I’m a lazy investor, which is why I’ve always liked passive investing and the NASDAQ 100 has pretty much always had a spot in my portfolio.

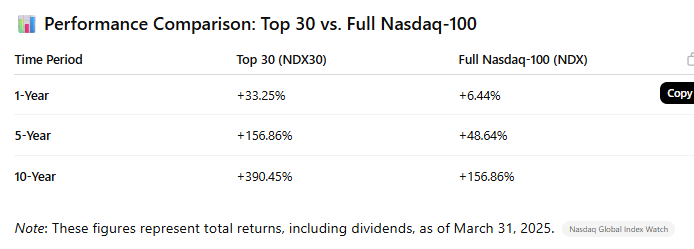

That said, I’ve always leaned more towards the top end of the index rather than the companies sitting down around 80–100. I asked my trusted research assistant (ChatGPT) to compare the top 30 companies in the index over the past 1, 5 and 10 years (with dividends reinvested), and the results told a pretty clear story. I haven’t fact-checked it, but directionally it seems spot on given most of the performance is coming from the top 7 or so companies, let alone the top 20 or 30.

With that in mind, I came across a relatively new ETF, well new to me, called QTOP (launched in Sep 2024), which simply holds the top 30 companies in the NASDAQ. If you’re on the same page as me and think the tech curve is going to keep accelerating, and that the big players will continue to lead that charge, then QTOP could be a nice companion to the broader NASDAQ. Something like a 50/50 split between QTOP and NDQ, for example.

There’s also a top 20 version of the ETF, with the same fee, which is probably even more appealing if you’re keen on an even tighter focus on the mega-cap tech names.

Setting aside capital gains tax and other switching costs (which are real of course), anyone else have thoughts on tilting towards the top 20 or 30?