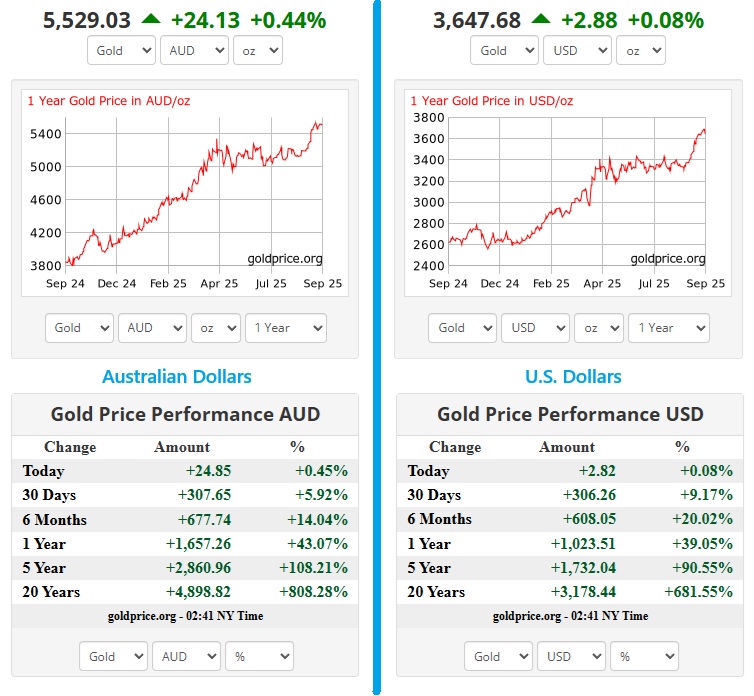

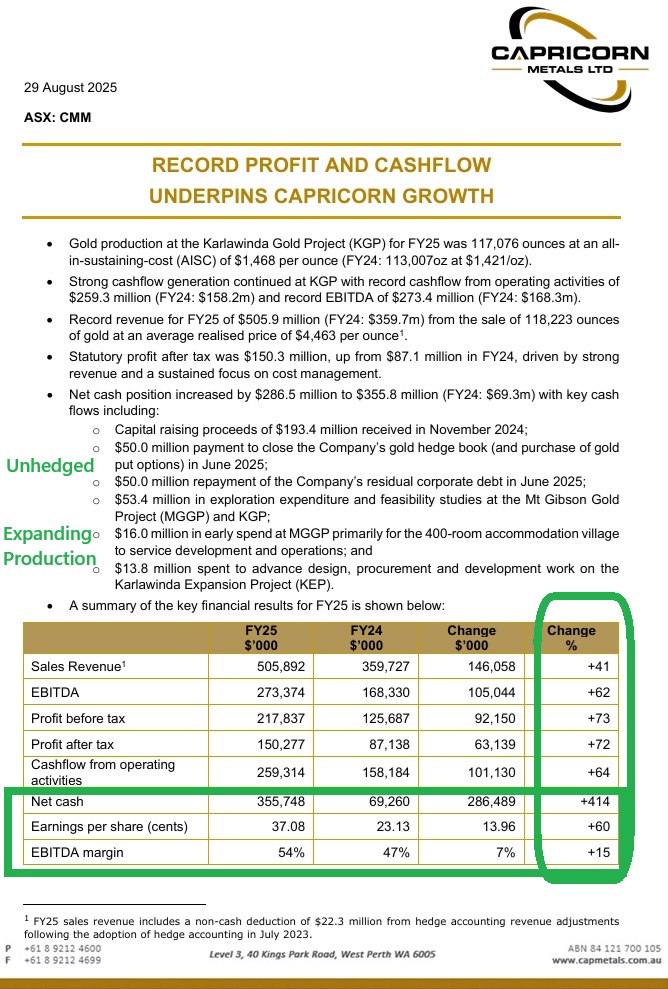

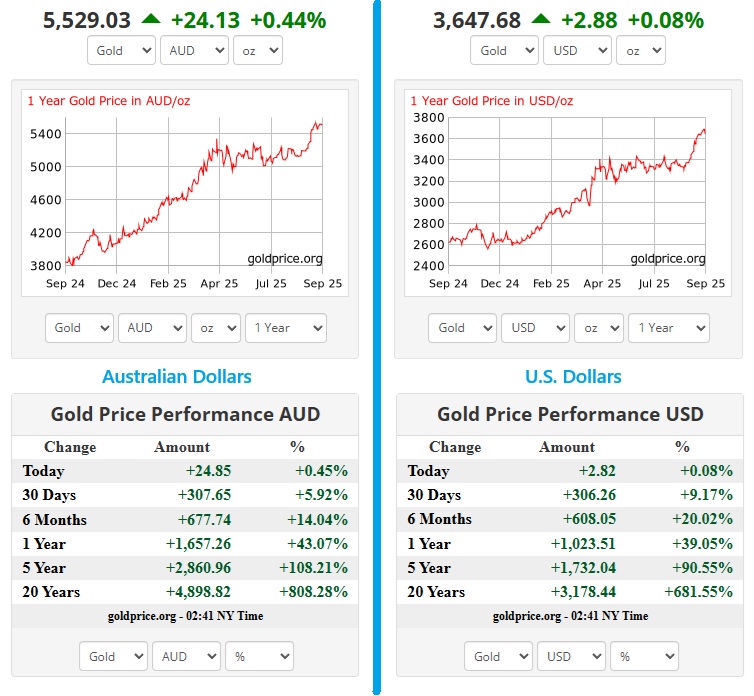

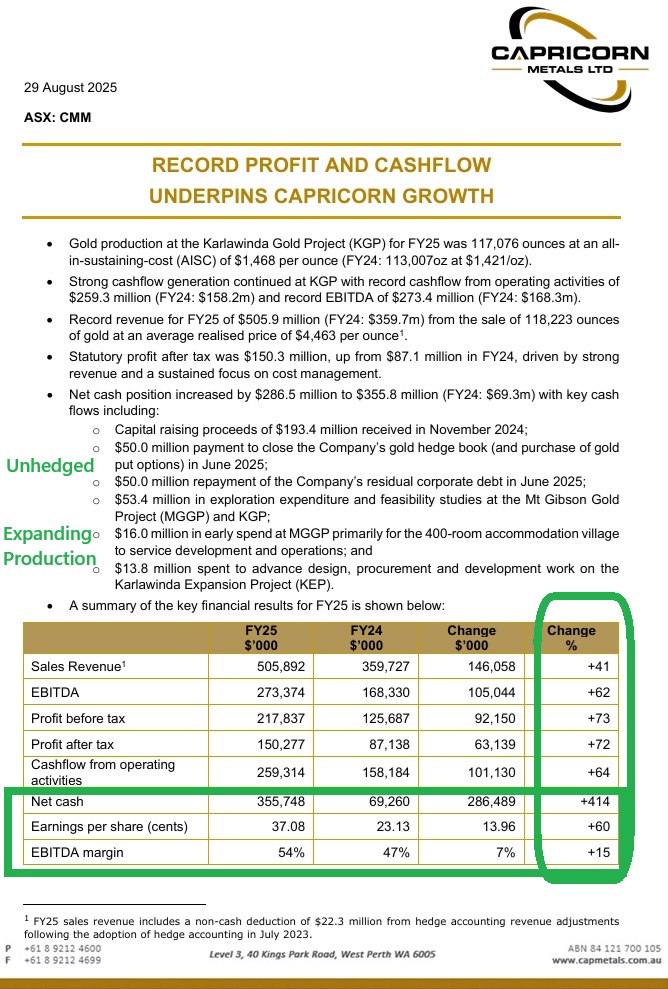

Friday 19th September 2025: I'm going back over a few of the results announcements from last month, and I reckon CapMetals (CMM) was a really good one:

Source: Full Year Statutory Accounts [29th August 2025]

And there's still Mt Gibson to come, with the impending final approvals for Mt Gibson likely to provide another positive catalyst to drive the CMM share price even higher.

CMM's Mt Gibson GP (gold project) is adjacent to the Great Northern Highway and had previously been an operating gold mine under previous ownership, so it's not a greenfields development and approvals are really just a formality, albeit a painstakingly slow formality.

So Mt Gibson will provide further upside, but so will their expansion at Karlawinda up to a whopping 6.5 Mtpa processing capacity:

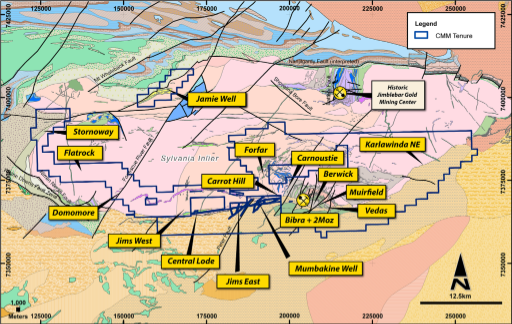

Karlawinda Background

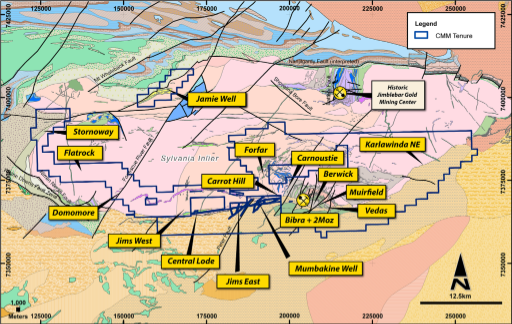

The Project area is underlain by a largely unexplored and only recently recognised belt of Archaean-aged greenstone rocks that were discovered in 2005. This belt of predominantly volcanic and sedimentary rocks is located on the southern margin of the Sylvania Dome, a major structure where Archaean predominantly granitic basement rocks thought to be part of the Pilbara Craton, are exposed at surface within surrounding younger Proterozoic aged sedimentary basins. Typically, at the KGP the bedrock geology is obscured by a thin cover of sandy soil up to 2m thick.

The Karlawinda Project consists of over 2,000 square kilometres of prospective tenure which includes the greenstone belt hosting the 2.2 million ounce Resource and 1.2 million ounce Reserve Bibra gold deposit and other areas deemed highly prospective for gold. Due to the location of the project in the Pilbara region of Western Australia (a region not historically explored for gold), very little modern and meaningful gold exploration has been completed outside of the immediate Bibra deposit.

Karlawinda exploration targets

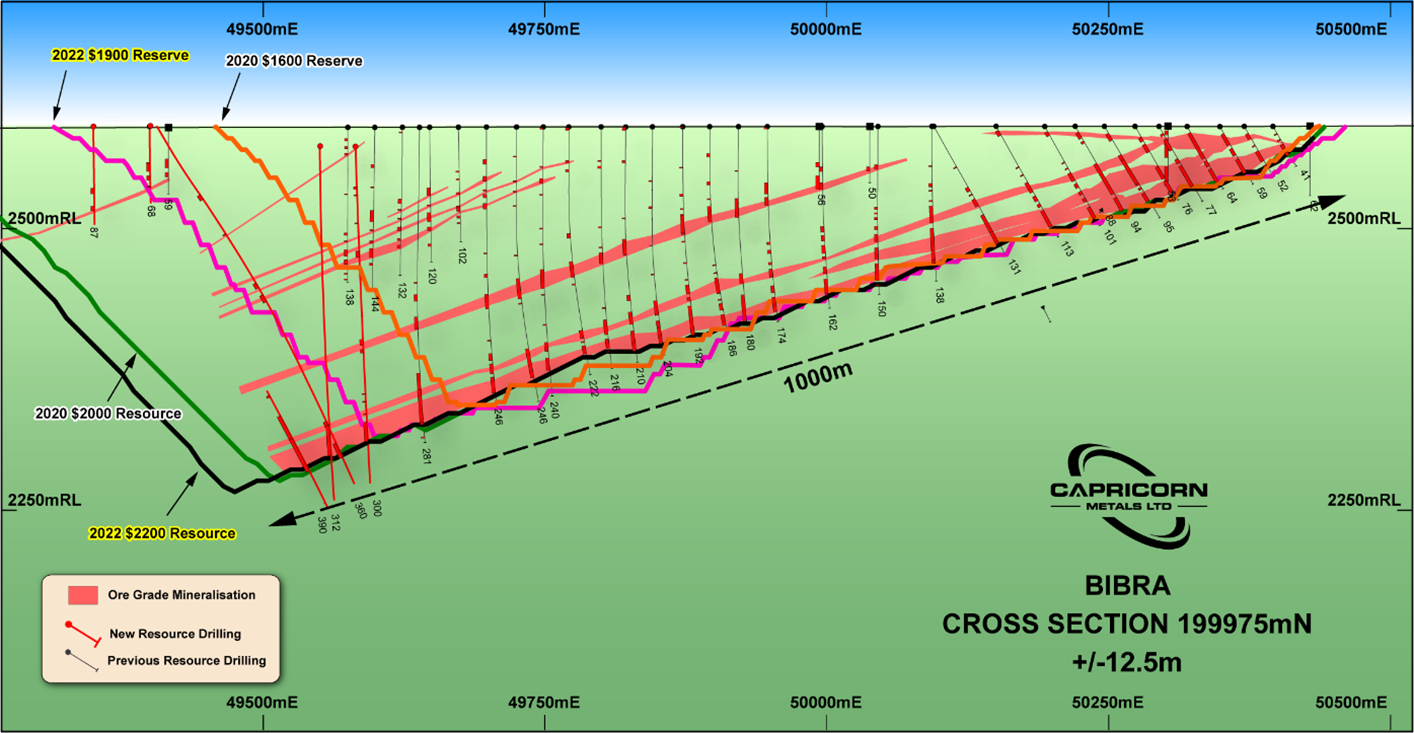

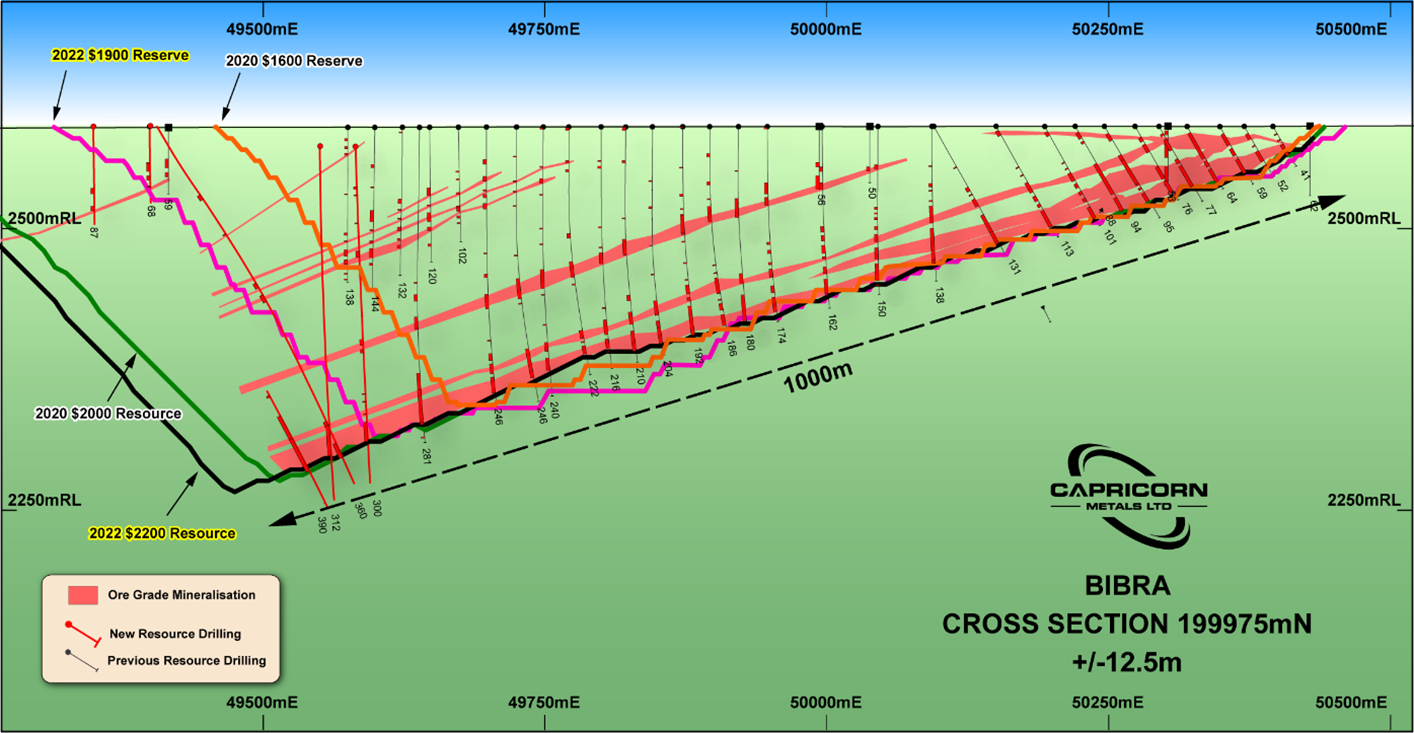

Bibra

The Bibra deposit is part of a large-scale Archaean gold mineralising system with mineralisation hosted within a package of deformed meta-sediments and meta volcanic rocks and is developed on four main parallel, shallow dipping structures. Close to surface in the weathered rock, oxide gold mineralisation has been developed over the structures from surface to a depth of approximately 60m. Mineralisation in fresh rock extends to at least 620m vertical depth where the deepest drillhole intersects the orebody, while the classified MRE extending 360m below surface which demonstrates the possibility for future MRE growth.

Cross section of the Bibra deposit

Karlawinda Mill Construction

Construction of the KGP commenced in December 2019 and was completed in June 2021 with the successful commissioning of the processing plant culminating in first gold poured of 386 ounces on 30 June 2021. The project was completed in line with time and cost guidance. In September 2021 the Company announced the project had reached steady state operations.

The KGP processing plant throughput capacity is anticipated to be:

- 4.5 – 5.0 mtpa in the oxide/fresh ore blend in the first 3 years; and

- 4.0 – 4.5 mtpa in solely fresh rock ore in years 4 and beyond.

These throughput capacities are expected to produce a long-term production range of 110,000 to 125,000 ounces per annum.

Source: https://capmetals.com.au/projects/karlawinda-gold/

So that's from their website today, and needs to be updated because they're now expanding Karalwinda up to a nameplate capacity of 6.5 mtpa, which will be capable of annual gold production of around 150,000 ounces, approx. 25% higher than their current annual gold production capacity.

Lots to like. Great management. They get things done, on time and on or under budget. Growing at a good clip with near-term and mid-term positive catalysts to drive further interest and share price appreciation. Not cheap but deserves to trade with a quality premium in their share price, so I expect they may always look expensive compared to some of their peers as long as management keep on delivering as they have to date.

Discl: Held.