Hi @Jarrahman - your link to that RGL announcement doesn't work but I checked the company out anyway. If their Executive Chairman David Lenigas does indeed call Monaco home then I reckon it might be because of the way he makes his money, i.e. getting others to do the work, not him, which is smart. In terms of skin in the game, he does own 6 million RGL shares plus another 52.5 million options, but to put that into some context, the company is currently trading at less than 1 cent per share and the entire company is worth less than $17 million in terms of their market capitalisation.

But the way they go about things is quite interesting - by way of farm-ins where other companies spend the money and do the work and take a percentage of the profits. It's not silly when you don't have the money to do very much yourself.

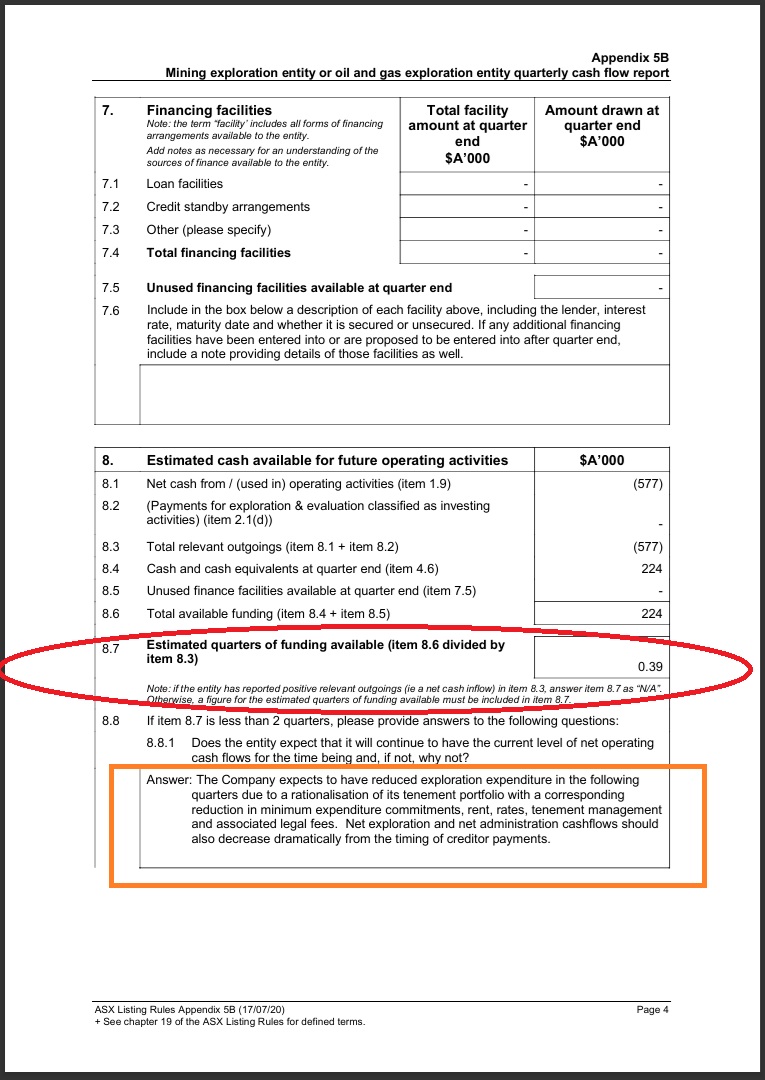

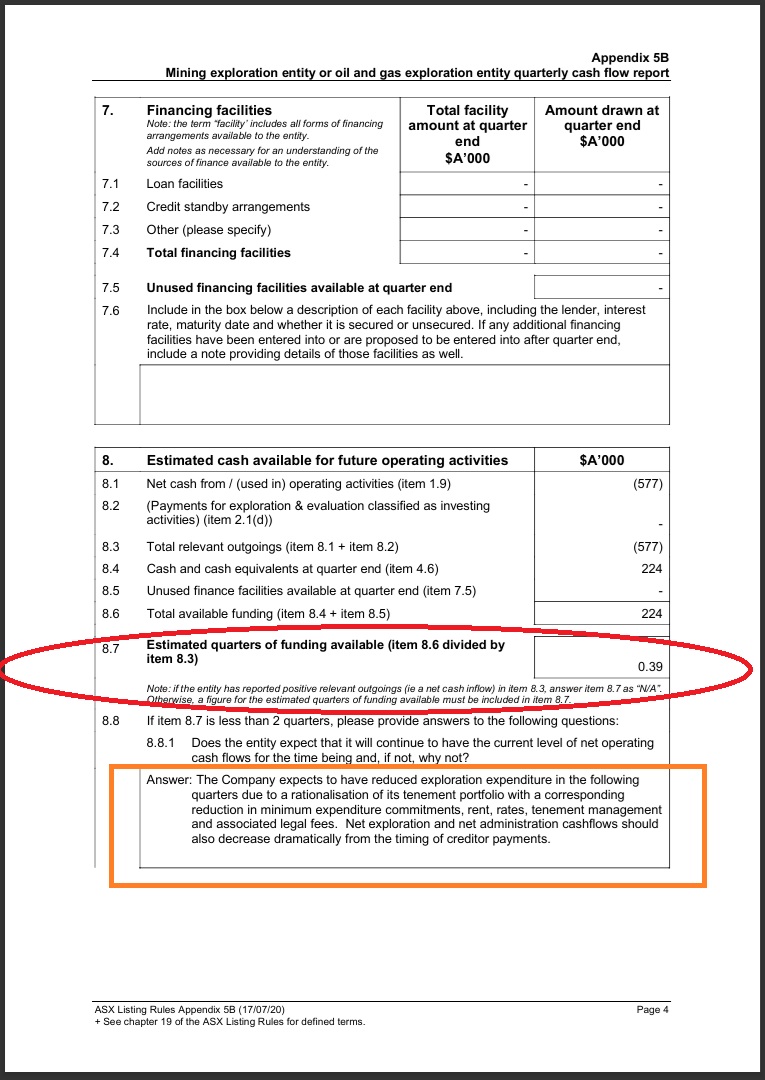

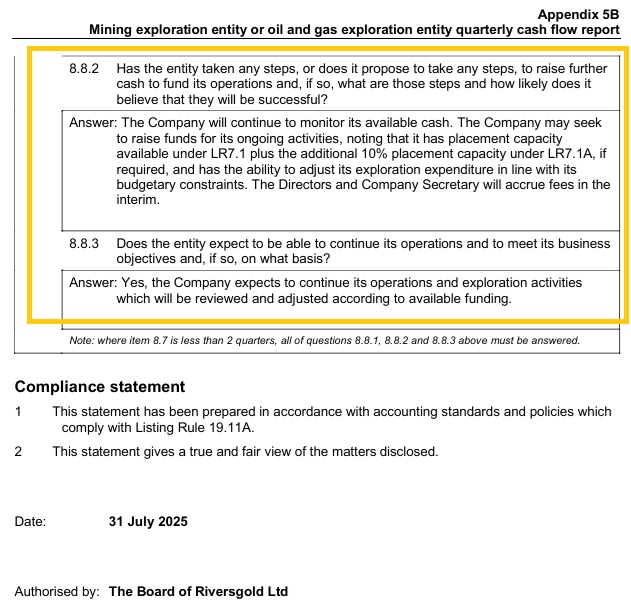

This is the last part of their last Appendix 5B (Mining exploration entity or oil and gas exploration entity quarterly cash flow report) for the June quarter. Their September quarter 5B will have to be lodged by the end of this month (October) but most companies leave it until the end of the month, especially companies this small.

No Financing Facilities and 224K left in the bank, with a quarterly cash burn in the June quarter of 557K. At the end of June they had enough cash to last just one month, and look at what they said their plans were - highlighted in the orange and yellow rectangles above and below:

--- ends ---

The company intended to reduce exploration expenditure and "may seek to raise funds". No sh!t Sherlock! That's a Captain Obvious statement if ever I heard one. Seeing as they only spent $401 K on exploration in the June quarter, being $134 K per month, they weren't doing very much to start with, but yeah, they can reduce that, to zero most likely, or very close to it.

As far as a company that was cum-capital-raise, yeah, they fitted that description for sure.

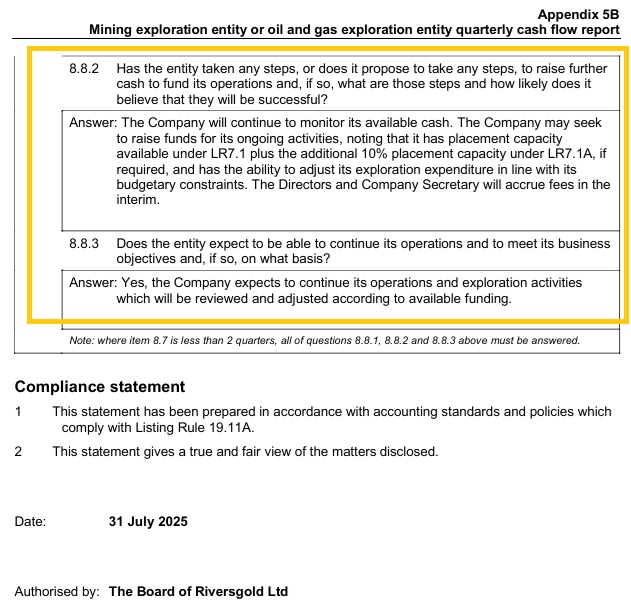

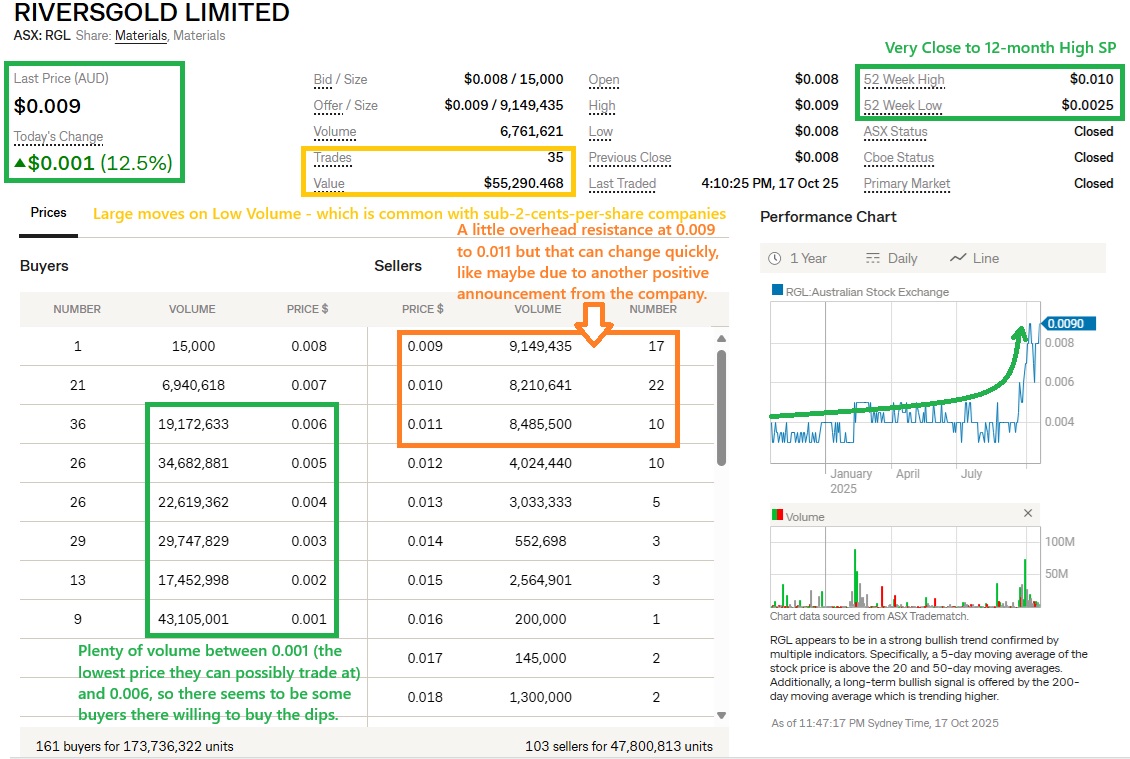

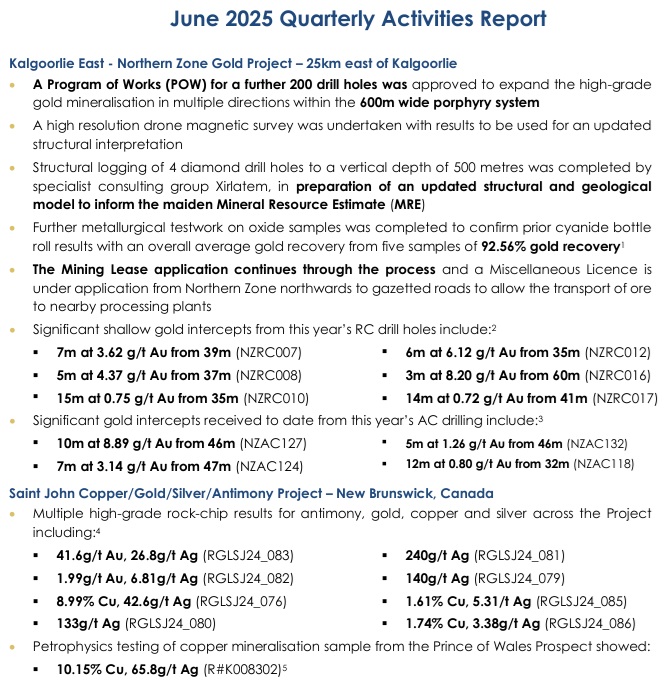

Their SP closed at $0.004 on the day, up +33.33% from their $0.003 close on the previous day. When your share price is three tenths of one cent it can only move up or down by 33.33% - i.e. $0.001 - that's the SMALLEST amount it can move by. That's one of the reasons we can't buy shares here on SM for less than 2 cents each. However the reason their SP went up instead of down when they were clearly on the bones of their arse financially according to that 5B is more to do with the 13 page Quarterly Activities Report that came in front of the 5B in the same announcement; not everyone reads the 5Bs and the Activities Report started off on Page 1 with loads of high grade gold (Au) hits as well as some decent silver (Ag) and copper (Cu) hits as well, as shown below:

Source: July 31, 2025: RGL: Quarterly Activities/Appendix 5B Cash Flow Report.PDF [Page 1]

The fact that those hits were from "this year's RC drill holes" and "this year's AC drilling" rather than from the quarter that the report was for (the June 2025 quarter) is just accentuating the positives I suppose. Some might call it positive spin, but it seems to be working for them.

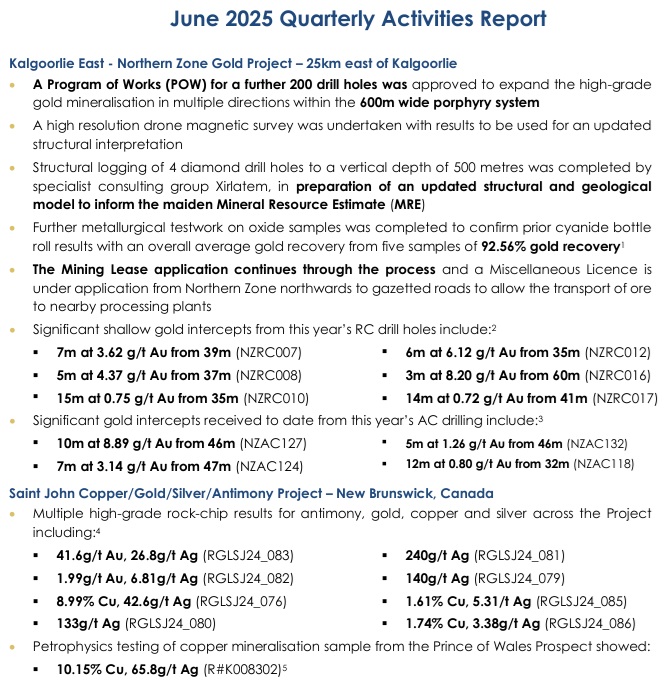

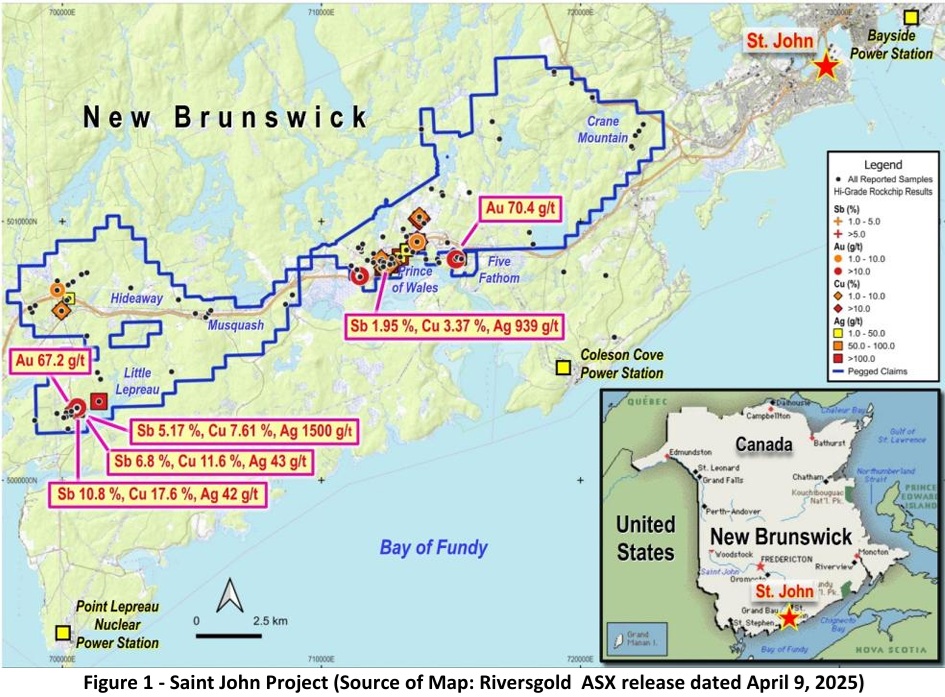

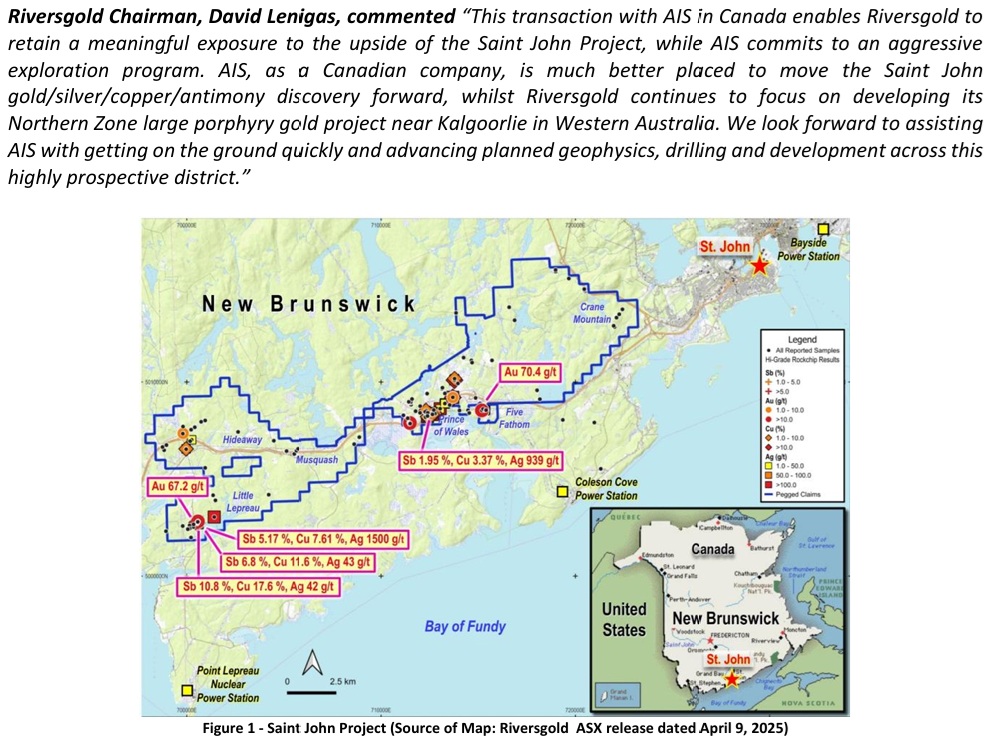

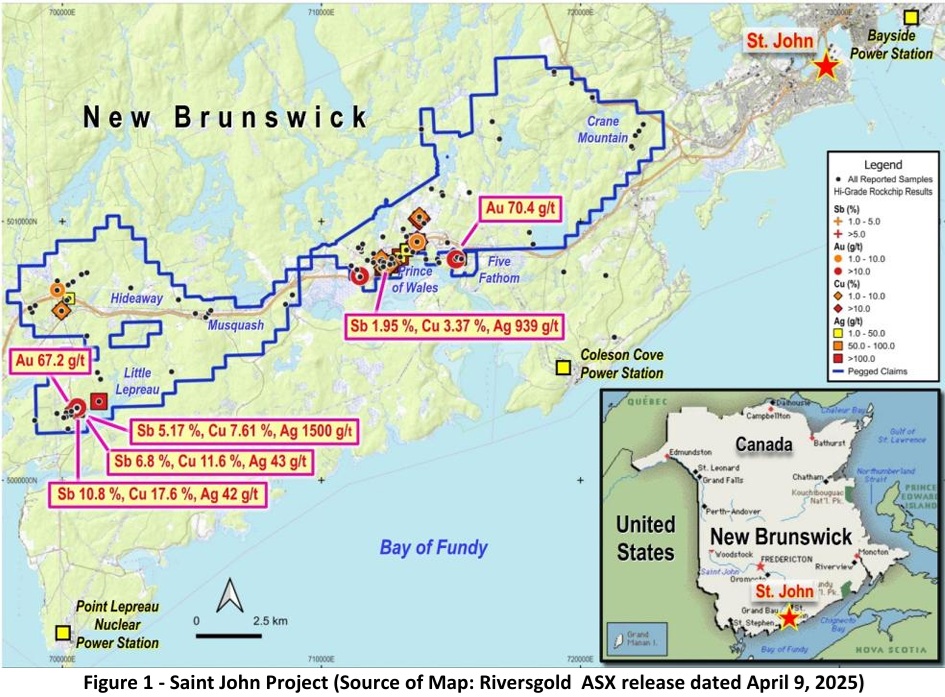

They then announced this on September 15th: RGL-Partners-with-Canadian-Company-on-Saint-John-Project.PDF

Let's see if I can blow that map up any bigger...

That's the best I can do.

Note that there was no cash exchanged in this deal. RGL was granted 2,860,000 A.I.S. Resources shares and AIS can earn up to 75% of the project by spending all the money on project development, with RGL retaining a 25% free-carried interest in the project through to decision to mine. "Free-carried" meaning RGL don't need to spend a dime on that project during that period. Their SP closed flat at $0.004 that day.

Next we get RGL's September 30th announcement: Mining-Agreement-for-Northern-Zone-Gold-Project,-$18M-Raise.PDF

Note that the amount they raised was $1.8 million, not $18 million as the file name suggests - you can't include decimal places in file names.

That one is 6 pages long and the gist of it is that RGL raised $1.8 Mill via a placement and they've signed an agreement that means that a company called MEGA Resources will fully fund the Northern Zone Gold Project operations with the Project Owners (who are mostly RGL who own 80% of it) to receive 50% of the profit. So, once again, RGL are free-carried through to the project becoming a profitable operation, and even then their financial commitment would be just 10% of their share of the profits generated by the project to be reinvested back into expansion grade control and step out drilling.

These guys ain't dumb!

Interestingly Riversgold (RGL) gained their 80% ownership of the Northern Zone Gold Project back in May 2023 when they formed a strategic alliance with Oracle Power through a legally binding farm-in agreement, paving the way for Riversgold to potentially acquire an 80% ownership stake in the project, which they have subsequently done, so Oracle Power still own the other 20%. (Source: https://www.riversgold.com.au/project/northern-zone-gold-project/) RGL gained their 80% share through a farm-in, and now they're getting the project developed through another farm-in, this time by MEGA Resources - see below.

Highlights

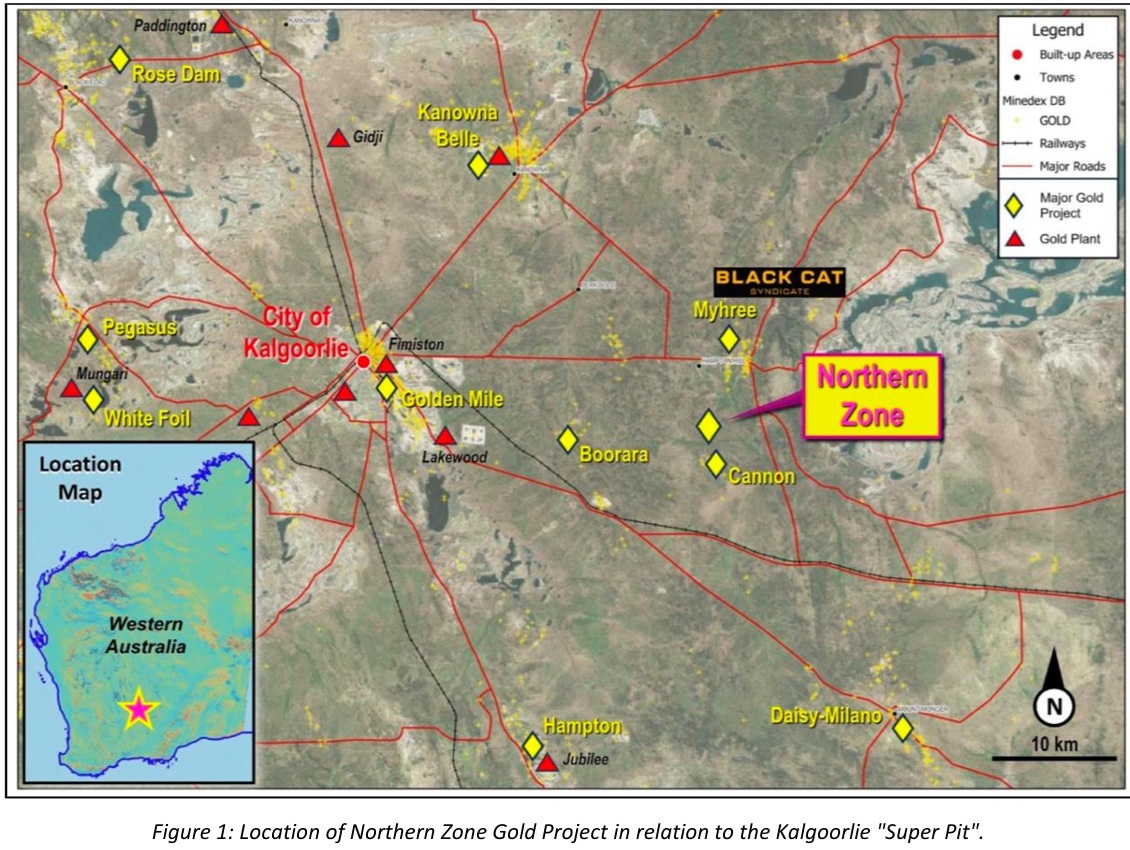

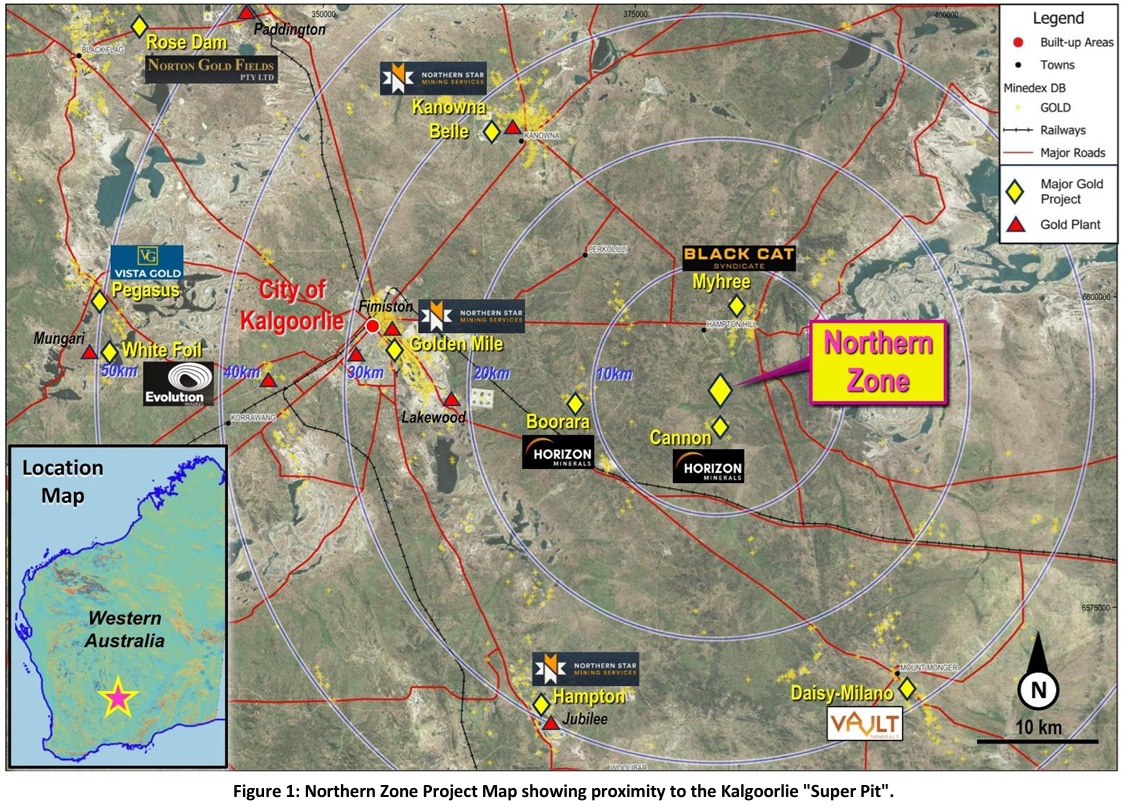

- Riversgold have signed, on the Project Owners’ behalf, a Right to Mine and Co-Operation Agreement with established WA Goldfields mining services provider MEGA Resources (MEGA) - for full project funding, mining, and haulage services at its Northern Zone Gold Project which is located 25km from Kalgoorlie.

- MEGA is a full-service mining contractor that will now be providing all of the funding for the operation; MEGA will also provide geological and engineering services and manage project approvals.

- The Northern Zone Gold Project Kalgoorlie is owned 80% by Riversgold and 20% by Oracle Power Plc ("Project Owners"). No upfront funding is required from the Project Owners.

- MEGA will share profits equally (50/50) from operations with the Project Owners.

- 10% of project profits generated monthly (funded on a 50/50 basis) will be reinvested back into expansion grade control and step out drilling.

- MEGA is aiming to break ground during the January quarter of 2026, subject to the partnership gaining all of the final tenement permissions, mining approvals and the signing of a binding ore purchase agreement with a third-party processing mill.

- The Northern Zone Gold Project Kalgoorlie drilling has already identified a gold mineralised porphyry around 600m wide and around 500m deep from diamond drilling.

- New Northern Zone drilling programs are being planned to test extensions of known gold mineralisation.

- Firm commitments received to raise $1.8 million (before costs) via single tranche placement to sophisticated investors.

Yeah, that'll work.

Some excerpts from that announcement:

About MEGA Resources

MEGA is a Western Australian-based mining company, see https://megaresources.com.au/. MEGA stands for Mining, Engineering and Geology across Australia, representing the collective expertise and industry experience of the company. MEGA is focused on the development of its own mining projects, supported by an in-house mining service team. In addition to internal projects, MEGA works with selected companies to provide mining expertise and technical knowledge, in addition to funding solutions through its partnership with mining giant BGR Mining & Infra Limited. MEGA supports companies such as Riversgold in monetising their projects and achieving long-term success. MEGA is committed to delivering value through a combination of hands-on mining experience and strategic partnerships that create meaningful, sustainable outcomes for all stakeholders.

About BGR Mining and Infra Limited

BGR is headquartered in Hyderabad, India and was founded in 1988 as an engineering contractor (see https://www.bgrmining.com). Today, BGR is one of India’s largest and most respected private mining companies, having a net worth of half a billion AUD, with an order book exceeding AUD 16 billion and contracts extending for the next 25 years. BGR has consolidated its services as one of the leading mining developers and operators (MDO) in India. BGR integrates design, planning and modern operation technologies for safer and more productive mines. Having achieved steady growth over the years since its inception, BGR has now set its eyes on the global stage to deliver mission-critical projects in a timely manner.

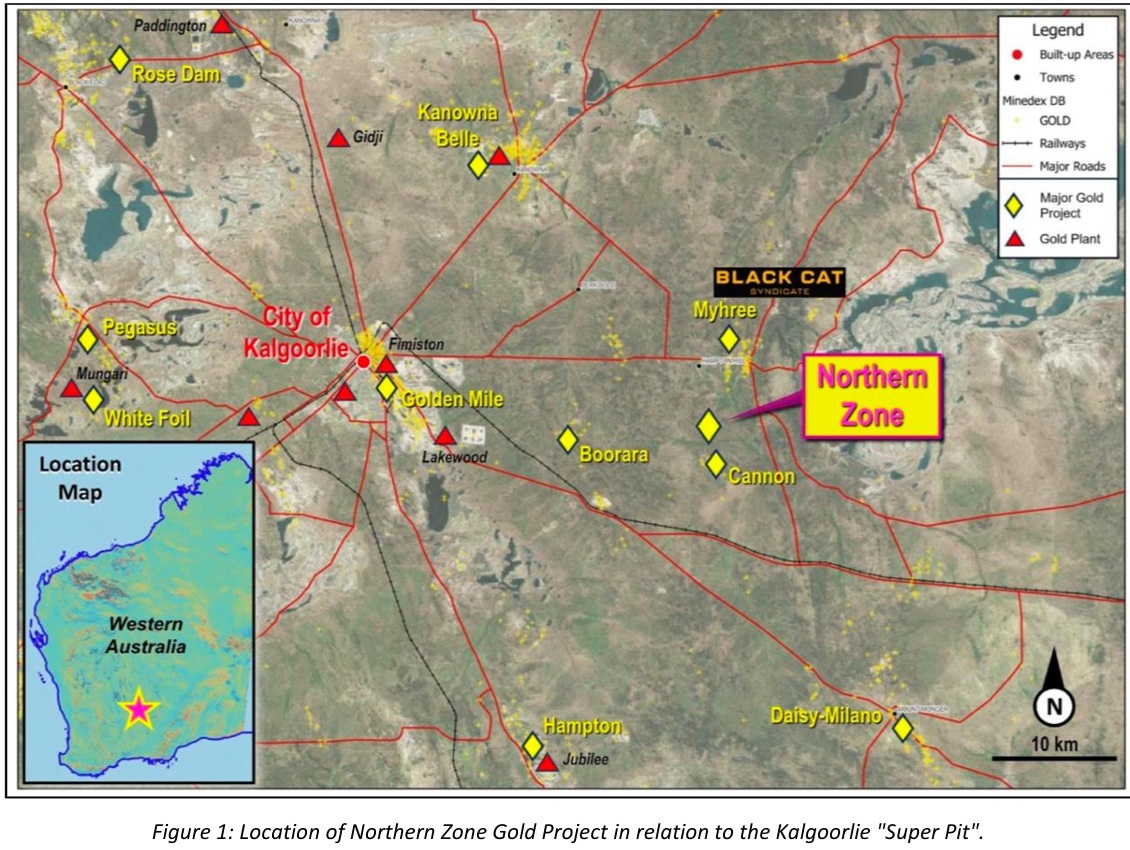

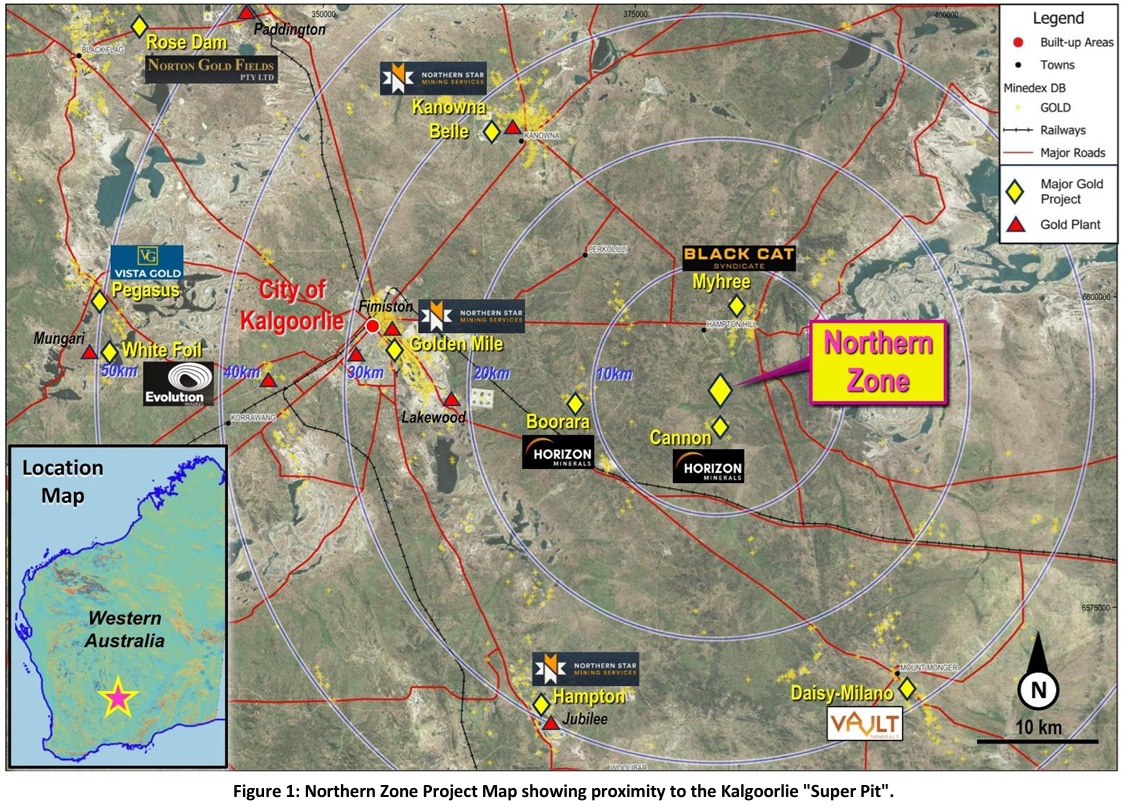

Interesting that they've mentioned the Kalgoorlie "Super Pit" there - under the map - which is the second largest open pit mine in Australia (behind Newmont's Boddington gold mine in WA) and is owned by Northern Star (NST), the largest Australian gold miner, but I guess it never hurts to try to associate a very early stage gold project like theirs with the Super Pit which is probably the most well known gold mine in the country. It is however a very big stretch to compare the two, even if you can get them both on the same map. You can see that there are a number of gold mines that are closer to "Northern Zone" than the Super Pit is.

For those who don't know, the main mill at the Super Pit is the Fimiston mill, just east of and right on the edge of Kalgoorlie. They've marked "Fimiston" on the map (next to Kal) but not the "Super Pit" - yet they've referenced the Super Pit under the map as part of the description of what the map is showing. Some people also refer to the Super Pit as "the Golden Mile" or just Golden Mile, which is shown on the map above, but Golden Mile is the name of the geographical area that the Super Pit is in, and the Super Pit does take up a fair whack of Golden Mile, but not all of it. That map seems to me to be a bit half-arsed, but there you go. RGL's SP closed up +16.67% (or up +$0.001) @ $0.007 that day (30th Sep).

Then 11 days ago (Oct 6th), RGL released this: Kalgoorlie Gold Project Area Getting Bigger.PDF

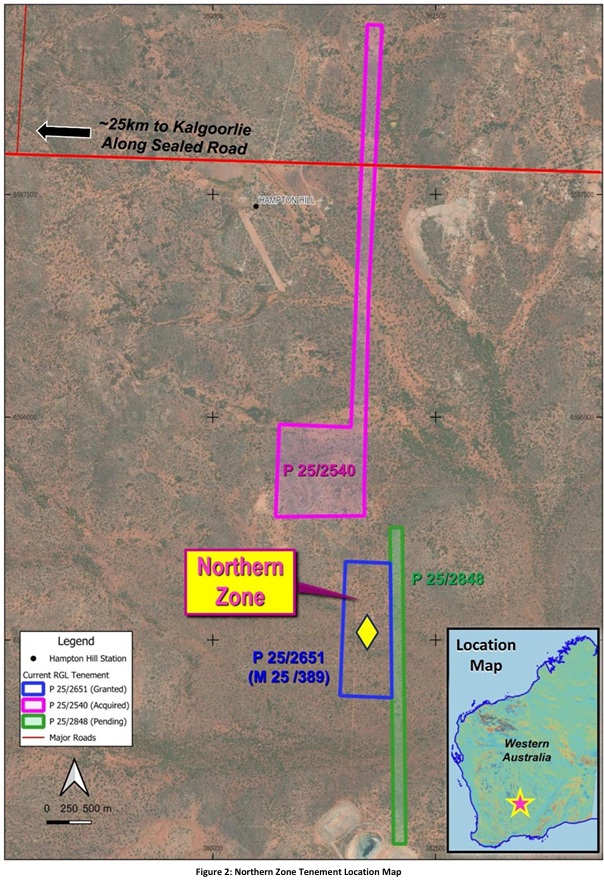

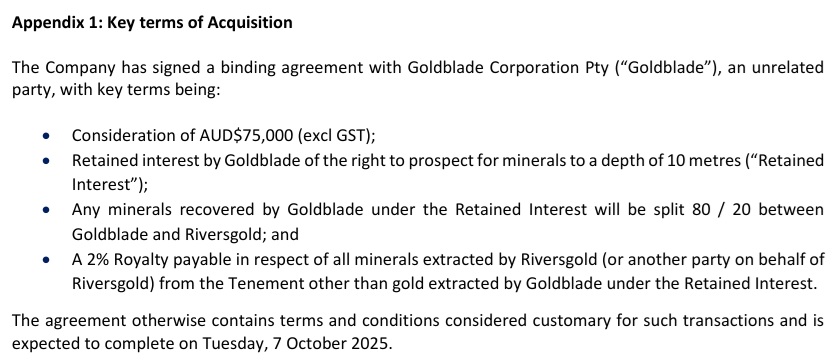

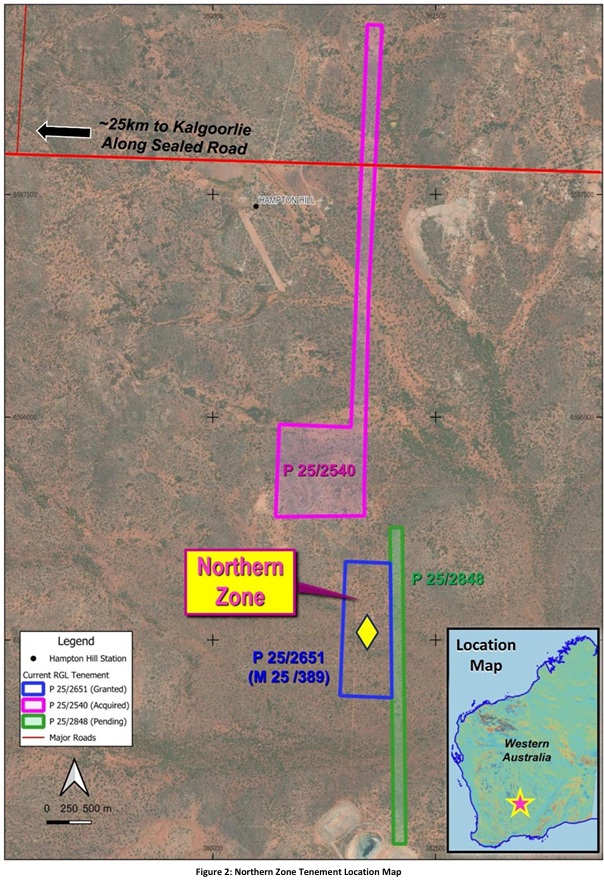

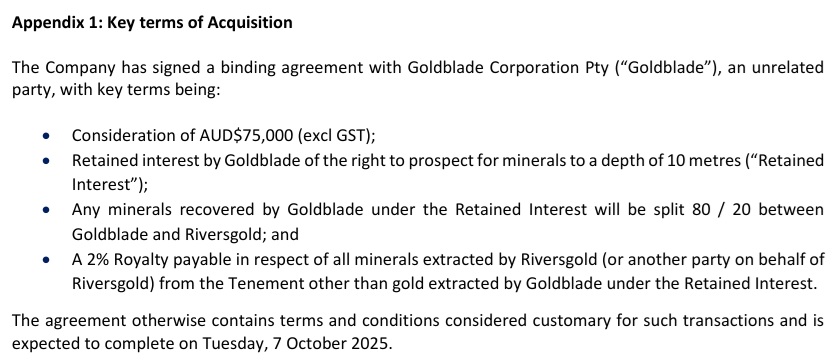

This one says that they've signed a binding agreement with Goldblade Corporation Pty Ltd to become the sole legal and beneficial owner of granted tenement P25/2540 (see Figure 2, below), located approximately 500m to the north of the Company's Kalgoorlie Gold Project (Northern Zone). The Northern Zone intrusive hosted gold project is located on P25/2651, 25 km east of Kalgoorlie in Western Australia (refer to Figures 1 and 2 for location, below). RGL has also applied for P25/2848 immediately contiguous to the east of P25/2651. The Company continues to assess opportunities for additional tenure in the region.

Ed Mead, Technical Director for Riversgold, commented, "These tenements are very strategic and important for our future gold production development plans, especially with respect to the deal announced by RGL with MEGA Resources on 30 September.”

Highlights:

- Riversgold to acquire 100% of granted tenement P25/2540

- Located ~500 metres due north of RGL's Northern Zone Kalgoorlie Gold Project (the Project)

- This represents a 170% increase in Project size

- Application for new tenement P25/2848 immediately east of Project

They're persisting with those "Super Pit" references eh!?! [Still without marking "Super Pit" on the map] [yeah, we know it's in the Golden Mile - just saying it ain't that clear unless you know]

Lucky they raised that $1.8m in the second half of September eh!!

Still, $75K isn't much to pay for land that is truly prospective for commercially viable gold, so they may have done a good deal there for sure - IF they do find commercially viable gold in those tenements.

But wait folks, there's more - also released on the same day (Oct 6th), a day on which their SP rose +12.5% (or +$0.001) to close @ $0.009, they released this: Grade Control Drill Rig Booked for Kalgoorlie Gold Project.PDF.

--- end of excerpt ---

I just love that image. That's the "type of grade control rig" they've booked to work on their tenements from (on or about) October 27th, however that one is working in a pit, and that's not what their booked rig is going to be doing - it's going to be "Drilling to focus on the shallower gold mineralisation between west and east mineralisation identified from previous drilling". So, not deep drilling then. And not in a pit.

And while Riversgold (RGL) say they have booked this rig, they won't be paying for it - no, that would be MEGA Resources, their JV/farm-in partners there who will be paying for it. Because RGL are free-carried by MEGA through to profitable gold production at the Northern Gold Zone project.

No, they're certainly not silly.

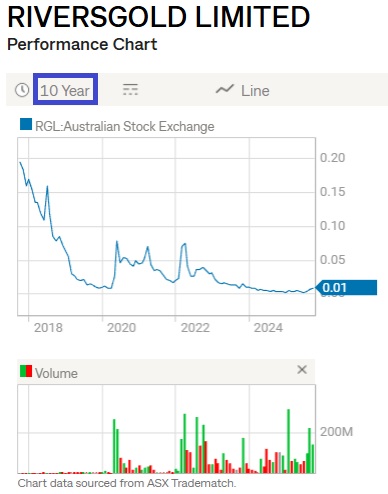

Very news driven share price, and the company is getting away with seemingly creating value without spending much money, however how does that all translate into shareholder returns? With a company like this 100% of the TSRs are going to come from share price movements because they burn cash, they don't sell anything, except percentages of their own projects to other companies as illustrated by these announcements. So - share price:

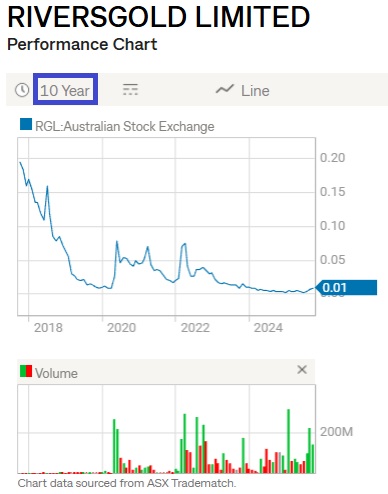

Over longer periods, not so good (that's using monthly data points over 10 years), and the current Board have only been involved with Riversgold since August 2019 for one director (Simon Andrew) and since 2022 for the other two. There is no data for directors prior to 2017, but it seems the company has been operating since 2017.

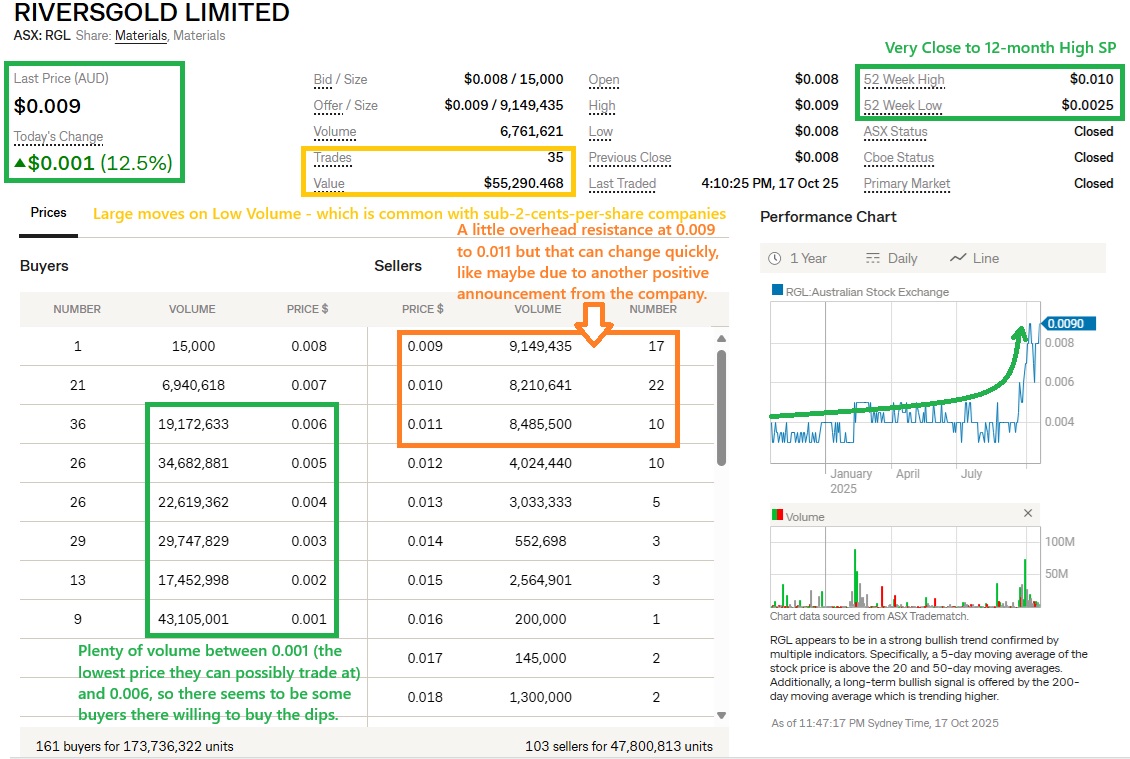

However, over the past 12 months it's a different story:

Sure, $0.003 (three tenths of one cent) is a low base to come off (their year low was $0.0025 or one quarter of one cent as shown there above that one year chart), but to not go broke, and to keep the momentum up in the past month on the smell of an oily rag has been almost inspirational.

Almost.

It's not for me, but I can understand the appeal of Monaco.