$IART Results

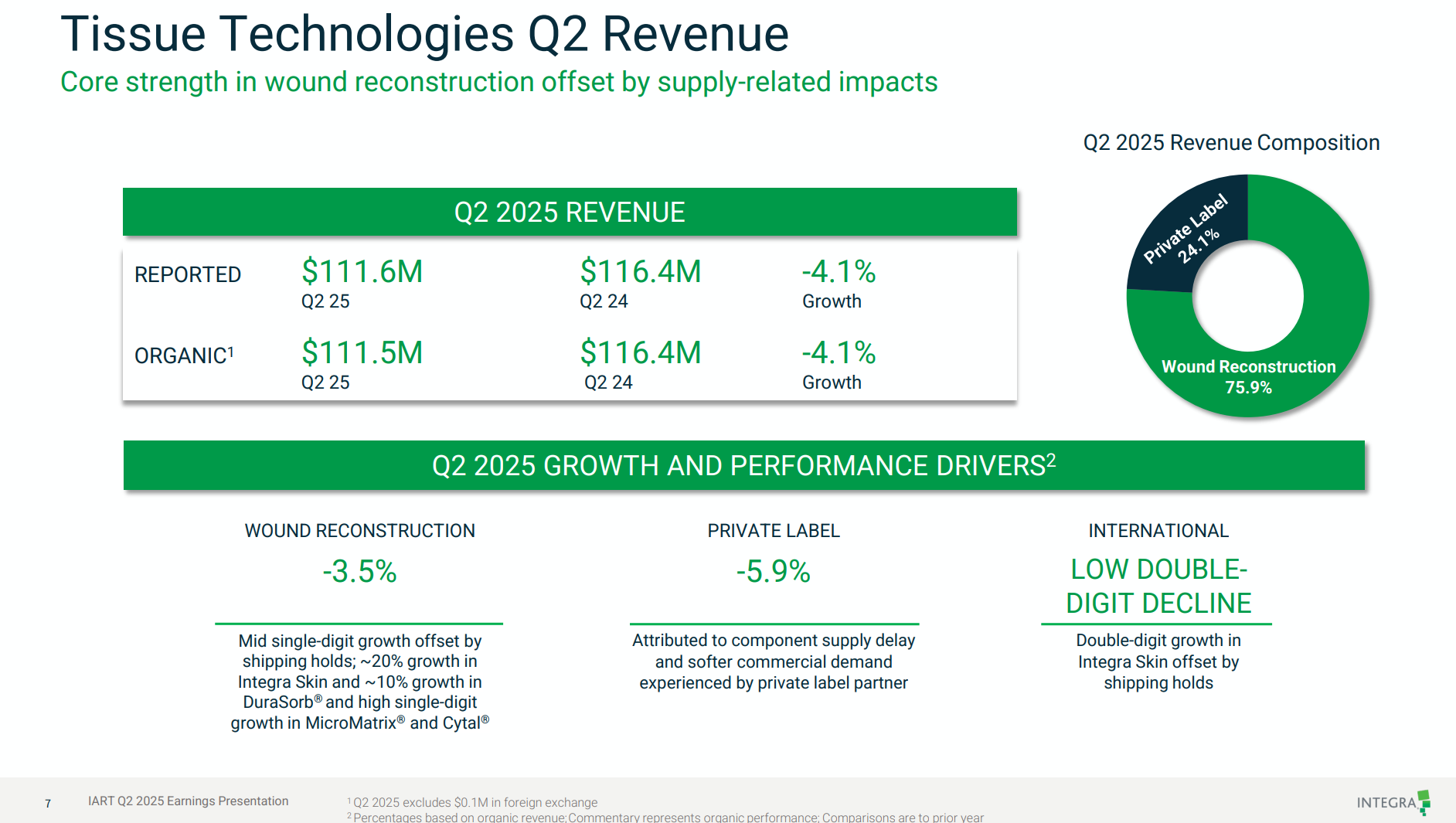

Integra Life Sciences posted its 4Q results last night. I'll ignore the corporate result and zoom in on the Tissue Technologies segment with the key slide below.

I wanted to call out two points:

1. Market Growth

Integra Skin is reportedly growing at c. 20% to pcp, which is significantly below the US revenue growth other both $PNV (29%) and $ARX (26% from cashflow).

But remember this +20% is to the pcp, and in the pcp the segment suffered signficant volume reductions due to impacts of facility closures following quality issue.

This indicates that the sector is overall still growing strongly, but that the underlying growth of $IART is well below the competition.

So this sets the scene nicely for next week, when we'll learn just how $AVH is faring. (The market is pretty pessimistic!)

2. Quality Issues

While Integra has apparently resolved the quality problems that led to recalls, shutdowns, and no doubt created space in FY24 for $PNV to achieve extra strong US growth, thus (in my view) masking its gradual maturing in the US. However, the report refers to "Shipping Holds". That's industry jargon for when you've made product, but can't ship it - in this case most likely for quality or regulatory reasons.

I think heard David Williams say on the $PNV call that $IART had withdrawn altogether from some of the international markets, no doubt as fallout from these issues.

On this latter point, here's my BA's analysis of last night earning call, including the Q&A.

TLDR: $IART is recovering from the product recall and facility shutdowns of FY23/24, but the reverberrations are clearing continuing into the next year.

And as an aside, this should be a reminder to anyone investing in healthcare (wehather pharma or medical devices) that quality is never something to take for granted, and a slip up can have very sigificant implications for a business!

Summary of Integra Earnings Call - Quality Issues in Tissue Technologies by ChatGPT (BA to mikebrisy)

Integra LifeSciences' Q2 2025 earnings call provided extensive detail on the quality problems, regulatory issues, and shipping holds affecting its Tissue Technology segment. Here are the key points:

1. Quality & Regulatory Compliance Issues

Compliance Master Plan (CMP)

- CMP Execution: Integra completed internal manufacturing site assessments ahead of schedule (originally targeted for Q3).

- No New Shipholds: Since Q1 2025, no new CMP-related shipholds have been identified.

- Remediation: Based on assessments, Integra began executing a risk-based remediation roadmap aligned with FDA Quality System Regulations and past observations.

- Program Oversight: A newly formed Transformation and Program Management Office oversees timelines, resource allocation, and deliverables.

- Duration: Some remediation will extend into 2026, with continuous improvement becoming standard operating procedure.

- FDA Status: Recent inspections at two non-warning letter facilities yielded positive outcomes.

2. Shipping Holds & Their Impact

Financial Impact

- 2025 Total Shiphold Impact: Estimated at $100 million, up from $70M previously—no new holds, but remediation delays extended the financial impact.

- Tissue Technology Segment Q2 Revenue: $111.6M, down ~4% YoY due to:

- Shiphold impact, especially MediHoney.

- Private label sales declined 5.9% due to component delays and lower partner demand.

- Integra Skin and DuraSorb showed strong double-digit growth, offsetting but not fully overcoming headwinds.

Operational Impact

- Shipholds particularly affected advanced wound reconstruction (e.g. PriMatrix, SurgiMend).

- The Braintree facility, key to restarting PriMatrix and SurgiMend, remains on track for H1 2026 relaunch.

- Shiphold recovery (resumption of shipping after remediation) is expected to partially drive Q4 revenue recovery.

- No material new shipholds are expected in H2 2025.

3. Gross Margin and Cost Impacts

- Q2 Gross Margin: 60.7%, down 450bps YoY.

- ~400bps of the decline from manufacturing inefficiencies tied to shipholds and remediation.

- Additional pressure from scrap, E&O costs, and tariffs.

- Full-year gross margin expected to be down ~300bps YoY.

- Remediation and supply recovery costs will continue through 2025, and some into 2026.

4. Customer Retention & Recovery Outlook

- Near-Term: For products under temporary shiphold, most business is regained once supply resumes.

- Long-Term: For off-market products like SurgiMend and PriMatrix, there will be a longer rebuild period, but Integra is confident in reclaiming share in the ~$800M soft tissue market.

- Integra emphasized its strong clinical evidence base and favorable reimbursement environment as tailwinds.

5. Investor Guidance and Confidence

- Management believes visibility into supply constraints is now high.

- Shiphold updates will no longer be reported separately after Q2 due to this improved visibility.

- No incremental new regulatory or shiphold risks were flagged for the remainder of 2025.

I'm creating a new forum on Dermal Repair, so tha we can post here some of the insights we find across the sector that are relevant to 3 ASX-listed stocks $AVH(held), $ARX, and $PNV. [The latter two both previously held.]

I generally find medtech and pharma fascinating, both because of the science and the advances in many areas, but also from an investing perspective because the industry offers so many different ways in which you can choose to invest (or speculate!).

Dermal repair is seeing an ongoing revolution over the last 20 years, which has really accelerated in the last decade, and is ongoing. Historical standards of care like skin grafts, dressings and ointments are giving way to new technology where tissue substitutes/implants (both organic and synthetic) are driving remarkable improvements in patient outcomes and health economics. It is another area where Australia punches above its weight globally.

So, I'll use this forum to dump insights which apply equally across $AVH, $ARX and $PNV.

And my first one is ...