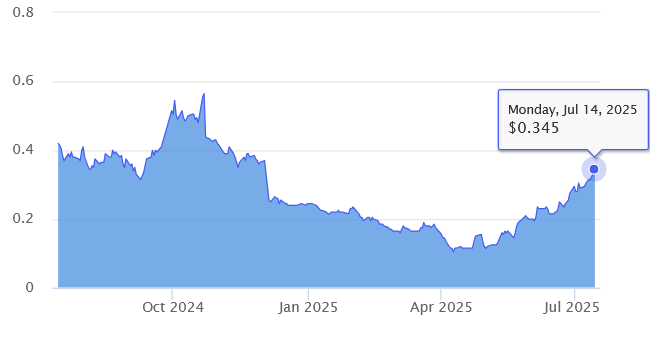

29M has been gaining traction in SP recently, from a low of 10c to 34.5c today. Rise has been steady over the last 3 months. Why?

29M is a copper focused metals mining company in WA (Golden Grove - Copper, Zinc, Gold, Silver) and Qld (Capricorn Copper - Copper and Silver). The company suffered flooding of its Capricorn mine in 2022 during a period of unseasonably heavy rains. Recovering from that they just about got back to dry ground when the story repeated the following year with heavier rains again. They decided to turn their mining processing plant into a dewatering plant, and together with evaporative dispersal and environmentally favourable approved licenses to release treated water into nearby creeks during periods of rain they have once again become quite close to clearing their underground workings. They have improved tailing's facilities and more carefully flood proofed the site. A recent $180 million equity raising gave them enough money in the bank to both complete return of Capricorn back to operation and invest in expanding mining through new discoveries in WA. They are forecast to start operations again at Capricorn towards the end of this year.

The copper price macro environment is favoring a push towards higher prices over time, although Trumps proclamations are causing some short term price volatility. Despite Trumps stated intention to apply 50% tariffs to processed copper going into the US it seems unrealistic to expect the US would actually cut off one third of its imports. It takes some years to expand domestic refining capacity through more processing plants.

29M have a quarterly report on 17th July, Thursday.

Prior to these flooding events they were trading above $2. If as seems probable they are close to recovering production start at Capricorn, and given the expansion in production in WA, it seems they might well have a ways to run in coming months.

Held in SM and RL.