Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Nothing lights up Street Talk’s radar like a company getting its defence strategy in order.

As Altium prepares to decamp from the ASX after snagging a $9.1 billion scheme bid from Japanese semiconductor player Renesas Electronics, the fund manager brigade has been scrambling to pick the next M&A target in the sector.

Enter cloud connectivity provider Megaport, capitalised at $2.2 billion and a hot favourite among daytraders and short sellers. The stock is trading at about 10-times revenue, while Altium was tracking at 18-times when Renesas came calling.

But its chairman Bevan Slattery’s decision to step down from the board by the end of the 2024 financial year that has got investors talking. Slattery, who founded Megaport more than a decade ago, held 6.1 million shares or about 4 per cent of the company, according to his most recent director interest filing from November 23. Now he’s off the board, prospective suitors may find prising a below-substantial stake away from ‘Bevdawg’ somewhat easier.

It comes as sources close to Megaport told this column Bank of America would be in-and-around the situation should the interest materialise into a formal approach. Megaport shares have gained 52.6 per cent year-to-date, up 154 per cent over the past 12 months. Quarterly revenue increased 5 per cent to $48.6 million.

Megaport boss Michael Reid is well-liked among investors, thanks to his track record of delivering circa 2.4-times growth in recurring revenue for network giant Cisco’s ThousandEyes, a software platform that monitors network infrastructure and troubleshoots application delivery.

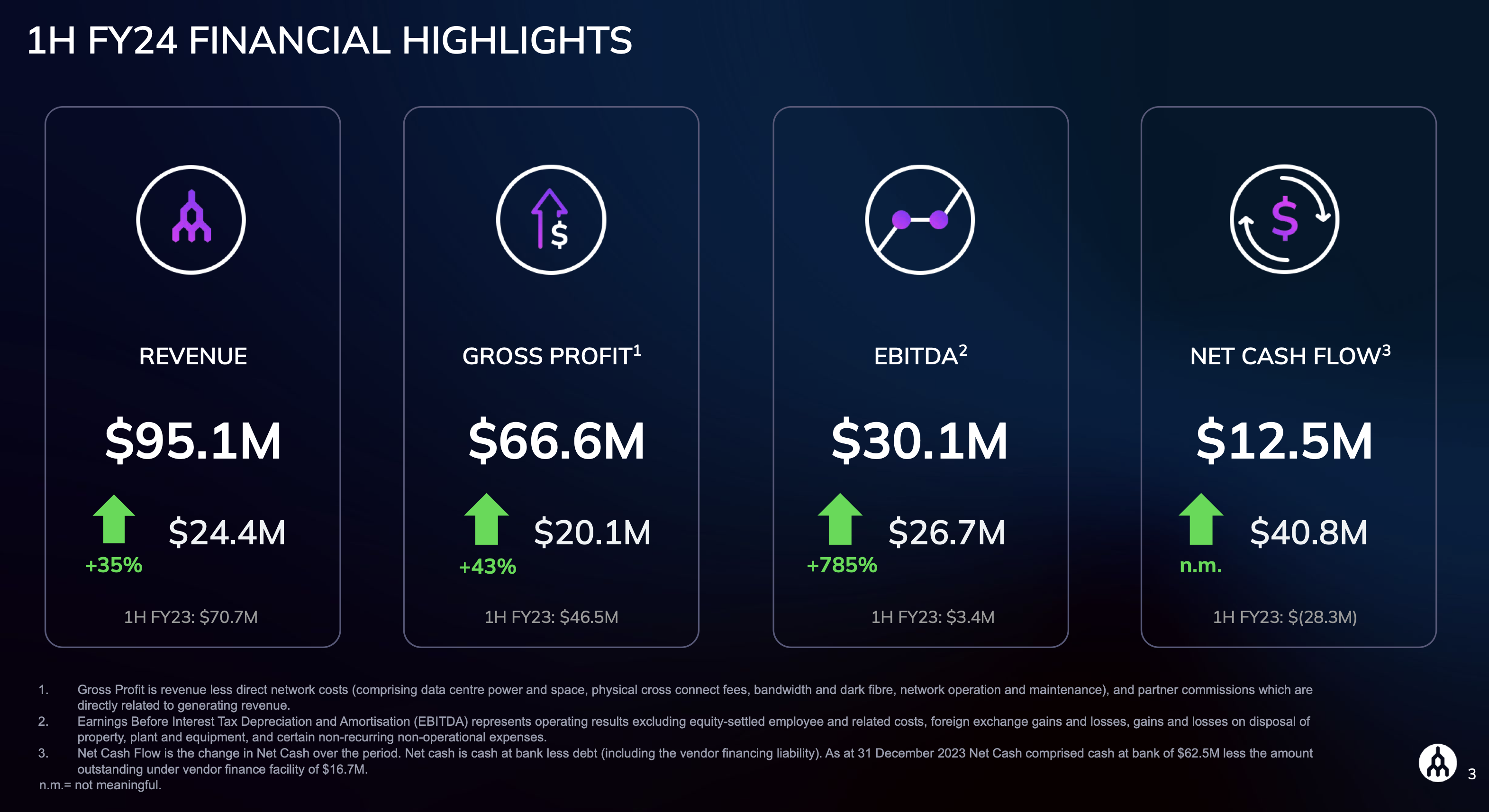

Megaport have emphasised some good looking numbers: positive net cash flow and big jump in EBITDA.

A few notes:

- Costs are down due to cost control efforts. These are expected to increase again due to investment in “the go-to-market engine.” So, expect costs to go up in the near term followed by, hopefully, increase in customer logo count.

- Revenue is up 15% compared to 2H FY23, while annual recurring revenue is up 7%

- Continue to increase customers (3% on previous period). Number of services and spend pre customer also continue to increase.

- Have to acknowledge the handy spreadsheet they provide investors at https://www.megaport.com/investor/business-overview/#kpis. Wish more companies did this!

- New CEO (well, in place since March 2023) seems to prefer simplified reporting metrics which I admire. For example, they break out ‘customer logos’ and ‘customer accounts’: the former will be lower, but represents the true number of customers because it counts multiple accounts for the same customer as one.

The presentation emphasises comparison with the prior corresponding half, which might be reasonable. Even compared to previous period the business is heading in the right direction.

Interesting comment from CEO Michael Reid in the call transcript:

And that we are then preparing for customers who go, I need to train my model, I need to move data from Oracle Cloud now, and I need to move it over to this GPU-as-a-service that sits in X, wherever it may be.

So as more companies want to leverage AI they will likely want to get there data from their own facilities to whoever is training models for them. This will be large amounts of data, infrequent, and to ad hoc locations. Perfect use case for Megaport but don’t think it’s fundamental.

[Held]

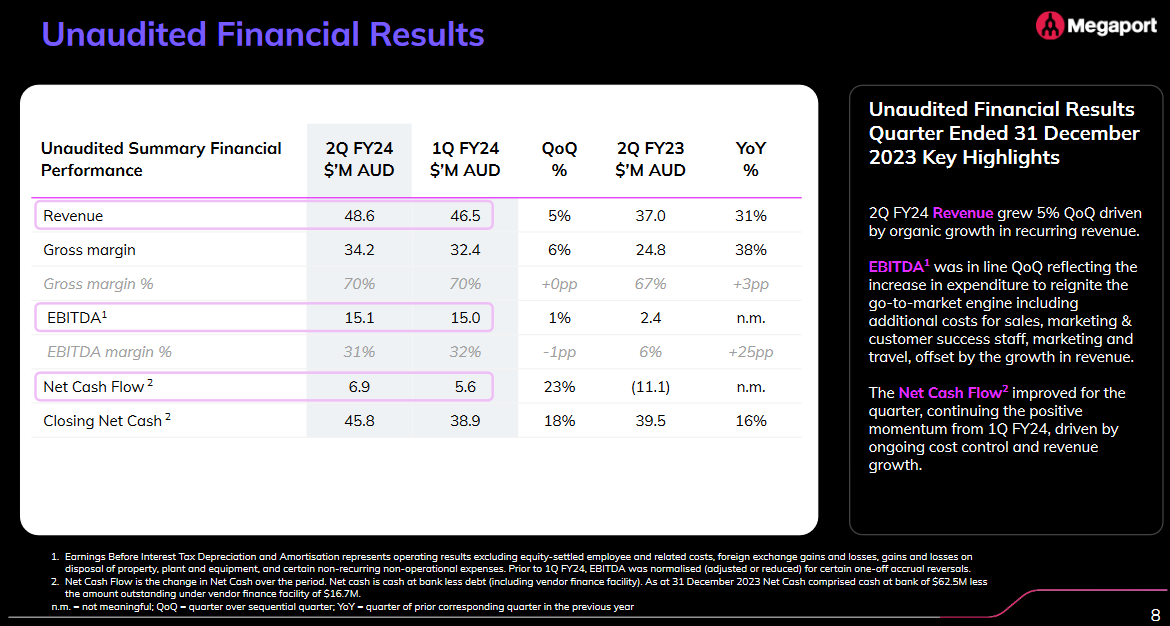

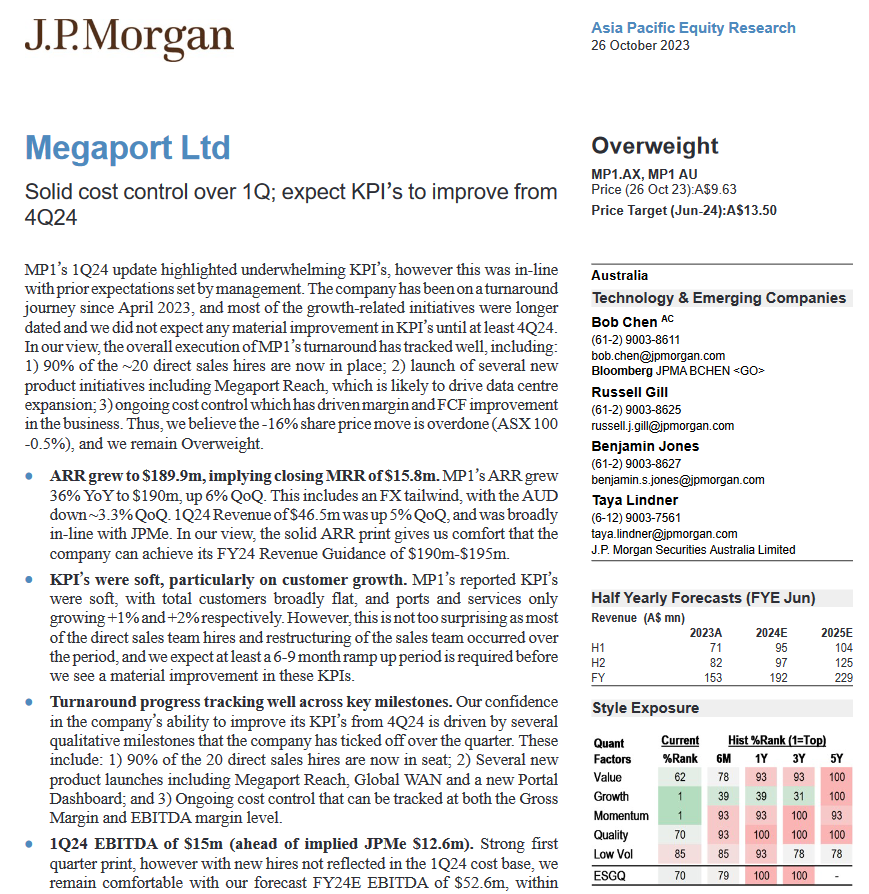

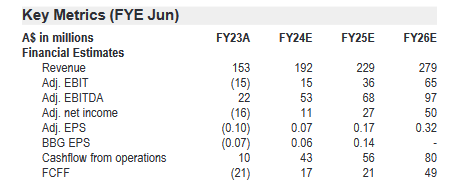

As we already know, Megaport broke the lights out today and probably sent shorts scrambling with a 25% rally to close at $12.48.

Seems like a beat on most metrics versus consensus

JP Morgan from 26-Oct-23 had forecasted 95m. See below

Finally a little summary from Citi - "Australia's Megaport soars over 30%, tops ASX 200 on earnings beat" - Reuters 30 Jan 24

The Brisbane-based firm reported second-quarter operating earnings of A$15.1 million ($9.98 million), compared with a Visible Alpha consensus estimate of A$11.3 million, according to Citi.

Its quarterly revenue of A$48.6 million was 2% ahead of Citi estimates.

"While KPIs (key performance indicators) continue to be soft, this was expected and we continue to see upside to VA consensus EBITDA (earnings before interest, taxes, depreciation, and amortization) FY24e forecasts given the 1H beat," Citi analysts wrote.

"We expect the share price to outperform today due to the FCF (free cash flow) and EBITDA (earnings before interest, taxes, depreciation, and amortization) beat."

Capital IQ Pro only had the FY24e but sentiment score is the highest for the last 12 months.

Given we are at the halfway mark, it looks like Megaport will most likely beat the full year forecasts on at least revenue and free cashflow.

[held]

The Market clearly liked the Qtr 2 Update from Megaport this mining ????

2023 was no exception with 26.7% voting against.

Assuming the new CEO, Michael Reid, meets his targets he will receive fixed remuneration each year of $1m, STI is 100% of that in the first year and 50% in the next two years, LTI is 225% of one year’s fixed remuneration but only paid at the end of the three years. Fixed remuneration is paid in cash with the other components paid in equity. That adds up to a total maximum opportunity over three years of $7.25m or $2.42m each year which is at the top end of the range for a company with a market cap similar to Megaport.

Oops objections around the wages..

Actual pay rates i would need to check the Annual Report 2023.

Goldman Sachs Target price : $11.90

UBS Target Price : $13.30

Since Megaport is a big following here I'll start with a straw with the results and leave the deep dive for others.

A bit of concern with some KPIs being flat QoQ.

MP1 at one stage down more than 20%. Was tempted to buy that dip (8.95) but seems to have recovered.

Megaport CEO Mr Reid's LTI and STI. If Charlie Munger's theory is correct that " Show me the incentive and I will show you the result" or something along those lines then next 3 years Megaport will have full support from the CEO.

STI

Gross Profit Margin: + 6pp

The CEOs like to track the Revenue: So Revenue change up 40%

Megaport released its FY23 report this morning

Revenue ( FY24 my estimate based on guidance)

Customer Receipts

Operating Cash

Total Customer

Debt

Cash

Voting power. 11.36%

Info Mitsubishi UFJ Financial Grou

Well 27th July.. "fly back in July"

= $10.62 (+14.4%) Last close price

=Announced:FY23 Investor Presentation

Needs to retest the low.

See how this chart trends during May 2023 ( fly away in May )

Megaport announced Q4 FY23 results and it demonstrated how cost cutting and price increase has changed the game in terms of cash flow narrative in 6 short months.

Story changed as much as that it actually generated free cash flow in the Q4 ( if you ignore redundancy payment)

So for FY23 it is expected to have Revenue of 153m and they are starting FY24 with ARR of 179m. ( My revenue assumption for FY24 will be satisfied even if they don't add any new customers - Nice place to start)

So in a hypothetical situation, if they don't increase the cost and serve existing customers and get 179m cash ( from ARR), they potentially be a profitable business but Management has guided that they will invest in the Sales function of the business for further growth specifically in the North America region. After that investment, they have guided the market that normalized EBITDA for FY24 will be in the vicinity of 20m

The board has decided to terminate $25m debt facility. and after this result, it will definitely won't require to dilute at the wrong price.

Looking forward to FY24 now...

Form 603

Voting power (6) 5.50% by State Street Corp

as Bear says ..A substantial shareholder is a person or entity that owns 5% or more of the voting shares in a company.

Interesting video

In case if you are wondering what just happened last week with megaport shareprice. I believe it has something to do with this.

Employment Agreement entered into between Michael Reid and Megaport (Australia) Pty Ltd dated 28 March 2023.

xa-09-2023-networking-report.pdf

The annual Cisco Global Networking Trends Report highlights important strategies and technologies within the enterprise networking and cloud industry.

In the 2023 report, cisco surveyed more than 2,500 IT leaders in 13 countries across North America, Latin America, Asia Pacific, and Western Europe.

Key Findings:

- Hybrid work continues to pose secure connectivity challenges

- The transition to Cloud and multi-cloud is accelerating

- Securing user access to cloud applications tops the bill of 2023 networking challenges.

Six best practices to provide secure access to Multi clouds can be accessed through the report ( one that relates to Megaport is as below)

New CEO Announced

Operational Review Commenced

Strong March Monthly Recurring Revenue

Improvement in Cash Flow

Cost-out Program on Target

Normalised EBITDA1 for 3QFY23 of AU$5.0M

Form 604 Corporations Act 2001 Section 671B. Present Voting Power 8.64%

Trend is up!! Buy some here.. see if this breaks to the upside..Needs to retest the low maybe

Oh then Month of May is nearly here. "fly away in May" on the stock market

First Sentier Investors (Australia) Present holding now 13.16%.

A robust holding there.

When you have to fill out these 604 forms well ..your a big holder...

The recent blog on Megaport website

https://www.megaport.com/blog/whats-new-with-megaports-services/#outposts

An interesting development from this blog for me :

State Street Corporation and subsidiaries named in Annexures to this form

Class of securities (4) Number of securities Person’s votes (5) Voting power (6)

Ordinary 8,098, 331 8,098,331 5.11%

State Street lads are loading the truck -up

Never a good sign to see the top brass leave abruptly, but with MP1, this may be the inflection point that is needed to accelerate the path to profitability with the new management likely to be well aligned with the founder, chair and major shareholder Bevan Slattery (who is no slouch).

The only question is whether the valuation stacks up (even after the enormous draw down hurtling the shares towards multi-year lows).

CEO and CFO exit is a red flag for me (I usually exit the position at a loss as a rule - Which has served me well in the past).

For Megaport, Bevan still has a significant shareholding in the company and I would like to believe that he is making the decision that aligns with me as a shareholder.

- I will wait for the 3rd Q result and make a call as to what to do with my position.

Incredibly consistent growth in revenue. Making the assumption they continue this and profitability comes eventually, easy to assume consistent 10-15% growth on the top line.

Bevan Slattery, Chairman, Vincent English, Chief Executive Officer, and Sean Cassidy, Chief Financial Officer, will give a short presentation on the 2QFY23 on a

webcast commencing at 9.00am (AEST) on Tuesday, 31 January 2023. This will be followed by 30 minutes of Q&A.

Capital Raisings – Raised total $308.3m today market cap $1.1 Billion

· April 2020 Raised 72.5m, $50m Institutional, $22.5m Retail (SPP) at $9.50 per share

· December 2019 Raised $62m Institutional at $8.70 per share

· March 2019 Raised $60m, $50m Institutional at $4.20 , $10m Retail (SPP) at $4.00

· March 2018 Raised $60m, $50m Institttional,$10m Retail (SPP) at $3.75 per share

· July 2017 Raised $27.8m Institutional at $2.10 per share

· July 2016 Raised $31m, $17.85m Institutional, $13.15m Retail (SPP) at $1.70 per share

· December 2015 IPO Raising $25m

Acquisitions History

· August 2021 InnovoEdge USD $15m comprising USD $7.5m in cash and up to USD $7.5m worth of ordinary shares. An AI-powered multicloud and edge application orchestration company. https://www.asx.com.au/asxpdf/20210810/pdf/44z50ks84rc5sc.pdf

· July 2016 OMNIX GROUP AD and PEERING Gmbh combined $3.1m AUD. PEERING Gmbh Germany’s second largest Internet Exchange operator operating under the brand ECIX. OM-NIX based in Sofia; Bulgaria is a carrier-grade pan-European network services provider with access to key interconnection facilities throughout Europe. https://www.asx.com.au/asxpdf/20160729/pdf/438y41x3xyydsj.pdf

Inside Ownership Ordinary Shares % MP1 Issued Net Value at $6.96

Founder Bevan Slattery 7,070,940 4.47% $49.22m

CEO Vincent English 907,426 0.57% $6.3m

Michael Klayko (Board) 25,000 - $174K

Naomi Seddon (Board) 24,000 - $167K

Jay Adelson (Board) 18,000 - $125K

Melinda Snowden (Board) 7,000 - $48K

Total 8,052366 5.09% $55m

Recent Selling

Bevan Slattery

· October 2022 Selling 1,000,000 at $6.15 per share ($6,150,000)

Vincent English

· 29 August – 1 Sep 2022 Selling 700,205 at $7.047 per share ($4,934,335.79)

Melinda Snowden

· 12 August 2022 Buying 7,000 as]t $8.50 per share ($59,482.80)

Being a devils advocate again for Megaport as usual

Was in a meeting yesterday discussing how to link a cloud network to an on premise environment at a tertiary institution with high bandwidth speeds..

Megaport wasn't even mentioned in the conversation even though we probably know we can use them despite the masses of Megaport youtube training videos done by the cloud provider. Instead we went with some other provider and it will take a few weeks to provision. That provider has a long term relationship with that institution.

I can't disclose the provider or the institution but it seems winning these "blue chip" government projects will be pretty tough for Megaport due to the preferred relationship.

Comment from the CEO in AGM Address:

I think this can provide safety for free cash flow and profitability.

Not on Megaport per se but perhaps the ecological issues of the 'Cloud' and date centres in particular and the challenges they face in cooling them - The Infinite Cloud Is a Fantasy | WIRED

UBS - PT $14.10

Megaport released 1Q global updates today. it achieved EBITDA profit and positive cash generated from operating activity. On the call, CEO and CFO confirmed that they have sufficient funds to achieve profitability and no need for capital raising.

At the time of writing, Shares are down roughly 15%.

So let me check my thesis as per my valuation calculation. I factored in as below. ( More detail in valuation straw)

- So is Revenue for FY23 on target to reach $138m?

- in 1Q it did 33.7m and ARR as of the end of Sept stands at $139.2m - so it is well and truly on track to achieve my target

- Is Gross margin on Track?

- On 33.7m Revenue, it achieved Profit after direct network costs and partner commissions equals to 21.7m ( i.e 64.4%) - So yes its on track

- Is employee Expense on Track?

- Total employee expenses were 13.7m for 1Q - so annualized comes to around 55m so yes its on track

- How is the partner channel performing?

- They signed 100 new partners and roughly 38 transacting so its gaining momentum

One concern is that one of the KPIs is Net new ports and it needs monitoring as you can see below - However, every other KPI moving in right direction.

They also advised that MegaportOne is also getting traction and sold it to two customers

I think overall, I am happy with the result (probably i was expecting a lot worse) and my thesis is still intact so will continue to hold IR and SM. I believe that Megaport is funded to achieve +ve FCF and Profitability.

There is very high short interest in this business. at some stage, they will need to cover those.

Megaport started channel partner program to develop indirect sales channel.

Blog article list how many partner they have added so far. I think it is impressive in roughly 1 year.

https://www.megaport.com/blog/partnervantage-new-partners-2022/#.YyG2O4KngXI.link

I had a look at an environment that uses Oracle Fastconnect.

One of them do use Megaport as a provider. Without disclosing too much into the project I can't say if this is permanent or not.

What I can say is, most fastconnect services - Megaport or otherwise, would be used for migrations than become a permanent fixture unless there is a specific requirement. So I think there is still some transient nature to Megaport's revenue even though they have the rare distinction for providing "rapid provisioning". So once the migration is done, my guess is the client will transition to a service that is less costly.

Hence why I'm not ready to dive into Megaport, even at this price and even after what I've seen. Their service is definitely revolutionary, but I feel there are many other options out there as well. Not to mention if a customer is a Microsoft house, they will most likely go with Azure Connect instead.

Obviously I'm someone that works on the "front line", have a very biased view and I may not be seeing the bigger picture (as opposed to some financial analyst attending the end of year financial updates). Or as my high school maths teacher likes to put it - "unable to take my blinkers off" and see the light of Megaport.

If you want to see an example of Megaport's coverage (ie: the company's network effect in economics terms), look no further than Oracle Fastconnect

https://www.oracle.com/au/cloud/networking/fastconnect/providers/

I have never used Megaport for Oracle Fastconnect services and we've never really mentioned it for work. Probably because at the end of the day we use whatever service is offered at the data centre and what the client prefers to do the connection.

You can probably see why from how the connectivity is set up for the tech savvy here.

https://www.ateam-oracle.com/post/fastconnect-design

Having given a couple of bear points, most of the Oracle Cloud certification videos uses Megaport as it is quick to demonstrate. So there is a bit of free marketing there.

Hope this personal insight helps give a better picture of Megaport as an investment thesis. Despite the demo I am on the fence with this one. I'm sure this straw will be viewed with a great deal of skepticism from the bulls here.

Megaport reports quarterly so the majority of things were already known to the market. Things that caught my eyes in FY22 report is:

Reduced workforce:

Now we can take this as positive that management is adapting to the new market conditions and responding accordingly or we can be sceptical about it : I am not 100% certain but I am leaning towards negative at this stage.

Gross and EBITDA Margin

On the call, it was evident that CFO is ok with guiding the market that an APAC-like Gross margin won't be achievable but they are comfortable with a 70% Gross margin in the future for the group.

Churn or Customer cohort survival

Compound annual churn rate is trending toward 7% and decreasing.

If I am reading this graph correctly, it tells me that Megaport loses roughly 20% of the newly signed customers in the first 2 years ( Probably because they used megaport services for a specific projects rather than recurring usage)

Competition

On the call, the CEO mentioned that they have never lost a deal because of the price or specific company as yet. They lose only if the customer chooses to go with the Internet instead of Megaport services ( i.e for workload not requiring great network and/or security).

CEO Remuneration

CEO fixed rate increase from 547K to 1m ( I find that's a huge jump)

How megaport sell its services

The following illustrates the evolution of other channels to sell its services. Obviously, we could see the investment in FY22 for it - but hopefully, it will increase the growth from hereon.

Overall, things are going very smoothly and still need to monitor the growth and margin trends - can't wait for FY23

A good call today. I just love the detailed metrics management continue to update on product growth and customer growth year after year.

Further to my earlier note, and without getting into a lot of detail, there were a few important items shared which are significant in the context of the key question: will $MP1 become profitable before havng to raise more capital?

- The high FY22 $50m investing CF, a big step up, had two non-recurring elements. First, a $10m acquisition payment and second a $10m inventory charge ensuring that $MP1 infrastructure rollout was not constrained by shortages in the chips and electronic components. Sean Cassidy (CFO) indicate they were holding 9 months of kit to stay ahead of supply chain problems. And I am glad they are because there were no supply chain stories given as part of the revenue narrative. (There are mixed industry report on semicondictor supply chain outlook, ranging from firms saying they are already easing to others projecting improvements later this year and into 2023. Irrespective, $MP1 appear on top of things and Sean even spoke about looking forward one day to this effect reversing, i.e., working capital reduction. Personally, I hope they don't hurry!)

- Sean guided that $30m would be a more normal capex going forward.

- Sean and VIncent both pretty confident that operating CF breakeven is now passed. So last Q not a one-off, despite the reported favourable one-off items.

- Sean said that once OperatingCF breakeven is achieved, then FCF break-even will follow soon after "in a few quarters" - you can do the maths.

- Sean stated that further capital raising would not be required before achieving CF breakeven.

- Sean stated repeatedly that he is confident that over time this will become a 70+% GM business (APAC already 79% but follows more of a direct sales model, so high margin that RoW)

I came away from the call with a sense of confidence in the management that the firm will soon move to becoming cash generative, even though they are very disciplined in not giving guidance or timelines. I do respect consistency!

Everything about the call gave me a sense of strong momentum. Still, I am going to be disciplined and will wait for one more Q to see operating leverage trend evidence before increasing my position. (Just hope the bear market lasts a bit longer!)

Disc: Held IRL not on SM (when I buy again IRL, I'll do it on SM too)

$MP1 presents this afternoon at 1pm. Registration link here: ttps://openexc.zoom.us/webinar/register/WN_Qs4uZ4i1RWyLGu7ylMUkeA

There's not a lot new that I can see in the presentation given the fairly comprehensive updates we get in the briefings accompanying the 4Cs. It is good to hear the focus on building operating leverage. (At the cash level you can see the gradual long term trend in the 4C analysis below.)

I also find the detailed cohort analysis helpful - each cohort of customers increases both number of services year on year and average revenue per customer... consistently going back 9 years.

One area of concern is that Total OPEX is growing fast than revenue (42% vs. 40%) with most of this occurring in the indirect cost elements. Part of this is due to the return of marketing and travel costs, now that international conferences are back on. So, something to watch in the next period.

For me the top line is that $MP1 is maintaining strong revenue growth, but I remain cautious because it is yet to demonstrate strong operating leverage. With the global footprint now established this should in theory now be easier to demonstrate. For now, with a cash balance of $82.5m and a cash burn of $54.2m in the last year, shareholders will be nervous about further capital raisings. I expect balance sheet and the confidence in the path to breakeven to feature significantly in the Q&A on the call today.

I reduced my holdings in $MP1 in March-21 and again in June-21 (as part of my paring back cash burners) so I now only hold 1.5% IRL. Am watching it closing and will increase if ca demonstrate progress in developing operating leverage while maintaining growth in the next 2Q periods.

Disc: Held IRL

$2070m market cap with $110 ARR.

I am assuming FY27 ARR will be $350m with $150m NPAT which roughly equates to $0.9 earning per share

If you give 35 PE in FY27 that gives the price of $31.5 discount it back to today $18.60

Updated after 4Q results - more information in corresponding straw

Customer Growth

Megaport, like clockwork, keep adding more customers -- in other words products/services it provides has been in great demand and customer is selecting to go with Megaport in the past

(Main questions --

- Will Megaport's products and services be in demand in the future?

- If Yes, Will the customer opt for Megaport or Any other competitor coming to the surface?)

MRR by Channel

Megaport at the end of 2021 switched from Direct Channel to Indirect Channel - in last year, it signed multiple Solutions Integrator to sell their product and services -- that strategy is showing the result

If it becomes successful, then it will provide scale and may be growth will increase in the future [ Need to monitor, How it is progressing each Q]

Future demand

All the research company is drawing a conclusion, that Megaport services is essential and will become even more critical in the future.

EBITDA Positive

Take that with little pinch of salt

Roger Montgomery's view

https://rogermontgomery.com/why-did-megaports-share-price-jump-23/

Valuation

Assumptions

Revenue will increase by 25%

Cost will increase by 10%

market will give PE of 30

discount rate 10%

If we calculate from FY26 figure - today's value comes down to $10.57

If we calculate from FY30 figure - today's value comes down to $22.11

Average = $16.34

New customers: Growth in new customers hasn't slowed based on the numbers

Existing customers: Existing customers keep spending more each half ( average monthly spend per customer cohort)

NaaS market prediction

How Megaport works to enhance Cisco SD-WAN: https://www.cisco.com/c/en/us/solutions/collateral/enterprise-networks/sd-wan/at-a-glance-c45-2361868.html

Nice podcast where Cisco and Megaport technical guys discuss solution: https://soundcloud.com/user-327105904/s8e26-build-a-global-network-on-demand-via-sdci

Found it Quick hard to value Megaport. I have assuming strong Growth next 5 years at 35% per year which maybe lower than what others have used and may end up being quite conservative. I have come up with Revenue of 365m in FY26. I have assume the share count will increase as it has in the past and have used 227,776,800. I have come up with valuation of 9.95. Love the business look for under 10 to start a position. Will update with more research.

Bevan Slattery just sold a lazy $39m of Megaport to "facilitate ongoing investment opportunities", whatever that means. The market reacted savagely by cutting around $165m off the company's market cap with the share price down 7.5% today. Still far too expensive for me...

Solid Result for MP1 for the half.

Loss narrowed from 38.42m to 20.23m although the foreign exchange contribution for the half comparative to 2020 $21,763m .

Costs clearly were ramped in the half up across the board which you would expect to deliver results moving forward in 2022 and beyond.

Looking through some of the detail liking the move into latin America from March 2022 based on the EBITDA margins being equal to that of Asia.

Asia EBITDA margins are 52% versus Europe 25% and North America 9% . North America is the largest market in terms of revenue followed by Asia and Europe.

I suspect this reflects the competitive environment in the North American markets.

Balance sheet solid with over $104m cash and short term debt $12,147m .

A long term buy and hold in real life and on SM.

Megaport published their HY FY22 result today.

Operating leverage is very much clear to see in the result ( ~15m increase in revenue only required ~2.5m in-network costs)

However, Cashflow paints a different picture

The main reason is for the investments megaport has done in the last 6 months.

- Employee costs increased by 8m ( as staff count increased from 229 to 300 --i.e added 70 more staff)

- New channel support division

- Acquisition of InnovoEdge ( which is what is driving the new Megaport ONE product)

- Integration with various SDWAN providers

Growth in Megaport services and MRR can be seen clearly in the diagram below

The below chart shows how MCR and MVE growth will affect the Average Monthly Revenue per Customer. ( MVE has just been started since last 6 months so there is plenty of growth in the future)

New Product ( i.e integration of InnovoEdge to Megaport)

2Q revenue was marginally softer but Megaport has made tactical and strategic investments in the last year to emphasize on the indirect sales channels.

- Launch of VantageHub ( onboarded 22 indirect channel partner)

- partnered with two big distributors ( Arrow and TD SYNNEX)

- Gone live with 5 SDWAN partners (Cisco, fortinet, aruba, vmware and versa)

My view is that there will be increased growth in the coming years because of the above. 3Q22 and 4Q22 results will indicate if that's the case. Normally it takes good 18 months for such businesses to develop successful sales channels and educate all concerned parties. All the blogs/collateral and youtube videos I have seen suggesting me that Megaport is doing it right.

https://www.livewiremarkets.com/wires/in-a-world-of-uncertainty-cash-flow-remains-king

Katie Hudson recently spoke about MP1, in comparison to APX. It is worth a read and she is bullish on MP1.

I agree with Katie's point around looking at the 'durability' of revenue and taking a long-term focus. 8.3x CY20 sales for Appen was an extreme price to pay back in August 2020 ($40 per share for a market cap of $5b AUD).

However, to play devil's advocate, Appen is now trading on ~2.6x CY20 revenue versus Megaport on ~30x FY21 ARR. I think this is more than taking into account the limited visibility into Appen's future revenue (and other challenges) versus Megaport's (admittedly) extremely sticky recurring revenue.

There are many concerns over the long-term viability of the data annotation industry (self-supervised learning etc.), yet the medium-term future of the industry is looking extremely promising. As a market leader, the opportunity (and risk) is for Appen to continue to reinvent itself and remain relevant in the AI space which has a spectacular decade's long runway of growth ahead of it.

I think it is also important to take stock of how Appen is evolving as a business. At the end of CY20, 31% of Appen's revenue was 'committed' (Figure 8 platform) up from just 7% at the end of CY2019. Appen is gradually evolving into a product-led, stronger technology business with stickier revenue. Data labeling for ML models is inherently sticky regardless due to the need for data refresh.

At these prices, we might easily see a surprise to the upside for Appen where expectations are so low, and a surprise to the downside for Megaport, where expectations are so high. The world is changing at a rapid pace and paying 30x FY21 ARR for Megaport is a bet that growth will remain uninterrupted over many, many years despite an uncertain world, competition and a myriad of other factors.

If growth at MP1 continues at 50% CAGR uninterrupted, it will take ~4 years before the ARR multiple drops from 30x to 6x. So today's price for Megaport is equivalent to 6x FY2025 ARR, assuming growth of 50% CAGR is guaranteed.

It is a wonderful business with a durable moat, so there is a good chance the MP1 will cruise through the next decade with uninterrupted growth. But, I don't like guarantees. "There is no such uncertainty as a sure thing" -- Robert Burns

Looking at the full year results it’s time to update my valuation and see if MF’s sell recommendation based on slowing ARR growth is justified given the current market value. I won’t double up on my comments on the Q4 Update (8/4/21), focusing on new information and insights.

FY21 Result

· Sales: +35% is healthy but a sharp drop on +66% and +78% growth in FY20 and FY19. Similar with MRR growth of +32% for FY21 Vs +57% & +82% for FY20 & FY19. Is growth slowing? Yes, but not as much as this implies due to a slow +10.5% Covid impacted H1 growth, H2 growth recovered to 19% for the half and Megaport Virtual Edge (MVE) only went live in March, which provides additional growth opportunities in FY22 along with the recently announced acquisition of InnovaoEdge.

· Margins: Improved from 50.9% to 53.7% which is a good improvement but not as impressive as the increase from 36.1% in FY19. North America (NA) drove the improvement up to 41% from 33%. Asia Pacific (AP) and Europe (EU) were flat at 70% and 59% respectively. The AP market is the most mature but still growing at 25%, it’s margins are a benchmark for the other regions and I still expect them to improve (see management comment below), so margins in the mid 70% range for the whole company once mature seem possible.

· Opex: Up 10% to $55.4m driven by employee costs and insurance associated with scaling for growth. Well below sales growth rates, leading to improved profitability.

· Non-Opex: Up 76% to $18.2m with FX losses making up $13.5m and Equity compensation $9.8m offset by income tax benefits -$6.6m. I ignore FX as a net zero impact long term and Equity compensation I consider in dilution, not the business performance.

· EBITDA (Normalised): -$13.3m is a solid improvement on -$21.1m last year and according to management they hit a EBITDA positive run rate at the end of the year, so FY22 should be EBITDA positive (ignoring FX and Equity compensation presumably).

· NPAT: -$55.0m Vs -$48.7m last year but note FX losses were $9.7m more this year, so an improvement excluding FX.

· Balance Sheet: Net Cash remains strong at $120.6m, operating cash flows improved to -$8.6m Vs -$21.7m and FCF still a long way from being positive at -$31.1m but better than -$49.9m last year. The deferred tax asset doesn’t include all losses available to offset future tax, which total $195.6m (or DTA of $58.7m @30%).

· Capex: MP1 is capital intensive in both capitalised network equipment (PP&E) and capitalised software development (Intangibles). FY21 additions of $24.7m were well down on $41.6m in FY20. Covid wasn’t flagged as an issue in this area and FY20 was 2.5x the prior year which may reflect more on an FY20 investment flurry in the US which went from $4.7m in FY19 to $18.6m in FY20, possibly normalising to $10.2m in FY21… hard to judge.

· Management Comment: Vincent English said, “Megaport achieved Group EBITDA break-even in June 2021. This is a strong validation of our business model, and there is additional operating leverage based on the investments to date. Asia-Pacific is Megaport’s most mature market and generated a profit after direct network cost margin of 73% at June 30, 2021. Europe achieved an EBITDA positive position for the entire fiscal year in 2021, and North America, which represents the largest target addressable market, is growing at the fastest rate with 47% growth year-over-year in monthly recurring revenue”

· My Comment: Obviously a disruptive year, Covid delaying decisions and investment in underlying network management, focusing on operating and urgent needs. Hence I wouldn’t like to call down MP1’s growth prospects because of the year gone. The HoH changes provide more insight than YoY, but MP1 is a very long term play, building infrastructure that will endure for decades to service business moving to and working on the cloud. Growth in NA is where it needs to be and margins continue to grow along with product offering and impressive leadership needed to maintain it’s innovative lead.

Valuation

Results looks great – but at what price!

IV = $19.85 (Bull case)

I won’t repeat assumptions from my 10/2/21 valuation, only flag amendments and add additional points and add the model assumptions for the attached detailed valuation.

Model Assumptions:

· Sales: I expect FY22 sales growth higher than FY21 with a Covid recovery and the introduction of Megaport Virtual Edge (MVE). MP1 is still very early in it’s growth runway in a very large and rapidly growing market, enabling it to 10x sales in the next 10 years from current and new product introductions.

· Margins: With AU hitting 73% GM in June 2021, I see these steadily increasing to mid-70% for the whole business by 2031, with more visibility on the direct cost drivers there could be more upside on these assumptions.

· EBITDA (Normalised): Ignoring share-based compensation and depreciation (ie looking at operating cash flow), I see Opex growing well below sales growth rates but above system rates, 8% average, improving EBITDA (Normalised) as a % of sales from, -17% in FY21 to 59% in FY31 due to strong operating leverage. Note this is more bullish than my previous valuation which assumed 40%, but Opex spend has been lower than I expected and gross margins are higher than I expected initially which drives the improvement.

· Tax: Note that due to accumulated tax losses, tax is not payable on profits until 2027.

· Capex: Network as a Service (NaaS) businesses need to build the network and so capital costs are significant, but the MP1 business model offers expansion in revenue across existing network infrastructure, hence less capital is needed for the same revenue growth going forward. As such I have capital spend linked to sales growth but at a reducing rate.

· Opportunity/Risk: This is a bull case and MP1 has ready access to capital from markets so I am not discounting for risk. However, I am applying an opportunity premium of 25% for the “Bevan factor”, which relates to the expanding opportunities for products and services the business has as exemplified by the introduction of MVE and acquisition of InnovaoEdge.

· Share Count: I am allowing 1% average increase for ESOP and have already added the shares issued for the InnovaoEdge purchase. Further issues for growth or acquisition I assume to provide EPS accretive returns on the assumptions already made in this model.

· Discount & Terminal Value: I retain a long term market average discount rate of 10% but the most significant variance to the valuation is a reduction in the terminal value multiple. I have dropped it from an EV/EBITDA of 20 to 12 which is equivalent to a P/E of 17 and perpetual growth rate of 3.5%. The reduction in terminal value assumptions is to take a less bullish view on growth rates in the terminal year, a balance to aggressive growth assumptions up to that year.

Management: A key component supporting a bullish view on MP1 is management. Firstly with Bevan Slater as founder and Chair you have THE leading business builder in Australia in this industry with a significant portion of his personal wealth (12m shares) backing its success. Skin in the game is a big one for MP1 with 16.7% insider holding and I also see confidence in future performance in their remuneration offering. ESOP exercise prices $8.43 to $14.50 for total of 1.85m shares at a weighted average exercise price of $13.08 and expiry date of December 2023. Below current prices, but not significantly tells me the management see strong results to continue.

Conclusion: Like my previous valuation this is a Bull case, but there is a strong track record in business performance and leadership to support a positive view of the company’s future. My valuation has dropped from $29.92 to $19.85 due to reduced terminal value assumptions, if these had remained the same my new value would have been $29.88 despite a significant rework of sales and margins.

I own MP1 and following this review intend to hold my position but expect significant volatility in share price because my valuation and the current share price asks a lot of the company and many will see the risk weighted return as unfavourable – which makes a market

Bullish on the prospects of MP1 for a couple of years now and have accumulated 11% positin in portfolio.

The growth of the sector in combination with MP1 position in the market and string balance sheets presents nice long term upside.

Looking at the growth of Amazon AWS and Microsoft Azure in most recent quarterly results as well the development of Virtual edge further adds the outlook.

Confirming cashflw positive on Tuesday 10th August will be important as this was a committment provided 12months ago.

Interested to obtain views on valuation as MP1 is trading today at 30X sales but growing strongly ?

An extensive Q4 update from MP1 today attached showed a strong Q4 result with full year revenues likely to land at just under $80m or around a 35% growth YOY.

Highlights:

· MRR up 11% QoQ to $7.5m: Annualised this is $90m which means MP1 is trading at just under 30x ARR.

· Data Centres +15 (4%) to 405

· Enabled Data Centres +19 (3%) to 761

· Customers +168 (8%) to 2,285

· Ports +652 (9%) to 7,689

· VXC’s +891 (8%) to 12,029

· MCR’s +80 (19%) to 502

· Total Services +1,656 (8%) to 21,712

· Average Revenue per Port +$23 (2%) to $982

· Cash on hand $136.3m (down about $1.5m QoQ): 4C due out 22 July.

· Product Updates: Megaport Virtual Edge (MVE) is currently integrated with three leading SD-WAN service providers. Megaport is currently integrating three additional SD-WAN providers and is working on growing it's ecosystem of partners that will host additional service functionality across MVE.

Comment:

· Growth was lead by North America +17% MRR, EU -1% and APAC +7%, over all underlying (ie ignoring FX) growth in MRR has been consistent at 10% for 3 quarters now.

· MRR in the US is now half total MRR but growing at a faster rate than APAC and EU, if this trend continues we may see increasing rates of overall company growth as the high US growth rate and market opportunity begin to leverage of a high base.

· Megaport Virtual Edge (MVE) is starting to generate revenue with the first 21 added in Q4. It offers simpler and cheaper ways for SD-WAN infrastructure, a market growing at 30% CAGR, so a strong revenue path for MP1 going forward.

· MP1 is still a few years of FCF positive or profitable, but the business continues to have strong QoQ customer, port and average revenue per port growth which justify the long-term potential of the business and it’s future profitability.

· It looks like FY21 result will land close to what I assumed in my valuation, also that high FY22 growth rates are achievable if the US business continues to perform.

I hold MP1, it is going to take a long time for this to play out and at current prices I see the risk Vs reward payoff as favourable.

Appendix 4C Quarterly cash flow report for entities subject to Listing Rule 4.7B...see attached

Global Update ~sorry from ASX site~

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02331589-2A1275629?access_token=83ff96335c2d45a094df02a206a39ff4

Executive Update

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02331591-2A1275631?access_token=83ff96335c2d45a094df02a206a39ff4

HIghlights of 4C

? Positive net cash from operations of $0.9M for the quarter.

? Revenue for the quarter was $18.7M, an increase of $1.4M or 8% QoQ.

? MRR for the month of December 2020 was $6.3M, an increase of $0.5M, or 8% QoQ.

? Total Installed Data Centres was 386 at the end of the quarter, an increase of one QoQ. This was the net result of the addition of four new sites and the decommissioning of three sites.

? Total Enabled Data Centres was 716 at the end of the quarter, an increase of 14, or 2% QoQ.

? Customers at the end of the quarter were 2,043, an increase of 63, or 3% QoQ

. ? Total Ports at the end of the quarter were 6,691, an increase of 358, or 6% QoQ

. ? Total VXCs at the end of the quarter were 10,741, an increase of 695, or 7% QoQ.

? Total MCRs at the end of the quarter were 382, an increase of 39, or 11% QoQ

. ? Total Services at the end of the quarter were 19,278, an increase of 1,133, or 6% QoQ

. ? Average Revenue per Port in December 2020 was $934, an increase of $21, or 2% QoQ.

? At the end of December 2020, the Company’s cash position was $144.8M.

Updating from 6 months ago as my straw got stale.

Update 1: I noticed I got a downvote for this. It would be good for someone to put a bullish view and why one should invest in a loss making firm with single digit growth (see below)

Update 2: Only 7% growth in customers. 2% increase in Qtr revenue. MRR (monthly recurring revenue) increase of 2%.

Update 3: MUFG is now offering borrowed stock to short sellers.

Share price has stayed resilient against all odds despite not making money. I've constantly watched this and feel bad about missing this boat

However I have seen the product presented in a few cloud training videos and it is pretty slick.

Plus there is that stake from Digital Reality.

Apart from that I can't think of anything else as to why price continues to go up despite the bearish views.

Maybe some brokers did some DCF valuation which resulted in the shares being pumped?

Somehow they must be doing something right to keep the share price afloat.

A Baggy I may becomin'

But this stock is one I am in

I like the overall plan

Though the price is rather blan...d