Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

My previous valuation (done in August of last year) was 15cps, and was based on the company hitting $90m in revenue by FY26 (about 15%pa top line growth) It also assumed better margins.

That doesnt seem reasonable anymore.

The company should do around $60m in revenue for FY24, and I'll grow that at 10% pa for 3 years to get $80m. On a 55% gross margin (generous) and $40m in OPEX you get close to $4m in pre-tax profit. So let's call it $3m in NPAT and apply a PE of 25 to get a market value of $75m.

That's $56m in present value (10% discount rate) or about 4.5cps. Let's call it 5 to get a nice round number.

That's a big drop from where I was (again a reminder of the sensitivity of these calcs), but i'm still assuming growth and a decent multiple.

Of course, you'd expect operating margins to improve over time and any demonstrable and profitable growth could well see EVS command a higher multiple. I modest tweak to things gets you to a much more bullish number.

I'm just not sure they deserve such assumptions at this stage.

I don't want to get stuck on false specificity, but the bottom line is that shares are probably around fair value (very broadly) if they do indeed manage to plod forward, and they are likely cheap if they accelerate growth and demonstrate a capacity to scale.

If growth slows, you'd have to consider shares expensive.

A reluctant hold for now. But the value prop suggests I should at least reduce my weighting, which I may do in the coming days.

I listened in to the call. It was popcorn-worthy.

One shareholder expressed his feelings about the SP and demanded to know when they would see a real profit. He also expressed frustration with the term 'adjusted EBITA less Capitalised Development on a run rate basis'.

Management started out sounding confident and then started fumbling as they tried to explain why they use various terms.They don't seem prepared to handle pushback, they just want to skate through until the brighter future. They closed by saying 'Thanks everyone, I can see we're all aligned on the need to (make money).'

They do like wishy-washy terms. I think they mentioned the establishment of 'centres of excellence' in the Philipines and LatAm.

Takeaways:

-Breakeven will occur in 2025, they said this twice, first hesitantly, and later more emphatically.

-Debt will be an ongoing source of funds to support inventory, beyond the current 3 year term. They claim a good relationship with their bank/s, and used as evidence an improvement in the current terms.

FY24 Q3 SALES UPDATE

New Sales of $2.9m, ARR grows 11.4% PCP to $62.6m

Key Highlights:

- New Sales of $2.9m, including New ARR of $1.8m and Project Sales of $1.1m. EVS Industrial continues to drive the Company’s growth, with the Americas region maintaining its strong contribution.

- Total ARR grows 11.4% PCP to $62.6m.

- New ARR of $1.4m in EVS Industrial underpinned by solid growth in the Mining sector, including the first mine site landed with new customer LKAB in Sweden, and expansions of existing solutions with Capstone Copper in the USA, Teck Resources in Canada and Glencore’s Cerrejón mine in Colombia.

- This includes New ARR of $0.1m in EVS Water sales. As EVS Water was recently consolidated into EVS Industrial, the Company will no longer provide sales updates for EVS Water.

- EVS Aviation achieved New ARR of $0.4m, including expanded solutions on top of a five-year renewal with Dublin Airport in Ireland, and a new noise and operations management system to be provided to Korea Aerospace Research Institute in South Korea.

- Envirosuite reaffirms its outlook to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24, continuing to focus on prudent cost management while delivering sustainable growth.

- Churn over the last twelve months (LTM) increased slightly to 3.7%.

- The Company will host an investor briefing session today at 11:00am AEST. Click here to register: Envirosuite FY24 Q3 Sales Update

24 April 2024 - Leading environmental intelligence technology company Envirosuite Limited (ASX: EVS) (Envirosuite or the Company) is pleased to announce that it has achieved $2.9m of New Sales in FY24 Q3 (Q3), with New ARR of $1.8m and Project Sales of $1.1m. Total ARR has grown to $62.6m, up 11.4% PCP.

Envirosuite has delivered solid new ARR growth this quarter particularly within the Mining and Waste sectors which are a strategic focus for EVS Industrial growth. Demand for environmental intelligence technology within these sectors continues to build, with both leading mining companies and US municipalities increasingly looking for innovative and proactive approaches to protect and optimise productivity while managing environmental and community impact responsibly and sustainably.

Envirosuite CEO, Jason Cooper, commented,

“The Company continues to achieve sustainable growth as it remains focused on delivering on its guidance target of positive Adjusted EBITDA less Capitalised Development on a run rate basis in FY24.

“The EVS Industrial growth we are seeing, particularly from the Mining and Waste sectors and in the Americas region, is a direct reflection of the Company’s focused growth strategy in these segments and is further supported by macro-economic drivers including ESG, Environmental Justice in the USA, and the increasingly prevalent need for industry operators to demonstrate responsible operational practices. The calibre of customers we are adding each quarter within these focus sectors coupled with our proven strategy to further expand and scale these relationships, is testament to this – demonstrated in Q3 through key wins with LKAB, Capstone Copper, Teck Resources, Glencore’s Cerrejón mine, Atlantic County Utilities Authority, and a fourth landfill site won with our strategic partner Byers Scientific.

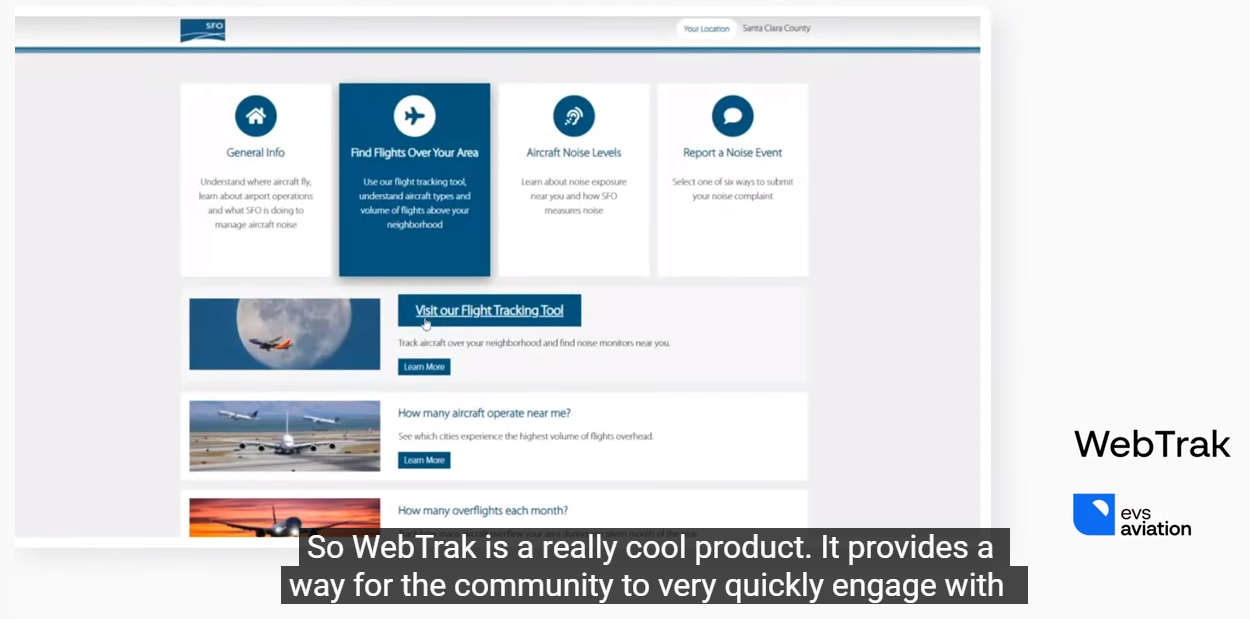

“Envirosuite continues to extend its market leadership position within the Airports sector, headlined this quarter by a long-term renewal with Dublin Airport to continue providing the existing noise and operations management system while also expanding the agreement further to provide additional community engagement and noise quota management solutions. We are proud of the long-standing, deep relationships we have with our Aviation customers and continue to work with them to solve the industry’s current and future challenges.”

Looks like Jason has continued to stick by his word (kudos) in not raising capital.

Instead they have extended their debt finance facility by $5m to $12.5m (up from $7.5m).

Fairly straight bat, forward-defense type stuff in the communication. In the announcement Jason has noted:

“We are pleased to announce the extension of the Facility, which remains strategically aligned with our core business objectives: driving growth, creating long-term customer value, and leveraging the increasing opportunity to bundle hardware and software into our Industrial customer contracts. This extension also funds our global inventory and working capital requirements. With this extension, the Company remains funded to pursue sustainable growth in our focus sectors as we transition to profitability. We currently have no plans to raise further capital to fund our organic growth.”

Looks like they appear confident this debt facility can provide them enough liquidity to transition them through to profitability.

I haven't done a run on the numbers yet, but cash on hand in their most recent half-yearly was circa $5.5m , and from memory they should be fairly close to break-even.

I applaud Jason sticking by his word - now it's about executing and sailing through to profitability.

Just saw the news this morning that EVS are merging their water products in under Industrial.

While I can see the synergies from a GtM perspective and hopefully they have a reduced cost of sale overall, it will be a shame not to be able to track Water's growth independently of the other product lines.

Albeit off a small base, my investment thesis has been that Water is the wildcard in the portfolio with potentially very large growth driving the future of this business.

- Aviation doesn't feel like a growth business (and frankly, I'm a bit sick of the moaning about the "one off churn event" as churn is a reality in ARR businesses that has to be expected and growth needs to cover for it).

- While Industrial is growing nicely, the challenge with that business seems to be the impact on metrics (shift in margins) as EVS are needing to borrow money to finance a bunch of site instruments rather than a pure software sale. So more and more I suspect that part of the business will put negative pressure on gross profit (and eventual earnings multiple once this company has more reliable profitability).

I caught the first half of Envirosuite's presentation, but had to duck away before the Q&A.

General vibe is that it felt very scripted, and Jason can come across quite salesy.

The numbers themselves were decent, not spectacular. EVS is a business that does seem to be grinding forward, just not at the clip I initially thought might have been achievable. Still, they are tantalisingly close to break even, a milestone that seems to always be just 6 months away...

Good to see gross margins improve, and the focus on better quality revenue seems to be paying off a bit, without sacrificing too much top line growth. (Although more site and revenue growth would be nice)

They are dropping the 'adjusted EBITDA' metric, which excludes share based comp, one-off restructure etc and will be reporting straight EBITDA going forward. This was negative $200k in the half.

The more telling operating cash flow was minus $1.8 million, though there's a sizeable working capital adjustment due to receivables from invoices issued at the end of the half, and an inventory build-up to support expected sales. Normalised for that op CF sits much closer to EBITDA at -$300k.

But if you add back capitalised development costs, which I think is appropriate, and am glad they call this out, cash flows were -$4.5m. And I think the market will be much more concerned with seeing this metric go positive, as opposed to just EBITDA.

ARR growth was (as already reported) pretty ordinary due to a 'strategic rationalisation' of low margin contracts, but the new ARR run rate is at about $9m for the last 12 months. If they add that again this year with minimal churn we would see a good return to growth. Moreover, given the gross margin, it'd essentially put them on a CF+'ve footing. Or at least get pretty close.

According top Jason today: ."we are confident on our ability to achieve a positive Adjusted EBITDA result less Capitalised Development costs on a run rate basis during FY24.”

So we'll see.

The company is reasonably well capitalised, with $5m cash and bunch of undrawn lending capacity. I think a further raise in unlikely, and management know it wouldn't be well-received at present. (But I wouldn't be surprised if they wanted to shore up the balance sheet at some stage if sentiment and share price improves.)

So the big IF here for me is whether they can indeed build up some more revenue momentum and support operations without much change in the fixed cost base. The second half is traditionally their strongest, so will be interesting to see how they go.

You can read up on some of the operational updates in their presentation

Held.

Latest sales update looks promising

https://envirosuite.com/insights/news/fy24-q2-sales-update

I’ll be interested to understand how much of these new sales are the “sell through” PPE (that I seem to recall was going to grow with debt funding) vs higher margin software revenue. I’ll be interested to see this when they publish their first half results which are supposed to be out in late February.

Inside Ownership Ordinary Shares Net Value at $0.09

Jason Cooper 1,150,000 $103,500

David Johnstone 7,033,016 $632,971

Sue Klose 1,000,000 $90,000

Stuart Bland 650,194 $58,517

Colby Manwaring 272,846 $24,556

Total 10,106,056 $909,545

*Note Inside Ownership of % of total share below 1% of total shares on issue so not included in table above.

Summary Management Bio from EVS webpage.

Jason Cooper – Managing Director & CEO

Mr. Cooper joined Envirosuite in July 2020 as chief operating officer, was appointed as Chief Executive Officer in March 2021 and appointed Managing Director March 2022. Since joining Envirosuite, Mr Cooper has been instrumental in driving the strategy for the Company during the backdrop of the COVID-19 pandemic. In this time, he finalised the integration of the major acquisition, commercialised EVS water nationally and internationally while driving growth across all product lines and regions.Jason is a highly regarded and well-respected industry leader with more than 20 years’ experience in the technology sector. He has had broad experience working in senior executive roles in both multi-national and start-up environments. During his career he has held senior roles across sales, operations and general management in the Silicon Valley, London, and Melbourne. Jason holds an executive MBA in Entrepreneurship and Innovation from HEC, France.

https://www.asx.com.au/asxpdf/20220223/pdf/4568f802457f05.pdf

https://www.asx.com.au/asxpdf/20210226/pdf/44t454mg5smsvq.pdf

David Johnstone – Non Executive Chairman

David is an experienced executive and chairman who has been actively involved in business for more than 35 years, successfully starting, owning and operating a vast range of businesses. David joined the Board as a non-executive Director in February 2014 and was appointed Chairman in September 2016.David also Chairs Cooper Investors, a specialist equity investor group with in excess of $12bn in funds under management, and Sports Club HQ a technology company that specialises in managing the Registration and Competition Management data requirements for Sporting clubs and associations. David is also a non-executive director of Southern Cross Partners and is an Advisory Board Member to NexPay. David has also served as both a director, non-executive director, Chair and advisor to both public and private companies in the technology, communications, finance, wealth management, insurance, risk management and sporting sectors.

Sue Klose – Non-executive Director

Sue Klose is an experienced non-executive director and executive, with a diverse background in digital business growth and operations, corporate development, strategy and marketing. Sue was previously the Head of Digital and Chief Marketing Officer (CMO) of GraysOnline and Director of Digital Corporate Development for News Ltd.

She is currently a non-executive director of Nearmap (ASX: NEA), Pureprofile (ASX: PPL), Halo Food Co. (ASX: HLF) as well as a number of unlisted groups.

Sue has an MBA in Finance, Strategy and Marketing from the JL Kellogg School of Management at Northwestern University, and a Bachelor of Science in Economics from the Wharton School of the University of Pennsylvania.

Stuart Bland – Non-executive Director

Stuart has over 30 years’ broad commercial experience primarily in global SaaS businesses undergoing high rates of growth. His industry experience includes technology (fintech, knowledge management), defence, sport, telecommunications, biotechnology and wine.

Stuart’s executive experience includes 14 years as Chief Financial Officer at Iress Ltd (ASX:IRE) and Chief Financial Offer roles at Melbourne IT Ltd and Panviva Pty Ltd. Stuart is currently a member of the Advisory Board to Cablex Pty Ltd, as well as consulting to a number of other Boards.

Colby Manwaring – Non-executive Director

Colby is an experienced board member and executive with a proven track record of driving growth in technology companies in Australia, UK, Spain, and several USA locations. Colby’s most recent executive roles included CEO of multi-national infrastructure analytics software company, Innovyze, which subsequently sold to software giant Autodesk in 2021 for $1Bn USD ($1.55Bn AUD), where he continued as a Vice President. Colby has successfully aligned organic growth initiatives to product and people resources to deliver balanced growth and profitability outcomes. He has also led buy-side and sell-side M&A initiatives for six businesses, in addition to advising on due diligence and integration planning of over 30 others. Colby is a licensed Professional Engineer and holds a BS and MS in Civil and Environmental Engineering from Brigham Young University, as well as a Minor of Engineering Business Administration from the Brigham Young University Marriott School of Management.

In the afr today...

Smith also likes air pollution and noise monitoring software provider Envirosuite. Its enterprise value is just one times its annual sales, and Smith says it’s the market leader in its space.

“It’s just in profitability for its mining and airports businesses, but there’s a water business losing money, so the water losses are distracting the market, but that’s easily fixed,” he says.

There's probably not much behind today's 13% pop in EVS, but I'll take it!

I did see that the new director Colby Manwaring has been issued 2,000,000 options.. That feels generous, but I take some solace in that the strike price is 20c and they expire in 3 years.

Frankly, if he is ever in the money with these, I don't think current holders will be too upset, and perhaps it reveals something about the board's expectations (although, we'll see whether or not they prove to be realistic).

Ana Rowe has been appointed to the role of Chief Operating Officer. She comes with almost 20 years’ experience in digital product management, strategy, consulting and operations.

Her background seems impressive, having previously been in leadership roles at SEEK, REA Group and Thoughtworks Australia. As COO, she will oversee all aspects of operations, and is responsible for "identifying areas of improvement and leading required change". Interesting choice of words, with lots of focus on improvement and change.

Ana was a Senior Product Manager in the media line of business at the REA Group (realestate.com.au), managing their content sections and delivering innovative solutions for over 3.5mil monthly visitors, and also looking after native media solutions for customers.

At SEEK Ana was a Product Manager for a number of years, managing the seekbusiness.com.au site, as well as delivering jobseeker products in the areas of search, personalisation and job application process.

Prior to product management, Ana's experience was primarily in marketing and market research roles. She also holds a Master's degree in marketing.

So in short, primarily product manager experience, including experience with reputable, ASX listed companies. Prior marketing experience also. An interesting fit for EVS who really need to encourage adoption of their tech/product suites. Hopefully a good hire.

Envirosuite held a webinar today after their AGM. The recording will be available on their website soon.

Nothing much new really, although Jason did mention they expect to hit $100m in ARR in the not too distant future (they are at $60m at present). I pressed him on this in the Q&A, and he didn't want to commit to a timeframe. He also said that achieving profitability was the primary focus at this stage, but that $100m was "in sight".

Someone asked when they expected to hit positive EPS and he said they didn't want to commit to anything just yet, but that they may make an announcement in the coming year. The intention it seems is "soon", but i'll be happy enough with a decent momentum in positive cash flows.

Overall, the messaging is that they have sustained growth, while transitioning to a more sustainable financial footing, and are experiencing good tailwinds in all geographies and sectors. Aviation, in particular, is showing some good signs of life as customers come out the other side of Covid. Regulation and ESG factors are big drivers, and this is true also for all segments. Water remains the potential "moon shot" within the business -- the target market is certainly massive, but time will tell if we see any sustained traction.

The share price seems insanely low if you put any stock in what management are saying. And, I suppose, given the company is currently valued at $78m, you can infer that the market doesn't currently hold a huge amount of faith.

Frankly, one of my biggest concerns is the lack of any material inside ownership. If the opportunity is so great, you'd think senior management and the board would be tipping in some of their hard earned money.

For better or worse, I remain a bruised but optimistic shareholder. So long as ARR continues to march upwards, ideally with some acceleration, and if they not only sustain positive cash flows but also deliver expanding operating margins, then I'm staying the course.

Last week I sent emails to Envirosuite, Pointerra & Kogan asking them in this day and age, why couldn't they include virtual attendance at their AGM.

Envirosuite replied very promptly, saying that they provided virtual attendance at their AGM's during Covid but it proved not to be very popular, but they would consider it for next year.

Well, it looks like they've brought that consideration forward as they are providing a virtual presentation with Q&A on Wednesday 29th 3pm (AEDT).

The recording will be available on their website afterwards if you're not able to dial in.

As for Pointerra & Kogan, I'm still waiting for an email response.

I was a previous holder of EVS however sold out some time ago based on disappointing revenue growth and an apparent inability to control growth in expenses. I have not followed EVS since.

I followed the forum post link by @Remorhaz and watched @Strawman call EVS a buy.

I thought it best to go back and take another look at EVS.

Revenue growth FY23/FY22 8.3%.

Loss before tax has remained in the -$11M to -$12M range since 2021.

Q1FY24 ARR growth 10%.

The Q1FY24 Outlook Statement (below) was as vague as they come:

So, after adjusting the EBITDA and capitalising expenses and based and the exit ARR for FY24 they should be cash flow positive.

They had $8.2M cash at 30 June 2023. Capitalised development costs of $5.8M in FY23 increasing at 55.4% pa over 2 years. The cash balance will get very slim unless they can cut costs or greatly increase revenue.

My valuation model indicates EVS as currently overvalued.

I don’t see EVS as a company you need to be invested in at present. There will be plenty of time to jump in later if they manage to improve the financials.

Not a terrible result from Envirosuite. I missed the first part of the briefing this morning, but my main thoughts are (starting with the negative):

- The team is way too focused on the share price. Yeah, i get it, I bet a lot of investors are asking wtf!?, but stop worrying about it if you truly don't have any near term funding requirements. I messaged the following during the call, but they didn't read it out:

- "Stop worrying about the share price. All you can do is be consistent, candid and clear in your communication and the market will either get it or not. But what it will ALWAYS "get" is a steady improvement in key fundamentals. But if you really did want to send a potent signal to the market in regard to your view on value, buy some shares on market -- and something reasonable! Money speaks louder than words.."

- The level of skin in the game is woeful in my view.

- Jason likes to talk a good game, and I'm sure he's being genuine. But everything always seems to be about to happen. Don't over-egg the pudding!

- Claiming $2m in new ARR as a "strong result" in a typically softer quarter (due to North American holidays) would be fair in comparison to other quarters, but it's still less than the $2.1m in the prior first quarter. Pretty sure holidays would have been a factor in Q1 FY23..

- Anyway, total ARR growth of 10% was reasonable, but not as high as i'd have liked. To be fair, if you exclude the "churn event" in the prior 3rd quarter, which isn't entirely unreasonable, ARR growth would have been 16%.

- Also good to see North America do well -- it accounted for 55% of new ARR -- and the company seems to be winning new clients across all segments.

- We seem to be seeing some traction with Water too, a new enterprise deal with Ion Exchange (an Indian based water treatment company) is encouraging. There's potential to roll out to a lot of additional plants if successful. Not sure of the exact quantum, other than it being "significant"

- Aviation won a significant expansion with a key UK airport customer (they couldn't say which, but seemed to hint it was one of the bigger ones). A rebound in the aviation industry is helping to stimulate more investment from customers and they are especially focused on community engagement.

- Industrial was pretty ordinary, although Jason did stress the lumpy nature of deals here. ARR also impacted by end of life contracts (ie. subscription not renewed because the customer project finished). It was good to see some new and notable customers -- hopefully we can see some of the "expand" phase of the strategy play out here, they certainly seem to have a lot of sites.

- While new ARR was ordinary, project sales were up 31% on the pcp -- and these are a good lead indicator for future revenue (Jason again stressed this in the briefing)

- Perhaps the main thing was the reiteration of the EBITDA +'ve target for FY24 (after rightfully deducting capitalised development spend).

- There was some rumour about a potential takeover of EVS raised by one of the attendees, but Jason batted that off as speculation. Frankly, i'd be annoyed if it was taken out for a low-ball offer.

The company has a market cap that is only 10% above its annual recurring revenue (It's a flawed metric, but you have to work with what you've got!). The near term working capital demands are no longer threatening a raise, we're seeing new customers and a reasonable level of growth in recurring revenues, as well as a large opportunity across the three divisions. It's a super niche area, but one in which EVS is the global leader.

Yeah, it hasn't executed as well as I'd have liked, and they got over their skis for a time there in terms of cost management and growth initiatives, but they've got a good offering across various sectors that all appear to have some traction.

I'm continuing to hold. I wouldn't call EVS a high quality company (although that potential exists for the future), but the valuation seems compelling.

FY24 Q1 SALES UPDATE

$3.7m Sales up 9% on PCP,

Company ARR grows 10% on PCP to $60.6m

Key Highlights:

- New Sales of $3.7m, including New ARR of $2.0m and Project Sales of $1.7m. A strong result in a seasonally softer quarter impacted by northern hemisphere Summer holidays

- Total ARR grows 10% on PCP to $60.6m (16% growth excluding one-off churn event reported in FY23 Q3)

- EVS Aviation achieved New ARR of $0.6m, with several customers taking up additional solutions during the quarter, including a significant expansion with a key aviation customer in the UK

- Strong contribution from EVS Industrial, particularly from the Americas region, achieving New ARR of $1.1m with the addition of several new customers, including a significant oil shale enterprise in Europe and premium copper producer Capstone Copper in the US

- EVS Water achieved New ARR of $0.3m, up 45% in Total ARR on PCP, including the signing of an Enterprise Agreement with Ion Exchange, a leading water treatment solutions company in India

- Envirosuite reaffirms its outlook to deliver positive Adjusted EBITDA less Capitalised Development on a run rate basis during FY24

- Churn over the last twelve months (LTM) of 8.1% includes a one-off churn event reported in FY23 Q3. Excluding this one-off impact, churn LTM would be 2.1%, consistent with the long term average

ASX RELEASE

6 October 2023

Funding facility secured to support growth

Highlights:

- Funding facility secured with Partners for Growth to provide up to $7.5m

- Supports funding of bundled Software and Hardware contracts

- The Company is funded to pursue its organic growth objectives

- Leading environmental intelligence technology company Envirosuite Limited (ASX: EVS) (Envirosuite or the Company) is pleased to announce that it has secured a debt finance facility (Facility) with Partners for Growth (PfG)i. The Facility will support certain contractual arrangements where Envirosuite allows customers to bundle their instrumentation requirements together with their software and support components into the recurring payments over the contract term. The Facility is also intended to provide funding to support the Company’s working capital requirements. The Company reaffirms its outlook to be adjusted EBITDA less capitalised development positive on run rate basis during FY24.

- CEO & Managing Director, Jason Cooper commented,

- “We’re pleased to announce the Facility, which strategically aligns with our core business objectives: driving growth, creating long-term customer value and leveraging the increasing opportunity to bundle Software and Hardware into our Industrial customer contracts. The availability of the Facility to fund the bundled contracts adds to the Company’s contracted and recurring revenue profile and is the best strategic match for the Company’s purposes. With the Facility secured, we currently have no plans to raise further capital to fund our organic growth towards sustainable free cash flow generation.”

- Key terms of the Facility:

Limit Interest rate Term Purpose

$7.5m

The greater of the 3 month BBSW rate plus 7.75% pa and 11.75% paii

3 years from 5 October 2023

Growth and working capital in the normal course of business, including funding trade finance and equipment finance investments

The terms of the Facility are summarised in Annexure A in this announcement – see overleaf – aside from which there are no further material items that need to be satisfied or approved prior to drawdown.

Authorised for release by the Board of Envirosuite Limited.

For further information contact: Adam Gallagher

Company Secretary

E: adam gallagher@envirosuite.com M: +61 428 130 447

1 Envirosuite Limited Level 30, 385 Bourke St

Melbourne VIC 3000

(ASX: EVS) ACN: 122 919 948 www.envirosuite.com Phone: (02) 8484 5819

ABOUT ENVIROSUITE

Envirosuite (ASX: EVS) is a global leader in environmental intelligence and is a trusted partner to the world’s leading industry operators in aviation, mining & industrial, waste and water.

Envirosuite combines leading-edge science and innovative technology with industry expertise to produce predictable and actionable insights, that allows customers to optimise their operations, remain compliant and manage their environmental impact.

By harnessing the power of environmental intelligence, Envirosuite helps industries grow sustainably and communities to thrive.

www.envirosuite.com

Colby Manwaring to be appointed as Director

'Colby has had an executive and entrepreneurial career in water and environmental software, covering nearly all aspects of the industry, including software development, sales and marketing, professional technical training, strategic business planning and execution, mergers and acquisitions, and strategic alliances. Starting his career as a software developer he went on to lead multi-national infrastructure analytics software company, Innovyze, with 3,000 customers globally, which subsequently sold to software giant Autodesk in 2021 for $1Bn USD ($1.55Bn AUD).'

Interesting that Colby is a) based in North America, EVS' largest region and b) has a background in water.

Colby was CEO when Innovyze was sold to Autodesk for just over $1b in 2021. Prior to this, he spent 10 years as CEO of XP Solutions -- another US based business -- which was eventually merged with Innovyze in 2017. Innovyze is a global leader in water infrastructure software. When the acquisition took place, Autodesk stated it positioned them 'as a technology leader in end-to-end water infrastructure solutions from design to operations, accelerates Autodesk’s digital twin strategy, and creates a clearer path to a more sustainable and digitized water industry.'

Very, very interesting. Colby will presumably add significant value and subject-matter expertise around the water segment and bring an established network with him to the director role.

Hugh Robertson to step down

Having served as a director since September 2018, Hugh will step down effective 1 September 2023. There is no justification given for his exit. On paper though, Colby seems a much better addition to the board, so I am not complaining..

My meeting notes for the August 2023 interview:

- $EVS does racetracks! However, I agree with @Rocket6 Racetracks are probably like Defence, they know they make noise and simply need to 'report' and not 'improve' - So no value for $EVS to invest.

- Jason suggested $EVS will be bigger in Africa soon!

- $EVS finished up cashflow +ve, true, but numbers can be flexible, and Jason did state it was a goal of leadership this FY... so I'm skeptically happy.

- No cap raise likely for $EVS. Jason firmly believes the path is set.

- I observed promotional language in Jason – pride? Or salesman? A bit of both, he is very careful with his words. A good sign IMHO.

- Jason's shoulder touching when talking about the restructuring costs was abnormal behaviour for the interview... Causes him stress maybe?

- A genuine laugh from Jason around the ‘fine line’ of profitability vs internal investment. Classic SaaS problem.

- The Americas are the growth engine for EVS. Industrials is 20% growth yoy, Aviation is biggest and strongest, Water is slow because of customer business processes.

- Methane monitoring/insights into the Omnis platform by external IoT provider is a thing for $EVS.

- China potential. Was a big $EVS narrative, but not anymore. On a country basis $EVS is cash flow +ve. however one wants to build a ramp with their supplier and in China it’s a one way street. So not rushing to leave, but not rushing to expand.

- Supply chain, they use a third party for IoT equipment. It sounds as if $EVS is the primary customer and thus has pricing power.

- Inflation. $EVS builds CPI increase into their contracts.

- $EVS software dev team is stable for employment and no high turnover.

- Jason's opinion is that Mr Market's low price assumes a Cap Raise. No CR unless they want to buy a ‘compelling’ offer.

- I agree with @mikebrisy I like the 'cut of the jib' of Jason. He has interviewed well multiple times now.

- Random fun fact, last time I purchased a parcel at $0.08 was in 2018! $EVS is definitely changed since 2018 and I think is a much stronger company than it was in 2018. I'm off to top up. Thanks @Strawman for the interview.

disc: Held IRL.

Another good meeting. My notes are below:

- Recap of results -- best results the company has ever delivered according to Jason.

- Suggested Q1 likely to be weaker as suspected. This is due to this period being holiday time for a lot of the regions they service and it is typically their weakest quarter.

- Provided a little bit more context around the churn of the Defence contract. Jason almost suggested the move was mutual – Defence need a focus on noise (loud planes/jets etc) – Jason suggests they aren’t going to be doing too much on the noise front to help them moving forward, a ‘strategic direction’ with the company, given they want to focus on commercial aviation due to it being ‘scalable, repeatable’ and ‘solving a real problem’.

- I just made a separate forum post to @Parko5 and @Strawman suggesting this is likely why they don't play more of a role in servicing racetracks.

- Jason indicates ARR is the key EVS metric to track and judge them on.

- Goal to transition to operating cash flow positive in the backend of FY24

- Firmly believe they will avoid a capital raise. Considering debt options.

- Transparent views about water – openly stated that water has not grown to the rate management expected due to additional information they have learnt throughout the journey – mainly around evaluation and procurement criteria, and the nature of their customers (utilities etc). Jason maintains the problem they are solving is scalable and real, it is now about evolving the business model so that customers can transact quickly and that they target the right customer segment.

- Just on water as well, and this does NOT relate to the interview but instead the results call – Jason suggested FY24 would likely be the year Water ‘takes off’ for the lack of a better term, in his view anyway. Lets see what happens over the next 12 months.

- Jason was more bullish on aviation than I expected – yes it is his job to spruik his own segments, but it genuinely sounds like he is excited for their products and the impact they can make on the market going forward. He sees lots of blue sky here.

- Prompted re: SGS alliance – more influential in some areas than others, South America and Australia for example which have strong traction moving forward. They have ‘heavily influenced’ some mining deals won. They are happy with where this is at but would like to see more growth result from that alliance.

- Some interesting discussion about the Chinese market. In short, there are more favourable markets for them to interact, dealing with business/countries that actually want them to do well. That said, they do still have some exposure to the Chinese market and they are cash flow positive in that region.

As always, it is great to hear a CEO in the Smiling @Strawman Starchamber.

My takeaway from the discussion is that Jason has been pretty consistent over the three meetings, and I certainly share his disappointment at the lack of a positive response to the annual results, which were good.

However, $EVS remains on my watchlist for now, because I want to see some further confirmation of the ARR growth / revenue trajectory. Because of the huge, global, macro-theme around its ESG-aligned offerings, one thing holding me back is that I don't understand the competitive dynamics in its three verticals. For sure, customers are investing in all three areas, so at some point we have to see a more material uptick in sales.

In concept, $EVS might become a Baby Giant, so I remain interested. And, indeed, the FY23 post-COVID recovery in ARR-uplift is a positive sign that there is more than a story here.

I'm all done with numbers for this week, so instead I will use an analogy to try and convey my assessment.

I'm standing on the 5th floor of a skyscraper (>100 floors), with a row of elevators (ride opportunities) in front of me and a dozen passengers I have to direct to queue at each door to ride to the top. As I see each elevator rising up from the 3rd or 4th floor, I direct each passenger to wait at the door to board the lift. There are several other elevators already moving up to my floor, but I can't see when the $EVS "elevator" is going to arrive, as it is still down at the 1st or 2nd floor. So, I am directing my passengers ($$) to those doors where I've got the confidence they won't have to wait too long. (In my analogy, the payoff is bigger if you get on at lower floors, but is reduced if the elevator is too slow - if that wasn't clear).

OK, not sure if that works. But it is how I am reading things.

Disc: Not held in RL or SM

Our meeting with Envirosuite CEO Jason Cooper this week is well timed; no doubt we'll have some good questions for him and he'll be able to speak much more candidly now their numbers have been published.

(BTW -- please add any questions for Jason here)

First off, the ARR results were known following their 4th quarter results . As mentioned at the time, these were pretty good thanks to a record 4th quarter.

Annual ARR growth in recent years has been:

FY20: (not relevant as the acquisition of EMS distorts things. fwiw ARR in 2019 was $5.6m, which at least points to the substantial growth of the industrials segment)

FY21: 8.1%

FY22: 14.0%

FY23: 12.1%

It's worth noting that the industrial segment ARR growth has been around 22%pa over the last 3 years. With airports no longer (hopefully) acting as a deadweight, we'll see group ARR accelerate a bit.

If EVS simply match the same new ARR in the current year, total group ARR should be up by over 15% for FY24. Which is about what's needed as a minimum for me.

(The water segment is still very nascent -- but a bit of traction here could really help too. I'm really looking at this as a free kick option right now)

This time last year, ARR was reported at $53m, and for the year just ended EVS said it had recorded $49.5m in recurring revenue. There was the loss of those defence sites in the second half, but there was also $4m in new ARR from the first half -- so i'm not exactly sure why there's a small mismatch. A question for Jason, maybe just timing issues?

(It's not a huge difference, but ARR metrics just always seem to be a little fuzzy. Yes, a useful guide for investors and management, but too subjective for my liking)

Finally, it's great to see some really strong ARR growth in the Americas and EMEA. These are big markets, of course, so hopefully they can sustain some momentum in these geographies.

Anyway, moving past ARR.

It was good to see improved gross margins. In fact they've been steadily improving for some time now. Tick.

Adjusted EBITDA was positive $500k, a big improvement from the $3.9m loss in FY22 and ahead of what they had guided for. The big swing factor here is the $1.8m in annualised cost savings due to restructuring efforts (ie redundancies), which is reasonable to strip out, imo. Less so is the exclusion of share based payments, which amounted to $743k -- add that back in and it was a negative adjusted EBITDA.

To be fair, they do breakout a better picture of things with what they call "Management Operating Cash flow":

So not to be negative (I'm certainly not unhappy with the improved trajectory with the financials), but the business is very much asking you to focus on their preferred metrics. Let's not forget that on a statutory basis they lost over $10m this year -- largely due to $9.4m in D&A charges.

In fact, capitalised development costs were up 21.3% to $5.7m. And accounting for this, operating cash flows were negative $3m (even if you add back one-off restructuring costs and the like). Still, they have been working on new modules and there's (hopefully) genuine value being created. And, yes, capitalising dev costs is just par for the course -- even Objective Corp has yielded to the practice! Still, i just make note of it. Those D&A charges may be "non-cash" but they are very real if you hope to maintain competitive software solutions.

There's a little over $8m in cash left. So it'll be a close call with a raise. Prudence suggests it's wise to expect one. Maybe they'll do a Pointerra and issue a big contract win first? (or maybe i'm just getting too cynical with age..)

Elsewhere, operating expenses were up 6.9% over the year to over $40m (see annual report, not the preso, for stat numbers). I'm keen to see what the 'normalised' cost base is like. The truth is, we need to see some operating leverage kick in -- and if they can sustain 16% gross profit growth while holding fixed costs steady (or at least only wear modest fixed cost growth), 'adjusted EBITDA' could really explode higher -- and even, dare i say it,NPAT growth too -- in the coming years.

Anyway -- there's a solid little business somewhere here. Overly aggressive expansion plans (remember the push into China?), ill-disciplined cost control, a global pandemic that knocked the biggest segment for six, a change in management...(have i missed anything?).. have all acted to impede the growth in cash flows and certainly tested shareholder patience. But i'm encouraged with the return of growth in aviation, the continued strong growth in industrial segment and the free kick potential with water (the Chairman has said this segment has the potential to be the "jewel in the crown"), especially in combination with more prudent cost discipline.

If all goes well, I cant see why Envirosuite shouldn't be generating $100m in revenue in 3-4 years. Ideally with at least a 20% operating margin. If achieved, the market cap could easily be $200-250m (around 16-20cps) at that stage, and offer a decent annual return for current investors.

An overly dilutive raise, mediocre top line growth or a failure to manage costs effectively would, of course, undermine any confidence here.

Will continue to ponder and hoping we can get a clearer picture after we chat with Jason this Thursday.

[HELD]

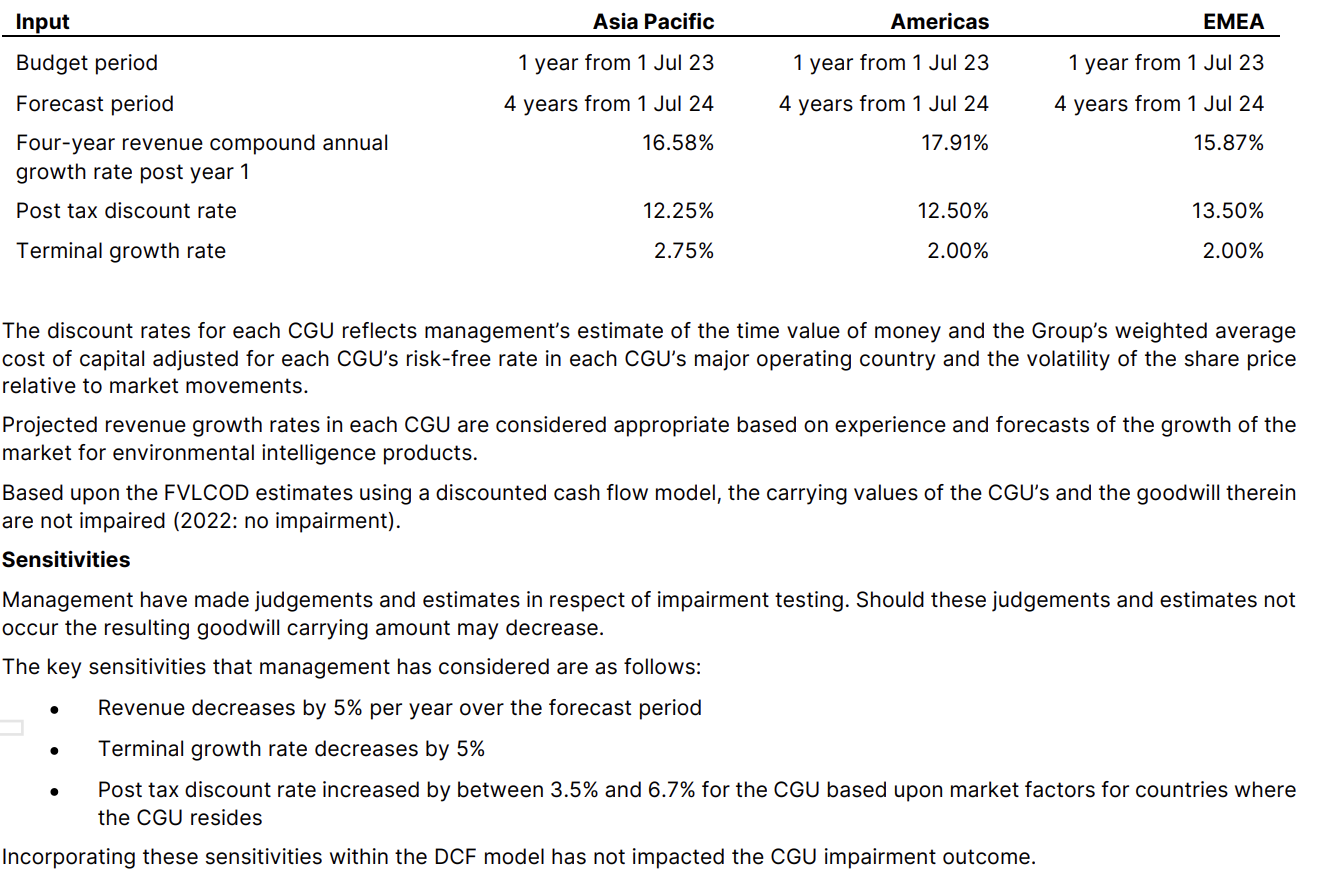

Just went down a rabbit hole on the latest annual report ... (trying to work out my latest valuation)

Trying to work out the negative cashflow -8.052M and get a feel for when these guys are going to run out of money and need to raise more capital. They've only got 8.22M cash so look to have less than a year or runway left. Based on their last raise and burn I'm guessing they are going to be looking for another $10m or so which would be a further 10ish% dilution.

In doing this digging I realised how large an amount of goodwill they have on their balance sheet. In viewing this, they have racked up 66m of retained losses to generate 107m of intangible assets. This seems to be backed up by a DCF model from management.

My key question here is how do these figures compare with those in your DCFs or estimates of value (mid teens revenue growth rate with 12.5% discount rate) that seem to have lead to a consensus valuation of 15c per share?

FY23 FINANCIAL RESULTS

$4.5m improvement in Adjusted EBITDA to $0.5m profit, cash flow positive of $0.7m from operating activities, ARR grows to $59.4m up 12% YOY

Key Highlights:

- Adjusted EBITDA profit of $0.5m achieved for the year, an improvement of $4.5m YOY, exceeding the Company’s goal of transitioning to Adjusted EBITDA positive during FY23

- Gross profit improved by 7.7% YOY to 51.6% on an EBITDA basis

- Positive cash flow from operations of $0.7m, an improvement of $3.9m YOY, successfully balancing cash management with investment in people, product and growth

- ARR increases to $59.4m up 12.0% YOY following a record $9.1m in new ARR with particularly strong growth in the Americas region, which contributed over 40% of new ARR

- Recurring revenue up 12.8% YOY to $49.5m, representing 85.5% of Total Revenue of $57.9m

- EVS Aviation – ARR of $36.4m up 7.4% YOY, demonstrated strong customer retention with key renewals and exciting growth from new marquee customers. The success of innovative aviation products (Carbon Emissions Modelling and InsightFull community engagement portal) highlights the industry’s growing response regarding the environmental and social impact of air travel

- EVS Industrial – The Company’s primary driver of growth, with ARR up 19.3% YOY to $21.6m, including strong growth in the mining sector and the Americas region, where the Environmental Justice movement and resulting legislation has generated significant momentum in the US

- EVS Water – ARR up 36.0% YOY to $1.4m and achieved significant product validation in every region during the year creating a strong opportunity pipeline through several channels

- Annualised churn of 8.1% (1.9% when excluding the previously reported one-off churn event)

- The Company ended the year with $8.3m cash and no debt

Envirosuite had some decent numbers for the 4th quarter of FY23.

Full announcement here

Highlights:

- Total ARR up 12% on the pcp, and at a new high following the dip in Q3. (That was a result of a "churn event" -- the loss of 3 Aus. Dept. of Defence sites using the aviation product.). Excluding the loss of that client ARR would have been up 20% according to the company.

- A little annoyed at the communication here tbh. Last quarter they really downplayed the loss of that client and said it only impacted ARR by 1.2% and was not material. Now we have a full quarter without those sites, it seems they were worth about $4.2m annually (If ARR would have been up 20% excluding the loss of those sites, as they suggest, we'd be looking at $63.6m in total ARR vs the reported $59.4. Or maybe they stripped out the contract value from the pcp? either way, it seems bigger than was originally suggested). Look, it's not a deal breaker, but I think the communication is lacking here.

- New sales of $6.8m for the quarter, which is up 13% and a company record. $3.1m was new ARR -- a welcome lift from the flat pace in recent quarters, but in line with what they did in the pcp.

- A record quarter for EVS Industrial, thanks to expanding relationship with BHP. Obviously a lot of potential to expand further with this client, which is also a great reference client, so encouraged by this. The industrials segment showed the best growth and for me has always been the best part of the business -- i wish they had simply remained focused on that. This segment represented 55% of ARR growth, and was up 19% on the pcp.

- Churn remains low (excluding the DoD contract) at 1.9%

- A small win in the nascent water segment of $0.2m ARR, the first for a few quarters. Total ARR from this segment is now $1.4m, up 40% from pcp

- Aviation looks to be doing well in the middle east. 7 new airports added in the quarter. The carbon emissions modelling product apparently getting some interest as companies look to improve their ESG credentials.

EVS reiterated its target for "adjusted EBITDA profitability" for FY24. That was negative $500k at the half, at which point they had just under $12m in cash.

Shares are on about 1.9x ARR. If the underlying growth can be sustained anywhere near the quoted 20% level, and if they can realise some decent operating leverage (there's been some tentative progress here), then shares are probably good value.

There's a briefing at 10:30am AEST if anyone's interested (click here)

Disc: held

Not quite the $50k Strawman was chasing however Susan Klose picked up 500,000 shares today. Always happy to see director buying but feel the dial won’t turn until there is an announcement that they are getting closer to cashflow positive. Certainly requiring lots of patience.

Noting two on market purchases for Envirosuite directors recently.

CEO Jason Copper and outgoing Chairman David Johnstone picked up $10-12k worth each at about 8c/share.

It's always nice to see insiders buying on-market with their own funds, but if I were cynical i'd say it feels more about market signalling than simply the private investment decisions of Jason and David.

These are tiny transactions. Jason is on a fixed salary of $363k, plus 50% extra under a STI. As far as I know, this is his first on-market purchase (the current 1m shares held were granted as part of his remuneration package). I mean, great to see him buying on-market, but $12k is pretty weak.

David already owns close to 7m shares, so it's not going to move the dial either way. It is a nice sign given his intention to step down later this year, but would have been better if it was a more meaningful swing of the bat.

I'm probably nit picking here, and not suggesting any grand conspiracy at all. But if this were purely about directors buying shares because they consider them cheap, then at least make it worthwhile for your own sake. It's like me picking up an extra $500 worth -- what's the point?

If part of the rationale was to show confidence to investors, which is what it feels like, then such tiny amounts ain't going to do it.

I don't pretend to know their personal financial situations, but had we seen transactions of at least $50k or more, i'd take more notice.

Envirosuite is getting pounded pretty hard on tax loss selling. Quickly approaching 5 year lows.

Speaks to the sentiment investors have towards the business at the time. Board renewal will now likely align with investors holding renewal.

The Chairman David Johnstone is stepping down and the company is planning on renewing the board, although to what extent is not clear.

As of August 2022, the board looked like this:

David has served as the Chair for almost 7 years and has been with the company since 2014. Back then, shares were 7c each and the company was called Pacific Environment. It was a fair bit smaller then, generating $12m in revenues BUT far more profitable with $1.3m in NPAT.

At the time, it was largely an environmental engineering consulting firm and they were still developing the software side of the business. They subsequently sold the consulting arm and focused entirely on the SaaS offering.

Today, it has over $57m in annual revenue and no profit. But at the same time, shares on issue have grown 12x (so sales per share have gone backwards). Retained losses on the balance sheet have also ballooned $50m from 2014 levels.

The market cap has grown from $7m to $110m, but the share price has increased from 7c to 9c since 2014, (passing through 29c along the way when the SaaS growth narrative was running hot).

This is a good example of a company that has gotten a lot bigger, but hasn't delivered much value for long-term shareholders -- at least so far. A great reminder that growth can be very expensive and not always value accretive to shareholders.

Of course, that was then, this is now. While it's taken nearly a decade to transform the business, it does now have much more reliable revenues, top line growth is much stronger, the market opportunity larger and the (potential) economics better.

But given the long and winding journey, why would you be leaving now, just when breakeven is in sight and there's some momentum in sales?

David has about 7m shares (0.5% of the total company) so maybe the larger shareholders have initiated this? The Omerod family still control a stake (i think about 2.5%) but Ellerston Capital is the main shareholder with a 7.9% stake, and have been increasing their stake over the last year or so -- maybe they have been agitating for change? (fwiw, their micro cap fund has outperformed since inception)

I remain of the view that there is a solid little business somewhere here -- but it's also true that the capital management hasn't been great (I've never been a fan of the reverse takeover of the Airports business), and like a lot of tech growth companies, costs could have been better managed. The newish CEO Jason Cooper has been only been on board for about a year, so cant really lay much blame at his feat.

Worth also noting that Tim Ebbeck was only on the board for 6 months before leaving to "focus on other commitments". A very short stint.

Of the other directors, the longest serving is Hugh Robertson who has been there since 2018 and easily holds the most shares out of all board members (22m shares). The others have relatively insignificant holdings and have been there for 1-3 years.

Anyway, today's news could be good or bad depending on how you look at it.

Is this a change that is badly needed to bring in more experienced and capable directors? Ones that will enable EVS to better realise its potential?

Or is it a sign of disunity? Or a lack of conviction in the future from someone who has been on the inside for almost a decade?

It's virtually impossible to know from the outside, but on balance I think it'll be good to see a change. No offense to David, but he's had almost ten years, and the execution hasn't been fantastic.

ASX Announcement

Board succession planning for FY24

29 May 2023 - Leading environmental intelligence technology company, Envirosuite Limited (ASX: EVS) (Envirosuite or the Company) is pleased to advise the commencement of a planned board renewal process that is expected to complete by the end of H1 FY24

At the commencement of the process, the longest-serving member of the Board David Johnstone has advised that he intends to step down from the role of Chairman at or by the 2023 Annual General Meeting subject to a suitable successor joining the board

Chairman, David Johnstone said,

"It has been a privilege to lead the board through so many years and significant events and see the Company grow into the leading international environmental technology company that it is today. The business is now at a scale and juncture where we are attracting significant commercial and corporate opportunities globally

Similarly, our positioning has attracted potential board candidates with the talent, industry knowledge and experience to lead and support the executive team in the next stage of our growth and by opening the Chair role I want to ensure that the strength of the Company and its prospects continues to be reflected in the board”

The Company expects to make further announcements on its board renewal process in due course

I don't really have experience with how these things normally work so unsure whether to take this at face value or a euphemism for something more sinister?

DISC: Held in SM & RL

Commented on them alongside 4 other reports in my Substack this week.

Short thoughts:

Thinking about the churn deeper, it would seem to me that the Department of Defence’s airports may be quite different to other commercial airports (the traditional Envirosuite client), so perhaps this can help explain the churn. The product may have been less fit for purpose for a Defence base. The fact that the world’s largest airport operator Aena expanded their contract may support my hypothesis.

In general though, the question mark on what potential future growth they can achieve remains. We see a lot of quarters coming in at $2M in new ARR, and with the base increasing, this can lead growth to the low teens soon.

There is potential here as always:

- They appear to be improving with relevant customer-led marketing (here)

- The water segment seems promising

- ESG tailwinds and blowing harder than ever before, so I think this is one to watch despite mixed results

Let’s see how they go in full year results. In future years, the water segment’s growth will be interesting to monitor.

20 April 2023: MA Moelis Australia: Envirosuite Limited (Buy): "Mar'23 4C: ARR broadly flat due to Aviation churn, 4Q pipeline remains strong"

That's the first page. Click here to access the full report.

Disclosure: I hold EVS shares here in my Strawman.com virtual portfolio and also in one of my real life portfolios.

Envirosuite MA Moelis AU buy rec 20 April.pdf

Solid broker report with a "target price" of 17c. Touches on much of what has already been discussed.

@raymon68 has provided the details on $EVS.

I only observe in addition that with New ARR of $2.0m in the Q - the same level achieved in the PCP - that Total ARR is moving into decline for the fist time in recent periods, from $56.9m to $56.2m. That's not what you expect in a growth play.

At the last investor presentation, Jason Cooper spoke powerfully about the quality of the pipeline and we were led to expect that there would be strong wins upcoming. However, I wasn't convinced, and exited at the time. Today's report indicates this questionmark remains.

I remain on the sidelines for now, with $EVS still on my watch list. This just isn't showing delivery progress commensurate with the story and earlier management rhetoric.

Disc: Not Held

EVS’ total ARR (annual recurring revenue) grew 15% in Q3 on pcp to $56.2m. Q3 new sales were $4.2m, up 14% on pcp. The company said it remains on track to achieve its target of transition to Adjusted EBITDA profitability during FY23.

EVS Aviation • Total ARR of $34.5m, up 8.5% on PCP (21% on PCP when excluding Australian DoD impact), with New ARR of $0.9m for the quarter.

• Abnormal churn increase in Q3 primarily due to the cessation of revenues for three of five sites currently contracted with Australian DoD. o Services going forward are for a different scope compared to the services that Envirosuite historically provided at these sites, and the services Envirosuite provides to other customers. o Envirosuite is contracted to provide services to the other two sites until at least FY25. o There was zero churn in Q3 aside from this in EVS Aviation.

• Multi-year €8.9m ($14.3m AUD TCV, $4.8m ARR) renewal and expansion of marquee European customer Aena, the world’s largest airport operator by passenger volume. Under the expanded agreement, Envirosuite will now provide its InsightFull community engagement solution at three major Spanish airports as part of Aena’s requirements under European Directive 2003/4/EC.

• New opportunities in China with a newly signed customer to be delivered with a local Chinese systems integrator, with several other opportunities in progress

This was a decent result for Envirosuite.

You can read all the details here, but the main things of note to me were:

- ARR growth more or less on pace (although hoping this starts to accelerate as aviation picks up)

- ARR growth across all geographies, but US especially strong

- ARR growth above customer growth (increased ARPU)

- Gross margin improvement

- Much closer to breakeven, Adjusted EBITDA (adds back capitalised dev costs) positive in final two months of the year. Expect to be so on a sustainable basis going forward this year.

- Plenty of cash at just shy of $12m

- Solid pipeline

Valuation remains undemanding at about 2.6x ARR (not a great measure, but somewhat useful as a benchmark at the current stage). Provided, that is, top line growth can be sustained (or exceeded) in the mid-teens AND the business scales well.

Held.

In answer to @Strawman 's question, overall the meeting commentary isn't adding much to the written release - beyond lots of positive talk about "opportunities" and "prospects", with lots of words like "huge" and "significant".

Both Jason and Justin stated that they see no need for a capital raise and that they remain on track towards profitability this year. Justin stated that he has a high focus on "contract-to-cash" to ensure the receipts flow.

There was some reference to their under-estimating procurement timescales on new deals. One reason cited was concern in Europe over energy costs. Based on the what was written and said, then H2 should be a very strong one for new sales. If it is not, then that would indicate that Jason is look at the business through rose-tinted spectacles.

They are very excited about the reported national airspace deal, as they think this is setting a new approach to how countries are looking at managing their airspaces. We'll see.

I agree with @Rocket6 's characterisation of progress at EVS as a "grind".

I have recently exited my RL holding at $0.135 in the belief that SP will not move materially until there is some demonstrated momentum. Of course, things can change quickly with one large deal or a strong quarter. I'd certainly be happy to jump back on board and EVS moves to my Priority Watch List.

I will align by SM position provided there isn't any SP deterioriation throught the day. (Which this post presumably doesn't help!)

Disc: Held on SM; Not Held in RL

Seems an ok quarter overall for Envirosuite. ASX announcement here

New ARR grew by 11% from a year ago. And total ARR up 16% to $56.9m, with Aviation recording its strongest quarter ever with air traffic rebounding in the US. The new carbon emissions module is showing some good potential.

That masked a drop in new ARR from Omnis, which added $0.6m in Q2 compared to $1.3m in the pcp. A number of deals were signed during the quarter with revenues expected in the current quarter. Overall Jason Cooper said he expects growth here to be at, or above, the historical growth rate for the rest of the year.

The nascent water business didn't see any new ARR (in total this segment is only at <2% of total ARR), but new features were released, previously signed contracts continued to be rolled out which, it's hoped, will provide useful reference sites and product validation. Combined with a proof of concept trial with a major US based water treatment services company, Jason reckons it provides the business with "an exceptional revenue opportunity"

Still have $12.9m in cash, down from $16.2 at June 30 last year, which implies an annual cash burn of $8.6m (although need to be careful here due to timing effects etc). I'm unable to attend the briefing today (register here for 10:30am), but it'd be good to get an update on how they see their cash burn evolving.

Overall, it seems the general thesis is on track. It's really encouraging to see some life in aviation after the impact of covid. Representing 70% of group revenues, previous sluggishness here has really limited overall growth.

While the level of total recurring revenue has been growing steadily -- the pace of growth hasn't improved for a while. EVS is adding an average of $8m in ARR per year, which represent mid-teen growth. Not bad, but it'd be nice to have all three segments increasing new ARR at the same time.

EVS shares are currently trading on 2.8x ARR

Held.

Environmental technology company showing strong momentum in the past few years. Has three primary verticals in the business - Omnis, Aviation & Water.

Omnis (environmental monitoring for mining/industrial) creates the greatest recurring revenue of the three, with some notable clients. Water looks to me to be the area with the largest growth opportunity - already we are seeing significant growth in it's top line revenue.

A technology company in the environmental area would tick a lot of boxes for a longterm investor. Has proven technology with a large addressable market and seems to be recruiting the right people to guide this towards long term profits. Possibility of a takeover later on also.

Moelis Australia broker report on Envirosuite BUY rating with price target 0.17

https://mamoelisaustralia.bluematrix.com/sellside/EmailDocViewer?encrypt=6edd91b6-48ba-41dc-89fa-07bbfdbcd1c4&mime=pdf&co=moelis&id=edward.day@moelisaustralia.com&source=mail

Have announced achieving adjusted EBITDA positive in fy23. Path to being NPAT positive seems much further away. Note from tables below that that the book value of the intangibles didn't materially move from fy21 to fy22 even though they made $5m amortisation. This because they capitalised another $5M in software development.

They have an eye watering $108M intangibles on the balance sheet. $89M is goodwill that they aren't amortising at all. Perhaps that's ok. That leaves $19M to amortise without adding any more which seems unlikely since they are capitising software dev to get to the adjusted ebitda break even.

I just attended the EVS investor call for their Q1 FY23 results and my notes are below. Unfortunately I missed the first 5 minutes of the call.

There were some good questions with people in particular digging into the (small amount) growth in the water segment and the value of the SA Water deal and expansion in number of sites at Water Corp. Unfortunately they didn't really shed any further light on specifics but said they were really happy with how it was progressing in line with their “Land, Expand and Scale” strategy.

Q1 Earnings call notes:

Very happy with the results.

Churn low at 2.3%, when it does happen due to construction projects finishing up (still good relationship with the builder/construction companies) and government spending reduction.

Water

Added second Australian water utility, SA Water, for SeweX. On top of existing customer Water Corp.

Only one site/catchment currently but great opportunity to expand. In line with “Land, Expand and Scale” strategy

Utilities like to start with one site/catchment as a trial and see how they can use it before rolling out to other sites.

Water Corp has expanded the number of sites using SeweX but they wouldn’t say how many specifically.

From a technology standpoint, continuing to add new features.

Outlook:

Q1 strongest start EVS has ever had to a year. Demand only getting stronger.

Validation on the SewX opportunity via acquisition of Water Corp and SA Water. Actively talking to many other water utilities in Australia. Unique product in the market.

New RGM (Regional General Manager) for Europe, to focus and drive sales in that region.

Pathway to profitability on track.

Philippines office going well and able to attract skilled and quality employees.

Continuing to look at supply chain improvements. Signed new 3rd party contract manufacturers. Adding on capability and de-risking.

Transitioning to an adjusted EBITDA profitable position in FY23. Fully funded to reach profitability, don’t see any need to raise further capital.

Did not answer a question in the chat box on reaching statuatory profitability.

SGS partnership focused on Omnis product.

SGS active in so many segments around the world but starting focus on mining, industrial and oil & gas.

Philippine office not a “cost reduction” strategy, but “cost efficiency” way to grow at a lower marginal cost.

Putting like minded people in one environment. A centre of excellence.

@Rocket6 has already added excellent comments, so i just wanted to add one point from the investor call (i did miss most of it unfortunately)

They emphasised they would be 'adjusted EBITDA' positive this year and had no need to access the capital markets.

I'll also second the significance of the SGS partnership. Will be watching that with great interest.

On initial impression, this report isn’t nearly as impressive as their previous quarter (Q4 FY22, which was a belter). Q1 sales was a modest 3.4m, which pales in comparison to the 6m recorded in Q4. That said, there were some real positives.

Highlights

- ARR 55.2m, a small increase on the 53m previously reported

- Another 18 new sites added, eight of which were from existing customers. Once again, Omnis did the heavy lifting for EVS, winning 13 of the 18 new sites.

- Omnis signed a ‘global strategic alliance’ with SGS. More on this below.

- Continued cross selling between products – 'land and expand' strategy

- Small increase to churn Q on Q – increasing from 2.5% to 2.8%

New contract win – SGS

This is a multinational company which provides world-leading inspection, verification, testing and certification services. With more than 90,000 staff, 2600 offices and a 2021 revenue of more than $6b (CHF), this appears an impressive ‘get’ for EVS.

So what exactly does the alliance consist of?

‘The agreement sets out terms that will see EVS and SGS work together collaboratively to promote, market, and sell bundled services that combine SGS’s testing, inspection, and certification services with the EVS Omnis environmental intelligence platform to provide complete compliance and operational optimisation solutions for companies in a range of sectors globally, including the mining, heavy industrial and oil & gas sectors.’

EVS anticipate the partnership – essentially the bundled services – will expand global market opportunities and accelerate revenue growth.

Yes, the expected revenue growth is excellent, but a company bringing in more than $6b per annum in revenue wanting to bundle their services with EVS (Omnis) suggests 1) EVS is clearly doing something right, and 2) confirms the unique point of difference Omnis provides. For SGS to sign this agreement, you would expect they are confident Omnis will provide strong value add for customers.

It is hard to gauge the impact this will have on EVS’s top line – and when we will see this occur – but I would have thought this is well and truly material for the business. In addition, it should provide EVS exposure to new geographical areas where they don't currently service; the beauty of bundling services with a global behemoth in their respective industry!

Product suite breakdown

More of the same for EVS. Again Omnis leads from the front – the agreement with SGS suggests to me this will be a common theme going forward. Some other points below:

- WA's Water Corporation, a current EVS customer, became an Omnis customer – highlights 'land and expand' strategy at work.

- The growing adoption of EVS Water continues with the signing of the first sewer network with SA Water. This further validates EVS technology and somewhat offsets what is otherwise a mediocre quarter for EVS Water (in terms of revenue). I think it is important to remember this signing only refers to one water catchment, so the validation here the most important factor for me.

I will tune into the investor presentation and report back with any significant commentary.

30-May-2021: My 2-year PT (price target) for EVS is 22 cps (cents per share). I think they have a good product which has achieved a good level of acceptance in most of the industries that they have targeted thus far, and that their growth runway is long and wide. I would hope that this latest capital raising at 8.5 cps will provide them with sufficient cash to execute their plans and possibly accelerate them.

EVS is a company that is in a space that I like, and while I'm well underwater on them at this point, having paid 18.5 cps in RL for my position, I think they will come good in the future. However, like Andrew (Strawman) and others have said, I also agree that if we don't see some good progress from Envirosuite in the next 12 months then we have to question our investment thesis, and if the thesis is flawed, then it's best to move on. You don't always have to make money back in the same stocks that you lost it in, you can switch what's left into something with better future prospects. I'm not at that stage here and now, but that's what I'll be doing in March/April 2022 if we don't see good progress from EVS between now and then.

The EVS SP has held up well considering the CR (entitlement offer) is priced at 8.5c. The retail component opens tomorrow. I'm leaning towards participating if the SP stays up here above 10c/share (closed Friday at 11.5 cps, up +15% on the day). The offer is expected to close on Friday 11th June, so we don't have a lot of time to make a decision - just the 10 trading days. Because it's an entitlement offer (EO), it will not be closed early due to oversubscriptions (which can happen in an SPP), so we can wait until the second week and continue to monitor the SP. Sometimes you can pick up the shares cheaper on-market (that was the case with the recent RRL - Regis Resources - EO - where they traded under the offer price so it was cheaper to buy the shares on-market than to participate in the EO), but it looks at this point like EVS might hold up above the offer price. We shall see.

For those with a larger position where you don't want to risk further capital, you could sell just enough to cover the cost of the shares you are being offered under the 1-for-14.5 EO (wait for the documentation to check your exact entitlement is usually best). So if you owned 100,000 EVS, you would be entitled to buy another 6896, or 6897 if they round up to the nearest whole share, so the cost (@ 8.5c each) would be either $586.16 or $586.25. You could sell 5,330 shares on-market to cover that, or sell a few more to cover the brokerage costs as well if you like. The brokerage for me would be $10 using Commsec, or $14.95 using NABTrade, or $19.95 through my industry super fund (my SMSF). Taking the highest one - being $19.95, that would mean selling an extra 182 shares, so you could sell 5,512 EVS @ 11c, or 5,272 @ 11.5c each, and then you would have the extra cash to participate in the EO, so you would (in this hypothetical scenario) end up with at least 1,384 extra EVS shares with no out-of-pocket costs (coz the sell paid for the EO participation). Just one option.

29-Nov-2021: EVS have taken out my previous 22 cps PT, so I'm now raising my PT to 27 cps, which - while not a huge leap from where they are now - is still onwards and upwards. Still like EVS, and still holding them in RL as well as being one of my larger positions here on Strawman.com.

03-Oct-2022: Reducing my Price Target from 27 cents to 22 cents per share. I hold this one both here and IRL. Good longer term tailwinds and a well run business. They were my worst performer in share price terms in September, however I'm happy to hold through this volatility. I think they'll be a profitable investment from here, and I think they look oversold, as small tech stocks like this will tend to do when the market is being sold off indiscriminately. Particularly those who lack consistent profitability, but I am comfortable to look through that at where they should be in 3 to 5 years, which is significantly higher than where they are today (12 cents per share) - which looks silly cheap to me. But in this market, silly cheap can get even cheaper.

@mikebrisy already gave an excellent overview of Envirosuite's recent product demo, but there's a recording available on Youtube if you want to watch:

https://www.youtube.com/watch?v=4Vn-5AuZ0q0

A very decent set of results I thought.

I'll let members read the full ASX presentation here, but a few points to highlight include:

- Cost of revenue was flat, leading to a solid boost in gross profit. This was delivered through improved implementation and right-sizing of the China business (frankly, i'd pull out of China altogether. Yeah, it's a big market, but the work they have won there is ultra low-margin and I think there's significant sovereign risk)