Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Just in the last month, BTI's listed equity Siteminder has gained 17% and STG also gained roughly 7-8%.

Cash + listed equity is better value than the current price- all private equity is free.

What am I missing?

MEDIA RELEASE

Bailador Technology Investments Limited Half Year 2024 Results ASX-listed technology expansion capital fund, Bailador Technology Investments Limited (“Bailador”, ASX:BTI), is pleased to release its interim financial results for the six months ending 31 December 2023 (“HY24”).

Key HY24 highlights include:

• Net profit attributable to shareholders totalling $22.0m (up $27.2m on HY23)

• Interim dividend declared totalling 3.5 cents per share fully franked represents an annualised 5.2% yield on BTI shares1 (7.0% on a grossed up basis)

• Post-tax NTA per share up 8% to $1.64; up 10% after including dividends paid in September 2023

• The BTI portfolio ended 2023 in a strong position with combined portfolio revenue of $379m (41% growth over last 12 months)

• $52m cash proceeds2 from full cash realisation of InstantScripts delivered 61% IRR

• $29m of capital deployed over the last 12 months across new and existing portfolio companies

• Dividend reinvestment plan (“DRP”) active with a 2.5% discount

• BTI is well positioned with Net Cash3 of $94m (Dec-23) to take advantage of additional investment opportunities

happy to add a wee bit more IRL

October update for BTI holders.

BTI_Monthly_Report_October_2023.pdf

I did it opposite to Strawman.

I took a small position IRL a couple of months ago and will look to take a position on SM in the not too distant future..

9/11/23

Becoming a higher conviction stock in RL. The company is usually conservative in their value outlook as they report with excitement on SiteMinder. I'm adding in RL

March 24:

Most of my previous sentiments remain, although I'd make the following updates to my observations:

1 I'm pretty sure Soul Patts sold down some of their holding.

2) I'm not so sure that some of the valuations are conservative anymore

3) The portfolio is even more poorly diversified, due to some exits and Site Minder (SDR) doing so well.

Point 3 is starting to annoy me. Most of todays NTA update involved a stock pitch for Site Minder (SDR).

The value of SDR is now almost 50% of BTI's SP or 33% of BTI's post taxNTA.

I have no opinion on SDR, it seems like a great business and Bailador seem to think it will continue to do well, and I hope it does. The problem is that shareholders aren't paying Bailador to manage a listed equity portfolio. Management seems to be doing some serious mental gymnastics to justify holding SDR at its current weighting.

IF I was to be very cynical, I'd say they want to avoid to whopping tax liability that will result in a lower NTA and resultant management fees.

Management - I'm not paying you 1.75% and 20% to sit a third of the portfolio in a listed stock . If it was 5, 10 or even 15% then I would be satisfied. This needs to be sorted out, otherwise it's clear to me that this needs to trade at least a 20% discount to NTA.

I can tolerate the cash holding on the basis that management are being patient and the market is still a bit too hot.

March 23: A lot has been said about BTI so I'll keep this briefish.

BTI is currently trading at a price equal to the cash and listed investments it holds. The other 26% of reported Pre Tax NTA are private companies. It's worth noting that in order to realise these investments BTI would incur a big bill to the tax man, bringing NTA below $1.50.

I think the current SP is about right, making the following observations:

1) Management appear to be skilled, however market conditions have been very rewarding to the kind of investment strategy that BTI employs.

2) Management have made a point of having conservative valuations for private investments. Now that the market has lost its froth it's unclear whether this is still the case.

3) The portfolio is currently poorly diversified .

4) Management fees are high. 1.75% of NTA and 17.5% over an 8% hurdle.

5) Souls have crept up on the share register. I can see how BTI would be valuable to Souls and think a takeover is possible.

6) I think the dividend policy is to pay out 4% of NTA p.a

The bottom line is that without a takeover offer, I don't see great value at the current SP. I'm not sure what probability to assign to a takeover and what sort of timeline is reasonable to assume.

With the valuation for Mosh scheduled for December I was doing some a bit of research on any recent updates for the company and came across this AFR headline.

https://www.afr.com/street-talk/men-s-health-player-mosh-set-to-appoint-an-adviser-20231213-p5er6r

I don't have access to view the article, but potentially there could be another potential exit for BTI in the near future. Currently Mosh only represents around 3% of the BTI portfolio ($7.5m at current carrying value) so there likely wouldn't be any significant impact on the NTA.

@NewbieHK has posted the results, but just wanted to add a few thoughts on Bailador's latest full year.

As co-founder Paul Wilson told us when we met with him last year (see here), the financials are always going to be both lumpy and a little messy given the non-cash revaluations as well as the occasional disposals and acquisitions.

But assuming you take their disclosed valuations for unlisted investments at face value (and I think they have a good track-record of conservatism) the NTA is probably one of the better metrics to track. On this front, we saw a modest 4.4% decline (although when adjusted for cash dividends it was up 2.5%).

There's some nuance needed here too due to the fact that it was the listed company investments that dragged the NTA lower -- and this is mostly a function of what SiteMinder shares did over the financial year. Unlisted investments actually did really well -- gaining 28%, and the value uplift is entirely based on recent 3rd party transactions (ie not just the opinion of a valuer, but based on real world transactions)

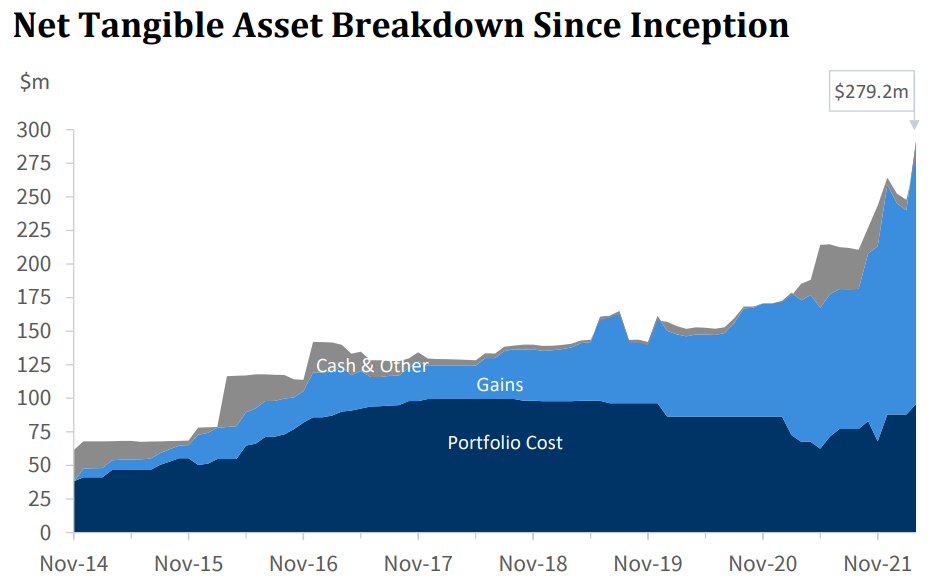

This slide shows it well:

So when you account for where we sit at present, NTA is up (modestly) from June 30 last year, even excluding dividends:

At any rate, this is, and always has been, a "bet" on management's ability to find and invest in early stage tech. And I think they have great form.

This slide speaks volumes:

An IRR of 23.2% is nothing to sneeze at. Yes, they benefitted from the exuberance in the tech space, but as they highlight they were sensible enough to capitalise on this opportunity (I wish I had been better at that!!) and now have a solid war chest of $104m.

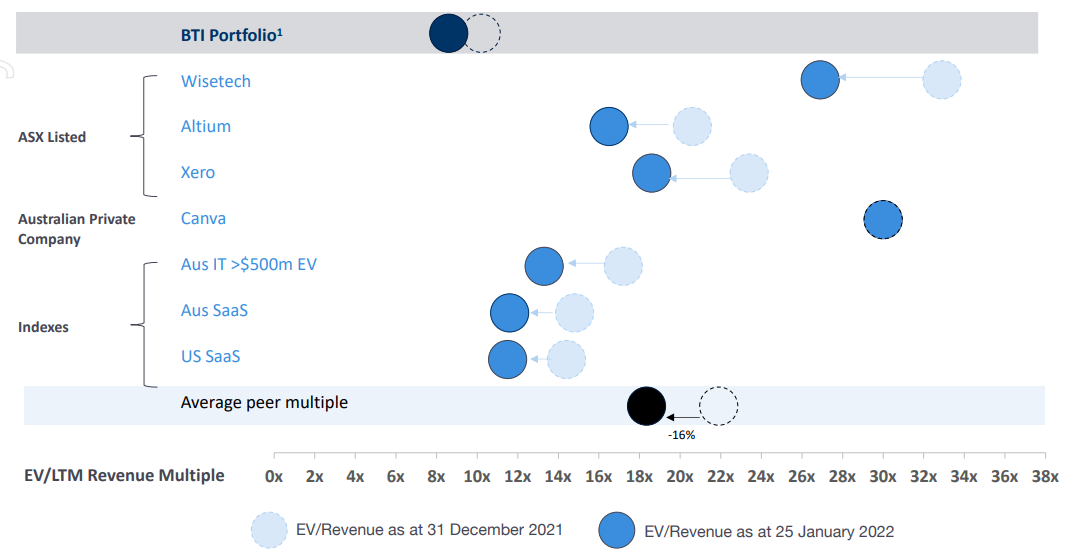

The revaluation in tech stocks hasn't been fun, but the silver lining is that things are now a lot cheaper for someone looking to make investments -- like Bailador (and many of us!). In fact, according to their presentation, average tech multiples are 28% below their 5-year average (still, this is with an average EV/revenue multiple of 7.8x which still seems up there, but is perhaps not unreasonable for fast growing, early stage companies. In the results announcement Paul called this "more reasonable", rather than cheap)

All up, their portfolio companies appear to be making genuine progress, they have a strong balance sheet and shares remain about 20% below their (post-tax) NTA.

I find some comfort in knowing that Soul Patts is a major shareholder too.

I'm taking a small position on SM today and will look to buy some in real life when I get some spare cash.

BTI Announces FY23 Results and Declares Fully-Franked Dividend.

https://bailador.com.au/assets/downloads/230816_FY23_results_media_release.pdf

https://bailador.com.au/assets/downloads/230816_BTI_Results_Presentation_FY23.pdf

David Kirk just bought another $245k on-market

Paul Wilson picking up 165,000 shares ($198,752) for himself and another 40,000 ($48,400) for his joint super fund.

Valuation based on latest post-tax NTA. No discount applied to the post-tax valuation due to the conservative nature Bailador uses to value the companies it holds.

Based on the current NTA (post tax).

company announcement below…

https://bailador.com.au/assets/downloads/BTI_Monthly_Report_July_2022.pdf

Some notes from today's meeting. First off, thanks to @Duffshot38 for the suggestion -- I found Paul to be very knowledgeable and definitely aligned with a lot of my investing philosophy.

Since listing in late 2014, the share price has gone from around $1 to $1.32. Add in a special dividend and you get an average annualised return of around 7% per annum. That's pretty ordinary, but at the same time there seems to be a big disconnect with what the company itself has done.

As I noted in the meeting today, net tangible assets have compounded at over 20% per annum over the period. That may be understated given the conservative way in which they ascribe the carrying value of their assets.

Indeed, as Paul said, shares are trading at a 20% odd discount to NTA on a per share basis, and likely a lot more given how they track this figure. Of course, LIC's will always talk a good game here, but as Paul said they have a 100% strike rate in terms of exits occurring at valuations that were far higher than the carrying value.

With 10 holdings in the portfolio, they are extremely concentrated and -- given they research 100's of companies each year -- very selective. They hold equity stakes of between 10-40% and also take an active role in these businesses, as either directors or advisors.

Paul was very candid on those investments that didn't work out (eg viastream), and how the carrying value of these were quickly written down when it was apparent the investment thesis wasn't working out.

I also liked how they seemed to be very mindful of cash burn for their investments, and how adverse they were to relying on ongoing capital injections to sustain operations.

It was also good to see both Paul and his co-founder each buying a further $500k worth of stock each a couple of weeks ago -- and AFTER they disclosed they (very successful) exit from Instaclustr.

At the end of the day, this is a bet on management, and whether they can continue to find, invest and exit from private companies. But they do certainly seem to have great form here (although, at the same time, there could be a good bit of 'key man' risk). It's also a great way to get exposure to early stage, private tech companies, and still have all the liquidity of an ASX company.

It's also hard not to notice the seemingly large discount to NTA. That being said, there's no law of nature that says these valuation gaps should close, and even if they do it can take a long time. Also worth noting that the financials are going to be very lumpy, and will depend on transaction events in the underlying companies for them to record revenue. From a cash perspective, it's going to be especially lumpy.

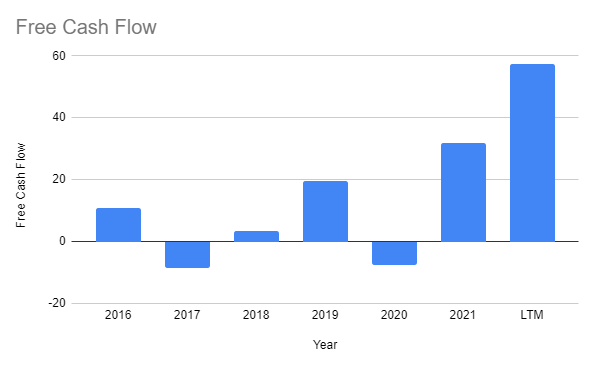

Here's what their free cash flow looks like since 2016 (using data from S&P) -- it'll be even better when the current half is reported, but the point to note is that it can and will go backwards for a while if they don't manage to get any successful exists from their portfolio companies. When they put some profits back to work, we'll see a big drop in FCF too.

To the uninformed, there'll be periods where it'll look like the business is doing nothing, even if their portfolio companies are genuinely improving their intrinsic value. In other words, things like revenue and cash flows aren't going to be particularly informative metrics in isolation -- as Paul said, NTA is the figure to watch. And one needs to have some trust that that is based on reasonable valuations.

Remember that their investments are very illiquid. And getting them away at good valuations will depend a lot on what current market conditions are like.

Investors in Bailador need to be cognizant of these factors, and as such I'd suggest you need a long term focus. Much of the market will likely miss a lot of the nuance for a company like this.

Valuing the company is also tricky -- unless we're able to individually value the component companies accurately, which we can't.

So, again, a lot depends on the faith and trust you have in management. With Paul and David holding over 10% stake in the business, it does provide some good alignment.

The implication of a potential deal for InstantScripts to the value of BTI shares is interesting, especially since they only recently did a follow on investment. AFR article below:

Wesfarmers’ dealmaking spree in healthcare isn’t letting up. Having acquired Australian Pharmaceutical Industries last year, Street Talk can reveal the conglomerate has turned its attention to online medical prescriptions business InstantScripts.

It’s understood Wesfarmers, via its API portfolio company, has been engaged in bilateral discussions with InstantScripts, which hung up the for-sale sign in October. It is not known whether those talks – which sources said were at an advanced stage as of earlier this month – were still alive.

InstantScripts was founded in 2018 and lets patients obtain express medical scripts in minutes online. It can do scripts for more than 300 medicines, all of which are low-dosage and low clinical risk for ailments including thyroid, urinary tract infections or melatonin for sleep. Wesfarmers’ strategic rationale centred on driving traffic to its pharmacies, sources said.

The business was founded by Asher Freilich, a healthcare investment banker at Citi and New York’s Piper Jaffray who retrained as a doctor. It is backed by investors including Perennial Private Investments, Microequities Asset Management and Bailador Technology Investments.

When Lazard was brought in to test buyer appetite last year, InstantScripts was making around $50 million annual revenue, had 250,000 active users, and connections to nearly 40 per cent of the pharmacies. It was tipped to fetch a $200 million valuation. As part of that process, InstantScripts presented to private equity firms, insurers, pharmacies, digital healthcare players and even deep-pocketed family offices.

BTI has marked down the carrying value of two of the companies they hold within their portfolio following an end of year review. The next review of these two companies will be in June 2023, so unless there is a third party transaction / capital raisings, Nosto and Access Telehealth will remain at the reduced valuation for 12 months.

This is probably prudent given the significant re-rating of technology companies and has minimal impact (3.7c) to the overall NTA which the mid year dividend will be based off. The market movements of Site Minder (ASX:SDR) have a much bigger impact to the NTA than the newer holdings.

Overview of Bailador:

Bailador is an LIC focusing on investing in private information technology and media companies. It is run by David Kirk (previous Fairfax CEO and All Blacks captain) and Paul Wilson (experienced in private equity).

The characteristics of the companies that Bailador likes to invest in are listed below (from their website):

- 2-6 years of operation

- Run by the Founders

- Proven business model with attractive KPIs

- Ability to generate repeat revenue

- International revenue generation

- Huge market opportunity

- Require capital to grasp this opportunity

- Important verticals within the technology sector: eCommerce, subscription-based internet businesses, online marketplaces, software, SaaS, high value data, online education, telecommunication applications and services.

"Bailador typically invests $2-10M of equity into an investee company. They target minority investments alongside highly motivated founders and management who have best-in-class technology or business systems." They typically don't invest without board representation.

Main Thesis:

When starting out my investing journey about 3 years ago I did look into BTI, however, at that stage only Siteminder had made significant gains and represented a large part of the NTA. Given I was only at the stage of investing in ETFs didn't know the risks in BTI so put it on the to watch list. The recent Strawman interview reminded me to take another look.

Bailador's list of characteristics and the point in which they invest I think is key to Bailador's success. They do not buy an idea or concept company. They buy a company with real traction in the market in which it operates. However, the target companies aren't large enough for public markets (or even large private equity), they require capital to grow and also need some experienced investors to assist with how to grow the business, Bailador fills this void. Bailador seems to have found a very nice sweet spot to invest in these growing companies.

Bailador has consistently shown that they are conservative in their valuations of the companies they hold and in recent times have been able to realise some of their investments to cash or companies held are now marked to market through IPOs. BTI has a consistent record of always having third-party valuation events that come in at or above the current carrying value. Therefore, the monthly NTA presented to shareholders is a conservative number and potentially provides investors with hidden value yet to be uncovered.

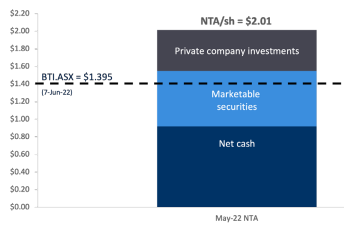

The downside risk of investment at this point in time is very small. The company is currently heavily backed by cash after realisations. See image below for a breakdown of NTA from the May 22 NTA update. I think investing at this point of time is the prefect time to buy BTI given markets have significantly reduced the valuations of tech companies that BTI likes to buy. Having a large amount of cash available in this market means BTI can buy the new additions to the portfolio at lower valuations. Additionally, BTI is trading at a 15% discount to the conservative post-tax NTA and more than 25% discount to the pre-tax NTA.

Bailador's valuations are somewhat conservative for the sector they operate in. Especially given the early stages of many of the companies they purchase I would expect the EV/revenue multiple to be higher than the average but this is not the case. See image below from 1HFY22 presentation:

General Notes:

- Companies held are predominately based in Australia but some holdings are based overseas.

- Stats from 1HFY22 presentation:

- Portfolio revenue $341m with 43% growth

- 66% gross margin

- 91% recurring revenue

- Management fees are expensive. 1.75% of pre-tax NTA and compound performance hurdle of 8%.

Positives:

- Large margin of safety given the cash backing, discount to NTA and conservative valuations of companies held.

- Plans to provide a 4% fully franked dividend based on pre-tax NTA.

- Currently many smaller investments $20 mil or less. Besides for recent additions to the portfolio all have had positive revaluations. Recent additions have yet to be revalued.

- Chart appears to have positive sediment.

- Very conservative NTA valuations which are validated by 3rd party transactions. As of 1HFY22 there had been 29 3rd party valuations and these all came in at or above BTI carrying value. This shows the NTA is likely under the real market value and a lagging indicator of actual value of all investments.

- BTI is trading at a significant discount to NTA. May 22 NTAs:

- Pre tax $2.01

- Post tax $1.70 - 15% discount to NTA.

- Management of the LIC have skin in the game:

- David Kirk owns around 6.2% of the company.

- Paul Wilson owns around 2.8% of the company.

Risks:

- Key person risk - David Kirk and Paul Wilson.

- Next round of companies BTI invests in are unsuccessful.

- Current market conditions result in cash realisations for BTI becoming hard execute.

- Potential for little insight into the companies that Bailador holds due to the commercial in confidence agreements that are likely especially given the board positions.

- Current weak capital availability limits short term valuations from increasing.

- The lag factor in valuation. This has shown to be very much on the conservative side but this potentially supresses the short term valuations and could have a shock downgrade.

- High fees eat away at performance.

When to get out:

- It is clear the current investments aren't working out.

- Trim if there is a significant premium to NTA (unless justified due to conservative nature of valuations).

- Key person risks eventuate.

The December update provides a good summary from management on why 2022 was a fairly quiet year for the company and a high level view on the private equity market.

Another item to note is that one of their holdings Brosa has been placed into voluntary administration. The value of this was already written down by management so it is likely they were expecting this outcome.

I'd suggest that BTI's NTA will rise substantially as a result of SDR's share price surge which is their largest holding. I get the feeling that SDR's surge is in part due to Webjet's positive 1H 23 results so hopefully this is the start of a turn in sector sentiment.

I've been buying SDR under $3 and will continue to do so although I think it's unlikely to get down to these levels again....subject to the normal caveats of course.

The opportunity I see right now is in BTI which was trading at ~26% discount below NTA and that's prior to today's surge in SDR.

Anyway I've bought BTI again today and will probably add more while trading at such a discount.

TPW earnings call recap: re Brosa BTI investment

I listened to the Temple and Webster earnings call today, to help understand BTI’s investment in Brosa whose valuation was upgraded in the latest results. TPW, I don’t follow, but at a top level, the results look pretty good, FCF, cash on hand, debt free.

Points relevant to both businesses from Q&A

- Aust 15% furniture sales online, US 30% and growing

- FY 23 sales yoy July down 21% Aug 17% down, however figures are ahead of the company’s expectations, whatever that was? Undisclosed.

- Inventories are bloated, some suppliers are trying to move stock, may offset some inflation/cost pressures

- FY23 seems to be tracking ok, but admit no idea how it will pan out, impossible to forecast.

- Freight logistics are complicated/expensive for large box furniture deliveries, so there is a bit of a barrier to entry. Retailer size feeds into better freight rates and optimization. (I live in reg Vic and can get deliveries from Brosa and TPW. However, I have had issues with other online retailers who don’t service the area, 2hrs from Melb.)

Overall, the tone was positive, careful expense control and holding cash for unforeseen circumstances. A bit of a pullback in marketing/promo expenses to help maintain and grow margins.

TPW’s stated goal is to be the biggest retailer in the online homewares space, so where does that leave Brosa? I think there is room for at least 2 major players in the space, perhaps 3. Customers like choice and TPW’s range is vast with no shortage of options. However, customers like to compare products from different retailers, styling and cost before purchasing an item that is expensive.

A couple of things that differentiate Brosa

- Smaller range, well styled

- Quick responses to questions and free fabric samples sent out

- Competitive price points,

- IMO, styling, quality, and price points are better than Freedom. Freedom also had terrible reviews during covid problems with online orders, usually due to delivery.

- Showroom in Melb and Syd. Think this is a great feature for Brosa. I know if I’m buying a couch, I want to sit on it. I have visited the melb showroom a couple of times, very busy.

- Brand recognition?? Seems low to me, how many people do you know are aware of Brosa compared to TPW? In my questioning, everyone is aware of TPW, Brosa, not at all. Interestingly when TPW first floated, and I asked people the same thing, TPW had no brand recognition then either. In the call TPW said their cost of customer acquisition had increased by 20%, so I suspect Brosa’s is up too, it may be expensive growing the customer base?

not held

Bailador has announced that the company will now be paying an ongoing 4% fully franked dividend as part of a new policy effective July 2022. Along with any special dividends as deemed appropriate by management.

The dividend amount is calculated from the pre-tax NTA , which will make the 4% much more attractive when BTI has been trading at a discount.

eg. April NTA announcement $1.99 pre-tax vs current share price of $1.38.

I feel like this will attract a wider range of investors who like consistent dividends and potentially close up the gap in share price to the carrying NTA of the Bailador portfolio.

Personally I would prefer if the capital was used for further investment, however if there are not any suitable investments, it shows the team there are being selective and are not just buying for the sake of deploying the available cash.

Just expanding on @Bradbury 's Straw.

With the dividend being based off pre-tax NTA, the actual yield will be pretty attractive.

Pre-tax NTA last reported at $1.99. 4% of that is 8c.

Last traded price was $1.41, which gives a forward yield of 5.7%

Adjust for franking to get a grossed up yield of 8.1%.

Not bad.

In the many pages about Site Minder is a number of over $400 debt at present. Is this something we need to worry about?

@Fereguru the debt structuring of Siteminder will change significantly following the listing as you will see much of it involves derivative financial instruments utilising convertible preference shares that are rewarding early investors. That’s why you will notice ~85% (~520m) of the raised funds are directed towards payments to selling shareholders which from a quick glance should reduce much of the debt to nil.

However, this is not financial advice (VIP) and I would suggest you do a much deeper dive and speak to your accountant to get approved financial advice so you fully understand the numbers.

In general companies typically IPO to pay down debt, reward early investors and to access capital for growth. This does not guarantee that the shares will pop on listing especially, if the market thinks the IPO is fully priced. Most of the time the pre-ipo beneficiaries are the ones who benefit most as they get multiple opportunities to get a capital appreciation especially if the listing actually takes place.

PS. On another note I see major investors involve BTI, Black-rock and Aussie Super.

@Feteguru At 5.06 the company is being valued at 1.3B or ~12-13x Revenue. When compared to similar SaaS companies it’s possible there is an opportunity especially, with travel only likely to get closer and closer to normal as we move forward.

Based on the 1.3B valuation BTI has reported that this will see their 7.6% valued at ~99m. They have already said they will sell down and take ~15m in cash (good idea as it rebalances them a little and releases $ for other opportunities). This leaves them with a ~6.5% holding.

So with this in mind it can be seen it’s the current duel in the crown for BTI and puts it around ~40% of NTA of BTI (please DYOR confirm this figure independently as this is a rough estimate).

So the question i suppose one might want to ask is are you happy with your current exposure to Site-Minder through BTI relative to your own personal portfolio?

Company update is encouraging on all their companies. Management value ( usually conservative) is now $1.61 on 11 Nov.

Wow!!! What a first day! From an IPO price of 5.06 to close at 7.01 day 1. For BTI holders Its a nice way to cover (and some+++) that 15m BTI took out in cash. Let’s remember the 5.06 price led to a valuation of BTI holding at $99m! They told $15m in cash held onto $84m and it finished today at 116m!!! The news Friday out of the US from booking, airbnb and the airlines was just the pre float news this stock needed! It should also (if holds) put a floor under the BTI price around ~1.80!

Is the IPO of Site Minder at $5.06 per share good value for prospective investors?

That is, should shareholders of BTI take up the offer to subscribe for shares in Site Minder?

The Site-Minder IPO seems to have possibility contributed to the recent surge in the price of BTI. I think the price is starting to get quite ahead of its NTA however, considering their conservative valuations and the likelihood of a positive re-rating in the valuation of the Site-minder holding for BTI this might close back up a little. In say that it might be worth anyone wanting to get in or topping up to wait until the next portfolio re-evaluation to see where the NTA is at before considering an entry.

Note: I own BTI.

BTI announced 19 October that it has increased its investment in Rezdy, a company with booking software for tours and activities. Value of Rezdy is now 9.1 cents / BTI share.

Rezdy is expected to have improved conditions post COVID.

Bailador Technology Investments BTI advises the ASX on 18 October, that there will be an IPO of Site minder before then end of this financial year.

The IPO revaluation of the Site minder shares of Bailador adds $0.12 to the NTA of BTI

Question posed to BTI: Is it Bailador's intention to keep its holding in SiteMinder following its upcoming IPO?

Email reply from Bevin Shields, Investment Director & Head of Investor Relations:

Bailador has a high level of confidence in the prospects for SiteMinder. We intend to retain the majority of our stake in SiteMinder in the event of an IPO, but may realise a small portion of our holding to enable further new investments and maintain portfolio balance.

Bailador also intends to provide an opportunity for a priority allocation in any SiteMinder IPO to BTI shareholders

Subject of a Foolish podcast on 25th August

https://podcasts.google.com/feed/aHR0cHM6Ly93d3cub21ueWNvbnRlbnQuY29tL2QvcGxheWxpc3QvODIwZjA5Y2YtMmFjZS00MTgwLWE5MmQtYWE0YzAwMDhmNWZiL2MxYzIyYTAzLWY0ZTItNDllNC05ZWZmLWFiYjIwMDNhYzA5OS8yNTExMTcwMi00N2I0LTQyM2YtOWQ1Ny1hYmIyMDAzYWMwYTcvcG9kY2FzdC5yc3M/episode/MDgzNTcxMTctOTVmMi00NWM3LWEzNzQtYWQ4ZjAwMGE0MzBj?ep=14

Some nice numbers out from BTI today. It seems 2021-22 could be much of the same with two of their major holdings lokking to IPO and BTI reporting they will continue to hold post IPO. Considering the NTA some considerable upside possible over the next 12m.

Key numbers...

NTA up 23% ($215m) (pre tax 1.53 v todays closing price 1.37)

Portfolio value up 35%

Net Profit 27.6m (realised investments and increases in key in valuation of companies held)

Cash (Only) at 30th June $43.5m

Special Dividend 1.4%

Opportunity to benefit from IPO of two major holdings in 2021-22.

For further info check out the whole release and company presentation at ASX.

BTI is a great way to get access to technology start ups that are unlisted (private) and in the early stages of dvelopment and expansion. This is a great way to access tech companies with global market potential in the pre-listing stage. Its a market that retail investors rarely get access to but, the opportunity presents exciting opportunities to share in a part of a companies early stage growth to listing. I own BTI in my personal portfolio and have put in an order on my Strawman account.

Bailador invests in digital health platform instascripts

Bailador Technology Investments Limited Half Year 2021 Results

Key HY21 highlights include:

~ Net profit attributable to shareholders totalled $13.1m

~ Gain on financial assets and marketable securities totalled $23.5m

~ Pre-tax NTA per share up 12.3% to $1.39, net of all fees

~ Instaclustr valuation increased 42.2% following another strong 12-month period of growth

~ Stackla revalued to $11.5m (previously $nil for 12-months) based on demonstrated business performance and market attractiveness

~ Straker valuation (marked to market) up 71.4% over HY21 (and a further 17.3% in Jan-21), largely driven by the announcement of a new global translation agreement with IBM

~The Bailador portfolio companies are well capitalised with no liquidity concerns

~ Bailador expects 2021 to be a significant year for profitable realisations

Based on Net Tangible assets reported in todays announcement by BTI (this is pre-tax) or $1.60(post tax). Interesting update to the market this morning.