He does like to waste money @stevegreenycom - including on a lavish lifestyle - I'm not sure if you'd also classify the following in the same category (wasted money):

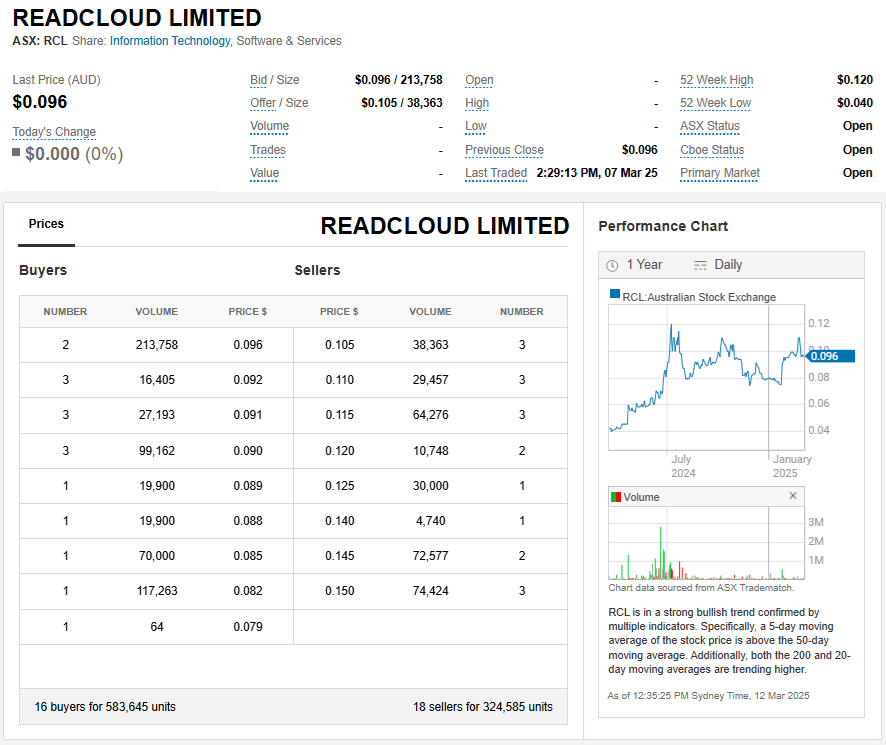

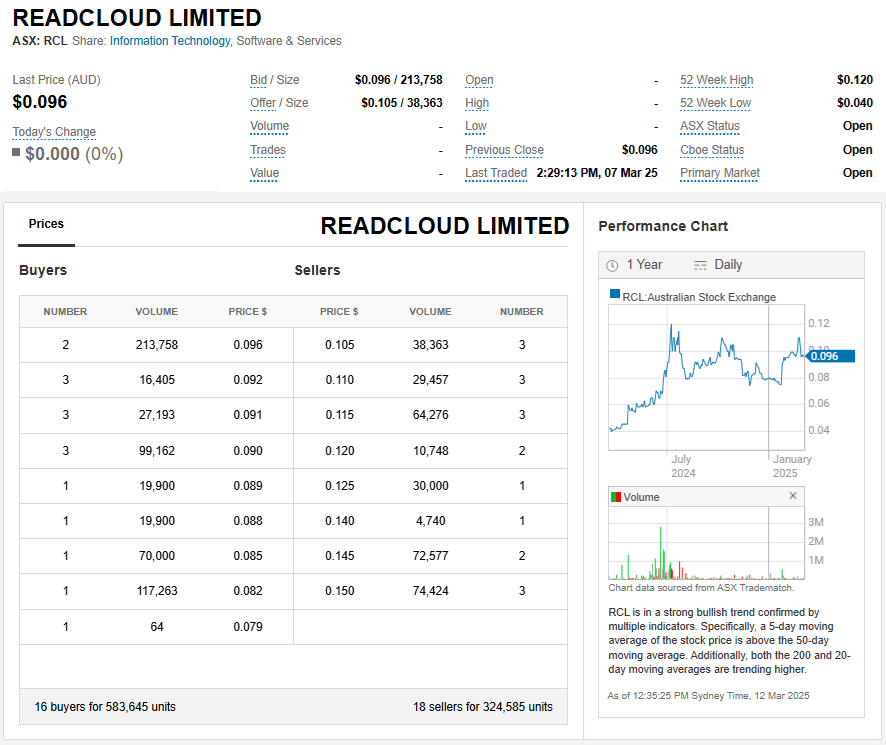

- 4-March-2025: Exercising $102,398.40 worth of options in ReadCloud (RCL) to take TOP/TIGA's stake from 10.92% to 12.27% (Link)

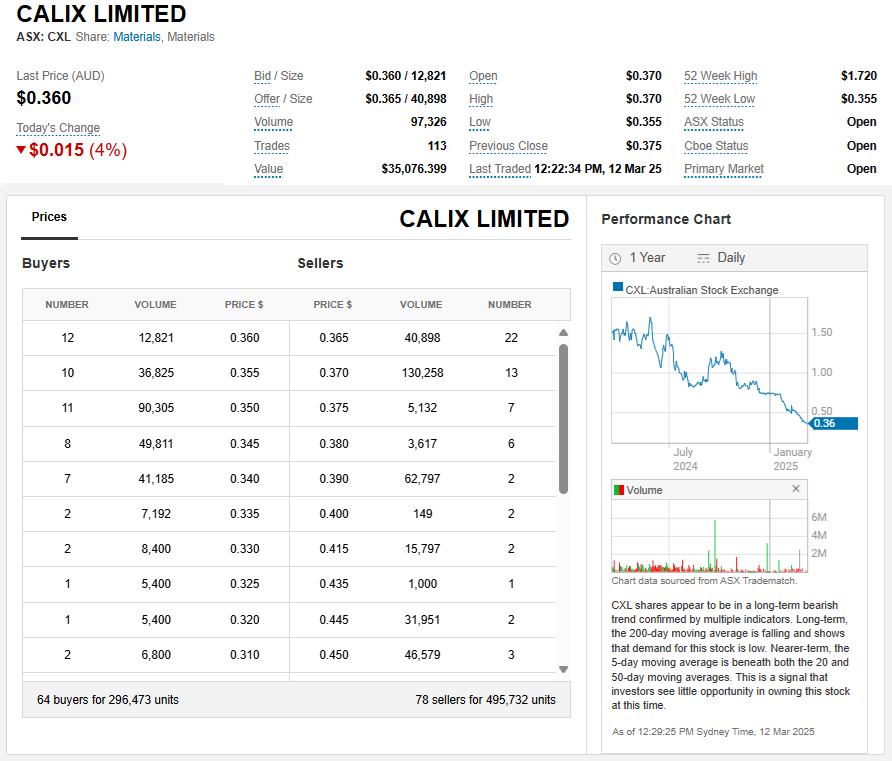

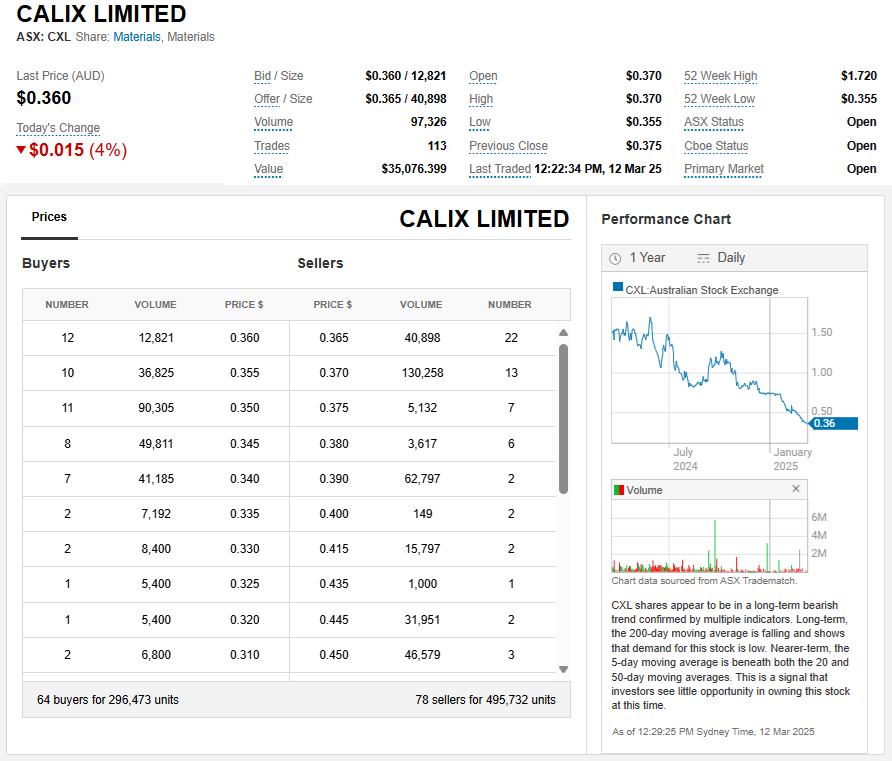

- 3-March-2025: Buying millions of dollars worth of shares in Calix (CXL) from 4th September through to 3rd March with the largest three purchases being $602K, $412K and another $1,765,000.50 in a placement in December. This has moved TOP/TIGA up from 8.67% to 10.81% of CLX (link)

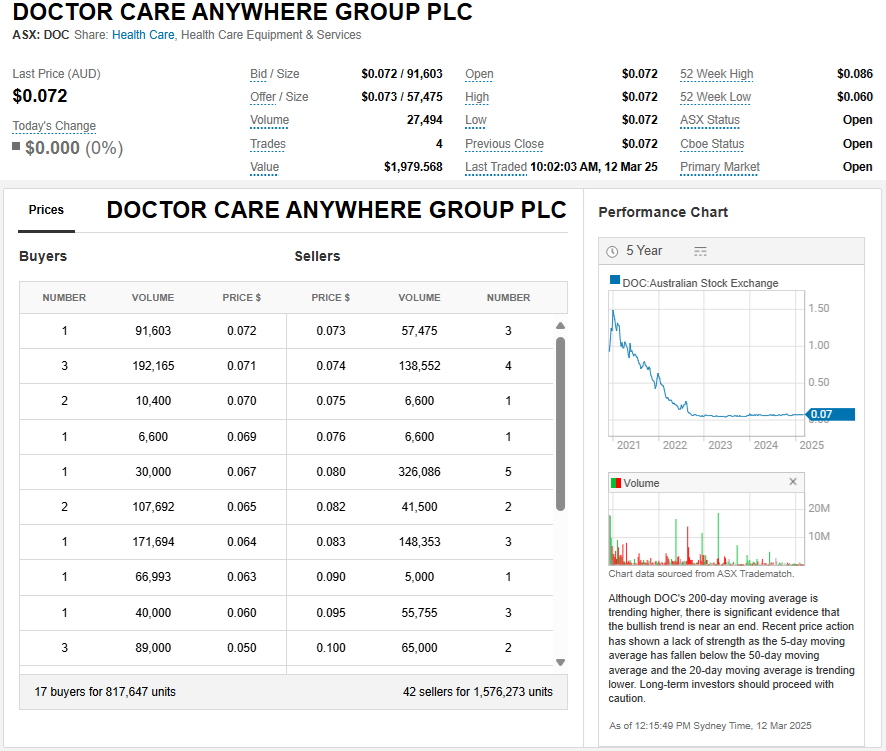

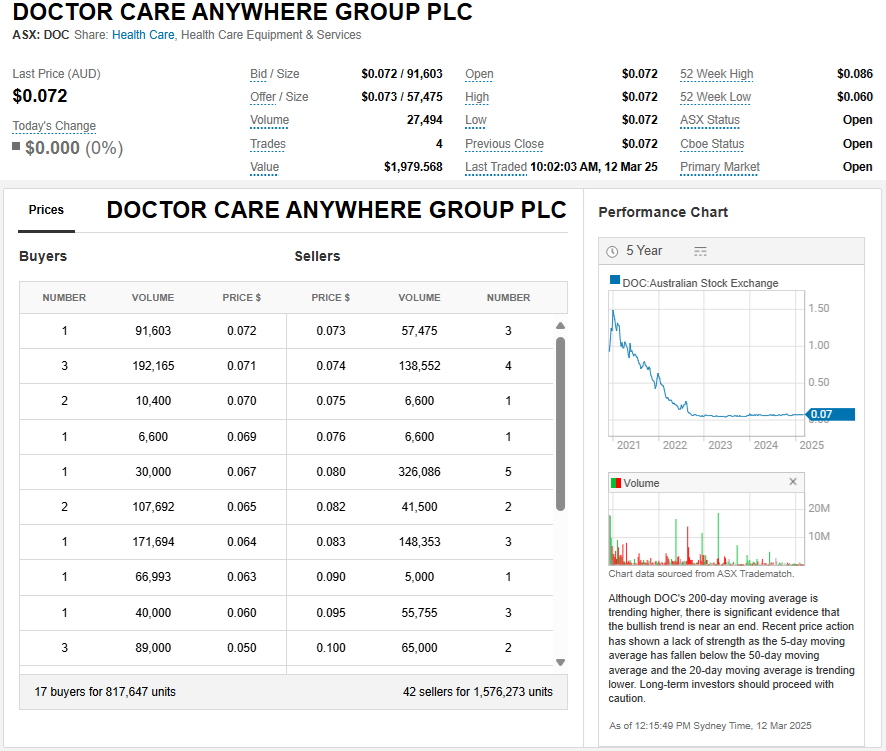

- TIGA/TOP also now own 27.51% of Doctor Care Anywhere Group (DOC), and were accumulating shares through to 12th Feb (Change-in-substantial-holding-from-Tiga-Trading-Pty-Ltd-(TIGA-TOP).PDF + Previous buying notice link here for July and August)

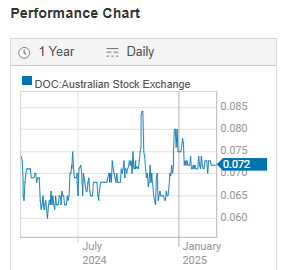

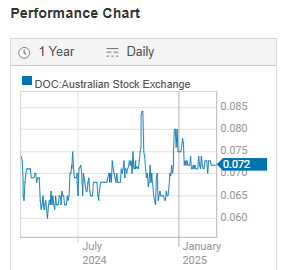

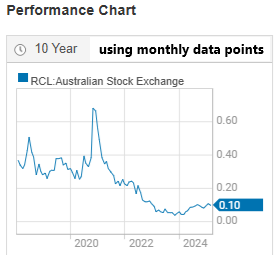

Looks like it's going nowhere fast on a 5 year chart (above) however, it's been rising during the past year (below):

Well, it looks like it's been rising, but it's actually just below where it was exactly 12 months ago...

ReadCloud (RCL) actually has been rising more than falling over the last 12 months (see below):

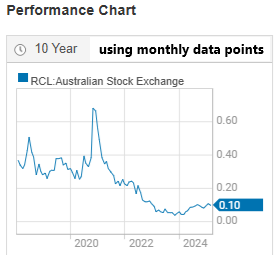

But over longer periods they haven't been a great investment:

Also, look at that liquidity (above, 2nd image up); the lowest offer (@ 10.5 cps) is +9.4% above the highest bid (@ 9.6 cps), which is likely why zero RCL shares have changed hands today (@ 12:35pm Sydney Time).

[EOD result was 4 trades in RCL for a total of $20.3K and the buy/sell spread still @ 9.6 vs 10.5 cps, i.e. still a 9.4% difference, less liquidity than a dead dingo's...]

I would posit a theory that anybody investing millions of dollars of other people's money is going to struggle to make money for their investors consistently at the nanocap end of the market, unless they are excellent stock pickers and those nanocaps turn into microcaps and then mid-caps over time, which hasn't been the experience generally with TOP and Thorney Investment Group Australia (TIGA). It gives Alex something to do clearly, because to accumulate positions or to reduce them, it does take time and a lot of trades, but he hasn't been a very good stock picker, so there's that...

TOP/TIGA own 10.81% of Calix (CXL), 12.27% of ReadCloud (RCL) and 27.51% of DOC.

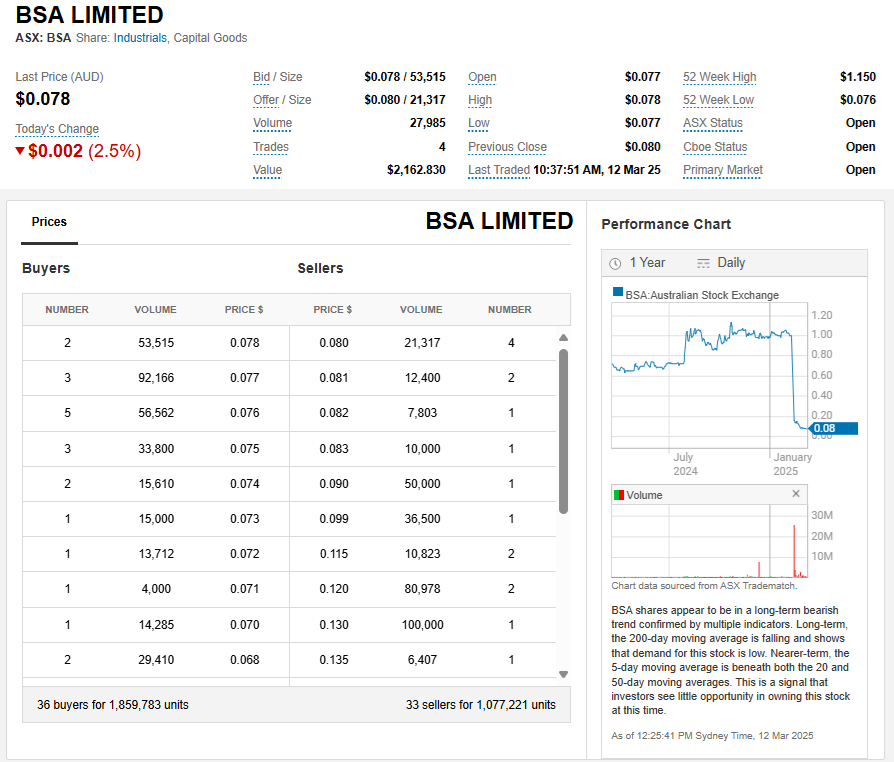

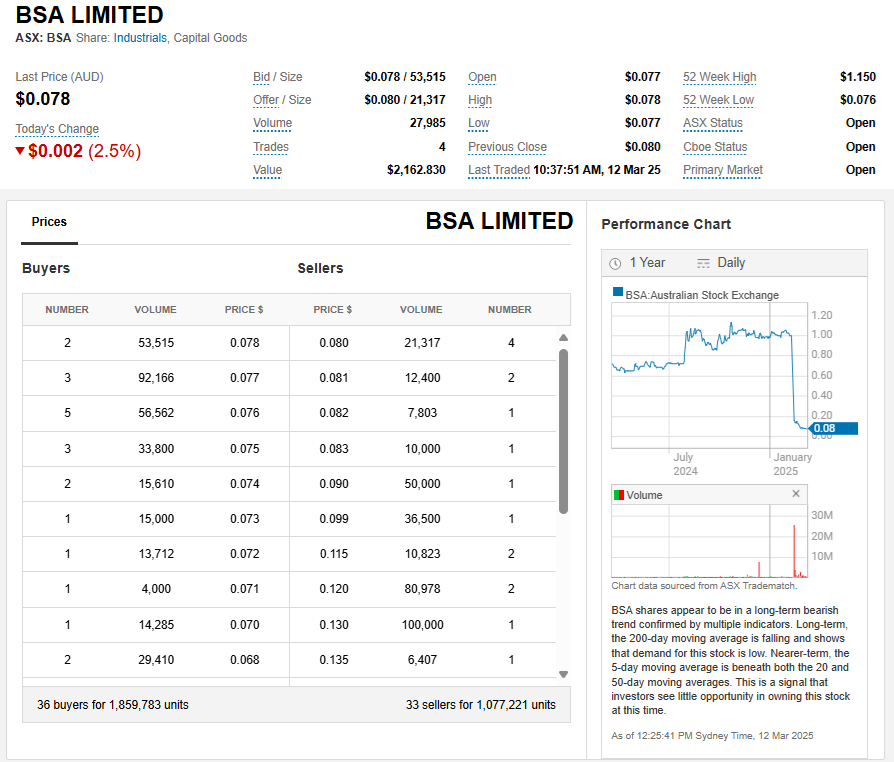

Another company that has far too many "investments" that crash and burn is NAOS Asset Management. I note that NAOS are still listed as the largest shareholders of BSA with 32.72%, and here's BSA's graph:

BSA's market cap has gone from $75.45m just 4 weeks ago to just $6 million today, all on the back of losing their services contract with the NBN (or "nbn" as they like to be known). Now that's a lobster pot!