Pinned straw:

May 14th, 2025: Gorilla Gold Mines (GG8) is an interesting company. Originally called Orminex Ltd (ONX), they were founded in 1970 and have always been headquartered in Subiaco, a suburb of Perth, Western Australia (Subiaco and West Perth are home to the HQs of a plethora of mining companies and minerals exploration companies). Marketindex.com suggests they were also formerly known as Mintails Ltd (MLI, 2018) and Trans-Global Resources NL (TGL, 1999), but ChatGPT only goes back as far as Orminex.

The company specialises in gold mining and has been involved in various mining ventures in Western Australia. In November 2021, Orminex Ltd underwent a rebranding and changed its name to Labyrinth Resources Ltd and its ticker code to LRL. It was at that time mostly focused on the Labyrinth Gold Project, located in the Abitibi Greenstone Belt in Quebec, Canada. The company also held the Comet Vale Gold-Copper-Nickel project in Western Australia and they later acquired the Vivien Gold Mine from Ramelius Resources (RMS).

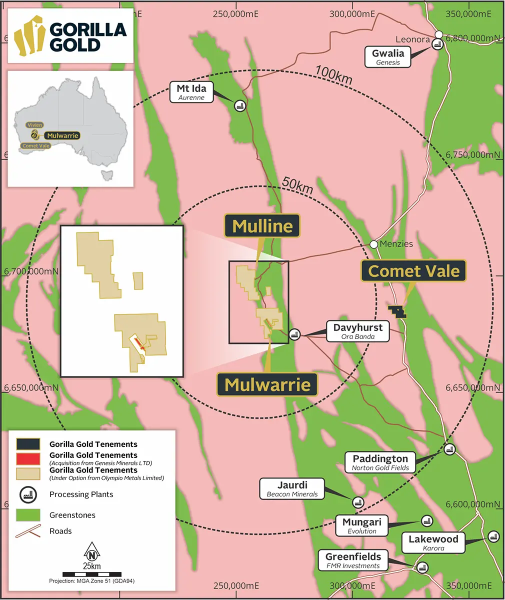

In November 2024, Labyrinth announced they had entered into a binding term sheet with Bardoc to acquire 100% of Admiral Gold, which owned 100% of the Mulwarrie Gold Project. Bardoc was a fully owned subsidiary of Genesis Minerals (GMD), which Genesis gained when they acquired St Barbara's (SBM's) Leonora (WA) assets in June 2023. That acquisition of Admiral / Mulwarrie from GMD by LRL was effected via an upfront consideration of $3.75 million settled via the issue of ~17.86 million fully-paid Labyrinth shares (17,857,143 LRL shares) at an issue price of $0.21 per share (21 cps), with a $1.0 million cash milestone payment due upon first commercial production from the tenements.

That's how Genesis Minerals (GMD) became substantial shareholders of LRL (now GG8). In addition to being issued those 17.86 million LRL shares, GMD acquired additional LRS shares in September, October and November and held 7.64% of GG8 (then LRS) on 29th November 2024 (when that deal settled), so 41,319,637 LRL shares at that time. When GG8 raised another $25 million in March (two months ago) "to accelerate exploration activities at its recent Lakeview discovery and maintain ongoing exploration momentum at its Comet Vale, Mulwarrie and Vivien projects", GMD committed to subscribe for another A$1.84m of GG8 shares to maintain its pro-rata 7.64% shareholding in Gorilla.

Commsec doesn't list GMD as being a "Sub" for GG8 because the Becoming-a-substantial-holder-from-GMD-for-Labyrinth-Resources.PDF announcement was only posted by the ASX to GMD, not to LRL (Labyrinth Resources, now GG8), which was clearly a mistake, so the system wasn't able to scrape the data and update the "Subs" list for LRL as it should have - so purely an administrative error by whoever compiles that data that Commsec displays - due to the ASX not posting that announcement to LRL.

But GMD remain GG8's 4th largest shareholder with 7.64%.

In February 2025, Labyrinth Resources Ltd (LRS) changed its name to Gorilla Gold Mines Ltd and their ticker code to GG8. Their new company logo is above. Gorilla Gold describe themselves as a gold explorer based in Western Australia focused on the exploration upside of under-explored mining projects close to existing infrastructure. The strategy is underwritten by its current global JORC Resource of 675koz at 4.7g/t, providing a platform for further resource growth.

Gorilla Gold benefits from access to capital and expertise for accelerated exploration within Western Australia. While the company continues to explore and develop gold, lithium, rare earth elements, copper, tungsten, and nickel deposits in Australia, it's their current focus on gold that interests me personally.

According to ChatGPT, regarding the founders of Orminex and Labyrinth Resources, specific information is not readily available, however the company has been associated with key individuals such as Kelvin Flynn and Alex Hewlett who are both current Non-Executive Directors (NEDs) of Gorilla Gold Mines and have been involved in driving value creation at other companies like Red Dirt Metals Limited (now Delta Lithium), Spectrum Metals Limited, Mineral Resources Limited, Silver Lake Resources Limited, and Wildcat Resources Limited.

Kelvin Flynn is currently GG8's 3rd largest shareholder through his company Sharlin Nominees Pty Ltd which owns 46,821,306 GG8 shares, being 8.38% of their SOI (shares on issue).

Alex Hewlett is currently GG8's 2nd largest shareholder through his company Elefantino Pty Ltd which owns 56,542,710 GG8 shares, being 9.02% of the company.

Their largest shareholder is Samuel Wilson who holds (mostly in his own name but also through a company he controls called Pilbara Conveyor Supplies Pty Ltd) 471,913,059 GG8 shares, being 10.62% of the company. Samuel Wilson was a non-executive director of Orminex for 4 years from March 2018 to January 2022, so when he left, the company had changed their name to Labyrinth Resources (in 2021).

The only other current Substantial Shareholders of Gorilla Gold (after Samuel Wilson, Alex Hewlett's Elefantino, Kelvin Flynn's Sharlin Nominees and Genesis Minerals) is 1832 Asset Management with 6.92%, and that position is usually attributed to the Bank of Nova Scotia because 1832 Asset Management is a wholly-owned subsidiary of the Bank of Nova Scotia (BNS), registered in Ontario, Canada. Some of those shares may at times be held in other controlled and managed entity of BNS, such as their Dynamic Precious Metals Fund. 1832 Asset Management L.P. also operates under the business name Scotia Global Asset Management, All part of the Bank of Nova Scotia, Canada.

Circling back to Kelvin Flynn (pictured above), a NED at GG8 and their third largest shareholder (with 8.38%), according to Commsec, Mr Flynn has 30 years experience in investment banking and corporate advisory roles including financing, M&A, private equity and special situations investments in the mining and resources sector. He has held various leadership positions in Australia and Asia, having previously held the position of Executive Director/Vice President with Goldman Sachs and Managing Director of Alvarez & Marsal in Asia. He is the Executive Chairman of Harvis, which is a specialist private lender and corporate advisory firm in Western Australia. Mr Flynn was previously a 14 year Director of Mineral Resources Limited (MIN, aka MinRes), a 13 year Director of Global Advanced Metals Pty Ltd and is currently a NED of Vault Minerals Limited (VAU). Prior to Red 5's recent merger with Silver Lake Resources to form Vault (VAU), Mr Flynn had been a Director of Silver Lake Resources for 8.5 years.

Regarding Alex Hewlett (pictured above), also a NED at GG8 and their second largest shareholder (with 9.02%), according to Commsec, Mr Hewlett has experience in project identification and acquisition. Previously Chairman of Spectrum Metals Limited, Mr Hewlett oversaw its growth from mid-2018 through to being taken over by established gold miner Ramelius Resources Ltd (RMS) in early 2020. More recently, Mr Hewlett led the identification and acquisition of Tabba Tabba (from GAM owned by RCF) for Wildcat Resources Limited and the acquisition and development of the Mt Ida project (from Ora Banda) for Delta Lithium Limited.

Another GG8 Board Member, their Technical Director, Simon Lawson (pictured above and below) is a professional geoscientist with more than 18 years of experience in exploration, production and managerial roles spanning multiple commodities and jurisdictions, and was a founding team member of Northern Star Resources Ltd where he held senior geology roles including Principal Geologist and, along with NST's then Executive Chairman Bill Beament and NST's current CEO & MD (then CEO) Stuart Tonkin, helped transform NST from a small WA gold explorer into a multi-billion dollar gold mining heavyweight that became (and still is) the largest Australian gold miner and a top 10 global gold miner in terms of both market cap and annual gold production.

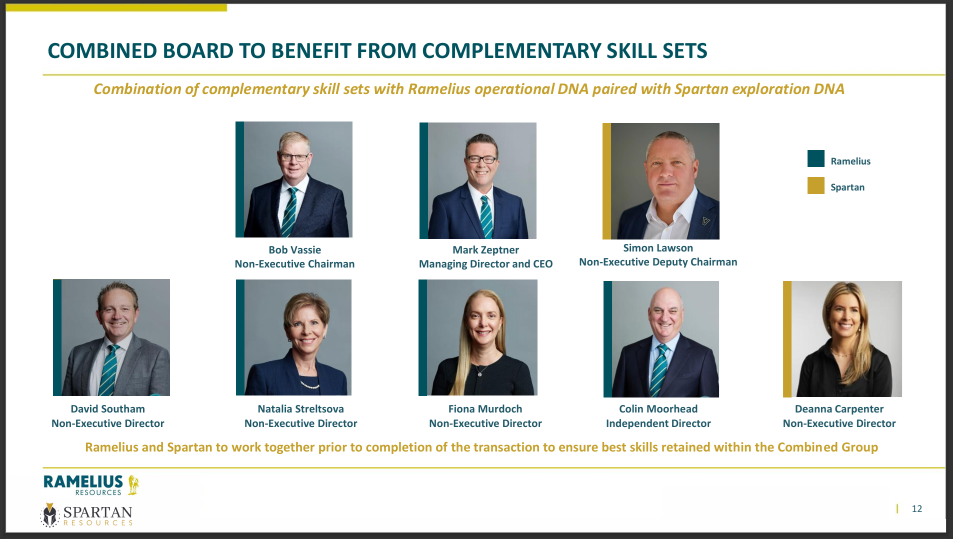

As well as being GG8's current Technical Director, Simon Lawson (above) is also currently a NED at Firetail Resources (FTL) and is the Chief Executive Officer (CEO), Managing Director (MD) and Executive Chairman of Spartan Resources (SPR), formerly known as Gascoyne Resources. Spartan (SPR) is now under an agreed takeover offer from Ramelius Resources (RMS) which Lawson helped to arrange and get over the line, and Lawson is one of only two people from Spartan that will be joining the Ramelius Board when the acquisition completes - expected to be in late July or early August this year:

Source: Page 12 of their March 17th "Transformational Combination of Ramelius and Spartan" Presentation

Prior to joining Spartan (SPR), but after his time at NST, Mr Lawson was also Chief Geologist at Superior Gold Inc. which was acquired by Catalyst Metals (CYL) in June 2023.

GG8 only have 4 people on their Board, and the fourth (after Lawson, Hewlett and Flynn) is their non-executive Chairman, Dean Hely, who is a corporate lawyer. Mr Hely is the Managing Partner of the independent West Australian legal firm Lavan and a partner in the Corporate and Reconstruction group. Mr Hely has over 28 years of experience working in corporate reconstruction, insolvency and commercial litigation. Mr Hely and others established Quadrant Advisory, a debt advisory practice that assists clients ranging from midsized companies though to ASX listed companies with their debt requirements.

So a decent board with relevant experience and plenty of skin in the game. And a couple of interesting Substantial Shareholders (Subs) in Genesis Minerals (GMD) and 1832 Asset Management / Bank of Nova Scotia (and their Dynamic Precious Metals Fund).

I should also mention that in mid-January this year, Gorilla Gold (or Labyrinth Resources as they were still known at that time) announced the appointment of Mr Mark Rozlapa as their new Chief Financial Officer (CFO). Mr Rozlapa is a qualified Chartered Accountant with over 20 years’ experience, including more than 15 years for listed mining companies across the exploration, feasibility, construction and production phases. Mark previously held senior finance roles across a broad range of commodities and jurisdictions including at Sandfire Resources, Ramelius Resources and IGO. He has experience in project financing and the implementation of processes and systems to support resource growth and development strategies. Another Tick.

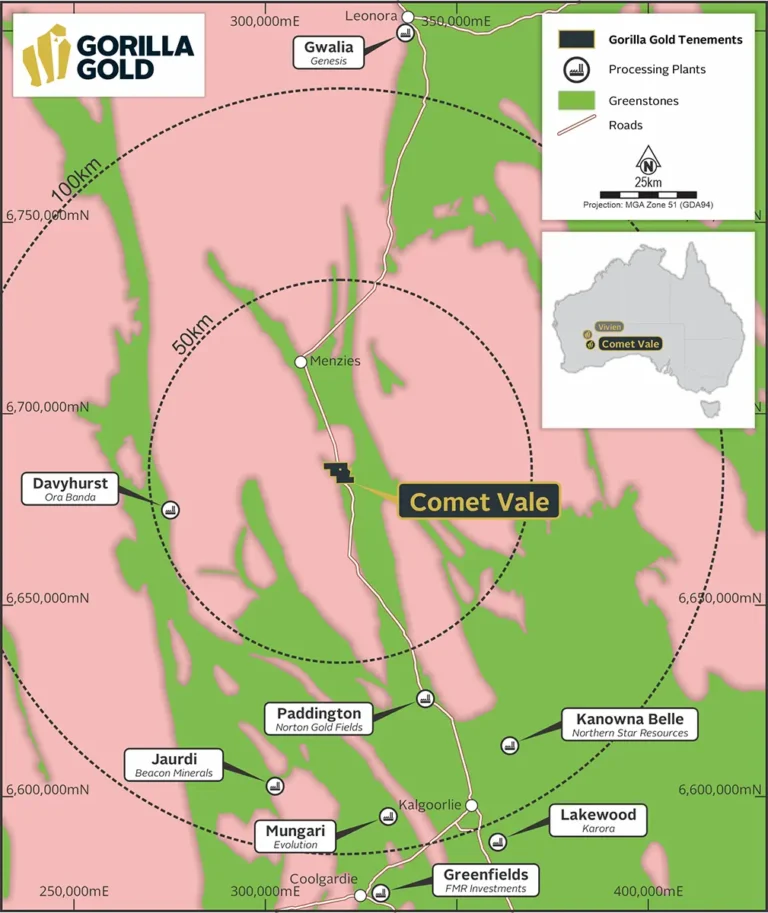

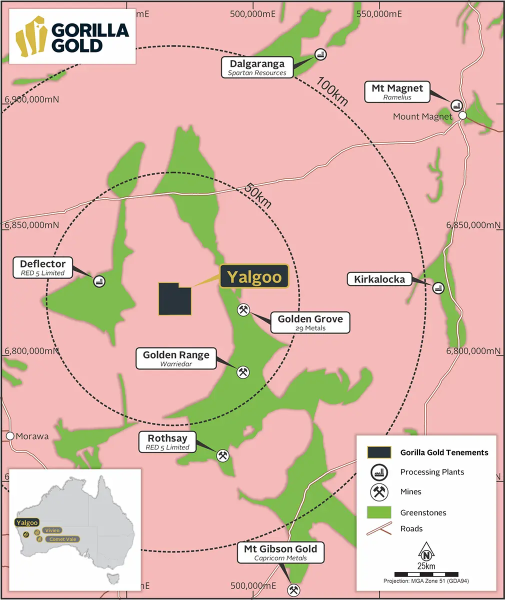

Now to where their projects are in relation to other players in the gold space:

Source: https://gorillagold8.com/

So, there's the background - they still own 100% of the Labyrinth Gold Project in Quebec Canada, approximately 40km NW of Rouyn-Noranda and 13km NE of the Kerr-Addison Mine which had historic production of 11 million ounces of gold at 9g/t, but that's not what interests me - it's these various WA goldfields projects that have existing operations all around them, and GG8 are drilling the crap out of these projects - as explained below - click on the image to load the page and then click on the "Play" icon in the middle after the page loads to watch the video:

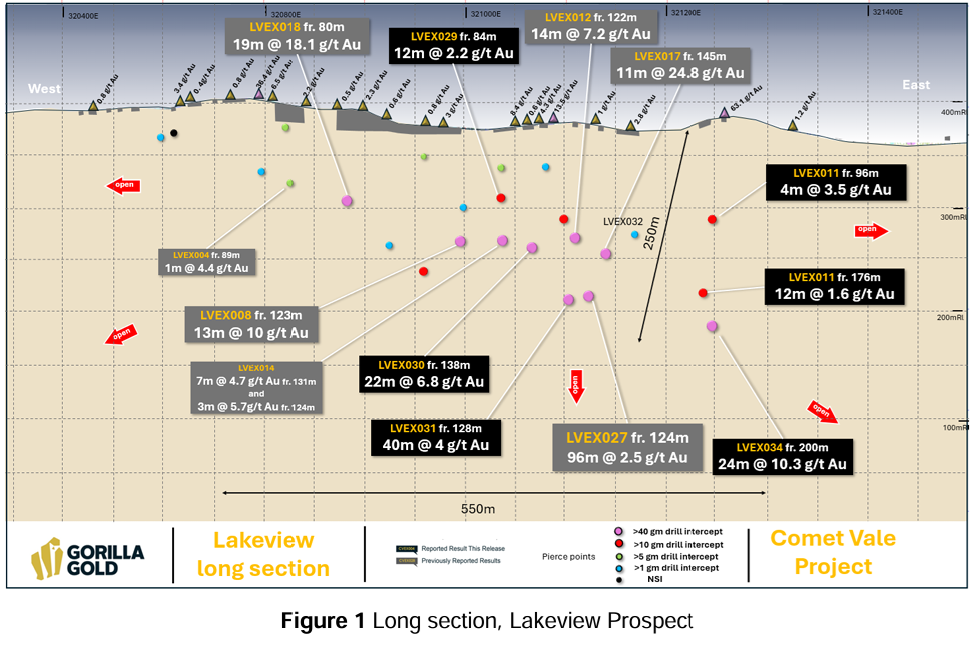

He mentions "Lakeview" being a priority at this point in time, and that was recorded last week (7th May 2025), so it's current, but you may have observed that Lakeview does not appear on the area maps above. That's because it's part of their Comet Vale Project, as shown below:

Source: Lakeview Extended 125m Along Strike.PDF [17th April 2025]

Have a read of that one if interested (link above).

I titled this straw "Business Model/Strategy" and after plenty of background we've finally got to that; their strategy is to pinpoint the best gold projects in the best WA goldfields locations - and then turn them into swiss cheese.

I'm not convinced they're going to take any of these projects through to production because they can make great money by proving up these deposits and then selling them off to existing gold producers who already operate nearby.

From those producers' POV, it's all about replacing depleting reserves and also trying to grow reserves where possible, and it's a lot easier to buy projects where the drilling has already been done than to find viable (profitably mineable) new gold deposits themselves from scratch.

Approximately 60% of major global gold miners are prioritising investments in exploration and development to replace depleting reserves. This focus addresses the industry's long-term sustainability challenge, as many mines face declining ore grades and reserves (source: https://discoveryalert.com.au/news/free-cash-flow-gold-mining-industry-2025/).

That development is most easily achieved through M&A, i.e. buying projects with plenty of gold from smaller players, and that's the demand that companies like Gorilla Gold (GG8) are trying to supply or cater for.

It's not easy. It takes a lot of drilling, which takes a lot of money, but GG8 have the cash and they're certainly doing the drilling. And at the end of the day, it's still a lot quicker than taking one of these projects through to production, which might be best done by an existing gold producer. GG8 have a number of highly prospective projects and they can hopefully prove up Lakeview and Comet Vale and then sell that off and recycle that cash into their next projects, and so on. Either that or one of the larger players might just buy all of GG8 - at a decent premium of course.

So, yeah, I bought a small position in GG8 this morning.

High risk, as all explorers with zero production are, but as high risk punts go, this is one of the better ones I've come across lately.

Gorilla Gold do have a lot of positives, as I mentioned earlier in this post.

I also bought a small position in Rox Resources (RXL) yesterday, a gold project developer whose Youanmi GP (gold project) sits directly north of (and very close to) Ramelius' exceptionally high grade Penny gold mine. In their 12th March, 2024, "Ramelius delivers 10 Year Mine Plan at Mt Magnet" Announcement Ramelius Resources (RMS) said that their Latest Mineral Resource for Penny (at that time, just over a year ago) was 380kt (thousand tonnes) at 22g/t Au for 270koz Au (270 thousand ounces of gold) with Penny West now included in their Penny Production Target of 380kt at 15.9g/t Au for 194koz (effective from 1st July 2024). RMS truck that ore from Penny to Mt Magnet, and it's significantly increasing their gold production and lowering their costs at Mt Magnet.

So far, RXL's grades at Youanmi aren't quite that spectacular - but they're certainly decent - they've declared a mineral resource estimate (MRE) of 2.3 million ounces (Moz) of gold at the Youanmi Project with the open pit portion estimated to contain 6.5 million tonnes (Mt) of ore at 2.7 g/t for 0.6 Moz of gold and the underground portion estimated at 9.7 Mt of ore at 5.5 g/t for 1.7 Moz of gold.

RXL is still very early stage and many punters will likely bypass them simply because their gold is intimately associated with sulphide minerals and silicates in zones of strong hydrothermal alteration and structural deformation. Typical Youanmi lode material consists of sericite-carbonate-quartz-pyrite-arsenopyrite schist or mylonite which frequently contains significant concentrations of gold.

The short version is that it's sulphide ore that requires additional processing to liberate the gold, however that's being done successfully at scale all over the place, including by Emerald Resources (EMR) at Okvau in Cambodia, and the Golden Mile ore, which is the primary ore type at NST's KCGM (a.k.a. the Super Pit, Northern Star Resources' largest mining operation), is known for containing abundant sulphides, including minerals like pyrite. That's one of the reasons NST weren't afraid to buy DEG (De Grey Mining) for $5 Billion recently because the ore at Hemi is primarily a sulphide ore, containing significant amounts of the sulphides pyrite and arsenopyrite.

That stuff can and is being viably mined, but a lot of people associate sulphide ore with cost blowouts, low recoveries and even company failures, citing the Wiluna Gold Mine in Western Australia as an example, however Wiluna Mining Corporation (formerly known as Blackham Resources) had other issues including logistical and funding issues coupled with too much debt, in a time of significantly lower gold prices, which ultimately led to them entering voluntary administration in July 2022.

On the flip side, one of the highest grade and most profitable mines in Australia, the Fosterville Gold Mine in Victoria, owned by Agnico Eagle (previously Kirkland Lake Gold before they merged with Agnico Eagle) has been making very good money extracting gold from sulphide ore there for many years, using a process that includes crushing, grinding, flotation, bacterial oxidation (BIOX), and carbon in leach (CIL) circuits. This process first involves crushing and grinding the ore to free the gold-bearing minerals. Then, flotation separates the sulphide minerals, including pyrite, from the rest of the ore. The sulphide concentrate is then treated with BIOX to oxidize the pyrite, releasing the embedded gold. Finally, the gold is extracted through a CIL circuit, which uses cyanide to dissolve the gold and then absorbs it onto activated carbon.

Extracting gold from sulphide ore is absolutely doable and people really shouldn't be scared of it, but some still are.

Finally, the ore at Ramelius' Penny mine is also sulphide ore, and Ramelius is probably the natural owners of Youanmi, IMO, so will likely buy Rox (RXL) at some point - again IMO - no guarantees - but RMS do have their hands full currently with the takeover of Spartan (SPR) which is going to take another 2 or 3 months from here.

OK, I got sidetracked talking about Rox and sulphide ore there for a minute, and this straw is supposed to be about Gorilla Gold, but it is relevant because Gorilla Gold has identified sulphide ore at both the Lakeview and Comet Vale projects. At Lakeview, the gold mineralisation is associated with quartz veining, sulphide development, and biotite alteration within a major fault. Specifically, that mineralisation has been associated with pyrrhotite and chalcopyrite sulphide development within quartz-carbonate veins. At Comet Vale, the Sovereign Prospect has high-grade gold mineralisation associated with biotite alteration and fine sulphide in quartz veins.

So, again, people may be thinking that's all too hard and they'd rather invest or speculate in gold projects that do NOT contain sulphide ore - because it should be a cheaper and easier to liberate the gold (extract the gold from the ore) from oxidized ore (or oxide ore) than from suphide ore. Sure, but grades matter. All other things being equal (and they rarely are), I'd rather invest in a project that has a heap of gold at 4 or 5 grams per tonne in sulphide ore than a project that has between 0.5 and 1.5 grams per tonne in oxide ore. As long as the people building the mill know what they're doing, and everyone's done their homework properly during the PFS and the DFS (now mostly just being called the FS - feasibility study) stages.

But, once again, always remember that explorers and project developers all carry far more risk than producers do, so if you want to roll the dice with these sort of companies, keep the position sizes appropriately small, and only speculate with what you can comfortably afford to lose.

Disclosure: As of right now (14th May 2025) I hold the following gold companies:

Explorers and Developers: Meeka Metals (MEK, who are very close to production now), Gorilla Gold Mines (GG8), Rox Resources (RXL), Medalion Metals (MM8) and New Murchison Gold (NMG). All held in my largest real money portfolio, with only MEK held here on SM.

Gold Producers: Northern Star Resources (NST), Genesis Minerals (GMD), Ramelius Resources (RMS), Evolution Mining (EVN, who produce gold and copper), Gold Road Resources (GOR, arbitrage trade on the Gold Fields Ltd takeover of Gold Road) and Bellevue Gold (BGL). All held in my two largest real money portfolios (including my SMSF) and most also held here on SM,

I sold all my Spartan (SPR) shares last week, as they were an arbitrage play on the takeover of SPR by RMS and I was happy to lock in the profit I'd made.

I also hold NRW Holdings (NWH) who do have a mining services contract with Evolution Mining at Mungari, and my largest position is in Lycopodium (LYL) who do a few different things but specialise in designing and building gold mills (processing plants). I also have a decent position in GR Engineering Services (GNG) who do similar work to LYL, but where LYL build plants outside of Australia mostly, GNG mostly build here in Australia. Both GNG and LYL do dozens of feasibility studies every year for different types of miners, but especially for gold and copper miners, which ranges from scoping studies to pre-feasibilty studies (PFS) to definitive feasibility studies (DFS, also just called FS) to front-end engineering and design (FEED) which all often lead into being awarded EPC (Engineering, Procurement and Construction) or EPCM (EPC + project Management) or EP&PM (Engineering, Procurement and Project Management) contracts if and when those projects do get a positive FID (final investment decision) by the project owners. I hold LYL, GNG and NWH both here and in my real money portfolios.

So, yeah, I do have plenty of exposure to gold, both directly and indirectly.

OxyBBear

@Bear77 Thanks for your gold posts as I am slowly allocating a small portion of my portfolio to gold

So I increased my very modest gold exposure today by buying NST at the expense of all the stocks I purchased (360, BRG, NWL, TNE, RUL, RMD) in early April when Trump's tariifs hit the markets. I'm usually a long term buy and hold investor and I intended to follow through with that but the dizzying rally since early April made it too tempting to sell as the annualised return in the space of just over a month was too hard to pass up. Obviously I run the risk that this melt up continues but I have only liquidated the stocks I purchased in April, not the stocks I held prior to that.

I think gold stocks will continue to fall in the short term so I'll gradually incerease my exposure as this an area I am underweight and I am unsure what will happen as we get closer to the expiry of the 90 day tariff pause.