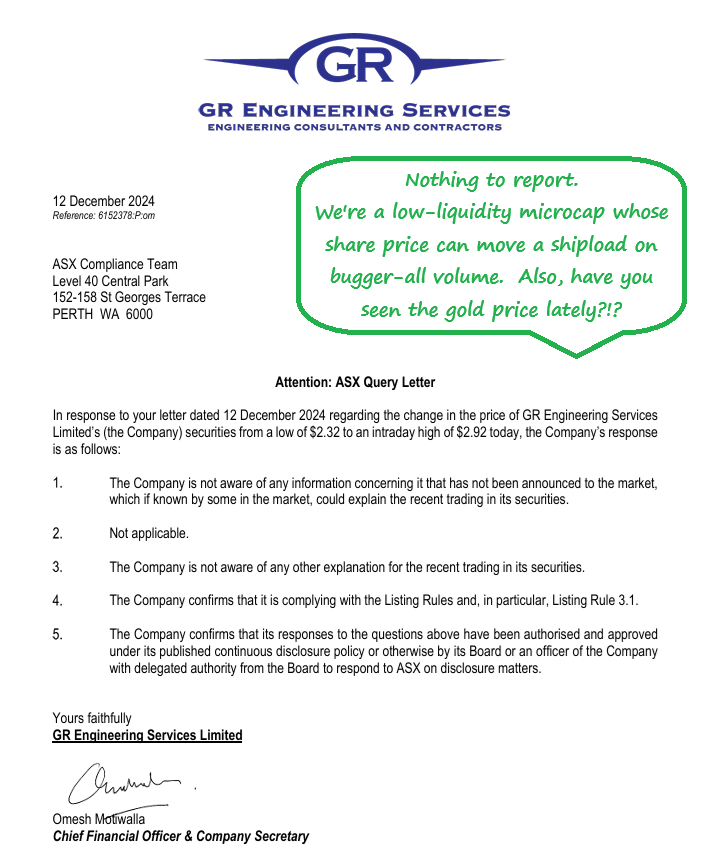

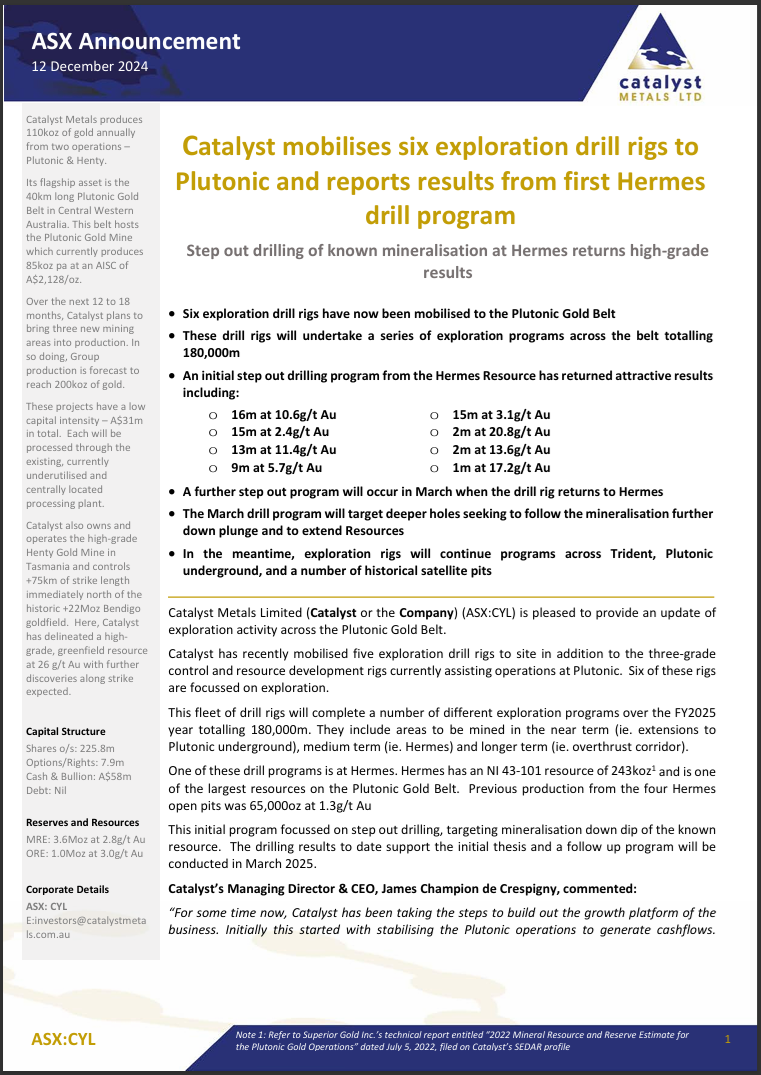

Page 1 of that announcement:

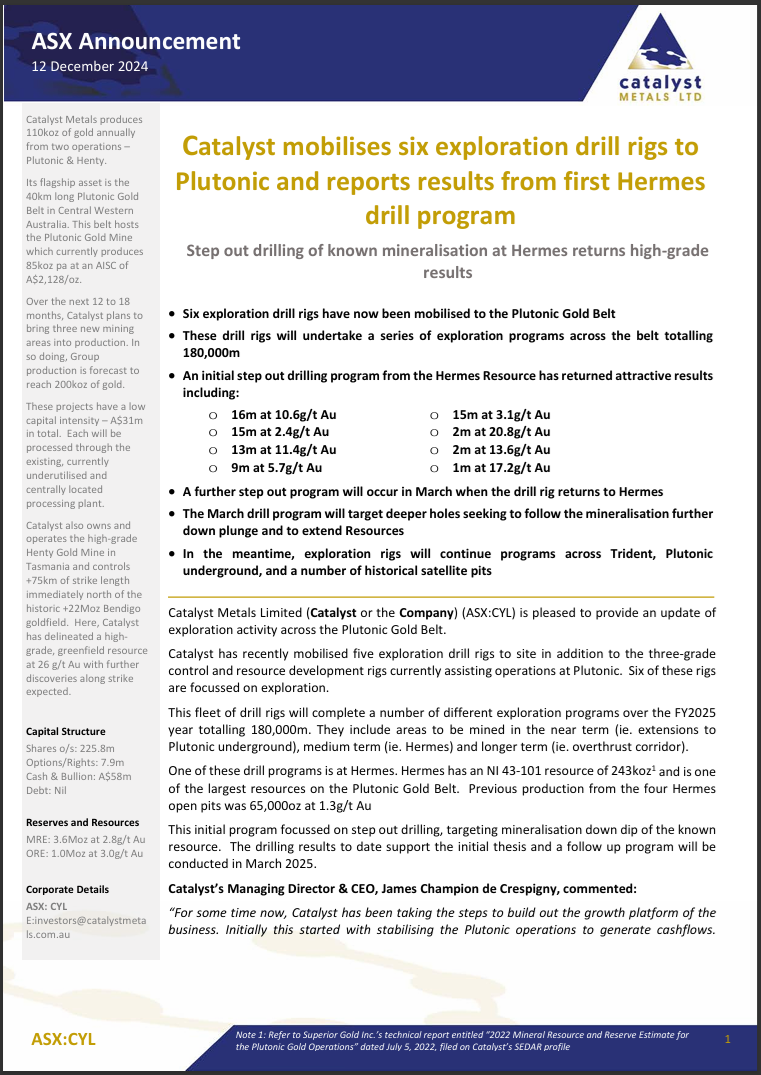

And here's a larger view of those drilling results from that page:

Decent grades indeed!

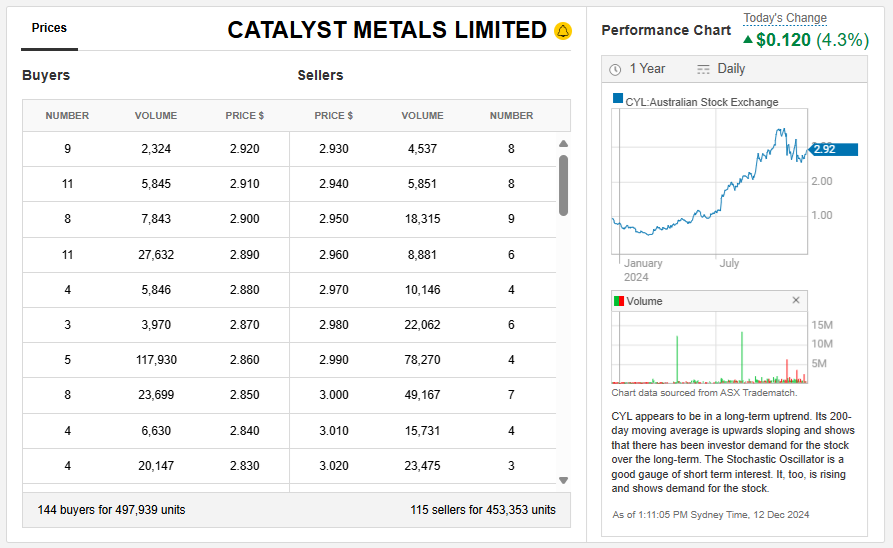

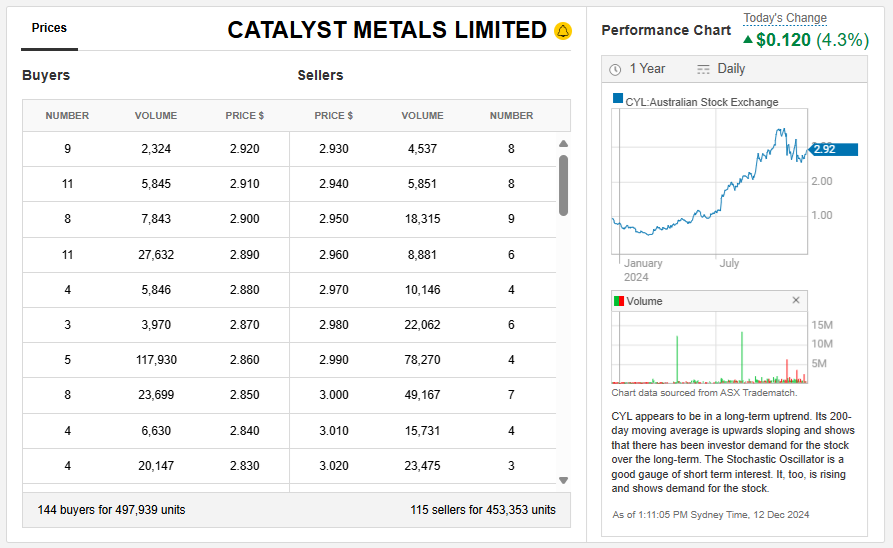

The market had bid CYL shares up +4.3% so far today on the back of these results and the promise of further newsflow as the driling continues.

Disc: I purchased $40K worth of CYL yesterday, as I shared here in my "Bull Case" straw yesterday.

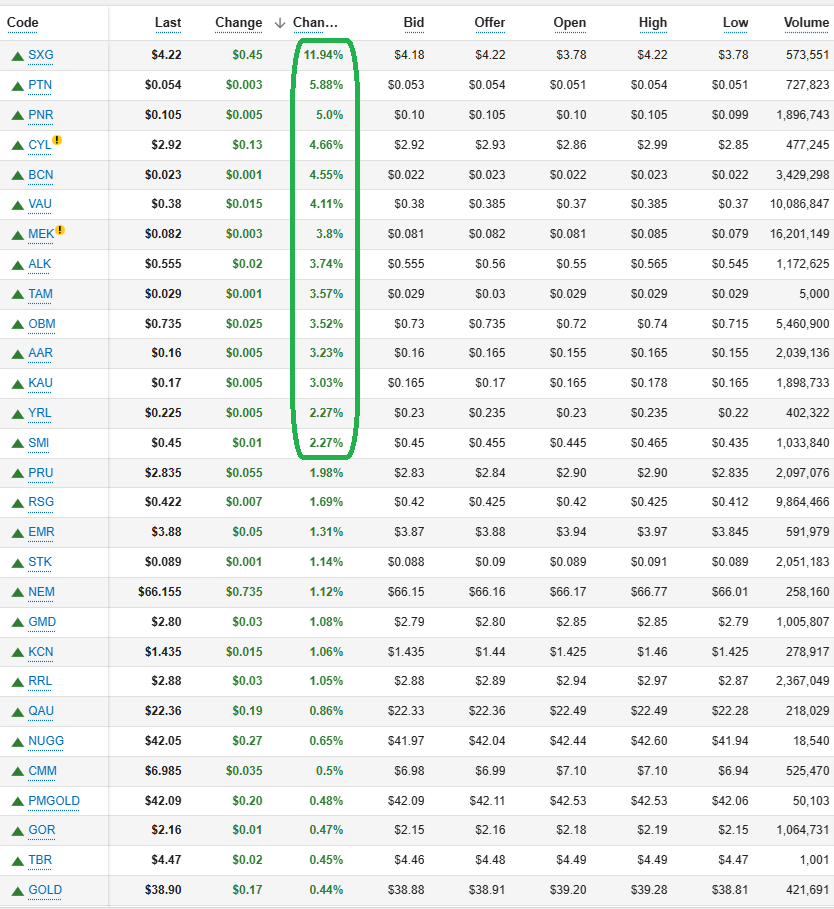

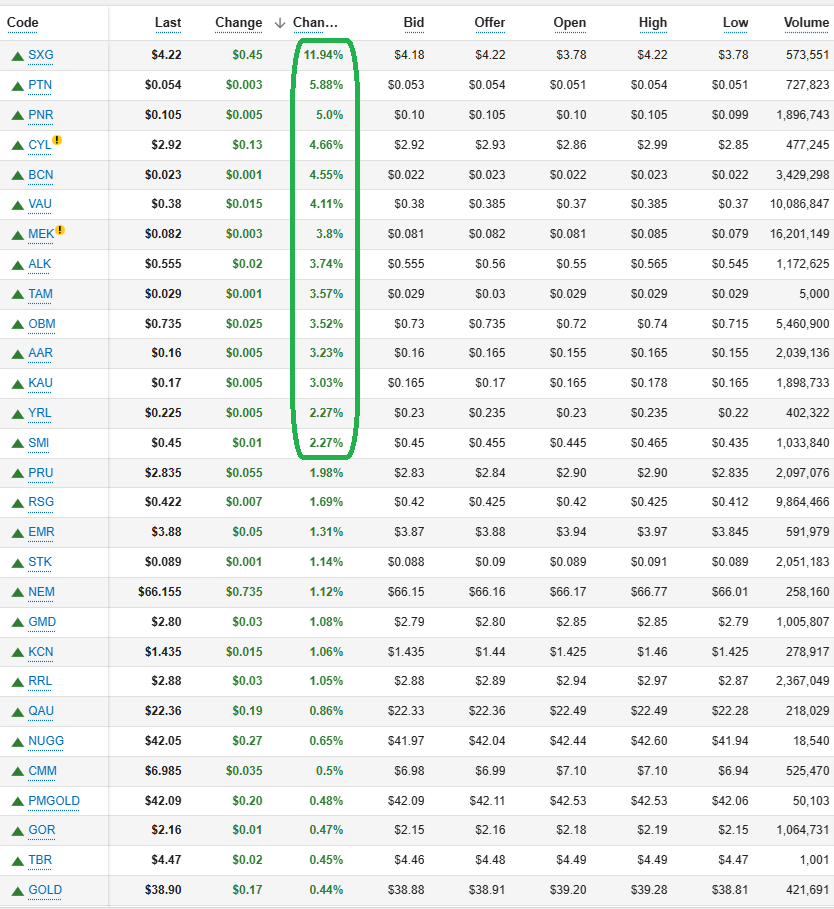

CYL are among the sector's best performers today:

As at 1:30pm Sydney time today (12/12/24). Source: Commsec.

14 goldies are up by over 2% today and 12 of those 14 are up by more than 3%. 6 of those are up by over 4% and half of those 6 are up by 5% or more. Of the 58 companies and ETFs/ETPs on my Aussie Gold Sector Watchlist, only 14 are currently down (in the red) today, with a lot more green on the screen than red.

Meeka Metals (MEK, held) is also up on new news, but I'll discuss that in a different straw.

Interestingly, when I looked 15 minutes ago, GR Engineering Services (GNG) (held) were up over 15% however they're now "only" up by +5.49% @ $2.500. They've been up to $2.92/share this afternoon (in the past half hour) which was +23.2% at the time. They closed at $2.37 yesterday. There's low liquidity with GNG most of the time, so there are often large gaps between offers, so buying "at market" can really move the share price, even on low volume trades, same as selling "at market" - always risky with low liquidity companies. While volume is up with GNG today - over 600,000 shares trading already, about 3 x yesterday's volume, and about a third more than Tuesday's volume, it's not crazy high volume, it's just the lack of offers that has caused the SP volatility.

With the gold price continuing to rise, particularly in A$s, more Aussie gold projects become economically viable, and that is good for an engineering and construction company like GNG who specialise in gold mills (gold processing plants) as well as studies through to DFS (Definitive Feasibility Studies) for gold project developers.

Lycopodium (LYL) is another company I hold (my largest real money position as well as my largest position here on SM) which does what GNG do, and more, but mostly overseas, particularly in riskier locations like West Africa, and now in western Pakistan as well (the Reko Diq copper/gold project for Barrick Gold). Both companies are going to do very well over the next couple of years if the gold price holds up at or near current levels, or rises further.

However, right now, they have share prices heading in different directions. LYL is in a downtrend, or they have been, and GNG is in a nice uptrend. In fact when I looked at them 15 mins ago, GNG's share price had gone vertical. Bit lower now, but it was exciting to watch at the time.