SUPERINVESTORS

One for the international investors. I found this site, Dataroma, that lists 81 “superinvestors” portfolios, many of which you would recognise. Every quarter, there are regulatory disclosures that make these guys list their portfolios, and this website records them. Two-month delay, I believe.

Interestingly, sometimes regulatory disclosures are useful; certainly, these guys would not disclose if they didn’t have to!

What you do with this info is up to you. I'm looking for ideas from investors who are reasonably LT holders. No traders, no info there. Movements in the portfolio going forward are of most interest; many of the existing holdings, I suspect, are long-term, so less info there. To see someone adding to a stock I'm closely looking at may be enough to put me over the buy edge or add conviction to an existing holding.

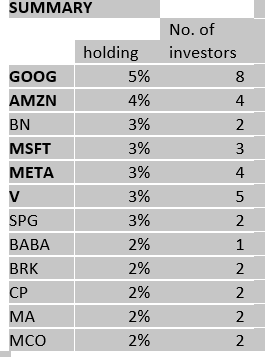

I compiled a list of 12 investors I know a bit about, including Ackman, Loeb, T Smith, Tarasoff, Polen, Nygren, Dorsey, Kantesaria, Hohn, Rochon, Tepper, and B Lawrence. Obviously, look at whoever you want. Below is their combined holdings, comprising those holdings over 5% of each fund. These guys are not index huggers and have a view, so this info is of some use imo.

I will follow this going forward. Hopefully, it steers me away from making more mistakes. we shall see.

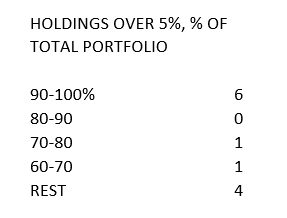

I wanted to look at portfolio composition, ie concentration. Again, holdings over 5% of their portfolios, we see an interesting mix, those that are “bxxxs in”, 6 have over 90% of their portfolio in the over 5% holdings (usually 8-10 stocks), and the rest are spread out. My view is that concentration depends on your own personal style, and this sort of indicates that, though all of these guys are concentrated versus most mutual funds, as you would expect.

Worth a look if you want to see what the superinvestors are holding or changes being made. I didn’t include Buffett or Akre because they are in retirement mode, up to you.

Bold are my current holdings.