I hadn't caught up with the recent Alex Waislitz issues @ Thorney/TIGA @PortfolioPlus - regarding the Pratt family - so cheers for pointing that out.

By the way, I haven't found anything to back up your assertion that Austral (ASB) has been a substantial position in TOP @PortfolioPlus, but Thorney Opportunities have been active in a few other companies. Did you perhaps use the wrong ticker code in your post?

The Pratt/Waislitz dispute is interesting:

https://www.afr.com/companies/manufacturing/heloise-pratt-alleges-ex-husband-alex-waislitz-falsified-board-records-20241121-p5kse9

Max Mason, AFR Senior courts and crime reporter, Nov 21, 2024

Billionaire Visy heiress Heloise Pratt alleges her ex-husband, prominent investor Alex Waislitz, falsified board meeting records to pay out money from their company to himself and his foundation over her.

The stoush between the one-time couple played in private for months before an escalation to the Victorian Supreme Court. In documents filed with the court, Ms Pratt, the daughter of late packaging magnate Richard Pratt, claims Mr Waislitz, a billionaire in his own right, falsified records at their jointly owned private vehicle known as Jamahjo, which was the trustee of their Halex Family Trust.

Alex Waislitz said he was very disappointed a private dispute had spilt out to the public. Arsineh Houspian

She claimed Mr Waislitz inappropriately appointed Ashley West, the legal counsel at his own Thorney Investments vehicle, as a director of Jamahjo in 2017. Ms Pratt said, in the Supreme Court filings, that she “was never provided with and did not sign the Ashley West appointment resolution”.

She also claimed that at another meeting that year, Mr Waislitz and Mr West passed a resolution that resulted in $1.1 million of dividends from Thorney flowing not to Jamahjo but instead to Waislitz Charitable Corporation and the businessman personally.

Ms Pratt alleged Mr Waislitz “exercised de facto control over the Halex Family Trust by creating false documents evidencing Board Meetings and resolutions of Jamahjo as trustee of the Halex Family Trust which never took place and by purporting to appoint Ashley West as a director of Jamahjo”.

She claimed in controlling the Halex Trust he “acted dishonestly for his own benefit and engaged in criminality”.

The matter refers to the private Thorney Investments firm, not any of the listed investment companies.

In a statement responding to the claims from his former wife, Mr Waislitz said he was “very disappointed that it has come to this”.

“It appears to be a highly provocative and unbecoming action in response to failed negotiations which had up until now been kept private,” he said.

“From the outset, my ex-wife chose to have no involvement at all in Thorney’s day-to-day operations. To come forward now with this claim and seek to involve other individuals including my brother Avee is offensive.

“Our son Jake has recently joined Thorney with the full support of his mother and I feel sad that he and his siblings now must witness this dispute being played out in public. I will be vigorously defending this inflammatory and damaging claim and will have further to say in coming weeks.”

Ms Pratt is seeking to have a new trustee appointed to the Halex Family Trust because “a history of friction between Alexander Waislitz and Heloise Pratt is likely to impede the proper administration” of the trust.

Mr Waislitz and Ms Pratt have been fighting over who gets control of Thorney, a vehicle that was founded in 1991 after Mr Pratt gave his future son-in-law a $1.2 million parcel of Amcor shares to start. Within the decade, Mr Waislitz grew his portfolio to nearly $300 million. He has now amassed a fortune worth almost $1.5 billion.

The pair met when Mr Waislitz briefly worked for Mr Pratt in a corporate finance role at Visy in 1990. He and Ms Pratt married in 1994 and have three children – Jake, Milly and Joseph. The couple split in 2015 but appeared to be on amicable terms, with Ms Pratt greeting guests at Mr Waislitz’s 60th birthday party in 2018.

The Pratt family fortune is worth about $27 billion, most of which is made up of the Visy packaging and recycling empire. Visy Australia is worth $10 billion, and the family has other assets including property. Visy’s American operations, which are not part of the family trust, are worth $15 billion.

The fight between the former couple is not the only dispute involving the Pratt family fortune.

Paula Hitchcock, the child of Richard Pratt and his long-term mistress Shari-lea Hitchcock, is suing her three siblings for a slice of the Pratt fortune in the family’s trust.

Ms Hitchcock’s siblings recently tried to have the matter thrown out of the Supreme Court of NSW.

She alleges she is, for the purposes of the family trust, a child of both Richard Pratt and his wife Jeanne. The siblings argue Ms Hitchcock cannot be considered a child of their mother because she has her own mother.

Related

Source: https://www.afr.com/companies/manufacturing/heloise-pratt-alleges-ex-husband-alex-waislitz-falsified-board-records-20241121-p5kse9

According to Thorney's website....

"When Thorney’s Founder and Chairman Alex Waislitz OAM established his investment company in 1991, he had a vision of being a “thorn in the side” of complacent company managers are not delivering full value to their shareholders.

From Thorney’s very beginnings, we took an active role in the companies we invested in. We get to know boards and management, as well as work actively with them to improve shareholder returns. Thorney has always been prepared to agitate for change when warranted. This remains part of our DNA today. At Thorney, investing is never a static game. We work with an ethos that “the more we roll up our sleeves and get involved, the more we will ensure success”.

--- --- ---

Not sure if they've been delivering very well on those stated objectives. Alex has done alright, but his investors? Not so much.

They have a property arm, but are best known for their two LICs, Thorney Opportunities (TOP) and Thorney Technologies (TEK).

Here's what TOP's largest positions were the last time they updated their website:

I note that the websites Alex has listed under those names are not all correct. Two are wrong.

SXE's website is https://www.scee.com.au/ rather than see.com (as suggested above) - see.com belongs to a company called "Space Exploration Engineering".

ACM's website is https://acm.media/, not acmadcentre.com.au, which goes nowhere.

Also, Money3 is now known as Solvar (SVR), MMA Offshore has been taken private (Cyan Renewables, an Asian offshore wind services platform, acquired 100% of MMA Offshore in July this year for A$2.70 per share valuing MMA at A$1.1 billion, making it the largest ever take-private deal in the offshore wind energy services industry in the Asia Pacific region), and ACM is privately owned by a company called 20 Cashews Pty Ltd which in turn is 25% owned by TOP (Thorney Opportunities).

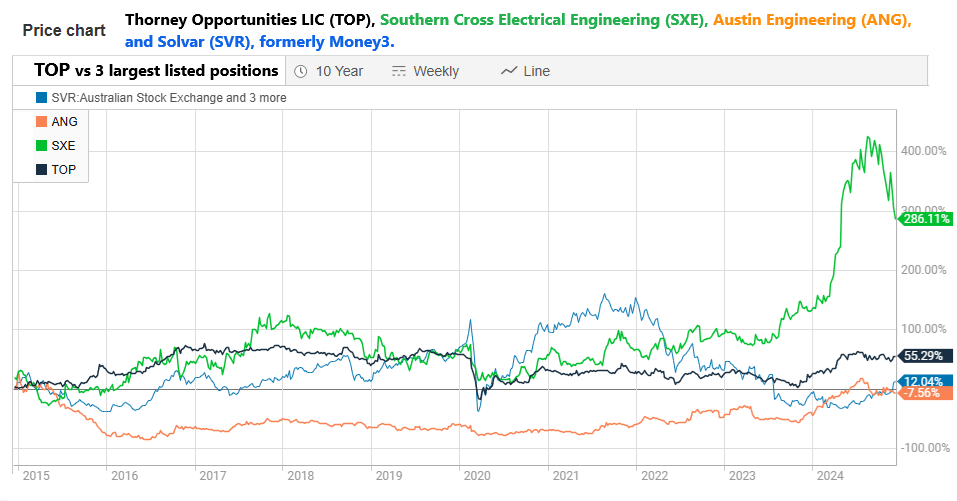

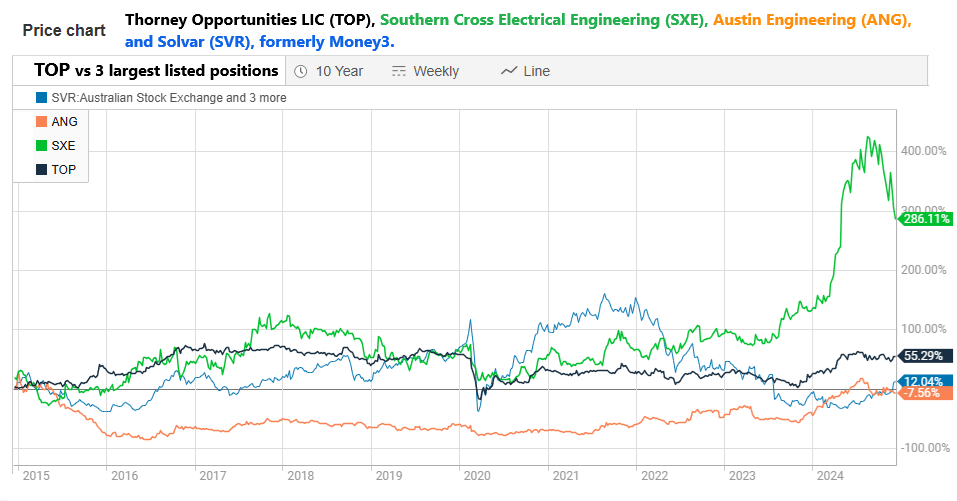

Here's what those 3 currently listed companies from the above list of 5 have done over the past 10 years:

And here's TEK's major positions:

Updater is a private company (not stock-exchange-listed) while Nitro Software was acquired by the Potentia-led PE (private equity) investor syndicate via a take-private transaction and was subsequently delisted from the Australian Stock Exchange (ASX) in April 2023.

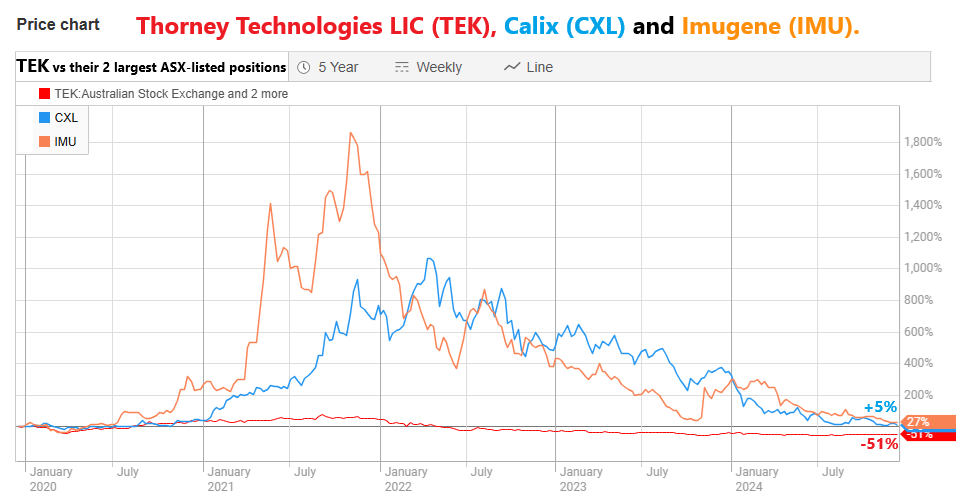

Iris Energy (IREN.NASDAQ) has been publicly traded on the Nasdaq Global Select Market since November 17, 2021 , so for only 3 years, so I can't even include them on the five year graph below without stuffing up the scaling and the start points. They also changed their name in mid-Feb this year; Iris Energy rebranded to IREN, so they have a new website (https://iren.com/), however the old website listed above on TEK's website (irisenergy.co) redirects to the new one.

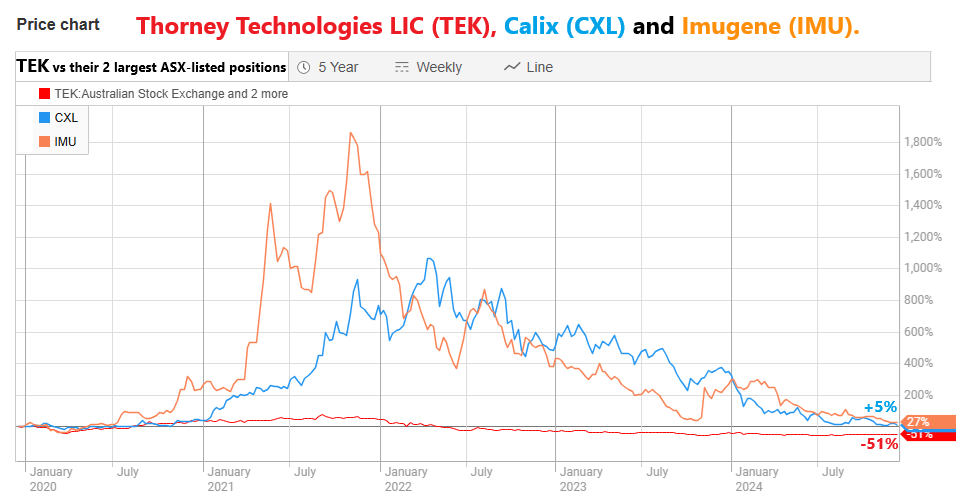

Here's what TEK and their two largest ASX-listed positions have done over 5 years:

TIGA/Thorney (TOP/TEK) have been doing some buying recently, such as:

- Becoming a substantial shareholder for Spirit Technology Solutions (ST1) on Sep 4th (5.24%);

- Increasing their Dubber Corp (DUB) position from 19.39% to 22.10% on Dec 3rd as a result of the recent Dubber capital raising - also TIGA did briefly hold up to 25.9% of DUB in November due to a sub-underwriting agreement for that CR;

- Becoming a Sub for XREF (XF1) on 15th October (6.73%);

- Increasing their position in Doctor Care Anywhere Group (DOC) in Feb, and again in June and again in August, now holding 26.42% of DOC; and

- Becoming a Sub for Retail Food Group (RFG) on 13th November (5.05%).

I have found details of two sell-downs:

- Ceasing to be a substantial shareholder of DUG Technology (DUG) on August 14th; and

- Reducing their position in Southern Cross Electrical Engineering (SXE) from 15.66% to 14.45% as at 21st August, selling at prices as low as $1.185/SXE share on April 18th up to $1.91/share on August 21st (and a few more on August 23rd @ $1.90). SXE spent 2 months between mid August and mid-October trading between $1.73 and $1.96, but they're down to $1.39 today.

If Thorney/TIGA had further sold down their SXE position to 13.45% or less (i.e. another 1% or more below their last notice which was at 14.45%) then they would have been required to have lodged another "Change of..." notice within 2 trading days, and they haven't, yet, but somebody has certainly been selling SXE shares in recent days.

Further Reading:

The Australian: Heloise Pratt suing estranged husband Alex Waislitz [20-Nov-2024]

Podcast:

Podcast: