Or FOS could be using this as an opportunity to promote themselves on the US tariff tailwind and a mouthpiece to broadcast all news related to tariffs.

I would much rather prefer they try and concentrate on running the business instead.

On another note, Flex is a similar company that has been on my watchlist that is on the NASDAQ.

Flex is a "one-stop shop" for providing solutions to manufacturing facilities, health centres and hospitals and even data centres in order to help them run more efficiently and supply the hardware/software to those facilities and not just lighting like FOS. I would say they are like a cross between SKS, SXE and FOS.

They had such a great run for the last couple of years till now.

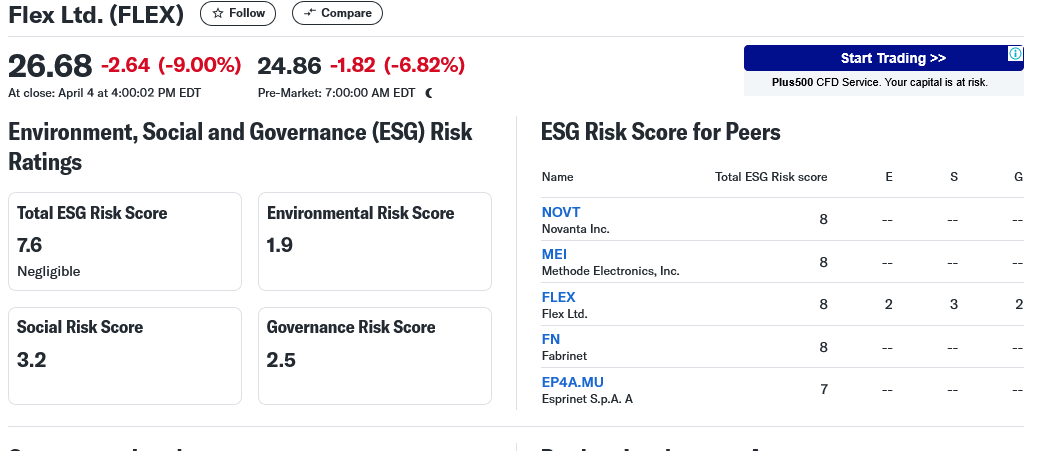

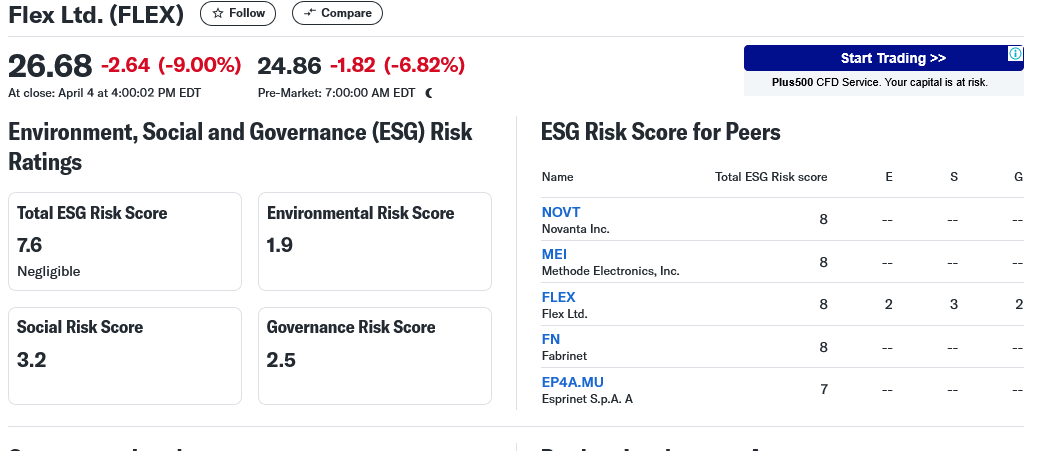

I actually found them through the ESG screener on Yahoo Finance.

They had a drop of 20% recently from a high of $40. My guess is that they were riding the Data Centre tailwind. But I also think the tariffs would be another factor as I found they had some factories in China so Flex would be impacted.

Anyone who has Flex as part of an ESG focused portfolio would be crying this week.

So while the announcement is a bit "cringeworthy", there is some truth in that some companies such as Flex import some of their products to the US for their designs and solutions and would be impacted by tariffs.