Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

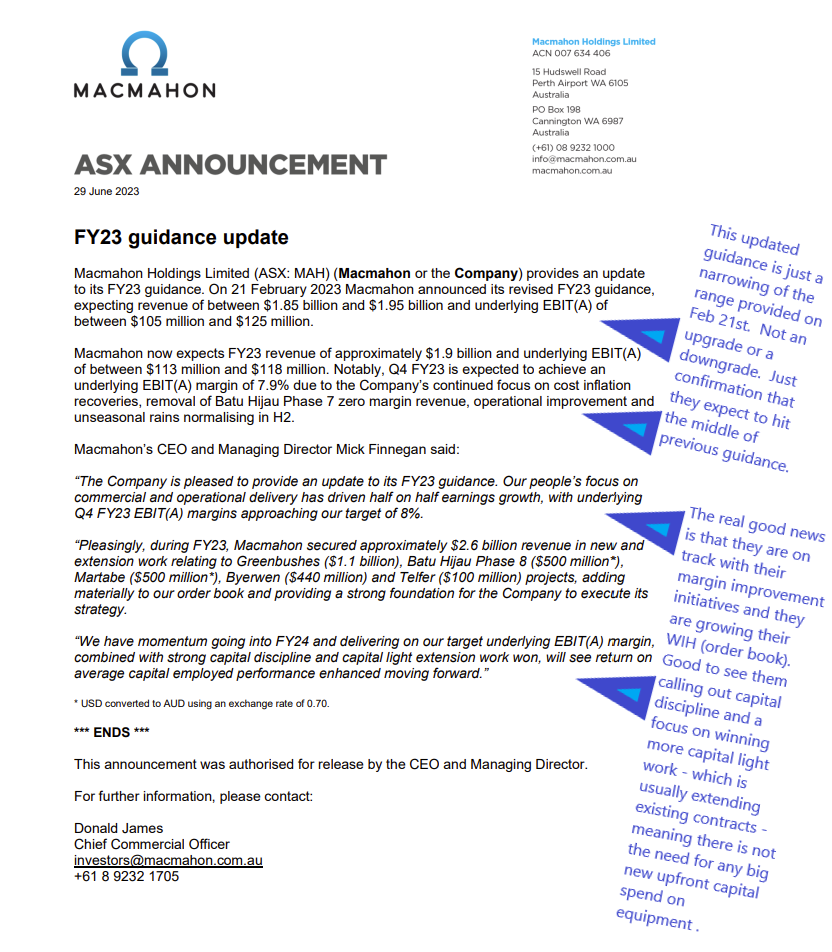

Thursday 29th June 2023: FY23-Guidance-Update.PDF

MAH closed today up +19.23% @ $0.155 on the back of this update.

They are coming off a low base. They closed at 12 cents/share earlier this month (6th June) and prior to today's move, they hadn't been above 13.5c/share since mid-May.

I rang Mick Finnegan up earlier this week and told him he better get something positive out there quickish-like, coz MAH was one of my three stock picks in the Strawman.com "FY23 Stock (Company) Picks" Forum and FY23 finishes on Friday (tomorrow), so it would be handy if they don't finish the FY on their lows. And he waited until Thursday!!

OK, I did not make that call. Mick doesn't know me or care what I think. But his remuneration includes incentives, and that also goes for other senior management personnel at Macmahon, and those incentives have to be earned, and one of the main hurdles that has to be conquered to qualify for the biggest incentives is achieving decent TSRs - Total Shareholder Returns - which includes share price gains/losses added to dividends and any other payments made to shareholders. Mick and the other KMP at MAH haven't been earning much in the way of incentive payments (either cash or shares) over the past couple of years, mainly because their TSR's have been dismal. It would be nice if today's guidance and business update could be the trigger that starts a share price turnaround/uptrend... Wishful thinking?! A +19.23% SP rise in one day is a good start, but they do need to keep rising from here.

It's in their interests to achieve much better TSRs for us shareholders, both because (a) they are also shareholders, and (b) because the incentive structure of their remuneration arrangements depends on it (for the incentives to be paid).

Steve Johnson, of Forager Funds, when talking about Macmahon's overly generous incentives a few years ago, said, and I'm paraphrasing here, so don't quote me on this, but something along the lines of... They are very generous, however they will not be easy to earn, and if they do earn them, we, as shareholders, will have done very well indeed out of holding Macmahon shares from here.

Well, fast forward a few years, and SJ was correct, in that they were NOT easy to earn, and they did NOT earn them (and they were NOT paid those incentive payments), and as a result we, as shareholders, have NOT done particularly well out of holding Macmahon shares over the past few years.

Plenty of potential, but so little delivered to shareholders recently...

Maybe one for FY24?!

Disclosure: I continue to hold MAH shares, both here and IRL (in real life). They are one of my two favourite mining services companies that do the actual contract mining for mine owners. The other one is NRW Holdings (NWH). NWH have performed better, and appear to have better management, and they are also more diversified than MAH are (in terms of revenue generation from different business units), however I still have high hopes for MAH.

Further Reading: Canaccord-Mining-Services-Series-Presentation-June-2023.PDF [15 June 2023]

Macmahon Holdings Limited | Mining & Construction Australia [company website]

15-June-2023: Canaccord-Mining-Services-Series-Presentation-June-2023.PDF

Disclosure: I hold MAH shares both here and IRL.

I expect their SP to remain under pressure until the end of the month (due to tax loss selling), but I would expect a bit of a rebound in July and especially in August when they report.

23-Nov-2022: Cannacord-Genuity-Investor-Roundtable.PDF

Also: NOTICE-OF-AWARD-TALISON-GREENBUSHES-LITHIUM-PROJECT.PDF

The following are three slides from Macmahon's presentation at the Cannaccord Genuity Investor Roundtable today:

Firstly, a one slide overview of the business:

Next, they have called out Labour Challenges (People Resourcing) as something that they are currently having to deal with:

Lastly, here's their "Outlook" slide:

Disclosure: I hold MAH shares. I'd like to see them pay down their debt a little quicker, and win more work, however the announcement today of the Talison Lithium Greenbushes project load and haul services contract win is a welcome step in that direction.

I own MAH IRL and have done for 3 frustrating years but I am selling out because of the debt position which expands YOY from FY18 as follows: $106m - $166m - $203m - $312m & $413m in FY22.

Yes, but many might argue that eps have also expanded over the same years as follows 1.6c - 2.1c - 3c - 3.5c & 1.3c in FY22.

I just cannot see how they get out of this debt spiral because they just do not generate sufficient FCF when you add in 'repayment of lease liabilities' which is really an expense under the old accounting regime. In fact, I calculate FCF for the last two years as being just $3m in FY21 and -$8m in FY22.

Hardly satisfactory to cover dividends of $13m in each of these years!

Bottom line: all eps gets sucked back into the business on an average ROCE (past 6 years) of just 8% - which is ordinary - whilst they appease shareholders with a lowly div pay out ratio which needs to be borrowed.

21-Oct-2022: Macmahon (MAH) held their 2022 AGM today, and here's a link to their AGM Presentation.

The Presso is 30 pages in length. Here are the main 5 slides (IMO) that sum up the company's FY22 performance and their current future outlook and priorities.

They're in reasonable shape actually. I do hold MAH shares both here and in real life. They are also one of my three FY23 Stock (Company) Picks here, and remain so, even though their share price hasn't done anything positive in the first 4 months of FY23.

I think they're the best gold mining contractors listed on the ASX and one of the best mining services companies overall also. I do not believe that their share price is reflecting their overall business performance, which is decent. However, while mining services remains an unloved sector, MAH will most likely continue to remain undervalued by the market.

They will have their time in the sun again one day, and I can wait. They are only growing the business in the meantime.

Macmahon Holdings Limited | Mining & Construction Australia

24-Aug-2022: I did post a long straw about Macmahon's FY22 full year results last night, and I posted a "Bull Case" straw and a "Management" straw about them on Sunday. This one is just about their Strategy, Priorities and Outlook, and is all taken from yesterday's Macmahon FY22 Investor Presentation.

So, to be clear, the "Results" straw that I posted last night was about what they have achieved, whereas this one is about what they say they're going to do in the future. I like to keep those two things separate sometimes so that I can easily go back and look at what a company says they're going to do, and see if they've actually done it.

The other way of looking at it is that this straw is about the "talk" and last night's was about the "walk". The best companies underpromise and then overdeliver, but they always walk the talk, they do what they say they're going to.

Just in terms of Macmahon meeting their previous guidance, I'll repeat one slide from last night:

Disclosure: I hold MAH shares, and as I said in last night's straw, if they keep performing as they have, they will either get positively rerated by the market or else they'll get taken over by another company, just as their competitor MACA (MLD) is at the moment with a $1.025/share offer from Thiess and a $1.085 offer from NRW Holdings (NWH, who I also hold). I sold all of my MACA (MLD) shares into this week's higher prices on Monday morning. I used the proceeds of that sale to buy more (another $21.5K of) Lycopodium (LYL) shares on Monday and Tuesday at between $6.04 and $6.14 (average price of $6.09).

LYL will report today (Wednesday 24-Aug-2022) and it will be another good one! LYL can have liquidity issues so the SP tends to have volatile moves, when it moves at all, but they pay very nice dividends and they just keep on performing and growing the value of the business over time. Lycopodium was once the engineering arm of Monadelphous (MND) who reported yesterday and their SP rose +5.86% to close at $12.11. Mono's are another company with strong and capable management who have skin in the game and tend to underpromise and overdeliver. I also hold MND shares. As well as holding them IRL (in real life), MAH, NWH, LYL and MND are all also in my Strawman.com virtual portfolio. They have all been good companies to hold as core positions and top up when they're trading at very cheap levels and trim the positions when they're fully priced. Another one is GNG, who had a cracker of a report on Monday (22nd Aug 2022). Based on today's closing share price ($2.32), GNG's dividend yield (including the 10c/share FF dividend they've just declared added to their 9c/share FF interim dividend paid in March) is 8.19% and when you include the franking credits the grossed up yield is closer to 11.5%. GNG is the largest position in one of my real life portfolios - the one that also holds LYL and is partially designed to provide a good income stream.

With all of those companies, I bought the bulk of my shares at significantly lower levels than where they are today, with the exception of Macmahon (MAH) who just look ridiculously cheap to me at current levels. I will likely keep buying more MAH shares if they stay under 18 cps, because at some point something will give.

23-August-2022: Good Results again from Macmahon (MAH). They finished the day up half a cent (+2.94%) at 17.5cps:

They have addressed the elephant in the room - being the high inflationary environment with rising labour and other costs:

As stated there, their contracts are structured so that increases in input costs - including labour - are passed through to their clients, with 43% of revenue derived from Alliance-style contracts with budget adjustment mechanisms, and the remaining 57% of revenue being from "Schedule of Rates" contracts that contain rise and fall provisions which are adjusted either monthly, quarterly, or twice a year (bi-annually).

That said, the most obvious negative in their results (amongst a plethora of positives) was a lower EBIT (Profit) margin (see bottom right, below), which was 5.9% in FY22 vs. 7.1% in FY21. They say this was impacted by new project starts, COVID and inflation cost recoveries, so either input and wage inflation has hurt their bottom line or their claims to recover those increases (through their various existing contract mechanisms) mean that they have paid the costs in FY22 and some of those costs won't be recovered until FY23, which still means their bottom line was affected in FY22.

They have chosen to highlight the fact that they have either met or exceeded their own guidance in every one of the past 5 years. They can't control market sentiment, and therefore their own share price, but they can keep putting runs on the board, increasing revenue, increasing profits, and delivering results that are comfortably within (or above) their own guidance.

Here's how they performed in FY22 compared to FY21:

The standout negative there is the lower reported NPAT and EPS, which was affected by a GBF earn-out payment (to the vendors who sold GBF Underground to Macmahon) and other one-off adjustments. If you back those out, the FY22 underlying NPAT was 5% higher than FY21.

This was how their revenue was derived in FY22:

So the Tropicana gold mine and it's underground extension, Boston Shaker (both owned 70% by AngloGold Ashanti and 30% by Regis Resources), have now together become Macmahon's largest revenue source (17% of FY22 revenue), just pipping the Batu Hijau copper/gold mine owned by PT AMNT (Macmahon's largest shareholder) which represented 16% of FY22 revenue for Macmahon..

The following addresses MAH's Cash Flow and CapEx (capital expenditure) in FY22 as well as FY23 CapEx forecasts:

This is not a capital light business, and new contracts often mean taking on additional debt initially to buy or lease the equipment required to perform the new work. While it's important to realise that this company DOES have net debt, and quite a bit of it ($215m of net debt as at 30-June-2022, as shown in the balance sheet summary below), that debt is underpinned by medium and long-term contracts. The debt has been used to purchase equipment that is used to generate revenue, and the ability of that equipment to continue to generate revenue is underpinned by the contracts that Macmahon have with their clients. If you subtract the $228m of equipment leases (listed below, right) that they had at 30-June-2022, they would actually be in a net cash position (with no net debt), as they had $198m of cash in the bank.

Their results announcement today said, "Macmahon retains a solid balance sheet with gearing reducing to 27.8% (including AASB 16 Leases) as at 30 June 2022 from 31.1% at the end of 1H22. Net Debt to EBITDA also improved in the second half to 0.74x. Cash on hand was $198 million with net debt of $215.5 million at 30 June 2022. Cash and unutilised working capital facilities at financial year end totalled $256 million (30 June 2021: $287.7 million). In July, the Company refinanced its existing $170 million bank facility into an enhanced $200 million facility with an improvement in interest rate and key terms, providing additional funding capacity. Liquidity post refinancing increased to $297 million providing substantial capacity to support the Company’s execution of its strategic objectives."

Again, they have highlighted their sustainability focus and their people focus:

As I said in my "Management" straw for MAH, this is important to me, and I did read something earlier today about that weasel Alan Joyce (the boss at QANTAS) which shows the opposite end of the spectrum when it comes to valuing people as your best assets:

Joyce’s apology scarcely credible from same old Qantas (msn.com)

That was penned by Bernard Keane and originally published by "Crikey" - https://www.crikey.com.au/ who have got some big brass ones - they are currently in an open war with Lachlan Murdoch - as their site clearly shows.

Anyway, back to Macmahon who clearly value their workers a lot more highly than Alan Joyce values QANTAS employees...

Macmahon do have analyst coverage other than from Macquarie. Macquarie is the only broker I have access to (via FNArena), but MAH are also actively covered by Argonaut, Canaccord Genuity, Euroz Hartleys, Jarden and Moelis, as shown below.

In terms of institutional investors and fund managers, Macmahon have Paradice Investment Management as substantial holders with 7%.

23% of MAH is owned by Australian Funds (which includes Paradice's 7%) and 10% is owned by Overseas Funds. If you add in the 44.3% owned by their Indonesian client and largest shareholder, PT AMNT (who I discussed in my "Bull Case" straw on Sunday), that only leaves a free float of 22.7% for Retail (& "other") investors. "Other" would include management, and I discussed management shareholdings in my "Management" straw on Sunday. Management are not large shareholders because their remuneration structure has largely been linked to performance hurdles that have not been met, so shares that might have been awarded to senior management have not been. Their main performance hurdle has been TSR - total shareholder return, a hurdle I am very comfortable with.

The following is a handy reference guide of where Macmahon's clients are located:

Most of the sites they work on (i.e. 21 of them) are located in WA, with 6 in Queensland, 4 in Indonesia, 1 in Malaysia, and 1 also in each of the NT, SA and Victoria, with none in NSW or Tassie. Remember that if these images are too small and you can't read them easily, click on them and they should get bigger.

Or you can click here to access the full FY22 Results Presentation (that all of the above slides have been taken from) that was released by Macmahon today.

There is also their Macmahon FY22 Results Release which contains the following overview of FY22:

The Board has declared a final dividend of 0.35 cents per share, bringing the total FY22 dividend payment to 0.65 cents per share, unchanged on FY21. The total dividend represents a payout ratio of 22%, consistent with the Company’s current dividend policy payout range of 10 - 25% of underlying EPS. The final dividend is unfranked, has a record date of 23 September 2022, and will be paid to shareholders on 7 October 2022.

FY22 Guidance and Outlook: [taken from that announcement today]

The global demand outlook for key minerals remains positive, notwithstanding recent central bank measures to increase interest rates in response to rising inflation. Interest rates whilst increasing, remain at historically low levels and with continuing activity across the mining and resources sector, Macmahon’s tender pipeline remains robust at $8.4 billion. A positive medium-term outlook is supported by a strong order book of $5.0 billion(*5) at 30 June 2022.

The tight labour market across Australia and global inflationary pressures are issues that are being actively managed by the business. Macmahon’s existing and recently commenced projects are expected to contribute to earnings growth in FY23.

Guidance for FY23 is for revenue between $1.6 – $1.7 billion(*10) and underlying EBIT(A) of $105 – $125 million(*6) with the width in range reflecting some uncertainty in the challenging industry cost environment. Approximately $1.45 billion(*7) of FY23 revenue is already secured.

FY23 capex is forecast to reduce to approximately $194 million which is sustaining and extension capex. The high level of investment in FY22 is expected to support earnings growth in FY23 and, coupled with the lower capex requirements, the Company is positioned to deliver improving financial returns towards its longer term targets. With the expected improvement in ROACE and balance sheet, the Company will be well positioned to take advantage of future opportunities that align with delivering on its strategy.

*** ENDS ***

Notes

1. Underlying EBITDA is earnings before interest, tax, depreciation and amortisation from continuing operations and excludes various one-off items. A reconciliation of Non-IFRS financial information is contained on slide 27 of the Company’s Full Year Results Presentation

2. Underlying EBIT(A) is earnings before interest and tax from continuing operations and excludes various one-off items. A reconciliation of Non-IFRS financial information is contained on slide 27 of the Company’s Full Year Results Presentation

3. Net operating cash flow excluding interest and tax and M&A costs.

4. Gearing = Net Debt / (Net Debt + Equity)

5 (*5). $5.0 billion order book as at 30 June 2022; excludes Batu Hijau Phase 8 (preferred), short term civil and underground churn work which do not take into account future contract cost escalation recoveries.

6 (*6). Guidance assumes an exchange rate of AUD:USD 0.72 and excludes one-off items and amortisation related to the GBF and Martabe acquisition

7 (*7). Secured revenue excludes short-term civil and underground churn and does not take into account future contract cost escalation recoveries

8. Return on Average Capital Employed = Underlying EBIT(A) / Average ((Total Assets excluding Cash) – (Current Liabilities excluding Debt))

9. Underlying NPAT(A) is earnings after interest and tax from continuing operations and excludes various one-off items and amortisation of customer contracts relating to GBF and Martabe acquisition. A reconciliation of Non-IFRS financial information is contained on slide 27 of the Company’s Full Year Results Presentation

10 (*10). Revenue guidance does not take into account future contract cost escalation recoveries

Notes taken from today's FY22 Results Release Announcement by Macmahon (MAH).

Disclosure: I hold MAH shares. I did also hold MACA (MLD) shares, but I sold them all yesterday. I also hold NRW (NWH) shares. MACA and NRW are competitors of Macmahon. All three companies provide contract mining for mine owners, and MACA (MLD) also specialise in gold mining (as do Macmahon). Macmahon's NTA (net tangible assets) per share as at 30-June-2022 had increased to 25.2c/share (as shown on the "Balance Sheet" slide above) and they closed today at 17.5c/share, being a 30.6% discount to their NTA. MACA (MLD) were also trading at a good discount to their own NTA and then Thiess recently lobbed in a takeover offer priced at $1.025 cash, being quite a bit higher than where MLD had been trading at the time. NRW (NWH) promptly offered the MACA (MLD) Board $1.085/share, which could be taken as all cash, all scrip (NWH shares) or 50% cash and 50% NWH shares. The MACA Board declared that the $1.085/share NRW offer was NOT superior to the $1.025/share Thiess offer because it involves shares. The MACA Board failed to point out to their own shareholders that they did not HAVE TO take any shares because one of the three options available under the NRW offer was 100% cash. The market has clearly decided that MACA are not going to be taken over at $1.025 but rather at a price much closer or above the $1.085 that NRW is offering, because MACA has been trading at between $1.05 and $1.075 since that NRW offer was made public (by NRW late last week) and MACA provided their initial response to it. Prior to that MACA was trading no higher than $1.01/share. They closed today at $1.075, being a new year high.

As there is still some uncertainty as to who is going to take over MACA and at what price, I have sold out and locked in my profit at the higher prices available this week. According to their announcement today, despite their $1.025 offer having been open for a fortnight already, Thiess have so far only received acceptances representing just 4.81% of MACA (MLD) so far, suggesting the majority of shareholders are holding out for a higher offer. And now that MACA is trading on-market at prices significantly higher than Thiess' $1.025/share offer, Thiess would be unlikely to be getting a flood of further acceptances now when people can just sell their MLD shares on-market for a higher price.

I didn't hold any MACA in my Strawman virtual portfolio, having sold out previously to top up my MAH and NWH positions, who I consider to be superior companies with superior management.

My point here is that a company like Macmahon (MAH) will not continue to trade so far below their own book value forever. Particularly when they keep increasing their book value every year. At some point either MAH will get positively rerated by the market, or a competitor will take them over, or try to. But something has to give eventually, just as it has done recently with MACA (MLD).

https://www.macmahon.com.au/news/nadine-linnartz-project-engineer-deflector-underground-mine-wa/

Thanks for the great dive into MAH @Bear77they have been around for a long time and good to get an insight into what they are up to. Back in the 80’s I worked in gold mines in both WA and the NT either drilling, driving dump trucks or on the bomb squad. This was back before the (necessary) confines of OH&S had been invented and so yes it was pretty loose but man we had FUN. The powers that be decided that they would be better off without me: the only job ever that I have gotten the sack from – and in this case it was THOROUGHLY deserved. I am sure if you look closely enough there was a spike in the MacMahons share price around that time……

21-Aug-2022: Most of the Macmahon Board and Management have joined the company in the past 5 years, since they turned decidedly pear-shaped in that 2015 to 2017 period and fended off the opportunistic takeover attempt by CIMIC Group in 2017 that I discussed in my Bull Case straw earlier today.

Eva Skira is the only current board member to have been appointed prior to the new CEO & MD's appointment (i.e. Mick Finnegan) in November 2016.

Denise McComish is also a non-executive of Webjet (WEB) and Gold Road Resources (GOR) (appointed to both boards last year - in March and September 2021 respectively).

Alex Ramlie and Arief Sidarto were appointed to the MAH Board by MAH's largest shareholders PT AMNT in 2017 when they bought their 44.3% stake in Macmahon and awarded Macmahon the mining contract for the huge Batu Hijau copper/gold mine in Indonesia, which was then and still remains today Macmahon's largest ever mining contract.

To get a sense of just how big that pit is, click on the image to make it larger and check out how small those massive haul trucks are in comparison to the pit. And Batu Hijau has more than one pit.

Alex Ramlie is concurrently the President Director and Chief Executive Officer of PT Amman Mineral International (AMI) and a Commissioner of AMI's subsidiary, PT Amman Mineral Nusa Tenggara (PT AMNT), which operates the Batu Hijau Copper/Gold mine in Indonesia.

Arief Sidarto is also a director of AMNT.

A fair selection of women on both the board and in KMP positions, particularly for a mining services contractor where it has traditionally been a male-dominated industry.

Macmahon do take gender diversity seriously, as well as equal opportunities for indigenous Australians.

See here: Shelley Dimer DTO Trainee, Telfer - Macmahon

and here: Thellie Tatow RTO Advisor, Telfer - Macmahon

You can explore that further by clicking here and browsing through their website:

About Us - Macmahon [ https://www.macmahon.com.au/about/ ]

Anyway, my point is that when you look at metrics like this:

and this:

...it pays to keep in mind that Mick Finnegan only took on the top role at MAH late in 2016 and the majority of the current board and management were appointed after that, so MAH has been a successful turnaround since 2017 and I don't think the mistakes that prior management made prior to then are going to occur again in the future, in particular they won't be going to load up on debt during a mining boom only to have it almost drive them to the wall when the boom goes bust, and secondly they are structuring their mining contracts a LOT better these days, with the ability to pass higher expenses through to their clients and they now avoid being locked into contracts where they can actually lose money - as was previously the case at Telfer (working for Newcrest).

This was evident in the dispute Macmahon had with Newcrest over that Alliance (Life-Of-Mine) contract at Telfer where a couple of years ago they were prepared to walk away from the contract if Newcrest didn't agree to vary the terms and conditions to allow MAH to actually make money and at the very least always cover their own costs at Telfer. After having a scout around and realising that nobody else was seriously interested in that Telfer contract (it's a horrible place to work according to my brother who has done a number of shuts [shut-down jobs] there as a heavy duty plant mechanic), at least it became very evident that nobody was interested in the mining contract at Telfer for the rates that Macmahon had been working for, Newcrest came to the party and agreed to restructure the contract with improved rates and a guarantee that ALL of Macmahon's costs would be covered as a bare minimum. This was Mick and the Macmahon Board drawing a line in the sand and saying Macmahon would NO LONGER perform work that was loss-making, and the results of this stand are evident in their improving metrics every year since, particularly their increasing net profit margin (NPM), ROE and EPS.

About Mick Finnegan, the CEO and MD of Macmahon:

Mick holds a Bachelor of Science (Mining) with 20 years’ experience in the mining industry. The last 15 years have primarily been spent in senior line management positions. Mr Finnegan has a strong commercial and technical background and has spent time in operations on the east and west coast of Australia as well as a number of countries throughout Asia.

It is his Asian experience and connections throughout Asia, especially in Indonesia and PNG that enabled him to line up PT AMNT to rescue Macmahon from the attempted takeover by CIMIC not long after he took over the top job at Macmahon. To be clear, being taken over by CIMIC in 2017 at 14.5 cents/share would not have been a good outcome for Macmahon shareholders. Speaking of which, Mick holds just over 5 million MAH shares, currently worth less than $1m, and he owns more than every other board member.

However there are long term incentive (LTI) arrangements with Mick and other senior executives at Macmahon (agreed to by shareholders at their 2018 AGM) that align those executives' interests with retail and ordinary shareholders' interests - in terms of share performance rights (that are equal to ordinary fully paid MAH shares, and would be swapped for those, bought on-market by the company, if and when the performance rights were earned) being granted only if certain hurdles were met and those hurdles being reasonably hard to achieve and all involving increased Total Shareholder Returns (TSRs) - as follows:

That's a small excerpt - Below is that entire page:

And that was just part of an Annexure to the announcement - the full announcement can be viewed by clicking on the link below:

Steve Johnson from Forager said at the time (because Forager's Australian Shares Fund [FASF, ASX: FOR] held a decent position in MAH) that while that does look very generous to MAH Senior Management, shareholders would do well if those hurdles were met and those Share Performance Rights were indeed granted, so as a Macmahon shareholder, FASF supported them at the time. Indeed, I can't think of a much better hurdle for management to jump over than decent Total Shareholder Returns over multiple-year periods.

So in terms of skin in the game, they have plenty, and the incentives are well aligned with our own interests as MAH shareholders. Obviously those total shareholder returns have been underwhelming over the past 4 years, and that's why Mick still doesn't own a hell of a lot of MAH shares because the hurdles were not met, and the shares were not earned, but I actually don't mind this sort of incentive structure at all. I would like to see them set up something substantially similar in the future, as that 4-year period is now coming to an end.

Also, if you read through the entire announcement (link above), there are other positives, such as a clear focus on interest alignment with both the board (through their own remuneration arrangements) and the senior management. And the fact that all of these shares would be bought on-market by MAH, so no new shares would be issued as part of this share-based remuneration.

From page 1 of the announcement:

This share ownership policy was adopted by the Board on 09 May 2018 and stipulates that, in order to increase alignment between the interests of Non-Executive Directors and the interests of shareholders, Non-Executive Directors should have a shareholding in Macmahon (directly or indirectly) that meets or exceeds the following minimum values (determined based on the volume weighted average price of Macmahon shares on ASX over the 30 calendar day period prior to the most recent financial year end) within the following timeframes:

- (a) 25% of their remuneration value within the latter of one year after their initial appointment as a director and 30 June 2019;

- (b) 50% of their remuneration value within the latter of two years after their initial appointment as a director and 30 June 2020;

- (c) 75% of their remuneration value within the latter of three years after their initial appointment as a director and 30 June 2021; and

- (d) 100% of their remuneration value within the latter of four years after their initial appointment as a director and 30 June 2022.

All shares to be acquired by participating Non-Executive Directors on vesting of share rights will be acquired on-market (and will not be newly issued shares). Accordingly, the NED SSP will not dilute existing shareholder interests and shareholder approval under the ASX Listing Rules will not be required for Non-Executive Directors to participate in the NED SSP.

--- end of excerpt ---

I like that a LOT.

So while things haven't panned out exactly as they had hoped, the incentive structures were there, and they were well crafted and created great alignment of interest. And if the (TSR) hurdles for Senior Management HAD been met, they would own a lot more MAH shares now and the share price would also be a lot higher due to the excellent TSRs we would all have enjoyed.

That's why I'm hoping they'll renew this arrangement with something substantially similar when it expires shortly (times out).

Management quality and track record, including their track record of making sensible capital allocation decisions (particularly with regard to M&A), and alignment of interests in terms of their remuneration arrangements, are things I consider very important, and MAH ticks all of the right boxes here.

Looking forward to their full year report for FY22 on Tuesday.

Disclosure: I obviously hold MAH shares.

21-Aug-2022: I hold Macmahon (MAH) shares, and I like the company a lot. They are the go-to contract miners for Australian (and, to an extent, also Indonesian) gold and copper-gold miners, they tend to negotiate LOM (Life-Of-Mine) contracts that embed them as partners with the mining company that owns the mine, and this gives us a fair amount of visibility around their future revenue, something that is often hard to determine or estimate with many other mining services companies.

https://www.macmahon.com.au/investor-hub/

Macmahon Euroz Hartleys Conference Presentation [09-March-2022]

Firstly, here's their client list, and how that has grown over the past 4 years which has been partly due to acquisitions.

Note that Boston Shaker is the underground mine at Tropicana, hence the same clients for both. Tropicana is the open pit mine there and Boston Shaker is the underground extension of that gold mine. Traditionally Macmahon have been open pit mining specialists, however they acquired GBF in 2019, an underground mining specialist company (who also focused mostly on gold mining companies as clients) and that acquisition also bought clients like Silver Lake across to MAH. The guys who founded and built up GBF came with the company and still work for MAH, and the integration has worked well.

Macmahon goes underground with GBF tilt | The West Australian

Macmahon buys GBF for $48m-plus (businessnews.com.au)

Prior to the GBF acquisition, MAH bought another company, TMM Group, back in 2018. TMM Group was a Brisbane-based group of companies that provided civil construction and operations and maintenance services to the Queensland coal mining industry. Macmahon stated at the time that the acquisition of TMM would provide them with additional civil capability that they expected to be an enabler to core mining work through contracts for initial site earthworks and construction services, as well as the ability to target site rehabilitation projects.

Macmahon to acquire TMM Group - Mining Magazine

They did not disclose the purchase price (for TMM) at the time of the acquisition.

Macmahon to acquire TMM Group (irmau.com)

Looking back at those two business acquisitions now, GBF was certainly purchased for a very good price from Macmahon's perspective, and I assume TMM was also, and the two acquisitions have really propelled Macmahon into now being full service miners for the gold sector and other sectors, with other mining services available as well (such as site prep, construction and site rehab).

The next slide shows how they've grown their order book (work in hand) but how their EPS growth and their share price have significantly diverged. In other words, their share price has gone down while the core metrics of the business have been improving.

Here's an overview of the business:

They are slated to report their FY22 full year results this coming Tuesday (23-August-2022) by the way.

Here's what the company has delivered over the past 4 years in terms of revenue and earnings (profits).

Here's their strategy for the next few years:

The following shows how 78% of their revenue in the first half of FY22 was derived from working for either Gold miners or Copper/Gold miners (22% from "other" miners), and how they plan to diversify this revenue in the future in terms of commodities.

And the following shows how they plan to further diversify their revenue in terms of the types of work they perform for their clients.

They do have a "People" focus, which I do appreciate. I believe that positive company culture is very important and provides companies with a competitive edge. We hear often about people who leave companies describing the culture as toxic and the management in far from flattering terms ("Glass Door" reviews and so on) and I really want to avoid companies like that who do not value their employees properly.

The first slide below shows Macmahon's commitment to employee development, and the one below it also touches on positive culture and how Macmahon not only view workplace sexual harassment as unacceptable, but also as a serious safety hazard. Classifying something as a safety hazard can only give it even further focus and scrutiny as keeping employees safe and reducing or eliminating accidents, injuries and incidents is so important in terms of key performance indicators these days. Lost time injuries (or LTIs) is something that almost every company is very focused on reducing. Apart from it clearly being the right thing to do, there is also an economic reason to do this. Many of these companies are self-insured, and the cost of insuring their workers ("work cover") is directly linked to the number of LTIs they experience each year, as well as the company's ability to prove to their insurers that they have good enough policies and procedures in place to keep their workers safe and free from harm. And that does include making sure all employees know the importance of safety, what it means, and how to achieve and maintain a safe workplace environment. That now includes eliminating bullying and all forms of harassment.

Those who are not self-insured have to pay fees to the relevant state government body (such as "WorkCover" here is SA) and once again their fees are linked to their safety record.

There is also often a lot of focus on keeping people safe and providing an inclusive and supportive working environment for everybody that comes from the top - from company Boards, as part of their good governance and oversight responsibilities, so the message is reinforced from the top down with the better companies. Instead of just being posters on the walls and company policies, it should actually translate to the frontline (or "coalface") workers feeling safe and respected at work, and knowing what they need to do to sustain that. And the company also needs to have a well promoted and easy-to-use whistle-blowers policy and system so that people can feel free and confident to easily speak up and report abuse and harassment, etc., and it can be dealt with in a timely and effective manner without any victimisation.

The following shows how Macmahon is incorporating new technology into their business and that they have a focus on embracing this tech, as well as reducing carbon emissions produced by their fleets of earthmoving and mining equipment.

This is how they like to summarise themselves:

And now, some background. I knew about Macmahon before I read about the reasons why Forager (ASX: FOR) invested in them, but that did open my eyes a fair bit to the opportunity. Back in 2017, while Forager had a substantial investment in Macmahon, CIMIC Group (the renamed Leightons Holdings) tried to take Macmahon over.

CIMIC unveils takeover offer for Macmahon - Australian Mining [14-Jan-2017]

That takeover was at 14.5 cents per share, valuing Macmahon at $175m. Forager and other shareholders thought this offer was too low and very opportunistic and encouraged the Macmahon board to reject it. I think everybody knows who CIMIC was, and also Leighton Contractors/Leighton Holdings (their previous company names), but for anybody who doesn't (living under a rock perhaps) suffice to say that CIMIC are no longer listed on the ASX, having been taken over in May this year by their controlling German shareholder Hochtief, which is (in turn) owned by giant Spanish contractor Grupo ACS. [Cimic’s 60-year ASX reign ends (afr.com)] [May 2022]

Because CIMIC already owned over 20% of Macmahon when they launched their takeover bid, it was a hard one to defend, but Macmahon did it, with a lot of help from Indonesian mining company, PT AMNT, whose subsidiary Amman Mineral Contractors (Singapore) Pte Ltd bought 44.3% of Macmahon and awarded them their largest contract ever, the US$2.8 billion mining contract for the Batu Hijau copper/gold mine in Indonesia. This issue of new shares to PT AMNT also had the effect of diluting CIMIC's ownership of Macmahon and providing a larger shareholder who could veto CIMIC's intentions regarding the MAH Board and ownership. However, just as people had previously been wary of investing in CIMIC because so much of CIMIC was owned and therefore controlled by Hochtief who were themselves owned by Grupo ACS, people also became wary of Macmahon when 43% of Macmahon became owned by a previously little-known (to ASX retail investors and most Australian fund managers at least) Indonesian mining company (PT AMNT).

The past five years have however shown that AMNT have been very supportive shareholders of MAH and have not attempted to interfere in the way Macmahon has been managed or with Macmahon's strategies.

It is probably instructive to have a browse through the historic timeline that Macmahon provide here: https://www.macmahon.com.au/about/our-history/

OK, now for some historical metrics. The first lot is from FNArena [https://www.fnarena.com/index.php/analysis-data/consensus-forecasts/stock-analysis/?code=MAH]

Of the seven brokers that FNArena covers (UBS, Credit Suisse, Morgan Stanley, Ord Minnett, Macquarie, Citi and Morgans), Macquarie is the only one that covers Macmahon Holdings (MAH). The following are the FNArena's summaries of what Macquarie have said about MAH in every client update back to the beginning of 2015, in reverse-chronological order, so latest first, oldest last.

You will see that Macquarie ceased coverage of MAH back in late February 2015, then re-initiated coverage in June 2021. Their latest update is directly below where they have reduced their target price (TP) from 30c/share down to 20c/share and maintained their "Outperform" rating. The main reason for the TP reducing is "cost and labour headwinds, and increasing competition continuing to impact on margins" across the mining services sector. They add that in a worst-case scenario, labour shortages could see providers default on contracts. It should be noted that this is a sector view taken by Macquarie and is not specific to Macmahon, although it HAS impacted Macquarie's TP for MAH.

And this is from Commsec [https://www2.commsec.com.au/quotes/financials?stockCode=MAH&exchangeCode=ASX#/financials/company]

So I think this all demonstrates that Macmahon as a company have very decent metrics and most of them are improving, but that they operate in a sector that has some headwinds. Their FY22 full year report on Tuesday will be instructive, in particular about whether they have been and are still able to pass increased costs on to their clients or are instead making less money due to reduced margins. I suspect they have structured contracts so that they are able to pass most or all cost increases through to clients, but we shall see.

Finally, regarding their largest contract the Batu Hijau alliance mining contract for PT AMNT in Indonesia, there is a profit sharing element that highly incentivises Macmahon senior management to ensure that the contract performs well. I won't go into too much detail about that other than to say that Steve Johnson at Forager Funds was alert but not alarmed when he responded to it a few years ago. While a lot of money in the form of profit-sharing bonuses could go to senior management at MAH, Steve points out that for that to occur, Macmahon would have to perform exceptionally well, and that should in all likelihood be reflected in an increased share price, so there would be benefits to ordinary shareholders as well, even though the bonuses did appear to be exceptionally generous. The main point was that the bonuses had to be earned and the hurdles were reasonably high, and were based on increased profits, so all-in-all, a good alignment of interests between company management and ordinary shareholders in Macmahon.

I hold MAH shares. My two favourite mining services companies who do the actual mining for mining companies are NRW Holdings (NWH) and Macmahon (MAH), and I hold shares in both of those companies in multiple portfolios.

I am also obviously a gold bull, so Macmahon's exposure to that industry is also a positive in my view, although I do note they are planning to diversify more away from gold and copper/gold miners in the future for risk management purposes.

Macmahon are cheap at current levels in my opinion (sub-20c and particularly down around 16 to 18c/share). They are in a sector that is not loved much by the market at this point in time, but they are one of the better operators in that sector and could be viewed as one of the babies that's been thrown out with the bathwater.

They are now paying dividends, which are increasing every year, they have decent metrics which are heading in the right direction, and they are well placed to navigate through the well-known current industry headwinds of higher costs and labour shortages.

They are also well placed to rebound strongly when sentiment around mining services companies turns positive once again.

Further Reading:

Contracting a Strong Result - Forager Funds [October 2019]

Cost Pressures Slam Mining Contractors - Forager Funds [June 2021]

Macmahon shareholder Forager Funds says CIMIC bid is too low (afr.com) [January 2017]

Edit: I have just made some minor grammatical changes, and one correction, which is that I had incorrectly said that Forager had encouraged the Forager board to reject CIMIC's takeover offer, and I have now changed that to read that: Forager had encouraged the Macmahon board to reject CIMIC's offer, which makes a lot more sense.

Of course, that means I've lost all 8 votes already received for this straw, so I'd encourage those who have already voted up this straw to do so again if you're no longer listed as having given it an upvote. Votes don't mean that much to me but it's a good way for people to find decent content on the basis that the more votes something receives, the more likely that it is worth taking the time to read (or skim through at least). That's the way I think about content here anyway.

09-June-2021: I am no longer a shareholder in FOR - the Forager Australian Shares Fund (FASF) LIT (listed investment trust), however I do follow what they are holding. Currently their portfolio includes two mining services companies - Perenti Global (PRN), which used to be called Ausdrill, and Macmahon Holdings (MAH), a company that FOR have held for at least 7 years - I also hold MAH, but not PRN, as I am still a little wary of Perenti from their Ausdrill days and concerns I had about them back then, including corporate governance issues. The following is a link to a weekly video from FOR in which Steve Johnson talks with Alex Shevelev about mining services as a sector (and the opportunity and risks of investing in the sector currently) and those two companies in particular.

Labour costs are continuing to inflate around the country while miners are buoyed by high commodity prices. So where does that leave mining services companies?

Forager Chief Investment Officer, Steve Johnson, talks to Forager Australian Shares Fund (FOR) senior analyst, Alex Shevelev, about the Fund's investments in mining services companies Macmahon (MAH) and Perenti (PRN) in this short video:

7-June-2021: Forager: Cost Pressures Slam Contractors (and Maybe the Rest of the Country)

14-Aug-2022: Disclosure: I hold MAH shares.

03-Mar-2021: St Barbara appoints Macmahon as new underground mining contractor at Gwalia

SBM have appointed MAH as their new underground mining contractor at their flagship Gwalia mine in WA, replacing Byrnecut, a private company who has been providing that service for many years. In their report last week (Tues 23-Feb-2021), Macmahon talked about their huge tender pipeline, and it is reasonable to expect them to win a fair percentage of those tenders, particularly with gold miners (like SBM), as Macmahon are now the leading listed gold mining contractor in Australia, both for underground (UG) and open pit (OP) mining. I hold SBM and MAH shares.

MACA (MLD) is the other ASX-listed contract miner who also specialises in the gold mining industry, and both MAH & MLD have the majority of their revenue coming from Australian ASX-listed gold miners. NRW Holdings (NWH) are also active in the sector, but the majority of NWH's contract mining clients are actually iron ore miners now, not gold miners. MLD are close to a 50/50 split between gold and iron ore, but I believe the majority of their revenue still comes from gold, and MAH are clearly working mostly for gold and copper/gold miners.

24-July-2021: I did originally place this straw under MLD in error, and I am now adding it under MAH. I have also updated that last paragraph to reflect that NRW Holdings is no longer exposed as much to the gold industry as they used to be.

Disclosure: I currently hold shares in MLD, MAH and NWH.

23-Feb-2021: FY2021 Half Year Results ASX Announcement plus FY2021 Half Year Results Investor Presentation and Interim Financial Report 31 December 2020 plus Appendix 4D

Macmahon continues earnings and margin growth in first half FY21

- Increased earnings and cashflow

- Revenue of $652.5m, down 5% pcp

- Underlying EBITDA* of $121.2m, up 6% pcp, EBITDA margin 18.6%

- Underlying EBIT(A)** of $46.5m, up 5% pcp, EBIT(A) margin 7.1%

- Statutory Net Profit After Tax of $44.8m, up 56% pcp

- Operating cash flow*** of $96.7m, up 7% pcp

- Strong balance sheet for growth

- Gearing**** at 20.0% and Net Debt/EBITDA of 0.5x

- Available liquidity of $255m (cash on hand of $148.4m)

- Interim dividend increased to 0.30cps (20% franked), up 20% pcp

- Order book of $4.2bn*****, including preferred contract worth $220m

- Tender pipeline of $7bn

- FY21 guidance******:

- Revenue $1.3bn – $1.4bn (reduced from $1.4bn - $1.5bn, due to accounting treatment of certain revenue at Batu Hijau)

- EBIT(A) $90m – $100m (unchanged, as Batu Hijau accounting treatment does not impact EBIT)

Macmahon Holdings Limited (ASX:MAH) has delivered earnings growth for the six months ended 31 December 2020. Statutory Net Profit After Tax increased to $44.8 million together with growth in underlying EBIT(A), margins and operating cash flow.

Revenue fell by 5% over the prior corresponding period (‘pcp’) to $652.5 million, due to a change in accounting treatment on certain client provided consumable items at Batu Hijau. Operational changes relating to COVID-19 have restricted control of these items, meaning revenue and costs have not been recorded, consistent with the application of accounting standard AASB 15*******. As there is no margin associated with these consumable items, earnings have not been impacted. Excluding this change, revenue grew approximately 3% across the remainder of the business.

Underlying EBITDA* increased by 6% to $121.2 million (EBITDA margin 18.6%) and underlying EBIT(A)** was up 5% to $46.5 million (EBIT margin 7.1%), reflecting an increase in activity across the Company’s operations.

This earnings growth has been delivered in a COVID-19 environment where disruptions to business and travel, and the risks posed to health and wellbeing were actively managed. Notwithstanding some additional costs and a tight labour market, the Company has been able to maintain earnings and margin growth.

Macmahon has recognised a $17.9 million Deferred Tax Asset in the results due to a change in the Australian income tax legislation announced in the October 2020 Federal budget, which provided an incentive to fully deduct the investment in new Australian capex. This has contributed to the 56% increase in in Statutory Net Profit After Tax of $44.8 million.

Cash Flow, Balance Sheet and Dividends

Macmahon generated operating cash flow (excluding interest, tax and M&A costs) of $96.7 million, representing a conversion rate from underlying EBITDA of 79.8%. Macmahon expects further improvement in cash conversion in the second half of FY21 in line with its full year target of 85%.

Capex for the half was $138.9 million, of which $46.1 million was sustaining capex. For the full year, total capex is forecast to be $230 million (up from $175 million previously), which comprises sustaining capex of $95 million (unchanged), $40m for extensions (Mount Monger, Deflector, Nicolsons, Batu Hijau) and growth capex (Foxleigh, Byerwen, Boston Shaker, Solomon, Bellevue) of $95 million. The Company remains focused on disciplined capital management and targets all capex to achieve at least 15% return on capital employed over the contract life.

Macmahon has continued to maintain a strong balance sheet, with gearing of 20.0%, cash on hand of $148.4 million, and net debt of $129.0 million at 31 December 2020 (all-inclusive of AASB 16 Leases).

Macmahon increased and extended its debt facilities during the period to $170 million from $75 million at a competitive interest rate of sub 3% plus swap. As a result, the Company is well placed to fund growth opportunities with cash and unutilised facilities of $255 million.

The Board has declared an increase in interim dividend to 0.30 cents per share for the half year ended 31 December 2020 (1H20: 0.25 cents per share). This represents a 20.7% payout ratio, which is in line with the Company’s current dividend policy payout range of 10 - 25%. The interim dividend will be partially franked (20%), with a record date of 17 March 2021, and will be paid to shareholders on 7 April 2021.

FY21 Guidance, Order Book and Outlook

Macmahon maintains its EBIT(A) guidance of $90 – $100 million******, which incorporates an increase in AUD:USD assumption from 0.72 to 0.75.

As a result of the change in revenue treatment at Batu Hijau, the Company’s FY21 revenue is now expected to be in the range of $1.3 billion – $1.4 billion, restated from $1.4 – $1.5 billion previously.

Macmahon’s order book as at 31 December 2020 excluding the Batu Hijau revenue adjustment was approximately $4.17 billion, which includes $322m of new work (Foxleigh and other contract wins). Following the award of a new contract extension at Deflector and finalisation of the Warrawoona contract (for which the Company is currently the preferred tenderer), the order book will stand at approximately $4.21 billion.

Macmahon is also in the process of finalising the commercial model for another significant cut back at Batu Hijau with AMNT (‘Phase 8’), which will extend the current mining activities by another 6 years from 2022 to 2028. As part of this process, Macmahon is in discussions to remove certain ‘pass-through’ costs on which no margin is earned. If finalised, this change will improve working capital, tax efficiency and reduce forex exposure.

Macmahon remains positive about the longer-term growth prospects with a current tender pipeline of approximately $7 billion, of which $3 billion relates to new clients and $1.2 billion in underground work, with the majority based in Australia. Excluding potential extensions, the Company has current submitted tenders of circa $2.2 billion and tenders under preparation of $1.6 billion.

Commentary

Commenting on the first half and the outlook for the Company, Macmahon’s Chief Executive Officer and Managing Director Michael Finnegan said:

“Macmahon has produced a solid first half result and I am pleased the business has continued to deliver growth in earnings and margins, despite COVID-19 disruptions and currency headwinds.

The first half was a consolidation period, but an important one for the business with continued growth of the underground division, and the award and appointment as preferred contractor for various projects including Foxleigh, Warrawoona, Coburn, Bellevue and Nicolsons. Since half year end, we have also secured the Deflector extension. This additional work of approximately $760 million aligns with key elements of our strategy and provides us with a solid platform for continued earnings growth.

The resource sector outlook is robust driven by high commodity prices and supportive capital markets. As a result, we have seen many clients advance their projects into the tender stage. This pending wave of potential awards over the next 12 months is reflected in our significant tender pipeline and our focus will be on converting more opportunities to drive growth into FY22 and beyond.

In addition, we will leverage off our competitive advantage of being able to service both surface and underground mining concurrently, expand our service offering across the mining value chain and optimising the safe delivery of our order book. This will be supported by our continued investment in people, mining technology and ongoing digital transformation.”

--- ENDS ---

Notes:

- (*) Underlying EBITDA is earnings before interest, tax, depreciation and amortisation, share based payments and M&A transaction costs. A reconciliation of Non-IFRS financial information is contained on slide 29 of the Company’s half year results presentation.

- (**) Underlying EBIT is earnings before interest and tax, share based payments and M&A transaction costs and GBF amortisation of customer contracts.

- (***) Net operating cash flow excluding interest and tax and M&A costs

- (****) Gearing = Net Debt / (Net Debt + Equity)

- (*****) Pro forma as at 23 February 2021, adjusted for Batu Hijau revenue treatment, includes Deflector, and Warrawoona (preferred tenderer)

- (******) Guidance assumes an exchange rate of AUD:USD 0.75 and excludes one-off items and amortisation related to the GBF acquisition.

- (*******) AASB 15, if a customer contributes goods, to facilitate fulfilment of the contract, an assessment is required as to whether the Company obtains control of these contributed goods.

--- click on the links at the top for more - I hold MAH shares, and they are also on my Strawman.com scorecard. ---

Macmahon secures 4 year $220m contract at Deflector underground mine

Macmahon Holdings Limited (ASX:MAH) (‘Macmahon’ or ‘the Company’) is pleased to announce that its underground mining division has been awarded a 4 year contract with Silver Lake Resources (ASX:SLR) (‘Silver Lake’) to perform the mining works at the Deflector gold and copper mine in Western Australia.

A Macmahon subsidiary, GBF, has been providing underground mining services at the Deflector mine since mining commenced in early 2016. Macmahon acquired 100% of GBF in 2019, and this business is now an important part of the Company’s strategy to expand in the underground mining services market.

The new contract with Silver Lake will run until April 2025, and is expected to generate approximately $220 million in revenue for the Company over this period. The contract is a full service mining contract and therefore incorporates all underground development, ground support and production activities, including the provision of all labour and mobile mining equipment.

21-Oct-2020: 2020 Annual General Meeting Presentation plus 2020 AGM - Address to Shareholders

Also: Preferred contractor for $250 million Foxleigh project

[I hold MAH shares.]

A Record Year – Financial Highlights (from page 13 of the presso - 1st link above):

- FY20 Revenue: $1,380.4m, up 25% on FY19

- FY20 Record underlying EBITDA*: $238.7m, up 32% on FY19

- FY20 Record underlying EBIT(A)*: $91.6m, up 22% on FY19

- FY20 Record reported NPAT: $64.9m, up 41% on FY19

- FY20 Record operating cash flow**: $218.4m, up 73% on FY19

- Net Tangible Assets: 22.1 cps, up 9% on FY19

- Return on Equity***: 14.6%

- Return on Average Capital Employed****: 14.8%

- FY20 Dividend: 0.60 cps, up 20% on FY19

- Order Book: $4.5bn

- Tender Pipeline: $7.5bn+

- Gearing [ND/E]: 10.9%

Notes:

- (*) Underlying numbers include total adjustments of $4.2m – refer to slide 30 of FY20 results presentation

- 2(**) OCF: Net operating cash flow excluding interest and tax and M&A costs

- (***) Underlying NPAT (A) / Average Equity

- (****) Underlying EBIT (A) / Average (Total Assets – Current Liabilities)

In addition to those exceptionally positive highlights, achieved in a year when many companies are/were blaming the COVID-19 pandemic for their own sub-par results, I hold MAH because the majority of their clients are gold mining companies, who currently have the strong tailwind of a high gold price. I am bullish on gold and believe we are in a multi-year gold bull market, with significant further upside. Companies like MAH provide good "pick and shovel play" exposure to that thematic, and MAH are a very good company in their own right - and are exceptionally well run. They do have Indonesian and PNG exposure, but they have the board and management to navigate through and manage those risks in my opinion. Most of their clients are Australian companies operating in Australia.

16-June-2020: ASX CEO Connect June 2020 Presentation

That link will take you to the Presentation slide pack that will be used by Macmahon (MAH) CEO & MD, Michael (Mick) Finnegan today at the ASX CEO Connect event. For more information on ASX CEO Connect, click here.

Disclosure: I hold MAH shares.

Strandline (STA) advancing major execution contracts as part of project financing and in readiness for construction.

HIGHLIGHTS:

- Early contractor involvement (ECI) agreement executed with Macmahon Holdings relating to mining services contract for Coburn project

- Under the mining services contract, Macmahon will provide and operate the large mining fleet associated with ore mining, overburden removal, pit backfill and land recontouring

- Macmahon is a well-established leading mining contractor, with significant experience in the Australian resources sector, including in mineral sands

- ECI agreement contains a detailed term sheet for an alliancing-style commercial framework with gain-and-pain share metrics linked to cost and performance targets

- Terms of the ECI agreement are based on the mine plan, methodology and productivity pricing assumptions contained in the Coburn DFS

- This agreement follows the completion of major binding offtake contracts with some of the world’s leading consumers across Europe, America and China (see ASX releases by STA on 20 April 2020)

- With the DFS completed and key development approvals already in place, Coburn is development-ready pending finalisation of project financing

--- click on link above for more ---

Steve tips MAH at around the 3:30 mark as his pick for a company that is going to produce some sustainable cashflow through this cycle. MAH is in Forager's Australian Shares Fund (ASX: FOR) and Steve explains why. I also hold MAH and I'm bullish that they'll get through this better than many other mining services industry participants due to their clients and the nature of their contracts (multi-year and often life-of-mine contracts, i.e. long term). Ben's tip is Objective Corp (OCL).

20-Mar-20: I've written plenty on MAH, so I'll keep this brief. They've been sold down from 30c to 18c, on poor sentiment and fund redemptions. However, the vast majority of their clients are gold miners, they have long-term (multi-year) contracts that are based on tonnes of ore processed (not linked to commodity prices), and excellent management. Like with NWH (NRW Holdings), this is a great opportunity to buy a quality company at a significant discount to their intrinsic value.

Some time in 2018 (before I started dating my straws):

Macmahon (MAH) have new management (Mick Finnegan), a new major (Indonesian) shareholder, have fought off a takeover attempt by CIMIC (CIM), are Forager's (FOR's) largest holding in their Australian Equities fund, and have taken steps to fix all of their prior year issues, including the losses incurred at Newcrest's Telfer gold mine - which was probably one of their biggest issues. There is heaps of upside if they can outperform on their biggest contract - which is the Batu Hijau contract (for their largest shareholder, PT AMNT). They have a gain share/pain share agreement where the pain is limited to basic project costs, but the gain side is pretty much unlimited. Basically, the downside is they could make nothing at all on Batu Hijau, if they underperform, and that would still be significant because that contract is massive - currently around half of their entire order book, but - importantly - they won't LOSE money on the contract (like they have been at Telfer - working for NCM). The upside (the gain share) is significant however, and is not really priced in to the MAH SP at this point, in my opinion. Mick Finnegan has plenty of experience working in Indonesia and PNG, and plenty of friends and industry contacts there, so they are not venturing out into the great unknown here.

Steve Johnson at Forager wrote about MAH in their March Quarterly report (in April this year), and I'm going to try to post that in here in two posts (split due to the 2,500 character limit on posts). For now, here's a small bit of it:

New contract wins, paired with extensions of existing contracts, have left the company in a fortunate position compared to some other mining services businesses: it doesn’t have to constantly win new work. For the next four-odd years, Macmahon has a lot of committed revenue.

Macmahon Revenue by Contract:

Contract, Remaining Contract Term (years), Annual Revenue ($m)

Batu Hijau, 5, $530m

Tropicana, 6, $225m

Byerwen, 3, $117m

Telfer, 4, $80m

Mt Morgan, 5, $50m

Other, $100m

Total $1,102m ($1.1 billion)

Source: Macmahon and Forager Fund

Disclosure: I own MAH shares.

June 2018: This is the 2nd straw of 2 - Comments from FOR about MAH in FOR's March 2018 Quarterly Report:

Recent wins in WA and Indonesia have grown the small underground mining business. Acquiring TMM Group in February has also pushed the business into civil work for mine sites, which fits in well with Macmahon’s other services.

New contract wins, paired with extensions of existing contracts, have left the company in a fortunate position compared to some other mining services businesses: it doesn’t have to constantly win new work. For the next four-odd years, Macmahon has a lot of committed revenue.

Macmahon Revenue by Contract:

Contract, Remaining Contract Term (years), Annual Revenue ($m)

Batu Hijau, 5, $530m

Tropicana, 6, $225m

Byerwen, 3, $117m

Telfer, 4, $80m

Mt Morgan, 5, $50m

Other, $100m

Total $1,102m ($1.1 billion)

[Source: Macmahon and Forager Fund]

The business has now come full circle on growth and capital expenditure. The half just gone saw $232m spent on equipment (including $183m of gear purchased from AMNT using shares), compared to only $27m last year. More capital expenditure will be needed for current and future contracts.

Despite having people and expertise, Macmahon remains a business where capital expenditure on mining equipment is critically important. Spending on gear to grow is easy when times are good. But picking difficult contracts, or executing contracts poorly, can destroy profit margins and even cause losses. Telfer is a good reminder of what can go wrong. Macmahon needs to be careful.

By next year Batu Hijau and the two new contracts will be contributing earnings for the full year. If it executes well, without any new contract wins, the business should be generating close to $1.1bn in revenue and more than $85m of earnings before interest and tax. At the current price the business is trading around seven times after-tax earnings. Macmahon remains the largest position in the Australian Fund.

[Source: Forager Fund, March 2018 Quarterly Report]

02-Mar-2019: Moelis Australia have released an updated Broker/Analyst Report on Macmahon (post MAH's 1HFY19 results) which is available free via the "ASX Equity Research Scheme", and that report can be viewed here.

For more details on the scheme or to sign up for a free email every Friday afternoon with links in it to that week's free reports - see here.

Moelis rate MAH as a "Buy" with a target price of 30 cents, which is 27.7% above yesterday's 23.5 cent closing price.

Disclosure: I hold MAH shares.

30-Aug-2019: Busy day for MAH. They have emerged from their trading suspension with the news that the recent negotiations with Newcrest (NCM) have been more positive and the most likely outcome now is that the remaining work at Telfer will be profitable for Macmahon as Newcrest are likely to increase the rates that they pay Macmahon for the work they do there. MAH have therefore NOT made any provision for Telfer (onerous contract provision/write-down) in their FY19 accounts, which improves their numbers.

Speaking of numbers, they are good, and they've managed to reinstate their dividend payments as well, beginning with a half cent (30% franked) full-year dividend. As an MAH shareholder, and a shareholder in Forager's ASF (ASX:FOR, which has MAH as one of their top 5 positions), I'm very happy with this report. No nasty surprises, and plenty of positives.

Macmahon FY19 Investor Presentation

2019 Full Year Results Date and Conference Call Details

Macmahon delivers strong earnings uplift in FY19 and reinstates sustainable dividends:

- Revenue of $1,103.0 million, up 55% (FY18: $710.3m) and above guidance

- Underlying EBITDA of $181.4 million, up 52% (FY18: $119.2m)

- Underlying EBIT of $75.1 million, up 81% (FY18: $41.5m) and within guidance

- Underlying EPS of 2.69cps, up 74% (FY18: 1.55cps)

- Operating cash flow of $125.9 million, up 24% (FY18 $101.9m)

- Robust balance sheet with low gearing at 10.5%

- NTA of 20.3cps, up 8% (FY18 NTA 18.7cps)

- Advanced negotiations to increase contract rates at Telfer – no onerous contract provision recorded

- Reinstatement of dividends - FY19 final dividend of 0.5cps (partially franked)

- Strong order book of ~$4.7 billion, providing considerable revenue visibility

- FY20 revenue and earnings guidance of $1.2 billion - $1.3 billion revenue and $80 million - $90 million EBIT

“Consistent project execution has been a key focus for Macmahon and is driving a real transformation in Macmahon’s financial performance, with FY19 revenue more than triple what we achieved in FY17 and earnings moving from negative to strongly positive in that period.

“This reliable performance and the good revenue visibility provided by our $4.7 billion order book has underpinned the Board’s decision to reinstate dividends to Macmahon shareholders. The FY19 final dividend of 0.5 cents per share is the Company’s first dividend in seven years with the Board aiming to pay dividends on a sustainable basis going forward.”

Cash Flow and Balance Sheet

Macmahon generated operating cash flow (excluding interest, tax and settlement for the class action) of $125.9 million in FY19 (FY18: $101.9 million), representing a conversion rate from underlying EBITDA of 69.4%. The cash flow conversion was impacted by an increase in working capital due to delayed receipts from trade receivables of $24m slightly later than expected. Including payments from customers received in the first week of July 2019, the EBITDA conversion would increase to 82.6%.

Macmahon maintained a robust balance sheet in the year, with gearing of 10.5% at 30 June 2019, cash on hand of $113.2 million, and net debt of $52.7 million. When factoring in the delayed receipts from clients, net debt and gearing is reduced to $28.7 million and 6.0% respectively.

Outlook

The Company is well positioned for growth in FY20 with secured work in hand of $1.2 billion. The Company expects FY20 revenue of $1.2-1.3 billion, and EBIT of $80-90 million.

Mr Finnegan said: “Over the past 12 months we have continued to position the business for growth, both organically and through the strategic acquisition of specialist underground contractor GBF Group.

“These initiatives have been in line with our growth strategy to enable Macmahon to be a leading mining contractor that can service clients through the life cycle of their mining operations.

“The acquisition of GBF, our $4.7 billion order book, and significant tender pipeline means the Company is well positioned to deliver further earnings and cash flow growth in FY20.

“This growth is underpinned by consistent execution on our secured work in hand, and a tender pipeline of more than $7 billion in potential new revenue. This pipeline includes over $4.5 billion of projects where Macmahon is the preferred or exclusive tenderer. Many of these opportunities are with existing clients which, given our ongoing strong performance, puts us in a competitive position.

“In FY20, our focus will be to integrate the GBF business, continue to execute our order book safely and secure new work, whilst leveraging our collaborative end to end offering to benefit our clients, people, and our shareholders.

“These initiatives will be supported by continued investments in innovation and technology, and improving the capacity of our human resources through training, all aimed at strengthening both our service delivery and operating efficiency.”

--- click on links above for more ---

19 June 2019: Moelis Australia: Macmahon Holdings (BUY): GBF acquisition & Telfer update

EVENT: MAH has agreed to acquire underground mining contractor GBF for $48m upfront + two potential earnout payments in FY20 and FY21. GBF is expected to generate revenue of $180m and EBITDA of $20m in FY20. The acquisition will be funded by existing cash and the assumption of GBF’s debt; target completion is mid-August 2019. MAH also recently flagged issues at its Telfer contract but reiterated FY19 underlying EBIT guidance of $70-80m and guided to “growth in underlying EBIT in FY20” (pre GBF acquisition).

IMPACT: Telfer negotiation outcome expected by 5 August 2019. MAH is seeking a rate increase due to changes in the mine plan and remains confident on a positive outcome but should there be any delays, MAH has flagged the potential recognition of a $25-35m non-cash, onerous provision at its FY19 result, representing the future unavoidable costs (based on the current terms) until the expected completion of the contract in Jan 2023 (~$7-10mpa).

Headline GBF acquisition multiples appear attractive. The upfront acq. multiple is 2.4x FY20f EBITDA (~6x EBIT based on MAe) with potential to be reduced by the locked-box mechanism which provides MAH economic exposure to GBF from 1 Dec 2018 (not included in our estimates but conservatively estimated at ~$4m). Further, the earnout cap of $53.5m implies a total acquisition multiple of ~2.5x (or better) based on ~$40m EBITDA. No details were provided on individual contract tenure but our high level analysis suggests an average reserves-based mine life of ~2.4 yrs (6.4yrs on M&I resources). We also note that the upfront component represents “a small premium to NTA” which appears undemanding given the immediate access to mining fleet and skilled workforce. GBF’s FY20f EBITDA margin of 11% is lower than expected but it is understood that there is potential for margin improvement under a more efficient overhead structure.

Small increase to FY20e EBIT to $82m (prev: $81m) to reflect the acquisition offset by our conservative assumption of ongoing Telfer impact with potential upside to our #s from a favourable resolution at Telfer/acquisition synergies.

INVESTMENT VIEW: The acquisition of GBF increases MAH’s exposure to the higher barrier to entry, underground service offering + provides earnings diversification. At 6.1x FY20e EV/EBIT, MAH appears undervalued – upcoming catalysts include: 1) resolution of Telfer issues; and 2) delivery of FY19 results in line with/ahead of expectations (cons. EBIT: $73m). Retain BUY & $0.30 TP.

--- end of excerpt from Moelis broker/analyst report ---