LOV FH25 –a mixed bag (again)

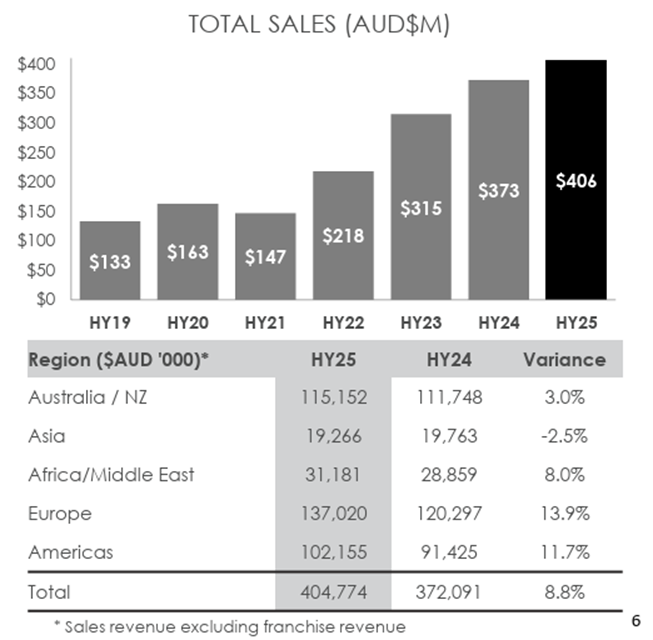

Sales up 9% (expecting 10% for FY)

PBT up 11% (expect 11% for full year)

NPAT + 7% due to tax rate changes and tax loss accounting

GOOD

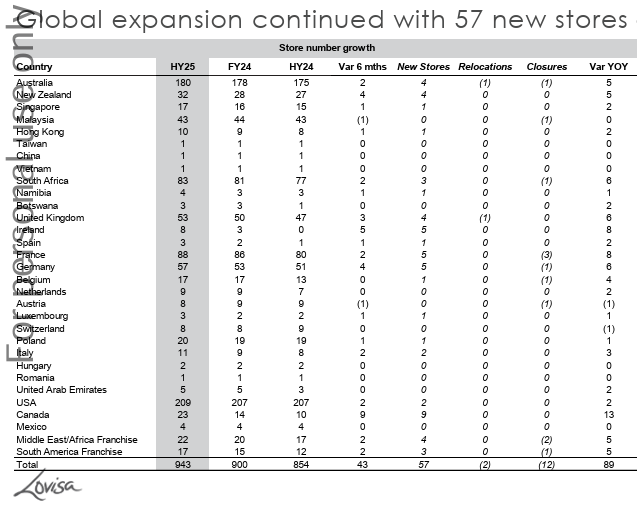

Europe and Canada store rollouts were good.

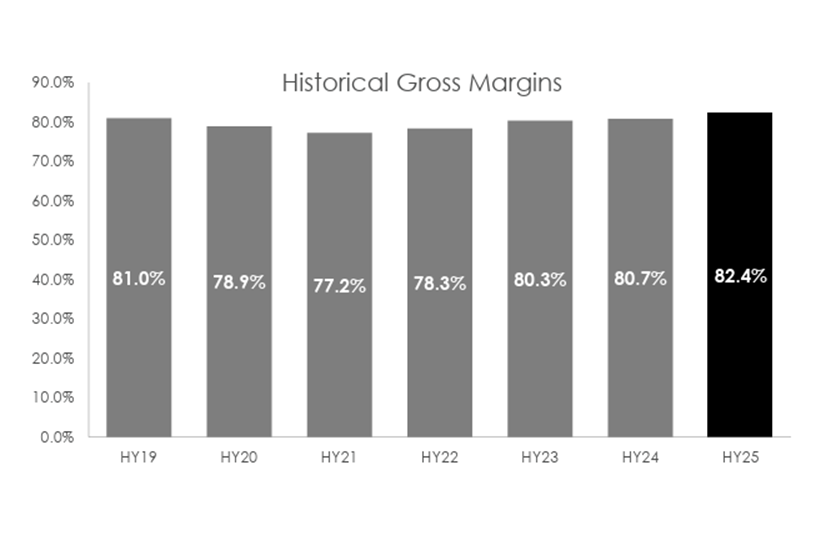

GM 82.4% (see below) at a record, LOV explained due to better supplier terms, being careful on promotions, and better pricing. Good result.

Inventory looks better after drifting over the last couple of years.

Comps 0.1% in 2H but +3.7% in first 7 weeks of 2H.

DISAPPOINTING

Store rollout was slower than expected, with 47 net versus 60 expected. LOV admitted slower than expected but cadence has lifted in q2. CEO (retiring) predicted more stores will be added in 2025 than 2024, implying over 1000 by year-end, est 1020. So overall, it's a bit slower. The US was a standout disappointment, and LOV forecast that the US should start to pick up in 2H (+2 in fh—low). Store roll-out cadence appears to be picking up, we shall see. Ohio DC (US) opened in August so part period and should gain momentum from now.

Asia is challenging and IMO LOV is a Europe and an Americas story, I have no big hopes for Asia, especially China, maybe a few of the peripheral markets can do well. LOV commentary is supportive of growth. LOV continue to analyse China (it's tricky IMO).

OTHER

Spoke to the competition, and said they see a new competitor somewhere in the world every week, LOV believes (as I do) they have a competitive advantage in superior supply chain (scale) and product innovation speed to market.

Lack of scale in various markets is in the results (drag). The CODB is changing as more expensive markets increase in the mix. Usually takes a few years for a store to mature.

Tariffs, not changing suppliers and believe most likely is cost will be passed through in the US by the industry. Ed. Maybe some volatility. They note that their Chinese suppliers are moving factories into SE Asia. I note that given LOV’s tight supply chain (its advantage) that they run changing suppliers is not an easy decision.

OVERALL

I think the positives outweigh the negatives, seeing some store rollout momentum from here is important. Having said that I will have to roll back my store rollout assumption which is 120pa then slow in a few years to 100. Not expecting a big change due to this. Underlying profitability measures are still impressive for LOV.

I was quite nervous going into this result given the CEO change could have seen an air pocket, maybe we have seen that but not too bad.