The Bond markets have not been happy since the Moody's blues, an UNholy trinity looks to be unfolding:

- The bond yields have spiked up again. Both 30Y and 10Y's are 0.2% from the all time high of both of the yields going back to 2012, when Trading View's yield data started. (at least in my subscription)

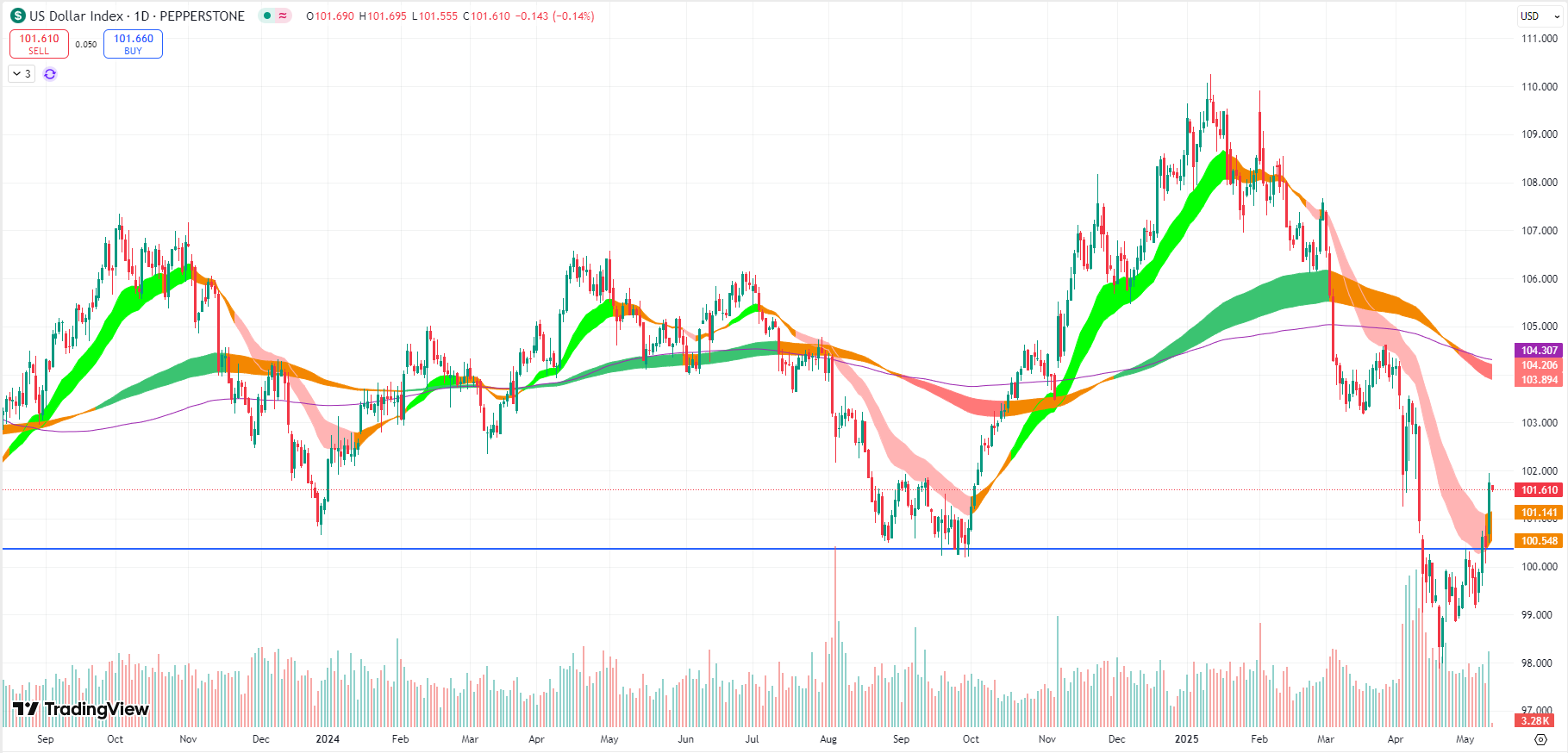

- The USD Dix has dropped from a short term peak of 102.000 to around 99.573

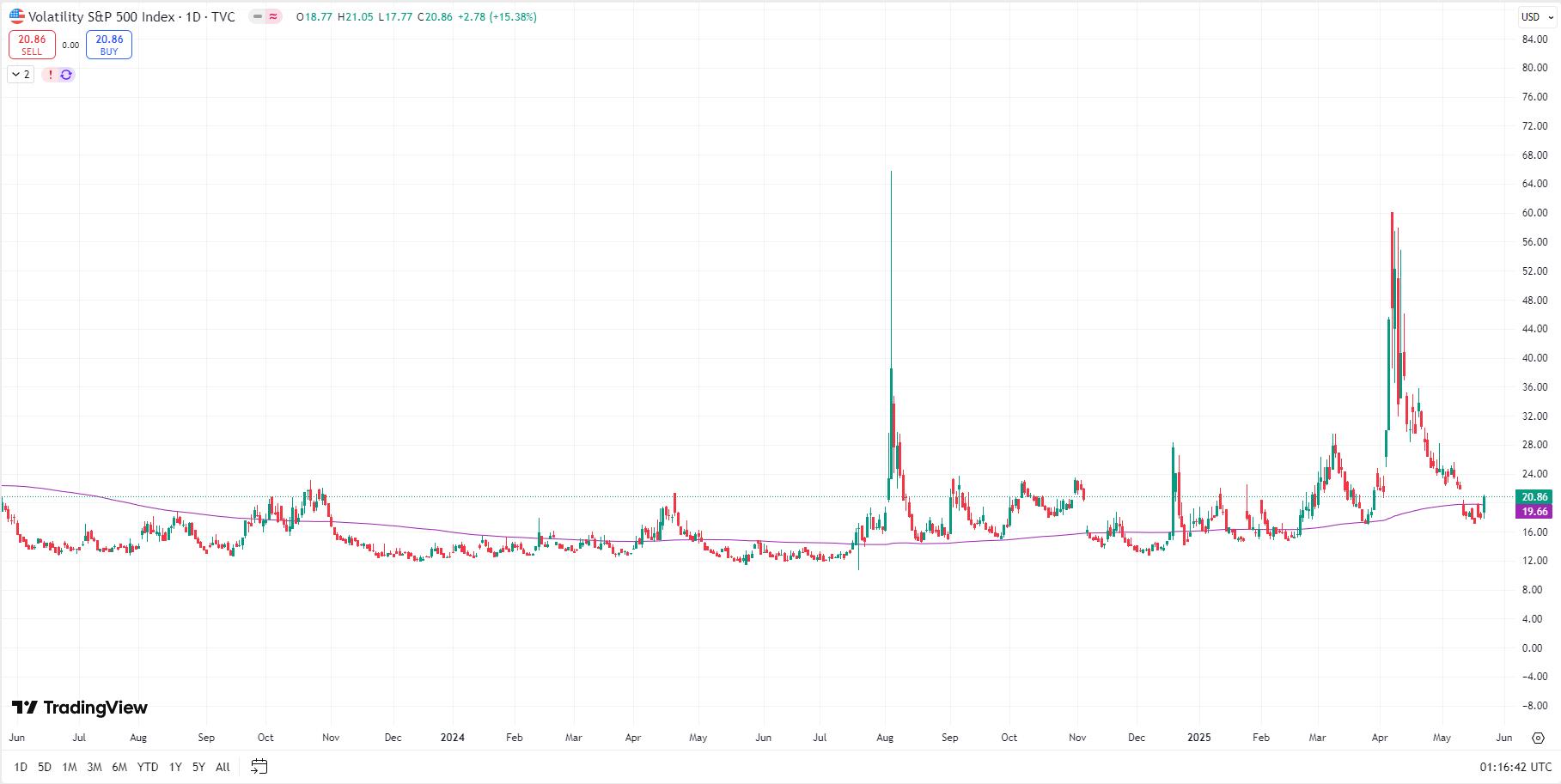

- The VIX indicator is ticking upwards

Bond market is not quite happy after the Moody's downgrade. Don't believe there are any auctions at this time of the month as both the 30 Year and 10 Year yields have gone higher than the levels in early April.

https://x.com/raydalio/status/1922337839825482027?s=46

ray Dalio’s thoughts are interesting… my biggest takeaway don’t focus on the short term craziness but the underlying forces. If bond markets continue to place a risk premium on US bonds at a higher rate what does this lead to? Does the US cut spending and enter recession? Does it continue to print money to pay ever higher interest rates and promote inflation?

Happily accepting the pop in the markets from last night! But this was the caution from the AFR Chanticleer. Have to still keep watching the flanks ...

Trump and his team are backtracking

And why shouldn’t the bulls be back in charge? The evidence is pretty compelling that Trump and his team are backtracking on all the positions they held just weeks ago.

Only a week ago, Trump was talking about how little kids needed only two dolls, not 30, and how some economic pain was required to rewire the global economy and “make America great again”.

Now, investors seem convinced that instead of showing the fiscal restraint required to bring the budget deficit down, they’re going to prime this sucker once again.

All those promises about Elon Musk and DOGE slashing spending? It seems like a failed experiment from another time, with only the culture war stuff still getting any attention.

All that stuff about tariffs? Sure, this is only officially a pause between China and the US, and Bessent is still waving the tariff stick. But the Treasury secretary is also making it clear America wants to avoid de-coupling, suggesting we may have at least found a ceiling for tariffs at the new rate of 30 per cent.

It’s hard to argue with the Chinese view that Trump has backed down without winning a single concession, other than a promise for fresh talks. Indeed, we had to laugh at this quip from Matthew Miller, a member of the past two Democrat administrations: “In exchange for getting nothing from China, we agreed to remove the gun we had pointed at our own head. We will continue to aim the gun at our own foot, however. Masterful negotiating.”

And what about all that stuff about budget discipline? Republican-controlled Congress is struggling to find $US2 trillion ($3.1 trillion) in spending cuts to pay for $US5 trillion in tax cuts and new spending.

Chew on this over the next few days

Indeed, we’re now back to the 96th percentile in terms of cyclically adjusted price-to-earnings ratios for the S&P 500 – in other words, the market has been more expensive only 4 per cent of the time.

Does that feel right when we’ve got an unpredictable president in the White House, lingering questions over the artificial intelligence boom, high geopolitical tensions and a clear shift away from globalisation towards protectionism? It’s something to ponder over the coming days.

More broadly, it’s time for markets to go back to the drawing board to try to reassess Trump’s grand plan in light of the US-China tariff pause. Has his apparent goal of pulling America’s budget deficit down from 7 per cent of GDP to 3 per cent been abandoned, or is he just willing to make this transition more slowly?

It’s a vital question. While sharemarkets surged last night, bond prices fell as yields moved higher (yields and prices move in opposite directions). The US 10-year Treasury yield was up 7 basis points to 4.7 per cent.

On the face of it, that looks surprising, given tariffs were going to cause a spike in inflation. But bond markets are telling us that America’s big fat fiscal deficit problem isn’t going away, and indeed may get worse if Trump delivers his big tax cuts without raising revenue or finding ways to slash spending.

As Trump and Bessent have made clear, the bond market is the thing to watch. Bonds didn’t greet Trump’s “triumph” with the enthusiasm that equities did. That tells us the bond vigilantes are keeping a close eye on America’s debt crisis, and this drama-filled presidency is just getting started.

-----

The 30Y Yield didnt join the party at all ...

Neither did the 10Y Yield

The USD Index is in a happier place