Wonderful economics once they're in full production apparently @edgescape - but every now and then the market frets about how long that will take, because apparently the project is in a real pig of a location. They're producing now of course, but it's taken a while to get there, and there have been more than a few setbacks along the way.

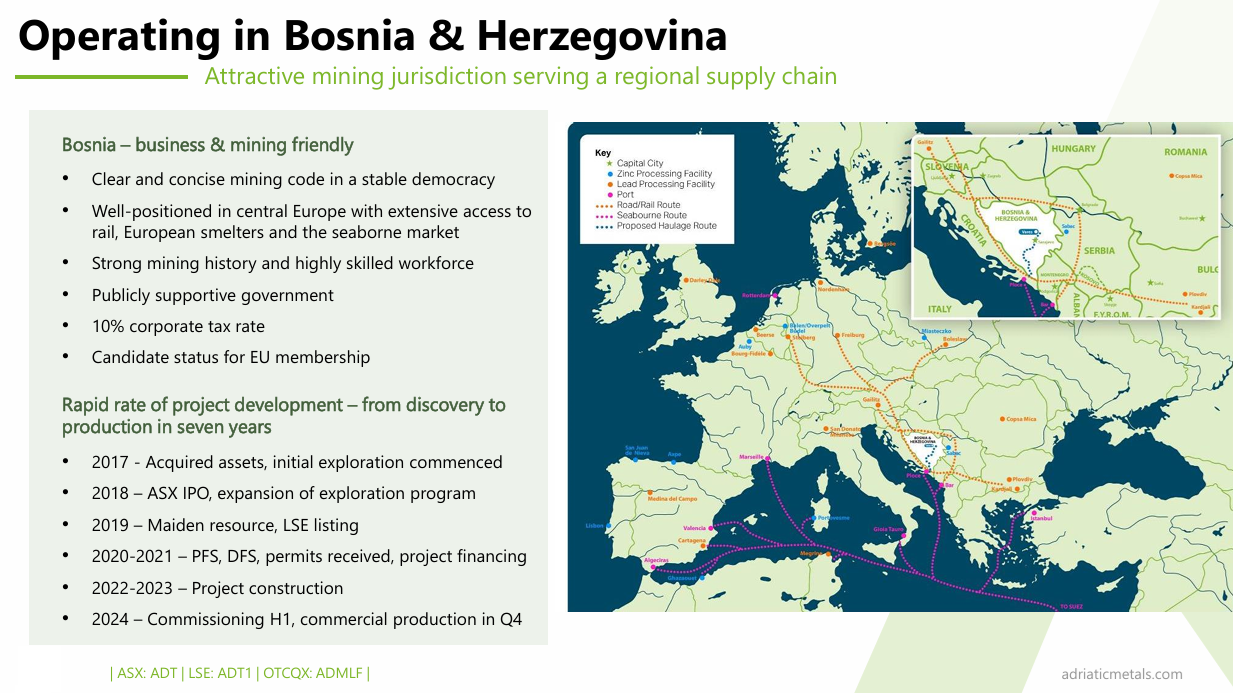

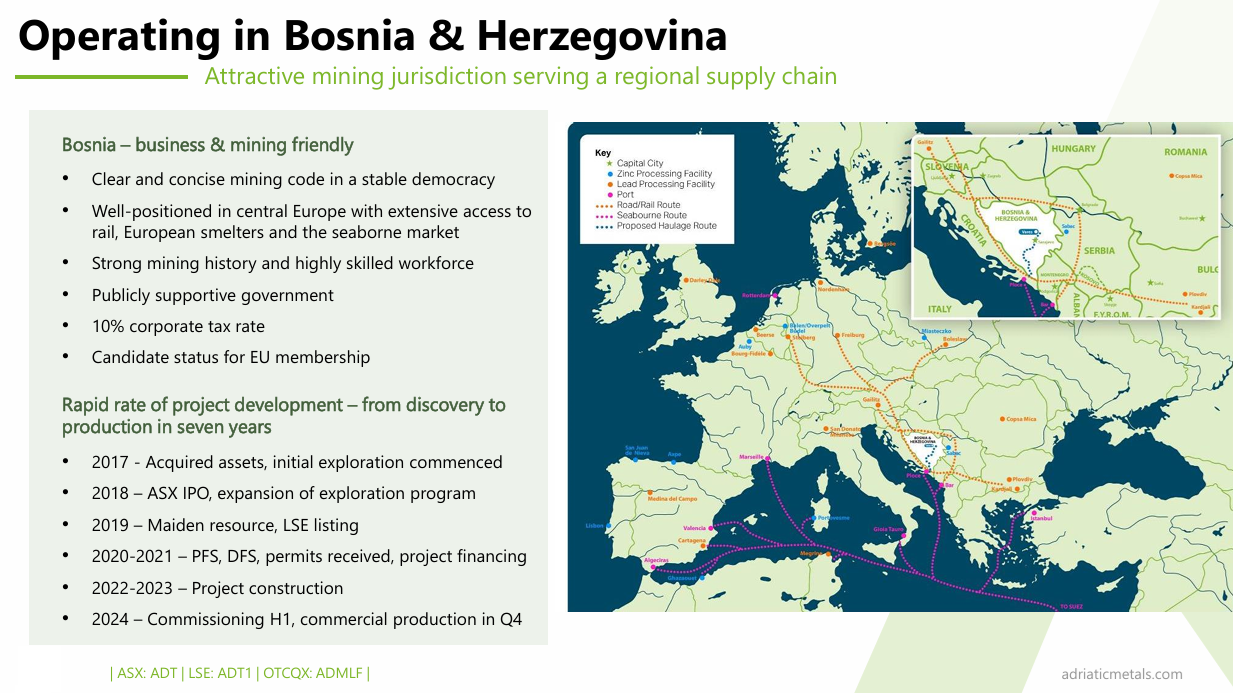

You wouldn't think that however from the following slide from their latest presentation:

Source: Slide 4 from Adriatic Metals' Vares Operation - Significant near-term cash generation - Q32024 Results Presentation [28th October 2024]

Accentuating the positives there, while ignoring the many setbacks.

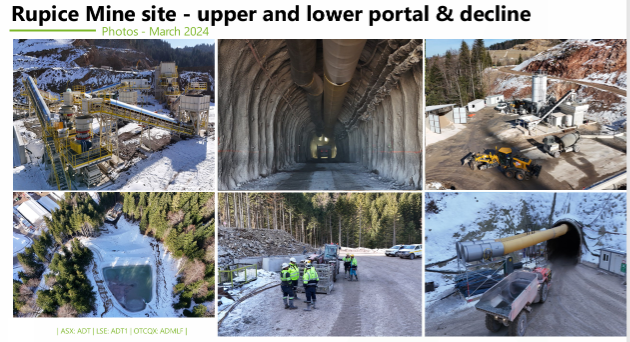

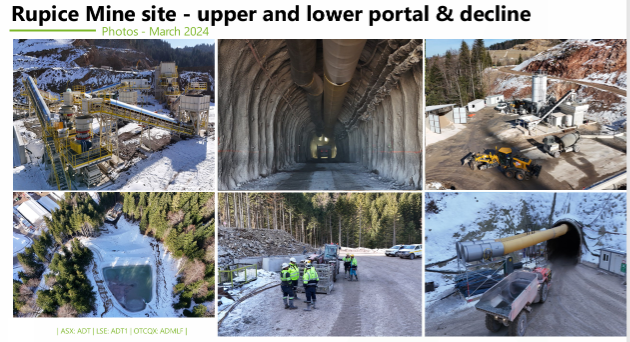

The following 4 images are from a variety of Adriatic (ADT) presentations over recent years:

Below, back in 2022:

According to Google, in central Bosnia, winter temperatures typically range from -6.0°C to 6.2°C, (yep, that first number was MINUS 6 degrees) with an average annual snowfall of 110 cm. The central and southeastern mountainous regions of Bosnia receive the most rainfall, with maximum amounts occurring in November or December.

Winter is fast approaching over there and they're currently in the first of their wettest two months of the year.

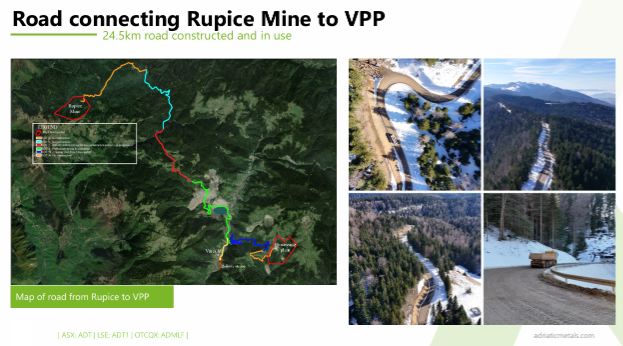

Below, January this year:

Here's a link to a video they produced in January this year: https://www.adriaticmetals.com/news/project-update-january-2024/

A Mining.com article in late May talked about their recent commissioning and first sales and said that the plant should reach nameplate capacity in Q4. Despite becoming a producer, they launched a US$50 million (approximately AU$75.8 million) CR on the same day they announced first production - https://mining.com.au/adriatic-sells-first-concentrates-from-vares-silver-operation/ [28-May-2024]

The previous month (April 2024) they had terminated the contract with their mining services contractor at Rupice and took on the mining themselves - Corporate-Update-22-April-2024.PDF

Their CFO then quit in May - Management-Update-03-May-2024.PDF

I've got to go do something outside now before it gets dark - but yeah, nah, I rode ADT up in the early years, but got out once I realised just how difficult it was going to be to operate there in central Bosnia in winter. I see nothing to change my mind yet.

OK, I'm back - after midnight now but I've added a bit more.

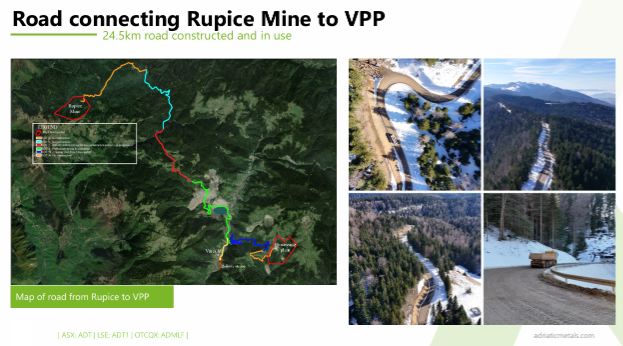

The haul road from the Rupice Mine to the Vares Processing Plant (VPP) is 24 km of twisty mountain road (map, below left, and some of the better sections of the haul road are shown below right); might be OK in summer, but not so much in the middle of winter during heavy rain or snowstorms I would imagine.

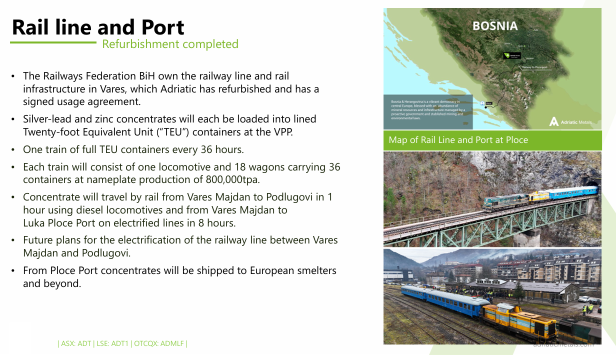

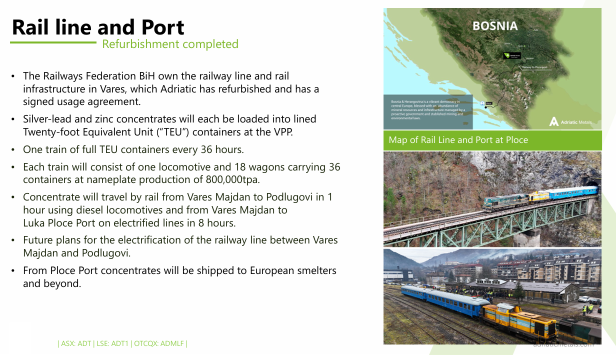

And then there's the bridges and tunnels along the rail line to port which Adriatic have had to bring back from the dead to be re-used again now. They had to rebuild a lot of the rail line, especially on the bridges, as it had been many years since that line had been used, and most of the sleepers and quite a bit of the track had to be replaced. So much money and time spent. Let's hope it all goes to plan from here.

Source - last three slides: https://www.adriaticmetals.com/downloads/corporate-presentations/2024/20230325-adt-corporate-presentationv2.pdf [March 2024]

Sub-zero temperatures, heavy snowfall, plenty can still go wrong there, especially during their winter.

This one I consider high risk, not so much because of the sovereign risk (like governments moving the goalposts, or armed rebels attacking the site, which you can get in some West African countries at times) but more to do with the location and the weather and the remoteness of the site which I believe could easily be cut off and isolated in a big snowstorm. There are also a lot of things that need to go right for this thing to hit its straps and stay producing at capacity, to make that promised money, and I can think of a number of things, most of them weather-related, that could go wrong.