Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

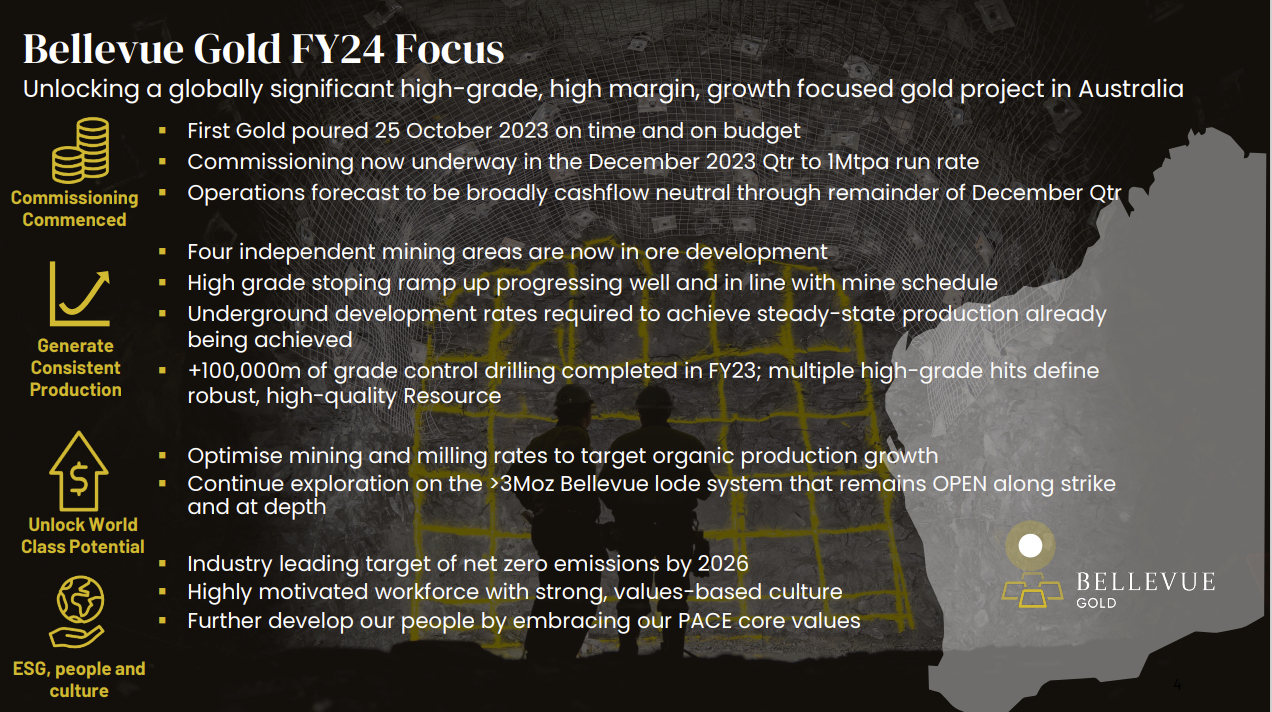

28-Jan-2024: Bull Case straw for BGL - I added them to my SMSF on Thursday (25th Jan 2024).

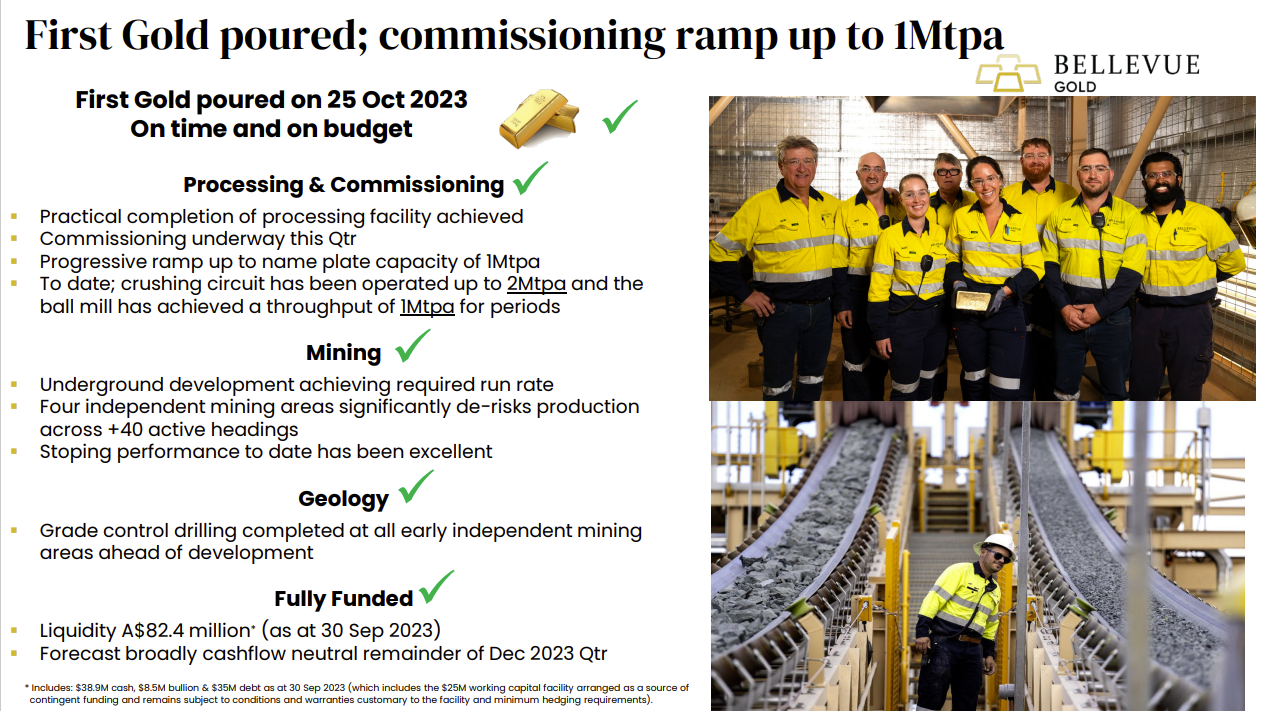

The SP has come down ~30% from a high of $1.84 in early December to $1.29 in late January. The company is going through the commissioning phase and ramping up the Bellevue gold mill to nameplate capacity currently, and the December Quarterly Activities Report will be telling in terms of how smoothly that has been going. That should be lodged by BGL to the ASX's announcements platform during the next three business days (the last 3 in January - and January 31 is their deadline for lodging that report). If things are going badly, then the share price will go even lower, but if things are going alright I reckon we could see some upside from here.

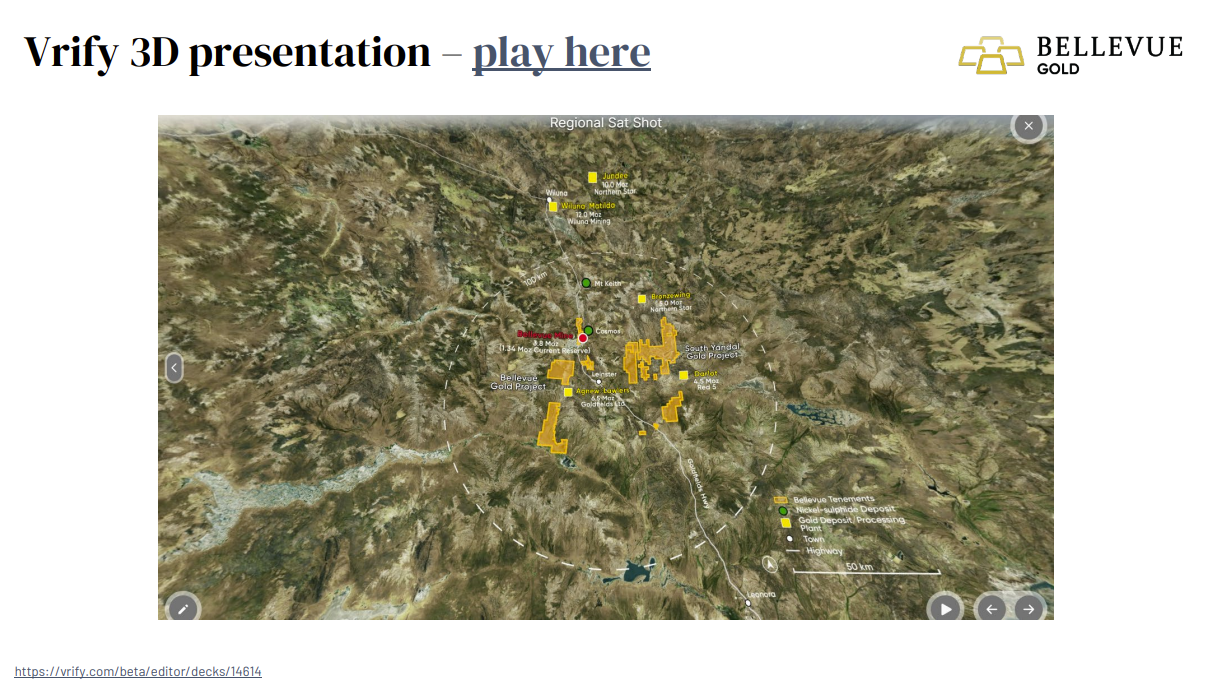

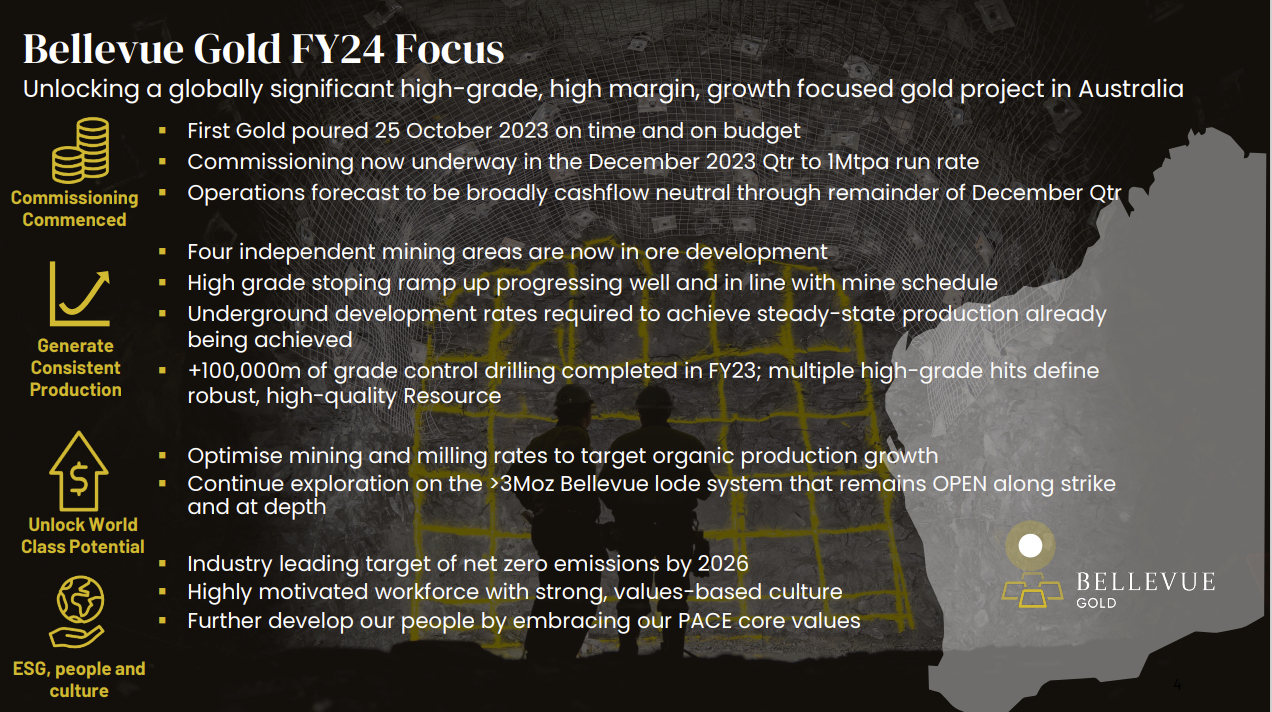

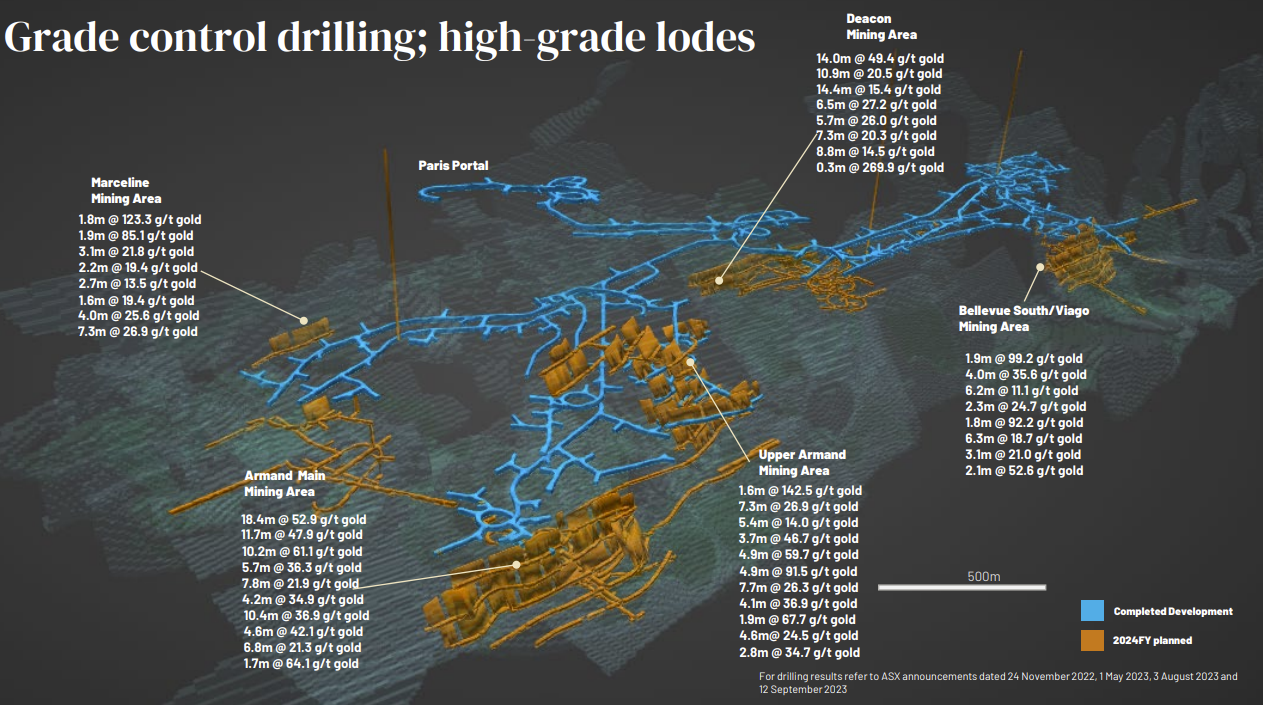

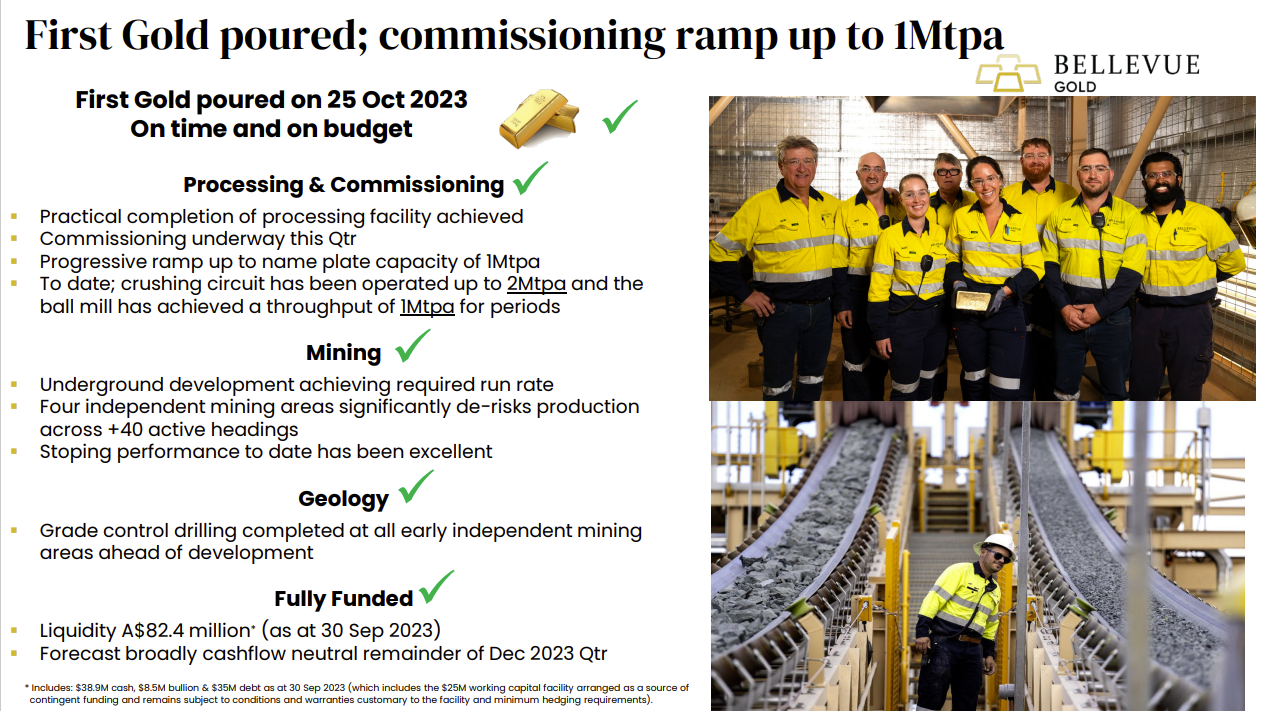

The following slides are from their November East Coast Roadshow Presentation slide deck:

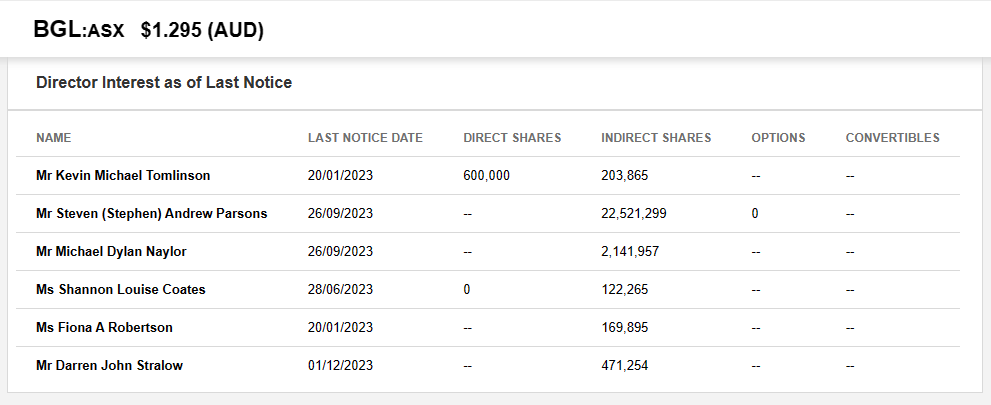

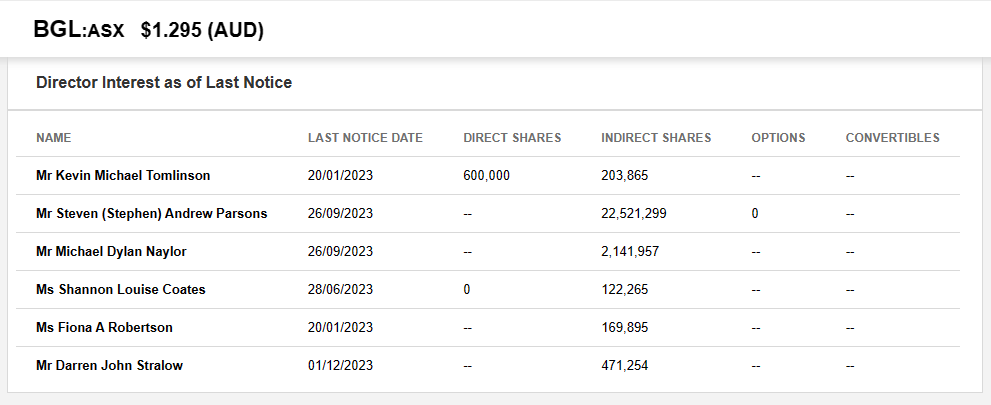

Some skin in the game - some more than others, but all directors own some shares:

Bellevue (BGL) currently have three substantial shareholders:

- 15.16%, Blackrock, the world's largest asset managers, they own and manage iShares ETFs and their IAU iShares Gold Trust ETF has US$25.6 Billion in AUM and their IAUF iShares Gold Strategy ETF has US$34.5 Billion in AUM.

- 5.71%, Van Eck, another ETF provider, Van Eck specialises in mining and materials ETFs and they have their NUGG Physical Gold ETF as well as their global gold miners ETFs, GDX (VanEck Gold Miners ETF, with US$11.4 Billion of FUM) and the US-listed GDXJ (VanEck Junior Gold Miners ETF, with US$3.8 Billion of FUM, available through NYSE Arca - or NYSEARCA - which is an electronic communications network - or ECN - used for matching orders - rather than a physical stock exchange.) and GDXJ holds BGL.

- 5.03%, Vanguard, the OG of ETFs, Vanguard's founder Jack Bogle is credited with inventing Index Funds (ETFs), and Vanguard have included BGL in at least two of their ETFs - see below.

According to https://fintel.io/so/au/bgl, "Bellevue Gold Limited (AU:BGL) has 63 institutional owners and shareholders that have filed 13D/G or 13F forms with the US Securities Exchange Commission (SEC). These institutions hold a total of 266,994,874 shares. Largest shareholders include AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Gold & Special Minerals Fund Class C, INIVX - International Investors Gold Fund Class A, GDXJ - VanEck Vectors Junior Gold Miners ETF, SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, FKRCX - Franklin Gold & Precious Metals Fund Class A, PRAFX - T. Rowe Price Real Assets Fund, Inc., ASA Gold & Precious Metals Ltd, Dfa Investment Trust Co - The Asia Pacific Small Company Series, and VTMGX - Vanguard Developed Markets Index Fund Admiral Shares."

From Bellevue's own website: (https://bellevuegold.com.au/)

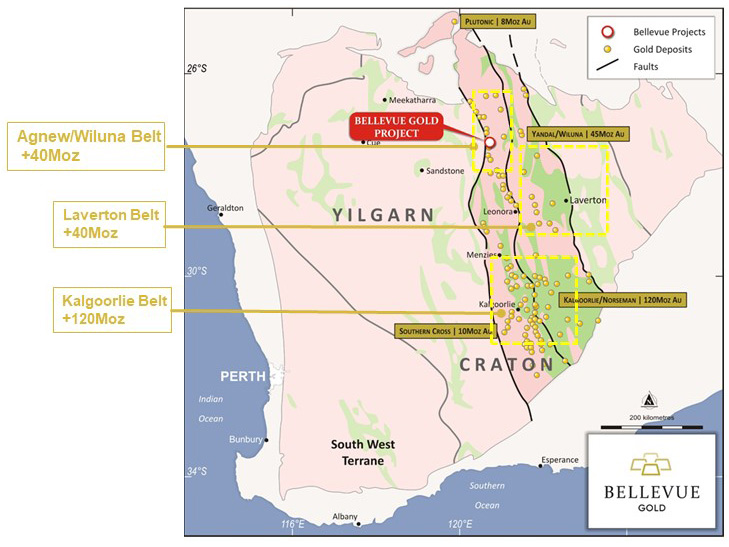

Bellevue Gold Limited is an Australian Securities Exchange (ASX) listed company developing the high-grade Bellevue Gold Project. The Project has a current global Mineral Resource of 9.8Mt @ 9.9 g/t gold for 3.1 Moz, including a Probable Ore Reserve of 6.8 Mt @ 6.1 g/t gold for 1.34 Moz, making it one of the highest grade gold discoveries in the world and the highest grade gold development project in Australia.

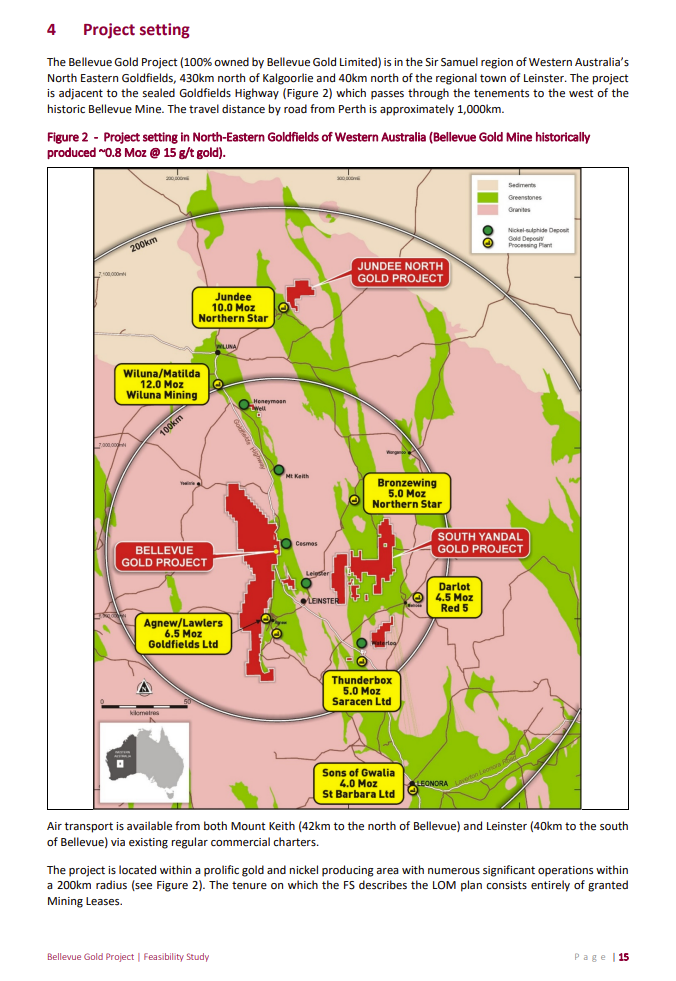

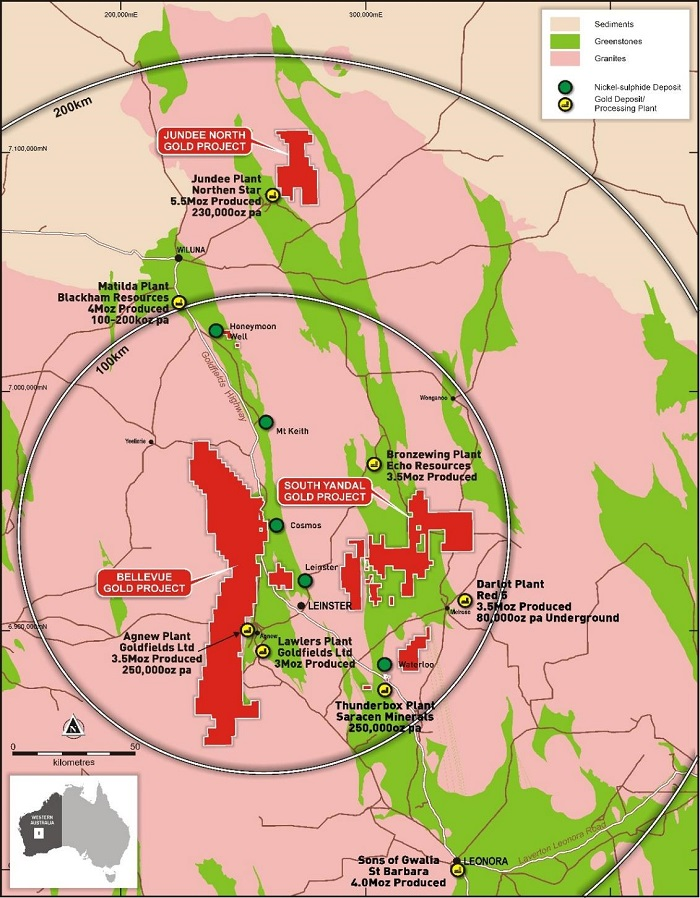

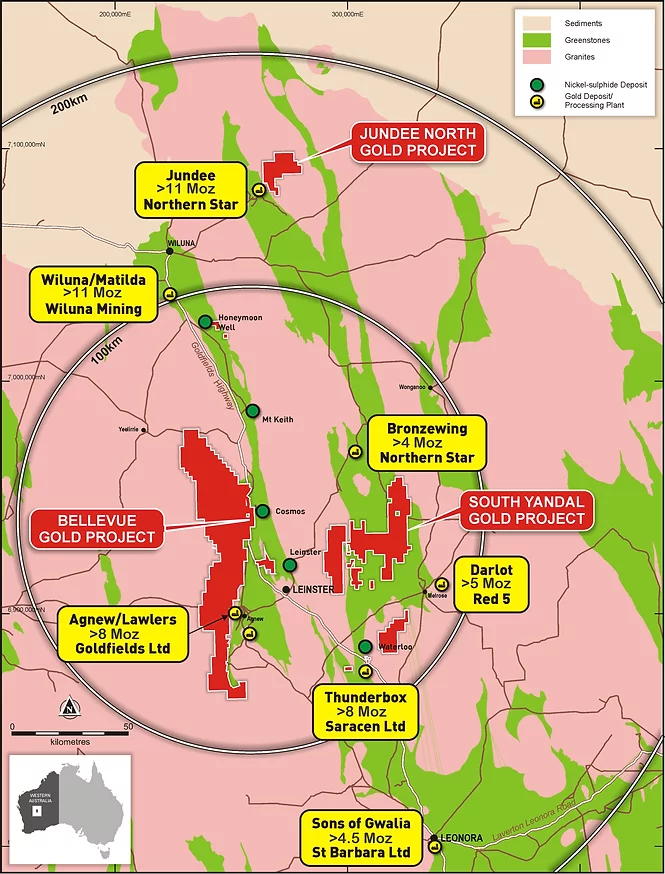

The Project is located 40km to the north west of Leinster in the Goldfields region of Western Australia and sits in a major gold and nickel producing district with mines such as Jundee (ASX:Northern Star), Agnew & Lawlers (Goldfields), Darlot (ASX:Red 5), Bronzewing (ASX:Northern Star), and Thunderbox (ASX: Northern Star) all in close proximity.

The Company has a highly skilled Board of Directors and Management team with a track record of discovery success and corporate growth and a strong supportive global institutional shareholder base.

--- end of excerpt ---

So, looking at all of that, including the number of ex-NST people at BGL (their MD & CEO, their COO, their CFO and their Chief Sustainability Officer and Head of Corporate Development all worked previously at Northern Star Resources, as I have highlighted about 8 images up), and the fact that their Bellevue Gold Project is located in close proximity to three of Northern Star's mines (Jundee, Bronzewing and Thunderbox) and also close to Red 5's (RED's) Darlot satellite underground gold mine (that helps feed RED's KOTH mill), I think it's fair to assume that there MIGHT be some M&A down the track... Economies of scale and all that. NST acquires BGL, or RED acquires BGL, or BGL acquires RED, something along those lines - I would prefer BGL to be a target than a hunter, but that would of course depend on the prices paid at the time.

Source: Bellevue Stage One FS (feasibility study) 18-Feb-2021

That map above is nearly 3 years old, so there have been some changes, including Gwalia now being owned by Genesis (GMD) instead of St Barbara, Thunderbox now being owned by NST (after the Saracen-Northern Star merger), and Wiluna Mining (formerly known as Blackham Resources) going into voluntary administration in July 2022, with mining ceasing in December 2022 and final ore processing completed in February 2023.

https://bellevuegold.com.au/bellevue-gold-project/

I'm heading back over there in a couple of weeks for a few days - to the SW of WA, SW of Bunbury. Flying, not driving, to Perth, then driving, so won't be going through the WA goldfields.

Source: Bellevue Gold Project (gres.com.au) [GRES = GR Engineering Services, GNG.asx, who I also hold shares in]

See also: Project_Focus_-_Bellevue_Gold_Project.pdf (gres.com.au)

Source: Bellevue Gold Project, Australia (mining-technology.com)

Source: https://247solar.com/bellevue-gold-mining-raises-the-sustainability-bar/

Not all positive unfortunately:

Bellevue Gold: Bellevue Gold Limited fined $41,000 after it left 'visible salt scar' (9news.com.au)

https://www.wa.gov.au/government/announcements/gold-miner-fined-hypersaline-spill-0

(21) Bellevue Gold Limited: Overview | LinkedIn

Investor Centre | Bellevue Gold | ASX:BGL | Australia

Disclosure: Despite getting pissed off with management in December 2022 when they said they didn't need to raise capital and then promptly did a CR (including an SPP) when the share price rose... I have now taken a fresh look at the company in the new light of their current position and the substantial de-risking of their Bellevue Gold Project which is nearing the end of the commissioning phase now and should be approaching nameplate capacity if things are going OK, so looking at BGL as a gold producer now who should be a top 20 Aussie gold producer, so not large, but not insignificant either, and as potentially one of the more profitable ones in the future based on those high gold grades they keep finding, I'm back onboard BGL. Bought some in my SMSF on Thursday (25th Jan 2024).

08-Mar-2021: I think they were heading over $1.50 before the gold price fell away, however even at a lower A$ gold price, I still think BGL are worth between $1.35 and $1.40/share, based on their high grades and projected low costs at Bellevue and also because they are going to get Macmahon (MAH) to do the mining for them and GR Engineering (GNG) to build the processing plant. I hold MAH and GNG and they are both the best at what they do, especially here in Australia, which is where the BGP (Bellevue Gold Project) is - in the goldfields north of Kalgoorlie in WA. I've put a lot more detail in a "Bull Case" straw, which was copied from one of my "Gold as an investment" forum posts. I bought a small position in BGL this afternoon, and also added them to my Strawman.com scorecard again.

They are speculative, because they're not yet producing any gold. They will have no income other than from bank interest and capital raisings until they get to production, and they haven't started the plant construction yet - they are still at the FS (feasibility study) stage currently.

07-Sep-2021: UPDATE: $1.37 is a fair way above where BGL are today, however they got there in November and again in December, and I reckon they'll be back up there again soon enough. This is one I do hold in RL as well as being in my SM PF.

BlackRock (the world's largest fund management group) increased their stake in BGL in July from 12.86% to 14.28%, and back in December Van Eck increased their BGL position from 6.43% to 9.78% of the company. The Bank of Nova Scotia (in Canada) also own 12.86% of Bellevue Gold (increased in June from 11.75%), so there are some heavy hitters on the register. Those three alone own a total of 36.92% of BGL.

Four days ago, on 03-Sep-2021, BGL released an announcement titled, "Bellevue Gold fully funded into production" - see here: https://wcsecure.weblink.com.au/pdf/BGL/02417370.pdf

Here's a snippet:

Bellevue on track to become a significant Top 20 Australian high-grade gold producer following successful completion of $106M Institutional Placement

Raising covered multiple times over after Stage Two Feasibility Study forecasts the Bellevue Gold Project to rank among the world’s leading gold projects based on the key criteria of grade, production, location and free cashflow generation

Bellevue Gold Limited (ASX: BGL) is pleased to announce it has received firm commitments for a $106 million fully-underwritten share placement (Placement) to institutional investors at $0.85 per share.

Proceeds of the Placement, together with the $200m debt facility, will be used to fund the development of the Bellevue Gold Project in Western Australia (refer to ASX announcements dated 2 September 2021).

There was strong demand for the Placement from both domestic and offshore institutions with bids covering the Placement amount by multiple times.

Bellevue Managing Director Steve Parsons said: “The strong demand from institutions around the world reflects the quality of the Bellevue Gold Project, the exceptional free cashflow generation forecast and the immense potential for further growth."

"With the project fully-funded to production, we will proceed full-steam ahead with development while maintaining a strong emphasis on further growth by increasing and upgrading the Mineral Resources and Ore Reserves."

“The Stage Two Feasibility Study is based on a Resource of 1.5Moz, which represents just half of the total 3Moz Resource base at Bellevue. We have already announced a host of high-grade drilling results outside that Resource, we have another 14,000 samples awaiting assay and there are now two rigs drilling from underground."

“This multi-pronged approach to expanding the Resource is aimed at growing the mine life, which will increase the already-strong financial results forecast in this Study.”

--- end of snippet ---

Disclosure: I hold BGL shares. They have to be viewed as speculative because they are a gold project developer, not an established gold producer. However their project is excellent, they have very good economics (high grades, easy and cheap enough to process the ore) and they are now fully funded through to production. They also have some top quality companies lined up to build the plant and do their mining for them (GNG & MAH) as I mention earlier (above). I hold shares in those two also.

11-June-2022: Update: Raising PT to $1.48 as I believe the BGP is now substantially de-risked and they have the funding sorted, so Bellevue Gold (BGL) should be able to put on around +50% from their recent $1 high IMO once the they get close to gold production (in 2023).

Meanwhile, Bill Beament's new mining services company Develop Global (DVP) have managed to snatch the Bellevue mining contract away from Macmahon (MAH) who had earlier been named as the future underground miners for BGL at the BGP. I hold shares in BGL, DVP and MAH and I'm not too fussed about that change of direction from BGL - MAH have plenty of ongoing work to keep them busy, with most of it being copper/gold mining or gold mining for other clients. DVP are just starting out in the mining services game, however I have enough respect and confidence in Bill to believe he isn't going to undercut a company like MAH just to get the Bellevue contract and then lose money on it. Bill held an executive position within an underground mining services contracting company before he ventured into actual gold mining with NST (Northern Star Resources) which he built up from nothing to become Australia's second largest gold miner and one of the world's top 10 gold miners. He's certainly no stranger to underground gold mining.

It's all good!

Our Core Values | Bellevue Gold | ASX:BGL | Australia

07-Dec-2022: Update: In light of BGL saying a week ago (in their presentation to the 2022 Macquarie WA Forum) they were fully funded through to production with $277.3m of liquidity and the plant now 69% complete as well as stating that their "pre-production expenditure status is ~90% contracted and long lead items are ordered"... and then having their share price rise from below $1 to above $1.20 on the back of that... and then (one week after saying they were full funded) they announce a raising at $1.05/share - see here: Progress Update and Capital Raising Presentation - I'm now lowering my "valuation"/price target for BGL down to that $1.05 capital raising level, because announcing this raising is drawing the SP down to that level naturally.

Management credibility is not good. You can no longer trust these people. Plenty of opportunities out there. I prefer those where the management tell shareholders the truth, mean what they say, and do what they say they will do.

I sold more than half of my BGL here on SM today (from 1,700 shares down to just 700 shares), and I only hold 1,000 BGL shares IRL, so just over $1K worth, so my exposure to BGL is not material at all. I have much greater exposure to better quality companies, including a number of better quality gold companies.

I will not be participating in this SPP at $1.05.

I've posted a straw about this BGL CR here earlier tonight.

28-January 2024: Update: Yeah, I cracked the sh!ts with Bellevue back in December 2022 after that capital raise and sold out here at the time, then sold my real-money portfolio BGL shares at $1.15 in early Feb 2023. However, last Thursday (25th Jan 2024) I bought back in - and I hold them once again this time in my SMSF.

I'll post a Bull Case on them, but in summary I've had a fresh look at the company and I've decided to get back onboard based on their high grades of gold and because I reckon their management (many of them ex-NST) have the experience to get their plant through this commissioning phase without too many more cost or time blowouts and run it without losing money (remain "broadly cashflow neutral") during the ramp up as they have stated they would:

Source: East Coast Roadshow - Bellevue Gold - In Production - 13th November 2023

See: Company Overview | Bellevue Gold | ASX:BGL | Australia

Some skin in the game; some more than others:

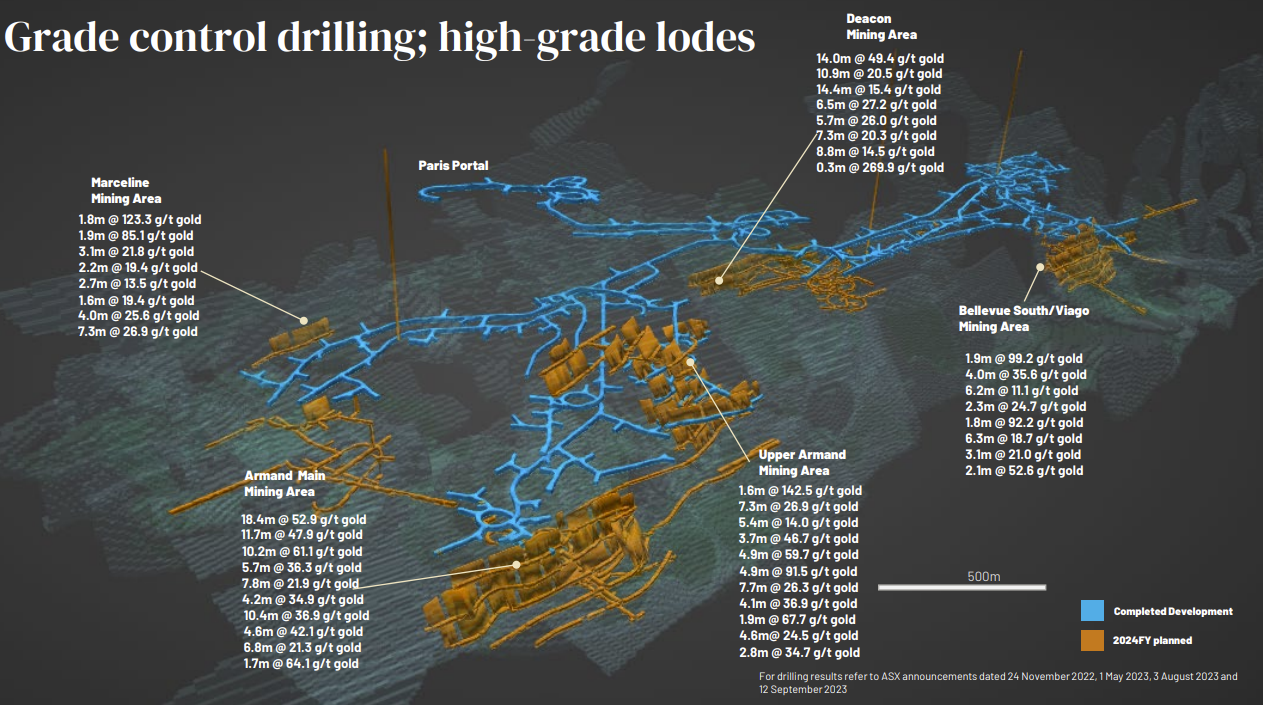

High Grades!!

And a decent Mill:

There's a lot to like, even if I don't fully trust management any more, especially when they are talking about not needing to raise capital...

The change for me is that that Bellevue as a gold project is largely de-risked now - they should be able to complete this commissioning phase and ramp up the plant. The risk if of course that they encounter problems and have to downgrade guidance and they'll get smashed again if that happens, but looking at their recent share price movement there's a fair bit of negativity already baked in I reckon.

They've come down by ~30% - from a high of $1.84 in early December to $1.29/share now. Looks like a decent entry point to me. It's above where I sold out around a year ago (@ $1.15/share IRL), but not too much above, and certainly a lot lower now than where they were 6 or 7 weeks ago.

Their not going to be a big gold player, not with just the one mine, they're going to be a top 20 Aussie gold producer which means one of the smaller ones, but also one of the more profitable ones I'm thinking, if this plays out as I expect (and hope) it will.

03-Aug-2023: Exceptionally-high-grade-infill-drilling-results.PDF

BGL (Bellevue Gold) is a company I've held before, and I've also been critical of management, particularly when they said they were fully funded through to production and then announced an opportunistic CR within a few weeks when the share price was up on a couple of positive announcements. Being able to trust management is usually a prerequisite for me in terms of one of the boxes that I need to tick before investing in a company (or speculating more than investing with a company that is burning through cash but should become a profitable gold producer shortly). Trusting management often boils down to whether they do what they say they are going to do, and saying they are fully funded through to production sends a clear message to the market (and their investors in particular) that they will not be raising more capital, at least for the next few months, and they said that, and then did a raising shortly afterwards, so a big "Fail" on that score for mine.

I'm not against capital raisings, indeed they are often necessary and expected, and can be a good way to increase your exposure to a good company - if the CR is extended to ALL shareholders rather than just an elite group (such as a placement). However, unexpected CRs force existing shareholders to stump up more cash or be diluted (i.e. make your existing holding worth less, as it's a lesser share of the company because the company has issued more shares), and we make our investing decisions based on a number of assumptions, and we have to make those assumptions based on what we know, which includes what the company's management has told us, so when they say one thing and then do another, that's not good at all.

All that said, BGL is finding some VERY good grades of gold at the minute. Have a gander at these numbers:

When you have companies that are profitable mining gold with ore that contains only 1 (one) gram of gold per tonne of ore, these results, which range up to 99.2 grams/tonne, suggest a very high grade deposit indeed.

So I guess that's the positive with Bellevue - they have some great grades which should result in lower costs and higher profits, when they get around to processing that ore. Maybe it's like that famous Tiger Woods quote, "Winning takes care of everything."

Maybe...

Disclosure: I do not hold BGL shares at this time.

28-April-2021: Quarterly Activities Report

March 2021 Quarterly Report

Highly successful quarter sets up Bellevue to be a high-grade, long-life producer

Stage One Feasibility Study completed; Subsequent Global Resource increase to 2.7Moz at 9.9g/t, including Indicated Resources of 1.2Moz at 11.0g/t gold paves way for potential growth in production and project economics as part of Stage Two Feasibility Study in progress.

Further drilling underway aimed at increasing and upgrading Resources at Marceline, Deacon North and the open pits for inclusion in Stage Two Feasibility Study.

KEY POINTS

- Stage One Feasibility Study delivered; key findings include:

- Bellevue Gold Project expected to be ranked among Australia’s Top-25 gold mines based on annual production

- Forecast to be one of the most profitable gold operations in Australia based on a Life of Mine (LOM) EBITDA Margin of 63% (based on gold price of A$2,300/oz)

- Initial projected mine life of 7.4 years

- Average annual production of 160,000oz in years 1 to 5 and a LOM average of 151,000ozpa

- LOM AISC costs of $1,079/oz

- Maiden Probable Ore Reserve of 2.7Mt at 8.0g/t gold for 690,000oz (based on a gold cut-off grade price of A$1,750/oz)

- LOM Mineral Resources and Ore Reserves of 5.6Mt at 6.4g/t gold for 1.1Moz

- Standout ESG credentials; including low levels of carbon, water and energy on a per ounce basis

- First gold pour targeted for December quarter 2022

- Strong ongoing exploration success during the quarter, including significant drill results at the Marceline discovery and two new emerging discoveries; Lucknow and Lucien.

- Subsequent to end of March quarter, Maiden Resource for the Marceline discovery announced: 0.98Mt at 9.7g/t gold for 310,000oz, including Indicated Resources of 410,000t at 10.1g/t gold for 130,000oz.

- Marceline and Deacon North sit in the upper levels of the mine plan, close to planned underground development, meaning their inclusion in the Stage Two Feasibility Study currently underway could have a positive impact on forecast financial returns.

- The Paris Decline has progressed >1,300m, advancing an average of 233m/month during the quarter. Stage 1 development is more than half completed, with current mining contract works on track for completion at the end of 2021.

- Experienced project director, Rod Jacobs, appointed.

- Bellevue is well-funded, with $116 million in cash at 31 March 2021.

- A 3D viewer of the project and recent discovery is available at: https://inventum3d.com/c/BGL/Bellevue

Bellevue Gold Limited (ASX: BGL) is pleased to report on an outstanding quarter during which the Company set itself to be a high-grade, long-life producer in a Tier-1 location.

--- click on the link at the top for the full report ---

[I hold BGL shares. I'm attracted to their project location, their high grades, and their low projected costs. Be aware however that they are targeting gold production some time in calendar 2022, not this year, so there will be no sales or cashflow coming in for some time.]

14-July-2021: Bellevue receives attractive project debt funding proposals

Bellevue receives overwhelming response to call for project debt funding proposals

Bellevue to draw up shortlist of potential lenders after securing non-binding debt offers of up to A$289M from 12 leading Australian and overseas institutions

KEY POINTS

- Bellevue has received indicative debt funding proposals for the Bellevue Gold Project from 12 leading domestic and offshore financial institutions, with non-binding offers up to A$289m (ranging between $170m and $289m)

- Bellevue had A$94m cash on hand at 30 June 2021; The project’s estimated capital cost in the Stage 1 Feasibility Study was A$255m (see ASX release dated 18 February 2021)

- The debt offers contain attractive commercial terms consistent with project financing of this nature

- Given the number of highly competitive offers, Bellevue will devise a short-list of potential lenders

- The strong response from lenders comes as the Company prepares to complete the Stage 2 Feasibility Study on its Bellevue Gold Project this quarter

- This study will consider expanding processing capacity from 0.75Mtpa to 1Mtpa as part of a strategy which would grow the production rate and increase project economics for minimal extra capital cost

- The Stage 2 Feasibility Study will be based on Bellevue’s recently increased global Resource of 3.0Moz at 9.9g/t gold (see ASX release dated 8 July 2021)

--- end of excerpt --- [click on link at the top for the full announcement]

Disclosure: I hold BGL shares.

23-June-2021: Drilling Results Underpin a Proposed Upscaled Operation

Bellevue Gold Project, Western Australia

Further exceptional drilling results underpin a proposed upscaled mining operation to 1Mtpa, to grow production rate and increase project economics for minimal extra cost

In light of these results, the deadline for new drilling data to be included in the upgraded feasibility study has been extended to ensure their full impact on the project’s value is captured

KEY POINTS

- Strong step out drilling results pave way for further increases in Resources and Reserves across the project; current total Resources of 2.7Moz at 9.9 g/t include 1.2Moz at 11.0 g/t of Indicated Resources and a Reserve of 0.69Moz at 8.0 g/t

- Drilling has identified significant extensions at the Deacon North and Marceline lodes, with the extensions expected to add further ounces at a low level of capital intensity

- Due to the location of the discoveries, they are expected to deliver a significant increase in the project economics for the upgraded Stage 2 Feasibility Study; the lodes sit proximal to planned development that was incorporated into the Stage 1 Feasibility Study

- Latest extensional results outside the Reserve at Deacon North/Marceline have defined some of the best intersections on the Project to date, results include:

- 5.6m @ 62.7g/t gold from 496.4m (UG drilling)

- 12.5m @ 18.8g/t gold from 704.7m

- 10.1m @ 9.7g/t gold from 412.2m (UG drilling)

- 0.8m @ 288.2g/t gold from 670.2m

- 2.7m @ 113.2g/t gold from 450m (UG drilling)

- 1.4m @ 125.7g/t gold from 524.6m

- 2.2m @ 22.9g/t gold from 447.7m and 2.7m @ 13.4g/t gold from 491.2m

- 3.8m @ 25.4g/t gold from 579.3m (UG drilling)

- 5.3m @ 14.9g/t gold from 417m

- 14.3m @ 5.5g/t gold from 692.3m

- 4.3m @ 15.6g/t gold from 696.6m

- 0.9m @ 97.0g/t gold from 376.3m

- 1.8m @ 42.1g/t gold from 506.8

- 2.3m @ 19.6g/t gold from 693m

- In light of the latest drilling results, the updated Feasibility Study is considering the option of expanding the production plant capacity by 33% from 0.75Mtpa to 1.0Mtpa at start-up

- Increase in processing capacity will see an increase in production and the overall project economics from the Stage 1 study that delivered $1.1B of free cash flow (at $2,300/oz) at bottom quartile All in Sustaining Costs (AISC)

- Given the potential impact of the latest results on the Resource, the cut-off date for inclusion of fresh drilling data in the upcoming Stage 2 Feasibility Study has been extended with the study now expected to be released in the September quarter, 2021

- Such an expansion is expected to incur minimal additional capital costs due to growth provisions contained in the original Feasibility Study underground mine design and upscalable plant layout: refer Figure 1 [image below]

- The Company remains well funded to complete existing works and exploration with $116m in cash and equivalents (as at 31 Mar 2021)

- Short-list of potential project lenders expected to be completed within weeks. Long lead items including Ball Mill purchase and construction of the mine camp are anticipated to commence in the September quarter

- Grade control drilling has commenced, as previously announced. Results confirm excellent orebody continuity of the Bellevue lode system with results (included in ASX announcement on 16 June 2021) of:

- 5m @ 76.4g/t gold from 55m (incl 2m @ 176.6g/t)

- 5m @ 31.7g/t gold from 43m

- 5m @ 30.5g/t gold from 28m

- 2m @ 48.9g/t gold from 20m

- 5m @ 17.1g/t gold from 52m

- 3m @ 24.8g/t gold from 42m

- 5m @ 14.5g/t gold from 27m

- 5m @ 12.5g/t gold from 35m

- Step-out and Infill drilling continues with five surface rigs and two underground rigs operating

- “These results are entirely consistent with our goal of growing the production rate and project economics for a minimal increase in the capital cost.” – Bellevue MD Steve Parsons

--- click on the link at the top of this straw for the full announcement ---

[I hold BGL shares, which rose +5% today to $0.925/share.]

11-Sep-2021: Macquarie sometimes stop covering companies for a period either because they are raising capital for them, or because they are in negotiations to raise capital for them. Macquarie were involved in BGL's CR in mid-2020 and they have just been named as one of the underwriters of the current CR by BGL.

See here: Bellevue Gold kicks off $106m placement, three brokers on board (afr.com, 02-Sep-2021)

and here: Gold play Bellevue set to launch $100m placement, two brokers hired (afr.com, 08-July-2020)

If those stories are behind a paywall, the main info is that Bellevue Gold is currently attempting to raise $106 million in an institutional placement underwritten by Canaccord, Goldman Sachs and Macquarie. It was also Canaccord Genuity and Macquarie Capital that organised the July 2020 raising.

Of the seven (7) brokers covered by FNArena.com, (Citi, Macquarie, Morgans, UBS, Credit Suisse, Morgan Stanley and Ord Minnett) - Only Macquarie currently covers Bellevue Gold (BGL) and they have an "Outperform" rating and a $1.40 PT/TP (price target/target price, a.k.a. target) for BGL. The following shows a little bit of their more recent coverage, with the most recent at the top and the least recent at the bottom.

Disclosure: I hold BGL shares. It should be noted that FNArena does NOT cover a number of other brokers (other than the seven listed above - in bold) - and some of the ones that they do NOT cover who MIGHT be covering BGL include Canaccord Genuity and Goldman Sachs who both - along with Macquarie (who FNArena DO cover) - have been involved with capital raisings on behalf of Bellevue Gold.

[Click on the below image to make it bigger]

10-June-2022: Bellevue Gold (BGL) updated their recent update after the market closed this evening (at 6:15pm) - see here: Project Production, De-risking and Growth Update-update

This is an update to the update released on Tuesday (07-June-2022): Project Production, De-risking and Growth Update

So far I've noticed some cosmetic changes such as a frame around figure 3 at the bottom of page 5, and that the wording of the 3rd dot point under the "Key Points" heading on page 1 has changed from:

"The life-of-mine (LOM) Reserves and Mineral Inventory has increased to 1.85Moz, underpinning an increase in mine life to 10 years"

to now:

"The life-of-mine (LOM) Project LOM inventory has increased to 1.85Moz, underpinning an increase in mine life to 10 years"

...which I'm guessing is to do with complying with the JORC code in relation to gold Reserves. Interesting that they do not provide any explanation of what has changed in the updated version of the update. I just opened both documents in different tabs and switched between them to pick up any differences. If you line the pages up exactly and switch between them you can easily see if anything has changed. So far I've only noticed those two changes that I've mentioned (wording on page 1 for one of those dot points and the frame around figure 3 on page 5), but there's probably some more further in.

Still looks like a very decent project to me. But then - I hold BGL shares, as well as shares in GNG (who are building the gold processing plant at Bellevue) and also Develop Global - who have been appointed mining contractor (mining has commenced already at Bellevue).

GR Engineering (GNG) has commenced early works and has ordered the long-lead and critical path items required for the plant construction. GNG is a company I have held shares in for many years and have written about here extensively. GNG are quite busy at the moment with a number of contracts on the go at the same time. They do have a division which generates recurring revenue from the energy sector (Upstream PS) but the bulk of GNG's revenue is from completing studies (FS, PFS, BFS, DFS, etc., i.e. Feasibility, Pre-Feasibility, Bankable and Definitive Feasibility Studies) and doing EPC (Engineering, Procurement and Construction) contracts, which means their revenue tends to be quite lumpy. After having a bit of a dry spell for a couple of years, they had an excellent first half and are tracking to back that up with an equally good second half (for FY22) - they also pay a very generous fully franked dividend yield. Definitely a company I'm happy to hold through their cycles, but I trim at the highs and load up when they look particularly cheap, trading around a core position. At over $2/share they are fairly fully priced compared to when they are down at $1/share or lower. They closed bang on $2/share today after rising +2% (or +4c) on a down day for the market. In April 2020 they were trading ay 64 cents/share. Very cheap at the time. It was a quiet period for them, but work always picks up again eventually, and it has recently.

GNG are one of two ASX-listed EPC contractors who specialise in the design and construction of gold processing plants. The other one is Lycopodium (LYL) who I also hold. LYL do most of their work in Africa, while GNG do most of theirs here in Australia. But that's not set in stone, that's just historical, and GNG do also do work outside of Australia and LYL do occasionally perform work here in Australia, but as a general rule LYL specialise in working in areas of the world where there are increased sovereign risks, and they get paid accordingly. Both are very good at what they do, and both have excellent risk management processes in place to deal with the risks they face, which are substantial. GNG tend to win the majority of the gold plant EPC contracts for new gold projects located here in Australia.

DVP (Develop Global) is Bill Beament's new company, the man, the legend, who built NST up from nothing to become Australia's second largest listed gold miner, behind NCM (Newcrest Mining) and also one of the top 10 largest gold miners in the world (both in terms of market capitalisation and ounces of gold produced per annum). Bill started off in mining services before he got into gold mining, and now he's back in mining services again. I think there are exciting times ahead for DVP. I'm excited to see where Bill B takes DVP.

Disclosure: I hold shares in BGL, GNG, DVP, NST and LYL (all mentioned above).

You can keep up-to-date with the Bellevue Gold Project development here: Investor Centre | Bellevue Gold | ASX:BGL | Australia

Image Source: July 2019: Bellevue Gold Ltd delineates 1.8 million ounces in under 18 months at namesake WA project (proactiveinvestors.com.au)

Updated version from the Bellevue website below:

07-Dec-2022: Yes @Gprp - in answer to your #Business Model/Strategy Straw earlier today - Management have indeed been very naughty - and have lost a fair amount of credibility in my eyes also - which is why I sold down more than half of my BGL position here in my Strawman.com virtual portfolio today - moving that money into RMS (Ramelius Resources, which look better to me sub-$1/share). I only have just over $1K worth of BGL IRL (1,000 shares, to keep me following them, because they COULD become a decent producer one day). I have a lot more RMS IRL, and I'm building an RMS position here on SM once again. RMS are a proven gold producer who always find ways to get around their issues, such as their recent issues with a number of their mines nearing the end of their useful lives. And I rate their (RMS') management quite highly. BGL - not so much, after this week's developments.

On the 29th November at the Macquarie WA Forum - BGL said this on the first page of their presentation (after the standard disclaimer pages) - - -

Then they went on to explain how close they were to becoming producers.

I won't reproduce the whole presentation again here, but it was very compelling. Here it is: 2022 Macquarie Western Australia Forum Presentation [29-Nov-2022]

That's a link to the presentation (as supplied on the BGL "announcements" page of their website) because the file is too large to upload to this site (believe me, I tried and failed).

Here's the crux of the issue as explained by me along with their recent share price history:

I like the opportunity. I like the contractors they've got building the plant (GR Engineering Services, or GRES, ASX:GNG, who I hold both here and IRL) and I like the contractors they've got to do the actual gold mining - Develop Global - Bill Beament's new company (he's the dude that built NST up from nothing to become Australia's second largest gold miner). But I no longer like Bellevue Gold's management too much.

I haven't dumped them completely, but I hardly had any to start with. On the one hand I can see that they wanted to sieze the opportunity, but what about all of the punters who believed what they said on the 29th and bought into the company at prices ranging all the way up into the $1.20s, only to have them pull this one? Raising money at $1.05, which naturally drags the share price back down to damn close to $1.05. Not a good look Bellevue!

It will be interesting if the market dumps them based on this credibility damage, or forgives them because it's all about the future value? I view management quality as a very important factor in my investments, and it's pretty high up on my checklist actually, and after this, Bellevue no longer tick that box.