Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

@LifeCapital and @BendigoInvesto covered this, so I won't back over what they've written. Except to say that I was scratching my head at this result. The numbers just looked too good, and I couldn't get them anywhere near to adding up until I re-read almost to the bottom of their trading update:

Talk about burying the lead - a 5.6% increase in GM is huge! Much higher than anything they've done for at least 10 years. What is that? Is that Technocorp? I'd thought of Technocorp as strategically important, but of lower quality than the existing business. That isn't borne out by the numbers though:

So Teknocorp appears to be holding its own and then some. But the underlying business appears to have had a standout quarter as well. While I thought the 1H numbers were fair-to-good, I had expected a lot more given the growth in order book and commentary around impacts of COVID impacts easing. Q3 appears to have made up for that.

It's just as dangerous to extrapolate a good quarter as it is a bad one, but I'll do it anyway cause I'm a slow learner. Although they disclose NPAT, I'll focus on EBITDA because their tax is all over the shop. They are run-rating at almost $10 million EBITDA, which is an EV/EBITDA ratio under 6. Add a record order book and I'm a happy holder.

What do they do?

Ausco develop software and hardware relating to healthcare communications systems, primarily nurse call and real time patient tracking systems, as well as re-sell and market complimentary systems.

They are also Systems integrators (nurse call and PTS installation contractors), through acquisitions, giving them sales channels into various geographic markets. It has achieved this primarily through acquisition, and is part of a strategy to enhance their direct sales channels in Australia, where systems integrators tend to have the customer relationships.

Financials

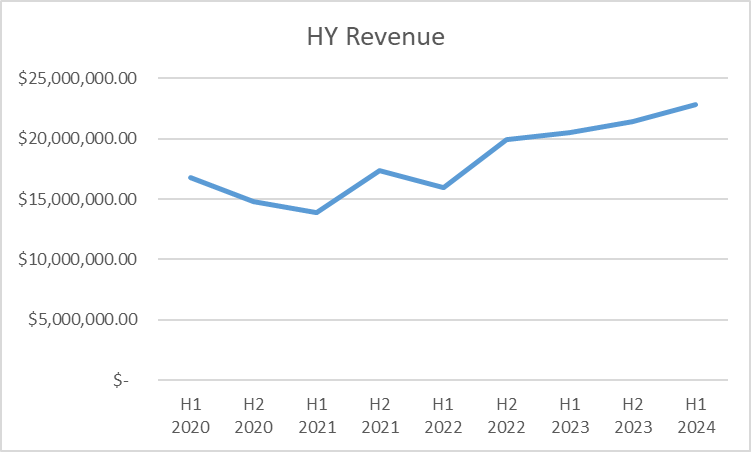

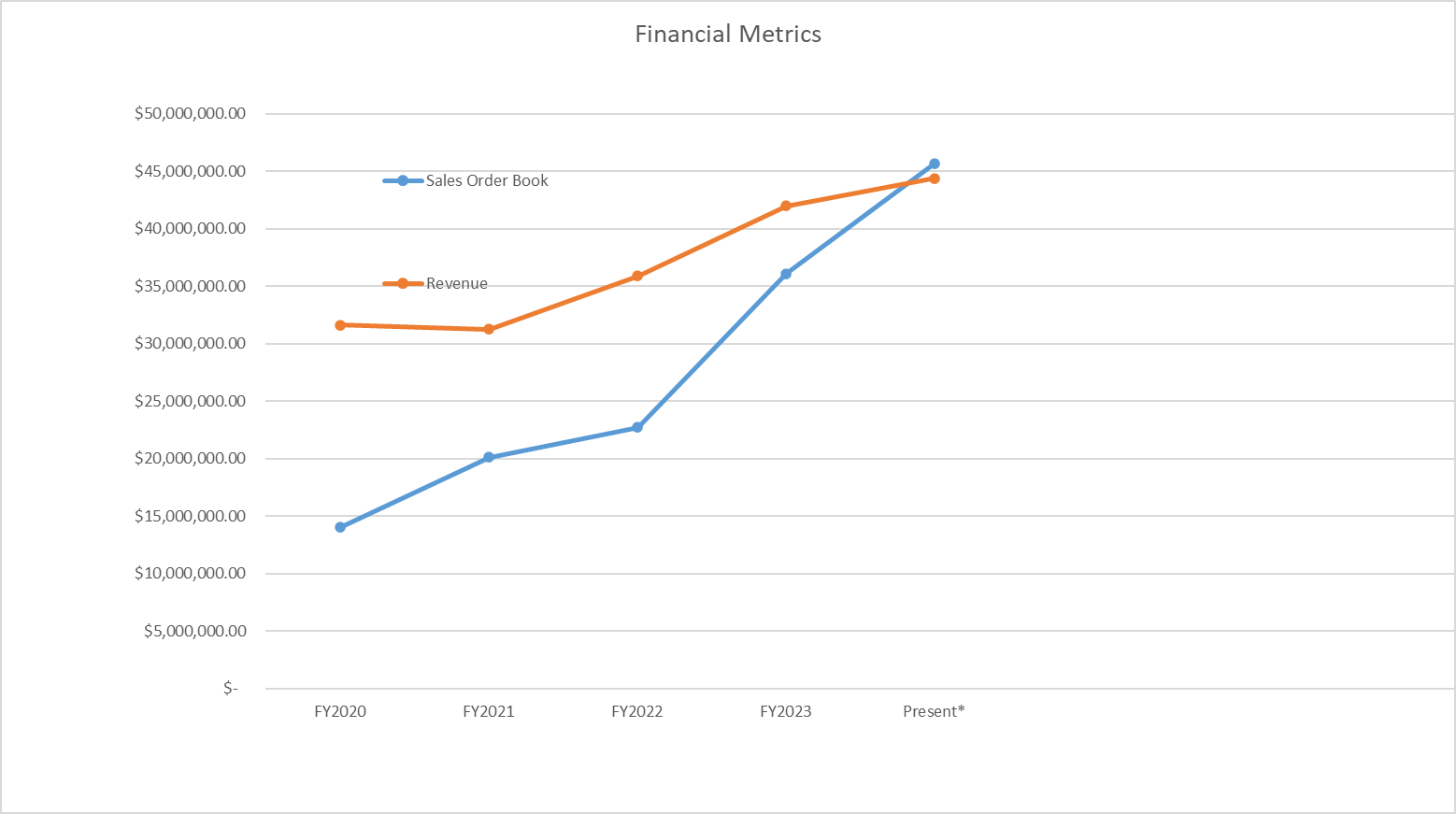

The business experienced significant disruption throughout FY 2021 due to COVID-19. Since then, revenue CAGR is 18%

Gross margins have remained relatively flat over the past 3 years at around 52%.

Profit margins have been in the range of 2-7%, noting the business has been profitable over the past 3 years.

Since H1 2022, software and software services revenue CAGR is 28% over the past 2 years, and is now 21% of total revenue. AHC has been developing its Nurse call and clinical comms platform Tacera,

Sales Pipeline: Sales pipeline has more than doubled to $44.4 million over the past 12 months, leading into H2. AHC revenue streams are seasonal, with H2 traditionally being the stronger half. The sales pipeline has benefited from the following recent acquisitions:

- Acquired Amentco (Integrator) for $10.6M (3.5 x 2023 EBITDA) - Feb. 2024

- Acquired Tecknocorp acquisition for $2.6M plus earnout (3.5 x EBITDA) - Sep. 2023.

- Present revenue value is annualising H1 revenue.

Share Price Performance

Share price has been in an upward trend since early 2019.

Valuation

Austco Healthcare Ltd is trading on a trailing PER of 24.5. However, given the strong pipeline into a seasonally stronger H2, I would estimate the forward PER is around 20, which appears to be reasonable value, assuming it can continue to grow at around 10-15% pa.

Ownership

The largest owners are:

- Former CEO / Founder: Robert Grey (19.2%)

- Aust. Ethical Investments (17.8%)

- Asia Pacific Holdings (18.1%)

The board is a lean one, with just 4 members

MD, Clayton Astles owns 1.1% of the company, and Brendan Maher (CFO) 0.85% . Other directors holdings of around $100-200k each.

AHC has some solid institutional investors, with reasonable inside ownership

Management Incentives

Short term incentives are based on pre-defined profitability, gross margins, and revenue financial targets. Non-financial are product development, process improvements, and Leadership and team contribution.

Summary

AHC strategy of rolling up integrators and re-sellers in Australia at about 3.5x EBITDA will juice revenue and hopefully profits over the next few years. The call option is it the re-sellers / integrators enable AHC to get their sticky Tacera platform on sites around the country. Once these systems are in, they are difficult to replace.

Presently, sales orders are exceeding the H1 2024 revenue run rate, indicating a strong H2 is ahead of us.

DISC - HELD

Austco has announced a $3.8 million contract win across two hospitals in Singapore.

They have also announced this has taken their order book to $40.7 million, up from the $38.7 million announced at the AGM last month. They've been on a bit of tear this year having more than doubled the order book since February this year.

Zooming out a bit the order book has been steadily rising since late 2019, apart from some COVID and supply chain impacts through 2022 and early 2023.

Nice to see at least one of my holdings kicking ass and taking names. I still think it flies under the radar a bit considering its history of profitable, non-dilutive growth. @Strawman have we spoken with Clayton?

I’ve only looked at the results quickly from being tied down with work, but I make it that the TLDR on Austco’s results is that they are mixed with growth that is yet again to come ‘in the near future’.

It’s not like they’re making this up because the continued and impressive growth of the order book supports this (up $5M to $44M total since reported at the AGM). But still, I’m a little surprised given I thought management had hinted they would start to chip away at the order book.

Perhaps someone that’s more properly read could shed a little more light and offer their opinion. Certainly nothing worrying here with top line of 11%, but thought we might get more, especially considering recent acquisitions (although I admit I reckon they would have only just been integrated and barely had time to add).

Looks like a good acquisition by Austco to expand their foot print and 3.5x earnings.

Austco Healthcare Limited enters into a Term Sheet for the Acquisition of Healthcare Communications Business, Amentco.

Austco intends to merge Amentco's extensive business with its current operations, spanning hundreds of sites. Key personnel from Amentco will be retained to facilitate a seamless transition for both customers and employees. This acquisition is anticipated to yield substantial revenue synergies by enabling cross-selling of products and services and streamlining operational processes.

Another win for AHC. Paid value of 2.6 mil for tecknocorp in November. Just won a contact for 1.2 mil through very same subsidiary. See below:

ASX Announcement 27 December 2023

Austco Healthcare's Teknocorp Secures $1.2 Million Contract for Whittlesea Community Hospital

Austco Healthcare Limited (ASX: AHC) is pleased to announce that Teknocorp, its recently acquired subsidiary, has been awarded an AUD $1.2 million contract to deliver state-of-the-art access control and CCTV solutions for the upcoming Whittlesea Community Hospital in Victoria, Australia.

Operated by Northern Health, the Whittlesea Community Hospital will play a pivotal role in providing integrated community health and specialized services, including chronic disease management, chemotherapy, social support, and women’s health. The facility will also offer after-hours care for non- emergency medical issues.

This significant contract win demonstrates the benefits of collaboration resulting from the Austco- Teknocorp merger and underscores the strategic significance of the Teknocorp acquisition in strengthening Austco Healthcare’s capabilities and extending its presence in the healthcare sector.

Clayton Astles, CEO of Austco Healthcare, expressed enthusiasm about this milestone, stating, "We are thrilled to share this significant achievement, which not only validates the immediate impact of our Teknocorp acquisition but also positions us for continued growth and innovation."

The substantial contract award underscores Austco's commitment to delivering state-of-the-art technology aimed at elevating patient care, operational efficiency, and the overall healthcare experience.

The acquisition of Teknocorp has allowed Austco Healthcare to:

• Pursue and secure larger opportunities that may exceed the financial capacity of traditional resellers.

• Engage with national corporate clients operating beyond a single reseller’s geographic jurisdiction.

• Concentrate on high-value solution selling, bringing innovative market solutions directly from the

manufacturer.

• Establish reference sites, crucial in proposal assessments, from a broader pool.

• Provide comprehensive, fully integrated low-voltage solutions, enhancing the overall customer

experience.

• Enhance the value proposition of software and software maintenance agreements.

The Whittlesea Community Hospital contact award marks a strategic advancement, further solidifying Austco Healthcare's position as a leading innovative healthcare solutions provider.

This announcement was approved for release by the board. ~ENDS~

1/31 Sabre Drive Port Melbourne VIC 3207 ABN 67 108 208 760 t +61 (03) 9209 9688

Further Information

Clayton Astles

Chief Executive Officer

Telephone AUS:+61 411 531 170 TelephoneUS: +16828031222 Email: clayton.astles@austco.com

About Austco Healthcare Limited (ASX Code – AHC)

Brendan Maher

Chief Financial Officer and Company Secretary Telephone AUS:+61 439 369 551 Email:brendan.maher@austco.com

Austco Healthcare Limited is an international healthcare communication and clinical workflow management solutions provider. Headquartered in Australia, the company has subsidiaries in six countries and supports healthcare facilities through its global reseller network, which includes growing markets in health, aged care and acute care. Austco Healthcare services markets including Australia, New Zealand, Canada, the UK, USA, Asia and the Middle East. For further information, please refer to the Company’s website www.austcohealthcare.com.

All important for small caps.

Share count @ June 2020: 284 188 951

Share count @ December 2023: 290 790 167

Share count growth: 0.8% pa.

Nice, company continues to deliver.

Further acquistion should add to bottom line if costs can remain low.

Austco has come out with a roadshow presentation today, with lots of funky graphs and "buy me" arguments. Not a lot new, although they did disclose sales orders were up again from last month's record high to $37.2m - so they're filling the funnel faster than they can drain it. (Ignore the 'Revenue from customers' tag - revenue it ain't).

Austco is one of my more comfortable holdings. They disclose often enough to make you feel wanted, without getting all over-promotional. When they make investments in product or people they set realistic expectations about how long it will take to get a payback from the investment. They certainly appear to be in that zone of getting a return of previous investment right now though.

If I were being hyper-critical I'd say the CEO is very well compensated for a company of this size. However, Clayton appears to be getting the job done so I'll not quibble while that remains the case. It's arguably not a screaming bargain but if they keep growing at the rate they are it will look cheap soon enough. Happy to hold.

Decent revenue growth, but I was expecting a higher NPAT result. This year should be strong though for the following reasons -

- record order book of $36m

- Software revenue up strongly by 66% to $8.5m, driving margins and set to continue

- The Technocorp acquisition to drive revenues and profits this FY along with the extra investment is sales and marketing

- An offshore team was setup to test and source products costing $1.1m, which will no longer be required after August, expect a saving of around $900k

- Trade receivables are $12m, up $5m on this time last year, which is very significant.

So putting this all together, I would expect Sales to come in at around $52m for FY24 up $10m on FY23. Adding back the saving on R&D of $900k, I would guess that AHC could achieve at least $4m in NPAT. Working on a 15x multiple I would value the business at around $0.21 cents for this FY.

If I have a pet hate - and I have many! - it's when a company describes an acquisition as earnings per share accretive when they're paying largely cash in the deal. As long as there are earnings how could it be anything but EPS accretive? Anyway, Austco are doing an EPS accretive deal for Melbourne-based Healthcare reseller Teknocorp.

Including likely earnouts they will pay $3.85m to purchase $9m in revenue and $1.1m in EBITDA. The EBITDA multiple of 3.5x seems reasonable even in these austere markets, although they're to some extent cannibalizing their own sales given that a significant but undisclosed proportion of Teknocorp's sales are Austco products. Also a reseller is inevitably going to have a lower quality people-based business model, relative to Austco's proprietary hardware/software model, and so should justify a lower multiple.

In addition to Austco, Teknocorp also partners with Avigalon, Gallagher, inner range and IndigoVision. The rationale would appear to be gaining a greater proportion of the reseller's sales and acquiring a direct sales capacity in Australia. Other regions in which Austco operates already have this capacity.

The deal is expected to complete in early Q1 FY24.

[Held]

I know this is followed and owned by some erudite members @Strawman @Wini and I also see a big future for this business. As frequently noted healthcare needs modernisation and from a big picture perspective I also see the worlds ageing demographics as a tailwind.

Aside from those external factors it’s great to see their R&D spend increasing and hope that this helps them cement more work noting the record sales order book…

look forward to other takes

24 August 2023

ASX Release

Austco Healthcare increases revenues by 17%, invests further in sales capability and R&D

• Revenue from customers up 17% to $42.0 million

• Software and SMA revenues up 65% to $8.5 million

• Gross Margins increased to 53.4% compared to 52.5% in pcp

• Research and Development investment up $0.9 million to $4.6 million

• NPAT down $0.07 million to $2.3 million

• Open Sales Order book grew to a record high of $36.1 million

• No dividend has been declared to fund organic and inorganic growth

Austco Healthcare Limited (ASX:AHC) (Austco), a global leader in clinical communications solutions, announces a 17% increase in revenue from customers over the prior comparative period (pcp) to $42.0 million for FY23.

Software and SMA revenues were the largest driver of increased revenues, up 65% or $3.3 million to $8.5 million. This growth more than offset supply chain increased costs and allowed for improved Gross Margins up from 52.5% to 53.4% for the year.

The company achieved revenue and gross margin growth during FY23 despite fluctuations in raw material availability and pricing due to ongoing supply chain disruptions. During the year, the company undertook proactive measures to ramp up manufacturing output, resulting in a corresponding boost in revenue recognition. Even with the increase in manufacturing output and revenues, our Open Sales Order book grew to a record high of $36.1 million as of August 16, 2023.

As outlined in recent investors presentations, Austco has taken strategic advantage of its increased revenues to invest in its future sales and product capability. We continue to grow our investment in Sales and Marketing resources across several markets but have also increased our investment in Research and Development (up $1.1 million to $3.2 million) and also have funded $0.2 million of M&A costs, some of which have been incurred in finalising the acquisition of Teknocorp, which is intended to complete this quarter.

The investment in additional Sales and Marketing resources and Research and Development is expected to give rise to further increases in organic revenue growth. Further, the earnings per share accretive acquisition of Teknocorp will drive inorganic revenue growth.

Reported NPAT was down $0.07 million to $2.3 million as compared to pcp, as funding investments in Sales, Research and Development and M&A utilised the margin improvement from this financial year.

1/31 Sabre Drive Port Melbourne VIC 3207 ABN 67 108 208 760 t +61 (03) 9209 9688

Revenue ($m) 50

45

40

35 31.2 30

25

20

15

10

5 0

42.0 35.9

FY22 FY23 2H Total

FY21 1H

Revenues from customers

Total FY23 revenues of $42.0 million were up $6.1 million or 17% on FY22. This is the highest reported revenue over the last 10 years.

Both halves contributed to the record revenues, although second half revenues of $21.4 million were up 3% on first half revenue.

The North American market continued to drive the increase in revenues from customers.

Despite the record revenues demonstrating our ability to convert our Sales Orders into recognised revenue, new contract wins have maintained a strong Open Sales Order book to underwrite revenues in FY24. The Open Sales Order book currently sits at $36.1 million.

Software and SMA revenues from customers

High margin software and SMA revenues are key to our strategic growth plan and have been our primary focus over the past few years.

With the prior year’s COVID-19 restrictions (which impacted our ability to drive software sales as high solution sales require face to face interactions) now passed, we have seen strong take up, with software and SMA revenues up 65% or $3.3 million.

Software and SMA revenues in FY23 accounted for 20.2% of total revenues, up from 14.4% of FY22 revenues.

We expect this trend to continue as customers navigate towards higher solution sales with a higher proportion of software and as customers renew SMA’s at a higher rate seeing the value of support and software upgrades over the life of their product deployment.

9 6 3 0

Software & SMA Revenue ($m)

5.2

8.5

4.4

FY21

1H

FY22 FY23 2H Total

24

22

20

18

16

14

12

10

FY21

55.0% 54.0% 53.0% 52.0% 51.0% 50.0%

Gross Margin ($m)

FY22 GM $

FY23 GM %

Gross Margins on revenues from customers

The Company recorded gross margin percentage growth despite ongoing global supply chain challenges, which have adversely impacted raw material availability and pricing.

Material growth in software and SMA revenues more than offset supply chain increased costs and allowed for improved Gross Margins up from 52.5% to 53.4% for the year.

In addition to software and SMA revenue growth, new products to market assisted in gross margin growth.

Off higher revenues and higher margins, the amount of Gross Margin delivered in FY232 materially increased from $18.8 million to $22.4 million.

Indirect Cost Base

During the year, our cost base grew from $16.9 million in FY22 to $20.7 million in FY23 as we:

• Invested in Sales resources across multiple regions;

• Invested in additional R&D activities by putting on an offshore team to deal with a restricted development cadence from the core US team as resources were diverted from our product roadmap to configure and test alternate parts necessary to deal with supply chain issues. This was a significant contributor to the increased $1.1 million in net R&D expensed in FY23. We disbanded this offshore team in August 2023 as they had completed the backlog of tasks; and

• Invested $0.2 million in M&A activity, mainly in relation to the recently announced Teknocorp acquisition which is

nearing completion.

With a long sales cycle, the payback for additional sales resources is not immediate; however, initiatives put in place in FY22 assisted in driving FY23 revenue growth.

Further, the Teknocorp acquisition will be EPS accreditive in FY24 and the increased R&D costs from the offshore team will be reduced in FY24.

Cost Base ($m) 24.0

20.7

18.0 12.0 6.0 0.0

16.9 14.7

FY21 1H

FY22 FY23 2H Total

4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0

NPAT ($m)

3.4

2.3

2.3

FY21 1H

FY22 FY23 2H Total

Statutory Net Profit after Tax

Statutory NPAT is $2.26 million for FY23, 4% lower than FY22 NPAT of $2.33 million.

Whilst higher revenues and stronger gross margins provided for a higher gross margin amount, this was strategically consumed, as discussed above, to position Austco for growth in future years.

During the year, Austco also increased the amount of deferred tax assets recognised, reflecting the profitable trading (and outlook) of its US business ($0.5 million) and Australian business ($0.1 million). This gave rise to an income tax credit for the year.

The FY21 result in the corresponding chart benefited from $1.9 million of one off Other Income, being COVID grants and legal settlement related.

Open Sales Orders

Recent contract wins in Canada and Singapore have contributed to the growth of Austco’s OSO. Our Open Sales Order book now stands at $36.1 million at 16 August 2023, up from $29.3 million at 30 June 2023.

Open Sales Orders (OSO) represent confirmed contracted orders from customers that have not yet been fulfilled and, as such, no revenue recognised.

During the pandemic, we have observed a material build-up in our confirmed orders as site access restrictions and supply chain challenges hampered our ability to convert sales into revenue. In FY23, we materially delivered on the backlog of orders.

Faced with the uncertainties stemming from supply chain disruptions, we made the strategic decision to augment our inventory levels. This strategy was pursued throughout FY23, resulting in our current inventory reaching $10.8 million.

40.0 35.0 30.0 25.0 20.0 15.0 10.0

29.8 20.1 22.9 24.5 23.3 22.5 22.1 24.7

36.1 29.3

14.5 15.7 17.1 11.1 11.3 10.7 11.6 12.8

Open Sales Orders ($m)

25.6

20.3 20.3 22.6

Jul-19

Oct-19

Dec-19

Mar-20

May-20

Sep-20

Nov-20

May-21

Aug-21

Nov-21

Feb-22

Mar-22

May-22

Jun-22

Sep-22

Oct-22

Nov-22

Dec-22

Feb-23

Apr-23

Jun-23

Aug-23

Cash and Working Capital Position

Cash on hand was $4.7 million at 30 June 2023, down from $7.6 million at June 2022. Cash generated from operating activities of $0.3 million was modest and reflected further increases in our working capital needs, mainly inventory and receivables arising from a growing business. Dividend payments in FY23 net of dividends reinvested also consumed $1.0 million.

Dividend

No dividend has been declared, to fund organic and inorganic growth.

Research & Development

In the reporting period, the Company invested a further $4.6 million (FY22; $3.7 million), of which $1.4 million was capitalised (FY22; $1.5 million) in the development of its innovative nurse call and clinical communications platform, Tacera. Austco involves healthcare staff of all levels in the design process, ensuring our products meet the requirements of nurses, patients and healthcare administrators.

Innovation lies at the core of the company’s product roadmap. Through collaboration and an openness to embrace emerging technologies, we aim not only to meet the demands of today’s healthcare industry but also position the company to exceed the evolving needs of our customers.

The company remains dedicated to its ongoing efforts to enhance its market-leading real-time locating (RTLS) solution and software suite. These advancements encompass not only the core RTLS technology but also include advanced clinical workflow optimization, efficient task management, and insightful business intelligence solutions.

By leveraging cutting-edge locating technology, caregivers can streamline their workflows with precision. This includes the seamless automation of essential tasks such as automatic presence tracking, alarm cancellation, and comprehensive logging of completed rounds. Additionally, the convenience of one-touch mobile assistance is integrated, providing caregivers instantaneous access to precise location notifications directly on their iPhone and Android mobile devices through Austco's innovative Pulse Mobile platform.

On a global scale, our Tacera and Pulse brands are recognised as premier healthcare communications and clinical workflow solutions. The development of an open architecture, VOIP capable system that delivers IP to the patient's bedside is key to the evolution of the Tacera and Pulse brands well into the future.

The Future/Outlook

The prospects for Austco Healthcare have never been more promising. Over the course of the financial year, we bolstered our sales and marketing capabilities in high-growth markets, strategically positioning the business to capture new opportunities within the growing healthcare technology sector. The investments we have directed toward sales resources and product development are expected to be the driving forces behind sustained organic growth in the coming years.

Fulfilling our $36.1 million order backlog will depend on the continued improvement of the global supply chain, which has encountered widely reported disruptions affecting lead times and manufacturing costs across various industries. Encouragingly, there has been a gradual improvement in the availability and pricing of raw materials, giving us confidence that the company can build on the momentum and continue to grow revenues and profits.

Austco’s strategic roadmap remains focused on growth-oriented initiatives. These include introducing innovative products, establishing strategic partnerships, and exploring potential mergers and acquisitions. These initiatives underpin our commitment to sustain and increase the company's growth trajectory well into the foreseeable future.

This announcement was approved for release to the ASX by the board. ~ Ends ~

Further Information

Telephone AUS: +61 411 531 170 Telephone AUS: +61 439 369 551 Telephone US: +1 416 565 7457

Email: clayton.astles@austco.com Email: brendan.maher@austco.com

About Austco Healthcare Limited (ASX Code – AHC)

Austco Healthcare Limited is an international provider of healthcare communication and clinical workflow management solutions. Headquartered in Australia, the company has subsidiaries in six countries and supports healthcare facilities through its global reseller network, which includes growing markets in health, aged care and acute care. Austco Healthcare services markets including Australia, New Zealand, Canada, UK, USA, Asia and the Middle East. For further information, please refer to the Company’s website www.austcohealthcare.com.

Clayton Astles

Chief Executive Officer

Brendan Maher

Chief Financial Officer and Company Secretary

Austco Healthcare wins AUD $2.6M contract to supply state of the art nurse call system and Tacera Pulse software platform

Azure Healthcare Limited’s (ASX: AHC) wholly owned subsidiary Austco Marketing & Service (Asia) Pte Ltd has secured a A$2.6M contract to supply its Tacera Nurse Call platform to Mount Elizabeth Hospital (MEH), a premier 345-bed private hospital located in Singapore.

Mount Elizabeth Hospital, a flagship of Parkway Hospitals Singapore, stands as a cornerstone of Asia's foremost integrated private healthcare provider, spanning Malaysia, Singapore, India, Greater China, and Brunei. With a reputation for excellence, MEH has emerged as one of Asia's largest private hospitals and boasts an unparalleled concentration of specialized medical professionals, including cardiologists, cardiac surgeons, neurologists, and neurosurgeons.

This strategic contract represents a significant advancement for the company. The contract includes Austco's innovative Tacera system, featuring RTLS-ready call points, Pulse Mobile, and industry-leading clinical workflow solution. Tacera's open architecture, coupled with its robust application programming interface (API), ensures seamless integration with a diverse range of hardware, software, and systems at MEH.

Critical messages, including medical emergency notifications, will be seamlessly transmitted to mobile devices and strategically placed application stations throughout the hospital. This immediate communication process ensures that medical personnel are promptly alerted, enabling rapid and effective responses. Furthermore, the two-way audio functionality establishes real-time connections between patients and healthcare providers, streamlining workflows, driving operational efficiency, and mitigating potential risks.

"We are thrilled to establish this partnership with Mount Elizabeth Hospital," commented Clayton Astles, CEO of Austco. "This contract win underlines our standing as a trusted industry leader and highlights our unwavering commitment to continuously enhancing our innovative solutions. The recent advancements in our leading Tacera nurse call and clinical workflow solutions align with our customers' objectives of enhancing patient outcomes and optimizing caregiver efficiency."

Austco Healthcare offers one of the world's most advanced nurse call systems by constantly updating the platform to meet the needs of any healthcare facility.

Revenue recognition will commence this financial year (FY24) and will be completed in FY25.

With this contract award, Austco Healthcare’s Open Sales Orders have grown to an all-time high of $36.1 million. Open Sales Orders (OSO) represent confirmed contracted orders from customers that have not yet been fulfilled and, as such, no revenue recognised.

Austco awarded $7.4m contract, largest in its history

New canada contract. Share price up on news

[Held]

22/2/23 Austco Healthcare Appendix 4D and HY Dec 22 Results

Catching up on reporting season for a few names.

A tidy result from AHC as they continue to emerge from the effects of Covid. Headline numbers were revenue up 29% to $20.5m and underlying NPAT (removing subsidies/grants from prior period) up 57% to $1.3m. A re-instatement of the dividend was also a sign management are confident the headwinds from Covid are abating.

The highlight of the result was software revenue up 47% and accounting for 18% of total revenue (a record result). This helped drive gross margins to 55%, not quite a record itself as the contribution from the high margin software revenue was offset by some lingering supply chain issues. Management did say that the second quarter was better than the first for executing on orders which bodes well for the second half and FY24.

In general cash conversion was solid with operating cash inflow of $1.2m despite another increase in inventories by $2m to $11m. I'd expect to see inventory begin to normalise as the company executes on it's backlog of orders from ~25% of revenue now to <20% pre-Covid.

At first glance the increase in the overhead cost base from $7.3m last year to $9.6m this year is concerning, but it is worth noting the frontloading of the cost base occurred in 2H22, with 1H23 largely flat on that result ($9.5m).

On the current numbers AHC's return on equity of 9% on the rolling 12 months looks lacklustre but I expect return on capital metrics to improve sharply in the next few reports. Most of the improvement will come from a general increase in margins as Covid effects on supply chains ease and software revenue continues to become a larger % of the total.

Beyond that, it is worth noting that nearly all of the capital in the business is working capital with only $400k of PPE and no debt. As inventory pressures normalise we should see the strain on working capital ease which will help improve profitability metrics.

Bull Case:

- $7m in cash and no debt

- Strong product offering: They seem to know their market, so have a good level of optionalty while also not trying to be "all things to all people" and as such watering down their core competency.

- Strong sales momentum coming out of Covid and catching up on the backlog of sales orders

- Great gross margins (for software plus hardware business) of 50+%

Things to watch:

- Continued sales momentum - increasing revenue and sales orders

- Software and SMA revenues as a % of revenue - ideally I'd like this to increase, but ultimately as long as the gross margins stay high it is not that important. It would be nice if they started reporting on actual recurring revenue as well.

A largely stagnant company - sales (in c/share) have gone nowhere in the last 10 years.

Inventories have ballooned in anticipation of a major sales push that history suggests, even if successful, will not last.

DISC: Held (and working on the bull case - but felt it necessary to highlight the counter-point first)

Pop in share price after AGM update

Would have been good if they had a slide that tracks their progress against competitors. Otherwise lots of content to take away and digest.

Still have watch position

[held]

Maybe I'm a bit picky but biggest concern is the lack of shares traded on AHC. Trading of shares seems very illiquid and is difficult to get a sense of what the market thinks about this company.

Another concern is there are other bigger players competing for the same pie including Phillips.

Despite this, I took a small starter after reading some of the previous straws by Noddy74 and Wini (must have taken weeks to finally get some shares), but then bumped my partial fill back down a bit while I do more research into the competitive landscape. Not keen on making a full position yet.

[held]

Austco snuck in a price sensitive investor presentation this morning, which was an interesting decision given they released results less than two weeks ago (sans presentation). It came two days after a competitor, Hills Limited (HIL.ASX) announced they had been successful in bidding for the New Footscray Hospital tender in Melbourne. I'm not saying it was because of that. I'll leave that to others.

Largely it replicated what they they had already released with some swanky graphics added. It did give a little more detail about the growth investment being made in each region. One nice little new tidbit it shared was an increase in the order book to a record $24.7m. That's $2m higher than they had disclosed at the end of August and is probably what justified it being price sensitive.

[Held]

The latest investor preso (see here) warns shareholders of supply chain issues -- increased raw materials and transport costs, semiconductor shortages -- and says that management expect these pressure to last for the remainder of FY22, and possibly beyond.

This will impact margins, and has prompted the company to build up inventory. The business will also be investing in added sales resources. With $7m in cash, they are also on the lookout for acquisitions, particularly in Europe and the US.

Will be interesting to see how sustained these supply chain issues are, and whether there is much capacity to increases prices (i suspect not)

I think there's good scope for sales growth as they prosecute their record order book, but with ongoing investment and added costs it'll make profit growth more difficult.

Not a great deal of insight provided in terms of FY22 trading or outlook. Main takeaways for me were:

- increase in open order book to $22.9m (from $20.1m at Jun 2021)

- Biggest risk being supply change shortages, particularly semi-conductors

Austco copped a first strike against their remuneration report in FY20 but this was passed comfortably this time around. The re-election of director Brett Burns was the most contentious with 22.69% voting against. Claude Walker chipped in with a question to Brett Burns to detail one opportunity and one risk to the business. To his credit he did answer it, although I wouldn't say I was left any more enlightened about Austco after doing so. Given the stage the business is at and the stated strategic direction of the business I think an acquisition in FY22 is probable.

[Held]

Austco has won a $3.3m contract to supply its Tacera Nurse call platform to Khoo Teck Puat Hospital -- a 795 bed hospital in Singapore (as a side note, Singapore has one of the worlds leading healthcare systems. Certainly in the top 5 globally).

ASX announcement here

The deal is a significant one, representing ~10% of last years total revenue.

Further, the hospital belongs to the Yishun Health Network -- and it is Yishun that the contract is with. This network encompases many other healthcrae institutions in Singapore, so although it wasnt mentioned, I assume there's potential for the contract to be extended to other facilities if all goes well.

Post a valuation or endorse another member's valuation.