tomsmithidg

Thanks everyone, a lot of interesting replies here. Like @Strawman I really think valuation matters, but I've seen plenty of companies that have ridiculous PE ratios that seem to trend higher with no rationale that I can make head nor tails of. I often think of Tesla that way, I think its PE is about 180, market cap equivalent to a bunch of big automotive manufacturers combined, didn't make a profit for years, and the profits it is making now are less than most of its US automotive competitors. On top of that, a lot of that profit doesn't even come from selling cars but onselling government credits etc.

Its share price was over $400US earlier in 2025, so a 400 bagger if you bought a decade earlier, a lot of profit there on the table. I guess that's why I like the clarity of dividend paying shares.

wonkeydonkey

Still after many years of podcasting with @Strawman Scott hasn't turned the corner on Bitcoin despite Andrews best efforts ????...maybe one day

JohnnyM

Haaaa I’m the same… I said to someone today… these crypto currencies are all bullshit.. Trump coin… OK sure.. It’s pretty much GOLD!! ????????

BUT I can feel myself being slowly convinced by this one twat, “Ram Page”… who does podcasts…

He makes some good points about bitcoin Vs crypto Vs fiat currencies…

Not today.. but maybe one day.

Lewis

I alone was to hear their voices, so @JohnnyM said,

but you must bind me with tight chafing ropes

so I cannot move a muscle, bound to the spot,

erect at the mast-block, lashed by ropes to the mast.

And if I plead, commanding you to set me free,

then lash me faster, rope on pressing rope.

Come closer, famous @JohnnyM – SM’s pride and glory –

moor your ship on our coast so you can hear our song!

Never has any sailor passed our shores in his black craft

until he has heard the honeyed voices pouring from our lips,

and once he hears to his heart’s content sails on, a wiser man.

We know all the pains that the small-cap investors once endured

on the spreading plain of the ASX, when the gods willed it so –

all that comes to pass on the fertile earth, we know it all!

(tongue in cheek of course, best of luck to you all)

Strawman

Ha, very good @Lewis

And apologies for the incessant rants @JohnnyM. Just spare a thought for those poor souls that have to live with me ;)

Lewis

I think there is a decent cohort of people who find it fascinating but can't quite get over the hump. It's a great mental model/bias tester for "what is money", "how is value measured and created", "what are my self imposed unbreakable rules of investing". I for one am a very happy spectator, very interested in what all the bitcoin believers and detractors have to say, but also happy keeping my feet dry. Rant on!

BkrDzn

Valuation is important and many ways to measure it. In an equities sense, valuations can often defy reasoning for extended periods. Typically this is when a company outperforms expectations regularly or delivers consistent performance over a long period of time. In an ASX sense, there is a crowding effect in quality.

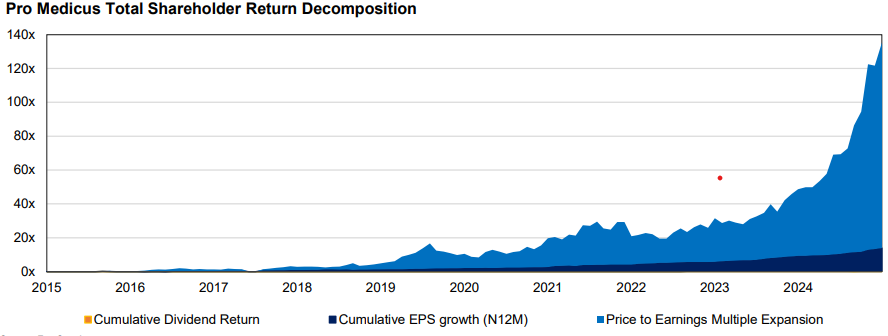

Below is a snip from Auscap fund on PME, which is the current posterchild of the above, and was highlighted to me by @Wini

The takeaway is that valuation can make it hard for many to buy along the way, whilst if you are along for the ride, it is not a good as an exit either. This can happen in any stock despite the quality assessment of the business. DMP look like this for 15yrs until it didn't. There are many other examples that can be brought up over time too. The trigger to exit is not so much valuation being XYZ but if the underlying business shows signs it can not sustain the performance that enabled the extreme valuation to occur.

edgescape

@BkrDzn Now that we've mentioned PME let's see if there's anything on HUB and WES as well.

@BigStrawbs70 You should try Monopoly GO, the online version of Monopoly.

Bear77

@edgescape - speaking of Monopoly, my youngest brother sent me a text earlier today to tell me he'd found a U2-themed board game called "Bonopoly"; like regular Monopoly, but where the streets have no names.

Lewis

Timely,

Someone bought $54,000 worth of bitcoin in 2011 and sold it last week for $8.6 Billion. A tidy 17,000,000% return over 14 years.

Who sits on a multi-billion unrealized capital gain? Talk about letting it run, there has to be a story there.

https://gizmodo.com/mysterious-whale-makes-a-17000000-profit-on-a-14-year-old-bitcoin-bet-2000634002

tomsmithidg

Good morning Strawmen, so I have a genuine question for you here now re the stocks bought here for capital growth (since few of them pay much in the way of dividends), regarding when they exceed your calculated 'fair value'. I saw a post, apologies that I can't remember by who, saying they'd like to see a valuation for Droneshield now it has shot up in value. That got me thinking about Catapault and Droneshield, both of which currently at prices above the Strawman 'consensus fair value'.

So the question - should everyone be selling out of those companies (or at least a decent proportion) now they exceed 'fair value'? If not, why not?

Are holders speculating that based on trends (sales growth runway etc.) that more value will be added to the company and that the 'fair value' will be revised up again in future? That dividends will start getting paid?

I'm very interested in the rationale of the strategy of the various holders.

Solvetheriddle

@tomsmithidg i think i wrote something a bit ago, trying, in part, to address this. In small/micro caps, i think you should be more flexible on valuation because their ability to eat into TAM is greater than WOW for example. i would produce valuation scenarios, which I think are plausible, and stretch scenarios. then place valuations on these. Maybe over a five-year view, enough to incorporate growth but not too far to be unrealistic. Finding smalls that are truly great is very rare. you do not want to sell one too early for sure. Of course, there are no free lunches if you overestimate the future, etc. you make a mistake. I would also adjust my holding around to reflect SP movements and new information, possibly averaging up. I don't think dividends are relevant in this case; earnings are. That's my view.

lyndonator

When I create a valuation I come up with a price that, below which, I am happy to buy the stock. Above this price I stop buying.

Generally, I prefer to sell only when the thesis for the company has broken, however I have begun to trim when the price is far above my valuation and, in the case of Droneshield, I completely sold it the last time it shot the lights out. I never bought back in as it's price never got below my valuation again (well, more honestly, I stopped tracking it closely to figure this out)...

Now, what I think I should do, is have both a buy price AND a pre-determined price that I start trimming for every stock I own. But, I'm not yet that organised. I tend to just revisit the valuation ofter they have pumped and then try to make the most rational call I can.

How do you determine what price is too high? It depends on the stock, and, as Solvetheriddle points out, depends on the TAM of the companies products and the conceivable range of growth I think is possible. For example, I started trimming Palantir last year when it was at $80 (USD) as the forward price to sales was 50 (it's now $150 with a P/S of 85!!). That valuation prices in a LOT of future growth already. I've now trimmed 40% of the position and will probably just hold on unless there is a fundamental change to the business.

Hope that makes sense/helps

Shapeshifter

All good points @Solvetheriddle @lyndonator @Saasquatch

For me I think there are four reasons to sell a stock:

- You need the money

- You were wrong about a business and the thesis is broken

- The business changes and the thesis is broken

- You have a better idea elsewhere

If you believe that the market is a long term weighing machine and you are investing for long term compounding then short term stock over-valuations is just noise that create tax events if you sell!

As Robert Hagstrom said in The Warren Buffett Way, "In a nutshell, the key strategy involves another of those commonsense notions that is often underappreciated: the enormous value of the unrealized gain. When a stock appreciates in price but is not sold, the increase in value is an unrealized gain. No capital gains tax is owed until the stock is sold. If you leave the gain in place, your money compounds more forcefully."

I don't think over-valuation in isolation is a reason to sell a business. I did sell DRO last time it got pumped but that was because I lost faith in management which for me fell into rule 2 - I felt I was wrong about the business and the thesis was broken.

Anyway I'd be interested to hear what others think about my reasons for selling.

jcmleng

The challenge I have is that I struggle with valuing a company, both at the buy and sell ends. Have bought the books, listened to the podcasts, viewed the video’s, but I get stuck in the theory, which then stops me from coming up with a practical (ie, non-precise) way to do a valuation. So almost all my buy and sells are not valuation driven at all.

I am undecided if my inability to come up with any valuation has been a handicap or not, in both the original buy and sell. To buy, I have a raft of things I look out for/must see, qualitative and quantitative, before I buy or top up and this has served me very well. I am also always prepared to average down by a fair margin in case my entry point (and implicit valuation) was wrong. Am not sure if coming up with a valuation is going to give me any more of an edge or if it will actually make things worse. This “no-focus-on-valuation” approach carries through to the rest of the time I hold a company.

I am truly in for the long haul - a good chunk of my portfolio holdings date back 8-10 years, so my approach is very much buy and hold.

Which is why I fully agree with the @Shapeshifter ’s 4 reasons to sell a company. I would perhaps add 2 more reasons to the list, which have held true for me in all my sales in the past few years:

- You need the money

- You were wrong about a business and the thesis is broken

- The business changes and the thesis is broken

- You have a better idea elsewhere

- I need to optimise/trim/re-balance my portfolio if a position has gone too big

- I was forced to sell due to a Corporate Action eg. BLD, PPH, ALU

I feel one of the major plus points of not focusing on valuations in buy or sell decisions is that it almost completely removes the tendency towards price anchoring. It removes the feeling that I have to do something if a certain valuation is reached. This allows me to let the winners run for long periods until one of the 6 sell reasons emerge that forces me to act.

It also ensures that I remain fully and exclusively focussed on the business performance/prospects of the company, the overall state of the portfolio etc, instead of looking out for a price target, and on reaching the target, feel like I have to do something.

lyndonator

@Shapeshifter Great list, and now you mention it, I actually didn't sell Droneshield purely for price/valuation reasons. Vlad (the CEO) always selling all of the shares when exercising his options fed into my decision. If he wasn't prepared to hold, why should I?

JohnnyM

This is a wonderful thought-provoking conversation, thanks! Like many investors, I am better at buying than I am at selling. I also know that we can have different answers and still all be right.. Given emotions, risk tolerances, valuation and trading styles are all individual, we can all have different answers. I'm not here to beat you, I'm here to beat Mr Market.

I struggle to putting an intrinsic value on a fast growing company. I know myself, I'm financially too conservative, and for that reason, CSL has always been too expensive for me and I wouldn't buy DRO today.

I'm also not a particularly attentive investor, I can easily go a week without looking at the market or my Portfolio. I'm never going to pick the top or bottom of the market, I'm not even going to try! I fully expect, without more exciting news, DRO's share price to drift back down to (say) $2 over the next 6 months. But does that mean I should sell DRO if I'm not prepared to buy it today or because I know (in my bones) price is heading downhill for a while? Hell nah.... the opportunity in front of DRO is just too big and I know, if I sell today it could be a long time before it gets low enough for Conservative ole me buy again. Even worse I may never get the opportunity again. As the price drifts lower the next best time to buy DRO is the day before it announces it's won another huge contract or it has completed an acquisition of a competitor or adjacent technology, and I have no idea when any of those things will happen and given my lack of attentiveness, I'll only read about it 5 days and a 50% uptick too late.

So, to the question at hand, as an investor with a long time horizon when will I sell? I'll sell when I get a sense management has lost discipline in capital allocation or the balance sheet becomes untidy (introducing unnecessary risk), I'll sell if I get the sense management is shifting towards being untrustworthy. I'll sell because the industry evolves yet again and DRO is getting left behind, but let's be honest the genie is out of the bottle, the battlefield will never be the same again, on the civilian side there are too many use cases to mention. Yes DRO will need to innovate to stay ahead of competition but the team is on it, to my knowledge no one has a decent answer to fibre optic tethered drones.

Should I sell because Mr Market is offering me 10x what I bought it for less than 2 years ago? Nah, he can get stuffed! The thesis for my initial investment was that this business is fast approaching the inflection point of becoming FCF positive, it'll then go on to compound returns for years to come given the global addressable markets. I'll sell when that doesn't look being the case.

Leaning into doing nothing by not constantly trading means I missed the recent top, I'll miss the next bottom, but I won't miss journey!

In short, I pretty much agree with @Shapeshifter

Cheers

JM

As an aside, I love being able to bring investing to life for my sons, because that's my time horizon, investing for Zack & Xander. Below is a photo of Zacky about 6 months after he became a part owner of DRO.. Wondering how he could connect the team at Osaka Castle with 'our' management team back home, they clearly need our equipment.

Strawman

Great thread, and I agree with pretty much most of what others have said. However..

I do think valuation matters. Quite a bit actually.

Not that i think you can ever really know what a stock is "really" worth (by definition, it's worth whatever others are prepared to pay for it), and even if you could, you cant ever know if others will recognise that and agree with you, or how long that process will take.

BUT i do think you need a general idea of what makes ownership in a company valuable in the first place, and how to relate that to the share price.

For me, the only reason to own a business (outright, or as a part owner) is because it gives you access to the cash flows. A business that doesnt generate any positive cash flows, and for which there is no prospect of ever doin so, is worth precisely zero (technically, less than zero if you resolve to keep the doors open). Similarly, a business (let's call it Company A) that generates twice as much net cash flows -- over its lifetime and adjusted for present value -- compared to another business (Company B) should be worth twice as much. Even if both could objectively be considered good, reliable business operations.

If you agree with the above, then you must necessarily agree that what you pay for ownership matters.

Otherwise you should be happy to pay for B the same as you would pay for A.

Of course, not only is it impossible to truly know the entirety of the net cash a company will generate over its lifetime, but how you personally discount all that cash will depend on your own circumstances and what alternatives you have access to.

So I'm not saying you should have a hyper-specific valuation that should inform all buy and sell decisions -- that kind of false specificity is what undoes a lot of investors (even the supposed pros). But you need to have an idea. Or at least an appreciation for all the different scenarios and what they say about valuation.

Let's say Woolies is trading at $200 per share. It's a great business, and is super defensive and safe. It throws of a lot of very reliable cash flows. And we can reasonably assume it will continue to do so for many, many years to come.

So the fundamentals are all in place and the share price has been on an absolute tear. So, excluding some weighting considerations, there is no reason to sell, right?

Well, given a PE of 130x it has an earnings yield of 0.75% -- far less than what you'd get in an ING savings account. And that assumes no reinvestment requirements, no business risks etc. Does that not mean that there is a better alternative elsewhere? Indeed, the acknowledgement that there IS a better alternative is an implicit acknowledgement that valuation matters.

Perhaps you could chalk this up to a short-term overvaluation, but iin continuing to hold you have to believe the market will never correct this overvaluation or wont do so to any material degree. Or perhaps Woolies just grows far faster than what most in the market expect. Which maybe is the case. But what about at $400/shares? or $1000/share? The point is that, at some point, valuation matters -- even for those that dont have a strict value focus. Because it will matter for others in the market. Because they will realise the opportunity cost.

So by all means, dont sell out just because your stocks are a little overvalued. Especially if they have material growth potential, are well capitalised and are executing well. But dont ignore the fact that every step higher in price requires better expectations for cash flows.

Reality has a way of reasserting itself, eventually.

Look at something like CSL over the past 5 years. It's a fantastic business, super durable and with lots of longevity. It's even compounded per share earnings at something like 7%pa in the last 5 years. But shareholders have gone backwards over the period in real terms. Not because its not a great business, or didnt grow or whetever. But because the price was clearly too high 5 years ago relative to what the business was ultimately able to deliver. Especially in comparison to other investment alternatives.

Anyway, this isnt at odds with what others are saying, just adding some nuance.

I definitely think its better to be roughly right instead of specifically wrong. And (as an example) I still hold a load of Catapult despite thinking its a decently overvalued. But it is getting harder and harder to justify the size of the position -- purely on valuation grounds.

Shapeshifter

There are not many alternative realities where Woolies on a PE of 130x makes any sense. A mature defensive company that grew revenue at 3.7% in the first half of FY25 basically marking inflation while EBIT went backwards by 14%? If someone were to offer me $10 million for my house would I sell - yes! But the chances of that happening are almost zero. Mr Market is mad but surely not that mad.

Why sell Catapult even you think it is decently overvalued? If you still believe in the long term growth prospects then the thesis is still intact. Yes the SP may correct in the short term but in the long term it should go higher than it is today if the business continues to grow. EPS growth not just multiple growth. Is there enough growth runway for Catapult to 100 bag? I've got not idea but if there was I would not be selling at current levels. Surely only sell if the business changes and the thesis is broken because it seems to be doing pretty damn well up until this point. The problem with CSL was it didn't live up to growth expectations. Perhaps there were signals along the way. This is what makes investing difficult in my opinion because what is obvious in retrospect is difficult in real time. This company changed and the growth thesis was broken.

@Saasquatch put it beautifully I thought with his Ian Cassel reference "You can't get a multibagger without holding a multi-bagger. That means holding through 500% ups and then 50% drawdowns."

What you pay for ownership definately matters and what you sell for also matters but does what happens inbetween those two events matter?

Rick

This is a very interesting topic, and a very important one! When does a stock become ‘overvalued’ to the point where you should sell it?

I treat stocks as businesses, and when I buy a business it’s because I believe there is a prospect of a high future return from that business with an acceptable level of risk. Because we don’t have a crystal ball we can never be certain about how a business will be performing in 3, 5 or 10 years time, however I believe forecasting this with with some degree of reliability is what gives investors the edge. I don’t know if I have that edge, but if I can do as well as the ASX 200 over the long term, I’m happy!

When I buy a business I aim for an annual return of 15% (based on valuation) and usually hold it until the expected return drops below 10% (unless it is a very predictable business with high ROE and low debt). If I actually achieved a 15% return across all my portfolio I’d be over the moon! That means I’d be doubling my investments every 4.8 years with returns compounded (the rule of 72). I haven’t achieved that, so I guess I’m still learning!

Anyway, that’s how I look at my investments. What is the ‘value proposition’ of buying a business. What is it likely to return over the next 5–10 years including the franking credits? What is the likelihood of this outcome and what are the risks in holding it? Are there other ideas that could perform better with less risk? What are the tax implications of selling a business that has run a long way and is now overvalued (like CBA)? There’s so much to weigh up here which seems to make selling an ‘overvalued’ business a much harder decision than buying an ‘undervalued’ business.

Strawman

We're pretty much on the same page @Shapeshifter -- im just using a silly example to illustrate a point. (although the real life PE of Woolies is far from rational at 25x, imo)

There is a point where even with the most bullish and realistic of growth assumptions fail to justify a price. Where that line is will be for each of us to decide. But There IS a point, and as munger said; no business, no matter how wonderful, is worth an infinite amount.