Discounted Cash Flow:

I DCF'd this and for what little it's worth came up with a valuation of $38.49 (all USD), which is around 155% upside. I included the whole enchilada, including MS and existing debt but I suspect I've undercooked the cash this will generate (versus earnings), particularly MS. A couple of years ago management held an analyst day where they targeted $1 billion in revenue by 2027 and $4 billion by 2032. The assumptions I've used are not even close to those targets and are more aligned to shorter term expectations and analyst expectations. I'll include it but only as one data point in the valuation.

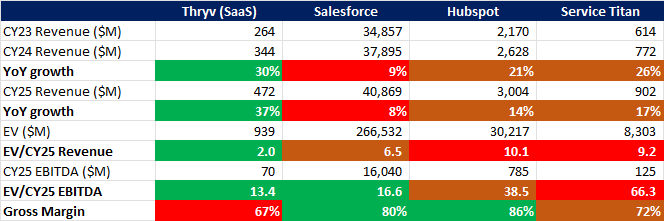

Peer comparison (in sector):

For this exercise I'll exclude MS.

Given its relative size you would expect Thryv to trade at a discount to its peers and it does. However, the size of the discount is stark. Of course, as micro/small cap investors the hope is always that the market rewards not only the absolute growth (which is well above its peers) but also the multiple disconnect.

The gross margin is worth noting as I see this as an opportunity for Thryv. Enterprise value and gross margin were the two figures I couldn't back out MS from and management have indicated that as MS is mothballed, gross margin should move closer to 80%. Given the SMB focus of the business I think 80% is fine as an aspiration but I'd be happy with something with a 7-handle.

In terms of valuation you can choose your own adventure but given the likely continued growth in the medium term I would put a 25x EBITDA multiple, which implies a valuation per share of $40.35, or 167% higher than today.

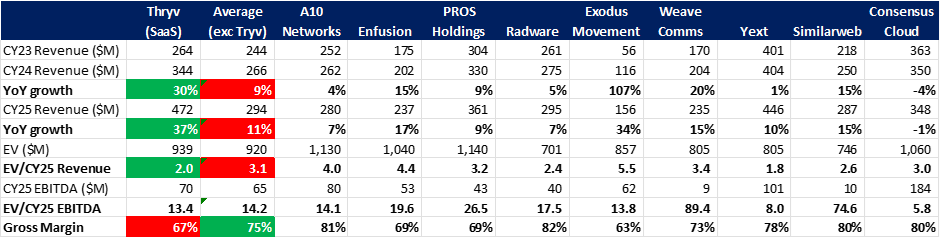

Like sized SaaS comparison:

I did a similar exercise with similar-sized SaaS, but without regard to the industry they served. I asked ChatGPT to give me 10 similar sized companies by EV, binned it when it brought back funky data and then used a TIKR screener to come up with the following:

Based off this on an EBITDA multiple basis it would appear to be fairly valued. However, given the disparity of revenue, revenue growth and the likelihood the SaaS business is carrying many of the transition costs from Managed Services (something management has acknowledged), I would contest that Thryv not only should not be trading at a discount to these peers, but should actually be trading at a premium. Arguably 25x EBITDA used in the previous section was too aggressive, so let's dial it back to a more pedestrian 20x. On that basis I get a valuation of $32.28, or 114% higher than today.

Average:

Using an average of all three valuations I come up with a valuation per share of $37.04, versus the $15.07 it closed at this morning.