Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

A high quality but cyclical large cap company. Again like AUB i mentioned a few months ago it is a large cap so maybe not of interest to many here.

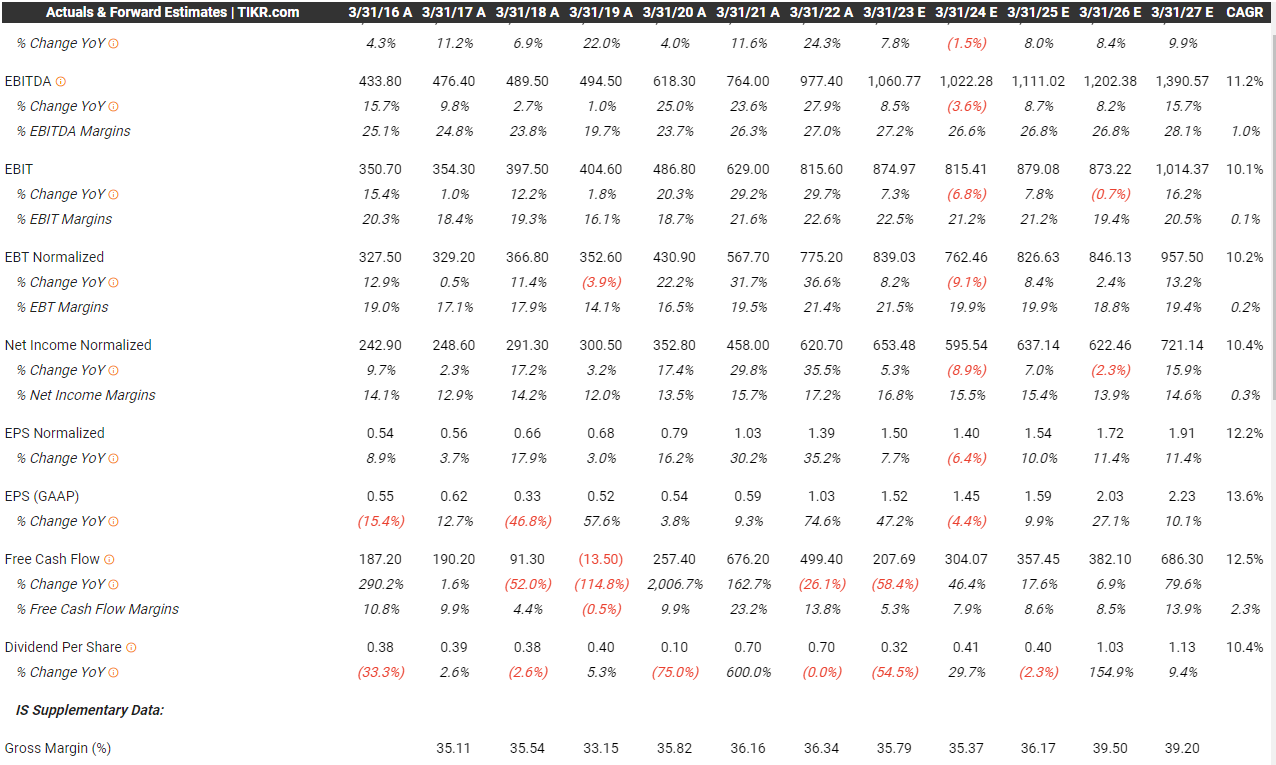

Interest was piqued again by this interview with Matt Williams at Airlie and hearing a pitch at Finfest from the analyst covering it- This Hall of Famer has uncovered a stock worthy of Warren Buffett’s portfolio | The Rules of Investing (podbean.com). They have got it very wrong thinking it wasn't cylical - shocker it is with recent downgraded guidance. Reminds me of semiconductor argument last year.

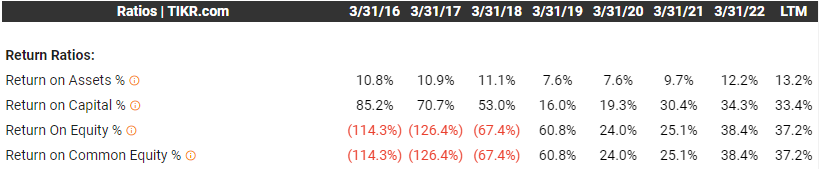

In any case some pretty interesting return metrics with eventual growth returning.

A lot of growth ahead and undersupply of housing in the US seems a long term driver as is the repair market from all the houses built inthe 60s and 70s. Product looks quite good. They've suspended their unfranked dividend to undertake a buyback. The Asbestos payments will continue until about 2045 but look well provisioned for.

It has dominant scale advantage position in the US and competes mainly with wood and brick as alternatives. Some concerns on market share in latest call which I don't yet fully understand. US is the dominant driver of earnings but there are operations in Australia and a presence in Europe.

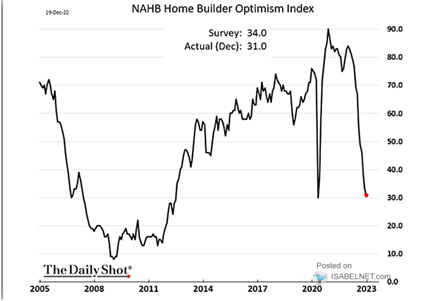

The US housing market is falling off a cliff. Home bulider confidence below:

JHX has halved but still looks pricey to me but below $20 I think this will be a great steal for a Buffett like company that will eventually see a recovery. Sherwin Williams (paint) in the US as well as other paint companies are often sought after by investors worldwide and can see JHX in the same vein there.

Again I think it is too early to enter now given the headwinds but worth keeping an eye on.

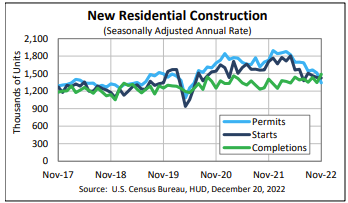

Continued decline in dwelling approvals in Australia - similar in the US.

Per the ABS below:

Whenever we get out of the market and economic malaise i'd expect building materials and fund managers to see the largest snap backs - risk on environment.

James Hardie (ASX: JHX) has reported its Q3 numbers. Here are the top lines

- Global net sales -4% to US$860.8 million

- Net income -16% to US$129.2 million

- Global EBIT margin of 19.2%

- FY23 net income guidance range lowered from US$650-710 million to between US$600-620 million, due to softer than expected volume in North America and Asia Pacific

Some commentary from Market Index:

According to the Market Index Broker Consensus board, the stock is rated a BUY by 13 out of 17 analysts. They include Citi’s Samuel Seow who wrote this recently about how the earnings of US counterparts Builders FirstSource (NYSE: BLDR) could have influenced the JHX result

“BLDR, the largest wholesale building material supplier (and a JHX customer) provided an insight into the macro environment during the quarter as SF housing starts are down 34% but Multis (multi-property sales) +12% and R&R (renovations) +3%. R&R, in particular, is performing better than implied market growth for JHX”

UBS’ Lee Power also has a BUY on the stock. In a recent research note, he reiterated his bullish case for James Hardie

“We still see FY24 as the low point for JHX earnings and conservatively forecast new housing volumes to decline 22.5%, and renovations to fall -12.5%”

Power notes that the company’s FY23 earnings guidance is another reason to look through to 2024. UBS’ price target for JHX is $44.50 (or $11 higher than where it closed yesterday)

When I look at the huge 14% rally today (46.62) the first thing that comes to my mind was a group finance assignment I did with a colleague

After doing a cashflow analysis we had to pick a company that could survive a sudden negative shock to the global system (ie: weather events or recession)

After pouring through the annual report hundreds of times we failed to build a convincing short or bull thesis for James Hardie on the event of a sudden shock (excluding the asbestos liabilities as that is not a global shock)

Nevertheless the group member kept plugging away trying to convince that we should shortlist James Hardie as one that can't survive a shock.

So it is interesting to see what happened today with the results being released and us failing to build a short thesis on James Hardie from a sudden shock to the global system

Perhaps JHX have learnt lessons from building asbestos and are building on those takeaways to grow their business?

Just like Wesfarmers and Promedicus, perhaps another perfect All weather stock?

Article in todays AFR - James Hardie profits jump as customers ‘sit on the sidelines’

For those not behind the paywall ...

James Hardie has posted an increase in earnings and higher margins despite a slowdown in housing construction, after pushing through price rises of 12 per cent at its Australian and New Zealand operations.

Shares in the building products group rose 14.4 per cent to close at $46.62 yesterday. They are now trading at their highest level since early last year, when the company lost its chief executive amid bullying allegations.

But investors were buoyed by the company’s ability to bolster margins through price rises and cost reductions at a time when the construction industry faced cost pressures and the amount of work was slowing.

James Hardie chief executive Aaron Erter said there was less activity in the renovation market, a key driver of the company’s earnings, as higher interest rates and economic uncertainty made households more reluctant to commit to large projects. ‘‘People are sitting on the sidelines and waiting for a little bit,’’ he told an investor briefing yesterday.

Earnings before interest and tax margins in the Asia-Pacific region – largely Australia and New Zealand, with a small contribution from the Philippines – jumped by 750 basis points to 33.1 per cent. EBIT rose 35 per cent to $69.5 million in the three months to June. James Hardie said average net sales prices in the Asia-Pacific region were up 12 per cent in the quarter compared with a year ago, while volumes were 8 per cent lower.

Over 12 months in the Asia-Pacific, prices rose 10 per cent, double the rate of increase last year, and significantly higher than in 2019, 2020 and 2021.

Several smaller builders have collapsed in Australia as their profit margins disappeared due to rising building material prices and labour costs, which were squeezed by fixed price contracts entered into when the economy was much stronger.

James Hardie chief financial officer Jason Miele said the strong earnings margin in the Asia-Pacific was unlikely to be repeated over the rest of the year. He described it as a ‘‘high point’’.

The company’s overall net profit for the three months ended June 30 fell by 3 per cent to $US157.8 million ($240.1 million) compared with the same period a year earlier. Sales revenue was down 5 per cent to $US954.3 million.

UBS analyst Lee Power said margins in all three of the company’s main regions were ahead of expectations. He has a ‘‘buy’’ rating on the stock, and a valuation of $49.50 a share. Citi analyst Samuel Seow said the June quarter result was materially higher than expected and showed the company was able to offset declining volumes.

Mr Erter said there had been a review of capital spending plans across the company, and a planned greenfield plant in Melbourne was a casualty.

‘‘We did an exhaustive review,’’ he said. ‘‘We had other options’’.

The company, which makes plasterboard and wall cladding products, also announced it would scrap plans to build a $400 million factory at Truganina on Melbourne’s outskirts as it reassesses capital spending priorities in uncertain economic times.

The plant in outer Melbourne was scheduled to be up and running by early 2025. It was announced by James Hardie in March last year. Mr Erter said there was ‘‘zero’’ influence on the decision from rising construction costs across the industry.

James Hardie said that in North America, which made up 73 per cent of sales, the total addressable market for its products would drop by between 5 per cent and 18 per cent in calendar 2023, compared with 2022. Goldman Sachs analyst Niraj Shah said that was a slightly improved outlook for North America, because in May the company had signalled a contraction of between 14 per cent to 19 per cent.

Mr Erter said James Hardie aimed to keep winning market share, but not at the expense of profitability. In the United States, it is stepping up its local area marketing to attract new customers, using slogans such as ‘‘Texas Tough’’ and ‘‘Florida Strong’’ in particular states. He said the long-term growth opportunities to tap into the renovation market were robust because there were 40 million homes in the US that were more than 40 years old, and therefore ripe for updating.

Mr Erter started at James Hardie in September. He was brought in after Jack Truong, the company’s former chief executive, was dumped over bullying allegations. Mr Erter previously ran PLZ and was a senior executive with paint maker Sherwin Williams.

Valuation based on EPS of $1.68 and 10% growth rate

Why would I own it?

# The market leader in fibre cement cladding in US and Australia with around 65% of business in US in 2023

# Long term structural tailwinds as population grows and hopefully they can keep taking some additional market share too

# Very good ROE and ROC, margins, cash flow and earnings growth

# New CEO seems focused on high ROC thru organic growth and keeping debt manageable thru the cycle

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed our 15%p.a. + target

# Current market share is around 20% of US siding market, with 90% of fibre cement siding market. They plan to get to 35% share. This is both the opportunity and a risk and why MOS is crucial.

What to watch

# Debt to equity and assets trend - want to see it steady or declining given cyclical nature of housing over a decade

# Insider position is low so are the adding / holding

# Need a better MOS to enter - A$25 or less in 2023

# Liability costs for asbestos victims to stay in allowance range