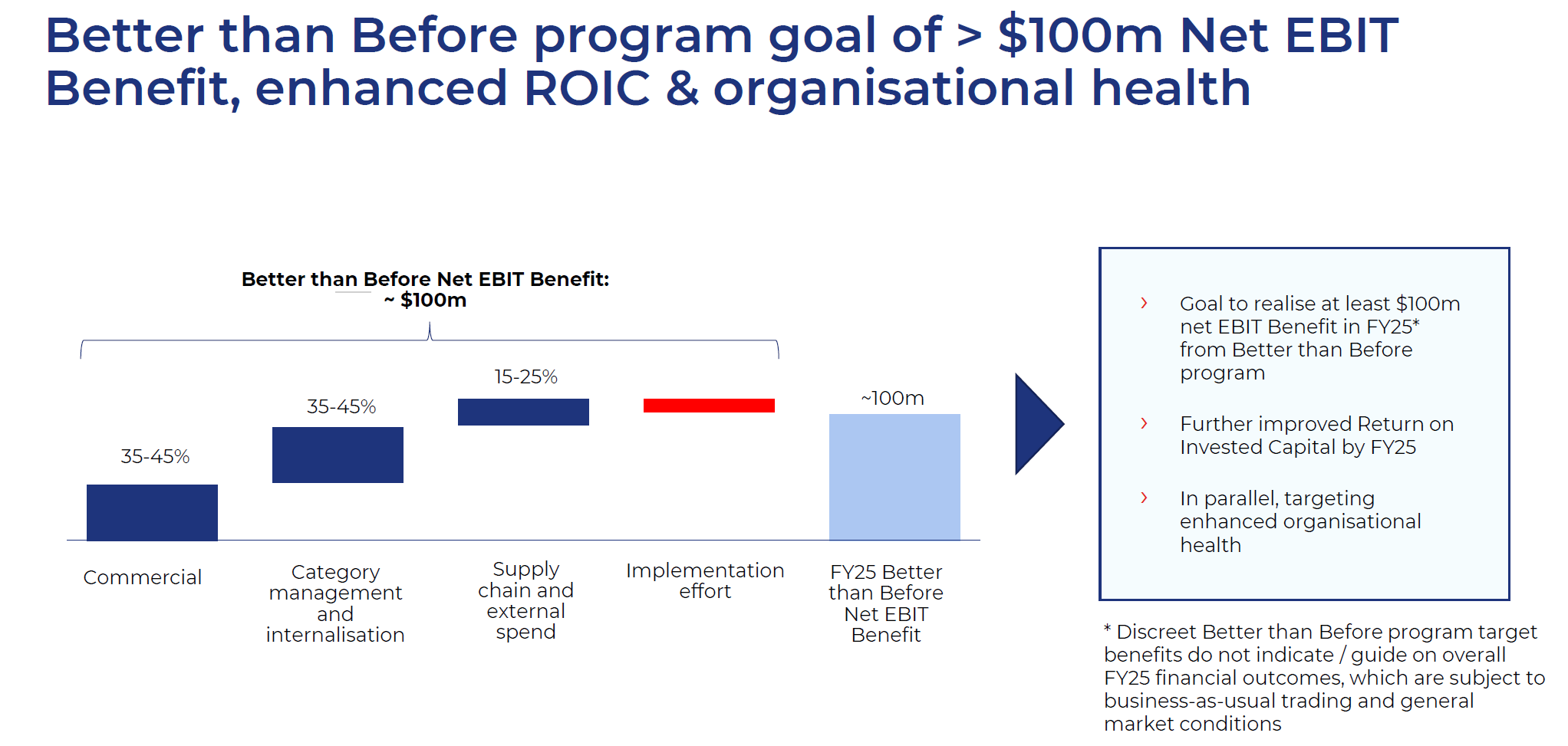

The aim of these efficiency improvements is to add $100m in EBIT in FY25, although the build-up to this will be:

- FY23 - upfront costs only partly offset by benefits in FY23 (a $20m opex hit)

- FY24 $20-30m EBIT delivery; and

- FY25 +$100m EBIT.

(Having spent some of own my career involved in and studying operations improvement, this is a reasonable even ambitious profile.)

The main components are shown below. NOTE: EBIT was $206m in FY22.

Now, many of us will be sceptical. After all, studies show that most transformation programs don’t deliver their targets and, even if they do, gains are often not sustained. But I am prepared to give $BAP management a better than even chance. Their basic function is to buy stuff, move it, sell it, and get it to customers. So, they need to be excellent at logistics. The ongoing programs to develop the two centralised DCs are already well-advanced (DCV up and running and teething problems largely sorted out, and DCQ on track, with opportunity to learn from DCV experience). They now must upgrade the systems to take the friction out of their internal and external supply chain. This is a much more well-worn path than say 10 years ago, and Noel has strengthened the management team in this area.

$BAP is now entering a more mature phase in its growth. ANZ is a maturing business, and Malaysia still remains just a growth option (given there are only 6 outlets to date). What is encouraging is that $BAPs future growth is now not going to be driven by 5-year new store targets. They are taking a more capital disciplined approach to investing only in proposals for new locations from the individual business units where they can get the returns. Given their footprint and the market maturity, this is good news. They will be much more focused on the quality of locations, refits/upgrades and focused on where new stores can take share from competition.

As part of developing the strategy, Noel and members of his team visited O’Reilly Automotive ($ORLY) the market leader in the USA, with more than 10x the scale. (So on a comparative basis it is the $BAP of the USA.)

By comparison $ORLY achieves ROA of 19% ($BAP 7%) and Net Margin of 15% ($BAP 6.8%). While Noel stated that they wouldn’t close the gap to $ORLY – which has much greater scale advantages – it is a benchmark they are learning from and it gave them confidence that their targets are achievable. ($ORLY achieves c. 12% earnings growth p.a. over the last 5 years.)

Analysts have updated as follows:

- Citi has upgraded target SP from $7.82 to $7.96, noting the transformation target is higher than they expected but comments on headwinds in the current macro environment

- Morgan Stanley revised SP target down to $7.00 from $7.20, focusing on the -$20m opex hit to FY23 from the transformation, and noting the reference to softening trading conditions since the AGM.

- Credit Suisse have increased TP from $6.60 to $6.80, crediting 60% of transformational benefits, 100% of the costs, and noting commentary on increasingly difficult trading environment.

- Macquarie has increased price target from $8.85 to $9.70, incorporating the program costs and benefits. (Note: compares to my upside case of $10.06)

As is the case more generally in the retail sector, SP’s are being held back by the macroeconomic conditions, with rising interest rates impacting consumer spending and business confidence. There were several references to this during the day, and it sounded like FY23 is not tracking all that strongly. However, Noel noted that when consumers slow their purchases of new vehicles it accelerates the ageing of the “car park” which over time is good for them. In addition, a lot of their spend is not really discretionary. If an owner tightens their belt for a year or two, the maintenance still has to be done and might cost more if deferred.

Looking longer term, Noel also showed current projections for EV penetration, which is widely considered to be a head-wind for $BAP. It is still several years before this meaningfully starts to impact the total fleet in Australia. Meanwhile, $BAP are working to figure out how to adapt. For example, while EVs require fewer parts and maintenance compared with IC vehicles, new categories of spend will emerge, such as charging cables. So, while it is definitely an issue to monitor, I wouldn’t write them off yet.

In closing, yesterday we got to see Noel’s refreshed management team – some long term $BAP team members and some new recruits with relevant experience for the challenges ahead. I am encouraged both by the commitment to operational capability and efficiency and to capital discipline. They've stuck to their core vales and overall strategy.

On an undemanding forward PE of 16.2, there is significant opportunity to outperform if the new team can execute. Equally, with the risk of macro-headwinds, softer FY23 trading conditions, and increased costs partly due to transformation as well as inventory levels still high due to supply chain issues, there is the risk of a disappointing FY23, which might be only partly reflected in the SP. So I am not a buyer today.

I remain a holder for now, because this is a strong business that is investing in its core capabilities with opportunities to continue to grow share through good customer service and competitive pricing. But the new management team need to prove themselves, so I can no longer say $BAP is a high conviction holding. For yesterday, at least, there were no mis-steps.

Valuation

I start with today’s SP of $6.68 and forward PE of 16.2. Assuming average annual earnings growth of 7% (pre-cost savings), then add 50% of the targeted EBIT benefit by FY25, at a PE of 17, I get FY25 SP of $9.29, which discounts back 2.5 years at 10% to $7.32.

If they deliver the full target benefits of $100m EBIT, then today’s value per share is $8.55 or if PE expands to 20, then it would be $10.06.

Of course, if earnings underperform consensus in FY23, there is further downside risk, which could offer an attractive entry point if it is driven by macro conditions and not the team's ability to execute.

On balance there is enough upside potential within management's control that $BAP remains interesting to me.

Disc: Held in RL only.

(I only hold companies on SM that are yet to prove themselves)

Bapcor Limited ASX:BAP

- Steady car and trucks parts business - operates mainly in Australia, but has international operations in NZ, Thailand. Acquired 25% of Singaporean listed entity Tye Soon, giving them indirect exposure to the Singaporean, Malaysian and Korean market.

- >90% of revenue derived from their Trade and Specialist Wholesale divisions - which are non-discretionary in nature (evident through Covid - saw record financial performances across all segments).

- Listed in 2014, and has since performed steadily. Operating on 46% gross margins. Consistent share count. Current ratio 1.9x, Quick ratio 0.6x, total debt/equity 41%.

- ROE and ROIC > 10% consistently.

Growth outlook

- Long term CEO Darryl Abotomey has just announced that he is retiring in Feb 2022, but will stay on to June 2022 to help with transition. He has been with Bapcor since 2011, overseeing their listing and taking their company on this steady growth journey. He still holds 1.4m shares. Quite a surprise announcement, considering the board extended his contract to 2023 just a few months prior.

- From what I can see, management has focused on the longer term and have proven to be nimble operators. Many initiatives to consolidate their position as the leader parts distributor in the region include:

- Growing store footprint, growing online offering and increasing store white label products (aiming for 40%)

- Leveraging group logistics capability and store networks (probably one of their biggest competitive advantage)

- Utilising scale to deepen supply relationships

- New Tullamarine distribution centre - much more efficient, and will reduce operating costs significantly in the long run. Plans to build a similar facility in Brisbane in the near future.

Thoughts

- BAP is one of the first companies I bought years ago, and one of my larger holdings in RL. Consistent, reliable, resilient business - not a sexy business, just one trucking along year after year. They have benefited from Covid, through increased second-hand car sales and more people doing local road trips / driving to work. As the economy reopens, I think certain parts of this business will be negatively impacted but I believe this company is worth holding for many years to come. I am confident management will rally around whoever comes in to take over from the retiring CEO.

BAP is an auto parts distributor and retailer. BAP is predominately Aussie based, but has started expansion into SE Asia. BAP has an exceptional CEO, Darryl Abotomey.

The obvious threat to BAP is electric vehicles (EVs). However, for the bulls, articles and research such as here and here, show Aussies are slow up-takers of EVs and even if there was a huge up-take, there are plenty of second hand vehicles to keep BAP producing profits for a many years (at least 10).

BAP is boring, but beautiful. It continues to compound quietly away in the background. Maybe no longer a small-cap and of interest to Straw-people whom crave excitement and risk… but may be of interest to those who want less risk.

[disc: I hold in RL]

Bapcor Announces Expansion In Asia Through Agreement to Acquire 25% Of The Issued Equity Of Tye Soon Limited

Bapcor Ltd is pleased to announce that it has signed agreements to acquire 25% of the issued equity of Tye Soon Limited, a company listed on the Singapore Securities Exchange.

Tye Soon was established in 1933 and is the most prominent independent automotive parts distributor in South East and North East Asia, distributing a wide range of genuine parts and aftermarket parts. The group’s main markets are served by its operations in Singapore, Malaysia, Thailand, Hong Kong, South Korea and Australia. Partnering with its principal suppliers from Europe, Japan and Korea, the group has one of the largest portfolios of top-tier global brands of automotive parts.

Tye Soon’s annual revenue is c. SGD 200 million across;

- Malaysia $43m 15 locations

- South Korea $43m 20 Locations

- Australia $42m 20 locations

- Singapore $19m 2 location

- Thailand $13m 1 location ? Other countries $40m

Bapcor CEO & MD Tenure Extended The Board of Bapcor Limited is pleased to announce that Darryl Abotomey, Chief Executive Officer and Managing Director has agreed to extend his tenure to 31 October 2023.

Darryl has been CEO and Managing Director of Bapcor since September 2011.

Bapcor’s Chair, Margie Haseltine said “We are delighted that Darryl is extending his leadership of Bapcor through to October 2023. Under Darryl’s guidance Bapcor has been one of the top performing ASX listed companies since it listed in April 2014, going from strength to strength, year after year. Bapcor has a clear 5-year strategic plan including specific targets, with many of the projects underway and which will be brought to fruition during Darryl’s remaining tenure.”

Bapcor has provided another trading update, revealing a 26% jump in group revenue for the 5 months to the end of November.

For the firsty half the business expects at least 25% top line growth but a 50% jump in NPAT due to operating leverage resulting from lower costs and the contribution from Truckline.

Bapcor noted that broker consensus forecasts for FY21 NPAT of between $110-115m "did not appear unreasonable".

That translates to ~33c EPS for the full year, and puits shares on a forward PE of 22 (using last close of $7.31). Investors can probably expect a 2.5% ff yield.

For a business that I expect can deliever upper single digit growth in the coming years, that seems undemanding. Especially in this low rate environment.

ASX anouncement here

Just in from The Australian

Bapcor hires McKinsey for strategic review

Bapcor hires McKinsey & Company for a strategic review, say sources.

McKinsey & Company is a global management consulting firm that offers professional services to corporations, governments and other organisations.

More to come

Disc: Held IRL

Thoughts for discussion on $BAP Forum

Hot on the heels of scuttlebutt about a possible tilt to take over BAP (intrigue deepened by the possibility that the cast aside former CEO might be involved in an offer), announcement today of the appointment of Noel Meehan as CEO. Has been acting as CEO since the dramas of late last year and CFO since 2020

Article in The Australian today that the vultures are circling BAP. The article says BAP has received two buyout proposals since December but the Board says it has received no bids... ahhh the games people play.

Share price hasn't recovered to its previous heights after the dramatic fall when the Board ousted the long-term successful CEO.

Article here --> https://www.theaustralian.com.au/business/dataroom/two-bapcor-bids-as-suitors-circle/news-story/88154b28b774c029d4ccd00a3061b816

Bapcor has released a trading update for the first quarter of FY21, which (remarkeably) have shown a 27% lift in revenue despite Government imposed restrictions in Auckland and Victoria.

Indeed, it was the retail segment that saw the biggest lift, with revenue up 47% thanks to an especially strong result for company owned Autobarn stores.

Bapcor is very well placed for a strong 1st half, but didn't give any full year guidance given the uncertainties that remain.

You can read the ASX announcement here

Bapcor (ASX:BAP) had a decent result all things considered.

- Revenue up 12.8%, or 7% excluding acquisitions

- NPAT down 5.5% to $89.1m, or 30 cents per share, proforma. (added provisions, promotions and new store costs appear to account for drop in net margin)

- Final dividend mainatin, with FY payments up 2.9% to 17.5c per share

- Burson trade same store sales up 6%, with record sales for 70% of network

- NZ the hardest hit due to lockdowns, sales down 5.2% and EBITDA down 14%. Sales down 80% at peak of lockdowns, but June levels ahead of where they were in February.

- Specialist whole saw a 26% boost to revenue thanks to acquisitions, but organic growth was 5.5% at the top line. EBITDA was down 7.1%

- Retail was surpringly strong -- I guess as we've seen elsewhere, consumers have continued to spend on discretionary items (so far) -- with a 14.7% lift in sales and 12.8% lift in EBITDA (record levels). As has been the theme for retailers, the online component grew strongly; up 240% for the year. May and June up 400% (!)

- Retail same store sales 9.5% up for the year

- Balance sheet in a very strong position following the capital raise. Burson has $126m in cash. Net debt is $109m

- 5 year targets unchanged (and, if realistic, show a lot of further growth potential. See attached presentation)

On these latest figures, at at the current market price, Bapcor is on a P/E of 22.2, with a yield of 2.6% fully franked (or 3.7% grossed up)

Results presentation is here