Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

$TNE announced their FY23 results today. It is my largest RL holding, so I attended the call, and here will bring out a few points.

Their Highlights

• Profit Before Tax of $129.9m, up 16%, beating guidance of 10%-15% growth

• Profit After Tax of $102.9m, up 16%, beating guidance of 10%-15% growth

• Total Annual Recurring Revenue (ARR) of $392.9m, up 23%

• On track to surpass $500m ARR by FY25

• Net Revenue Retention (NRR) of 119%. Above our long-term target of 115%

• Total Revenue of $441.4m, up 19%

• Revenue from our SaaS and Recurring Business of $390.7m, up 22%

• Expenses of $311.5m, up 21%

• Cash Flow Generation of $104.6m, up 36%

• Cash and Investments of $223.3m, up 27%

• Total Dividend of 19.52 cps, including a special dividend of 3.0 cps, up 15%

• R&D investment of $112.0m before capitalisation, up 21%, which is 26% of revenue

My Analysis

The results are impressive, and the highlights above speak for themselves.

Yet the market had run up in anticipation of the results - both expecting a good result given the strong 1H and as part of the wider macro pick-up in recent weeks. So, $TNE closed the day down 2%, as those who play with a shorter-term horizon took some profits. This is often the pattern with this stock.

The presentation held some interesting insights, which continue to support my thesis to continue to hold $TNE long term.

Cash generation was particularly strong, reportedly due to good performance by the collections team, with Cash Flow Generation (a number they use which is close to FCF) was 102% of NPAT – something CEO Edward Chung claimed was a year earlier than expected.

$TNE upgraded their target to hit $500m ARR by 2026 pulling it forward to 2025 – again, this was widely expected.

Net Revenue Retention was a very strong 119%, aided by pricing increases in an inflationary environment. However, even excluding the inflation effect, Edward said the result was very close to their ongoing goal of having NRR of 115%. This "target" allows the company to double revenue every 5 years, from existing customers.

Churn remains low at 1%, which was also positive. As $TNE gets to the end of the transition to a 100% cloud SaaS company, this was expected to lead to the loss of some customers on legacy platforms.

Although profit growth beat consensus, it was weaker than indicated by the strong ARR growth because costs have increased, driven by increased spending in R&D to drive development of the SaaS+ platform, and building out their full One Education offering.

Two case studies presented on Slide 25 showed where they are winning full government department ERP and whole of university ERP deals (student management, finance, HR and payroll). So, it has taken a lot of development investment to get to this point.

Consequently, PBT margins have fallen back to 30% from FY21’s high of 31%, however, Edward said that this will now gradually ramp up towards 35% over the coming years. Given the prospect of strong, ongoing revenue growth, this should turbocharge earnings growth over the next 3-5 years.

Long Term Prospects

My thesis for long-term sustained growth rests on two pillars: 1) continued strong growth from existing customers and 2) UK as a material future growth horizon. I’ll update briefly on both.

1) Growing Existing Customer with SaaS+ the next phase

A lot of rubbish gets written about $TNE by analysts who talk about the company’s growth slowing as they run out of room in ANZ, and today’s presentation addressed this head on.

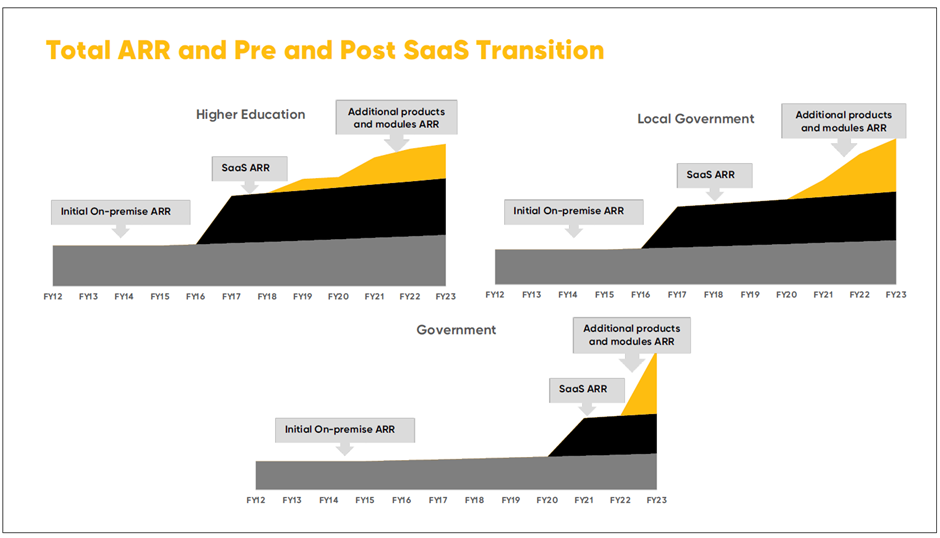

Without going through the detail of the product suit that makes this possible(but they now have 16 products and over 400 modules), I include on chart from the presentation below that shows how $TNE’s innovation allows it to grow revenue strongly from existing customers.

Presentation Slide 29: Case Study of Existing Customer Growth

The slide shows selected case studies indicating how the transition to SaaS from the on-premises legacy drove the initial step-up in ARR, to which over time they have added new modules. Nothing new here, it’s the classic SaaS modular land and expand model.

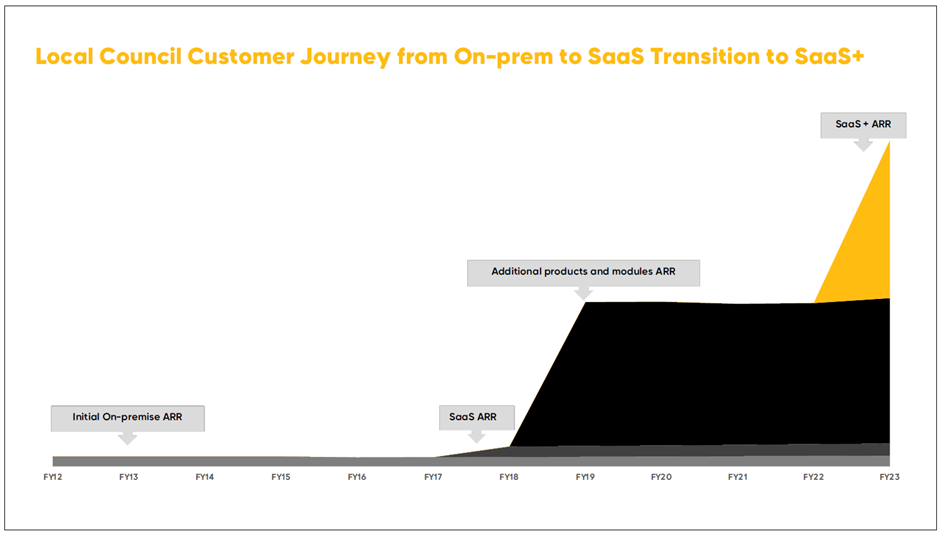

What’s exciting is the new SaaS+ model, which is an enhanced SaaS ERP service including support for implementation and training and other services bundled around it. The offering has been developed to enable customer to adopt the service without having to use system integrators to manage the implementation. Slide 30 shows how this added value creates a new horizon of growth – one that is not yet material at the portfolio level, but which drive growth over the coming years.

Slide 30: Impact of SaaS+ (Case Example)

Edward was at pains to point out that while their competition in education and local government (including SAP) have now moved their offerings to the cloud, unlike $TNE these systems have not been designed as SaaS, cloud native products. Edward stated that $TNE have rebuilt their entire tech stack 4 times over 36 years. He claimed that no other ERP player has even ever done it once. So, they have a massive advantage against competitors in having very low technical debt. Importantly, the architecture is design for ease of implementation, as well as modular expansion.

Customers of competitors, on the other hand, generally continue to face the historical implementation challenges, including hefty consulting bills. As evidence, Edwards showed that $TNE consulting revenues actually fell 11%, which was celebrated as a good thing, demonstrating the ease clients face in implementation.

SaaS+ is proving an early hit with clients. 2023 was the first year of implementation, and they had targeted 10 deals. They delivered 34.

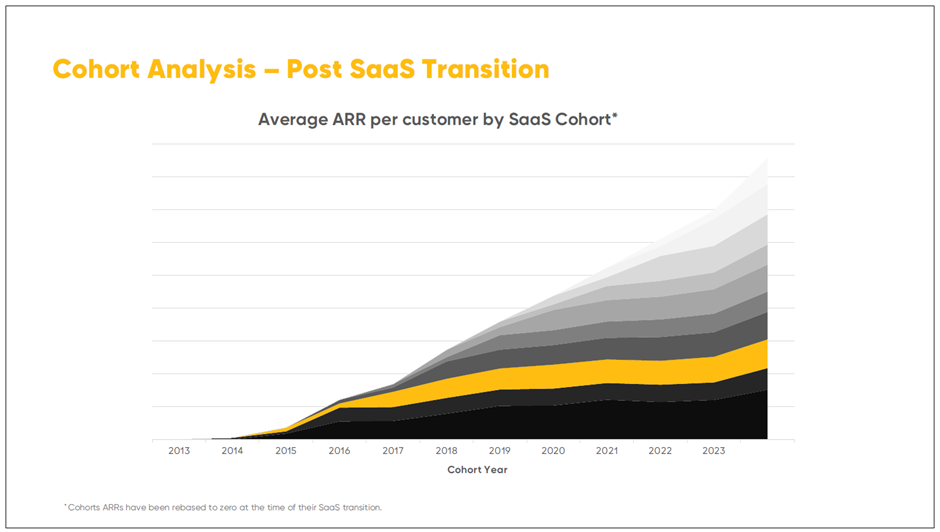

To show the enduring nature of the growth from existing customers, they included a cohort chart (which looks very much like what you see from $ALU and $WTC).

Slide 28 – Cohort Analysis

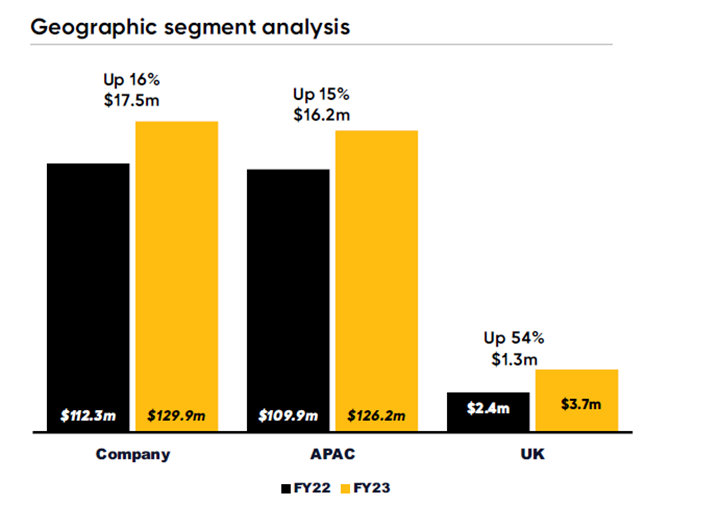

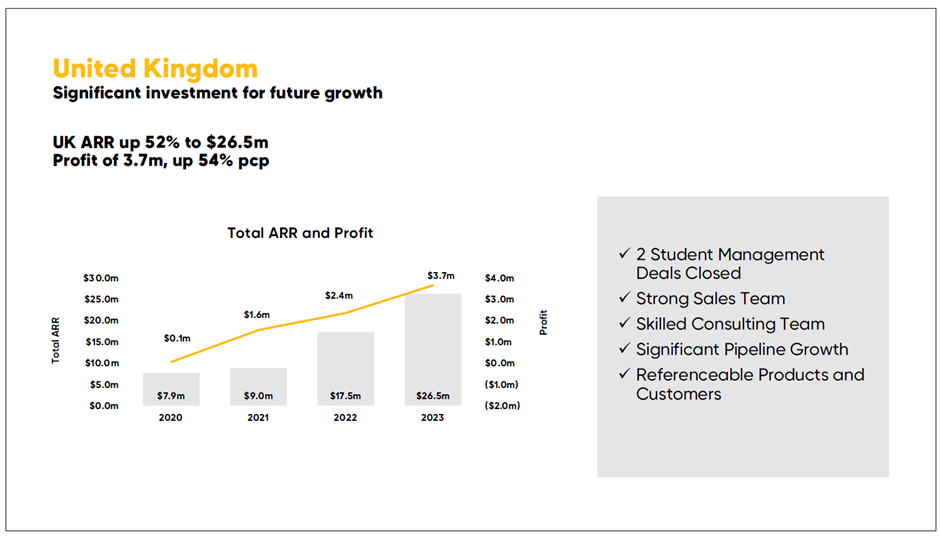

2) UK is making progress

The UK is the second part of my long term growth thesis.

$TNE started operations in the UK just before the pandemic, turning a profit in the first year, 2020. (Just think about that in the context of some of our other SaaS favourites here on SM that have spent 2-3 years around the inflection point!)

In FY23, ARR was $26.5m (up 52%) and profit of $3.7m was up 54%. It is still not a material part of the business, but it is intereesting nonetheless.

See the following two charts for an overview. (They have been just a bit naughty, in that the first chart is not to a consistent scale!)

One question mark in my thesis is whether $TNE can replicate their ANZ success in the UK. Or, are they late to the party in the UK, and up against established competitors who are all now also in the cloud. (Perhaps like we’ve seen with $XRO in its international expansion, where the international business is facing slowing growth, and represents objectively a lower quality business.)

While it is still early days, the signs are promising, and the management team expressed confidence that they are going to continue the trajectory established.

The reason for the confidence is the innovation their have built into their products which beats the competitor ERP offerings in the core verticals of education and local government. In fact, examples were presented where clients using competitor on-premises products, rather than risk a painful transition to the cloud used that transition decision as the opportunity to switch to $TNE. If $TNE develops an industry reputation as offering the best customer experience for on-prem to cloud transition, then perhaps they are just in the right place at the right time.

Progress in the UK is one I am watching closely. It’s not material at the moment, but looking out over 5-10 years, it could be a very important part of the long term growth story.

Valuation

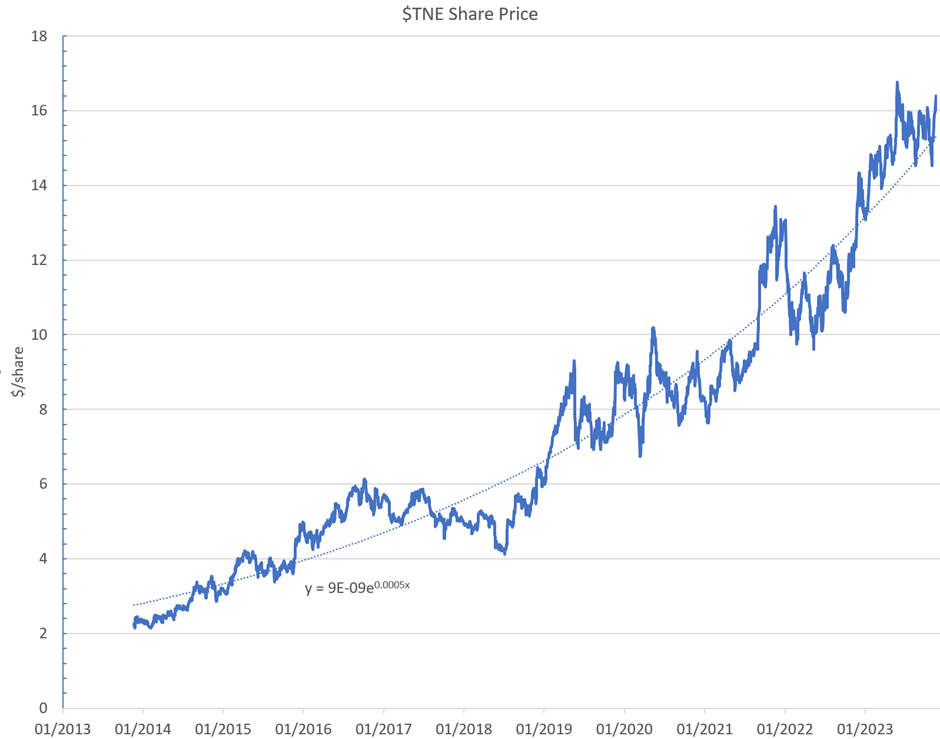

$TNE is not cheap (understatement). Based on today’s result and closing price, the p/e is 51. That’s well into the upper half of its p/e range over the last 5 years (p/e range c. 35-60).

In my basic DCF models, I get valuations ranging from $13.50 – $22.00. With a stable margin structure, it really comes down to how long and how hard you believe it can continue to grow.

I’ve plotted the last 10 years SP below, with an exponential best-fit curve overlaid. If that curve is a good approximation to fair value, then pretty much every year you can get an opportunity to buy $TNE at a 10-20% discount to fair value. That is in fact when I last topped up in early 2022. But today, I’m not a buyer.

I’m certainly also not a seller, as I have a high conviction that with continued good management, this journey can carry on for the next 5-10 years. $TNE is my largest ASX holding in RL, and second only in conviction to $WTC.

My Key Takeaways

The FY23 was good on all fronts. There is really nothing to be critical about.

This is a high-quality business, and it appears to have a good runway ahead. In truth, it is hard to know just how good the market runway ahead of it is in ANZ. They claim to be no more than 15% penetrated in any of their verticals. I am happy to judge them year-by-year on delivery. The interest for me is the early progress in the UK – a market 2-3x ANZ. They’ve started well, and if the trajectory can be sustained, then even buying at today’s price will look like a great decision in 5 years’ time.

Disc: Held in RL (7.5%) not held on SM

Update 21/11/23

Been a year since I've updated this..

TNE released their results and saw NPAT increase 16% to $102.9m. Their ARR target of $500m is now expected to be hit in FY25 rather than FY26.

I've updated the valuation to a price that I would be happy to pay. Assuming 15% NPAT growth for a further 5 years and a terminal PE of 35x. Gives a valuation after discounting back 10%pa of $13.63.

Disc: Not Held.

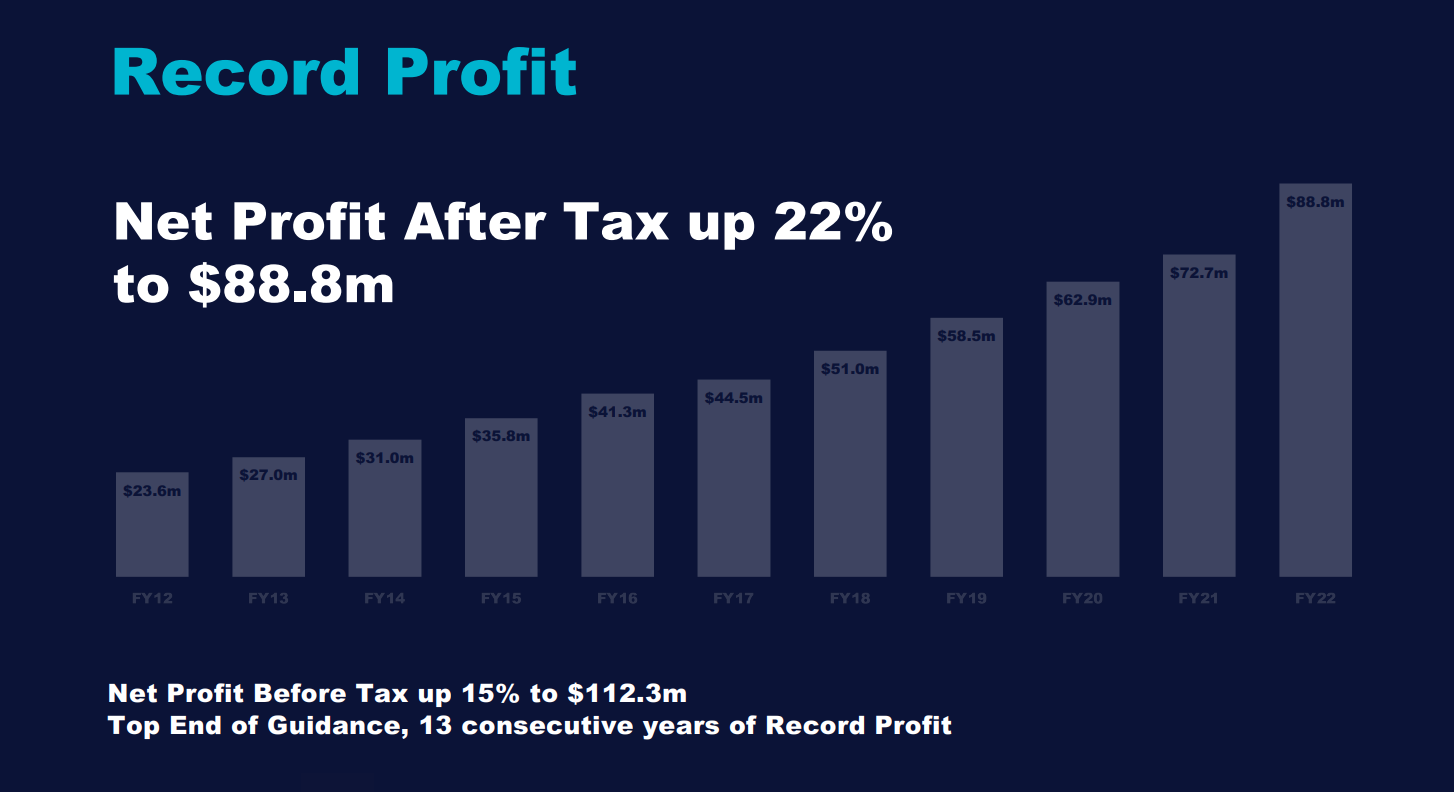

Update 22/11/22

TNE FY22 results saw NPAT at $88.8m which was an increase of 22%. Higher than expected growth of 15% pa that they were targeting after a strong 2nd half

Using the same assumptions as below but plugging in the new figures sees the valuation lift to $10.60.

I had TNE shares in my IRL portfolio but recently sold as I thought the valuation was getting a bit stretched. Was meant to sell on Strawman as well but mixed up the sell order. Will likely look to buy back in if the share price came back into the $10s.

Disc: Held on Strawman. Not held IRL.

Update 25/05/2022

TNE released half year results yesterday and they were pretty much in line with what I expected. 15% NPAT growth, which has been consistent with what they have achieved historically.

I do now own a small amount of shares in TNE and am looking to slowly average into my position. My only concern is that the PE range has expanded from between 30 and 40 to now between 40 and 50+. With interest rates rising, I can't see their being much more PE expansion, but rather their may be contraction back to their historical range. This may put some downward pressure on the share price in the near term.

On my current estimate of 15% NPAT growth, a $10 share price has them trading at a fwd PE of around 38x. A fwd PE of 30x would have the valuation at $7.76. However as per my calculations above, a $10 purchase would still achieve a 10% pa return if they trade at a PE of 35x in 5 years time, given they maintain their stability of earnings growth at 15%.

Original Valuation

Assuming 15% NPAT growth for the next 5 years gives an EPS of around $0.418 per share.

Assuming it trades on a PE of 35x in FY26 and discounting back 10% per year gives a valuation of $9.99.

Will likely look to start buying under $10.

$TNE announced H1 results this morning, with the investor call at 11:00am.

Their Key Results

• Profit After Tax of $41.3m, up 24%

• Profit Before Tax of $52.7m, up 24%

• SaaS Annual Recurring Revenue (ARR)1 of $316.3m, up 40%

• Revenue from our SaaS and Continuing Business of $200.0m, up 18%

• Total Revenue of $210.3m, up 22%2

• Total Expenses of $157.6m, up 21%3

• Cash and Cash Equivalents of $139.1m, up 20% from 31 March 2022

• Cash Flow Generation4 of $1.3m as expected, and will be strong over the full year

• Interim Dividend of 4.62cps, up 10%

• R&D expenditure (before capitalisation) of $49.4m, up 19%, which is 24% of revenue

• UK profit of $3.0m, up 29%

My Further Observations

With SaaS growing strongly and now the dominant revenue component, $TNE is forecasting a one-off unusally high annual churn of 1.6%, due to its End of On-Premises milestone later this year. Regardless, it is forecasting NRR of 115%-120% for the FY.

In reviewing the results it is important to recognise the historical pattern that cash receipts are stronger in H2, due to payment seasonality.

New SaaS large enterprise customers increased 27% to a total of 903.

All industry verticals are growing ARR strongly, with above average growth in the three smallest segments: Health and Com (+23%), Asset & Project Intensive (+28%), and Fin Serv. & Corp. (+33%). Only Government was significantly below average at +12% (vs. Group 22%). Strategically, if this trend continues, it will over time mark a further diversification in $TNE's customer base, and indicates a broader market appeal for its products.

The UK business is continuing to grow profitably with PBT up 29%, ahead of the group growth of 24%. UK is only making a small contribution to 1H FY23 profit of $3.0m in the total of $52.7m.

Overall, $TNE says it is on track to achieve $500m+ ARR by FY26. No change.

Wide range of guidance given for PBT growth for the FY of 10-15%. (Note: some commentators consider this guidance as conservative, expecting a "beat" in November.)

They re-iterated their view that SaaS-enabled economies of scale will see margins expand from 30% (32% ex-Scientia impact) to 35% over the coming years.

My Key Takeaways

$TNE continues to consistently deliver with nothing exceptional in this report.

Results are broadly in line with market consensus and the shares appear fully priced for the march to FY26. Of course, outperformance could drive further upside. Given this, I have recenltly halved my $TNE position, to deploy capital to holdings were I see greater upside opportunity. Of course, I'll be happy to pile back in should the market offer any opportunity!

I'll be listening for an update on the cyber breach on the call. No reference to this in the release or the slides.

Disc. Held RL (3.0%);not held in SM

Upfront about the Back Office incident.

to Add: TechnologyOne will update the market on its performance and outlook with the release of its 1H 2023 financial results on 23 May 2023.

11/5/2023 : * In the portfolio ( Trading Halt )

Share growth Return (inc div) 1yr: 49.29% 3yr: 14.45% pa 5yr: 26.15% pa

Dividend pay-out ratio conservative ~ 60% at present

so quality here steady Price growth 'left to right'

1/5/2021:ROE steady Free cashflow covers the dividend. ARR near term growth. Alpha

Threatened - internal Microsoft 365 back-office system.

Trading Halt:

TNE Acquisitions History

· September 2021 Scientia Approx GB£12 million - Scientia’s market leading product Syllabus Plus provides advanced academic timetabling and resource scheduling. Their products provide mission critical software for over 150 leading Universities across the United Kingdom, and Australia including the University of St Andrews, University of Exeter, Monash University and the University of Queensland. https://www.asx.com.au/asxpdf/20210903/pdf/45043zzkw45z0d.pdf

· October 2015 Jeff Roorda and Associates (JRA) approx. $10m - This acquisition supports our strategy of providing innovative and relevant solutions that offer deep, enterprise wide, functionality for local government, government and asset intensive organisations. Established in 1993 to specialise in asset management planning for government infrastructure, JRA is recognised nationally as a leader in local government reform in the areas of asset management, capacity building and financial management. JRA’s strategic asset management solution provides long-term planning, risk management and performance optimisation strategies for critical public infrastructure assets including roads, drainage, buildings, pipe networks, mechanical and electrical plant. https://www.asx.com.au/asxpdf/20151002/pdf/431tf708yjrxth.pdf

· May 2015 Desktop Mapping Systems Pty Ltd Approx $12m - DMS’s software allows for the storage, retrieval and management of spatial data, which is critical for these sectors, and will play an important part in delivering our enterprise software as a service to our customers on the TechnologyOne Cloud. This acquisition will allow us to easily and deeply embed spatial data with enterprise data such as property and assets. It also opens up innovative possibilities to use spatial data in ways that have not previously been possible. https://www.asx.com.au/asxpdf/20150508/pdf/42yg4bq3x59rz1.pdf

· January 2015 ICON Stategic Solutions Pty Ltd $10m - providing innovative and relevant solutions for the local government sector. The unique IP and specialist functionality we are acquiring with ICON supports our vision of enabling councils to interact with their communities efficiently through online and digital channels. https://www.asx.com.au/asxpdf/20150130/pdf/42w9p22g1s45k4.pdf

*Previous acquisition before 2014 not included

Technology One (TNE) released FY22 results (Sept year end). From their release:

- Profit After Tax of $88.8m, up 22%

- Profit Before Tax of $112.3m, up 15%, at the top end of guidance

- SaaS Annual Recurring Revenue (ARR) of $274.2m, up 43%

- Total Annual Recurring Revenue (ARR) of $320.7m, up 25%

- Total Revenue of $369.4m, up 18%

- Revenue from our SaaS and Continuing Business of $358.7m, up 22%

- Expenses of $257.1m, up 20%

- Cash Flow Generation of $77.2m, up 21%,

- Cash and Cash Equivalents of $175.9m, up 22%

- Total Dividend of 17.02cps, including a special dividend of 2.0 cps, up 22%

- R&D investment of $92.2m before capitalisation, up 19.6%, which is 25% of revenue

Another fantastic year for TNE with NPAT growth of 22%. Management have had long term targets of $500m+ in ARR by 2026 and also to double the business every 5 years (implying 15% CAGR).

I have updated my valuation on Strawman to reflect these results. I still think the current share price is a bit expensive and have sold my shares in my real life portfolio but continue to hold on Strawman. However TNE is definitely one of the highest quality business' on the ASX and a company I will look to re-enter at the right price.

Full Announcement Here

Full Presentation Here

Full Report Here

Disc: Held on Strawman. Not held IRL.

Management calling for $500m+ revenue by FY26 and margins of 35% after migration of all customers to cloud.

Lets assume they just hit $500m and margins of 30% and a share count dilution rate of 1% per year to 339m shares. In this scenario EPS would be $0.442 per share.

Historical 10-year average PE is 40x.

Bull case scenario FY26 = 40 x 0.442 = $17.68 discount 10% pa = $12.07

Base case scenario FY26 = 35 x 0.442 = $15.47 discount 10% pa = $10.5

Bear case scenario FY26 = 30 x 0.442 = $12.07 discount 10%pa = $8.24

Upside catalysts to above scenarios would be if they beat their revenue guidance or if they can achieve 35% net margins or higher.

For now ill stick with Base case as fair value.

29-Nov-2021: Technology One (TechOne, ASX:TNE) released their FY21 full year results on Tuesday morning last week, and their SP dropped -2.86% (or -37 cps) on the day, then their SP dropped another -8.61% on Wednesday (24 Nov) as two brokers downgraded their calls on TNE. Macquarie dowgraded TNE from "Neutral" to "Underperform" with a new $11 TP (target price) and UBS dowgraded TNE from "Neutral" to "Sell" with an $11.90 TP. It didn't seem to help that Morgans maintained their "Add" call on TNE with a $13.73 TP (raised from their previous $10 PT). The other broker covered by fnarena.com who covers TNE is Credit Suisse who maintained their "Neutral" rating with a $12 PT. See below:

I note that as of right now (around 3pm on 29-Nov-2021), fnarena.com have not yet added TNE's FY21 numbers to those graphs in the top half of that screenshot. The broker updates at the bottom ARE up to date however. (As of today at least)

Here's some more detail:

Macquarie - 24/11/2021, Downgrade to Underperform from Neutral, Target: $11.00, Loss to target $-0.47

Following FY21 results for TechnologyOne, Macquarie raises its FY22-24 EPS forecasts by 10%, 15% and15%, respectively, due primarily to lower opex. The broker lifts its target to $11 from $9.20 and notes solid momentum in the SaaS transition.

However, Macquarie reduces its rating to Underperform from Neutral after comparing multiples for domestic and overseas peers. Management's lower revenue growth forecast was also taken into account.

Target price : $11.00 Price : $11.47 (24/11/2021) Loss to target $-0.47 -4.10%

(excluding dividends, fees and charges - negative figures indicate an expected loss).

UBS - 24/11/2021, Downgrade to Sell from Neutral, Target: $11.90, Gain to target $0.43

UBS assesses a solid FY21 result for TechologyOne though downgrades its rating to Sell from Neutral after a 30% share rally in the last three months. The profit result was a 1% beat versus the broker and towards the top end of guidance, primarily due to cost efficiencies.

Management reiterated the FY26 $500m annual reccuring revenue (ARR) target, after progress on SaaS transitions during 2H21, points out the analyst. The broker lifts its target price to $11.90 from $11.70.

Target price : $11.90 Price : $11.47 (24/11/2021) Gain to target $0.43 3.75%

(excluding dividends, fees and charges - negative figures indicate an expected loss).

Morgans - 24/11/2021, Add, Target: $13.73, Gain to target $2.26

TechnologyOne's profit result was in line with Morgans' forecast and towards the top end of the guiidance range. Both revenues and expenses were lower than forecast but tight cost controls supported earnings.

The transition of customers to SaaS continues with SaaS annual recurring revenue up an "impressive" 43% year on year. The legacy on-premise business will be disconinued in 2024 and management remains comfortable with its $500m SaaS ARR target for 2026.

Add retained, target rises to $13.73 from $10.00.

Target price : $13.73 Price : $11.47 (24/11/2021) Gain to target $2.26 19.70%

(excluding dividends, fees and charges - negative figures indicate an expected loss).

Credit Suisse - 24/11/2021, Neutral, Target: $12.00, Gain to target $0.53

Credit Suisse increases its target price for Technology One to $12 from $9.50, following FY21 results that came in at the high-end of guidance. Despite a lack of near-term catalysts, the analyst now expects sustainable double-digit profit growth.

By FY24, the broker forecasts a 35% profit (PBT) margin. End of on-premise support is planned for October 2024, which should accelerate the completion of the shift to SaaS.

In the longer term, the broker weighs positive drivers (product and geographic penetration) versus increased competition. Neutral rating maintained.

Target price : $12.00 Price : $11.47 (24/11/2021) Gain to target $0.53 4.62%

(excluding dividends, fees and charges - negative figures indicate an expected loss).

--- end --- Source: fnarena.com

The TNE share price was then up +4.27% (or +49 cps) on Thursday, then down -3.34% (or -40 cps) on Friday, and now today they are up +44 cps (or +3.81%) so far, so trading at exactly $12/share as I type this, and they have been as high as $12.19 earlier today. I couldn't really understand the market's negative reaction to the TNE results last week, however it is good to see TNE rising today in a falling market. The cream rises to the top when all is said and done. And TNE is the cream of the ASX IMHO. Disclosure: I hold TNE in multiple RL portfolios as well as here on SM.

As I have stated before, including in my valuation for TNE, they have managed to double their revenue and profits (+100% as a minimum) in a five year period three times already:

Their share price (SP) has reflected that:

30-Nov-2005: $0.57

30-Nov-2010: $0.96

30-Nov-2015: $4.35

30-Nov-2020: $9.18

Today (29-Nov-2021): $12.

As they explained on Tuesday last week:

$500m+ ARR by FY26 - With our fast-growing SaaS business and the announcement of the end of our On-Premise business, we are on track to hit our target of $500m+ ARR by FY26. Given the current ARR is $257.5m, this is an additional $242.5m of Annual Recurring Revenue in the next 5 years.

Revenue from SaaS & Continuing Business was up 9% [in FY21]. This is our future state business. By FY24 we expect our total business to be growing by 15%+ per annum.

Some people might call this optimistic, but TNE have a track record of achieving their own ambitious targets.

Rudi put it best: https://www.fnarena.com/index.php/2020/12/03/rudis-view-be-respectful-of-the-past/

I agree with Rudi that TNE is one of the best quality companies available to invest in on the ASX, and has been for a number of years. If you are after good growth year after year and a company that sets ambitious targets and then hits those targets, then TNE fits the bill perfectly.

That said, I'm possibly not going to be topping up here at these levels because I last bought TNE shares in January 2021 (this year) at $7.74, and they had significantly more shorter and mid-term upside from those sub-$8 levels than do up here at around $12/share, plus I have a large enough weighting to the company already, particularly considering the capital growth I've enjoyed. If I was underweight TNE shares however, these levels would look pretty good if you take a medium to longer term view, say 3 to 5 years.

Sample photo from their media kit - see here: Media Kit - TechnologyOne (technologyonecorp.com)

Edward Chung (CEO & MD) and Adrian Di Marco (Company Founder, Executive Director and Executive Chairman).

Yet another strong year for Technology One.

Annual Recurring revenue (ARR) up 43% to $192.3m following an 18% lift in SaaS customers.

NPAT came in at $72.7m, a gain of 15%.

The dividend increased by 8% (for the 7th year in a row), with 62% of NPAT returned to shareholders. This is a business that can grow really well with minimal capital reinvestment.

Like many software businesses, they are transitioning away from a license model to a recurring revenue model -- something that is a great long term move, even if it drags on revenue during the transition.

The company reckons it can roughly double its ARR over the next 5 years, achieving a ~14% compound annual growth rate. And that it can also increase its pre-tax net margin to 35%.

Taking these numbers together, and assuming around 330m shares on issue, that gives an EPS of roughly 40cps (compared to 22.6cps in FY21).

Over the last 5 years, the average annual PE ratio has been between 30-40. So if we assume a PE of 35 for FY26, that gives a target price of $14, which is $8.69 if you discount back by 10%pa.

Even a more bullish assumption of a PE of 40 and a target EPS of 45cps, you get a target price of $11.18.

To come at it another way, let's assume the dividend continues to grow at 8%pa and that the company trades at a yield of 1.5% in FY26. That also gives a target price of $14 or $8.69 when discounted back.

TNE is a very high quality company. High margin, high retention, high growth, rock-solid balance sheet. But I think a lot depends on the market maintaining high multiples for shareholders to achieve attractive returns. My concern is that even if the company does indeed double sales every 5 years (as they claim), any multiple contraction -- which would be likely under a higher rate environment -- would add some significant downward pressure on the share price.

I have a small holding which i'm happy to keep, but not tempted to add more at these prices.

14-Jan-2021: $9.50 is my 12 months PT for TNE (so by January 2022), however I believe they will double their business again by the end of 2027, being seven years, and they will be trading at over $15/share at that point. Management have restated their belief (in their November 24th results announcement) that they can do it in 5 years once again, but I'm going to give them an extra two, due to COVID.

There are very few companies of higher quality than TNE. They have managed to more than double their revenue and profits every five years for the past 15 years, so they've doubled in size 3 times. Why wouldn't that be reflected in their share price. Well, it has been. Have a look at what their SP has done:

30-Nov-2005: $0.57

30-Nov-2010: $0.96

30-Nov-2015: $4.35

30-Nov-2020: $9.18

Of course, the entire IT sector including all 5 of the WAAAX stocks and the XIJ (the ASX200 IT Index) have all dropped during December and so far this month as well, and TNE has too - closing today down at $7.65, some 16.7% below that $9.18 level at the end of November. APX has dropped the most, due to downgrades, but they've all dropped due to rotation out of growth stocks and growth sectors (like IT) into value stocks and cyclicals (mining, materials, energy, the better quality retailers, etc.). I loaded up on TNE in one of my portfolios today, and I'm planning on doing some more buying (in another portfolio - my super PF) tomorrow.

They weathered a short-seller attack in July that focussed on their accounting and our own @Wini ( https://strawman.com/Wini ) (a.k.a. Luke Winchester) had already posted a great article here on some of the changes they had made - see here: https://strawman.com/blog/beware-false-profits/

I believe that the results they produced in November for their full year (FY20) - which ends on September 30 - have put those concerns well and truly to bed.

Some FY20 highlights:

· ROE = 44.3%;

· ROC = 38% (both from Commsec);

· Their underlying PBT (Profit Before Tax) increased from 27% in FY19 to 29% in FY20;

· They expect their margins to gradually improve to 35%+ in the coming years driven by significant economies of scale;

· They stated that they are on track to double the size of the business once again in the next 5 years;

· They only need to keep growing at 14% p.a. to achieve that, and they managed underlying PBT growth of 13% in FY20 despite COVID-19;

· Cash Flow Generation in FY20 of $66.4m, up +49% on FY19;

· Cash and cash equivalents of $125.2m as at 30-Sep-2020;

· No Debt;

· They've posted record revenue and a record profit every single year for the past 11 consecutive years;

· They've increased their dividend every single year for the past 8 consecutive years, and by +8% in FY20;

· They spend at least 20% of their revenue on R&D each year to stay at #1, and in FY20 it was a $68.1m R&D investment before capitalisation, up 13% on FY19, and that was 22% of their FY20 revenue;

· Their UK business, which they built up from scratch, has just hit breakeven (no more losses), and will be profitable this year;

· Their Australian business has been consistently profitable for over 25 years;

· They've already expensed all of the costs of building up that UK business (from nothing), so it too will be highly profitable in the future;

· They don't grow via acquisition - they grow organically, and it's dependable and sustainable growth, they have the track record to prove that;

· They are a $2.6 billion company that is in the ASX200, they are Australia's largest and most successful ERP (Enterprise Resource Planning) SaaS company, and after carving out a niche in Universities, TAFE Colleges and other education facilities plus local governments and councils, they have successfully expanded their offering to other government departments, financial services, health & community services, utilities and managed services, with more to come;

· They were early to move to the cloud and they are now reaping the benefits of that, and so are their customers. Their customers now pay less for the same service but it costs TNE heaps less to deliver that same service, and they are upselling (additional modules to their existing clients) as well;

· Most of their revenue is recurring in nature, from the same clients, so is predictable and dependable;

· They have unbelievably low churn, averaging less than 1% per year and around half of one percent in FY20. What that means is more than 99% of their customers are loyal and stay with them every year, and keep paying them every year;

· Part of that is because of the quality of their software, and the other part is that ERP software is incredibly risky and difficult to change once it's in place;

· They have had a single high profile unhappy client, the Brisbane City Council, who sued them a couple of years ago and that was settled out of court. However, leaving them aside, the vast majority of TNE's clients are happy and loyal; and

· Unlike SAP, one of the World's largest ERP software suite providers to large corporations (I worked for Coca-Cola Amatil when they adopted SAP and I know the problems it caused) who have more of a one size fits all approach, TNE's "single instance multi-tenanted Global Saas ERP Solution" is tailored to suit specific industries and then individual companies and organisations within those industries. And with their high R&D spend, they are staying on top of new developments, improvements and new products.

I could go on. Well, I already have, clearly... Anyway, in case I haven't mentioned it already, I'm a fan of TechnologyOne (TNE). And I hold TNE shares.

30-Mar-2021: In January (14-Jan-2021) I set a 12-month PT for TNE of $9.50. They closed at $7.81 that day. They got there (to $9.50, being a +21.6% rise) in less than 6 weeks. And they got there on 22-Mar-2021 during a period in which the NASDAQ had a technical correction and most "Tech" stocks both in the US and back here on the ASX were being sold off quite aggressively.

They've pulled back a little over the last two trading days (i.e. this week), but they're still within spitting distance of $9.50. They closed at $9.28 today. This could be the start of another leg-down. We shall see. I'm continuing to hold TNE.

They have a financial year the ends on 30-September, so their half year finishes tomorrow (31-Mar-2021) and they are due to release their half year report in mid-May. It's a quality company and I'm going to hold them now, not trade them. For those who are happy to trade them, this could be a good time to lighten the position and then look to load up when they drop below $8 again, assuming they do drop back below $8 again. They might not.

24-Oct-2021: Yeah, Nah, they did NOT drop below $8, far from it, they are now trading at over $12, after announcing in early September the acquisition of Scientia - UK’s Leading Higher Education Software Provider. So it’s not just organic growth now, there is growth via acquisition on top of that. Market like! TNE were trading at $10.13 the day before that announcement and are now trading at $12.35, so they’ve put on +21.9% since the announcement of the Scientia acquisition. Good thing I decided they were a “Hold through the cycles” stock, eh?! My position six months ago was that they MIGHT have another leg down, but that their superior management, track record and industry position would see them continue to rise at a good clip over time, although probably (almost certainly) not in a straight line.

Rudi Filapek-Vandyck, the founder and editor of FNArena.com, penned an excellent article in December (2020) about TNE which can be read here:

https://www.fnarena.com/index.php/2020/12/03/rudis-view-be-respectful-of-the-past/

It is probably the best bull case for TNE that I’ve read actually, and it echoes my own views.

One thing to be aware of is the ongoing wrongful dismissal dispute known as “TechnologyOne vs Roohizadegan” which has been explained well by TNE in various announcements, their latest two can be read here (05-Aug-2021) and here (10-Sep-2021). Essentially, while I know that there are two sides to every story, I think this case has significant similarities to the one that EGL faced after they terminated the employment of their former CEO, Peter Bowd, in 2017 after he made serious allegations against the company regarding money laundering and accounting irregularities (fraud) including payments made for services not provided. As explained in a June 2019 article published in “The Market Herald”, and in the AFR in July – see here: https://www.afr.com/work-and-careers/workplace/whistleblowing-ceo-not-unlawfully-sacked-20190621-p52020

…Bowd had embarked on a dangerous (to the company) path of trying to undermine and oust the Managing Director of EGL at the time, whose family had built up the Baltec I&E business that is now a division of EGL, and there had been a widespread employee revolt and a situation had developed where the people under Bowd were refusing to work for him. He had effectively become ineffective as a CEO, or to put it another way, the EGL Board had no option but to terminate his employment. When what he had been doing (which included trying to get authorities to initiate investigations into the company’s overseas dealings without the knowledge of the Board) and the fact that employees no longer felt they could work with him, and he was putting contracts at risk because of his actions which could see the company go broke, Bowd stormed out and then the following day went to the Police and to ASIC to complain about alleged illegal activity. He was suspended and then dismissed, and he sued for wrongful dismissal. He claimed general workplace protections (“General Protections”) in respect of being terminated for exercising his workplace rights, and one of those rights was taking sick leave. The Federal Court found that he was NOT dismissed for taking sick leave – see here and here. He also claimed whistleblower protection, but the Federal Court found that his allegations were unfounded and malicious with the sole intent of saving his own job (or presumably allowing for a wrongful/unfair dismissal claim – or breach of general protections under employment law claim - to be made if he were to be dismissed), so the whistleblower protections under employment law did not apply in this case.

The AFR article is likely behind a paywall (the one I’ve linked to above), but it’s worth reading for some context, here’s some of it:

'Whistleblowing' CEO not unlawfully sacked

By David Marin-Guzman, Workplace correspondent, AFR, Jul 2, 2019

A chief executive who was fired for alleging his own company was involved in fraud and money laundering has lost his unlawful dismissal case because a court found he made the complaint only to "save his job".

Former CEO of ASX-listed exhaust producer The Environmental Group (EG), Peter Bowd, told the Australian Securities and Investment Commission in 2017 he had uncovered more than $400,000 in irregular transfers between TEG and its Indonesian subsidiary, PT Baltec.

The complaint alleged the money, paid over 12 months, was in the form of loans not repaid, payment of tender expenses and costs of goods sold but without supporting records.

“As CEO I believed there is substantial fraud and laundering of funds from the Australian business into the Indonesian company by the managing director and sales director," Mr Bowd told ASIC.

He told EG's chairman David Cartney the subsidiary might have paid bribes, parties were "skimming monies out of the company", and that managing director, Ellis Richardson, whose family was the former owner of Baltec, might have engaged in insider trading.

Shortly after the complaint, the board suspended and later terminated Mr Bowd for poor performance.

Rejecting Mr Bowd's subsequent $500,000 damages claim against the company, the Federal Court found no evidence to support his allegations.

Justice Simon Steward said the claims were made in the context of a "severe" breakdown in the board's relationship with the CEO.

"Mr Bowd made his complaint to ASIC with the intent of triggering the whistleblower provisions as a means of preventing his dismissal for poor performance as CEO," he said.

"The allegations contained in that complaint were concocted, or at the very least, deliberately exaggerated."

Mr Bowd had alleged EG's dismissal breached whistleblower protections in the Corporations Act and was adverse action for exercising his workplace right to make a complaint.

But Justice Steward ruled the ASIC complaint was not a workplace right or covered by whistleblower protections because the allegations were "not made in good faith", which he held was a requirement under the Fair Work Act.

"There was no or no sufficient basis for their making. The complaint was used as a calculated device," he said.

'Extraordinary actions'

Mr Bowd was appointed as CEO in September 2016 and, after some success, turned his focus to Baltec.

His scrutiny led to the sacking of a key employee for serious misconduct, the resignation of another and an aborted push to get BDO accounting to undertake a forensic audit without the board's knowledge or consent.

But Baltec staff started to revolt, accusing Mr Bowd of prosecuting a "personal agenda" and claiming a major client was at risk and the company could fold in three to six months.

When Mr Richardson confronted the board with these concerns including that staff morale was low and EG risked losing $4 million in value, Mr Bowd allegedly "stormed out".

Mr Bowd had assumed the board was going to remove him as CEO, the judge found, and the next day decided to complain to ASIC and the police.

Justice Steward said Mr Bowd had complained without the board's knowledge or consent and without waiting for an external audit into his concerns to finish.

"In my view, such extraordinary actions must have played a significant role in the board’s decision that it could not continue to work with Mr Bowd. In my view, in the circumstances of this case, that is entirely understandable."

The company's auditor ultimately found the "irregularities" Mr Bowd identified were actually supported by documents and that his other claims were incorrect.

Two years later neither ASIC nor police have taken any action against EG.

--- end of article/report ---

Now that concerns EGL, not TNE, and the Roohizadegan case is clearly not the same, but there are similarities in my view. I think Adrian Di Marco, TNE’s founder and Executive Chairman, had no choice but to dismiss their Victorian manager Behnam Roohizadegan, who then sued TechOne for breach of general protections under employment law. He won that case and was awarded a record $5.2m payout by the court. TechOne then successfully appealed that decision and have now been granted a retrial. It’s worth noting that while the original decision has been set aside pending the retrial, TechOne have already sensibly made a provision in their accounts for the $5.2m payout, and that provision remains in place. If the retrial also goes against TNE, they will NOT be in a worse position than they already are, as the money has already been set aside and accounted for. If however TechOne is found to have lawfully terminated Roohizadegan’s employment, they’re going to be able to reverse that provision, so they’ll effectively have another $5.2m cash available.

The Roohizadegan case was explained well in this 11-June-2021 AFR article: https://www.afr.com/technology/no-basis-for-5-2-million-unfair-dismissal-ruling-techone-tells-court-20210611-p5806j

‘No basis’ for $5.2m industrial relations ruling, TechOne tells court

By Hannah Wootton, AFR Reporter, Jun 11, 2021.

Software company TechnologyOne and its vocal founder Adrian Di Marco are calling for a retrial of an employment law case that has them on the hook for $5.2 million in damages, claiming the trial judge “ignored ... a very large amount of evidence” and made legal errors “in every one of his reasons”.

Justice Duncan Kerr of the Federal Court last year ordered the growing company to pay former Victorian manager Behnam Roohizadegan the record payout after finding the company breached general protections he was afforded under employment law by dismissing him in 2016 after he complained about being bullied at work.

A Federal Court judge found that Adrian Di Marco stood with the bullies, not the bullied, in an unfair dismissal case. Tertius Pickard

According to Justice Kerr, Mr Roohizadegan was subjected to abusive language, victimisation, gas-lighting, and “boorish” conduct while at TechOne, with his treatment at the hands of its executives leaving him “incapable of ever working again”.

But in a full Federal Court hearing littered with legal heavyweights on Friday – industrial relations guru Stuart Wood, QC, appeared for TechOne while Mr Roohizadegan retained Bret Walker, SC – Mr Wood said the trial judge failed to consider key evidence that supported his client’s case.

“ ... Everything was put to his honour, and everything was ignored,” the silk said.

“There was a failure to take into account or analyse ... a very large amount of corroborative material, which was put to His Honour for his consideration in the assessment of the statutory task in which he was engaged.

“The reasons that His Honour provided do not reveal, despite referring to in a number of places ‘the whole of the evidence’, the manner in which the corroborative material that we say should have been deployed was deployed.”

This allegedly included evidence that Mr Roohizadegan’s performance was dropping – which TechOne said was the basis for his dismissal – and an email in which TechOne executives discussed terminating Mr Roohizadegan’s employment that pre-dated the bullying complaints.

He added that there “was a legal error in relation to every one of [Justice Kerr’s] reasons, especially around his alleged failure to consider the nature of the complaints made by Mr Roohizadegan.

The barrister alleged that this was “never considered” by Justice Kerr, forming an “obvious error” in the decision which gave grounds to a retrial.

He also hit back at the judge’s characterisation of Mr Di Marco as an “evasive” witness who, as a boss, chose “to stand with the bullies rather than the bullied”.

In the original judgment, Justice Kerr said Mr Di Marco’s own conduct toward Mr Roohizadegan was “deceptive and self-serving if not cruel” and his evidence before the court as “highly unimpressive ... tortured and evasive”.

When awarding the record damages payment, he said that to achieve “effective deterrence”, CEOs needed to know that “there will be a not insubstantial price for failing” to stand with bullies.

Mr Wood dismissed these findings: “There was obviously no basis on the evidence presented to draw that conclusion,” he said, adding that it “was never” the trial judge’s role to consider Mr Di Marco’s behaviour at that time.

Mr Di Marco’s criticism of proxy advisors has come under scrutiny over the past two months as he has publicly advocated for efforts by the federal government to limit the power of proxy advisors, building on his previous complaints about the firms.

His outspokenness follows TechOne shareholders delivering a first strike against the company’s remuneration report at its February AGM after two proxy houses, Ownership Matters and CGI Glass Lewis, recommended voting against it.

--- end of article/report ---

Two sides to every story, but at the very least I don’t think this has any further negative potential to hurt TNE, particularly as they’ve already provided a provision for the full $5.2m payout as well as legal fees. In their recent ASX announcements regarding this matter, TechOne said, “this was a senior executive earning close to $1m per year, who no longer had the confidence of the board and his fellow executives and against whom serious allegations had been raised by staff, and we took action to address in 2016.”

So, sorry to delve into that murky cesspool for a while, but I think that is one of the two skeletons that have been found in TNE’s closet, the other one being the dispute with Brisbane City Council that was settled out of court in the end a couple of years ago. Their one high profile unhappy client. A lot was made of that dispute at the time, but once again there are two sides to that story as well. I won’t waste time talking about TNE’s side of that one. It’s enough to know that their churn rate is less than 1% p.a. and was less than half of one percent in FY20, and there is no evidence that this very low churn rate deteriorated in FY21. Their FY finishes on 30th September, so they will report their FY21 results towards then end of November.

Happy holder of TNE in two of my RL portfolios (including my SMSF) and also here on SM.

Raising my TNE PT (price target) to $13.70, and that’s a 2 year PT, so by late October 2023.

Further Reading:

Annual Reports - TechnologyOne (technologyonecorp.com)

Life@TechOne: Company Values - TechnologyOne (technologyonecorp.com)

TechnologyOne - Global SaaS ERP Solution (technologyonecorp.com)

Management has guided for FY21 Net Profit Before Tax of $94.3-$98.6m, representing a 10-15% increase on the FY20 underlying result. Perpetual licence fees are expected to decline by $7m as the focus remains on growing the SaaS business. As a result, SaaS's annual recurring revenue is expected to grow by at least 35% on FY20. Consensus currently has expectations of ~10.9% EPS growth (GR3). Furthermore, the ~£12m acquisition of UK higher education software provider, Scientia, is expected to be earnings neutral for FY21.

*Scientia provides mission critical software for over 150 leading universities across the UK and Australia

Disc: RL, not in the SM portfolio,

03-Sep-21: Acquisition of Scientia - UK’s Leading Higher Education Software Provider

BRISBANE, 3 September 2021 – TechnologyOne (ASX: TNE), one of Australia’s largest enterprise Software as a Service (SaaS) companies, today announced it has entered into an agreement for the acquisition of Scientia Resource Management Limited (Scientia), a United Kingdom company servicing the higher education sector.

The likely consideration will be GB£12 million and includes an initial payment of £6m and further payments, based on achieving progressive earnouts out to FY23. Total consideration will be in the form of cash payments funded from internal sources. The acquisition is earnings neutral for FY21.

Edward Chung, TechnologyOne’s CEO said, “This acquisition forms part of our strategic focus to deliver the deepest functionality for Higher Education and it will accelerate our growth and competitive position in the UK as well as have significant benefits in the Australian Higher Education market.”

“Scientia’s market leading product Syllabus Plus provides advanced academic timetabling and resource scheduling. Their products provide mission critical software for over 150 leading Universities across the United Kingdom, and Australia including the University of St Andrews, University of Exeter, Monash University and the University of Queensland”

“The acquisition further expands our Global SaaS ERP solution for Higher Education. The integration of the Scientia’s advanced academic timetabling and resource scheduling capabilities, combined with our market leading Student Management, HR & Payroll, Enterprise Asset Management and Finance capabilities, will provide smarter decision-making eliminating underutilisation of space and resources that is paramount for Higher Education across the globe in a post-covid world” Mr Chung said.

Adrian Di Marco the company’s founder and Executive Chairman said “This is our first international acquisition and demonstrates our deep commitment to both Higher Education and the UK market. The unique IP and marketleading functionality of Syllabus Plus supports our vision of delivering enterprise software that is incredibly easy to use and that substantially enhances our customers’ experience in the Higher Education sector. We are excited about the opportunities this will bring to both our UK and Australian customers in the coming years.”

More details will be provided with our full year financial statements and results presentation.

--- ends ---

I hold TNE in one RL PF and also in my SM PF. They tend to trend well and they are a good one to either buy and hold, or to buy low and sell high. I'm tending towards the buy and hold strategy with TNE now. They have been an excellent performer in terms of business KPIs for a long time, and while they may not have the explosive growth potential of a new start-up or a disruptor, they are also a LOT less risky - there is far LESS downside with a company of this quality that have a track record that is this good. I like investing in smaller companies, but the spine or core of my RL portfolios tend to be larger, high-quality, proven companies like TNE, CSL, ARB, etc. Those provide the core growth and stability - and allow me to also play in the smaller end of the market with a smaller percentage of my investable capital - where there is a different (higher) risk/reward equation.

Technology One has delivered a strong first half result, reporting a record pre-tax profit of $37.3m, up 44%. ARR from SaaS was up 41% to $155.8m.

The dividend was lifted by 10%, something the business has done consistently since at least 2012.

Total revenue was up 5% with an 18% drop in license revenue offsetting a 35% lift in SaaS revenue -- as expected, with the business transitioning customers to the new payment model.

Revenue from the SaaS business is expected to grow at ~15%pa as the legacy license fees are wound down in the coming years.

The business continues to invest heavily into R&D, lifting the investment by 14% (it's about 24% of revenue). However general expenses have dropped 5%, which has helped lift the net margin.

In fact, the net margin in FY20 was a record 29% and management expect this to further increase to 35% in the coming years.

The balance sheet looks very strong, with $100m in cash and no debt -- a 20% improvement from the previous corresponding period.

The business (as usual) reported negative free cash flow for the half, but this is expected to be "strong" for the full year (invoices are typically issued in the second half).

In fact, FCF is expetced to be roughly 80% of NPAT in the full year, and is expected to grow to 100% as capitalisation of R&D and amortisation rates start to align in FY24.

The UK business is now profitable and is expected to deliver a net profit for the full year. The company sees "significant upside" in this market in the coming years, and the market there is 3x the size of the local region.

Customer churn remains insanely low, at 99% across all markets. As such, the lifetime value of a new client is significant.

For the full year, Technology One is expecting to report a 10-15% lift in underling profit (or a 14-20% lift in statutory profit). At the mid-point, and applying the usual tax rate, that's an EPS of ~23c and puts shares on a forward PE of 39x

That's up there, but given the reliability of cash flows, the expected growth and a super resiliant balance sheet, it doesnt seem unreasonable. The business expects to double in size over the next 5 years thanks to improving margins and continuing top-line growth.

That suggests an EPS of 46c in FY26.

What a great business.

You can read the results presentation here.

25-May-2021: TechnologyOne SaaS up 41% & H1 FY21 Profit After Tax up 48%

plus: TNE H1 FY21 Half Year Results Presentation

and: Half Year Report 2021 - Amended

Key results were as follows:

- Profit After Tax of $28.2m, up 48%

- Profit Before Tax of $37.3m, up 44%

- SaaS Annual Recurring Revenue (ARR)* of $155.8m, up 41%

- Revenue from our SaaS and Continuing Business of $140.6m, up 7%

- Total Revenue of $144.3m, up 5%

- Expenses of $107.4m, down 5%

- Cash and Cash Equivalents of $100.1m, up 20% from 31 March 2020

- Cash Flow Generation** of ($2.9m) as expected, and will be strong over the full year

- Dividend of 3.82cps, up 10%

- R&D expenditure (before capitalisation) of $34.6m, up 14%, which is 24% of revenue

Notes:

- (*) ARR represents future contracted annual recurring revenue at period end. This is a non-IFRS financial measure and is unaudited.

- (**) Cash Flow Generation is Cash flow from operating activities less capitalised development costs, capitalised commission costs and lease payments. This is a non-IFRS financial measure and is unaudited.

[I hold TNE shares.]

Proxy Advisor Recommendation Against TNE Rem Report

Introduction

Proxy reports have been recently issued pertaining to Technology One Limited’s (ASX:TNE) Remuneration Report as follows:

~ CGI Glass Lewis – recommendation vote against Remuneration Report

~ Ownership Matters– recommendation vote against Remuneration Report

~ ISS - recommendation vote in favour of the Remuneration Report

The recommendation against the Remuneration Report is because the TechnologyOne Board exercised discretion pertaining to LTIs, that resulted in LTIs fully vesting.

TechnologyOne has been approached by Shareholders on this matter. We have issued this ASX statement to ensure all our shareholders are fully informed.

TechnologyOne believes that the recommendation by the Proxy Advisors does not take into account the real-world considerations faced by the TechnologyOne Board, as outlined below. (see attachment)

Board discretion occurred to avoid unintended and unfair consequences that would have had a profound impact on executive motivation and retention.

The Board believes executives should be acknowledged and rewarded for the exceptionally strong outcomes delivered during COVID19. Board discretion has not led to an unreasonable outcome. There is a clear alignment between shareholder rewards and executive remuneration after Board discretion.

We ask shareholders to consider the following information and vote in favour of adopting the Remuneration Report at the upcoming AGM.

28-Jan-2021: UBS, the only broker to have been bearish on TNE, has just double-upgraded TNE from a "Sell" to a "Buy" - quite a turnaround! Which means TechOne is one of the few stocks rising today amidst a sea of red. Here's a summary of what UBS said:

UBS - 28/01/2021: Upgrade to Buy from Sell: Target: $9.15: Gain to target $0.69

In the wake of TechnologyOne's recent de-rating, the broker has double-upgraded to Buy from Sell. The stock has underperfomed the Small Ordinaries by -15% since its November earnings result, and -25% since the prior May result.

The broker sees upside risk from faster SaaS conversion, improving UK momentum and greater traction in domestic state/federal government business. Value is on offer compared to both domestic and foreign peers, the broker suggests.

Target rises to $9.15 from $8.45.

--- ends ---

Macquarie has the same price target ($9.15) with a "Neutral" rating. Morgans has a $9.99 PT and a "Buy" call on TNE. I hold TNE shares, and they are also one of the largest positions on my Strawman.com scorecard currently. I was lucky enough to buy them two weeks ago at $7.74/share, at very close to the bottom of their recent decline. They're heading north again now. If you have a quick glance at their chart you'll see that they trend very well for months at a time and then reverse direction and trend the other way. It's a different type of volatility, like volatility in slow motion. They don't tend to move up and down by large percentages on a day to day or week to week basis, but they have these longer trends - for 2 to 4 months at a time - where they just head North-East or South-East at a steady clip. About a week ago they started their next North-East leg. In addition, as I have explained in my valuation and bull case straw, they are one of the most dependable and highest quality companies on the ASX.

[I hold TNE.]

13-Jan-2021: The best bull case I've read for TNE is here: https://www.livewiremarkets.com/wires/be-respectful-of-the-past

That's Rudi Filapek-Vandyck from FNArena.com and if you've followed him on Ausbiz's "The Call", you'll know he's a big fan of TNE.

Here's another one: Mark Moreland of TeamInvest: https://www.ausbiz.com.au/media/the-call-monday-11-january?videoId=6479

Our own Strawman (Andrew Page) asks Mark about TNE from about the 5:30 mark of that video. I wouldn't worry too much about Ord Minnett's Francesco De Stradis' concerns about lack of growth, etc, in the coming years. As Rudi and Mark say, TNE's management are so good, and their track record is so brilliant, that you'd be wise to keep backing them rather than expect their excellent run to come to an end. Francesco tows the company line, so if Ords have a "buy" on the stock he'll be positive, and if they don't he'll be wary. That's fine. Horses for courses. I tend to listen more to those who clearly know what they're talking about, those who really KNOW the company they are discussing - and ignore the rest.

Disclosure: I hold TNE shares, and if they stay below $7.80 tomorrow I plan to buy more (for my superannuation portfolio). I'm also planning to add them to my Strawman.com scorecard this week.

I've presented my own bull case in my valuation for TNE, so I won't repeat it all here.