1H23 announcement here

A surprisingly bullish forecast.

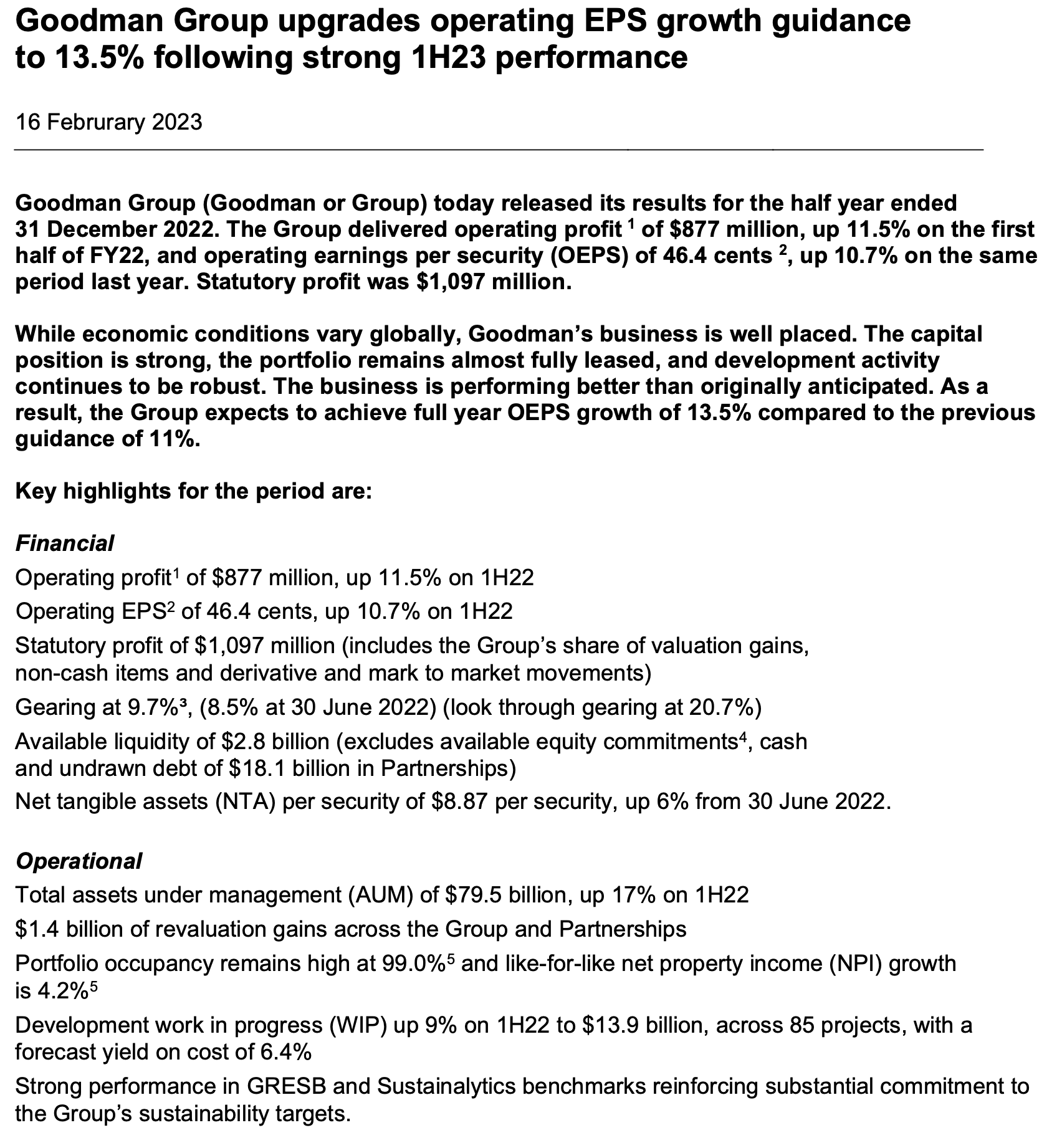

REITs generally are expected to take a bit of a beating over the coming 6-12 months as their assets get revalued (down) and interest costs and gearing get re-stated (up). Currently most REITs are on a dividend yield of 4-5% which compares very unfavourably to a risk free cash deposit or government bond yield of marginally less: there is next to no risk premium for these assets.

GMG is a bit different in that it has direct holdings in industrial real estate (distributions and fulfilment centres) but is also an industrial property (re-)developer and manager of these assets for other clients. Clients provide the majority of the working capital. For these reasons I think it is considerably less risky than the only other REIT I hold ASX:CIP. (I am avoiding Retail and Office REITs like the plague). It is unlikely that the outsized recent returns are going to be repeated ad infinitum as the re-development opportunities become less obvious and competition for greenfield sites increases.

I like that it is geared very modestly 9.7% (20.7% look through) though I anticipate this will rise with asset price re-valuations.

They are forecasting a rise in EPS of 13.5% for the full year.

I would love to see an increase in the dividend which has stayed flat at 30cps for a number of years now, but management state they can generate attractive returns by re-investing into a growing business.