@Noddy74 thanks for this - I had seen THRY in the title of an investing substack I follow but didn't have time to dig in. Your deep dive spurred me to action!

I've come to really like this story while researching it over the last couple of days. The financials don't look great but are hiding growth in the higher margin/recurring SaaS segment, the CEO has a great track record and has been purchasing on market since 2020 and the outlook in my opinion looks really interesting.

I agree that it looks like AIM, and would add that it also looks a little like RUL a couple of years ago - I own both due to convincing myself of a similar narrative (ie leveraging then cannibalizing a less profitable or declining segment to benefit another). Perhaps most importantly, convincing myself I reached this conclusion before the broader market figured it out...

With everything going on in the US and the likely volatility we will experience over the next period I figure THRY could trade at a big discount at times.

I've purchased a small 'watching' parcel of 100 shares overnight (my first individual US share purchase!) and will be watching the uptick in SaaS growth like a hawk.

I've spent the last couple of weeks of the market's Trump tariff dummy spit looking at US opportunities, in particular a little company called thryv (NASDAQ:THRY), market cap circa $660 million (all amounts in USD). What’s interesting about Thryv is that you get two companies for less than the price of one. The legacy business is selling something I thought went belly up decades ago - business directories i.e. Yellow Pages. The other is a fast growing SaaS platform with little direct competition in its market segment, other than point solutions. So if you’re interested in the story let your fingers do the walking (to your…mouse wheel) as it should be a real page turner.

Before addressing the two very different business segments I just want to take a moment to highlight what they have in common. The single most important thing to understand is that both businesses are focused on the same customer set and that is Small and Medium-sized Business (SMB). Here that typically means under 20 employees, but in the US it extends up to 100 employees. Thryv have been focused at the smaller end of that market i.e. 5-25 employees, although their strategy is to gradually move upmarket to target businesses with up to 50 employees.

As anyone who has either been part of an SMB or has tried selling to SMBs would know, they’re a really tough customer. They’re time poor, they’re often cash poor, they’re hard to engage, they can be resistant to change and they churn. The combination of the two businesses is crucial in understanding how Thryv thrives.

Shitco

Let’s deal with the shitco first – Marketing Services (MS). This business literally publishes the books that used to/still do get distributed and occasionally make it past the recycling bin to sit in a cupboard somewhere gathering dust. They make money from businesses who advertise in those books or online as they also operate digital directories, including owning the domain name yellowpages.com.

It’s a business that was once a behemoth, but has been in decline for at least the last 30 years. Thryv’s management have confirmed that decline will be terminal when the last directories are distributed in 2028. In the meantime, however, it will serve two purposes. Firstly, it throws off what the CEO describes as “a metric shit tonne of cash”. Between now and 2030 (cash will continue to come in for two years after the last books are distributed) it is expected that it will book $250-300 million in free cash flow. That’s going to be handy because Thryv has around $290 million in net debt. That sounds like a lot – and it is – but it’s down from around $2 Billion a decade ago. Essentially, management expects MS to pay off the remaining debt.

The second purpose of MS is as an incubator for the SaaS business. They call it the zoo and they’re farming the zoo, to convert them to SaaS customers, as quickly as they can. In management’s view the zoo gives Thryv an "unfair advantage", in part because they have an enormous register of successful, lasting SMBs. But also down to little things like the fact the SMB owner will open an email from an existing supplier or take the call of a known sales person.

MS is still the largest business segment by revenue but that will invert imminently as it gets actively managed down and SaaS continues to grow. One thing to point out is revenue is recognised once the books are printed and delivered, but advertisers are billed and pay monthly. That delinking of the income statement from the cash flow statement will only increase as management has reduced the book printing frequency from 12 months to 24 months. It's something to bear in mind when analysing this company.

Goodco

Thryv's SaaS business started as a CRM tailored for SMB, but is increasingly looking like a lite ERP. They started with the Business Centre and aim to roll out what I call a product but they call "a center" (sic) once a year. So the current offering looks like this:

Business Centre

- Basically a CRM for SMBs

- Customer database

- Lead management

- Scheduling and customers

- Social media management

- Email and SMS marketing

- Client portal

- Estimates, invoices etc

Marketing Centre

- Website design

- Website heatmap

- AI generated marketing posts

- Marketing campaigns

- Analytics on who is viewing them and when

Command Centre (FREE)

- Centralised inbox

- Team comms

- Calls

- Webchat

Keap

- Lead conversion

Reporting Centre

- Didn't have great reporting previously

- Integrates with other centres

Workforce Centre (due out in 2025)

- Payroll (working with a partner - much easier to do than start anew)

- Staff Management

- Time Management

Rolling out a new centre per year is aggressive but it's a key driver to increasing ARPU. At the most recent report only 12% of customers pay for more than one product, but the only options at that point were Business Centre and Marketing Centre and the latter had only been an option for a short time. I'd hope to see that metric grow at 2-3% per quarter and would expect them to start reporting on average Centres per customer in the next 12-24 months.

They've indicated they intend to grow ARPU from below $4k p.a. to $8k p.a by 2030. They intend to do this by:

- targeting slightly larger businesses (25-50 employees), but still stay well within their SMB lane, and;

- selling more products per customer

Competition

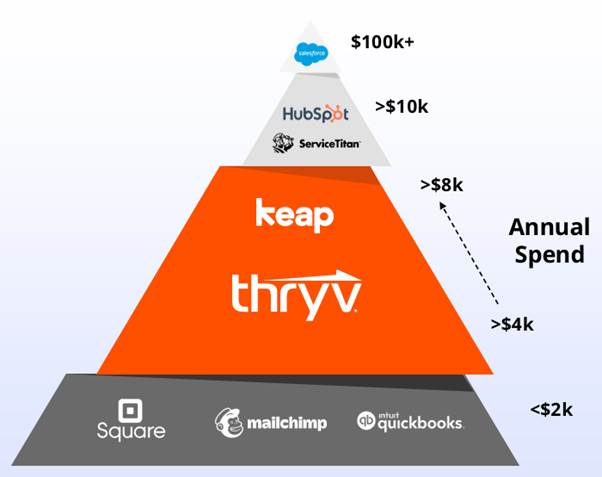

This slide is how Thryv represents its competition.

At the top of the pile you have what everyone thinks of when you speak of CRM, which is Salesforce. This is the gold standard in the enterprise space but they have a lite version, which I'm sure larger SMBs might use. Below that you have Hubspot and ServiceTitan. Those two are commonly referred to as competition but they play in different parts of the market. In fact Thryv's management are massive fanboys of HubSpot and hope to emulate it. Thryv is even a customer of HubSpot. In the SMB market management claim there isn't a lot of competition. Keap is shown on the slide but only because thryv recently purchased them. In truth I think there's a little more overlap in market segments than management acknowledge. But I do accept that in terms of growth the legacy Marketing Service business gives them a leg up for the remainder of the decade.

At the bottom of the pile you have point solutions. They've included Square, mailchimp and quickbooks but the main products Thryv claim to be migrating customers from are excel, google calendar and post-it notes.

For what it's worth here is the G2 magic quadrant for CRM solutions.

It looks messy, but I think it tends to look messy when you look at any major product group. I'm not sure who did the notations. I think it was a 4yo.

They shared what I thought was a very interesting slide at a recent investor day.

I'll revisit some of this comparison in the valuation, but I include it here for a couple of reasons:

- It stacks up pretty favourably relative to peers, plus;

- They make the Rule of 40 (YoY Rev growth plus EBITDA margin%), which is a metric the U.S. has adopted a lot more widely than we have but is a useful heuristic.

AI has changed the game in terms of SaaS moats, such that we should all be critically evaluation software-led businesses to determine whether they really do have a sustainable moat. The zoo represents that to me for Thryv and gives them a distribution moat that will be very hard for others to cross.

Management

CEO Joe Walsh joined the company in 2017, when the company merged with YP Holdings (which later was rebranded as Thryv). The equity stake he brought with him makes him the largest shareholder of Thryv.

Prior to the merger Joe was Chairman of Cambium Learning from 2013 and was instrumental in pivoting the company from printed education content to digital-led solutions i.e. a very similar dynamic. The turnaround they orchestrated took the share price from $1.01 to $14.50 when it was sold to private equity in 2018. In short, this is a journey he has been on before. He has been buying additional shares since 2022.

Before Cambium Joe was CEO of Yellowbook (1993 to 2011), during which time the company’s revenues grew from $38m to over $2bn.

How is the transition going?

As the MS business winds down, the SaaS business has been growing at over 20% p.a. This will result in SaaS forming the majority of revenues in 2025. Based on guidance revenue by segment looks like the following.

The faster uptick in SaaS in 2025 is mainly acquisition-based, although organic growth is a still reasonable 18-20%.

Although SaaS is a higher gross margin segment (ultimately expected to approach 80%), the investment in sales and product development means MS is still contributing more to EBITDA. That will change in coming years as SaaS scales. The following milestones were provided at the recent Investor Day:

- 2025 - SaaS to contribute majority of revenue

- 2026 - SaaS to contribute majority of EBITDA

- 2027 - Return to overall growth in revenue and EBITDA

What might the market not like?

Plenty:

- It's not going to screen well given at a combined level it would appear to have declining economics, whose main offering up till now is a business being shuttered.

- Even if you get past the headline it's a couple of years before the growth in SaaS overtakes the decline in MS and the combined business starts to grow again.

- It also doesn't screen well in terms of Average Revenue Per User (ARPU). This has been in decline over the past couple of years from $380/month to a little over $307/month. However, this is a feature rather than a flaw with the implementation of the lower priced Marketing Centre plus introductory priced offerings to entice SaaS adoption from MS customers.

- $290 million in debt is significant, even if MS is likely to service that debt before it goes terminal.

- Things are likely to look worse before they get better with management indicating debt will peak in mid-2025 as they integrate the newly acquired keap.

- It's GICS classification is as a Comms business, which is likely to suppress the valuation multiple. That should change in the next year or two.

Conclusion

I like the setup for this business. It reminded me a little of AI Media in terms of the segment dynamics and the aggressive strategy to cannibalize one segment for the benefit of another. I'll post a separate valuation straw but on the basis of the SaaS financials and also comparison to peers it looks particularly undervalued. I'm keen to see where management take this business. The expected implementation of a payroll solution suggests the possibility of becoming an all-encompassing ERP in the future, with financials/inventory management/logistics etc. potentially on the roadmap. I expect that - like payroll - they would partner with an existing vendor and white label their product for some of these. That's just supposition though and even if that isn't the direction they take, I think there's enough to get excited about what the next decade looks like for Thryv.