Good results which the market has reacted well to [ASX announcement]. Key takeaway from this and investor presentation, for me, is the unexpected reduction in net debt. Prudent management in uncertain times.

Of course, if I owned the lot I reckon I’d have taken the $30 million in dividends and just rounded up that yearly debt repayment to $90 million. But, we all know Australians love their fully franked dividends — especially in this sort of space.

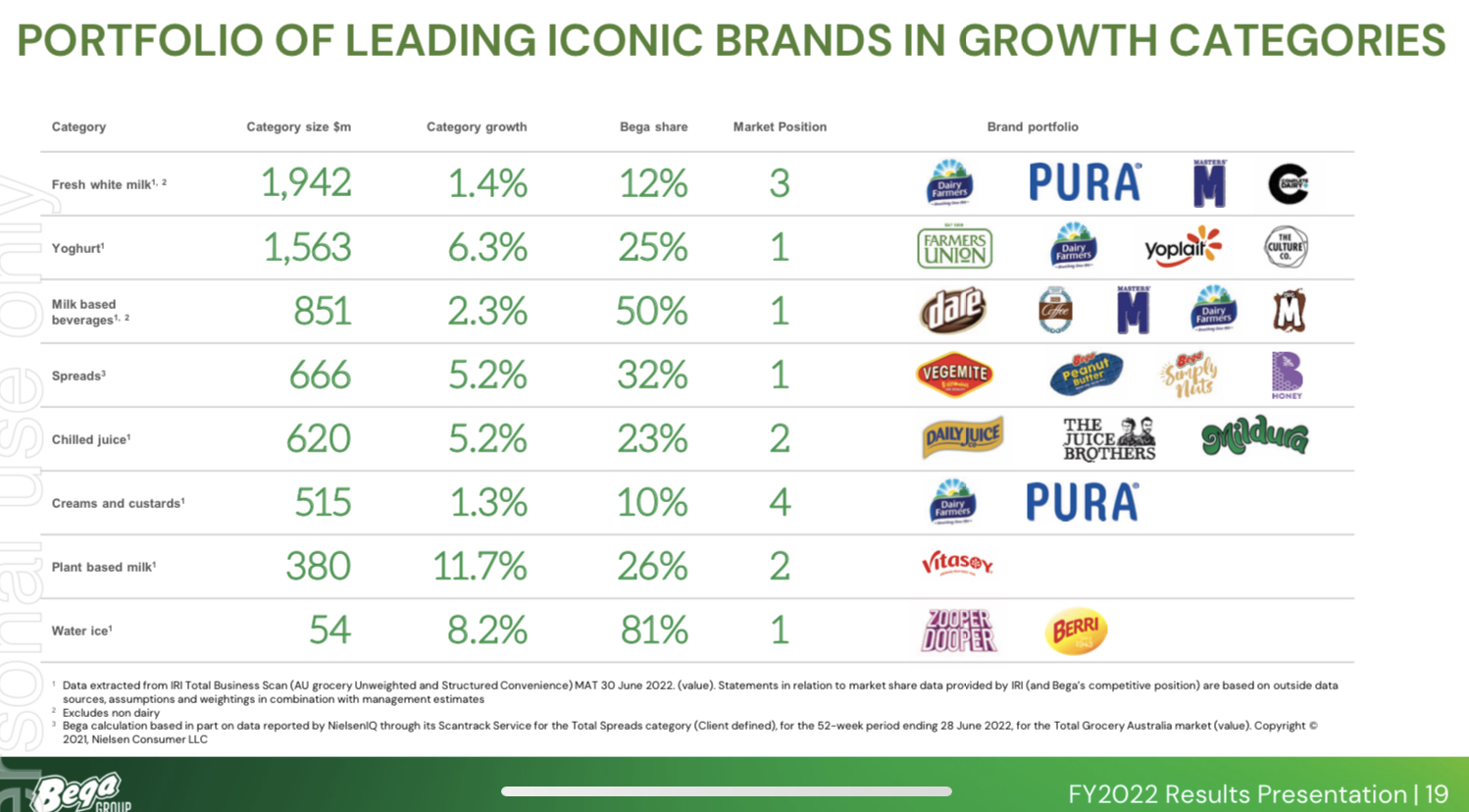

Meanwhile, Bega also appears to be transitioning nicely into a branded products company. This is especially good to see the potential for some resilient pricing power in such a low-margin industry — particularly because of the remaining debt on the books. It also shows Bega achieving some diversification away from the cyclical dairy/milk market.

This will present its own challenges of course. I mean how long can we really expect Australians to tolerate our ‘Master-of-the-Universe’ style domination of the supermarket lolly-ice water market? Surely, soon enough the man is going to have to come after us with anti-trust suits like we are Bill Gates in the late 1990s.