Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

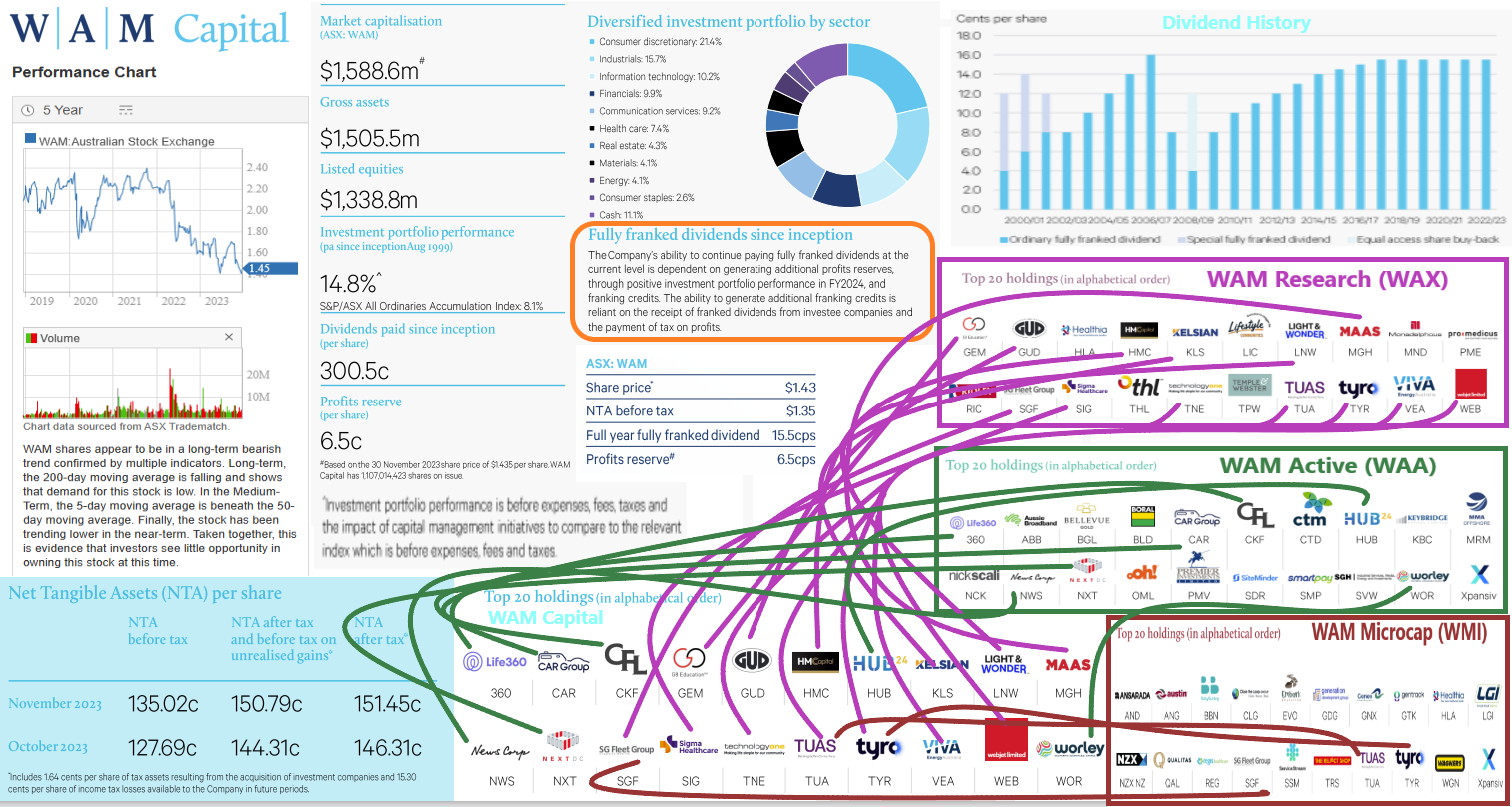

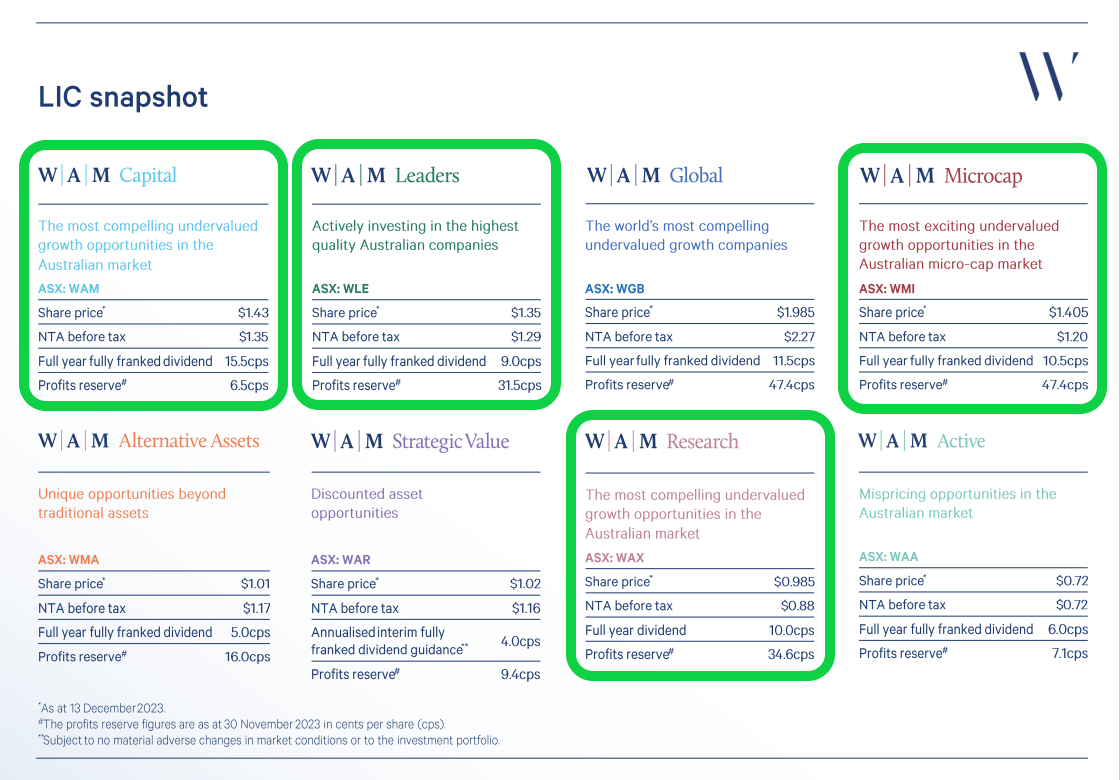

16-Dec-2023: They have a very low profit reserve, they haven't raised their dividends in 5 years (since 2018), and they can't continue to maintain their current 15.5 cps/annum in dividends unless they top up their profit reserve and also generate more franking credits - via trading profits, so above and beyond what they get from their investee companies with the dividends they receive from those companies. Despite their previously massive premium to NTA now just being a large premium to NTA (it's shrunk, or narrowed substantially), it's STILL too big - this LIC does not deserve to be trading at a premium at all. There are far better LICs that are outperforming WAM Capital and growing their dividends - yet they trade at discounts to their NTA - and one of them is also managed by Wilson Asset Management - it's WAM Global (WGB) - you can read more about the various LICs that they manage here: https://strawman.com/forums/topic/7044

But WAM Capital (WAM.asx) is one of the worst LICs in their stable of eight, despite it being their "flagship fund" - or it used to be - it was the OG of the 8 anyway, but it's been all downhill lately, as that five year share price graph (top left above) shows.

So, flat dividends, not a "Growing Stream" of fully franked dividends as promised - the fund's stated aim and purpose is to provide a growing stream of fully franked dividends to their shareholders, and they have done that if you leave out the word "growing" for the past five years.

And little prospect of increasing dividends, as they have bugger all in their profit reserve, which is where their dividends are paid from, and every chance of a reduced dividend if they can't turn things around, like, yesterday or earlier.

And they disclose the fund's performance BEFORE expenses, fees (both base fees and performance fees) and taxes, which according to Geoff a few years ago is poor behaviour from a fund manager.

And every stock held in WAM Capital is held in at least one of their other funds. As shown there by the purple, green and brown spaghetti, 7 of WAM's top 20 positions are also held in WAA, and the other 13 are held in WAX, with 3 of those 13 also being held in WMI - their Microcap fund. I wouldn't recommend WAA and their "Active" (mostly arbitrage) strategies, but WAX is a far better option than WAM in terms of their healthy profit reserve, their good portfolio performance and their excellent record of growing their dividends every year - although WAX has just run out of franking credits and is trading at an even bigger premium to NTA than WAM is.

My point being - WAM Capital (WAM.asx) just holds companies that are held in their (WAM Funds') other LICs, but it has none of the positives that those funds have, like 3 or 4 years worth of dividends in their respective profit reserves, dividends that are rising every year, etc. When they finally either suspend or reduce the WAM Capital dividend, I expect carnage. And I do believe that is inevitable unless they can get VERY creative and work out some other way of funding the dividend - instead of from their profit reserve - so against what they have been telling us since the inception of the fund - which is what I've highlighted in orange above - that the dividends are funded from the income received from their investee companies and profits they make from trading - which is all stored in their profit reserve and the balance of that profit reserve is reported each month (in their monthly reports) in cents per share. At the end of November, WAM Capital's profit reserve contained just 6.5 cps.

At this point, WAM Capital has less in their profit reserve than the last half yearly dividend they paid - which was 7.75 cps, same as the previous 10 dividend payments before that. And they have an interim dividend coming up for the 6 months that ends at the end of this month (December 2023). They have been just scraping through so far, but I have a feeling that's just from selling stuff they don't really want to sell, just to lock in enough profit to fund the dividends, hence the poor performance, as shown by a declining NTA and a declining share price.

Compare the Eight:

The ones trading at premiums to their NTA are highlighted in green.

I have held WAM, WAX, WMI, WGB, WLE, WMA and even WAA at various times over the years, but not WAR (which is the most recent one), but I hold no LICs, LITs or any other managed funds at this point in time, having recently exited the last of them (SNC, in October) - I haven't held any WAM Funds for a few years now, and I have no plans to jump back in. I'm steering clear of LICs and other managed funds for a while, just managing my own funds.

In terms of how I rate each of those 8 funds, I would say that WGB and WLE are clear standouts in terms of consistent performance and quality portfolio managers, plus rising fully franked dividends, then WMA has its place for those who want that exposure (to "Alternative Assets" like water rights, debt, private equity funds, some property and agricultral assets, infrastructure, etc.), and WAX and WMI are OK if you can close your eyes and ignore the premiums to NTA they trade at, but I don't rate WAM, WAA or WAR as being too flash - I'd give those three a wide berth. They might be individually good for a trade now and then if that's what you're into, but their performance over recent years has been very sub-par. There are some good LICs in there (in those 8) - with high fees but good total shareholder returns [TSRs] after fees, but WAM isn't one of them - not any more, in my opinion.

Shifted my valuation to the end of the month to compare to the announced value in next NTA update.

NTA Before Tax - $1.544

Increase in All Ords From End of Month - 2.44%

Estimated NTA - $1.582

Profit Reserve

*Before 7.75c Dividend

18.5c up from 13.0c

Top 20

February

January

Notes from WAM Group (WAMG or WAM Funds) Roadshow in Adelaide on Wednesday 15th May 2019:

Straw #2 (of 3):

Disclosure: Of those companies mentioned, I hold WAM, WAX, WAA, WGB, WLE, FGX, MND, IGO, WSA, SBM, NST, EVN, CSL, CDA, ICQ and MGG (MGG is managed by MFG).

Notes:

- See Straw #1

- See Straw #1

- See Straw #1

- See Straw #1

- See Straw #1

- Each of the portfolio managers was asked to name a mistake they have made over the past 6 months and what they learned from it. The most interesting one was Martin Hickson's answer, which was Magellan (MFG). They bought MFG in October-November, sold out in December when they were going to ~50% cash, and their mistake was not buying MFG back in January, because they've risen 55% this year - from $28.54 on December 31 to close at $44.39 on Wednesday (15-May-2019). Marty said the lesson was that you should always be prepared to look at something again that you've previously sold out of in case they are worth buying again. Good companies can go through bad periods (or look like they are about to go through a bad period) and still remain good companies. Sometimes one of the best buy ideas could be something you recently sold.

- Asked for a stock pick each, the PM's answers were:

- Oscar Oberg: APE (post the acquisition of AHG)

- Catriona Burns: Entertainment 1 (Pepper Pig may do well in China in this, the year of the pig, and content is becoming more highly valued)

- Martin Hickson: 5G Networks (5GN)

- Mathew Haupt: WSA (Western Areas, again, the WSA/IGO amalgamation theory involving WES) but also because WSA have some very low cost and high grade nickel mines and should do well if Trump does the China-US trade deal. Ditto for IGO by the way.

- Oscar Oberg (again): CDA (Codan, a nice little Adelaide success story, selling telecommunications equipment and MineLab metal detectors to all parts of the globe). Roger Montgomery was also a fan of Codan last time I checked. Oscar thinks they should do 20% earnings growth annually over the next couple of years.

- Geoff Wilson: WGB & WLE.

- When asked to rank the banks, Matt said that NAB was the standout because the have the been increasing provisions (for debts that may become bad but haven't yet) which can increase profits in later years if those provisions are not required (ANZ have been doing the opposite, so may get caught out badly if they get too many bad debts), and NAB have the greatest exposure to business, especially small to medium businesses. They also have the most opportunity for cost cutting to improve profitability. He rates CBA as the second best, and Westpac a fair way behind. ANZ is the worst and he said that at best ANZ could trade sideways but in a low credit growth environment, there were no obvious catalysts that might cause a positive re-rating of ANZ, so there's little reason to hold them.

- He mentioned that CBA may well announce a special dividend or off-market buyback this month because they have a $5 BILLION franking credit balance, and it would make sense to try to get that out to shareholders before June 30. They also have more than adequate capital in terms of cash they need to hold, so they will be able to distribute quite a bit without worrying about their capital adequacy requirements. That may not be as relevant now that Labor have lost the Federal election.

- When asked how often Matt meets with senior executives from the big four banks, he replied that he would see somebody from one of the banks at least once per fortnight. Altogether, the team estimate that they now have between 4,000 and 5,000 meetings with company management teams every year. If I recall correctly, Geoff mentioned that WAM are now the 4th largest LIC in Australia, although he could have meant LIC fund manager, but either way their size gives them relevance and opens more doors, especially now that they have a large cap fund and a global fund.

- Profit reserves, from biggest to smallest, in cents per share:

- WAX: 28c

- WMI: 19c

- WLE: 8.4c

- WAM: 7.6c

- WGB: 5.6c

- WAA: 4.5c

- Those are what the dividends are sourced from, so the higher the profit reserve (per share), the more sustainable the dividend yield is.

- When asked if they were still holding stocks based on the expected boom in infrastructure construction Marty said that they were, but some of the names had changed. They hold CIM, DOW & SVW now.

- See Straw #3

- See Straw #3

- See Straw #3

https://wilsonassetmanagement.com.au/about-us/

[click on the above link and then scroll down until the entire team comes up - with photos and bios]

03-Sep-2020: Off-Market Takeover Bid for Concentrated Leaders Fund (CLF)

04-Sep-2020: Late yesterday arvo (03-Sep-2020), WAM announced that they were making an off-market takeover bid for CLF. Good for CLF shareholders.

18-Jan-2021: WAM Capital announces strong investment portfolio outperformance and FF interim dividend of 7.75 cps

WAM Capital announces strong investment portfolio outperformance and fully franked interim dividend of 7.75 cents per share

This is the fourth year in a row that WAM Capital has maintained their dividend at 7.75c per half and 15.5c per annum. There have been no changes to their interim or final dividends since 2017. I have warned on here that WAM Capital would struggle to increase their dividends because of their very low profit reserve. The other LICs that WAM Funds manages have mostly all got far more in their profit reserves (WAA and WAM are the exceptions) so they (WAX, WMI, WLE and WGB - and hopefully WMA too soon) are all increasing their dividends each year, as WAM (WAM Capital) used to do, up until 2017.

I thought WAM Capital (WAM) would actually DECREASE their dividend this year, but they have managed to finish the 2020 calendar year strongly and have managed to maintain their dividend yet again (for the 4th year on the trot). It was (and remains) this lack of a healthy profit reserve, and thus lack of good potential for dividend increases, combined with a rediculous circa 25% PREMIUM to their pre-tax NTA (in their SP) that keeps me out of WAM Capital (WAM) shares.

I currently own WMI (WAM Microcap) and WGB (WAM Global), both bought at significantly lower levels than where they are currently trading, and I've held all of the others in the past, but WAM and WAX definitely do NOT interest me at current prices. WAX (WAM Research) is trading today at $1.58, and their December 31 (2020) pre-tax NTA was $1.14. That's a +38.6% premium to NTA. WAX is good, but they're not THAT good.

As we have seen with many other LICs - such as FOR & CDM - these large NTA-premiums can turn into similarly large NTA-discounts rather quickly when the market loses faith or interest in a LIC (and their management). If you think that is unlikely to happen to WAM Funds LICs, have a look at WLE and WGB (WAM Leaders and WAM Global) - they both spent the vast majority of CY2020 trading at significant NTA-Discounts - while their stablemates WAM & WAX were still trading at huge NTA-Premiums (as they still are).

What's keeping those NTA-premiums so buoyant with WAM & WAX is their very loyal shareholder base who are reluctant to sell, which keeps the prices higher due to reduced supply. That part I can understand. What I do find hard to understand is why there are so many people still willing to BUY them at these prices - why is there still so much demand? Why would you pay $1.25 for each $1 worth of assets in the case of WAM Capital (WAM), or $1.38 for each $1 worth of assets in the case of WAM Research (WAX)? That's a lot to pay for a reliable stream of dividends, and in the case of WAM an income stream that has not risen in four years and has actually gone backwards in real (inflation adjusted) terms. What about the capital gains? Yes, what about them - using last night's closing prices, WAX was +2.6% higher than where they were 4 years ago (in mid-Jan-2017) and WAM Capital (WAM) are now -6.3% LOWER, so they have provided a capital loss while failing to increase their dividends for 4 years. As they say, past performance is not a reliable indicator of future performance, and that certainly applies to WAM Capital pre-2017 and post 2017.

There are reasons why of course, and to understand those, you need to know that WAM Capital, being Wilson Asset Management Group's flagship fund, contains ALL of the companies that are held by WAA (WAM Active, which is 100% market-driven/active trading focussed) and WAX (WAM Research, which is 100% Research-driven), however, WAM Capital (WAM) is a MUCH larger fund so it holds a LOT more of each of the companies held by WAA and WAX. WAM also holds stocks held by WMI (WAM Microcap) and WLE (WAM Leaders) and both WMI and WLE use a blend of both market-driven (active) and research-driven methodologies. WLE is managed by Matt Haupt and his team, while Oscar Oberg is the lead PM (portfolio manager) of WAM, WAA, WAX and WMI. Oscar previously looked after the Research side of those portfolios and Martin Hickson looked after the Active/Market-driven side. Both worked under the watchful eye and supervision of Chris Stott, the WAM Funds CIO (chief investment officer). After 12 years at WAM Funds, Stotty left in November 2018 to run his own funds management company, 1851 Capital. Marty left WAM Funds in September 2019 and began working for Chris' 1851 Capital in November 2019, leaving Oscar to run those 4 LICs by himself. He has the full WAM Funds Team at his disposal, so he's certainly not alone, but my point is that in late 2019 he went from being the PM of one fund (WAX) and the co-PM of two (WAM & WMI) to being the sole PM of four LICs (Listed Investment Companies, being WAM, WAX, WAA & WMI). He was also required to handle BOTH of their investment methodologies:

- a research-driven process focused on identifying undervalued growth companies; and

- a market-driven (/active) process that takes advantage of market mispricing opportunities.

...instead of just the research-driven side that he had looked after previously. Again, he had help, but it's still a big role change. And I would argue that while Oscar Oberg is undeniably very good, he is better at the Research side than the Market-driven/active side.

In addition to that, Geoff Wilson, the founder and boss of WAM Funds dabbles in a number of other LICs and investment companies, and those positions, which run into the tens of millions of dollars - hundreds of millions at various times - are all held within WAA and in the "market driven" half of WAM. Examples of their current holdings which are all down to Geoff are AUI, CIE, CLF, PDL, PIA and TGG - which represent 6 of both WAM Capital's and WAM Active's respective top 20 positions - plus KBC - which is also held in both WAM and WAA but only makes the top 20 in WAA, not in WAM.

Some of these positions - like PIA and TGG have been in there for many years.

PIA is as a result of Geoff's failed attempt to takeover the management of HHV (the Hunter Hall Global Value Fund) in 2016/2017 after Peter Hall quit and sold all of his HHV shares to SOL (Washington H Soul Pattinson for $1/share, well below the traded price at the time). WAA and WAM had actually been accumulating HHV shares prior to that move by Peter Hall, and Geoff then got involved in a battle for control of the LIC which ended up being won by Pengana Capital Group (PCG) with the backing of SOL (who own 38.7% of PCG). HHV was then renamed Pengana International Equities and the ASX ticker code was changed to PIA. WAA and WAM still hold PIA shares, which peaked at $1.46/share in August 2016 and then traded down or sideways for 4 years before bottoming at 86 cents per share in March 2020 and then recovering somewhat to be at around $1.24 now.

TGG (Templeton Global Growth Fund, which is actually a value fund, NOT a growth fund), another long term position in WAA and WAM, has traded in a channel between $1 and $1.50 for over 7 years, since mid-2013. It is currently towards the upper end of that channel, at $1.40, but it has provided nothing except dividends and share price volatility for all of that time.

My opinion is that these legacy positions as well as Geoff's current battles with other LICs and investment companies (which usually end up with a takeover attempt at some stage) are a big drag on WAA's results and also WAM's, and that's why WAX (100% research driven with zero other LICs in their portfolio) has performed SO much better, despite being managed by the same PM. Remember that Oscar Oberg, the PM of these funds has no other option; he has to accomodate those LIC and other investment company positions within his WAA & WAM portfolios, because Geoff is his boss, and those battles/positions are Geoff's babies, and also where the majority of Geoff's focus lies these days. Geoff Wilson leaves the everyday running of (and all other portfolio decisions relating to) all 7 of their LICs to the respective PMs and their teams. He is their CIO (Chief Investment Officer) but unlike Chris Stott, their former CIO, Geoff is much more hands-off, except for those other LICs and investment companies that I've discussed.

As you might be able to pick up from all this, I've been following WAM Funds for many years, and have attended their roadshows and talked to Geoff, Matt, John, Oscar, Martin, Chris, Catriona, Kate, etc. on numerous occasions. I've also had lengthy phone conversations with Kate Thorley (their CEO) and Martyn McCathie (Head of Operations) about these matters. My call with Martyn was actually in May 2020 when I was in hospital recovering from a total right hip replacement. I'm going in tomorrow to have my left hip replaced also. I should be home some time next weekend. Marty called me to discuss an email I'd sent to FGX expressing concern that they were still using LHC Capital as one of their fund managers and asking why LHC had not been removed either for underperformance or for values and actions that were entirely inconsistent with the values of Future Generation Funds. This related to their disastrous investment in iSignthis (ISX), which was worth almost $100m (at $1.07/share) before ISX were suspended from trading on the ASX in late 2019 - and was by far the largest position in the LHC Capital High Conviction Fund at that time - and is now worth around 5 cents per share according to LHC and $0 according to me. But it also related to other activities that the two guys running LHC were alledged to have been involved in relating to other companies. I have posted straws on these matters under ISX. Anyway, Martyn spends much of his time working out of the WAM Funds office for FG Funds (the two Future Generation Funds - FGX & FGG) alongside Louise Walsh (FG Funds' CEO) with WAM Funds paying the associated costs of that as part of their support of FG Funds (which were founded by Geoff Wilson). While Martyn could certainly understand my concerns (my kids own FGX shares), he explained that ulimately the decision would be made at the appropriate time by the FGX investment committee who were well aware of these concerns because they were widely held concerns. I checked recently and I am happy to see that LHC Capital has now been removed from the list of fundies who manage FGX's FUM (funds under management). See here for the latest FG Funds update. And we ended up discussing a lot of other stuff related to WAM Funds as well.

Later in the year, Kate Thorley rang me up prior to the BAF shareholder meeting - where we voted for the management transition and the change of fund name to WAM Alternative Assets - to talk about the vote and the opportunities that Kate saw for the fund under their management, and, once again, I managed to steer the conversation in a number of other directions and discuss a lot of other stuff related to the other WAM LICs and their PMs - and Geoff. Kate does not agree with me about Geoff's positions (and the market-driven/active side in general) being a drag on WAM Capital (WAM) - she says that the majority of those positions should provide adequate returns in time, either via being taken over by WAM Funds or via other means. I do not disagree with that. I just think that those returns are likely to be inferior to what Oscar is achieving using his Research-driven methodology with WAX and WMI and the Research-driven side of WAM Capital (WAM).

In summary, I did hold BAF and did vote "Yes", and then sold WMA after the transition to lock in those profits. I still hold WMI and WGB. I like WAX but think it's FAR too expensive to be buying with an NTA-premium of over 30% in the share price. WAA is too small and irrelevant, and I prefer WAM Funds Research-driven methodology to their Market-driven process that is used for all of the positions in WAA, so I am not interested in WAA at this point, although that could change in the future. I won't hold WAM for all of the reasons I've detailed in this straw, but I might reconsider if their profit reserve was a lot larger AND their share price was a lot lower, like at or below NTA instead of at a circa 25% premium to NTA. I think WLE (WAM Leaders) is a hold, but I don't personally want to hold a LIC full of large caps at this point in time, so I'm currently out of WLE, but may buy back into them again.

The following might be useful to compare the 7 LICs managed by WAM Funds to each other:

- LIC, fully franked full year dividend (cents per share), Profit Reserve (cents per share), years of dividends in profit reserve, 31-Dec-2020 pre-tax NTA, 17-Jan-2021 SP (share price), premium/discount to NTA in SP:

- WAM, 15.5cps, 20cps, 1.3 years, $1.80 (NTA), $2.24 (SP), 24.4% premium

- WLE, 7cps, 24.3cps, 3.5 years, $1.30, $1.34, 3% premium

- WGB, 10cps, 43cps, 4.3 years, $2.51, $2.43, 4% discount

- WMI, 9cps, 37.5cps, 4.2 years, $1.59, $1.885, 18.6% premium

- WMA, 4.6cps, N/A, N/A, $1.09, $0.985, 9.6% discount (only managed by WAM Funds since 14-Oct-2020)

- WAX, 9.8cps, 37.5cps, 3.8 years, $1.14, $1.59, 39.5% premium

- WAA, 6cps, 12cps, 2 years, $1.00, $1.095, 9.5% premium

As it turns out, the two I am currently holding (WGB and WMI) have the largest profit reserves in terms of years coverage of their dividends and the ability to increase their dividends. The profit reserves also reflect the underlying success/profitability of those funds, so the ones with the largest profit reserves have outperformed the others.

In addition to being one of those outperforming funds, WGB (WAM Global) is also currently available to purchase at a small discount to their last reported pre-tax NTA (net tangible assets, a.k.a. NAV - net asset value). This is consistent with almost all of the other globally focussed LICs on the ASX who are virtually all trading at NTA-discounts.

While WMI's (WAM Microcap's) NTA-premium (in their SP) is getting up towards 20% again, I will likely continue to hold them for a while because I purchased them at a discount to NTA (at the time of purchase) and they are very likely to increase their dividends substantially over the next few years, including during 2021, in my opinion, based on their performance and large profit reserve. Unlike WAM.

Geoff Wilson has been on a buying spree recently picking up ~$200k in WAM shares on market over the last 2 weeks.

WAM-Solid-investment-performance-increased-775cps-ff-interim-dividend.PDF

The market liked that report yesterday (Thurs 2nd Feb 2023) with the WAM Capital (WAM) SP finishing the day up +10.07% (up 15c from $1.49 to $1.64) and they rose another +4% today (Fri 3rd Feb) to close at $1.705.

That's a nice rise in two days, but they've been falling for most of the past 12 months.

And while the increased dividend is positive, and the dividend yield is excellent (10.4% for FY23 - Annualised - and based on their closing SP on Wednesday, which was $1.49), I'm not keen on a number of their holdings (their portfolio as at 31-Dec-2022 is shown below) and their most recent FYTD performance (+8.1%) was actually less than what the S&P/ASX All Ordinaries Accumulation Index (XAO) returned (+9.6% FYTD). WAM Capital did beat the S&P/ASX Small Ordinaries Accumulation Index (+7% FYTD, so WAM beat that index by +1.1% but they underperformed the XAO by -1.5% - all shown below):

Note FYTD = Financial Year To Date, but they are actually just talking there about their performance up until the end of December.

There are only a small handfull of companies in that lot that I am happy to have exposure to, and the main one, NRW Holdings (NWH) is a company I already hold both here on SM and IRL (in three different portfolios - including my SMSF). PME is another good one of course. I also have PME in my SM portfolio. I'm happy with exposure to PRN, LIC, REA, SVW and PMV but there are also a number of companies in there that I would just as soon not have any exposure to.

The biggest deal-breaker for me however is that their share price is trading at a significant premium to their NTA.

Their most recently disclosed NTA was their pre-tax NTA on 31-Dec-2022, which was $1.39, and their share price was $1.59. Their share price is now over $1.70. Oscar Oberg, the Lead Portfolio Manager (PM) of WAM Capital and a couple of WAM Funds's other LICs said in yesterday's announcement (link above) that, "2022 proved to be a challenging year for equity markets, and in particular small-cap companies. Over the past 20 years we have seen many cycles in the market and believe our proven investment process can generate robust returns over the long term. As we head into 2023 we are optimistic on the outlook for small and mid-cap companies, with the investment portfolio already delivering strong returns in January."

The ASX200 Total Return Index (XJO) returned +6.2% in January, and the All Ords (XAO) returned +6.4%. Even if WAM Capital (WAM) beat them both and managed +7%, that only takes their NTA from $1.39 to $1.49, and they are trading at over $1.70; $1.705 is where they closed today, being a +22.7% premium to their 31-Dec-2022 pre-tax NTA, and a +14.4% premium to a guestimate of their current pre-tax NTA (which assumes they have grown their portfolio market value by +7% since Dec 31).

At the end of the day, WAM is a LIC - a Listed Investment Company - and it's worth is really the market value of all of their investments, which is what their NTA is - their Net Tangible Assets, also known as NAV (net asset value) or net tangible asset backing. They disclose that as a cents per share/unit value, which is common for LICs and other traded funds because it enables you to quickly compare that number to their current share/unit price.

They have traditionally - usually - traded at a significant (circa 20% to 40%) premium to their NTA because (a) they have an enthusiastic and loyal shareholder base, (b) they are thought of as being reliable above-average dividend payers and therefore worth paying a premium for - for that access to a reliable dividend/income stream, particularly for retirees (who tend to make up the bulk of their investor base), and (c) they always seem to do the right thing by their shareholders, or try to.

I like them more now that the other (external) LICs and funds they held within WAM Capital have been moved across into WAM Strategic Value (WAR, another of the eight LICs managed by WAM Funds), but I prefer WAX - WAM Research - which holds only "Research Driven" companies, i.e. zero "Market Driven" (opportunistic or shorter-term plays). WAX has a far healthier profit reserve and much better performance, and better dividend growth as well, but unfortunately tends to trade at an even bigger premium to NTA than WAM Capital (WAM) does.

The last thing about WAM Capital (WAM) that puts me off is that they have a very low profit reserve (PR), which is where their dividends are paid from. At 31 December, their PR held just 11.9 cents per share (cps), not even enough for 1 year's worth of dividends. They have enough to cover the 7.75cps div just declared, but not enough for the full year dividend later this calendar year, unless they reduce that dividend. It is likely there WILL be enough in the PR by then to cover that dividend, but that depends on them continuing to perform and lock in profits as they go of course.

By contrast, WAM Research (WAX) has enough in the PR for 4 years of dividends (at the current dividend rate), WAM Global (WGB) has 3 years, WAM Leaders (WLE) and WAM Microcap (WMI) both have 5 years worth of dividends in their PR, and WAM Alternative Assets (WMA) has just under 5 years covered. WAM Strategic Value (WAR) only has 2 years, and WAM Active (WAA) only has just over 1 year, being the second worst PR of all 8 LICs in the WAM Funds Stable after WAM Capital (their flagship fund) which has less than 1 year, as shown below:

Source: December-2022-Investment-Update.PDF

I imagine the past two trading days (yesterday and today) was a bit of a relief rally in WAM Capital (WAM) because they didn't reduce their dividend as many may have been expecting considering their low PR (profit reserve). And the yield is there, but only because their share price had come down so much. Their SP was $2.29 in early April last year, and was $2.40 briefly in October 2021 (just 16 months ago). They close at $1.49 on Wednesday (1st Feb 2023), so they've come down a lot. As the share price reduces, the dividend yield increases naturally, which is why I tend to look at dividend yields based on what I paid for the shares, not on their current market value.

They will suit some people, particularly people who want income but don't want to do a large amount of research themselves, so are happy to outsource that to professional fund managers who have a positive track record. For them WAM Capital at current prices probably looks OK, but not for me. The premium to NTA is too large, the profit reserve is too small, and I'm not too bullish on a number of their portfolio positions, so it's a hard pass from me.

That said, Oscar Oberg has done a good job over recent years with the LICs that he manages within the WAM Funds stable, which are WAM, WAX, WAA and WMI, but his performance has been better with WMI and WAX than it has been with WAM and WAA, and that is borne out with their respective profit reserves.

I do occasionally hold some of these WAM Funds LICs, and the three that interest me the most remain WLE, WGB and WMA, purely because large caps (WLE), global shares (WGB) and alternative assets (WMA) are not areas that I personally specialise in or follow closely, so those three would compliment my own stock picks, if I could buy into them at a reasonable price (meaning a decent discount to pre-tax NTA).

They do have an extensive and experienced team: About Wilson Asset Management | LIC Investment Professionals

Notes from WAM Group (WAMG or WAM Funds) Roadshow in Adelaide on Wednesday 15th May 2019:

Straw #3 (of 3):

Disclosure: Of those companies mentioned, I hold WAM, WAX, WAA, WGB, WLE, FGX, MND, IGO, WSA, SBM, NST, EVN, CSL, CDA, ICQ and MGG (MGG is managed by MFG).

Notes:

- See Straw #1

- See Straw #1

- See Straw #1

- See Straw #1

- See Straw #1

- See Straw #2

- See Straw #2

- See Straw #2

- See Straw #2

- See Straw #2

- See Straw #2

- See Straw #2

- See Straw #2

- During the FG (Future Generation) Funds Roadshow that followed the WAM Roadshow, Geoff, Mathew Kidman (representing Centennial Funds Management), and Victoria Somebody from Magellan (didn't catch the surname) were asked to give some stock picks. MK tipped ICQ - iCar Asia - although he warned that they're high risk as they are only up to breakeven now, so not profitable yet. His second pick was Think Childcare (TNK). He said they were smaller than G8 (GEM) but better, and that the oversupply in childcare was done, and occupancy rates were rising again, and that a potential federal Labor government could be a net positive for the childcare industry. Again, not so relevant now. Victoria tipped Starbucks - as these ladies from Magellan always seemed to do. GW tipped Vista Group (VGL) - and FGX (which he was buying personally that day).

- I spoke to Catriona Burns, the PM of WAM Global - WGB - during lunch - about Scout24 ("the REA and CAR of Europe", listed in Germany). She said they didn't hold them, having sold a few weeks ago into the takeover offer from Private Equity, which has fallen over in the past couple of days. As PE have now walked away (I understand the scheme was voted down - did not receive the required majority), the Scout24 SP has fallen back again, and I asked Catriona if she was considering buying back in, and she said, Definitely! She likes the company a lot. She just thought that there were risks around the takeover proceeding, especially as it involved PE (private equity) and they often make these bids before they have all of the necessary funding completely sorted out, so she sold out into the euphoria around the bid, and it paid off for her, as the bid did fall over and the share price is back down again now. I explained that I don't follow Scout24 closely but I was impressed with her description of the company last year, and I do hold shares in WGB so was interested if she still held it (answer: no, but possibly yes again soon-ish).

- No GVF Presso this time around. Miles and Emma are only coming out (from London) once a year nowadays, instead of every 6 months. Also, no Chris Stott of course. Geoff, Matt, Marty, Oscar, Catriona, Louise (from FGX/FGG), and Kate (WAMG's CEO) were all mingling and taking questions before and after the presentations, and during lunch. The sandwiches were excellent. The orange juice wasn't bad either. The parking fee was pretty steep however - $18 for 4 and a bit hours. Might have to catch the bus in next time, after my knee operation.

That's all folks.

21-June-2020: Firstly - sorry about the multiple copies of this straw below - I had to edit the attached file and had trouble getting the new version to replace the old one (which contained a typo).

Anyway, hopefully, when you open that attached file, you'll get the corrected word document I've created (in "landscape" orientation) which contains a comparison table that provides a good overview of the 6 LICs that are currently in the WAM Funds stable (WAM, WLE, WGB, WMI, WAX and WAA) as well as BAF which will soon also be managed by Wilson Asset Management. BAF (the Blue Sky Alternatives Access Fund) is going to be renamed as "WAM Alternatives" and will get a new ticker code, possibly WAL, as WAF and WAA are both already taken.

The comparison provides the following points:

- WAM Capital (WAM) clearly presents as the worst value buy at today's prices, as they are trading at a premium-to-NTA of over 20% and have less than one dividend in their profit reserve, so their dividends are likely to reduce.

- While WAM Research (WAX) has a much better dividend reserve, they are trading at the largest premium of almost 40%, which is just crazy.

- WAM Global (WGB) presents as the best value. They are trading at the largest discount to NTA (other than BAF) and have plenty in their profit reserve as well.

- For those with a little higher risk tolerance, BAF looks good, trading at a discount of over 30% and cash represents over one quarter (26.2%) of their portfolio, so their dividends look secure. On top of the discount and the cash levels, another big positive should be the "Wilson effect" when BAF is renamed as "WAM Alternatives" and gets a new ticker code.

- After BAF & WGB, the next best LICs in the Wilson stable - to be buying at current prices - look like WLE and WMI.

10-Feb-2020: WAM - interim profit up 168% and 7.75cps FF interim dividend

The following was written on Feb 10th, 2020. Please scroll down to read my update today (July 8th, 2020).

WAM Capital achieved a 168.4% increase in operating profit before tax to $95.6 million and a 176.9% increase in operating profit after tax to $70.4 million in its FY2020 half year results. The operating profit for the period is reflective of the solid investment portfolio performance over the period.

The Board of Directors is pleased to deliver a fully franked interim dividend of 7.75 cents per share, currently representing an annualised fully franked dividend yield of 6.9%*. Since inception in August 1999, WAM Capital has paid 238.5 cents per share in fully franked dividends to shareholders.

The fully franked dividend has been achieved through the solid performance of the investment portfolio since inception and the profits reserve available and is consistent with the Company’s investment objective of delivering investors a stream of fully franked dividends. The Company’s profits reserve at the end of the period was 10.6 cents per share and forms part of the net tangible assets (NTA).

The investment portfolio increased 8.9% during the period, outperforming the S&P/ASX All Ordinaries Accumulation Index by 5.3% with an average cash level of 20.1%.

We were pleased with the investment portfolio’s solid outperformance, which was achieved by the investment team’s rigorous application of our proven investment process.

WAM Capital provided shareholders with a total shareholder return of 15.2% in the six months to 31 December 2019, reflecting the Company’s solid investment portfolio performance and the increase in the share price premium to NTA.

We look forward to providing an update to our WAM Capital shareholders during our Investor Conference Call on Thursday 12 March 2020 at 4.00pm-5.00pm (Sydney time) and meeting you at our next Shareholder Presentations in May 2020.

*Based on the 7 February 2020 share price of $2.25 per share.

--------------------

Click on link above for more.

Disclosure: I hold WAM shares, as well as WLE & WGB shares. I often also hold WMI, WAA and WAX shares although not currently. I also hold BAF shares, with BAF soon to become the 7th LIC managed by WAMG. BAF will be rebranded as "WAM Alternative Assets Fund". Not sure of the new ticker code, as WAA and WAF are both already taken.

---------------------

Update (8-July-2020): I no longer hold WAM shares. I should point out that this half year result was cycling off a terribly poor PCP (prior corresponding period), so while the headline numbers of a +168.4% increase in OP (operating profit) before tax and a +176.9% increase in OP after tax look impressive at first glance, it's off a VERY low base. The reality is that WAM (WAM Capital, the flagship fund) has had a poor 2 years in FY2019 and FY2020, and despite these good looking headline numbers at the half, they've actually lost money over the entire FY2020 year (their investment portfolio lost -2.8% of value). And they've depleted their dwindling profit reserve (from which dividends are paid) to virtually nothing now with the declaration of this latest 7.75 cps final dividend for FY2020. I view this fund as the one most likely to be cutting their dividend in FY2021 if they can't radically improve their performance - because they don't have any profits in their profit reserve left to pay dividends from. I go into this in a lot more detail in my straw on their results announcement today (8-July-2020) which I posted in the past half hour.

What are the WAM investments:

can we learn from these holding ideas?

8-July-2020: Investment portfolio outperformance, 15.5cps ff full yr div

So WAM Capital (ASX: WAM), the flagship fund of Wilson Asset Management (WAM Funds) has maintained their dividend at 15.5c for the year (7.75 cps for the half).

This is the first year in 10 consecutive years that have NOT raised their dividend, which is hardly surprising because, as I pointed out last month, at May 31st WAM Capital only had 6.1 cps in their profit reserve (see the 2nd page of their May Report). And, as they say in today's announcement, "...the Company's ability to continue paying fully franked dividends is dependent on generating additional profit reserves and franking credits. The ability to generate franking credits is reliant on the receipt of franked dividends from investments and the payment of tax on profits." [emphasis added by me]

They did NOT make a profit in FY2020. Their investment portfolio declined in value by -2.8%. They only outperformed the S&P/ASX All Ordinaries Accumulation Index (their chosen benchmark) because it lost even more (-7.2%) over the same 12 month period.

I stand by my statements made previously that WAM Capital (ASX: WAM) is the one LIC in the Wilson (WAM Funds) stable that is MOST at risk of having their dividend cut, due to what must now be close to $0 in their profit reserve.

Because WAM Capital is their flagship fund, with the most shareholders, it would have a ripple effect through all of their LICs I would imagine if they were to cut their dividend, but having now completely depleted their profit reserve, they are either going to have to get very creative to maintain that dividend - or else start making good profits again, which the fund has struggled to do for the past 18 months.

They MIGHT cut the WAA (WAM Active) dividend due to even worse underperformance (going backwards in absolute terms; these Wilson LICs all regard themselves as absolute return funds), but that would have less of an impact - because WAA is their smallest fund, and has the least amount of shareholders. With a tiny $42 million market cap, WAA is almost irrelevant. WAM Capital (WAM) has a market cap of over $1.3 billion and is VERY relevant.

Their other LICs, WLE, WGB, WMI and WAX, all have heaps in their respective profit reserves, so their dividends do not look to be at risk at all. Which is why I recently sold the last of my WAM shares and invested in WMI and more WGB, as I disclosed here at the time. I already held plenty of WLE.

While WAX has got a heaps-healthy profit reserve, it's trading at a rediculous premium to NTA, even larger than the WAM premium, which is over 20% (+25.7% on May 31, with WAX trading at an unbelievable +44.5% premium to their before-tax NTA on May 31).

Chris Stott, who was WAM Funds CIO (chief investment officer) for the bulk of their most succesful years has now gone out on his own - with 1851 Capital. During his 13 years with WAM Funds, Chris had a major influence on their approach and performance as Geoff Wilson became more and more distracted by other interests - such as takeovers and acquisitions of underperforming LICs and investment companies, shareholder advocacy, the establishment and success of both FG (Future Generation) Funds, the establishment of his own new additional LICs (WMI, WLE and WGB), other philanthropic interests, and politics (becoming the leading voice against Federal Labor's proposed changes to the refundability of franking credits prior to the last Federal election).

Martin Hickson, who used to head up WAA and was then co-PM (portfolio manager) - with Oscar Oberg - of WAM, WAX & WMI, then left the group (last year, after Stotty did). Not sure where Marty went actually.

Now we have Geoff Wilson remaining as Chairman of the group (and founder too of course) and he has taken back the CIO title also, but the day-to-day running of his LICs are left up to Oscar (WAM, WAA, WAX & WMI), Matt Haupt (WLE, with help from John Ayoub), Catriona Burns (WGB) and shortly Adrian Siew - who will take over the management of WAM Alternatives, which is currently trading as BAF - the Blue Sky Alternatives Access Fund. Each of those 4 Lead PMs leads their own small team, and they have a larger team supporting the whole group.

Oscar's original role was to run the "Research Driven" side of WAX (100% research) and WMI (mix of active and research driven) and Martin ran the "Active/Trading" side of WAA (100% active/trading), and WMI (mixed approach). WAM, as their flagship fund, just held the same stocks as WAX, WAA & WMI, but in greater quantities because it's a much bigger fund. WAM never held a single stock that was not in at least one of those other three funds. They used to talk about WAM being roughly 50% research and 50% active/trading, which means that the stocks within WAA (a tiny $42m fund remember) would have been replicated in far greater quantities within WAM Capital (WAM). This included a number of legacy positions in other LICs like PIA (formerly HHV, the Hunter Hall Global Value Fund, now Pengana International Equities) and TGG (the Templeton Global Growth Fund, which was actually a very poorly performing value fund, not a growth fund at all), which have not performed particularly well for WAM or WAA. TGG & PIA remain top 20 positions within both WAM & WAA today. My understanding is that the management of those two positions - and positions in other LICs and investment companies - is down to Geoff, as they were his babies back in the day - he brought them in, and he's going to have to be the one to take them out.

Martin Hickson has left the business now - as I've already mentioned, so the responsibility for the management and performace of WAM, WMI, WAA & WAX now rests on the shoulders of Oscar Oberg, who I've talked to in person on a couple of occasions, and he's a smart guy, has plenty of passion, and strikes me as competent enough to handle that pressure. However, he's a thinker - a research guy - not a trader like Martin was, and I think it's no surprise at all that the fund that has performed the best - of the 4 funds that Oscar now manages - is the 100% research-driven fund, WAX (WAM Research). And that the two funds with the most active/trading positions in them - being WAA (100% active) and WAM (around 50% active last time they disclosed the numbers) have underperformed in comparison to WAX. And that WAX is now trading at a REDICULOUS premium of around 35% to 45% above their before-tax NTA.

Probably more detail there than most people needed, but LICs has been a sector I've closely followed for more than a decade, and none more so than the Wilson stable of LICs, so it is an area of particular interest to me.

I wouldn't count WAM Capital (WAM) out just yet, however, I think there is certainly potential for their 20%+ premium to evaporate and for them to come back to much closer to their NTA, particularly if their NTA keeps shrinking as it has been for the last year and a half. And that's why I no longer hold WAM shares.

And why I DO hold WLE, WGB and WMI shares.

19-Feb-2021: Interim profit up 144% and 7.75cps FF interim dividend plus Appendix 4D and Financial Report

- 144.1% increase in operating profit before tax

- 22.8% investment portfolio performance in the half year to 31-Dec-2020, outperforming the Index by 7.1%*

- 7.75 cps fully franked interim dividend maintained, representing an annualised fully franked dividend yield of 7.0% (based on the 31 December 2020 share price of $2.23 per share). [WAM closed yesterday at $2.06/share and is up a little today - to $2.07 as I type this.]

* Investment portfolio performance and Index returns are before expenses, fees and taxes.

As I have said previously, I am wary of WAM (WAM Capital) and WAA (WAM Active) because they have the lowest profit reserves out of all 7 of the LICs that Geoff Wilson's WAM Funds manages, and it's that profit reserve that funds the dividends, hence WAM Capital (ASX:WAM) has not increased either their interim or final dividend since their interim div was paid back in April 2018 (3 years ago).

My preference has been for WMI (WAM Microcap), WGB (WAM Global) and WLE (WAM Leaders), which have all been increasing their dividends at a good clip over the same period.

I also like WAX (WAM Research) but they are just too expensive in terms of having a very high premium (to NTA) in their share price. WMI is getting up there too now - with a 20%+ premium, but the WAX premium of OVER 40%!! is just rediculous. After WAX and WMI, the next worst WAM Funds LIC - in terms of NTA premiums in the SP - is WAM Capital (WAM) whose 31-Jan-2021 NTA (net tangible asset backing) was $1.81, and they closed yesterday at $2.06, around 14% above their January NTA. That's certainly towards the bottom of the premium range for WAM Capital in terms of their usual NTA premium in the share price, which is often 30%+, however it's still means you're paying around $1.14 for each $1 of assets.

These are LICs - listed investment companies - we're talking about, so their net tangible assets (NTA) or net asset value (NAV) is just the market value of their portfolio of investments. The premium in the share price is usually the result of increased demand and reduced supply, and that is usually mostly because people love the steady income aspect of these LICs and are prepared to pay up for that. Doesn't make too much sense to me however. Most of my investment income has always come from capital gains. I don't mind some dividend and distribution (or capital return) income - I'll take it - but I want the share price to rise at a good clip as well. Or a bit of both ideally. If the SP isn't rising, the dividend better be rising. Otherwise you're standing still and losing money in real terms.

In WAM Capital's case, the dividend hasn't moved for 3 years, and the share price - at $2.07 today - is 17% lower than where it was 3 years ago (at $2.50), 6% lower than where it was 2 years ago (at $2.20), and 12% lower than where it was 1 year ago (at $2.36). So we have a capital loss (on paper at least) and no increase in the dividends over a 3 year period in a strong bull market (except for that COVID blip last year). That's why I no longer like WAM Capital (WAM) and have been of that opinion for a few years now. I used to be a shareholder years ago, but not in recent years. I prefer their other LICs, or some of them: WMI, WGB and WLE, and I'd also hold WAX if it was around 40% cheaper. I did hold WMA (WAM Alternative Assets) and held them when they were still called Blue Sky Alternative Access Fund (BAF) too, but I've since sold out of WMA. I'm currently only holding WMI and WGB of the 7 LICs that WAM Funds manages.

I would also much prefer them to give their performance numbers AFTER fees and expenses. I don't see much point in doing otherwise, other than the fact that it makes their performance look better than it actually has been (in terms of what they have achieved for their shareholders). If for instance you say that your fund had a portfolio performance of 15% (before fees and expenses), outperforming the index by 1%, but your fees and expenses were around 2%, then shareholders would have been better off being invested in the index through a low-cost ETF. It just seems logical to me to discuss your returns AFTER fees and expenses, because the numbers are pretty meaningless otherwise. AFTER fees and expenses is the ONLY thing that matters to investors when it comes to portfolio performance.

Five years ago, Geoff Wilson was quite vocal about that himself, saying that to not disclose your fees up front in your regular shareholder communications, and/or to talk ONLY about performance BEFORE fees and expenses, was disrespecting the owners of the business, i.e. the shareholders. Of course he was talking about other LICs that he was trying to takeover at the time, and now he's doing the very thing he used to criticise those other funds for doing.

Speaking of takeovers, WAM also announced today that they now own 84.27% of CLF - the Concentrated Leaders Fund. It's taking some time, this one. I can't see any insto's on the CLF share register, so perhaps it's a bunch of retail investors holding out for a better offer. Seeing as the CLF board has recommended the offer to their shareholders, and the CLF SP has been heading south since 7-Dec-2020, I wouldn't be holding my breath.

Anyway, I admire Geoff Wilson and what he has done in terms of ordinary retail shareholder advocacy, and standing up for the "little guys" when he sees other funds being run more in the interests of their directors and/or major shareholders, but he's not perfect, and nor are all of his funds. Some are pretty damn close to perfect, from time to time, if you get in and out at the right times, but certainly not all of them.

Just Add to the August Report:

Aug Update: PowerPoint Presentation (stackpathcdn.com)

What are the Wilson Stocks vs Straw Stocks? Wilsons have RMD

Snap shot at 13th September

Top 20 Holdings

Microcap>

Microcap:

Scroll down for updates.

30-Apr-2019 Pre-Tax ex-dividend NTA for WAM Capital - $1.8534. Post-Tax NTA (also ex-div) was $1.861. A true per share valuation for a LIC is usually the per share value of their NTA (net tangible assets). In some cases, you might want to discount that NTA - due to poor management, or high fees, or poor investments (or for some other reason), or just to get a margin of safety. In other cases, you might be prepared to pay a premium to NTA. Reasons why people might be prepared to pay a premium may include superb management who add value at a reasonable cost, and/or above-market dividend yield, and/or dependable and sustainable dividends, and/or track record and convenience.

WAM closed on Friday (17-May-2019) at $1.975, which is above their April 30th NTA, although the premium is only 6.5% to 7%, which is a lot less than what they have been trading at in recent years. They have often traded at around a 20% premium or even higher. Past share price performance is not a reliable indicator of future performance however. Some of Wilson's LICs (and there are six, being WAM, WAA, WAX, WMI, WLE & WGB) are trading at NTA-discounts. WAM and WAX have underperformed over the past 6 months, and they deserved to have the NTA-premium in their share price reduce. I suggest you do some more digging before pulling the trigger on these LICs based purely on NTA vs SP.

21-June-2020: WAM's before-tax NTA as at 31-May-2020 was $1.57, see here: https://wilsonassetmanagement.com.au/wp-content/uploads/2020/05/11.-May-2020_NTA.pdf

Worse still, WAM's May 31 After Tax but before tax on unrealised gains NTA is even higher - at $1.64, and their after tax NTA (including all tax - including on unrealised gains/losses) is higher still - at $1.67, which means they are sitting on both realised and unrealised losses that result in tax credits.

Even worse still, WAM Capital's (ASX WAM's) profit reserve is now down to 6.1 cps (cents per share), being lower than their most recent interim dividend (which was 7.75 cps). Their trailing annualised fully franked interim dividend yield looks very nice - at 8%, but they declared a total of 15.5 cps in dividends in each of the past two 12-month periods, and they don't even have enough in their profit reserve to declare the same 7.75 cps final dividend this year that they declared last year. Profit reserves allow LICs to smooth out dividends rather than the lumpier dividends/distributions that you usually get from trust structures and open ended funds, however that only works while you maintain a decent profit reserve, and WAM have no longer got one. Their profit reserve has been depleted to the point where they actually do NOT have enough for the next dividend, unless they reduce the dividend. The reason this has happened is of course that they have made losses instead of profits for the past couple of years. And the losses have come from the "Active" (/trading) side of the portfolio. We know this because WAM holds the same stocks as WAA (active only) and WAX (research only), and WAA is in a similar position to WAM - WAA has only 5.9 cps in their profit reserve (all of these numbers are as at May 31, 2020 remember, being the last reported figures), while WAX has done well and has 26.2 cps in their profit reserve. So, it's the Active/Trading side of the WAM portfolio that has gone backwards, and that includes the various other LICs that WAM and WAA hold - like AUI, PIA & TGG, the latter two being longer term holdings (they've held PIA since they were HHV). I'll continue this in a straw titled "Relative Value/Risks" in which I'll discuss the various profit reserves, cash levels, and premiums/discounts to NTA in Wilson's 6 LICs, plus BAF - which is soon to become their 7th managed LIC. Hint: WAM is looking like the worst option of the 7 currently.

21-Dec-2020: WAM Capital's (WAM's) before-tax NTA as at November 30, 2020, was $1.77, so that's my new valuation for them. They have also reported that they now have 17.9cps (cents per share) in their Profit Reserve (PR), which is enough to cover the next two 7.8cps dividends, i.e. one year's worth (divs are paid every 6 months). Due to their declining PR, WAM Capital has not increased their dividend since April 2018, whereas their other LICs that have more in their PRs have been increasing their dividends. I still feel that the legacy LICs that are held by both WAA and WAM (i.e PIA & TGG) as well as the other Geoff Wilson positions held by WAA & WAM (i.e. AUI, CIE, CLF, KBC, PDL, PTM) do provide a drag on their performance. However, it's good to see that WAM is also holding some new positions like Nuix (NXL), Infomedia (IFM), Ramsay Health Care (RHC), Healius (HLS), Viva Energy (VEA) and Codan (CDA - which has been a VERY successful investment for me). I'm still not going to be buying WAM, at a 25% premium to their NTA when they've got just over 1 year's worth of dividends in their profit reserve. Of Wilson's 7 managed LICs, I currently hold just two: WMI and WGB. WAM & WAX are too expensive, WAA is too small and too hit-and-miss, and I've made my money on WMA as they transitioned from BAF to WMA - and have moved on. I've also made money on WLE as the NTA discount was closed over a period of months, and have recently taken profits and moved on. Happy to holding WMI & WGB however. Have a look at the WMI chart! Oscar is doing a great job with WAM Microcap! Catriona is also doing a great job with WAM Global (WGB) - their chart is almost as good as WMI's. WAM's chart isn't quite so good, with their SP drifting down for the past couple of months, and Oscar Oberg is also the PM (portfolio manager) of WAM (along with WMI, WAA & WAX), but, as I've said, he's a little hamstrung with a number of LICs and other investment companies in both WAA and WAM which are Geoff's babies and Oscar is just stuck with them. Oscar has much more control over the makeup of the WAX and WMI portfolios, and they're both doing very well. I would own WAX shares if they weren't so crazy expensive. I've done very well out of WMI over the past few months. I may buy WAM shares again one day, but they do not appeal to me currently.

21-June-2021: The pre-tax ex-div NTA for WAM Capital (WAM) as at 31-May-2021 was $1.8655, so we'll call it $1.865. The SP on the same day was $2.22 - having dropped 11c from 2.33 the day before, due to 31-May-2021 being the ex-div-date for a fully franked 7.75cps (cents per share) dividend. However, even at $2.22, that's a 19% premium to the fund's NTA (value of their net tangible assets, also known as NAV - net asset value).

The three reasons I do not hold WAM Capital (ASX:WAM) is (1) the double digit premium to NTA in the SP, (2) the fact that they haven't raised their dividends from 7.75 cents per half since April 2018 (3 years ago), and (3) because they have one of the lowest profit reserves of all of the WAM Funds' LICs.

The PR (profit reserve) is a reflection of the underlying profitability of the fund, and it's where the dividends are paid from, so having such a low PR (being only 20 cps as at 31-May-2021, enough for just over 1 years' worth of divs, but not enough for 18 months) is, in my view, the main reason why they are not raising their dividends. They need to build up a decent PR before they can sensibly start raising their dividends again.

Their stablemates, WAX, WMI, WLE and WGB (WAM Research, WAM Microcap, WAM Leaders and WAM Global, my favourite [fab] four WAM Funds LICs) are all in much better shape, with all having rising dividends (and most of them are rising at a good clip too) because all have between 4 and 5 years worth of dividends in their respective PRs.

WAM Alternative Assets (WMA) has only been managed by WAM Funds since October 2020 so it's still early days there, but of the other 6 LICs that they manage (not including the new one, WAR, which is being IPO'd now - and will be their 7th) it is clearly WAM Capital (WAM) and WAM Active (WAA) that have underperformed - and have the lowest profit reserves in terms of years worth of dividends covered. WAA's PR is much the same as WAM's with just over 1 year's worth of divs in it.

The thing about WAM Capital (WAM) is that they have a very loyal shareholder base, that is loathe to sell, because the dividend yield is great, particularly for those who paid lower prices than where they are trading today, even though the divs are not rising, or haven't risen during the last 3 years. Compared to the rest of the market, WAM Capital's dividend yield actually makes them look relatively attractive to many people at current prices too - compared to most of the rest of the market, and because there are usually not too many sellers, while demand remains strong, so they just keep trading at double digit NTA-premiums despite the relative underperformance (relative to other WAM Funds managed LICs).

There is also the added advantage with WAM Capital that, as their flagship fund, and their largest fund (with a market cap of around $2 billion) WAM Capital holds shares in ALL of the companies that are held by WAM Active (WAA) and WAM Research (WAX), plus many of the companies held by WAM Microcap (WMI) and WAM Leaders (WLE), so WAM Capital does give you exposure to more companies, and generally larger position sizes (because WAM is a larger fund than their other funds they tend to hold larger positions in those same companies). WAM Capital also gives you exposure to BOTH of their trading strategies, the Research-driven stocks as well as the Market-driven stocks. Personally I think their research-driven positions have performed WAY better than the majority of their positions bought due to their market-driven strategy, so that's why I prefer WAX (WAM Research) which ONLY holds research-driven investments. But that's another discussion. WAX is way too expensive to be buying up here anyway, WAX is even more expensive than WAM Capital!

I currently don't hold any of them, but I usually do, particularly when their respective SPs get down close to their NTA or when I can pick them up at an NTA-discount.

WGB is OK, trading at a 5% discount to NTA on 31-May-2021, but WAX, WMI & WLE were (and are) all trading at premiums, with WAX having a whopping 37% NTA-premium in their SP at 31-May-2021. WMI was trading at a +15% premium. WLE was at an +8% premium.

Of them all, currently WGB looks the most attractive to me, and the one I would most likely get back into first.

03-Feb-2023: Update: WAM finished CY 2022 with a pre-tax NTA of $1.39 (and a share price of $1.59). They say the portfolio delivered strong returns in January, so even if they beat the ASX200 Total Return Index (XJO) - which returned +6.2% in January, and they also beat the All Ords (XAO) index, which returned +6.4%, and let's say they put on another +7% in January, that takes their NTA from $1.39 to $1.49, and they closed today at $1.705.

They have less than a year's worth of dividends in their PR (profit reserve), and their share price has been declining for most of the past year. Their dividend yield looks good, but that's really because their share price has come down so far.

Better opportunities out there IMHO.

I'll update my valuation for WAM to $1.49, which is their Dec 31 (2022) pre-tax NTA (of $1.39) plus 7% for a good January. We'll see soon whether they did that well (7%) - when they release their report for January.

About Wilson Asset Management | LIC Investment Professionals