The market liked it @Solvetheriddle with MIN up +13.15% today, i.e. up $2.39 to $20.57 from their $18.18 close yesterday.

Mind you, $18.18 is a very low base to rise from. The same $2.39 rise in a single day for MinRes 12 months ago would have been a +3.31% rise (coz they closed at $72.19 one year ago) rather than being a +13.15% rise, which it was today.

Good commentary on this today from the MoM lads. It wasn't all negative. I actually thought it was fair and balanced:

Has MinRes Really Turned the Corner?

Money of Mine [16.8K subscribers]

"We’re in the thick of quarterlies now, so we plucked out 2 of the most fascinating stories to chat about.

First up we dived into MinRes, who saw their stock rocket 15%+ on the back of their release.

And for our second story, we peeled back the layers at Emerald Resources, looking at the opportunities that lie ahead for the miner with 2 growth projects."

[note: MIN's SP was up +15% at the time they recorded the poddy, but closed up +13.15% at the end of the trading day]

Mark Wilson, MIN's CFO, was certainly painting an Equity Raise as his LEAST preferred option if they do need to raise more money:

Click on his left ear to hear Mark's explanation of why he does NOT believe that a capital (/equity) raising while their share price is this low is a good option for them, or any of their shareholders who don't participate in it. They continue to view further asset sales as much more preferably to a CR if they need to raise more money.

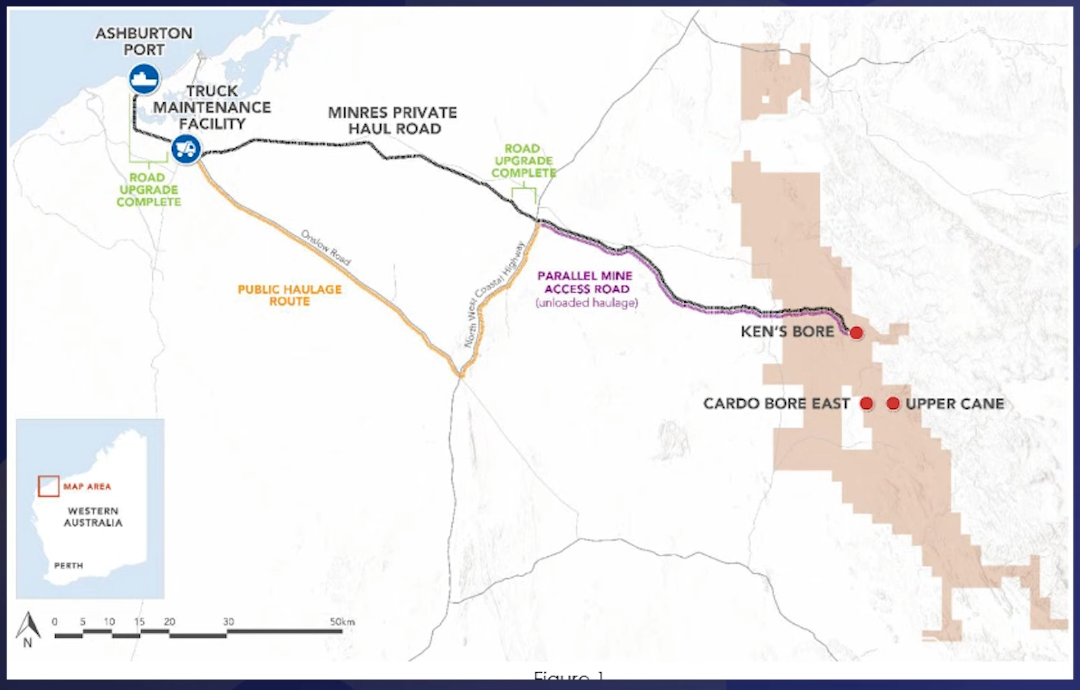

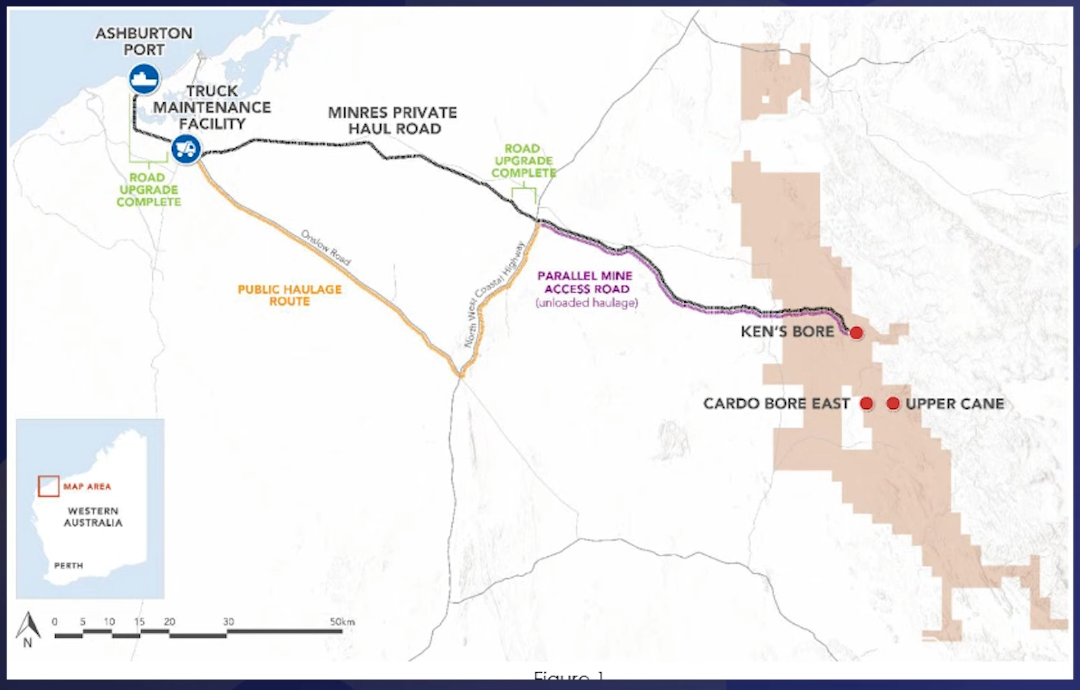

This map is interesting:

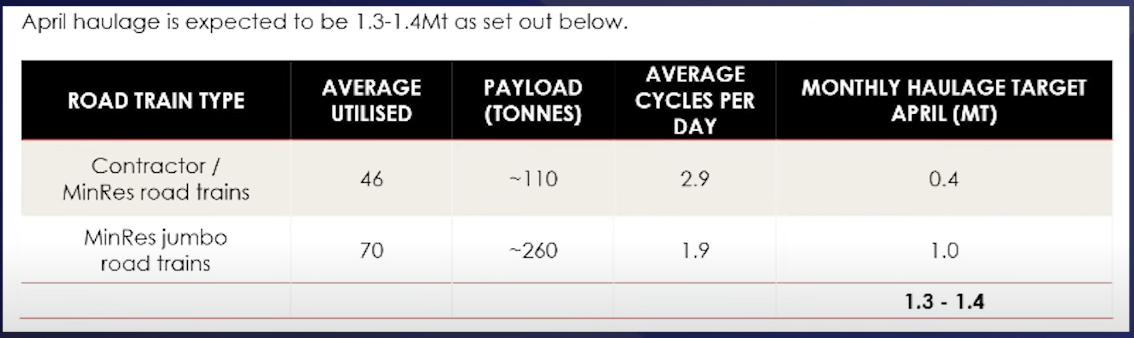

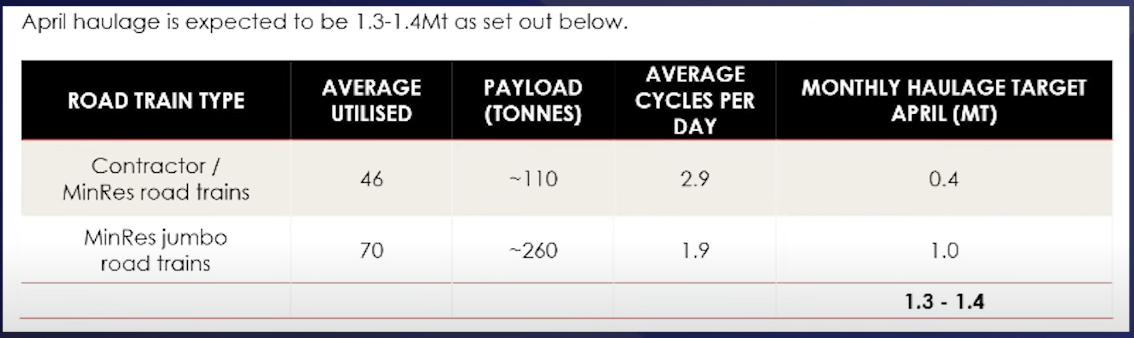

MinRes are currently using 70 of their own jumbo road trains plus another 46 Contractor road trains and the contractor road trains are using the existing Onslow Road to the North West Coastal Highway and then using the parallel mine access road between that highway and Ken's bore, as shown above. As shown immediately below, this is expected to deliver them a run-rate during April of between 1.3 and 1.4 million tonnes of iron ore, so that annualises to around 16 to 17 mtpa, well short of the 35 mtpa nameplate capacity that they need to achieve to get the balance of the road payment from MSIP (Morgan Stanley Infrastructure Partners) and to also meet their production schedule over the coming years.

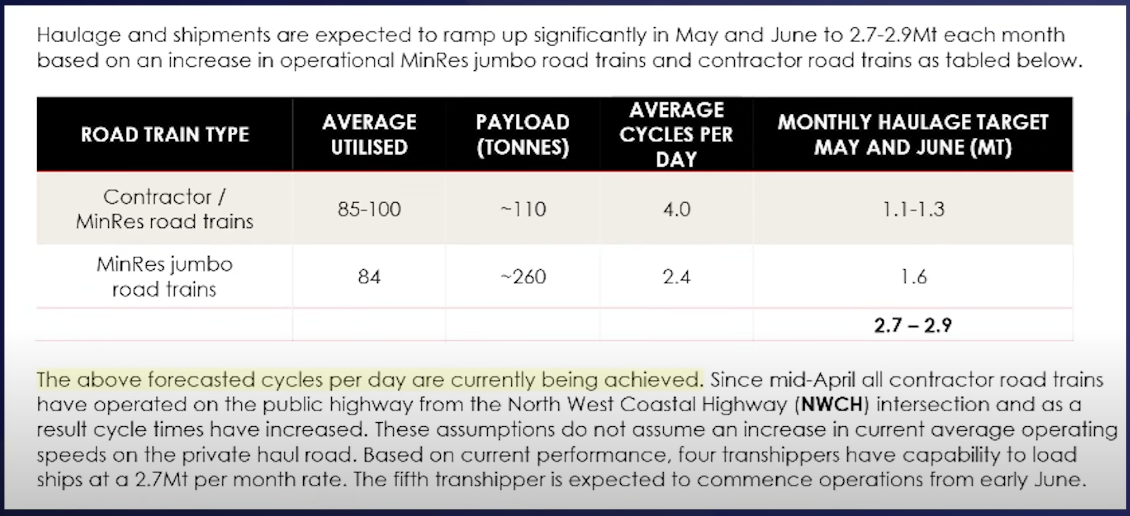

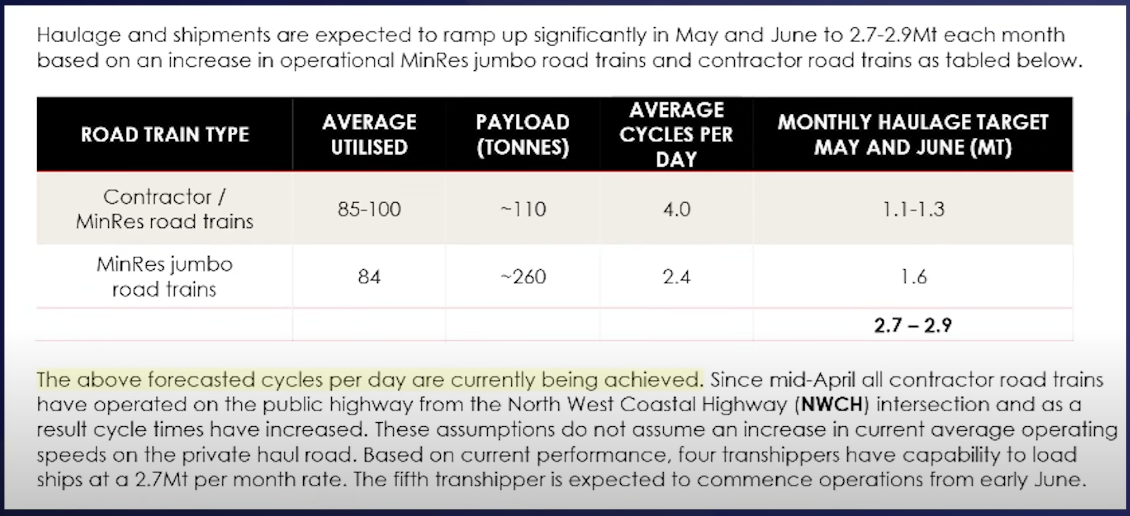

But wait, have a gander at the following table! This one is what MinRes believe they expect to achieve in May and June, and if they hit the upper end of that monthly haulage target range - i.e. 2.9 million tonnes, that annualises to a bee's whisker under 35 mtpa. To achieve 35 mtpa they need to haul 2.917 mt/month.

How are they going to more than double their April haulage numbers while over half the haul road is still being repaired? They aren't increasing the payloads, but they are planning to increase the cycles per day by the contractors by 38% (from 2.9 to 4 cycles/day) and by 26% for their own trucks (from 1.9 to 2.4 cycles/day), and they're also planning to increase the number of trucks used, with an additional 14 of their own jumbo road trains (84 instead of 70), and potentially doubling the contractor trucks from 46 to between 85 and 100.

If they can indeed get to 35 mtpa while still repairing that haul road, that would be a phenomenal feat indeed. The market certainly liked the plan!

Let's see what they say in 3 months' time in their June quarter report, and then in August when they provide an update along with their FY25 full year numbers.

I agree that if they CAN haul that ore from Ken's Bore to Onslow at a rate of 35 million tonnes per annum, even with all of the extra costs of using contractors and using a longer route, they should be OK. Achieving 35 mtpa is however by no means a given. But if they manage to pull that off, without blowing out their costs too much, they should certainly be trading at that time a good deal higher than where they closed today, so people buying at these levels, around $20/share and below, are likely to do very well indeed. That's the bull case.

It may be possible, but it certainly won't be easy.

Disc: Not holding.