Disclosure - Not held IRL, held in SM

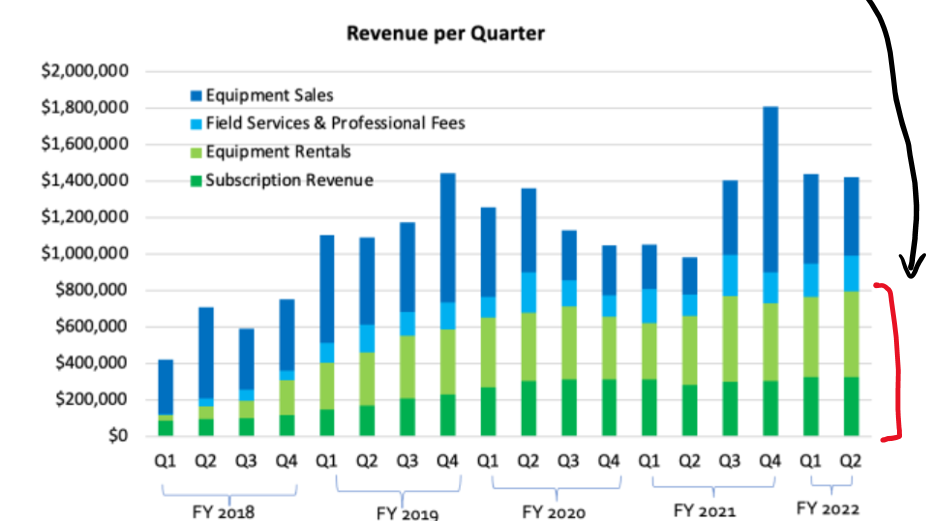

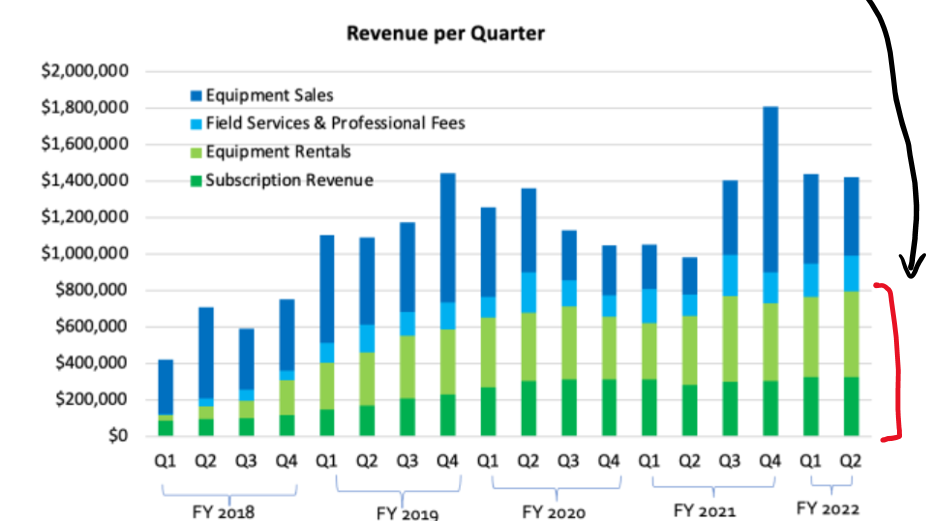

As Andrew points out, Spectur have reported a strong result in terms of revenue;

“record with $1.42m in revenue -- a 45% gain from a year ago.” And “For the calendar year, the business did $6.1m in revenue, a 44% lift on CY20”

A breakdown of the revenue by ‘type’ can be seen below, with approximately 57% of revenue being recurring in nature.

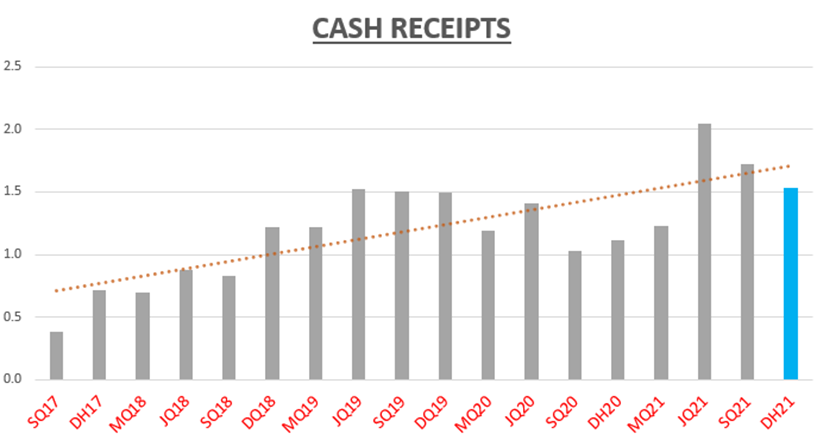

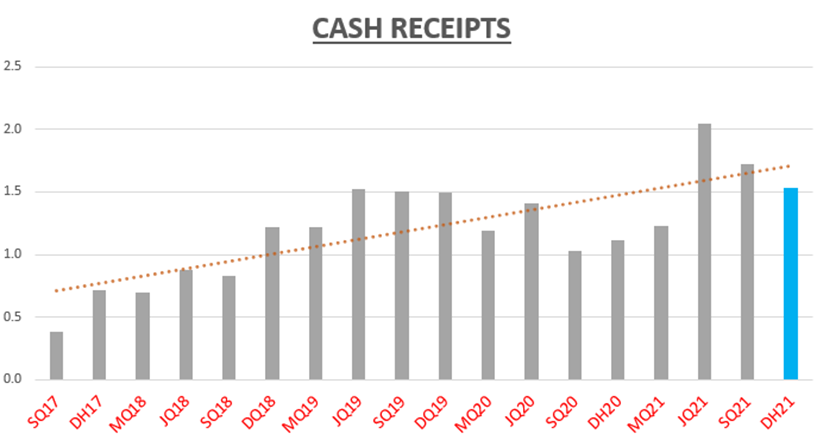

The following trendline accentuates the growth of revenues (depicted by cash receipts). This growth been strong, especially when considering the impact that Covid has had on the businesses ability to deploy sales people & sell product.

Keep in mind, Spectur may be marketed as high-tech surveillance but they still need to physically manufacture and drive around and install these camera systems and there is lot of actual labour needed to run the business.

The problem I’ve had with this business in the two years I have followed it – what is the plan to reach self-sustaining commerciality?

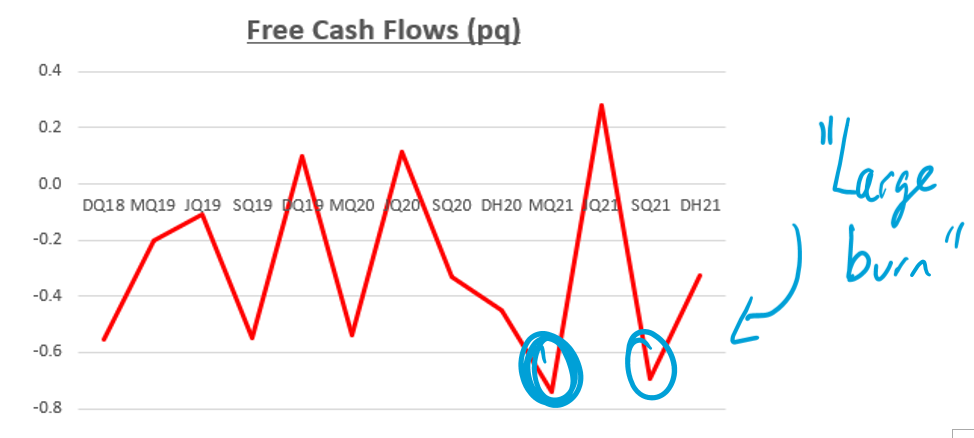

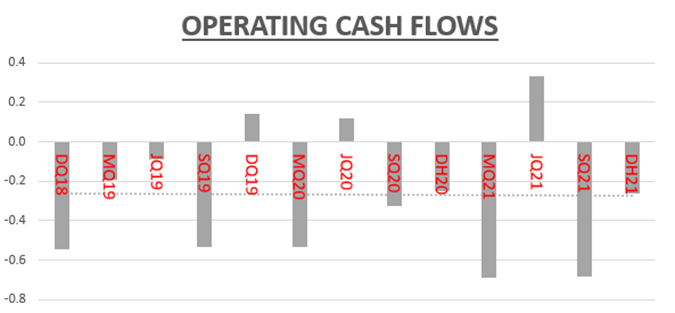

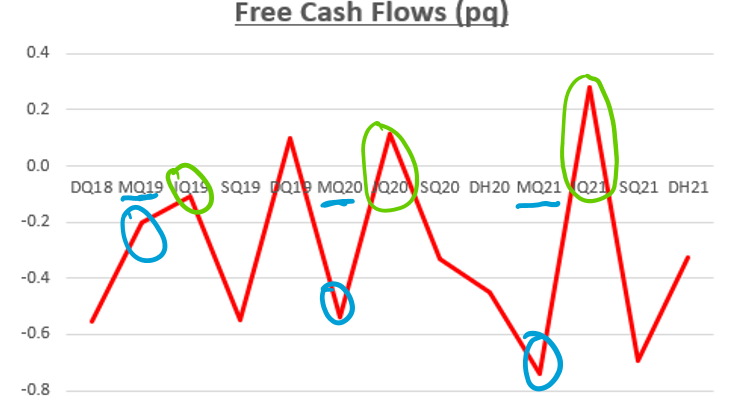

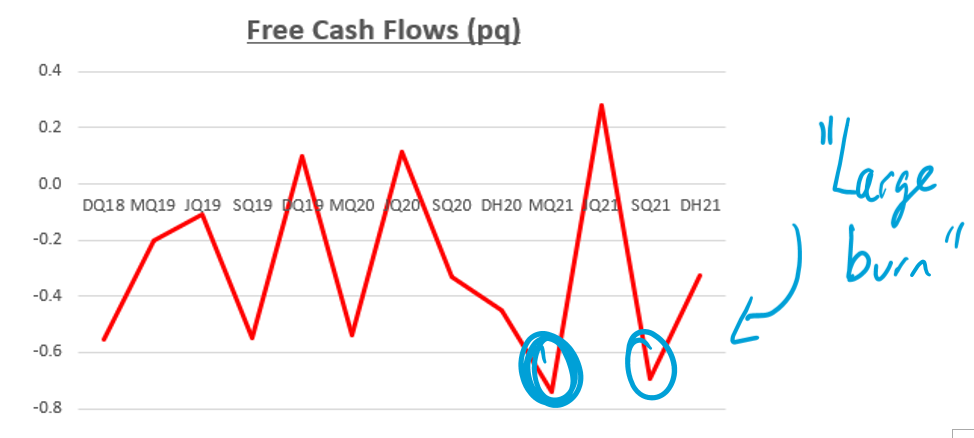

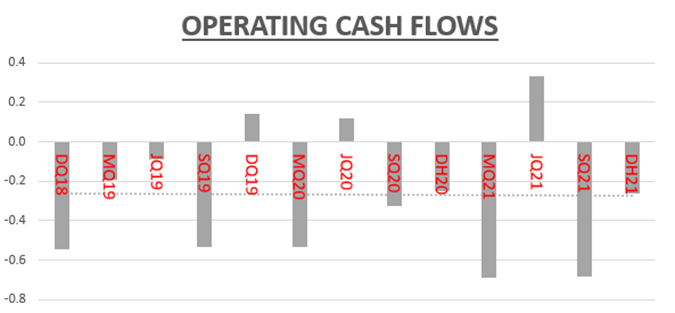

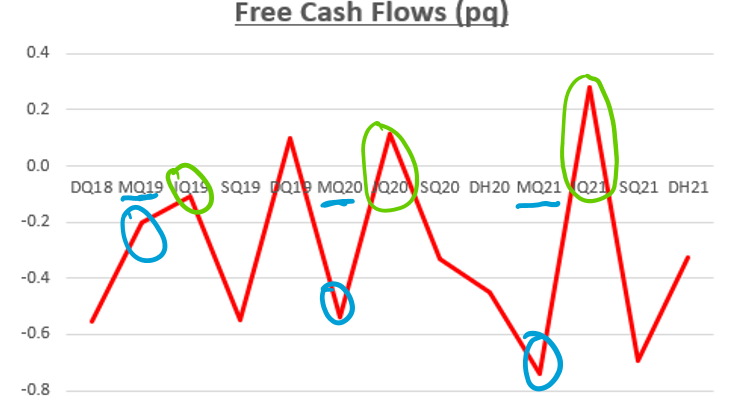

We can observe that there seems to be no obviously-defined trend in terms of cash-burn, operating cash flow and free cash flow over the past three years.

On closer inspection I did note some similarities in performance in correspondence to seasonality.

Highlighted in green, the past three free-cash-flow results for the June quarter (Q4) have been there-abouts the best result. My theory is that this trend is caused by tax implications that come to surface at the end of financial year in relation to the depreciation of the camera units Spectur sells.

Given the temporary changes to the tax treatment of depreciation, namely; Instant Asset Writeoff (IAWO), Temporary Full Expensing (TFE) and Business Backing Investment (BBE), it becomes more attractive for businesses to purchase product that can be fully depreciated just a few weeks later after the EOFY.

To support my theory, I spoke with Gerard regarding the June 2021 (JQ21) 4C result and he mentioned that legislation changes to asset write-offs led to a “flurry of sales”, which we can see is the record for both cash receipts and free-cash-flow within a quarter.

The second trend that is noticeable relates to the aforementioned. To support the anticipated splurge in demand, Spectur makes noticeable investment into raw materials (etc) and produce enough supply to meet June-quarter demand. These investments are made in the March quarters and are highlighted in blue.

Given that the temporary changes to tax treatment of depreciation are all still applicable/valid in FY22, I anticipate that my theory will hold to be the case again in the coming two quarters.

As a result, I anticipate that the March quarter will be weak in terms of financial performance due to seasonal investment being made to support demand towards the end of the June quarter. The share price may well fall further off as well, presenting an adequate buying opportunity to those that believe June quarter 2022 will be the strongest result yet.

In saying all of the above, the ‘trends’ I have spoken about may not really be trends at all and just random alignments of dates and financial results. We are yet to see & hear this confirmed by management.

To link back to my original point, the business is not adequately on a path to financial self-sustainability and then comes the hole in the ground; funding.

At 31 December, the business had $1.018m in cash and $1.1m in debt funding available through the EGP facility. $400k of the debt was drawn in the last quarter. It’s worth noting that the debt is relatively cheap for a business of this risk; 7% p.a on the $1.5m and a 3% line fee. (all up the cost of servicing the debt assuming it is fully drawn-down is $150,000, I believe). There is also the cost of dilution through the 2.25m in options that were issued to EGP, however these options are exercisable at 0.12 and thus their fair value would be low considering the probability of them becoming in-the-money.

For a manufacturing business that has a high demand for upfront capital to produce units, the funding situation is of major concern to me. Based on the large downswings in free-cash-flow performance, the business is only two or three quarters of cash-burn away from seriously needing to consider a capital raise.

At this point in time and based on the anecdotal evidence I am observing; it is more likely than not (>50% chance) that the company will need to raise capital again in the next 2 years.