@DrPete123 Sorry for the delayed response , I was snowed under last week .

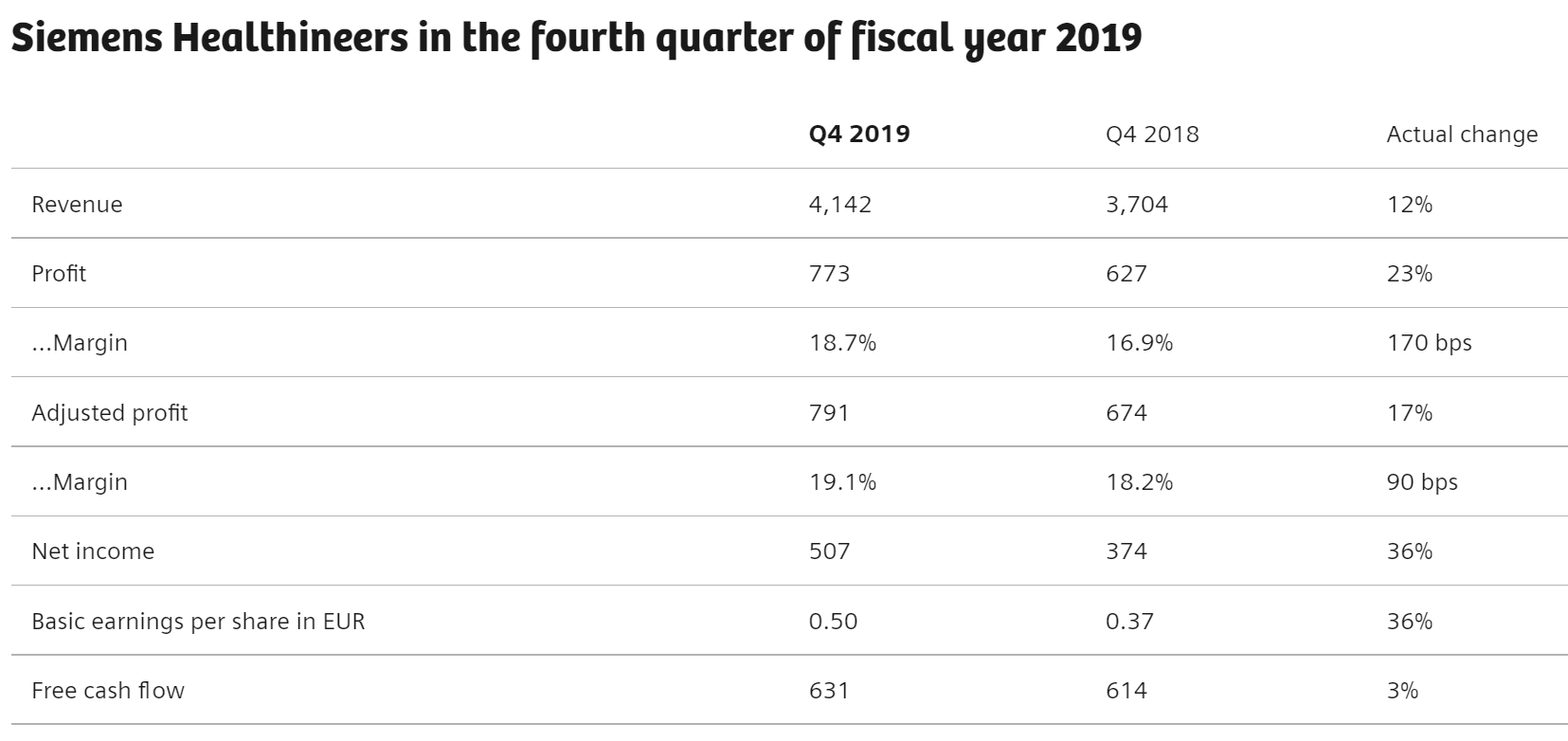

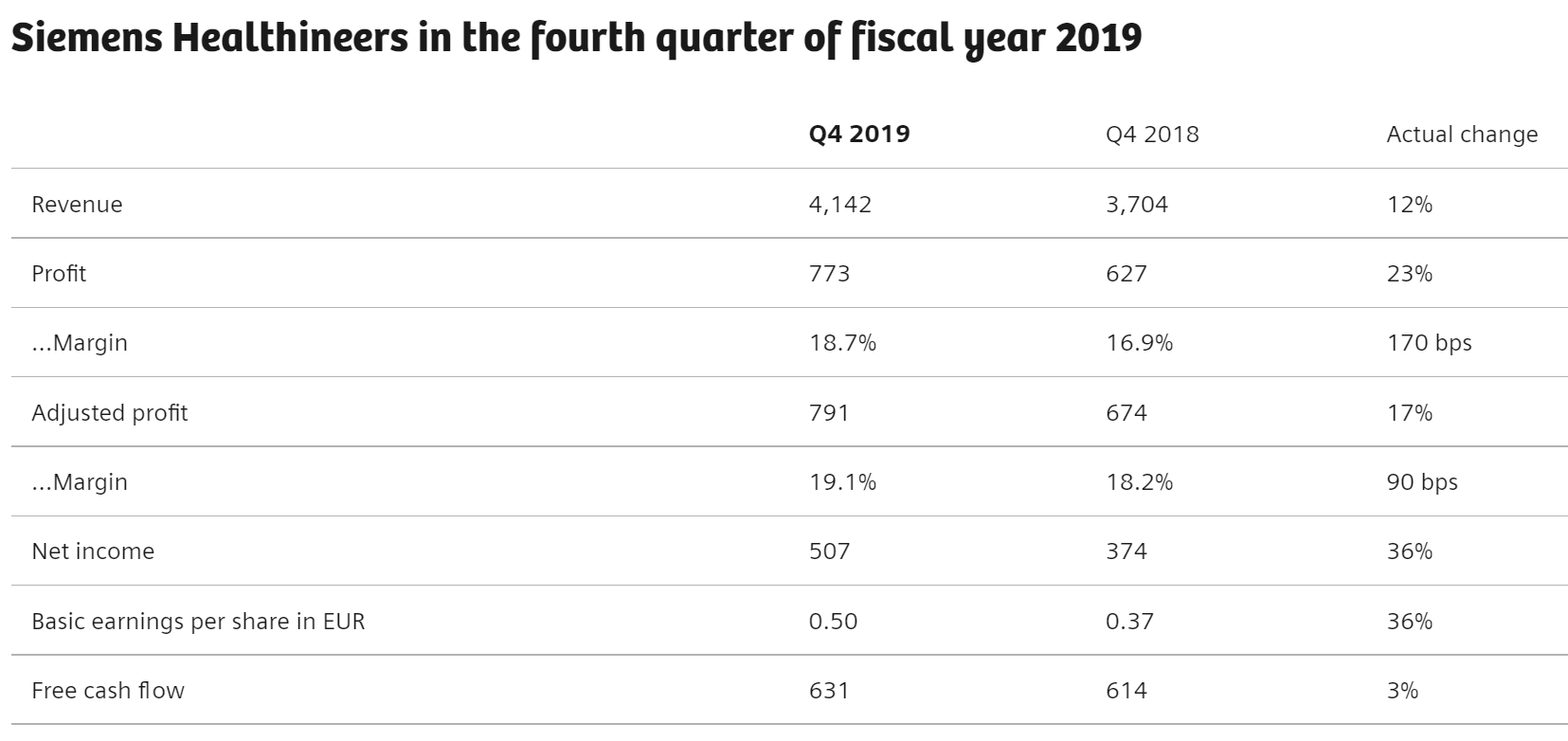

It is an interesting point . You are correct . I’ve checked GE and Siemens Healthineering’s financial reports , and indeed it is based on a range of 16-20% profit margin and net income around 30-36% depends on a specific divisional performance .

https://www.siemens-healthineers.com/press/releases/pr-2019q4.html

I totally agree with you that companies have many ways to manipulate financial data , and we don’t have full transparency to make an informed decision about company’s real net margins .

In the case of EMV , I believe the market will only look at 3 main drivers initially :

1) Competent management that has a clear roadmap/development plan and delivers milestone results ;

2) Commercialisation of the products – sales growth/customer acquisition Q-n-Q ;

3) Revenue growth .

Market loves storytellers and growth , and very often illogical .

I wish you and your family a relaxing Easter break !