by Adrian Rauso, The West Australian, Fri, 11 July 2025 5:30PM

Chris Ellison’s younger brother Andrew has agreed to bin 13.3 million performance rights attached to the ailing Mineral Resources subsidiary he runs.

Andrew Ellison. Credit: Matt Jelonek

In an unusual move, a bundle of performance rights controlled by Resource Development Group managing director Andrew Ellison were cancelled on Friday “after agreement between the company and the holder”.

MinRes, which owns nearly two-thirds of RDG’s stock, declined to comment about the cancellation.

Mr Ellison received the 13.3m of performance rights at RDG’s 2023 annual general meeting, with the performance hurdles tied to RDG’s 2024 financial year performance.

The exact criteria was not detailed but it was split into “sustainability” (20 per cent weighting), “strategic growth targets” (30 per cent weighting), “financial management” (30 per cent weighting) and “organisational culture” (20 per cent weighting).

But they would only vest into shares if Mr Ellison remains as managing director of RDG until June 30, 2026.

The rights had a nil issue price and could have been converted into shares on a one-for-one basis. At the current RDG share price, which has fallen 80 per cent over the past two years, they were worth a maximum of about $133,000.

RDG’s troubles stem from the misfiring Lucky Bay garnet mine near Kalbarri, which has also placed a big burden on the cash-strapped MinRes.

RDG by the end of 2024 had drawn down $130.7m of a $135m loan provided by MinRes, according to its most recent half-year accounts.

RDG is using the money to fix Lucky Bay and is yet to pay any interest on the entire loan. First payment is theoretically due in September.

Lucky Bay, which is about 20km south of Kalbarri, eked out first garnet in early 2023 but is still yet to reach anywhere near its nameplate capacity of 130,000 tonnes a year.

Garnet is commonly known as a gemstone in jewellery pieces, but the garnet-rich sand scooped up at Lucky Bay is used as an abrasive in waterjet cutting and the blasting process to apply protective coatings.

Mr Ellison saw his pay jump at RDG from $525,296 to $948,107 for FY2024, despite Lucky Bay’s woes.

--- end of WA News article ---

Source: https://thewest.com.au/business/mining/mystery-swirls-as-andrew-ellison-agrees-to-cancel-performance-rights-at-struggling-minres-subsidiary-rdg-c-19323941

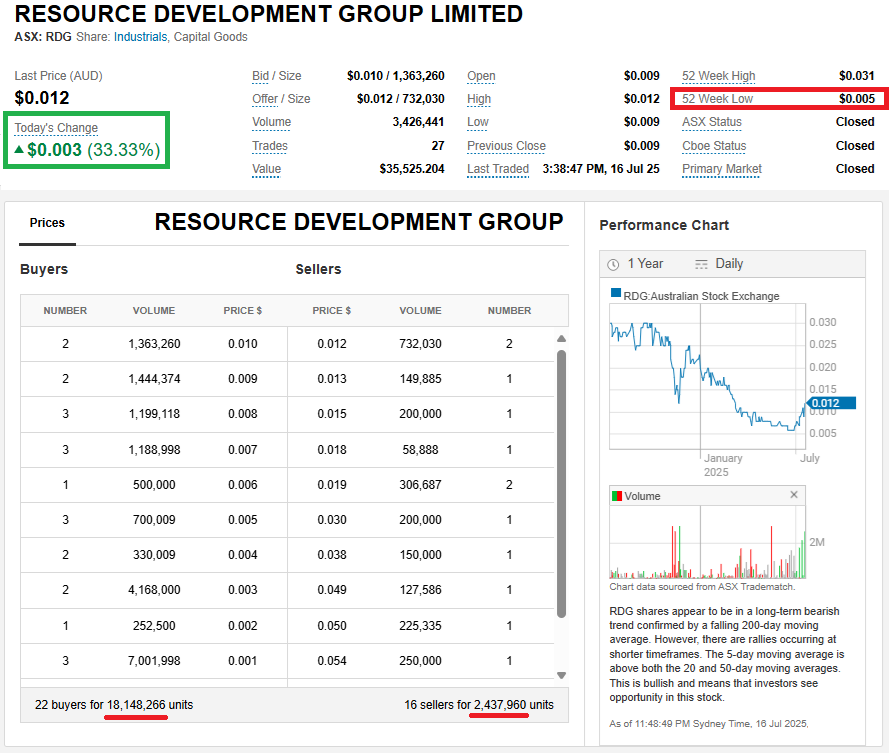

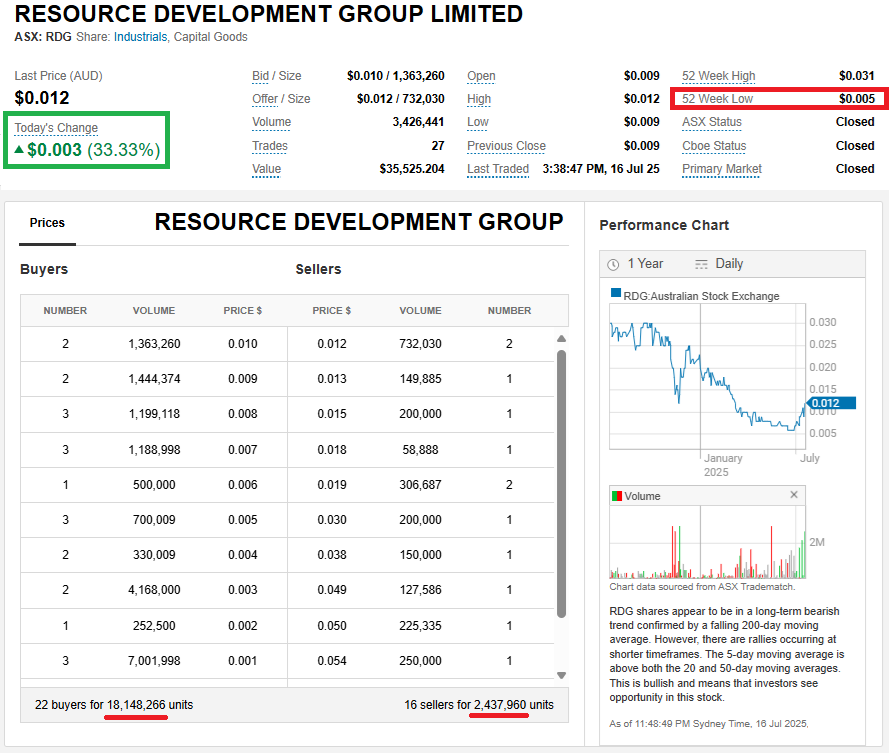

Note: RDG (Resource Development Group) is ASX listed but is considered to be a controlled entitiy of MinRes (MIN) because MinRes own 64.3% of RDG (or 1,897,587,201 of the 2,950,858,124 RDG SOI - shares on issue). RDG's current market cap is less than $27 million according to the ASX so it's now a nanocap company. Like their majority owner, MinRes, RDG haven't had a great year:

Sure their SP rose +33.33% today and since they made a new all-time low of half a cent per share recently - on June 23rd - their share price has risen +140% to close today at 1.2 cents/share, but there are a couple of things to note about that:

- Share prices tend to be fairly volatile when they're sub-10 cents, and especially when they're sub-2 cents/share;

- Even though there are over 18 million shares on the buy side and only 2.44 million on the sell side, the daily volume is still rediculously low, with less than $36 K worth of share traded today to provide that +33.33% rise (from $0.009 to $0.012);

- The company's share price got over 8 cents/share in December 2021, so they're currently down -85% from that level - even AFTER today's +33.33% rise; and

- When the company's MD is Andrew Ellison, Chris Ellison's younger brother, and his remuneration jumped from $525,296 in FY23 to $948,107 for FY2024, despite their main project, the Lucky Bay garnet mine near Kalbarri, losing heaps of money and the company performance being dismal, you have to wonder if management's interests are truly aligned with the interests of ordinary retail shareholders of either RDG or their parent company MinRes, or if, as Andrew's big brother Chris has consistently done, Andrew has instead been primarily looking after his own interests.

It also pays to note that RDG has a three person Board:

- Andrew Ellison, Managing Director;

- Mark Wilson, Non-Executive Chairman and NED; and

- Mike Grey, NED (Non-Executive Director).

...and Mark Wilson is MinRes' CFO, and Mike Grey is MinRes' Chief Executive Mining Services, so they're both in the MinRes' C-suite, with zero fully independent directors at RDG to provide any real oversight or accountability beyond what is acceptable to Chris Ellison and his MinRes C-suite, which, as we have seen at MinRes, is a fair bit, as in: Almost anything goes, or has gone on in recent years. So I wouldn't be piling into RDG, now, or ever.

Disclosure: Not holding RDG or MIN. They both have management you can't trust and/or management who have made a bunch of poor decisions over recent years that have negatively impacted their company and the company's shareholders. That's a bunch of red flags. Won't go near either company now.