Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

11-Dec-2023: Regis Resources (RRL) had a diabolical hedgebook that would have seen them continuing to sell a good portion of their gold at around half the current spot price through until the middle of 2024. However they've just closed that hedgebook out - see here: Closure-of-Hedge-Book.PDF

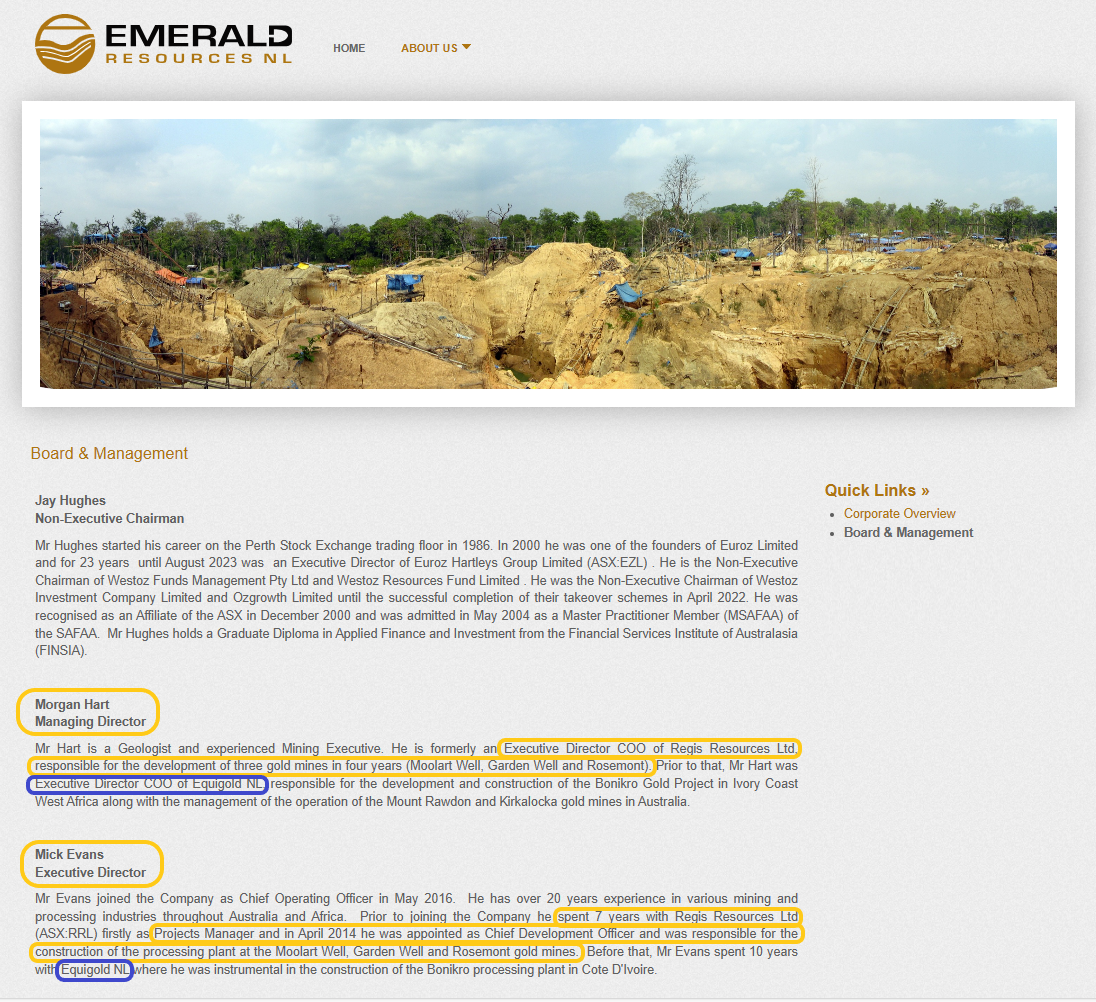

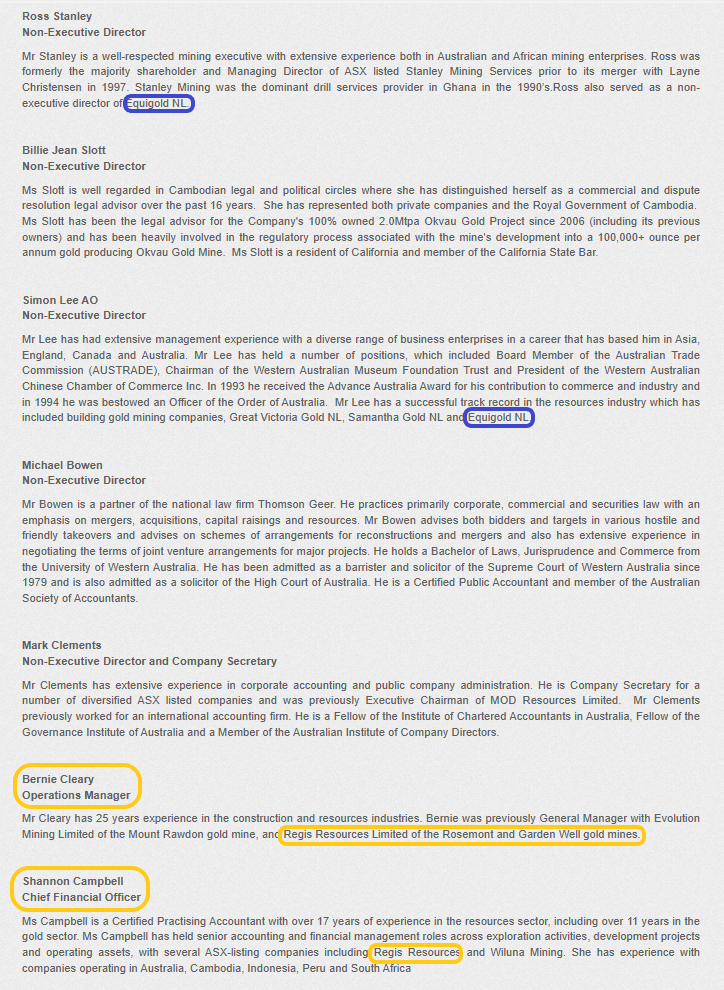

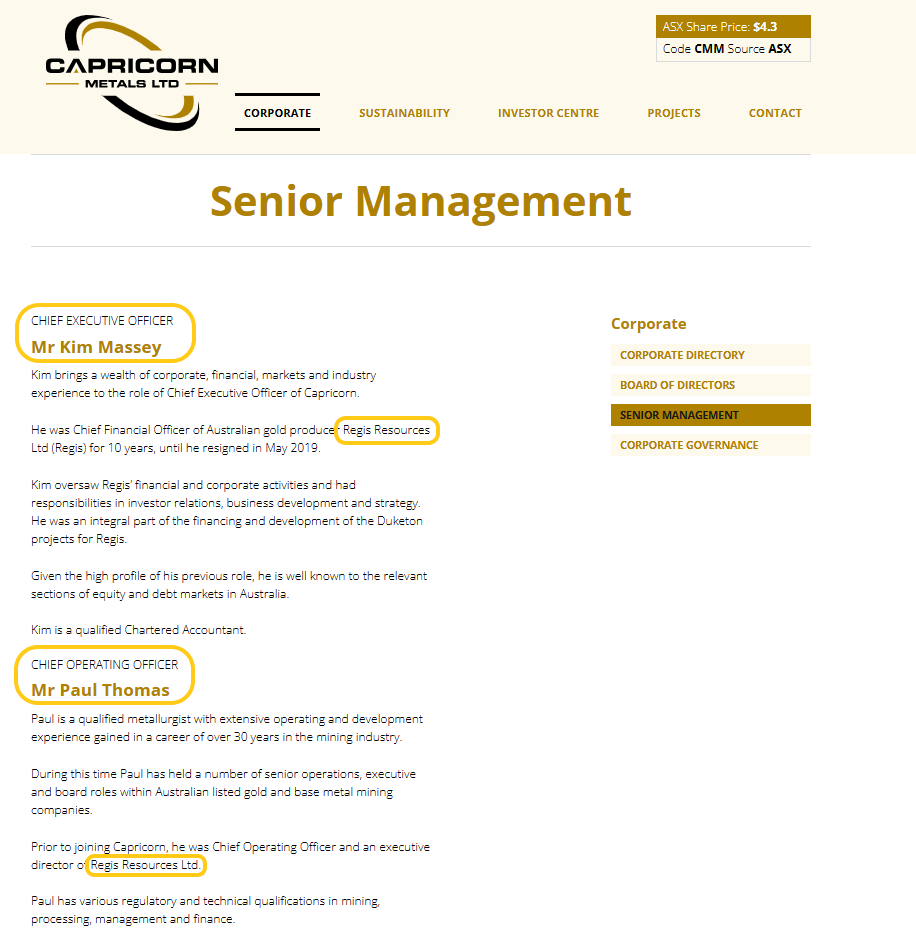

That's a very positive move by a management team that has made their fair share of mistakes. It's not the same management team who were there during the Duketon build-out when Regis were fast growing and also one of the best dividend paying gold companies in Australia - no, those people all ended up at either Capricorn (CMM) or Emerald (EMR) - see screenshots from their websites below - and that former management team would NOT have signed up for such low priced gold hedges that didn't even gurantee profitability in the recent inflationary cost environment. But this lot - that are in charge now - have finally bitten the bullet and closed out all of their hedges - and are now fully exposed to the high spot price.

Not before time!

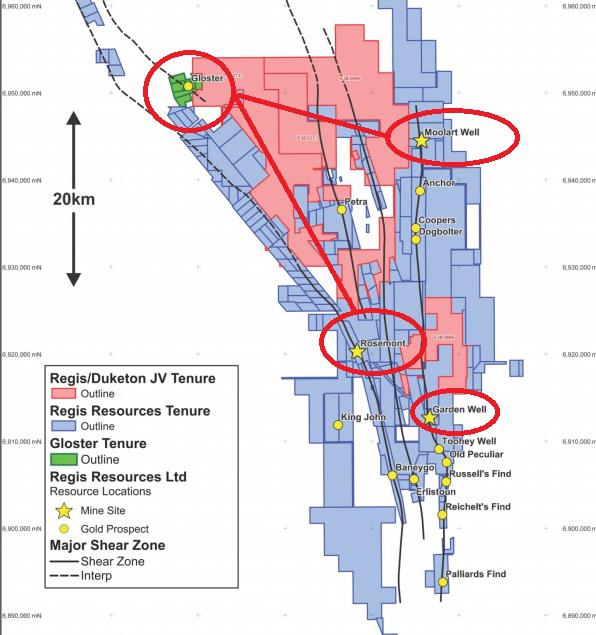

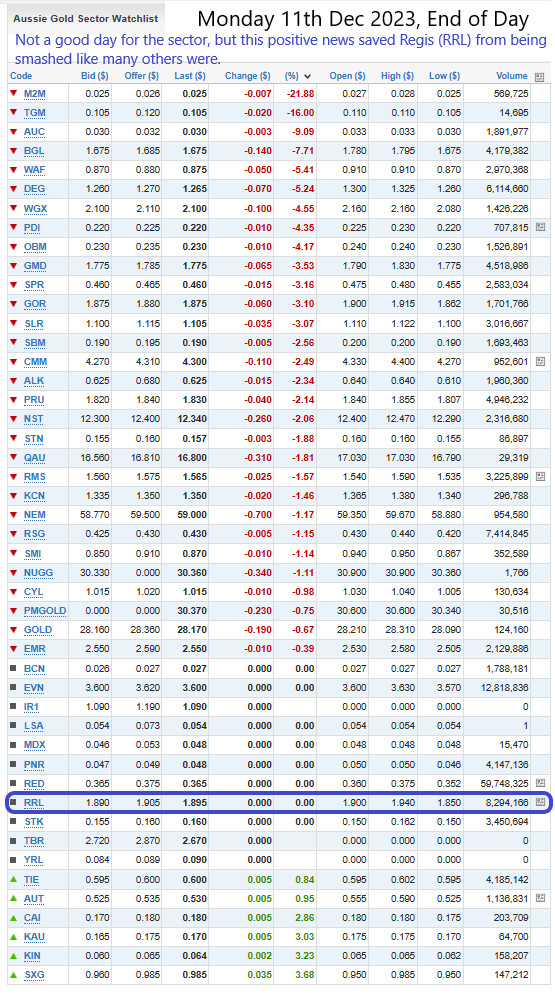

Their (RRL's) share price didn't rise, but it also didn't fall today, which was actually a good result, because there was a sea of red across the Aussie Gold Sector.

Here's where the early Regis management (prior to 2020) ended up. Some of them were together at Equigold before Regis:

I've highlighted some of the Regis experience in orange and Equigold in blue.

And here is a link to the list of current Regis Board and Management: Our Leadership - Regis Resources

DYOR if you are interested enough. Disc: I hold Regis (RRL) in my SMSF as part of a group of gold miners, but nowhere else currently. I hold CMM shares here on SM, and have held both CMM and EMR in real money portfolios previously, but do not currently hold any shares in either of them.

I am bullish on Regis IF they can get McPhillamys (in central NSW) up and running, but they're a few years away from that at this point. This news today about them now being unhedged is a definite positive. Imagine how much better off they'd be now if they'd done this last year!

I haven’t seen anyone talking about metals. In specific Gold & Silver. I am very Bullish of these 2 metals. They have started to show promise for there next powerful move up for the start of there 3rd wave to higher highs. I am looking to enter the American Market for these 2 metals, however just recently I have made great returns on RRL. They extracted a record amount of Gold and they are well run. That in conjunction with the Gold rally I see coming (and believe has already started in its infancy) should play out very nicely. Dont let me hype you though. You need to satisfy yourself ( I was supper hyped in the past by a name I wont say and now slowly clawing it back). We can all make mistakes. I love setting stop losses or alerts for my positions. I will come back with my chart tecnical analysis. for you soon.

The four logos at the top of that 14th June "Media Release" letter are the main 4 protest groups that RRL have to deal with in relation to developing their McPhillamys Gold Project.

- The Belubula Headwaters Protection Group (BHPG): The Belubula Headwaters Protection Group | Kings Plains NSW | Facebook - this group is the one most focused on McPhillamys. They were trying to stop it, but now that McPhillamys has been given development approval by the NSW Government, the BHPG is probably going to switch their efforts to trying to ensure that all environmental conditions stipulated in the approval documents are adhered to in full by RRL. They are also reportedly considering whether to spend the money required to appeal the approval decision. No appeal has been lodged to date.

- The Mudgee Region Action Group (MRAG): Mudgee Region Action Group (lueactiongroup.org) and Mudgee Region Action Group | Facebook MRAG is more concerned with stopping the Bowdens zinc/lead/silver project near the small village of Lue, 28 km east of Mudgee, but all of these groups are against mining and metals processing plants (including gold mills) in the NSW Central West region.

- The Cadia Community Sustainability Network (CCSN): Cadia Community Sustainability Network | Orange NSW | Facebook The CCSN is mostly concerned with the nearby Cadia mine, owned and operated by Newcrest Mining (NCM), and its environmental impacts, and holding NCM to account for environmental damage they might cause, but they also don't want a second open-pit gold mine in the area, which is what McPhillamys will be.

- The Central West Environmental Council (CWEC): About CWEC | Cwecouncil The CWEC is an umbrella network of district environment groups in the Central West of NSW. Member groups are based in Orange, Bathurst, Dubbo, Lithgow, Mudgee, Rylstone and other parts of the region. The CWEC provides resources to their member groups, helps to coordinate protests and meetings, submissions, etc, and organises Media Releases like the one at the top of this post on behalf of various member groups.

These groups held a public meeting yesterday (Saturday) in Orange:

If I see any newspaper coverage online (usually in the local rags like the Blayney Chronical or the Central Western Daily in Orange) of this or any other relevant meeting - I'll add a comment to this straw.

The last meeting they held was attended by around 100 people.

It is par for the course to encounter opposition to new mines being developed, however it is up to the mining company and the relevant government departments to ensure that the community and the environment are protected to the fullest possible extent and that all opposition concerns are heard and addressed. It is the mining industry's woeful prior track record that results in such opposition to new mine development, which is entirely understandable.

The industry needs to do a LOT better, and the relevant Government departments responsible for new mines being developed around the world are, for the most part, acting to enforce much greater environmental protections during the development and production phases throughout the mine-life of new mines that are approved for development. This means that companies wanting to develop new mines have to be prepared to spend a LOT more money these days than they would have had to spend 50, 40 or 30 years ago to develop a similar mine in a similar location.

The consultation and approvals processes are longer and more costly, they need to spend more on the design and construction to protect the environment (and their neighbours, including from excessive noise), they need to spend more during production to monitor environmental impacts (did somebody say Envirosuite? No? Just me then...) and there are much stronger compliance and reporting programs in place which also result in greater costs during the production years.

There are also usually higher costs included in a gold miner's ongoing AISC (all-in sustaining costs) during production, which relate to complying with environmental regulations and conditions. For instance, while mines can often still use Arsenic in the extraction process, that very toxic Arsenic has to removed from the tailings (a.k.a. waste slurry, which is all of the ore and processing chemicals and water used in the gold extraction process that remains after the gold has been extracted). And not just Arsenic. There are a lot of potentially harmful substances which can't be pumped out into TSFs (tailing dams) these days, especially in the better regulated countries like Australia and Canada.

Companies don't always get these responsibilities 100% right all of the time, but it can be very costly for them when they stuff up and do cause environmental damage, especially in countries like Australia and Canada.

To be clear, I am pro-mining, but only when the mining is done in an environmentally responsible manner, so I fully support these changes that have resulted in increased costs that miners have to endure. It means that the hurdles that new mines need to overcome are higher - the bar has been raised - so you need a project to be VERY good before you get serious about developing it into a mine, and that's a GOOD thing. And proper environmental protection during construction, commissioning and production, plus proper site rehabilitation after the mine has reached the end of its life, are essential.

It's just a pity that these much stronger approval processes and compliance monitoring/enforcement - plus environmental bonds that cover the rehab cost up front - were not introduced decades ago.

Disclosure: I am a RRL (Regis Resources) shareholder. I do not own NCM shares (NCM own the Cadia gold mine and mill). My IT (investment thesis) with RRL is fairly dependent on them getting McPhillamys into production in the next few years, as they aren't nearly so good without McPhillamys gold.

I expect most punters won't have the patience, or won't want to hold RRL shares during the next couple of years while McPhillamys gets built and commissioned. Meanwhile RRL have another year of low-priced gold hedges to close out, which limits their exposure to the higher gold price (much higher than their hedges which are all priced at AU$1,571/ounce and are due to last through to June 2024). So, RRL have gone from a low-cost, high-dividend-paying mid-tier Aussie gold miner to a middle-of-the-road-AISC, low-dividend-paying mid-tier Aussie goldie who are selling some of their gold at a loss over the next 12 months due to diabolical hedging mistakes by their overly conservative and short-sighted management team. Not much going for them, except for McPhillamys, which could be as good for RRL as nearby Cadia was for Newcrest. Cadia is not only Newcrest's best mine, it's their ONLY good gold mine - the other two (Telfer and Lihir) are rubbish IMO.

Further Reading:

McPhillamys gold mine, near Bathurst, approved to operate open-cut pit for 11 years - ABC News

McPhillamys Gold Project determination - NSW Mining

McPhillamys Gold Project | Mining, Exploration and Geoscience (nsw.gov.au) [McPhillamys Approval details from the Gov. Dept.]

Independent Planning Commission gives the go-ahead for McPhillamys Gold Project - McPhillamys

Green light for McPhillamys Gold Project - Mining Magazine

5_MGP_Community-Consultative-Committee-CCC-updated-310523.pdf (mcphillamysgold.com)

Community Consultative Committee (CCC) - McPhillamys (mcphillamysgold.com)

30-April-2023: I have recently written about this over in the "Gold as an Investment" forum, however I think it also deserves a straw under "Regis Resources", as McPhillamy's is their largest growth project, and this permission to go ahead from the IPC of NSW (in late March) has been a long time coming.

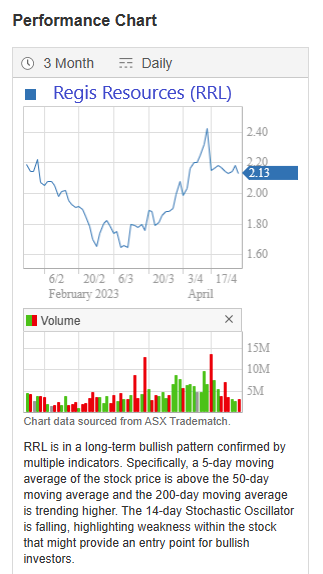

RRL have been in a nasty downtrend that is evident on their 3-year chart below, however they had a decent March and the first couple of weeks of April weren't bad either - the last two weeks have been fairly ordinary however...

Regis Resources (RRL) had a share price that rose +19.5% in March and another +2.4% in April, and while a lot of the recent rise can be attributed to the gold price which is making regular new all-time highs of late, they've also had a big win in late March with their McPhillamys gold project in rural NSW (not far from Newcrest’s flagship Cadia/Ridgeway mining complex) receiving approval from the NSW Independent Planning Commission (IPC) for an initial 11 year mine life – see here:

McPhillamys gold mine, near Bathurst, approved to operate open-cut pit for 11 years - ABC News [30-March-2023]

ABC Central West / By Xanthe Gregory and Hugh Hogan - Posted Thu 30 Mar 2023 at 1:35pm

The company has received conditional approval to extract gold for up to 11 years. (ABC Central West: Micaela Hambrett)

Regis Resources has received approval, with conditions, for its McPhillamy's Gold Mine at Blayney, near Bathurst, which includes an open-cut pit and tailings storage at the head of the Belubula River, as well as a pipeline to transfer water from Lithgow's Mount Piper Power Station.

The company intends to extract up to 60 million tonnes of ore, and, produce up to 2 million ounces of gold, during the mine's estimated 11-year life span.

The plans also include the construction of a 90-kilometre pipeline to supply excess water to the site from a coal mine near Lithgow.

The Department of Planning and Environment recommended the mine for approval, but, it was up to the NSW Independent Planning Commission (IPC) to make the final determination due to the number of submissions opposing the plan.

Key points:

- The mine has created significant debate in the community

- About 80 locals spoke about it at a meeting in February

- Strict conditions will be put on the mine's operator, Regis Resources

There was significant community debate about the mine.(ABC Central West: Xanthe Gregory)

The three-member panel found "on balance" the project was in the public interest.

The benefits, the IPC said, included "producing a significant mineral resource to meet the growing demand for raw materials".

It also said the mine would create employment, training and investment opportunities for the community, which would "outweigh the negative impacts".

Regis Resources wants to build the open-cut mine in the rural area.(ABC Central West: Tim Fookes )

In February, community members fronted IPC commissioners at a meeting.

About 80 people spoke, with most opposing the mine due to environmental concerns, particularly about water contamination, and, dust.

At least 85 people live within 2 kilometres of the proposed mine.

The IPC today acknowledged the various concerns about the mine, including its impact on Aboriginal cultural heritage, but said they could be "effectively avoided, minimised or offset through strict conditions".

In a statement to the Australian Stock Exchange, Regis Resources said it was "pleased" with the result.

"McPhillamys is one of Australia's largest undeveloped open-pittable gold resources and underpins significant value potential for Regis," said managing director Jim Beyer.

"We look forward to working with local communities, stakeholders and companies to mitigate the risks and concerns surrounding the project," he said.

Local environmental organisation The Belubula Headwaters Protection Group said it was disappointed with the decision but not surprised.

"We're working in a system that's skewed to approve projects like this, so unfortunately it's not surprising," said President Daniel Sutton.

Many locals are concerned about potential impacts on the Belubula River.(ABC Central West: Xanthe Gregory)

The group said it was good to see conditions placed on the mine to minimise impacts such as noise, dust and water but the focus should now be on enforcement.

"It's one thing for something to get approved and have conditions on it, but it's entirely different to actually enforce them," Mr Sutton said.

The group is now considering whether to appeal the decision to the Land and Environment Court.

--- ends ---

Related Stories

'It makes the village unliveable': Dust from gold mine will leave residents unable to open windows, panel hears

Critics claim proposed gold mine would risk food security, planning panel told

Mental health decline, fears for river dominate hearing into community's struggle with gold mine plan

So there is an option for the Belubula Headwaters Protection Group to appeal the decision, but I can't imagine an appeal would be succesful unless they are able to introduce new evidence or data that they have not already provided to the NSW DPE (Department of Planning and Environment) and/or the IPC (NSW Independent Planning Commission). Both sides have now had a number of years to present their case and I would expect that all sides of the argument have been carefully considered and, in the words of the IPC, "on balance" the project was deemed to be in the public interest.

In handing down their decision the IPC said that the benefits of the proposed mine (McPhillamys) included "producing a significant mineral resource to meet the growing demand for raw materials".

It also said the mine would create employment, training and investment opportunities for the community, which would "outweigh the negative impacts".

So, as I said, I'm not counting my chickens yet, but it's looking positive, and I just need to give Regis time to progress this through. They have allowed for a substantial amount of spending in relation to progressing the McPhillamys gold project in the current and the next financial year, so I'll continue to watch and wait. In the meantime, they continue to benefit from their 30% stake in Tropicana and their 100%-owned Duketon assets (producing gold mines in WA).

They are saying that McPhillamys has at least 2.5 million ounces of gold there and that they expect to extract at least 2 million of that during the initial 11 year open-pit period (that they have been approved for at this stage). Anybody who knows anything about Newcrest's (NCM's) nearby Cadia mine, without which NCM would be a total basket case in my view, as Cadia is the only really good gold mine they have (Telfer is rubbish, and Lihir has been a huge disappointment), may have an inkling about just how good McPhillamys may well end up being. Cadia is the mine that just keeps on giving for Newcrest.

Newcrest's flagship Cadia/Ridgeway gold mine and processing plant is shown there (in the map above) to the left (west) of McPhillamys, which itself is west of Bathurst and NE of Cowra (and very close to Blayney). Cadia is the open pit and the processing plant, while Ridgeway is the underground extension of Cadia. Together they are known as Cadia/Ridgeway and they are by far the best asset that Newcrest Mining (Australia's largest gold mining company, currently under a takeover offer from the World's largest gold company Newmont Corporation) have. Their other producing mines, Telfer and Lihir are very inferior to Cadia/Ridgeway.

Anyway, McPhillamys is NOT in production yet, and they're probably still a couple of years off being in production, but I definitely want to still be holding my RRL shares when they start producing gold at McPhillamys (in addition to Duketon and Tropicana).

While the approval can be challenged (appealed), I would doubt that any appeal would be successful given the lengthy consultation process that has already occurred in the lead up to this decision by the NSW IPC. So this is an important milestone for Regis.

I should also note that I expect the initial 11 year mine life to be extended at some point, just as the mine life at Cadia has been. It is, after all, a heck of a lot easier to get permission to extend the life of an existing operating mine than it is to get permission to build a new one from scratch. The more gold they find (at good mineable grades) the greater the chances of a mine life extension down the track.

Disclosure: I hold RRL shares (both here and IRL).

Companies can have positive announcements too it seems. =)

"Regis Resources Ltd (ASX:RRL, “Regis” or the “Company”) is pleased to advise that the New South Wales Department of Planning and Environment (DPE) has assessed the McPhillamys Gold Project (“the Project”) as approvable with conditions. In accordance with the prescribed process, DPE has now referred the Project to the Independent Planning Commission of NSW (IPC) for final determination. "

https://hotcopper.com.au/threads/ann-mcphillamys-achieves-major-approvals-milestone.7093546/?source=email

Only a qualitative ballpark valuation. See other straw.

https://www.shortman.com.au/stock?q=RRL

Between 5 and 8% of the float has been shorted since January according to Shortman. It has dropped over 1% since April 6, which is curious.

Have been two directors increase their stake recently. Smallish trades, but significant.

Had a look at these guys today. DCF model here - https://docs.google.com/spreadsheets/d/1NmgXyvSXOiua11X8cENRz_Sg9auhpfIiIKzu66p6R6k/edit?usp=sharing

Main project is Duketon, 30% stake in tropicana, and potential project at McPhillamy's that looks attractive at this gold price.

Tropicana looks like it will produce between 135-150k pa. for at least 10 years (though I'd guess 15+)

Duketon looks like it will be producing for at least 10 years, though they do need to find more gold here. They roughly look like they will produce 340-380k p.a.

Adding these up, I think we're looking at 500k oz/yr. Company is expecting an upper AISC of 1365 for next year.

There are a few nuisances in the balance sheets. 300m is owed for their purchase of Tropicana, which from what I can work out looks like it needs to be paid back in 3 years, but interest is negligible or < inflation (~bank bill something +2%). There is also 320k of bad hedging over the next 3 years, which at a 1700USD gold price will cost them ~240m.

I've estimated 460k oz this year, 480 in 23, and 500k from 2024 onwards, an AISC of 1365, a Gold price of 1700USD, conversion of 1.4, and a tax rate of 30%, subtracting the hedging and repayments over the first 3 years. Using a DCR of 10%, I get a value after 10 years of 1.6 bil. Run that for another 10 years and you get a NPV of 2.3 bil. I think these assumptions are probably mostly on the conservative end, though it is very much ballpark as it doesn't really consider corporate costs or depreciation/amortisation (which should be a benefit).

Current market cap is 1.4 bil.

Oh, and I haven't even mentioned McPhillamy's, which has approval risks, but seems quite attractive at this gold price. This could generate another 200k oz/yr after maybe 3-5 years (at a guess). McPhillamys I think (don't quote me, dyor, had a NPV @ 5% of 525m at a gold price of 1600aud on their pre feasibility study).

I think I tend to agree with Bear's assessment. If everything goes wrong, these guys are looking fairly valued, but there seems to be a lot of potential for upside. I may selling some GOR shares and buy these tomorrow.

27-Sep-2021: https://www.ausbiz.com.au/media/the-call-monday-27-september?videoId=15169

That link will take you to "The Call" on Ausbiz at midday on Monday 27th September 2021 where Gaurav Sodhi from Intelligent Investor and Mathan Somasundaram from Deep Data Analytics both have a positive view on Regis Resources (RRL). The commentary on Regis starts from the 35 minute mark.

Gaurav says at one stage that Regis could be the cheapest gold stock on the market (at this point in time obviously, they have all fallen but Regis has clearly fallen more than most, this bit in brackets is my own commentary, not from Gaurav) and that the valuation looks extremely attractive. He also says that while Regis clearly overpaid for the 40% of Tropicana that they bought from IGO, that should not hurt them longer term because Tropicana is a wonderful asset, and one of the best three gold mines found in Australia over the past 20 years; it will be producing gold for decades to come, and with low costs as well.

While they both said that RRL is a Buy, the boys did not mention the ace up Regis' sleeve, being the McPhillamys gold project (in NSW), but I can tell you that if Regis get the approvals through for McPhillamys, it's going to cause a significant positive re-rating of Regis by the market, regardless of what the gold price is doing at that time, because McPhillamys is going to be a major gold mine with very attractive economics, and the fact that it is so close to (28 km from) Newcrest Mining's (NCM's) flagship Cadia/Ridgeway gold mining operations which processes approximately 27 to 30 million tonnes of ore per annum; Cadia produced 76,000 ounces of gold and 106,000 tonnes of copper in FY21.

Disclosure: I hold RRL shares.

FY21 Half yearly summary

Exploration Spend Cut A$7M to A$28M

Interim Dividend of 4 Australian Cents/Share (down from 8 cents)

EBITDA A$199m up 7% (from PCP)

EBITDA Margin 50%

1H Profit Before Tax A$123.2 Million, Down 9% On-Year

1H Net Profit A$84.8 Million, Down 9% On-Year

Net Profit Margin +21%

[Holding RRL]

27-Jan-2021: Evolution of value potential with Regis, Silver Lake combo - MiningNews.net

That article points out that the combined value of RRL (market cap = $1.9 b) and SLR ($1.5 b) of $3.4 billion looks a LOT cheaper than EVN's $7.9 billion market cap, even though the production numbers are not too different - comparing EVN with a combined RRL + SLR. And RRL is a superior company to SLR. In other words, RRL is cheap relative to larger peers.

While my numbers above are market capitalisation figures, I believe MNN (MiningNews.net) are using Enterprise value amounts in that article which includes in its calculation the market capitalisation of a company but also short-term and long-term debt as well as any cash on the company's balance sheet.

Either way you look at it, EVN (Evolution Mining) looks WAY more expensive than both RRL (Regis Resources) & SLR (Silver Lake Resources). Or, to look at it the other way around, RRL & SLR are a LOT cheaper than EVN. If you put RRL & SLR together, I daresay the combined company would most likely trade at a significantly higher multiple.

[I hold RRL, and EVN, but not SLR.]

Not a good quarterly hence weak price action. But maybe oversold

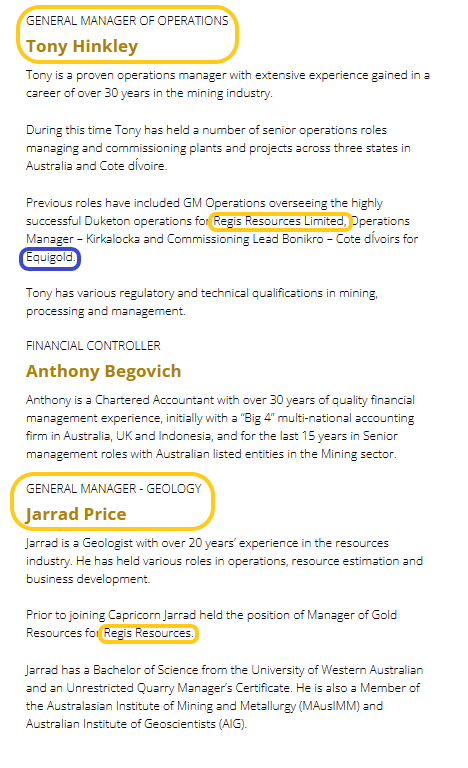

Bear points is the lower production compared to last year at the main operations (Rosemont, Garden Well, Moorlart Well).

They still have quite a bit of hedges to get through and will now need to rapidly find ways of getting more production to minimise impact. Perhaps accelerate their exploration work.

I do own Regis

17-Oct-2020: In his latest "Under the Radar" report on small cap companies, Richard Hemming has listed Regis Resources (RRL) as a spec buy. They had previously recommended Saracen (SAR) but SAR are now merging with NST, so they've been looking for a new up-and-coming gold producer to replace SAR.

You can get free access to all of their research by taking advantage of their free trial offer - see here:

https://www.undertheradarreport.com.au/

I personally have a bundled subscription to UTR (run by Richard Hemming) and FNArena (run by Rudi Filapek-Vandyck, a regular "expert" analyst on Ausbiz's "The Call").

Here's an excerpt from UTR (Small Caps) issue #417 (from this past week):

REGIS RESOURCES

With Saracen removed from the list of independent gold producers, Regis well and truly fills the vacuum, currently producing 370,000 ounces, forecast to grow and potentially become a 600k ounce producer in the next two to three years.

INVESTMENT PROPOSITION

Regis controls 90% of the Duketon Greenstone Belt, north of Laverton in WA. The belt remains very prospective for greenfield and brownfield discoveries, offering considerable potential to the company’s existing WA resources of 5moz. The production rate in FY21 will be approximately 370koz and is tracking higher as mines are extended. The company’s McPhillamys gold project in NSW, with 2.7moz resources, offers potential for a 200kozpa step up in gold production from 2023, which would transform the company into a 600k ounce gold producer.

STRONG PROFIT GROWTH AND CASH FLOW

The company increased net profit after tax to $200m in FY20, up 23% on FY19. Earnings per share of 39.3 cents increased at the same rate. EBITDA was $394m while cash flow from operations was a mighty $424m. Cash and bullion was $209.3m at 30 June 2020 with no debt. The company declared dividends of 16 cents per share, equivalent to 21% of EBITDA.

CORE AND SATELLITE OPERATIONS WITH SEVERAL GROWTH PROJECTS

The main operations are at Moolart Well, Garden Well, 30km to the south and Rosemont, 9km NW of Garden Well. There are approximately 10 individual mines, including satellite operations. There are treatment plants at Moolart Well and Garden Well and a crushing/milling circuit at Rosemont with ore slurry transported to Garden Well by pipeline. There are also a number of mining projects:

- The most significant is an underground development at Garden Well where there is a zone of continuous mineralisation up to 10m true width, 80-100m in height, 300m along strike and extending 300m below surface. The deposit remains open.

- Other projects include drilling of the Ben Hur open pit where there is a high grade southern plunge and drill testing the Rosemont underground, where the company believes there is considerable mine life extension potential. There are also significant low grade oxide resources at Moolart Well which could potentially extend the mine life for up to five years if costs can be reduced

ACCELERATING GREENFIELD EXPLORATION

Regis is accelerating exploration in 2021 on its landholding that now covers 90% of the Duketon Greenstone Belt. Over time 8moz has already been discovered in the belt and Regis is giving itself every chance to find more, having tripled its landholding through acquisitions and plans to generate new targets (+1moz) and significantly increase the chances of new discoveries.

At the Risden Well basin, to the west of Moolart Well and Rosemont, there are signs of a large hydrothermal system with potential to host a sizeable gold deposit. Aircore drilling has defined a 5km long geochemical anomaly. An aircore and RC drilling programme is underway.

MCPHILLAMYS – POTENTIAL FOR ~200KOZPA STEP CHANGE LIFT IN PRODUCTION

McPhillamys offers the potential for a step change lift in Regis gold production of approximately 200kozpa. The project has a mineral resource and reserve of 2.3moz and 2.0moz respectively with additional resources of 390koz at Discovery Ridge.

GOLD HEDGING – AN OPPORTUNITY COST

Regis has a hedge position of almost 400koz at an average of A$1,614/oz with the range from A$1,400 to 1,900/oz. Because the hedging is spot deferred, the company has flexibility in the selling process. The company is selling into the lowest priced hedges and is delivering into its most out of the money hedges to 20koz per quarter.

KEY RISKS: THE GOLD PRICE, WILL MCPHILLAMYS BE APPROVED?

The gold price is inherently volatile, even within a trend. While we believe the current gold price trend is up, there is no certainty this will continue. With regard to McPhillamys, we believe the market is cautious on the prospect of the project being approved, so the impact of a no decision may have limited impact on the share price. However, a positive decision could have a surprise effect and start a re-rating.

REGIS IS ACCELERATING EXPLORATION IN 2021 ON ITS LANDHOLDING THAT NOW COVERS 90% OF THE DUKETON GREENSTONE BELT. OVER TIME 8MOZ HAS ALREADY BEEN DISCOVERED IN THE BELT AND REGIS IS GIVING ITSELF EVERY CHANCE TO FIND MORE, HAVING TRIPLED ITS LANDHOLDING THROUGH ACQUISITIONS AND PLANS TO GENERATE NEW TARGETS (+1MOZ) AND SIGNIFICANTLY INCREASE THE CHANCES OF NEW DISCOVERIES.

- RADAR RATING: SPEC BUY

- ASX CODE: RRL

- CURRENT PRICE: $5.09

- MARKET CAP: $2.6BN

- DIVIDEND YIELD: 3.1% (FY21 forecast 16 cents per share)

- NET CASH: $209M

BULL POINTS

- Major gold producer with exploration potential

- Highly profitable dividend payer

- Potential step change in production

BEAR POINTS

- Uneconomic hedging

- Development risk

WHY WE LIKE IT

We like the low cost WA based gold producer because it is trading on metrics such as prospective PE ratio, EV/ EBITDA and ROE that are lower than most of its peers despite the quality, scale and growth potential of its existing gold operations and the McPhillamys project in NSW, with 2moz ore reserves, included for free! Production of 355- 380koz projected for FY21; it has gold resources of 5moz, reserves of 1.6moz in WA and strong exploration potential. Among its peers, it is one of the lowest cost producers at A$1,230-1,300/oz all in sustaining costs.

WHAT’S NEW

Regis achieved another milestone in the development of the McPhillamys Gold Project, located near Blayney, NSW, lodging a Development Application in early September, with a possible decision by the regulator during the first half of 2021. The mine could add another 200k ounces to Regis’s 370k current production. It’s a big deal, putting Regis into the next league with 600k plus of gold production.

--- end of excerpt ---

[I hold RRL shares.]

If you found this helpful, or liked the style of the report, please check out their free trial offer here and have a look at all of the other companies the UTR covers.

29-Apr-2020: Quarterly Activities Report

Key Points (All figures expressed in Australian dollars unless stated otherwise)

- Regis’ response to COVID-19 was initiated during February and has included establishment of a Crisis Management Team to coordinate its response to the pandemic. Initiatives continue to be developed and actioned.

- The 12 Month Moving Average Long Term Injury Frequency Rate to the end of the quarter was 4.4, up from 3.5 at the end of the prior quarter. The Company has commenced a review of its Health and Safety standards, processes and culture.

- Quarterly gold production was 86,300 oz (Dec 19: 90,849 oz).

- Cash flow from operations increased by $7.4m to $107.4m for the March quarter.

- Cash and bullion was $168.8m at the end of the quarter (Dec 19: $168.8m), after payment of $40.7m in dividends, $30.0m in capitalised mining costs, $7.7m on exploration and feasibility projects, $15.6m in income tax payments and $12.1m on a number of discrete capital projects.

- Cash cost before royalties for the quarter were $880/oz (Dec 19: $866/oz). The minor increase in quarterly cash costs was primarily driven by the reduced gold production for the quarter.

- AISC for the quarter was $1,174/oz (Dec 19: $1,219/oz). The decrease in AISC was driven by lower strip ratios and ore stockpile build-up at Duketon South.

- Assuming no further COVID-19 related impacts:

- Full Year Production Guidance remains unchanged with a production range of 340,000-370,000 oz; and

- After excluding the royalty cost impact associated with the higher prevailing gold price (currently ~$27/oz), full year AISC guidance is maintained at the upper end of the $1,125-$1,195/oz* guidance range.

- The assessment phase of the McPhillamys Development Application is now well underway with Responses to Submissions (RTS) expected to be complete by the middle of the year.

- Diamond drill testing of the Garden Well underground target confirms a wide, robust high-grade mineralised zone beneath the pit. Results in fresh rock include 16.0m @ 4.9 g/t gold from 314m. Work defining underground potential expected to be completed in December Quarter.

- Drill intercepts at the Baneygo project continues to support the potential for underground resources.

*Full year AISC guidance assumes a A$1,750/oz gold price – see page 5 of ASX release 23 July 2019.

Comment

Regis Resources Managing Director, Jim Beyer, said: “Regis achieved another solid quarter of production and cash generation and its strong performance to date in FY20 saw it return another $40.7 million in dividends to its shareholders.

We are currently well placed for the June quarter and not withstanding any further impacts from COVID-19, remain on track to deliver our production guidance for the year of 340,000 to 370,000 ounces with our AISC expected to be at the upper end of the guidance range of $1,125 to $1,195 per ounce after excluding the impact of higher gold prices on royalty costs.

I am very pleased to see the good progress with our McPhillamys Gold Project and also at the Rosemont Underground Project where we are commencing stope production. Our potential Garden Well Underground Project is also proceeding through to completion of a PFS.

Overall Regis remains in a strong position to weather the COVID-19 related uncertain economic environment. This is due in no small part to the hard work and effort of our staff, contractors and our families to help manage this challenging time. To all of these people I would like to take this opportunity to say thank you on behalf of the Regis Board and management.”

--- click on link above for more ---

[Disclosure: I hold RRL shares.]

29-Apr-2020: The following was part of the Quarterly Report that Regis (RRL) released today (the bulk of which I've included in a different straw):

GENERAL COVID-19 STATUS UPDATE

The Regis response to COVID-19 was initiated during February and has included establishment of a Crisis Management Team to coordinate and implement the Company’s COVID-19 Response Plan to the pandemic.

The wellbeing of our employees, contractors and local communities remains Regis’ priority. Accordingly, the Company has implemented a range of measures across its business consistent with advice from State and Federal health authorities. These measures help ensure the health and welfare of our employees and their respective communities and includes the following:

- Implementation of systems and procedures for health monitoring which includes health checks prior to check-in for travel to site;

- Initiating social distancing protocols across the business including on aircraft, which has included chartering additional flights for travel to the Duketon sites;

- Implementation of site management protocols for dealing with potential COVID-19 cases;

- Relocation of interstate and international personnel to Western Australia;

- Temporarily extended roster arrangements for our operations;

- Implementation of ‘work from home’ arrangements for Subiaco and Blayney offices;

- Increased mental health awareness and support for both employees and their families;

- Implementing plans to limit the potential impacts in the local communities in which we operate; and

- Actions to ensure maintenance of adequate inventories with major contractors and suppliers.

To date there have been no confirmed cases of COVID-19 across the business. To assist communities in WA to deal with the ongoing impacts of COVID-19, Regis has joined with fellow resource companies in providing financial support to the WA Royal Flying Doctor Service, Foodbank WA and Lifeline WA through the Chamber of Minerals and Energy Community Support Fund. These donations are providing essential supplies, medical and mental health support to vulnerable communities.

Regulatory and guidance changes remain dynamic, but at this time the increased restrictions are not expected to have any material impacts on the Company. Regis continues to have regular and frequent communications with mining industry representative bodies and Government about actual and potential changes to requirements and is responding accordingly.

--- --- ---

Click HERE for the rest of that quarterly report.

17-Feb-2020: Half Yearly Financial Results Presentation

Also: Half Yearly Report and Accounts

RRL is up over 6% (so far) today on the back of this positive result:

Key Points (All figures expressed in Australian dollars unless stated otherwise):

- Record Net profit after tax of $93.4 million and net profit margin of 25% reflects the ongoing strong profitability of the Duketon operations.

- Revenue of $371.4 million*, with 182,807 ounces of gold sold at average price of $2,063* per ounce.

- EBITDA of $185.6 million with a strong EBITDA margin of 50%.

- Cash flows from operating activities of $147.2 million.

- Cash and bullion of $168.8 million**, after the payment of $40.7 million in fully franked dividends, $20 million on the strategic tenement acquisition from Duketon Mining Limited, $33.0 million in income tax, $19.9 million on exploration expenditure and feasibility costs, $23.2 million on the development of the Rosemont underground and new satellite projects, $32.0 million on capitalised mining costs and $35.9 million on other capital including a significant TSF expansion, the Duketon airstrip uprgrade and land acquisitions in New South Wales.

- Fully franked interim dividend of 8 cents per share declared.

- Gold production of 178,482 ounces for H1 FY20 at an AISC of $1,226 per ounce.

- Duketon operations continue to be on track to deliver the annual production guidance of 340,000-370,000 ounces with all in sustaining costs at the upper end of annual cost guidance of $1,125-$1,195 per ounce after excluding the extra royalty cost impact associated with the higher prevailing gold price.

Comment:

Regis Managing Director, Mr Jim Beyer commented: “Regis has produced another strong performance, recording a record half-year profit after tax of $93.4 million and operating cash flows of $147.2 million. This outcome again demonstrates the reliability and quality of the operations at Duketon.

We continue to deliver solid cash flow with robust net profit margins of 25% which has allowed the Company to undertake a period of significant capital investment towards the development of the Rosemont underground and new satellite deposits at Dogbolter-Coopers, Baneygo and Petra.

The Company’s solid performance has meant that in addition to investing in our future, we can continue to provide returns to our shareholders with a declared dividend of 8 cents per share which is a very pleasing result.”

The board of Regis Resources Limited is pleased to announce a strong half year net profit after tax of $93.4 million for the six months ended 31 December 2019. This represents a 17% increase from the first half net profit after tax of $79.9 million reported in FY2019 and is a record result for the Company.

*Gold sold from preproduction assets not included in revenue.

** Includes bullion on hand valued at $2,220 per ounce.

---

[continues... click on link above for more]

Disclosure: I don't currently hold any RRL, but I have in the past. My current gold exposure is via NST, EVN, SAR & SBM, plus a much smaller position in PNR. I also hold shares in some companies that produce gold as a byproduct of other production, such as SFR (whose main game is copper). There's nothing wrong with Regis (RRL), it's just not one I currently hold. However, they're always on my watchlist. This was a good report, and the market has responded positively to it.

25-Jan-2019: RRL - Corporate Update Presentation - January 2019

23-Jan-2019: To view Regis Resources' December quarter report - see here.

I also note that RRL have awarded the underground mining contract for Rosemont to Barminco (which is now owned by Ausdrill - ASX:ASL) - see here (and for ASL's announcement - see here). MACA (ASX:MLD) are still doing all of RRL's open pit mining.

19 Oct 2018: Regis (RRL) have released a presentation to the ASX announcements platform titled, "SEPTEMBER 2018 QUARTERLY REPORT & EXPLORATION UPDATE" - see here

Highlights:

- Q1 gold production 90,879 ounces at AISC of A$923/oz

- Another very strong operational quarter at the Duketon project

- Production above mid-point of FY19 guidance & AISC below bottom of guidance

- Continued strong cash-flow from operations $77.9m for Q1 (Q4: $85.3m)

- Cash and bullion holdings were $190m (Q4: $209m)

- $15.3m growth capex spent on satellite prestrips & TSF lifts (FY19f: $40m significantly weighted to H1)

- Board approved development of Rosemont UG operation

- Portal to be developed in Q3, development ore Sept19Q and production ore Dec19Q

- Exploration results indicating expansion opportunities beyond current stoping/resources

- Exploration efforts continue to deliver:

- Early stage drilling of Garden Well high grade underground targets very positive and suggest GW to follow same path as RMT

- Very strong extensional results at Discovery Ridge in NSW – exciting addition to MGP

- McPhillamys EIS and DFS work continuing

- PEA submitted and EARs issued, facilitating completion of EIS and DFS in Q3

- Investment decision expected Q3

Disclosure: I hold RRL shares.