@edgescape - although much anticipated, the announcement came out late Thursday, so it was in the US for the Friday trading day.

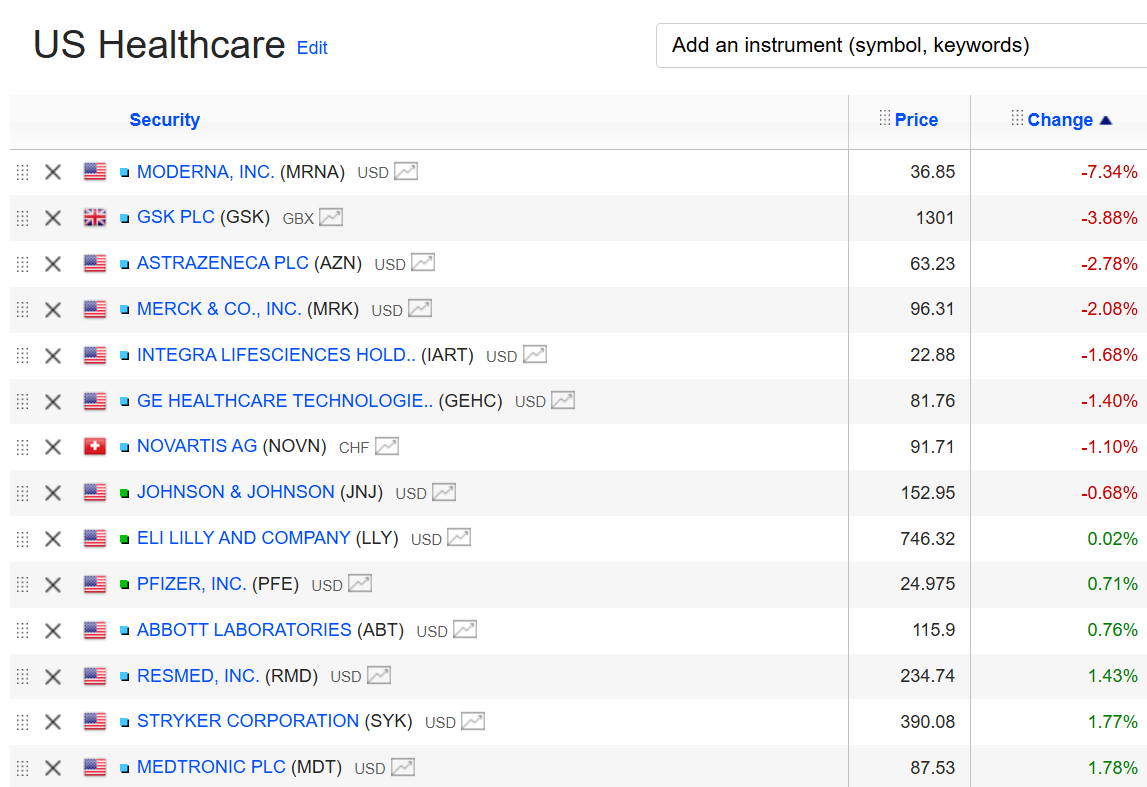

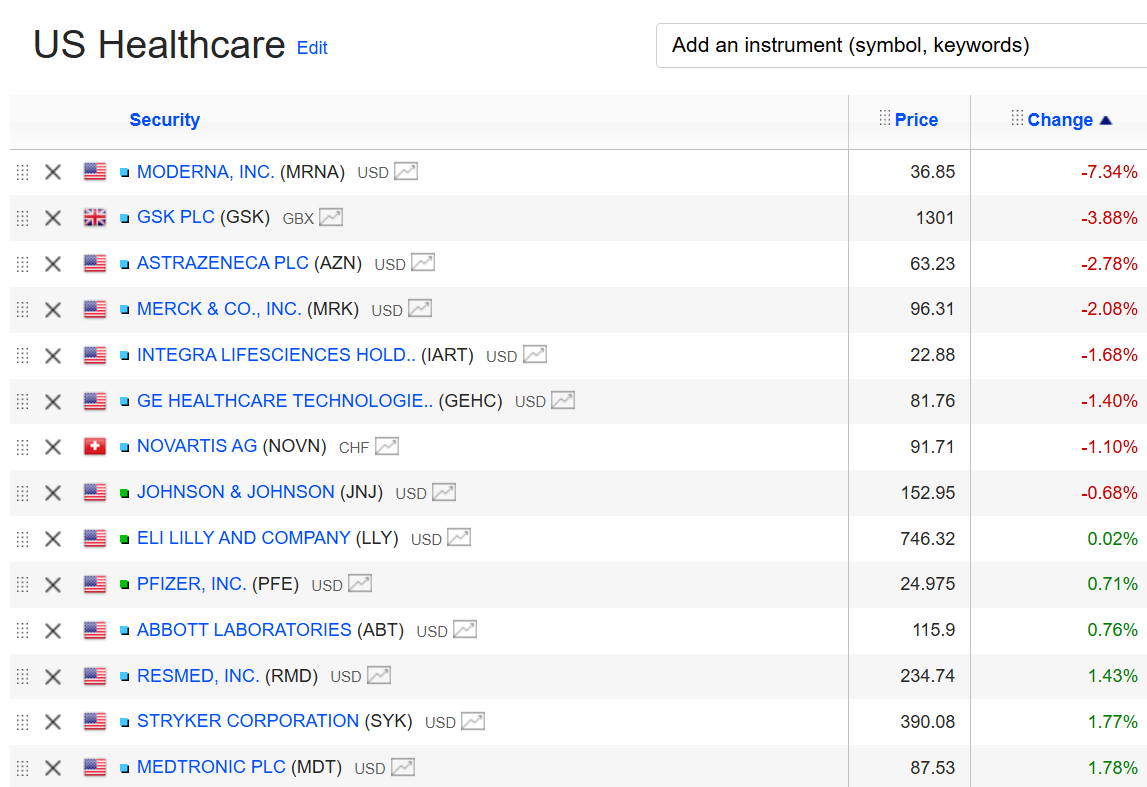

From the selection of stocks I've looked at below, the big vaccine makers have been hit hardest (top 4 on the list below), but interestingly, medical devices have fared pretty well, with the 4 at the bottom of the list being big medical devices makers. IART and GEHC also big in medical devices, but weren't down nearly so much as the vaccine makers, on what was a big down day for the market.

It remains to be seen what Kennedy will do - beyond vaccine mandates, fluoride in the water, and the nutrition mandate of the FDA. On the latter, there is something seriously wrong with food labelling in the US. There is no shortage of books and films that have blown the whistle on the regulatory capture by the food industry. So it is an area that probably needs some serious reform.

He also seem's focused on chronic disease, which should be good for conditions like obesity, diabetes, OSA, and firms that serve these. He has said things against DTC marketing of drugs.

So, while his appointment introduces a wild card into the world's biggest healthcare market, the agenda is Make America Healthy Again! My guess is, if his appointment is confirmed, there will be winners and losers, and I think that's where the market is too.

Below is an article from the WSJ on the subject:

Updated Nov. 15, 2024 11:15 am ET

WASHINGTON—Investors slashed billions of dollars off the value of the world’s top vaccine makers after President-elect Donald Trump nominated environmental lawyer and vaccine skeptic Robert F. Kennedy Jr.as health and human services secretary.

Shares in Pfizer fell 2.6% on Thursday, erasing roughly $4 billion from its market value, and were down 3.5% in Friday trading. Shares of BioNTech and Moderna also fell sharply. In Europe, shares in Danish Mpox vaccine maker Bavarian Nordic fell 17% Friday, while pharma heavyweights AstraZeneca, GSK and Sanofi dropped 3% or more.

Kennedy has promised sweeping changes to food-and-drug regulation and government-funded scientific research, in recent days saying the Food and Drug Administration’s nutrition department needed to be eliminated and warning the agency’s employees to “pack your bags.”

Kennedy, 70 years old, abandoned his independent presidential bid in August and endorsed Trump, promising that he and the Republican would work to “make America healthy again.”

Kennedy said on social media after his nomination that “we have a generational opportunity to bring together the greatest minds in science, medicine, industry, and government to put an end to the chronic disease epidemic.”

Earlier, in his own social-media post, Trump wrote: “For too long, Americans have been crushed by the industrial food complex and drug companies who have engaged in deception, misinformation, and disinformation when it comes to Public Health.”

Billionaire Elon Musk and one of the president-elect’s sons, Donald Trump Jr., both advocated behind the scenes for Trump to pick Kennedy, according to people familiar with the discussions. Trump transition team co-chair Howard Lutnick previously had said that Kennedy wouldn’t head the department if Trump won the election.

The scion of an American political dynasty, Kennedy in recent years has been best known for his critiques of public-health leaders’ approaches to the Covid-19 pandemic and vaccines. He has argued that unhealthy food, medicines and water have fueled the rise of chronic disease in America, and that government regulators have been corrupted by corporate influence.

Kennedy, who could face a tough confirmation battle, would take over a department with an annual budget that tops $1.7 trillion, more than 80,000 employees and 13 operating divisions, including the Centers for Disease Control and Prevention, the National Institutes of Health and the FDA. Most of its spending goes to Medicare and Medicaid.

The department funds healthcare for millions of Americans, including the elderly and disabled; decides which drugs are safe and effective; investigates food-borne illnesses; prepares for pandemics; funnels tens of billions of dollars to basic scientific research, and much more.

Kennedy has pledged to advise against fluoride in drinking water—a stance that would put him at odds with public-health officials. He has said he would ask for more data on vaccine safety to be made public, though he told NBC last week he wouldn’t “take away” vaccines. He is also eager to investigate food colorings and pesticides restricted in European countries but widely used in the U.S.

Kennedy made the case to Trump’s advisers that he would be able to enact more sweeping change as HHS secretary than he would as the administration’s health czar, the other position he was being considered for, according to people familiar with the matter. He has told associates one of his goals as secretary is to overhaul the department’s subagencies, including the FDA, the people said.

Like other Trump allies, Kennedy has spent much of his time at Mar-a-Lago, Trump’s private Florida club. He is renting a house owned by Mehmet Oz in Palm Beach, near the Trump estate, people familiar with the matter said.

Kennedy’s nomination is another setback for antiabortion groups whose relationship with the president-elect is already strained. Kennedy at one point said he supported banning abortion after the first trimester of pregnancy but later endorsed broad abortion access. Antiabortion groups were hopeful that a Trump health department would tighten access to abortion pills.

Scientists and public-health leaders have said they are worried about Kennedy’s influence if he were to land a position of power in Trump’s administration, pointing to children’s measles-vaccination rates that are already below the health department’s targets and dropping. Vaccine scientists worry he could put his fellow vaccine critics on boards overseeing immunization advice.

“He’s a science denialist,” said Dr. Paul Offit, an infectious-disease physician at Children’s Hospital of Philadelphia. “He’s taken his name, which is a famous name, and used that as a platform to frighten parents unnecessarily about vaccine safety.”

Kennedy would face some barriers to broad changes. He has pilloried the user fees that drug companies pay to the FDA to ensure the agency has the staff needed to do speedy reviews of drug applications. But eliminating those fees would require congressional action.

In other areas, Kennedy would have free rein. Drug-approval decisions are typically made by career staff scientists, but they can be overturned.

“It’s totally within the law for the president or the HHS secretary to overrule the entire FDA,” said current FDA Commissioner Robert Califf this week before a gathering of cancer researchers. “So that could happen.”

Trump’s selection of Kennedy underscores how willing he is to back controversial nominees and ignore objections from regulated industry and even members of his first administration with more traditional health-policy credentials.

Kennedy might face a difficult path to confirmation, as public-health allies in the Senate are likely to be wary of his views on vaccines especially.

Although Republicans are set to take control of the Senate in January, Trump has demanded that the chamber suspend its power to confirm nominations and instead go out of session so that he can use “recess appointments” to install at least some administration officials, such as cabinet secretaries, without Senate approval. The demand has taken on greater urgency after Trump has floated controversial nominees, including former Rep. Matt Gaetz of Florida for attorney general.

Sen. Bill Cassidy (R., La.), the ranking member of the Senate’s health committee, said in a statement: “RFK Jr. has championed issues like healthy foods and the need for greater transparency in our public health infrastructure,” adding: “I look forward to learning more about his other policy positions.”

Incoming Senate Majority Leader John Thune (R., S.D.) didn’t comment directly on the Kennedy pick and emphasized that the broader nomination process was just getting started. “I’m not going to make any judgments about any of these folks at this point,” he told reporters, adding there will be “plenty of scrutiny of these nominees’ records when the time comes.”

Initial Democratic reaction was mostly negative. Sen. Patty Murray of Washington said the selection “could not be more dangerous” given Kennedy’s past statements on vaccines. But Gov. Jared Polis of Colorado said the pick excited him, posting on X: “hope he leans into personal choice on vaccines rather than bans (which I think are terrible, just like mandates).”

Kennedy is the third child of Robert F. Kennedy, who served as attorney general under his brother, President John F. Kennedy. Kennedy Jr. spent his early career as an environmental lawyer, suing companies that activists blamed for polluting rivers. A longtime Democrat before his independent presidential run, he has said he twice sued Trump in the 1980s to block his golf courses from being built or expanded. In 1999, Time magazine named Kennedy one of its “Heroes for the Planet.”

In 2005, he wrote an article in Rolling Stone and Salon.com linking vaccines to autism. Both publications issued corrections to the article, and scientists have shown Kennedy’s claims to be false. A 2015 study in JAMA of the health records of 95,000 children showed the MMR vaccine didn’t increase the risk of autism.

Kennedy founded the nonprofit Children’s Health Defense, where for nearly two decades he continued to question vaccine scientists and public-health officials. Kennedy repeated his claims that vaccines leave children at higher risk for autism in a podcast with Joe Rogan that aired in June.

Kennedy has questioned the safety of the Covid-19 vaccines, using unverified reports to conclude they are the “deadliest vaccines ever made.” All medical interventions have risks, but the Covid-19 shots’ benefits outweigh their risks and are safe, public-health officials have said.

Kennedy has also questioned whether HIV causes AIDS. The National Academies of Science said in 1988 that HIV causes AIDS is “scientifically conclusive.”

Kennedy has insisted that he isn’t “antivaccine” and instead wants transparency and informed consent for parents.

A former heroin addict, Kennedy attends Alcoholics Anonymous meetings daily and has said he wants to fight opioid-overdose deaths by making addiction treatment simple and affordable.

He has said that since 2005 he has prayed every morning that God would allow him to “end the chronic disease epidemic.” He views the role leading HHS as an answer to that prayer, a person close to him said.

Kennedy is married to actress Cheryl Hines. She is writing a book about his presidential campaign, he said in a podcast interview Nov. 9, and one of the titles she is considering is: “I didn’t see this coming.”

Anna Wilde Mathews, Rebecca Ballhaus, Laura Kusisto, Xavier Martinez and Dana Mattioli contributed to this article.

Write to Liz Essley Whyte at [email protected], Andrew Restuccia at [email protected] and Vivian Salama at [email protected]