stevegreenycom

Just noticed this on Linkedin I think it was,, refer further down..

Curious if anyone knows the historical performance of this "Strategy Portfolio" mentioned below. I remember checking their website a few years ago and I could at least find some performance numbers of their managed portfolio products (albeit comfortable trailing their benchmarks), but struggling to find the numbers when I checked then.

They love him over on the Livewire site. A few more down sessions on the markets this week and I am expecting an early crow livewire article that attracts attention and 100s of comments about timing the market vs time in the market etc!

"We sold our only holding in the Strategy Portfolio today, taking us to 100% cash.

The job now is to time the bottom. At this point, I don't see this sell-off as likely to develop precipitously; it seems to be happening in slow motion. But that risk is there.

We have a choice in a storm: stand on the beach or ride it out in the waves. Let's stand on the beach.

With 100% cash, we have all the power. We can re-enter at any moment. We can now sleep at night without taking any risk and wake up hoping the equity markets collapse. It's a 180-degree mindset change.

Let's see what comes and re-time our entry, hopefully lower down, and either way, with less risk than we have now."

lowway

Yes @stevegreenycom , Marcus is very loud and proud about his ability to "time the market".

Whilst I do enjoy listening to his podcasts, I don't subscribe to his timing the market strategies. Probably easy to do when your only using play money portfolios, but much tougher in real life with tax and other implications (not to mention simply missing the timing both ways).

Dominator

Marcus is an interesting character! While I don't agree with 100% cash and always being in and out. Ive been trimming/selling to build cash especially from core ETF holdings then looking at every company individually. So I think the sediment is right.

The US administration is actively trying to break things, undermine separation of powers/rule of law and disregarding basic economics principles. To me it feels like everyone is waiting to see if it all does break. I'm not waiting, there is no way this ends well for the US in my opinion so have to take some risk off the table.

If you haven't already, take a look at Atlanta Fed GDPnow figure. Currently predicting -2.4% (annualised figure) GDP growth for the US in the first quarter. To note this figure becomes more accurate as more data for the quarter becomes available so not entirely reliable but not a great sign...

Solvetheriddle

I dont know if he will be right or wrong, and dont care, but i bet if he is right you will never hear the end of it, and if he is wrong...........whats that swept under the carpet? lol

long record of multiple talking heads doing that

actionman

I was a fan of Roger Montgomery who also had an amazing crystal ball and intelligent narrative, such as predicting the over building of housing around 2018 triggering a downturn in retail from droves on unemployed chippies and sparkies. Then he predicted a tech crash in 2019 with unprofitable businesses like Xero (~$50) and WiseTech (~$20) etc. https://www.professionalplanner.com.au/2018/12/cash-might-be-king-in-2019/ .

What I like about Strawman is we have our portfolio performance on display.

DrPete

I initially found Marcus interesting, but these days I avoid reading his material. He likes promoting a bold opinion. But I don't find his reasoning coherent. With most of his articles I got to the end and felt he'd used a lot of words to say very little. Or worse, what he did say seemed to contradict itself. He may have a good intuitive sense of the market. But for me, I don't find his communications valuable.

OxyBBear

Well for those interested here is Marcus' post on X. Obviously he is talking up his own book after going 100% cash.

Quick observation - The big falls in our big stocks, particularly the banks yesterday (ANZ -2.1%, BHP -1.8%, CBA -1.4%, NAB -2.1%, RIO -1.8%, WBC -2.0%, WES -2.6%, WOW -1.5%), suggest that some large international fund manager(s) gave up on Australia (and the Australian dollar).

This would reflect a negative view on global growth, Chinese growth, and commodity prices. And you can't blame them. US brokers have been going negative on Australia this week, and some major fund managers (BlackRock, Bridgewater) have cut their exposure to Australian equities, with BlackRock saying they "viewed Australian equities as overvalued, considering their weaker earnings compared to international peers. If you look at the outlook for earnings growth for Australian equities, it is an outlier compared to other countries around the world—it really does have poor earnings growth and valuations are stretched".

UBS says Australian equities are "too expensive, given the softer outlook for earnings". The ASX is trading at nearly 18x forward earnings, above the 25-year average of 14.8x.

If a US (global) recession comes, and China lives with 20% tariffs for 12 months, commodities, the A$, Chinese growth, and the ASX are going nowhere.

Scoonie

I too saw where Marcus Padley from MarcusToday has gone the full cash. I guess in a world flooded with stock market porn, selling tip-sheet subscriptions is a tough game.

And like a financially mutant version of Dirk Diggler, more and more outrageous acts are needed to get any attention. The Dirk Digglear Story - Wikipedia

It’s tough earning a living, so good luck to him I guess.

Karmast

The other point to note for those following Marcus Padley is his opining in 2021 about the idea of a "one stock portfolio". His musing was if you only owned one stock you would learn everything you could about it, follow it, understand etc, so it should be "less risky".

And if it does well you do well. If something happens and it doesn't do well then you sell it.

Summary of it all here on the fool site - https://www.fool.com.au/2022/03/02/i-personally-only-own-2-asx-shares-fund-manager/

Sounds simple enough. What did he choose? Poisedin Nickel (ASX:POS) and here is what he had to say when he recommended it -

- Poseidon Nickel (POS) – I have seen the life cycle of a Nickel project turning into a mine before (Sally Malay – it listed at 20c and went to 600c). If Peter Harold (a mate) can do it again at POS it will multi-bag again. It has the Nickel price behind it being driven by electric vehicle/electrification/battery demand. Because I know Peter, I know his history, have seen him execute the “project to production” job before (at Sally Malay/Panoramic Resources), and know he is a family man with experience, reputation, integrity, honest intention, and perpetual effort. I see the stock as ‘safer’ than any other investor might see it.

The share price was 7c at the time. Things started to go badly a year later...so what did he do...sell as suggested above? No, he recommended people buy more.

The sad end of this story is POS was delisted, basically worthless, in early 2025.

Now, we all know stock picking and forecasting is hard but if anyone thinks Marcus possesses super powers or above average insights, this horrible example, that no doubt some of his supporters would have followed him in to, should give you pause for thought!

Strawman

Beware gurus, especially financial ones.

One of the biggest epiphany's I ever had was the realisation that no one has any real clue as to what's going on, or what's going to happen. Some people are closer to the truth than others, but our tiny ape minds cant ever fully grasp the insane complexity of the world. The more hubris and confident someone is, the more sceptical i am.

The only rational standpoint is one of humility and to continually try and destroy your own beliefs. Strong opinions, loosely held.

(Of course, I have plenty of strong opinions, and am never afraid to share them -- passionately -- but I'd like to think I'd drop them in a heartbeat if ever there was good cause to do so. That being said, i'm 90% sure i'm lying to myself in saying that!! haha)

mikebrisy

Great thread, and I especially love these two latest posts by @Strawman and @Karmast (especially the way you always offer evidence and examples!!).

I reflect on my own journey in stock picking.

In late 2016, I transitioned from investing in broad-based ETFs (like $VGS, $IVV, $NDQ) where, to be honest, for 20 years I'd earned a nice market return. This was the only way for me to invest, as before then I had a very demanding full time career, and could not pay attention to individual stocks.

In these early days, even knowing the research on how returns via fund managers on average under-perform, I'll admit to often being easily impressed by recommendations, and investing with relatively little personal research.

But over time, as I increasingly followed my own research, made as many mistakes on my own "discoveries" as by following recommendations, I increasingly got to observe a few things:

- There is a "survivor bias" in investors and funds that claim to out-perform over 5, 7 and 10 years etc. (I don't care about shorter time horizonz)

- Many, if not most, cherry pick to market their wins, while staying silent on their losses

- Some are blatantly full of BS, "I bought AAA when it was $X and I'm out now at 3x$X" or, when BBB has fallen 50%, "we got out a month ago" (I think, for example, that some of the "talking heads" on things like Ausbiz forget that you can go back over historical recordings and see what they said, 1 or 2 years ago ....oooops)

And, importantly, I have gone from completely ignoring technical analysts and momentum investors, to at least considering technicals and momentum in timing or phasing my investment decisions, some times. However, my timeframe is such that technical investing remains largely irrelevant.

Some of the best marketers and loudest talking heads say things that sound impressive, but in reality I've concluded that they have no clue ... or not much more of a clue than me.

It also worth remember that some of the giants are very fallible. I remember that after decrying what a bad investment airlines were for decades, Warren Buffet eventually bought a bunch and then lost of ton of money doing so. And again, after for many years saying he didn't understand and wouldn't invest in tech, it turns out that his holdings in $APPL have been THE major contributor to $BRK's total returns over the last 5 years. Without that, BRK would have very ordinary returns over recent years.

So, nine years into my stock-picking journey, I tend to ignore some of the grand claims (e.g. like the one stock portfolio idea) or "rotate from X into Y for reason Z".

But I do listen a lot to what others say and to what other write. They provide ideas, stimulus, challenge to my own thought process. They help me answer the questions I make before every investment: "What is my counterparty to this trade seeing that I'm not? What time horizon is at play here? What am I missing?"

The more experience I get, the more I learn to be humble, curious, and cautious. By all means, I'll have a point of view and a conviction, but I'll accept I might be wrong and I'll analyse the consequences of what that might entail.

But I've long moved passed believing that someone has the secret sauce, the magic formula or the big idea. And the more a "talking head" makes a claim like that, the more I switch off.

Strawman

Well said @mikebrisy

I've always found it strange that most of the AusBiz guests don't publish any audited results on their websites. Feels like something you'd crow about if you had a good track record... ;)

mikebrisy

I have a theory that might one day become Mikebrisy's Law:

[Portfolio Return of Ausbiz Talking Head] is inversely proportional to a function of [Volume of Word Salad and Use of Terms including {rotation, thematic, cycle, going forward}]

But. as you say, they don't publish their returns, so we'll never know, so at best it will remain The Mikebrisy Hypothesis.

topowl

Sometimes I feel the only relevant question when talking to a financial guru doling out advice is...."so what's your money in ?".

Alternatively, if they ask you what your money is in....I simply reply "you first".

Strawman

Strong agree @topowl -- money talks, and you know what walks!

Also, love that law @mikebrisy. And i'm definitely going with Law over hypothesis!

Reminds me of Cunningham’s Law: 'The best way to get the right answer on the internet is not to ask a question, but to post the wrong answer". Which in this context might be rephrased as "the best approach with the advice from pundits is to do the opposite of what they say!"

I'm being a little unfair, there are some awesome investors on Ausbiz (they just happen to be the minority)

Karmast

Great contributions @mikebrisy and @Strawman and @topowl

We all need to remember incentives here, as Charlie regularly reminded us. What's the incentive of a fund manager? To get more funds under management. What's the incentive of a market commenting newsletter service? To get more paying subscribers.

So what behaviour should we expect? Attention grabbing efforts to convert more investors into those outcomes.

Doesn't mean they are all shysters or definitely have no skill...but the best test is long term performance to determine the probabilities of it being skill rather than luck. For me, that means if I can't outperform the market on average, after 10+ years, I will pack up my stock pickers tent and head off to the Index ETF campsite. And I'll do that knowing I gave it my best shot but I didn't seem to have any real edge.

edgescape

Marcus Padley has changed his mind today!

I also topped up on the dip in IVV yesterday at around 54. Not sure if that was a good idea but it is up today (23 Apr). So far so good ...

thunderhead

The only problem with following folks who change their mind this often is they can do it again before you are fully bedding in their last tip/call. Can't see how that will work sustainably for moi personally.

edgescape

One point mentioned at a lecture course is that we should try to embrace volatility not run away.

The moves in ORG to below 9.00 and back to 10 and IVV SP500 ETF down 6% this week when I bought/added seem more emotional driven than fundamental. Although I am aware prices could go lower but I think there's already enough news priced in

Walking the dog in the park while markets experience such volatility sometimes isn't the smart thing to do.

topowl

Markets throwing a tantrum isn’t exactly breaking news. ORG bouncing around and IVV down 6% feels like classic emotion > logic stuff. Fundamentals haven’t changed much, but the mood sure has.

Thing is, this kind of volatility is where the opportunities usually hide. If you're confident most of the bad news is already baked in, then yeah—walking the dog while the market melts down might be the most rational move you can make.

Panic sells, patience buys.

Bear77

Sunday 27th April 2025:

From MP's "MarcusToday" Saturday email yesterday:

Trade news - Uncertainty over trade negotiations is the big one.

- Trump claims the US are in talks with China. Disputed by China.

- Foreign officials 'swarm' Washington to negotiate trade deals.

- Trump claims "200 deals" will be done in 3-4 weeks. So much for tariffs not being a negotiating tactic. Remember that?

- Trump says "very close" to deal with Japan - seen as a test case.

- Bessent says initial talks with South Korea 'very successful'.

- UK finance minister met Bessent and Germany yesterday at IMF gathering.

- Trump in Rome for Pope's funeral.

- China says "The U.S. should stop creating confusion."

- China has exempted some US imports from their tariffs (131 products including pharmaceuticals).

Volatility is destructive. It's not just about the ‘end’ price. The White House remains oblivious and unaccountable for the damage being done.

Although we are now fully invested, we cannot assume the worst is over or that the skies are about to clear. There has been significant economic and corporate damage done that has yet to show up in the economic numbers. That’s still ahead of us.

Markets are a short-term game right now. We have played it well so far, but there is no time to relax. My Primary Mission remains simple: Make money in the Managed Strategy Portfolio while avoiding the worst of the risks (and sleeping at night). That doesn’t mean outperforming others, it means making money in any circumstances. This is not traditional funds management, where the focus is on performance relative to a benchmark or competitors. It’s about actual returns, and half the game is about avoiding losses.

We could cash up again if needed. I assume nothing. For the moment, the balance of probabilities says stay fully invested — but that can change.

Things could easily deteriorate again. We cannot relax. For Monday, things look good.

Tuesday is another day.

--- end of excerpt ---

One day at a time, eh Marcus? Reacting rather than anticipating. Except that the process of going to 100% cash in at least one of his portfolios (the "Strategy" portfolio) and saying to his subscribers that he hoped they copied him and did the same (a few weeks back), and then swiftly buying back in last week, are both examples of anticipating as well as reacting - so reacting to indicators that he assumed (based on the balance of probabilities in his team's opinion) pointed to a significant shift in market sentiment, significant enough to reverse course and take the opposite approach, so go from 100% invested to 100% cash, then back to 100% invested. There's certainly an element of expectation in that, so anticipation of what markets are likely to do next.

As a bunch of us said at the time he was 100% cash (in at least one of his portfolios, but certainly not all of them), it's easy enough to be smug when you get that call roughly right and the market falls further while you're in cash, but significantly harder to know when to dive back in before you miss some of the market's best "up" days, which usually occur directly after some of the market's worst down days. Easy to miss some of those gains because you're not exposed to the market on those days. Also, easy to get the re-entry point wrong, as he's alluding to in his newsletter yesterday - as shown above - preparing/warning his subscribers that just because he's 100% invested again doesn't mean the worst of the market volatility is necessarily over; he is prepared to go to 100% cash again in a heartbeat apparently. Easy to see how the ASX and brokers do very well in such times. Massive increases in transactions - and the associated fees they generate.

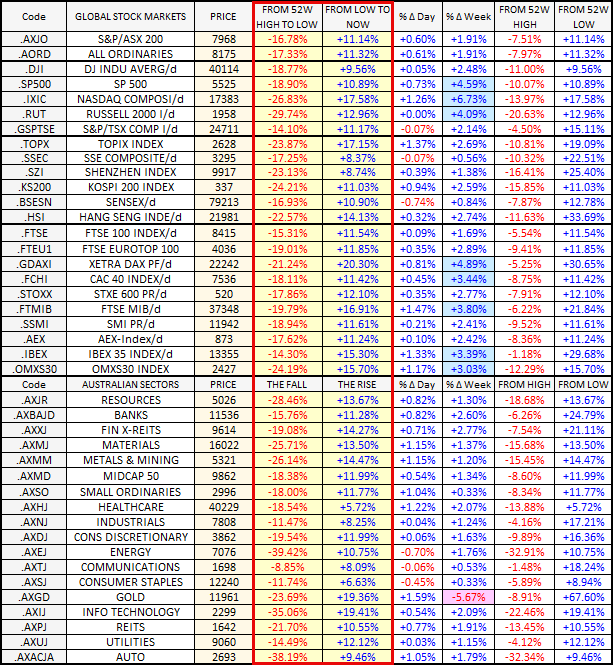

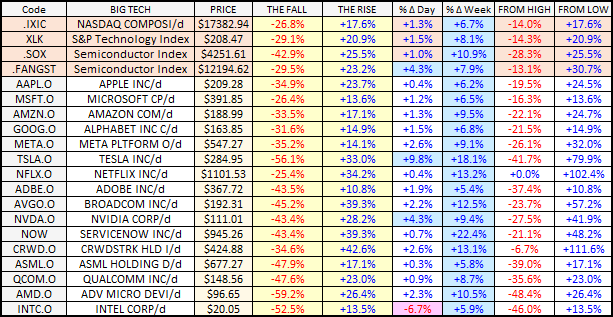

In terms of whether it may have been better to just stay fully invested instead of trying to time the market, MP also had an interesting section on the extent of the drawdowns in Feb-to-April and the rebounds from there:

THE VALENTINE'S DAY MASSACRE - THE RISE AND FALL OF THE EQUITY MARKETS

Most markets and stocks peaked on Valentine's Day (Feb 14), and bottomed on "90 Day Pause" day - April 4. This table not only shows the move overnight and over the week but it also shows the drop from the top and the pop from the bottom. We live in extraordinary times. From the 52 week high to the April 4 low the ASX 200 fell 16.78% and has since bounced 11.14%. It has been a remarkable three months. And whilst it is interesting to observe, this really isn't good. There are two elements to equity investment - risk and reward. The White House have abused the world with their lack of care for risk and volatility - it is not all about price. This volatility is extremely unhealthy. It is a very sad moment in stock market history. If you have survived thus far, well done. But I fear it is not the end. There are many more chapters to come. Our assumption that we have hit bottom has a probability factor of what - 60%? It's one and a half times more likely that the odds that we are going back to the low, and that will have to do for the moment.

In the last three months:

- The ASX 200 has dropped 16.8% and rallied 11.14%.

- The NASDAQ has dropped 26.83% and rallied 17.6%.

- The S&P 500 has dropped 18.9% and rallied 10.9%.

- The Bank sector has dropped 15.8% and rallied 11.3%.

- The Resources sector has dropped 28.5% and rallied 13.7%.

- Our Technology sector (small sector) has dropped 35.1% and rallied 19.4%.

- Tesla has dropped 56.1% and rallied 33.0%.

- Nvidia has dropped 43.4% and rallied 28.3%.

Tables above and below are accurate to Friday 25th April 2025 in the USA (the ANZAC day PH here).

- Technical break of downtrend (not that lines on a chart mean much, but...) - The NASDAQ, S&P 500 and ASX 200 have all now broken the downtrend for the moment.

--- end of second excerpt ---

I would simply highlight what he placed in brackets in the line introducing those charts: "(not that lines on a chart mean much, but...)"

When sentiment turns on a tweet, or a "Truth Social" post, charts are more useful for telling us where we've been than telling us where we are going.

I have just over half of my investable capital invested directly in gold producing companies, and another 25% invested in companies that service the gold industry as well as other industries (LYL, GNG, NWH) and my portfolios have held up well this year so far - all showing decent gains despite some individual positions being in the red. And I remained fully invested through the past few months.

Hope for the best, but prepare for the worst. And don't spend too much time staring at the rear-view mirror.