Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Nanosonics provided a trading update for 1H24

- Revenue for 1H24 will reduce ~4% compared to PCP ( to $79.6m )

- Nanosonics revenue comprises 2 components (Capital sales and Consumables)

- Consumable would have increased by definition because of more installed base ( no figures provided)

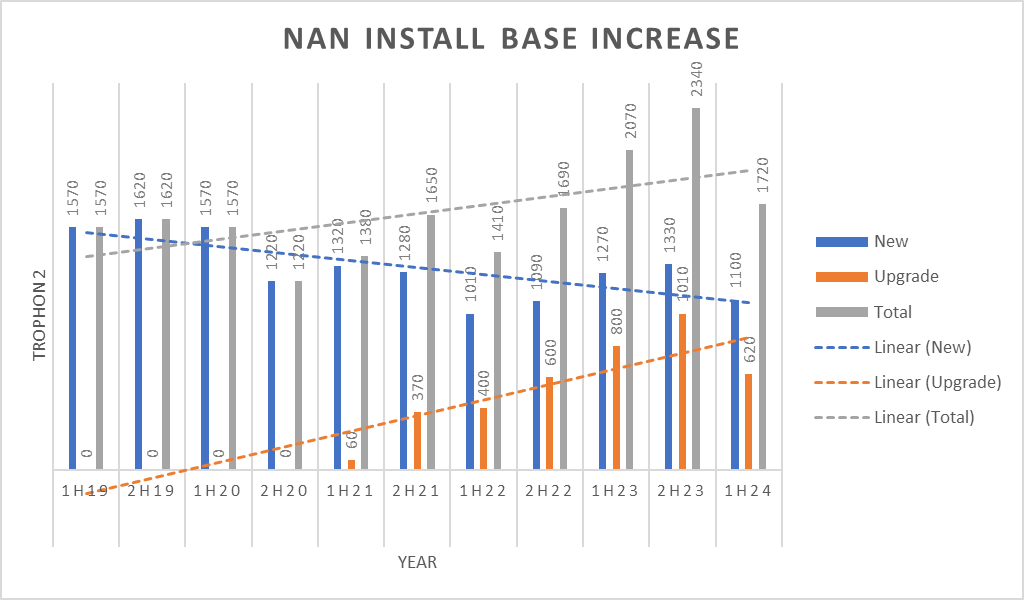

- In this half, Nanosonics only sold 1720 units ( 1100 new and 620 upgraded) compared to the 1H23 figure of 2070 (1270 new and 800 upgrades)

- Management is saying that the revenue miss is because of lower-than-expected capital sales ( I think management would have factored in around 2250 capital sales in this half i.e ~10% growth over pcp) so they are short of 530 units this half - reason given in the announcement is "Hospital capital budget pressure"

- The following chart shows historic capital sales for the last 5 years and trends.

Now the question for investors is, is this a structural issue, or Market penetration issue, or an economic cycle issue? More information will be provided in half year result at 26th feb.

One thing is for sure that I was wrong in expecting 25% growth this year - Market has slapped 35% of its market cap in a day and to be frank market is right in doing so - Nanosonics was ( and is) on high multiple and it can not afford to not grow and miss the guidance. So hopefully, I learn and grow from this experience ( like i did with EML and KME and others)

As Nanosonic is one of my big holdings, I keep an eye on all available public information.

My speculation is that Nanosonic will announce coris product along with 1st half 2024 report. All the signs are telling me that it is coming closer.

One of the mandatory compliance requirements for any electronic equipment is to complete FCC part 15 radio frequency test. which provides a CE mark here is the result of the test which has an issue date of 16th August 2023

https://apps.fcc.gov/eas/GetApplicationAttachment.html?calledFromFrame=Y&id=6739852

It was initially tested on 21-22nd March and then again on 31st July and 1st August ( Probably, something wasn't right in march but has been rectified and retested)

A few other indications in their FCC filing - a few things are permanent confidential and few things are short-term confidential i.e user manual, External photos until 13th Feb 2024. - which is around the time 1H result will be announced.

I attended the Nanosonics AGM virtually - they have uploaded a recording to their website

https://www.nanosonics.com/investor-centre/investor-conference-calls

If you want to learn about their new Product CORIS and time poor - check from ~41min to ~56min

It seems that Nanosonics has started advertising Endoscope solutions in Australia/NZ and the UK/Ireland but not in the USA, Canada, France, and Germany ( based on their websites). Seems like an imminent launch is approaching near.

at the same time, short selling is increasing as well

Pre-results confession, not a pretty sight unfortunately ...

All my writing is here in various straws about Nanosonics. I have put together my current thinking here - Nothing new from what I have posted in strawman so far - this is just an amalgamation of all my straws and current thinking

https://growthgauge.substack.com/p/asxnan-nanosonicsbetting-on-innovation

Assumed a variety of growth outcomes ranging from 20% - 10% over next 5 years giving valuation range $3.22 - $5.17. Assumed share count of 322m in FY28. Conservative numbers Net Margin of 10% in FY28 discounted back todays numbers.

FY26 Revenue = $293 ( 25% growth)

77% margin

226m Gross margin

149m total expenses

76m profit

Assume PE of 35 will give market cap 2664m

Assume Share count 311m

Share price (FY26) = $8.56

10% discount it to FY23 = $6.25

Nanosonic added more details about Trophon's business performance by excluding operating expenses related to the development and commercialization preparation of CORIS.

Why is this given now?

Charts look a lot better now

Yesterdays big sell off corrected all the issues I had with the charts. Obviously now you probably all realise I need all the lines in my Stochastic indicator to be heading in the same general direction and keeping relative pace with each other across all 3 time frames (1D, 3D, 9D). You will note however that across all time frames they are still pointing down as well as the MacD (next indicator below with lines changing from red to green etc) also pointing down. In my last post I mentioned I thought it would drop to 3.18 (Tick) and possibly further down to 3.00 (Tick). The next targets are 2.83 (Yellow rising T.Line) - 2.77 ($ Support). Will it go straight there? no probably not. It will probably correct after last couple of trading days for a wave up (as my blue arrows show on the 1D) however following @Rocket6 analysis which I feel to be on the money, NAN still trades at lofty multiples. On that note, Im still holding out for further declines as market sentiment medium term is terrible. If one was to trade in after days like yesterday then be aware it should only be for the short term trade (make a little coin) and leave again. Yes I feel it will go down to the Yellow T.Line Support of 2.83, however as @Rocket6 said, the multiples are still looking inflated so NAN definatly could see lower $. We all try to time the bottom regardless if we say we arent, thats what we wish for. I think it will bottom and go side ways for a while within a range before we see some kind of medium term bullishness appear. Idealy you would want to see the 3D chart indicators turning up before participate in a decent upswing. If your really conservative, you would wait to see the 9D turning up.

So Here's how the charts look now after the recent drop

and the 4hr below.

Nanosonic updated the market about their Q4 performance, sales model transition progress, and FY22 unaudited result.

- Q4 performance

- At the end of Q4, the total install base had reached to 29850 (at the end of Q3 it was 28900) which means in Q4 they did 950 new units

- The expanded Direct team sold 91% of the newly installed base units

- Sales model transition progress

- Transition to revised sales model in NA substantially completed successfully with significant proportion of all consumables sales now going through direct channels

- All planned new headcount(15) associated with the expansion of direct operations now in place - total headcount 100 in North America

- Nanosonics and GE have extended the current Capital Reseller agreement for further 12 months from July 2022 ( not sure why? - probably GE hasn't completed its entire stock? or full transition hasn't been successful as announced? NAN and GE going conservative to resolve any teething issue or don't want to miss any opportunity?

- FY22 Results ( unaudited)

- At Q3 update they said total revenue for the year is anticipated to be in line with market consensus. ( which was ~116m)

- Today they said that they expect revenue of 120.3m

Looks like a strong updated from NAN - 45c402x7vskr60.pdf (asx.com.au)

Sales of $120M beating market consensus of $116M for FY22 - some 3% beat.

Narrative around transition to direct seller from GE distriutor appears to be negative whereas it really seems it should be a positive. GE continuing to sell Tophon units as well with extended 12 month agreement.

NAN is not cheap at today at over 10x revenue but large short postion of 11.6% from Shortman - today's trade will be interesting given slight market beat.

Nanosonic updated the market about their Q3 performance, sales model transition progress, and outlook.

- Q3 performance

- At the end of Q3, total install base has reached to 28900 ( at 1H it was 28160) which means in Q3 they did 740 new units

- They said the upgrade was also in line with Q2 ( which means it was better than FY2021)

- Sales model transition progress

- The majority of customer has been updated - customer data has been provided

- warehousing and logistics operation is set up for increased volumes

- New hires came from GE High-level Disinfection teams ( example below)

- Head of GE High-Level infection team

- GE Operation lead

- number of sales managers

- Outlook

- Total revenue for the year is anticipated to be in line with market consensus. ( what is market consensus?)

I beleive its still got a way to drop yet.

I thought some may like to see an update on the chart Analysis from my post recently. As you can see on the 9D its still ahead of itself even after the recent drop I forcasted in my past post, has been confirmed. So it dropped to test the recent bottom it made approx 3 weeks ago on the 1D and has stalled there. It is re-testing that bottom as I write this post.

Below in the 4hr chart, you can see the Yellow long term indicator is still declining (denoted by the yellow 6.32) with the white indicator (Current action) chasing it down. My thoughts are it will probably go down to at least the next Support level approx $3.18. Once there I will re evaluate. I have a bad feeling though it may drop as far as ?a ($3 ish) or ?b ($2.85 -2.90 ish) as shown on the 1D chart above. FYI the Yellow Line on the Chart is the historic Trend Line from way back. When it gets within ear shot of it, it usually goes all the way to it to test it out. I dont think we are close enough yet to test that one though who knows. I see the only thing to turn this around would be a great end FY22 report.

I will keep you posted if something changes my mind and results in myself taking a position in NAN.

Sorry for any spelling or Grammer mistakes. Short on time today.

Be careful, I see weekness. I have noticed over the last month many Starclub members buying nanosonics. I have held out buying in even though it has had a run up of its most recent bottom of $3.37 bottom as my charts tell. You will note that on its recent high (on the 25th May, high volume day) off the so called bottom, it hit 2 of my resistance trend lines and failed to push above. It has since come back a couple of days later to test those same 2 resistance T.Lines and so far today failed again on weak volume (making a possible double top pattern).

The reason I have stayed out was due to its weak volume on the Daily chart and also you will note by the 9day Chart on the far left, its indicator line (the white one) in the Yellow highlighted circle is way ahead of its long term indicator line (the Yellow line, also in the Yellow highlighted circle) . When this happens it tends to revert back towards the Yellow which currently has only kicked up a little and hasnt gained as much pace as I would like to see.

Three things can happen here obviously. 1st_price action could now go side ways for some time in a range until the longer term Yellow line catches up some what (not likely though possible until this finacial years result come out to verify direction), 2nd it could retrace towards its yellow longer term line (I think this is the most probable according to my chart analysis) and 3rd it may drop to the recent Support line (the red dotted line on the daily) bounce of and continue on its way up slowly with volatility until the result for the year come out and then who knows what. For me, Im taking the second scenario, however I cant stress enough make your own decisions.

Below in 240m chart it is also showing a change in direction. Stochastic curling over, momentum indcator is week and chaikin money flow is pointing down or weakening. The $3.69 - $3.74 support and the 50DMA & 15DMA is going to be critical. If it breaks below this range, Look out. Hopefully this all helps with your current thoughts and actions or maybe just creates more confusion.

An article from a decontamination specialist ( Published in the clinical services journal in May 2022 edition) - suggest that there is a trend toward wireless/compact probe near patients and that will require modification to existing devices. [ Nanosonic has developed a wireless Ultrasound Probe Holder for it)

The shares have retraced to an area of support marked by the 200-day moving average, as well as horizontal support going back atleast a year. If the larger uptrend is in tact, it should find support here and move higher, indicating that the recent distribution phase is likely over.

Nanosonics did update the market prior to the result so there wasn't that much surprise - There were a few things that I didn't like and will need to monitor

- Management says that, there was roughly $13m impact on the 2H result because of sales model transition - If that's the case - should 20-25% revenue growth guidance for FY23 is bit low - is it a case of underpromising or should we read something into it?

- AuditPro was launched a year ago and has yet to contribute to revenue - is it too slow or normal? is it not a market fit? if that's the case, question can be raised about the process to select product/stream all the R&D $ they are spending - is it something to worry about?

- Coris launch will still take longer than I expected - (maybe I thought it was going to happen in FY23)

- From the outlook that they gave, I was expecting a margin increase because of the sales model transition but that's not the case - I wonder why?

However, there was quite a bit that I like as well. Nanasonic is no doubt a great quality company - and this report in no way changes that view. This is just an exercise to put all negative possibility that comes into mind so if any of them eventuate hopefully we can act a little faster than the rest.

Hard to fault Nanosonic's latest numbers (see full results preso here)

Installed base up 10%, with the new installed count bouncing back strongly. Revenue up 35% (27% in constant currency), and an improved gross margin (exactly what you'd want to see after transitioning to a direct sales model). Pre-tax profit jumped from $3,3m to $11.4m, of which $6.1m was free cash flow.

The balance sheet is a fortress: $99m in cold hard cash.

The new Coris product seems to have some supply chain disruption, but on track for release towards the end of 2023.

All told, the company lifted the FY revenue guidance from 20-25% growth, to 36-41%. The gross margin may moderate a bit in the second half due to a higher proportion of capital revenue, but the FY guidance here was lifted from 75-76% to 77-79%.

FX and additional investment will also see a bigger than previously indicated increase in operating costs, which are now expected to grow between 22-27% for the full year (prev. 15-18%)

At the lower end of those ranges, we should see a FY revenue of $163m and gross profit of $126m (compared to $91m in FY22). That's at least $12m in EBIT.

Still, shares are on a forward EBIT multiple of around 100. I really like this company, but that's quite a lot... Still, probably justified if Coris sees similar success to Trophon. Of course, a lot of profitability being masked by the $26m they're spending each year on R&D too.

I retain a small position in RL, and none on Strawman. It's just a question of price for me, although it's probably not something I should be too fussy with.

Good insight from the Lakehouse guys.

We caught up with representatives of the Nanosonics board during the month to discuss voting resolutions ahead of the AGM. A key focus of our conversation was their framework to assess return on investment for the company’s increasing research and development (R&D) spend. We came away with a better understanding of the board’s focus on delivering the CORIS platform in the year ahead after a very drawn out expectation-setting with the market. Launch of CORIS will be an important milestone for the business after years of R&D spend as it will move the business toward its ambition of being a genuine multi-product Lakehouse Small Companies Fund Monthly Letter Page 4 company. In the meantime, we expect the existing trophon platform to continue growing at a healthy clip and generating a satisfactory annuity-like income stream.

I am in agreeance with @Valueinvestor0909 and @Jimmy; their FY23 update is impressive. NAN benefitted from currency conversion, but even with this excluded, total revenue is up 36%. Installed base (IB) has increased by 815 since the last update, which is consistent with both business expectations and my thesis -- an increase of 2000-3000 per annum is broadly what I want to see. As forecast by other members, we are entering an upgrade cycle for many of NAN's customers, so it's not surprising to see this tracking along nicely too -- up 51% vs PCP. Perhaps importantly, the business revealed they are performing well across all regions.

We also got some insight, albeit limited, into NAN's cost structure. In FY22, 43% of costs went to market growth/expansion, 25% to R&D and 32% to supporting general business, support and HQ costs. The allocation of costs for FY23 is expected to be very similar in comparison to FY22. The business also expect R&D costs -- as a percentage of revenue -- to decrease as NAN continues to scale. Unfortunately there is no indication (unless I missed it) of cash on hand, but I would anticipate this has increased since the FY22 report (94m).

Due to uncertainties with the North American market -- possible covid disruptions during winter, inflationary pressures on hospital budgets and currency movements -- the business elected not to provide updated outlook for the full year. This is a good move in my books.

Are we starting to see the business benefit from NAN's direct sales model in North America? Short term forecasts and uncertainties aside, this remains a bottom drawer stock for me. We have a market leader with a large addressable market, who continues to invest in its future cash flows -- making entry into the market a difficult proposition for competitors. Everything appears well here.

Disc: held

Nanosonics was asked yesterday by the ASX if they had any information that would explain yesterday's 11% share price drop and increase in volume.

Predictably their REPLY indicated they had no information that might explain it though the fact a substantial share holder (State Street Corporation) sold 3.5M shares last week may have contributed to the volatility. It's possible a few short sellers may have snapped up a few shares in the process to reduce their exposure.

Nanosonics according to Shortman is the 7th most shorted stock on the ASX as of the 7th December at 8.4%.

Being a few days behind it will be interesting to see if yesterday's shenanigans have had any impact.

Nanosonics updated the market with its H1 FY23 performance and based on solid performance it upgraded the FY23 outlook.

and Revised FY23 Guidance

Based on this announcement, it is safe to say that the transition of the sales model to direct has been successful.

I will be keen to see the progress of the product portfolio expansion effort.

- AuditPro traction

- Coris update

But So far, all my assumptions are okay on the valuation front, so I will stick with it.

Most of the things are documented by @Strawman so no point in me re-doing it here.

Few things to consider for poor cash flow

- They have made the following upfront investment ( on top of the R&D) for long-term benefit ( on the call, it was mentioned that in pass-through model nanosonic will get an extra US$2000 per trophon unit ( there were no mention of extra margin for consumable - I would think minimum 10% margin - even if you calculate 5% margin then it comes down to roughly ~ 3.5m)

- They have built up inventory ( 6m more than PCP) in preparation for the transition to the pass-through sales model

- Expanded warehouse capacity and established logistics facility/operation

- Established Sales and Clinical organization - increased sales & Clinical employees to 54 ( further 12 new roles being recruited)

One thing I was expecting was some sort of sales traction for AuditPro but it was mentioned that AuditPro integrates with Hospital's IT system and hence it requires a security clearance and currently going through ISO 27001 ( Security cert?) certification and expect it to contribute to revenue from FY23 onwards.

@Strawman has put together a nice summary of the result so I won't repeat anything here.

In any case, I was a little disappointed to be honest as I didn't get any new information that was not already disclosed prior to today.

I was hoping to get some information about AuditPro's progress - Nothing was mentioned in the call and no analyst asked as well and I didn't get a chance to ask questions for some reason.

Apart from Coris's picture in the presentation - nothing mentioned in the call was new information. No clear details about the process and timeline etc.

Regarding Valuation, I am still sticking with my assumption and calculation as per my valuation straw - even though, NAN will easily beat my FY23 forecast.

Nanosonics (ASX: NAN), today announced the resignation of Chief Financial Officer and Company Secretary, McGregor Grant after 12 years in the role. Mr. Grant will continue as CFO until August 2023.

Michael Kavanagh, CEO and Managing Director, said “McGregor has been an integral part of the Nanosonics Executive team playing a critical role in making Nanosonics a leading Australian global medical device business. During this time, he built our global finance function and capability and has been involved in every aspect of the Nanosonics growth story. McGregor has made a significant and lasting contribution to the success of Nanosonics and together with the Board I sincerely thank McGregor for his valuable service and wish him well in the future.”

Nanosonics has commenced a process to identify a successor for the CFO role.

Mr Matthew Carbines, General Counsel, and member of the Executive team has been appointed as Company Secretary effectively immediately.

Michael Kavanagh

CEO / PresidenT

Nanosonic released FY23 results this morning.

Revenue:

Customer Receipts

Expense

Operating Cash

New Installed Base declined by 16%

Coris delayed (again)

@Valueinvestor0909 thanks for sharing your valuation model. It gives me confidence to show my calculation for Nanosonics.

What I wanted to highlight is how the valuation can vary substantially by just minor variations in the input assumptions: For example:

1. Rev growth: Your model 25% . My model 19% reducing to 10% over 10 years.

2. Cost growth: Your model 12%. My model 19% reducing to 5% over 10 years.

3. Share count growth: Both 1%

4. PE: Your model 35. My model 25 based on 10% at 10 years.

5. Discount rate: Your model 10%. My model 15%.

6. Valuation: Your model $6.25. My model $2.17.

@Strawman has just posted a valuation of $3.88. Who is correct?

FYI if I adjust my PE to 35 and discount rate to 10% I get a valuation of $4.54.

This just highlights the difficulty of predicting future valuations.

*EDIT* (Turns out I couldn't add five years to FY22...d'oh!!)

I'll keep this simple.

FY22 revenue is expected to be around $120m in revenue.

Grow that at (roughly) 15%pa to get FY27 revenue of $250m. (new products could boost this further, but let's not count those chickens just yet)

I'll give that a net margin of (roughly) 15% to get a NPAT of $38m (this could also be a lot higher if they pull back on growth initiatives, but not convinced they would or should.)

Assume 305m shares on issue to get EPS of 12.5cps.

Give that a PE of 50 to get target FY27 price of $6.25. (that's a high PE, but there's a mountain of cash here and they'd still hopefully have a lot of runway in a very large global market, and with plenty of traction)

Discount that by 10%pa to get IV of $3.88

Like I said, pretty simple. But it shows that you either need even high sales growth, margins or market multiples to do well at a higher entry price.

fwiw, i really like the business.

H1 FY22 saw revenue increase to 60.6m, up 41% pcp – a revenue increase of around 17m, while cost of sales increased by 8.9m. This reflects NAN’s ability to scale effectively. But we also saw cash flow from operating activities in the minus range (-887,000) partly due to increases to selling expenses (5m increase) and admin expenses (2m increase). R&D expenses also increased by approx. 3m vs pcp – but with a war chest of 90m at their disposal and no debt whatsoever, I think its sensible investing in R&D to (hopefully) achieve further growth.

That said, accountability is important here. NAN and their management team continue to cite increases in R&D like it’s a positive thing. But from a shareholder point of view, we need to see ongoing innovation and competitive advantage stem from such investment. An ROE of 7.8% doesn't reflect particularly well on management. I consider this one of the primary bear cases for NAN. I think we can all agree that if the company isn’t sufficiently using funds to generate profits, questions need to be asked. Their low ROE, in conjunction with what many consider a disappointing second product, is something I want to monitor closely going forward.

It would also be fair to suggest NAN has a lumpy history re: FCF (noting that Covid obviously disrupted their operations significantly). This makes forecasting future FCF more difficult than I would have hoped. But in more positive news, since FY18, gross profit margins have increased while CapEx has remained steady at around 3-4m per year. The below helps articulate some of the lumpiness I refer to above:

With cash inflows in the minus range in H1, and a one-off impact to NAN’s H2 revenue in the range of 13-16m, FY22 will likely look even more mediocre than last year – particularly if investors don’t do their due diligence and look under the bonnet. This might cause further short-term pain to NAN’s share price over the next half a year.

Based on expected impacts, I will conservatively estimate that FY22 FCF will come in at 1-2m. Again, its difficult to forecast future years and how R&D might impact future profits, but I think forecasting increases of 5m per year up until FY25 is a reasonable assumption.

The recent decline in share price has provided investors like me – who initially sat on the side-lines citing valuation concerns – with an opportunity to start taking a position. But alas, there is still some risk here. The business still attracts significant multiples (P/E ratio 104x) – in fact my traditional DCF returned a low-ball valuation of $1.50 (which is unfair but provides insight into the expectations priced in). While there is next to no risk in terms of NAN’s significant cash holdings and no debt, there is with failing to impress a market that wants to see growth from the market leader. As mentioned above, the underlying business is impressive. @Strawman’s recent straw re: HY results touches on this in more detail – there is lots to like. But stalling growth, disappointing product updates and a management team that isn’t using capital as efficiently as it could mean I am treading carefully here. As it stands I think a valuation of $3.50 is fair value, noting the risks highlighted above.

Nanosonics products are now available via NHS Supply Chain

Thanks to @Valueinvestor0909 for the NAN post as for some inexplicable reason had been dropped off my watch list. Nonetheless your post bought them back to my attention and I was able to buy a parcel soon after.....cheers once again.

The market isn't impressed with Nanosonics' latest half-yearly numbers -- shares are down 12% at the time of writing and now sit at their lowest level since 2019. In fact, shares are down roughly 50% from their all time high of $8.25 reached at the start of last year.

I think this is mainly due to valuation concerns, and let's face it, shares aren't that cheap according to traditional measures. At the current price of $4.15 (a market cap $1.25b), the company trades on over 10x sales (trailing 12m basis), or a trailing PE of 111x. And this is after a 50% fall from all time highs!

But let's put valuation aside for now, and see how the underlying business is doing.

The installed base of Trophon units continues to grow -- up 12% in the past 12 months and up 5% in the last 6 months.

The pace of growth here has clearly slowed. The company highlighted a 14% improvement from Q1 to Q2, as covid impacts waned, but compared to the first half of last year you're looking at only a 2% lift in new installed units added. Given the circumstances, i think that's far from terrible, but we certainly need to see improved new installed unit growth in the coming periods.

Covid likewise had an impact on ultrasound volumes, so little surprise to see consumables revenue (the juiciest, high-margin revenue) down 3% on the preceding half. Still, compared to the prior corresponding first half you're looking at a very decent 23% lift.

Add to that a very decent doubling in capital revenue, which was also 10% higher from the preceding half and you're left with a overall top line result that came in at $60.6m -- 41% higher than the pcp (but essentially flat from the preceding half).

A big part of this was the upgrade cycle of customers switching to the new and improved Trophon 2 unit. More than a 1/4 of their fleet represents units that are over 7 years old and will need to be replaced in coming years. That's about 7000 units.

So at this stage, although there was a loss of revenue momentum from H2 FY21 to H1 FY22, which i think is reasonably explained by the delta and omicron impact, i think the result is pretty good. But things look worse as you move down the income statement.

Operating expense increased 29% over the year, and R&D costs were up by 41% as the business continues to develop new products and build out its team. Added with some expenditure on the new corporate digs, and free cash flow dropped into the red by $3.8m. That's dropped the cash balance to $92m -- but, let's be honest, there are few ASX companies of this size that can boast such an impressive war chest.

Still, combine it all together and net profit was down 45% from the previous first half. And the market is also still not impressed with the revised sales agreement with GE (but I think it's actually a very good thing in the long run) -- that's going to have a $13-16m impact in the next half.

When I stand back, i see a market leader with a lot of runway, a very attractive "razor & blade" revenue model with super high customer retention, new products on the way, a fortress balance sheet and (eventually) improved operating margins.

Yes, there's a lot of uncertainty with their new product roll outs. They could well flop. But the new areas build on their core skillset and have a lot of parallels with the trophon product.

Yes, the transition to a direct sales model is going to have a nasty one off hit, and perhaps they'll be less effective with direct sales. But they know have enough important reference sites and relationship (especially for consumables sales) that make me optimistic they'll be better off long term here.

Yes, the price multiple is still eye watering, but added growth investments are depressing this. They could step back massively on this expenditure and the multiple would correspondingly drop rapidly, but that'd be a mistake longer term in my opinion.

Nevertheless, while i understand the need for added costs, i also want to see this expenditure justified by accelerating sales. It's definitely one of the main things to watch.

So it's really just about valuation -- something i need to revisit -- and not quality to my mind.

Full results presentation is here

Not getting much love from brokers following results.

Nanosonice said it has seen a "Significant" increase in Q3 sales and that sales of cosumables have been in line with pre-covid-19 expectations.

That being said, access to hospitals is obviously restricted at this time and that is likely to impact sales for the final quarter. However it is hard to quatify, and the company is taking measures to reduce expenditures.

Nanosonics reiterated its (incredibly) strong balance sheet, which has ~$82m in debt, and said that a weaker AUD is helping.

ASX announcement is here

Nanosonics has reported the following results for FY20:

- a 19% lift in full year revenue to $100.1 million

- (revenue growth was 26% for the first 3 quarters, with covid impacts allowing only a 1% increase in the last quarter of FY20.)

- The installed base was up 13%

- Consumables and services up 36%, at 70% of total sales.

- again, a noticable impact to sales in the last quarter, but overall have held up relatively well in my opinion

- Capital revenue was 9% due to covid and impact of prior year inventory management from GE (a new version of their Trophon product was released)

- Operating expenses up 28%, including a 37% rise in R&D. Total operating expenses are expected to rise a further 20%-odd in the current year.

- As a result, operating profit was down 26% to $12.4 million. If costs had been steady, operating profit would have grown around 50% on prior year.

- Cash of over $90 million (massive)

- $20m in free cash flow

All told I'm pretty happy with these results, which highlight just how attractive the business model is. Despite the impact to capital sales, the higher margin consumables revenue growth was very solid in a tough environment.

The slow down in ultrasound examinations resultant from the impacts of covid will be temporary (are already recovering), and overall I dare say the entire saga will only heighten awareness towards infection control.

And it was great to see so much free cash flow and a growing mountain of cash, both of which hit record levels. Nanosonics really does have a fortress balance sheet with oodles of capital to support growth (or a cash return to shareholders).

The company reckons it has about 20% of the global addressable market, so there's a lot of runway ahead.

But some things are concerning.

Disappointingly, new products slated for release in the current financial year will now likely be delivered the following year (pending regulatory approvals and project milestones). With shares on 20x sales, i was hoping they could commercialise new product lines more quickly.

Also the cost base is expanding rapidly. A lot of this is R&D, but also a load in infrastructire and people. Whether or not this is a good thing all depends on what return they can get on this spend, and how effectively they can scale their resources. Nanosonics will need to grow sales by more than 20% this year just to record a flat operating profit given the increased cost base.

And there's no guarantee that new products or new geographies will emulate their earlier success.

The company did not provide any guidance for FY21 due to the uncertainties of Covid, but the business expects an ongoing impact to capital sales.

All told, I really like Nanosonics and continue to hold a small parcel. My only issue -- as with so many of the good stocks right now -- is the valuation.

I'm not one to over think price for high quality, fast growing businesses -- especially ones that have a big market opportunity and attractive operating leverage. But at a PE of 200 and a P/Sales of 20 there's very little that can go wrong for shareholders to get an attractive return from here.

Results presentation here

Nanosonics has been talking of new products for a while -- to date it's been a one product company -- but they have always kept the specifics close to their chest.

Today they revealed the first new product offering; a digital compliance management system called AuditPro.

Consisting of a handheld scanning device which links to a browser-based SaaS application, AuditPro allows clinics to keep track of what instruments have been used & disinfected, providing traceability and compliance data.

Initially it will be focused on ultrasound probes (Nanosonics' core area of focus), but is applicable across a broad range of devices.

It will generate subscription revenue, but pricing levels and the exact sales model were not disclosed. Presumably it will also be offered as a bundle with the Trophon unit.

The product will be launched at the US APIC conference today. Other new products are exected to be revealed over the course of FY22.

Hard to infer too much from this announcement -- details were very scant. Obviously the potential is attractive, but it's all about execution and whether or not they get a good ROI on their investment.

Hopefully will get more details soon.

Disc. Held.

ASX announcement here

On the conference call the management were questioned about what to expect for FY 2022. The analyst suggested "Approx doubling of exit rate in 21 wouldn’t be a bad start for 22"

And management agreed, though it wasn't clear if they were talking about revenue or profit or both.

Either way, that would imply revenue growth of about 16%.

Not in rhyme this time,

but thought you might want to know,

though earnings call tidbits can be tastey,

or they may just be for show.

Nanosonics just released their plan for a revised sales model.

I have to go and write through what it means going forward but they also announced that NAN is expected to report revenue of $60.6m for H1 FY22 ( which is actually what I was looking for the first half - If you look at my earlier straw).

Good to know that there won't be any nasty surprises come H1 FY22 result

One of Nanosonic's non-executive directors (Marie McDonald) bought 19,600 shares on market on the 4 March. This was just over 49k.

Good to see I am not the only one sniffing around at these share price levels..

While the pandemic probably helps Nanosonics longer term (increased awareness of infection control), it did knock the business around in the first quarter of FY21, sending revenue for the half down 11%.

In part, GE Healthcare (a major wholesaler) reduced purchases due to "impacts of covid on its inventory", which basically says lower sales through that channel. And that's due to a big drop in ultrasound proceedure volumes, with hospital resources -- particularly in US -- focused on the Covid-19 response.

Most of the damage was borne in the first quarter, though, with the company bouncing back strongly in the last few months of 2020.

The much stronger AUD also had an impact.

Geographically, it was North America that really floundered, with revenue dropping 38% in the first quarter, before largely recovering in the next. Interestingly, Europe & Middle East and Asia PAcific both saw growth over both quarters, with revenue in these regions up 50% and 8%, respectively, for the entire half. (though these segments represent only ~14% of total revenue.)

Despite the challenging half, Nanosonics continued to invest in its growth strategy, with operating expenses up 8% to $33m in H1. For the full year they are expected to come in around $75-$78m -- a ~20% increase on 2020.

Combined with the lower revenue, pre-tax profit was all but wiped out, coming in at just $0.2m vs $6.7m in the previous corresponding half.

Free cash flow also took a hit, down $2.4m compared to an inflow of $10m in the last first half, due appraently to timing effects of payments and receipts. Still, the company has a genuine fortress balance sheet -- almost $88m in cash with no real debt.

Part of the added costs were associated with R&D, something the company has invested over $50m in since 2017. It was up another 12% this year. That's fine, but we've been waiting for new products for a while now and it would be good to see some more progress here. There's a lot of intangible value to write down if they dont get a good return on all that money.

At any rate, it's good to see the impacts of covid appear to have been short-lived. Total revenue grew 48% in Q2 relative to Q1, and i-MED's 200+ unit upgrade will occur in the current half. GE has also resumed purchases. Revenue from consumables was up 29% in the same period, and in constant currency terms was a new company record.

Importantly, the Global installed base was up 12%, and 6% in the last 6m to just over 25,000 units. Q2 installs were up 38% on the first quarter.

Consumables sales are, of course, the best margin sales, and they were essentially flat with a 2% decline in US revenue being partly offset by an 11% increase in consumables revenue for Europe& Middle East. As procedure volumes continue to track up, there should be a return to growth in the current half.

Loking ahead, the company didnt give any guidance, other than to say they expect market conditions to continue to improve, and that the company remained focused on its strategy of (essentially) new products and new geographies, and cementing Trophon as the standard of care in hospitals.

Bottom line, it was a disappoing result -- especially for a business that is trading at 20x sales (traling 12m basis).

That being said, you can hardly blame management for COVID, and that really does seem to have had a legitimate impact on non-essential ultrasound proceedures, as well as a big interuption to sales cycles. The business appears to have recovered very well in the second quarter and has good momentum going into the second half.

I expect Nanosonics to be around and much larger in another 5-10 years. The company has been very good to me over the years, and i think there's still some value to be had for long-term investors.

But I would like to see an acceleration in the pace of growth from the core offering, especially outside of the US, as well as the release of some new products. We need to see some jutsification for all that investment.

Disc: held

Results here

Nanasonics has released there FY2021 results, key highlights include:

- Revenue 103.1m - up 3% (or 12% in constant currency).

- Second half revenue 60m (up 60% in constant currency).

- Earnings before interest and tax 10.7m (down 7.8%)

- USA total addressable market revised from 40K to 60K Trophon units

- Consumable and service revenue of 42.7m (up 27% compared to first half)

- Cash & cash equivilence 96m

Although, the initial results read poorly (with only 3% revenue growth and EBIT down 7.8%). There, were some positives coming out of the report with the announcement of a new product platform - Nanasonics Coris which sounds like it is a decontamination device for disinfecting endoscopes.

This device would fit in line well with the Trophon product which disinfects ultrasound probes for early stage pregnancy.

My assumption is both products would have a similar "razor blade" model with recurring revenue for disenfectant consumables.

With PE over 200x it is difficult to give it a buy. I do own shares in my strawman & real portfolio but purchased around the $2.50, I would like to add more at a more reasonable multiple.

Lakehouse Capital February letter discusses the following about Nanosonics

Wow, what a jump for Nanosonics today.

Not bad for a business that just reported 3% revenue growth and a 15% drop in net profit!

(ASX results here)

As usual, there's a lot going on under the hood.

For starters, FX movements were not favourable. In constant currency terms, sales were actually 12% higher. And this was a tale of two halves, with second half sales 50% improved on the first, and an all time record result.

The installed base was 13% improved over the year, and consumable revenue was up 20% in constant currency.

We have seen the launch of their new audit product, and they're getting closer to releasing a platform for strerilising flexible endoscopes -- hopefully by calendar 2023. There's been a lot of investment here, but the market opportunity does seem compelling.

The drop in profit was due to an increase in R&D and sales resources. That being said, Nanosonics still threw off $6m in free cash flow and increased it's cash balance to a very formidable $96m (with zero debt)

With growth across all regions, lots of reliable recurring consumable revenue, new revenue opprtunities and a fortress balance sheet -- there's just so much to like about Nanosonics. Having first bought at 92c in 2014, it's served me very well (although, once again, would have been better if i didnt sell a few down along the way..)

The question again is one of price. On today's numbers, shares are on a PE of over 240x! Or a P/S of 17.

Then again, there's a lot of growth to be had if the company executes well. Having revised up the estimated addressable market, NAN reckons it has only 39% penetration in the US, but only 4% each in Europe and Asia (19% globally). And that's just for the trophon product.

Shares are very expensive, but bear in mind the company could easily, if it chose to, boost EPS up 3-4 times this year if they cut back on headcount and R&D and just focsued on the core. The underlying economics are very impressive, just masked by all the growth investment, and that could well prove to be money very well spent.

So i'm prepared to maintain my holding, even though i think a lot of growth is baked in. This is one for the bottom draw for me.

Latest updates from Morgans

https://www.morgans.com.au/Blog/2023/June/Nanosonics-Back-Into-Buying-Territory

I don't have access to full blog so not sure what has been written but it seems the target is raised to $5.49

As per today’s presentation here (slides 41-46).

What stood out to me most, was all the detail (i.e. greater than zero) around future products. Someone in marketing has finally gotten their way is my guess! It was marketing style detail, but it was detail!

The constant vague and ethereal promises of another product or product line has long been a complaint against NAN. Additionally, the recent release of AuditPro, whilst seemingly a value-add, just wasn’t want long term holders wanted! (Well, I wanted more!!) To use Peter Lynch’s classifications; NAN in my opinion was trending as a stalwart, and not a fast grower, but with this new detail, I must reconsider this view.

Assessment: I am excited to see this level of detail regarding their future potential products lines, starting with Coris. NAN has been a long-term winner for me IRL, and this new detail provides lots of consideration for at the very least a HOLD at todays prices, and probably to a BUY should the opportunity arise with a pull back in price. I always seem to win the most when I hold and do nothing except top-up, and I think I’ll keep to that plan for NAN at least for the next three years.

Nanosonic Current Snapshot (August 2021) :

- Shares on issues : 305.2m

- Insider ownership : 19.6m

- Market cap = 2198m ( $7.20 a Share)

- EV = 2100m

- Revenue = 103m

- Profit before tax = 11m

- FCF = 5.9m

- Cash = 96m

Looking just at the above numbers, you would be crazy not to sell at the current price.

Risks and How i think about it

- Valuation

- Nanosonic investing in headcount for growth and R&D is reducing profit on paper

- Probably suggest the Quality of the company and market expect high growth

- Customer concentration ( GE Health)

- GE Health is a distributor - one would argue if customer doesn't buy from GE, and need the device, other distributors can supply

- Currently only a Single proven Product in market

- The second one was just released and the third one is in development

- Execution

- The management team can be trusted based on past records and alignment

Growth Opportunities

- Trophon2 upgrade cycle

- The large addressable market for Trophon2 in current geography

- Current market penetration ( NA: 39%, EMEA: 4%, APAC: 4%)

- Market expansion

- Japan

- Foundation is established

- China

- Company registered and appointed qualified local consultant

- Developing regulatory stratergy

- ASEAN

- Received regulatory approval for Malaysia, Indonesia, Thailand, and the Philippines

- Japan

- New Products

- AuditPro

- CORIS

- Intellectual Property

- In FY21, Nanosonic filed an additional seven new provisional patent applications

- Established dedicated IP function that manages its active program of IP development

- In FY20, established separate business development function to identify and assess potential strategic acquisitions and investments in infection prevention opportunities

- The current cash reserve is building and sits at $96m.

- It is safe to assume, 1 acquisition in the next 2 years to justify investment in a new business function

Looking at Risks and Growth opportunities, I am more than happy to keep my money to Quality Company and Proven as well as Aligned management to execute the strategy they have put in front of us.

Interesting

- Higher USD

- Lower freight charges

Margin guidance given factored in very high freight charges. It can potentially surprise to upside for margins.

- The business performed well in Q1 FY22

- Management could have easily compared Q1FY22 with Q1FY21 ( and shown high % growth) but they chose to select Q3FY21 to make a fair comparison

- All directors provided background information about themselves made me even more comfortable with the quality of the management

- One of the top 10 US hospitals went live with "AuditPro" recently -- a Major tick in my box for the product and market fit validation

- Product development on track to release CORIS in CY23

- Margin in FY22 will reduce little because of the product mix change

Overall happy holder -- bottom drawer closed -- will open again in February when they report 1HFY22 ( it will be compared against weak 1HFY21)

As preparation for the HY22 result, Going back and writing down what I will be happy to see ( at a very high level - not accurate numbers) from Nanasonics so I have something to compare to on the result day before being biased and getting affected by Share price movements.

- Global install base should be around ~28300 ( ~775 units in each Q)

- Total revenue ~60m ( 40m consumables + 20m capital)

- Would like to see Trophon2 upgrades

- Would like to see AuditPro adoption within customers

- some level of revenue and customer case studies

- Would like to see Coris development and probably some sort of ETA ( confirmation of commercial launch in 2023 CY - no more delay)

- Increase in Cash balance + commentary around potential acquisition or efforts around it.

Others have outlined the key details with Nanosonics' update on it's revised sales model with GE (ASX announcement here), but a few thoughts:

- The inventory unwind from GE will impact sales in the second half of FY22, somewhere in the order of $13-16m for FY22. With the company expecting H1 Revenue of $60m, this will be a material one-off hit.

- The required boost to Nanosonics direct sales operations will increase expenses by around $1m in H2 FY22

- The direct sales model will result in higher margins over time, and with North America accounting for 88% of the installed base (and 76% of revenue there is consumables), it should be a big positive over time (assuming Nanosonics can at least match GE's sales efficiency of trophon units)

The market is down 13% on the news, but I cant help think it's being a bit short sighted here

As NAN approaches its half year results on 22 February, I was researching reasons to top up or not pre-result.

I jumped on shortman and discovered almost 10% of shares are shorted, and that had increased since NAN flagged its revenue hit due to change of business model.

NAN has pre-warned the market that half year results will be impacted (more details in other straws!) and assuming "Mr Market" knows best, then based on the volume traded around the 08 February and the change in price, that has been factored into the share price (ie was $5.05, and is now $4.71).

Yet... shorts are up, implying the expectation that "Mr Market" will react again on results day (22 February) and drive the price lower, and stay lower once combined with other macro-market factors (inflation, threat of war, tech sell off, etc).

If I was to anchor to price:

- The March 2020 covid low was $4.61

- The most recent low was $4.50

I hold IRL and am looking to top up. I think the short-sightedness of Mr Market will occur, and NAN will dip again on report day. I will wait until pre-close on the 22 February or pre-open the 23 February.

This was one of the thing missing for AuditPro adoption as per last few calls

Solid update in AGM:

NAN was constantly among the top 20 most shorted stocks last year. As of today, that short position is normalized with the historical level. It is just a reminder that shorter doesn't always get it right.