i realise this is not an Aussie spec, but the progress of AI o/s continues to interest me, hopefully of some interest to the group, my Meta musings.

META 2Q 25 RESULTS

If I had to identify the biggest mistakes in my investing career, one would surely be underestimating operational momentum. The thinking here is that the exhaustion of operational improvements is uncertain, and maybe they end soon, maybe just after you have put a position in. The reality is that in most cases, operational improvements last well beyond an arbitrary reporting period and beyond my concerns. If the starting point for investment is a reasonable (although not cheap) valuation, investing and seeing how far operational improvement stakes us can be a very profitable exercise. That is the overarching approach with my Meta investment.

The benefits of AI spent by Meta in the digital advertising world have been prolific. Meta stands as perhaps the largest beneficiary of the large caps in AI operational usage. Digital advertising perhaps opens itself as one of the most pliant businesses to engage AI. That is probably true, but it may also be an indication of what is possible for many industries over time. Certainly, the results encourage companies to invest in AI. That helps to explain the huge capex that Meta and the others are undertaking. Secondly, it helps explain Meta’s enthusiasm to aggressively expand its so-called Superintelligence efforts to develop a personalised AI assistant and capture that market, maybe ahead of GOOG and OpenAI. That depends on LLM progress. Meta doesn’t have to be the best; their access to over 3 billion active users will help here, but they have to be competitive.

Meta has lagged the others recently, but has identified and seen the potential of AI and is aggressively attempting to catch up and hopefully pass their rivals here. Therefore, the aggressive acquisition of personnel, Meta thinks that a small, highly focused and talented team will outperform a larger, unfocused team.

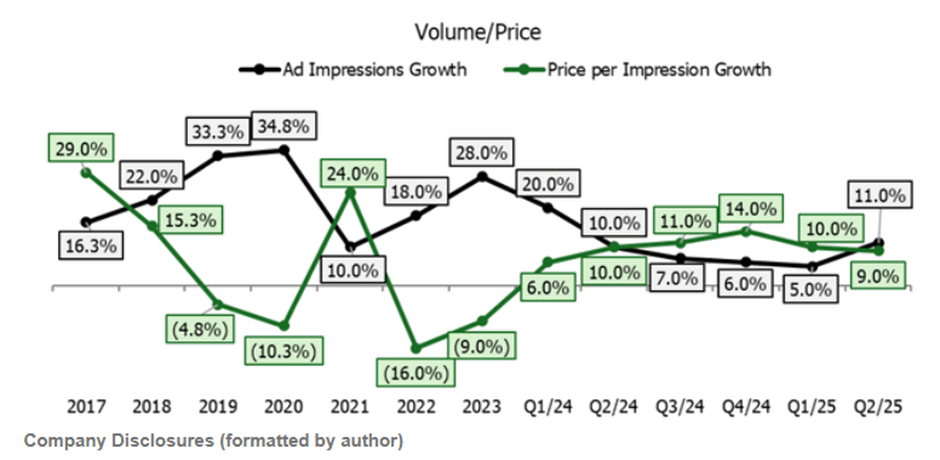

Last quarter numbers of interest are User growth 6%, Pricing +9% and ad impressions +11%, Revenues +22% and costs +12%. Operating margin is 43% with Reality Labs losses, 53% without these losses. Much better run rate than my numbers for the FY25, revenues by about 3% better, and NPAT may be +10% higher. The benefits of the AI spend on ad targeting and ad marketing support are reaping large benefits.

Note the strong ad impression growth along with strong price growth (graph below), which was explained in detail by Meta and is counterintuitive, as more supply (impressions) usually leads to lower prices or lower price growth. Both were strong. The explanation was that AI is improving the content available, adding to dwell time for FB and IG, while concurrently, AI is improving ad selection, making them more relevant, and that is leading to more views and more conversions to sales for advertisers. Execution rarely gets any better than that.

The next question is, can the ongoing capex continue to generate these types of returns? Capex was upped, like GOOG. Meta plans to attack the universal agent market and simultaneously develop the AI glasses as a potential new platform. These are two huge areas, but the outcome of both is uncertain.

Capex is both long-term, glasses and a personal assistant, and short-term, including AI-targeted ads and AI marketing assistance tools for advertisers. The last one is paying off well, and the LT is in development and uncertain.

Longer term investing in Meta is most likely to be tied to the success of glasses and the universal assistant, shorter term the ability to keep the revenue growing above expenses as AI is embedded further into the business, which is likely to have a shorter duration. That dictates the investing strategy.

The bulk of improvements (unit growth, dwell time, conversions) are in the big platforms, FB and IG, but Threads and WhatsApp are potentially in the firing line at some point for the same treatment. Note: The Threads data was not disclosed, showing probably some slowing for the Twitter competitor.

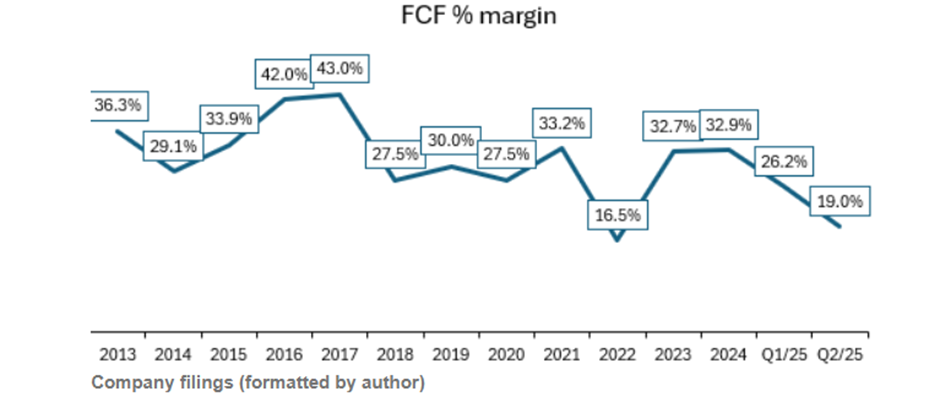

Risks to me are that Meta is fighting a war on each front, usually not a good thing and highlights management's aggressiveness and its financial muscle. The first war is AI and the push for a universal assistant; the second war is Reality Labs and a platform to potentially replace the Apple iPhone with AI glasses. Both huge risk/reward endeavours. If Meta proves successful in either, it is a big payoff. Reality Labs continues at about $18b losses pa. Meta has the resources to continue this fight, and results like we have just had add more ammunition. See FCF margin below. While the markets remain supportive of this strategy, anyway.

The next risk is regulatory, which is a theme amongst the large US behemoths. The EU has suggested limited personalisation of ads, which would directly impact profitability. Long way to play out here.

Valuation I see value at $650, which includes 5Y 14% eps cagr and 22X exit PE. Not stretched assumptions IMO if no neg macro issues eventuate. Success or failure on its large ventures will move this valuation around

Discl--medium holding

note below comes from Seeking alpha