17th April 2025: https://www.theaustralian.com.au/business%2Fmining-energy%2Fmineral-resources-directors-jacqueline-mcgill-and-susie-corlett-quit-as-proxy-advisers-turn-up-the-heat%2Fnews-story%2F564e330078dfd4d9e3e296ffb56d1f3a

Mineral Resources board member Jacqui McGill has quit, alongside Susie Corlett. Picture: Tricia Watkinson

Mineral Resources directors Jacqueline McGill and Susie Corlett quit as proxy advisers turn up the heat

Brad Thompson

Published in The Australian, Wednesday evening, 16-Apr-2025

Efforts by Mineral Resources to clean up its act after a series of scandals involving managing director Chris Ellison are in disarray after the resignation of two independent board members.

Jacqueline McGill and Susie Corlett have resigned effective immediately, just five months after they were named as key members of the independent ethics and governance committee to oversee the company’s compliance and to ensure it met legal and ethical standards.

The resignations come as proxy advisers turn up the heat on MinRes directors who sit on other boards, given the extent of the governance issues at the Perth-based mining services provider and iron ore and lithium producer.

The resignations point to tensions within the board over efforts by Ms McGill and Ms Corlett to get the MinRes house in order. The company share price fell 9 per cent to $16.61 in trading on Wednesday.

Proxy adviser Ownership Matters recommended against Ms Corlett’s re-election to the board of mineral sands miner and taxpayer-backed rare earths player Iluka Resources based on her link to MinRes.

Mineral Resources founder Chris Ellison. Picture: Supplied

Iluka defended Ms Corlett, saying she should be judged on her performance at Iluka and that had been exemplary.

It is understood any MinRes directors who sit on other boards will face similar proxy recommendations against their re-election.

Ownership Matters said that during Ms Corlett’s time on the MinRes board, there had been “material corporate governance shortcomings”, particularly regarding related party transactions and board oversight.

In response, the Iluka board said Ms Corlett was a highly experienced and effective director of their company.

“Her contribution to the board has been invaluable in driving Iluka’s objective, which is to deliver sustainable value. The board has the fullest confidence in Ms Corlett.”

The MinRes ethics and governance committee, which also included independent non-executive directors Denise McComish, was set up after revelations about Mr Ellison’s involvement in a tax evasion scheme, misuse of company funds and third-party transaction involving members of his family.

The future of the committee and its work remains unclear now that Ms McGill and Ms Corlett have quit.

The committee was tasked with reviewing related party transactions involving Mr Ellison and overseeing internal and external investigations, including whistleblower reports and ethical breaches.

MinRes said last November that the committee could reopen previously closed investigations if further information came to light.

Ms McGill only joined the MinRes board in January last year. She serves as a non-executive director at Goldfields Limited, New Hope Group and 29 Metals Ltd as well as the Royal Automobile Association of South Australia.

Ms Corlett joined the MinRes board in January 2021. She serves as a non-executive director at Iluka Resources, Aurelia Metals and Silex Systems.

Their resignations come hot on the heels of The Australian revealing that MinRes is at war with Chevron and the WA government over shipping levies on every tonne of iron ore it exports from the Port of Ashburton in WA.

MinRes said at the weekend that it opted not to disclose the levies or a legal dispute over payment to the market because it considered the charges invalid.

The levies are the latest blow to the embattled company’s Onslow Iron project. The success of Onslow Iron — already facing cost blowouts and production downgrades amid big question marks over a 150 kilometre-long haul road connecting mining operations to the port facilities — is crucial to MinRes’ survival and thousands of jobs as it teeters under a $5.8bn debt pile.

Oil and gas giant Chevron stands to pocket more than $1bn from over the life of the Onslow Iron project under the terms of a secret port agreement with the WA government.

MinRes has launched legal action after being ordered to pay the levies by the Pilbara Port Authority that will be passed on to Chevron, which built the Port of Ashburton before handing it over to the WA government as public state-owned infrastructure.

The WA government has in turn taken action against MinRes in an attempt to recover what it alleges are already more than $5m in unpaid and overdue charges.

The Australian revealed the dispute over the previously undisclosed levies a day after Mr Ellison sent a message to the company’s 6000-strong workforce vowing to “once again prove the naysayers wrong”.

“Our financial position is strong – solid earnings continue to underpin a strong liquidity position. Our debt is unsecured, long-tenor and covenant-light bonds that were designed to ensure we had the flexibility to invest in the next stage of our business growth,” Mr Ellison said in the message to staff obtained by The Australian.

MinRes chairman James McClements, who is on his way out the door in the wake of the scandals now under investigation by the Australian Investment & Securities Commission, said: “Both Susie and Jacqui have dedicated substantial time and effort over recent months in our efforts to improve governance and procedures across the business, while navigating their significant other professional commitments.”

Mr Ellison has agreed to exit as managing director by April next year.

--- ends ---

Source: https://www.theaustralian.com.au/business%2Fmining-energy%2Fmineral-resources-directors-jacqueline-mcgill-and-susie-corlett-quit-as-proxy-advisers-turn-up-the-heat%2Fnews-story%2F564e330078dfd4d9e3e296ffb56d1f3a

MinRes announcement to the ASX yesterday: Director-Resignations.PDF

Also:

Updated

Mark Wembridge and Mark Di Stefano - AFR - Updated Apr 16, 2025 – 5.03pm, first published at 10.02am

Major superannuation investors are demanding Mineral Resources explain the sudden exit of two key board directors who were privately the most critical of the conduct of embattled founder Chris Ellison.

The iron ore and lithium miner said on Wednesday that Susie Corlett and Jacqueline McGill would leave the board. They were two of the three-member ethics and governance committee established after a board review found Ellison had “failed to be as forthcoming” with the company about his personal transactions, creating a “significant reputational impact”.

Susie Corlett (left) and Jacqueline McGill, who were both critical of founder Chris Ellison, have left the MinRes board

AFR Weekend has confirmed that two senior in-house lawyers tasked with assisting the same committee have also departed. The directors did not outline their reasons for leaving – McGill has only been on the board for 16 months – but Corlett raised a litany of issues in a letter to MinRes chairman James McClements as she quit.

Two people familiar with that letter, who requested anonymity because they were not authorised to speak publicly, described its contents as scathing about efforts to overhaul the company’s culture.

Ellison, a blunt-speaking New Zealander who is now MinRes’ managing director, has vowed to quit the company by next year after acknowledging his participation in an offshore tax scheme that enriched him and others at the expense of the iron ore and lithium producer he founded in 1992.

McClements has also committed to standing down as MinRes’ chairman, and his replacement is due to be announced within weeks.

Ed John, the executive general manager of the Australian Council of Superannuation Investors, which advises big retirement funds on how to vote on governance matters at shareholder meetings, said the resignation of the two directors raised a “major question”.

“The company needs to explain to its shareholders what has happened to prompt the departure of the directors and what this means for plans to improve independence and transition the roles of board chair and managing director,” he said.

Mineral Resources’ headquarters in Perth. The company has been in a corporate governance crisis for months. Bloomberg

HESTA, which invests on behalf of health workers, has requested a meeting with MinRes to “understand more about the future of the committee, whose work we see as critical in driving action to address … governance failures”.

“Having viewed the formation of the ethics and governance committee as a positive development, we believe today’s news delivers a significant hit to investor confidence,” said Debby Blakey, HESTA chief executive.

The company remains on the fund’s watch list, which means its stake could be sold if HESTA remains concerned about its governance issues.

Those issues, and broader questions about the business, are piling up.

The Australian Securities and Investments Commission is investigating MinRes and Ellison over alleged failings including interparty transactions, and forcing company employees to work on his $30 million private yacht.

MinRes has been bleeding cash from its lithium division after low prices forced the loss-making miner to mothball operations at Bald Hill, a project close to Kalgoorlie in the Goldfields region. Over six months, MinRes has also cut iron ore production, axed dividends, and flagged it will have to spend significantly more money than expected repairing a new haul road.

Board within a board

The company put its ethics and governance committee in place in November, in the hope of reassuring shareholders after The Australian Financial Review revealed Ellison’s British Virgin Islands tax scheme, and that he had reached an agreement with the Australian Taxation Office.

Corlett, McGill and another director, Denise McComish, were selected to sit on the committee. People with detailed knowledge of the board’s deliberations said they were the three directors who were the most critical of Ellison as the company’s governance problems spiralled.

The committee is chaired by McComish and its scope includes “reviewing related party transactions involving Ellison; enhancing internal controls regarding related party transactions; overseeing internal and external investigations, including whistleblower reports and ethical breaches”.

It could reopen “previously concluded investigations if further information comes to light and strengthening conflicts of interest procedures”.

Two weeks later, MinRes’ in-house counsel Jenna Mazza quit as company secretary, joining the board’s committee as specialist legal counsel. Soon after MinRes’ general manager of commercial and legal, Nick Rohr, did the same, becoming counsel-assisting to the governance committee.

Both have now left MinRes, serving out their notice periods.

McGill joined the MinRes board in January last year. She is also a director on several other resource company boards, including coal miner New Hope and copper and precious metals developer 29 Metals. Corlett joined MinRes in 2021 also serves on the boards of Iluka Resources, Aurelia Metals and Silex.

Ownership Matters, which advises institutional investors on how to vote at shareholder meetings, has recommended Iluka shareholders vote against Corlett’s re-election to the critical minerals producer’s board.

It advised that there were “material corporate governance shortcomings at MinRes, particularly regarding related party transactions and board oversight”. It recommended that Corlett not be re-elected to Iluka “in the interests of seeking non-executive director accountability”.

MinRes shares ended the day $1.64 lower at $16.61. They have slumped more than 70 per cent over the past 12 months.

--- ends ---

Source: https://www.afr.com/companies/mining/minres-board-in-turmoil-as-governance-committee-directors-quit-20250416-p5ls3x

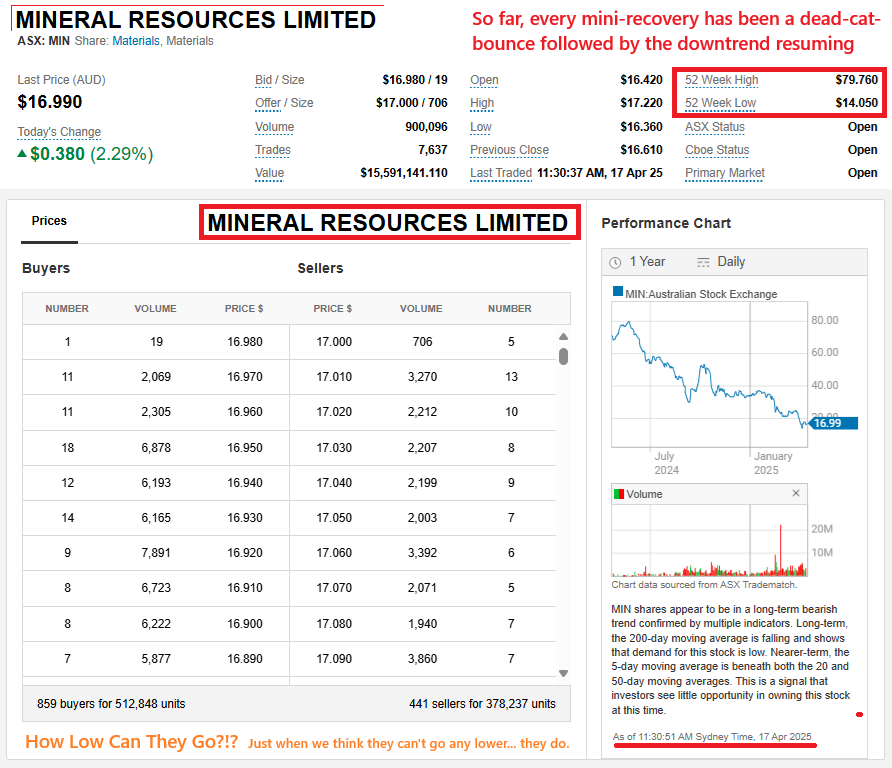

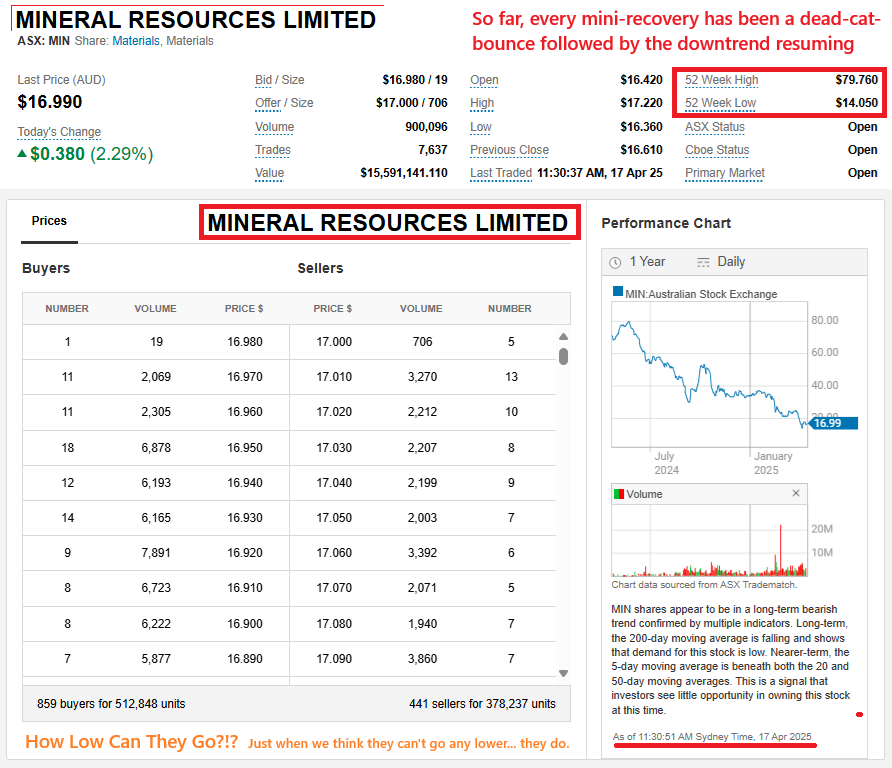

Despite MIN being up over +2% today, they're STILL in a horrible downtrend:

I'm actually not trying to troll MinRes, just pointing out that when there's more smoke than Woodstock in '69, it's likely going to be a higher risk "investment" and there's ALWAYS going to be further downside potential. So many better companies to invest in; We don't need to be invested in this one.