I sure did @Summer12. When the world's largest asset manager and arguably the most influential banker in the world is talking up the utility of Bitcoin, well, it's noteworthy.

I also saw Scott Bessent, the US Treasury Secretary, advocating for Bitcoin on CNBC a few weeks ago, and also yesterday on Tucker (not that I watch Tucker, I hasten to add! Lol).

Surreal.

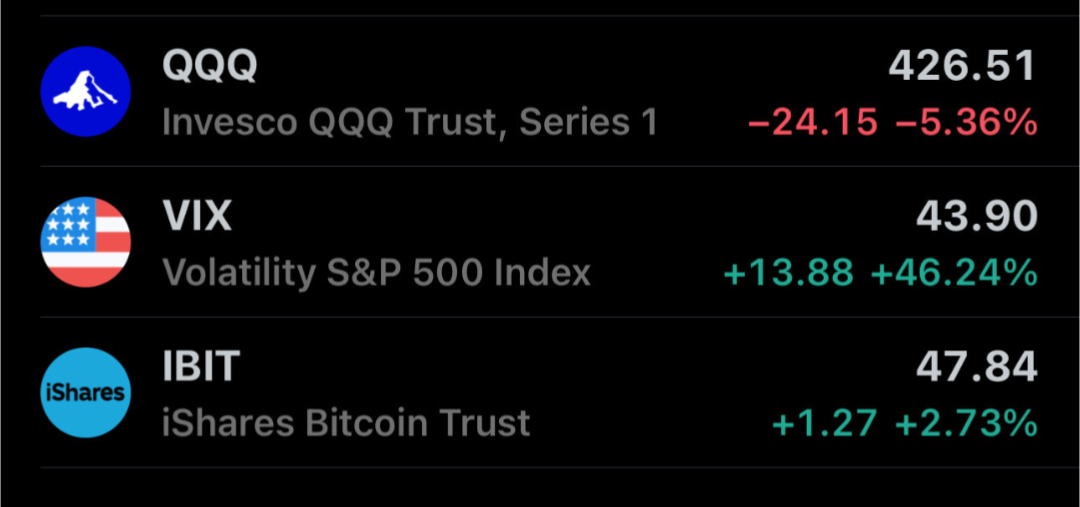

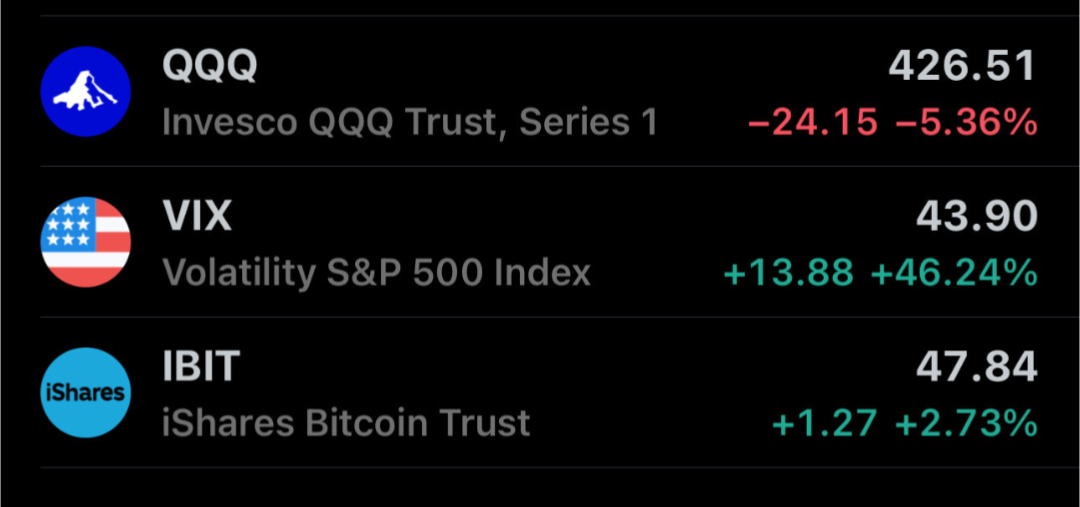

But what is really wild, is that overnight we saw global risk assets sell off in one of the biggest slumps of the year, and Bitcoin went up..a decent amount too.

It's way too soon to claim it has decoupled from risk assets, as has long been anticipated by those who are deep down the rabbit hole. But, again, it's noteworthy.

In fact, zooming out, BTC has performed better than many of the big tech names since these shenanigans all began. In earlier times, it was always far, FAR more volatile. IE. When markets sold off, btc sold off much harder.

Again, noteworthy.

Oh, and the Trump's are now starting a Bitcoin mining operation, and Eric Trump is doing the rounds talking up the significance of Bitcoin. It's almost like they know something... I mean, forget about what you think of the Trump's. The old adage of follow the big money seems relevant.

I know this is a super decisive topic, but once you put preconceptions aside, approach it from first principles and take stock of whats happening at the highest levels of business and government.. well, I just think any investor owes it to themselves to come at this with an open mind.

Maybe it's a useless token that's going to.zero, or maybe it's something far more significant.

I can't give advice, but the risk-reward on a 1-2% position seems far from reckless at this stage.