Saw this tonight @Eand

Street Talk - AFR:

by Sarah Thompson, Kanika Sood and Emma Rapaport, AFR. Apr 21, 2025 – 6.29pm

It’s time for the big guns to come out at the $34 billion Sigma Healthcare amid a wave of selling triggered by Chemist Warehouse’s reverse listing.

Sources told this column Australia’s biggest investment banks – galvanised by the prospect of another lean year on the fees front – are throwing everything they’ve got at wooing Chemist Warehouse co-founders Jack Gance, Sam Gance and Mario Verrocchi, ahead of the first leg of expiries on escrows or selling restrictions.

Chemist Warehouse founders Mario Verrocchi and Jack Gance. Eamon Gallagher

The three own about $16.7 billion worth of Sigma shares, and are allowed to sell 10 per cent – $1.7 billion or about 559 million shares – after the FY25 results. Investment banks know that’s a fraction of the billions they have already traded on behalf of smaller Chemist Warehouse franchisee owners, but there’s a bigger prize down the line – the founders’ remaining 90 per cent that comes out of escrows with the FY26 results.

Street Talk isn’t suggesting the Gances or Verrocchi have committed to selling – they’ve pocketed fat dividend cheques for decades, and are widely expected to wait a bit longer for passive flows to work their magic on Sigma’s share price. But that won’t stop the bankers, who’ve got the scent of a big pay cheque in their nostrils.

As noted by this column, Barrenjoey, Goldman Sachs, Unified Capital Partners and David Di Pilla’s favourite Morgans have done brisk trade in Sigma shares in recent weeks.

Gance jnr leads the charge

It comes after Street Talk last week noted that around $300 million shares in Sigma Healthcare traded via Barrenjoey’s equity desk, with fingers pointing at Chemist Warehouse franchisees. A change of director’s interest notice, filed on Wednesday, confirmed this was the case as Damien Gance sold 100 million shares at $2.97 a pop in an off-market sale. Gance also goes by a different title: director. Gance, a pharmacist by trade and the son of Chemist Warehouse founder Sam Gance, was the retail giant’s first franchisee, opening the first Chemist Warehouse pharmacy in June 2000.

Damien Gance from Chemist Warehouse. Jesse Marlow

Gance junior was Chemist Warehouse’s long-time commercial director and was named to the Sigma board in February after the $30 billion merger with interests in over 400 million securities. But the director has been in sell-down mode since, disposing of 40 million shares in mid-February and 100 million last week.

Sigma Healthcare managing director Vikesh Ramsunder has also been selling, trading 11.7 million shares in February at $2.92 per share on the market.

Street Talk understands investment banks are still sitting on more than $1 billion worth of sell orders from smaller franchisees, who will be hoping to get out before the June 30 results in case the big bosses commence selling. Game theory, anyone?

--- ends ---

Source: https://www.afr.com/street-talk/bankers-circle-chemist-warehouse-founders-16b-plus-stake-20250421-p5lt5g

That (above) was published Monday evening (last night). The following was published by the same Street Talk crew at the AFR back in February:

Street Talk - AFR:

by Sarah Thompson, Kanika Sood and Emma Rapaport, AFR. Feb 13, 2025 – 8.01pm

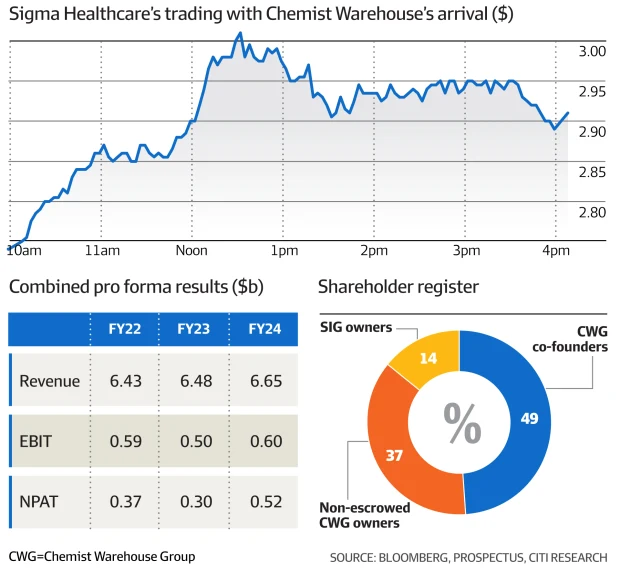

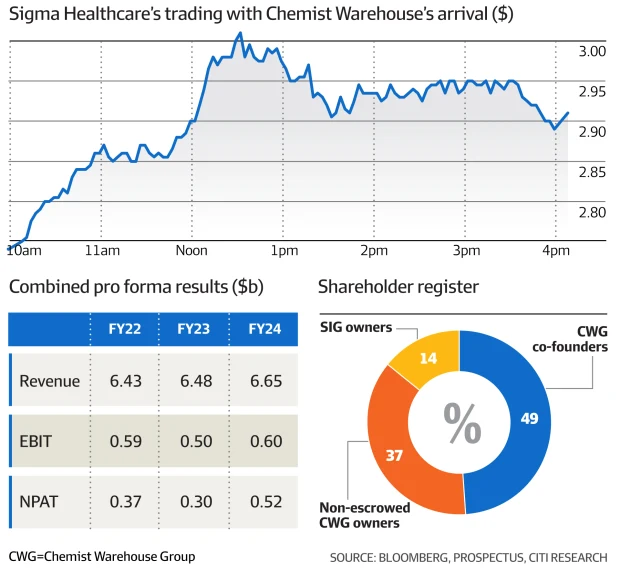

It’s the largest addition to the ASX boards ever. But Chemist Warehouse’s $34 billion public markets debut has also turned out to be a big disappointment for bulge-bracket investment banks’ bosses.

As the dust settled on the pharmacy giant’s first day as a publicly tradable entity, it was mid-tier stockbroker Morgans that had traded the lion’s share of the nearly $1 billion worth of Sigma shares that changed hands. Known to be close to the Di Pilla family, Morgans kept chipping away at small but numerous sell orders on behalf of Chemist Warehouse franchisees. It ended the day with a 28.6 per cent market share, according to Bloomberg.

A crowd of franchisees, advisers, family and friends, and employees cheer at the bell-ringing ceremony on Thursday. Louie Douvis

That was in line with how the day began, with Sydney’s Unified Capital Partners – not a Wall Street bank – having already sold a nearly $110 million block on behalf of a couple of franchisees, several hours before founders Mario Verrocchi and the Gances were due to ring the bell at the ASX.

UBS caught up through the day, coming in second on market share. Wall Street giant Citi, nursing a circa $75 million loss from a Goodman Group block trade in December, had dusted itself off and was among the first out of the gates at the opening bell and ended at the third spot.

Barrenjoey placed fourth, followed by Morgan Stanley. As this column has noted, the franchisees were handed Sigma shares a day before the trading began, blindsiding some ECM teams.

Of note, sources suggested the $10 million-plus block trades, rather than the share of day’s trading volumes, were a truer measurer of banks’ market share as well as the franchisees’ selldowns. On this yardstick, Morgans sold nearly $200 million, Citi nabbed $90 million and Barrenjoey had $73.7 million.

Rothschild, Oaktower Partnership’s moment

While every equities desk tries its best, the fact is neither succeeded in shaking out what we now know could have been a billion-dollar block trade.

The only advisory houses expected to walk away with sizeable cheques – and league table deal credit – are Rothschild, led by Melbourne boss Sam Prentice and Sydney’s head of equity solutions Stuart Dettman, and Oaktower Partnership, where Terry Walsh and Jason Mendoza have been advising Verrocchi and the Gances for the better part of the past decade.

Goldman Sachs’ Melbourne-based executive directors Lisa Tan and Stuart McKelvie advised Sigma. The bank also ran a $200 million raising for Sigma last year, but was largely missing in action in Thursday’s trading.

Several sources blamed the lack of a mega block trade on ANZ’s botched capital raising from 2015, where the underwriting banks’ deliberations on whether to hold or sell their combined leftover shares raised ACCC’s eyebrows. That incident, sources said, had killed investment banks’ offers to Chemist Warehouse to wrap several selling franchisees into a mega block trade, as noted by this column.

Sigma shares ended the day’s trading 5.4 per cent higher, laying to rest concerns about a bloodbath from the franchisees’ sell orders. Plenty of people were caught short and came out in droves to buy, while others took the view that Chemist Warehouse was among the highest-quality addition to the ASX boards in years despite the short-term noise around the un-escrowed franchisees. Yet another cohort is waiting to see where the share price settles before jumping in.

--- ends ---

Source: https://www.afr.com/street-talk/chemist-warehouse-s-34b-debut-has-bulge-bracket-banks-licking-their-wounds-20250212-p5lbid

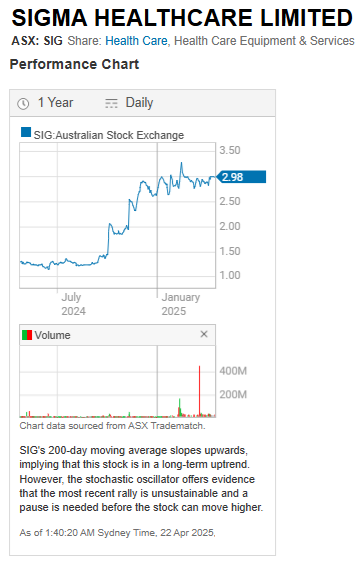

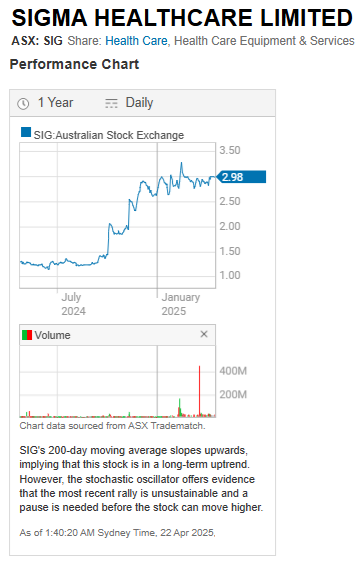

Bear77 Comment: I don't hold this one, and don't follow them closely, but based on this one year chart (below), I would say the selling that AFR Street Talk is reporting hasn't done too much damage to the SIG share price.

Of course, the risk of shares coming out of escrow and being sold, putting downward pressure on the SIG share price is a real risk, however it's only 10% of the Chemist Warehouse founders' holdings that are initially coming out of escrow (so that 10% will no longer have any selling restrictions), and that represents only 4.89% of SIG's total shares on issue (SOI). It's that 10% of the founders' holdings (4.89% of SIG's SOI) that the latest AFR Street Talk article is talking about (the first article above, not the second one) that is due to come out of escrow with the release of SIG's FY25 full year report in August this year, and the other 90% (or 43.3% of SIG's SOI) remains escrowed for another year, so common sense suggests it is not in the CW founders' interests to crash the SIG share price for the sake of selling that 10% when they are still holding 90% of the shares they received when Sigma and CW merged (the reverse takeover of Sigma by Chemist Warehouse).

Any CW founder selling in or after August would likely be done via block trades, and in any case even if sold on-market it would most likely be done in an orderly way working with available market liquidity. These founders will want to cash up at some stage, however if it is done in an orderly way, it doesn't have to be a major negative for other smaller retail shareholders of Sigma. While they still remain major shareholders, it is in those founders' own best interests to keep the SIG share price as high as possible, and with 90% of their shares remaining escrowed until August 2026, it's as we get near to August 2026 that it becomes much more of an issue.

To be clear, that 90% that is escrowed until August 2026 represents 43.3% of all SIG shares today, and the 10% the Chemist Warehouse founders will be able to sell in August this year (2025) only represents 4.89% of SIG shares on issue. Next August (2026) is therefore WAY more important in this context than this August (2025) - in terms of possible / potential downward pressure on the SIG share price, IMO.