Good topic @navrock1 - I thought I recognised the name BCI from years back when they owned iron ore assets and I was interested in them because I was following where WA's billionaires were investing their own private cash - people like Twiggy Forrest, Gina Rhinehart and Kerry Stokes (now more his son Ryan Stokes) - and Kerry Stokes' private investment vehicle Wroxby Pty Ltd were the main shareholders in BC Iron @ that time. I had a good trade in Capillano Honey around the same time when I followed Wroxby into that company and they (Capilano, was CZZ) got taken over at a good premium. I was also invested in Beach Petroleum (now Beach Energy, BPT) and Drillsearch Energy after seeing Kerry Stokes invest heavily into those companies, mostly through SGH, which was at that time known as Seven Group Holdings. I believe Kerry was the main driving force behind those two companies merging back in March 2016 - which was effected through Beach acquiring Drillsearch; Kerry & Ryan Stokes own 50.93% of SGH today and SGH owns 30% of BPT.

BCI Minerals (formerly BC Iron) was heavily involved in iron ore for a while, developing the Nullagine project and acquiring the Iron Valley and Buckland assets via its merger with Iron Ore Holdings (IOH) in 2014. I had followed Wroxby into IOH initially and got out when BC Iron acquired IOH. BC Iron's initial focus was iron ore, but it has since transitioned to focus on its Mardie Salt and Potash Project after divesting its iron ore assets to Polaris Metals, a division of Mineral Resources Limited (MinRes, ASX:MIN) - MinRes had previously operated the Iron Valley mine (under BC Iron & previously IOH ownership) under a royalty-based agreement. MinRes completed the acquisition of the Iron Valley iron ore assets from BCI Minerals in July 2024, while it had previously acquired the Buckland iron ore project from BCI Minerals back in March 2020, and went from operators of those assets to owner-operators.

Interestingly, despite BCI Minerals now changing their focus to Salt and Potash, the Stokes boys' Wroxby Pty Ltd still owns 36.12% of BCI today. AustralianSuper, which is Australia's largest super fund and one of the 20 largest super funds in the world, owns another 32.07% of BCI and Ryder Capital owns 10.41%, so between those three Subs (substantial shareholders), that's 78.6% of BCI's SOI (shares on issue) accounted for, leaving a free float of just 21.4%, which is bugger all really, except that BCI isn't a microcap - their market cap is around $1 Billion (currently $996 Million today acording to the ASX website) and BCI do trade on each and every trading day - not huge volumes but there's enough liquidity there to get in and out as required, for people at our level anyway.

Ryder Capital, who own 10.41% of BCI are a Sydney based equities fund manager pursuing a high conviction value focused investment strategy, founded in 2008 and wholly owned by its Principals. Google tells me that the principal individuals at Ryder Capital include Executive Chairman & Chief Investment Officer Peter Constable, Executive Director and Portfolio Manager Lauren De Zilva, and David Bottomley, who is also an Executive Director and the Company Secretary - see here [scroll down after clicking] for more.

BCI's MD, David Boshoff has over 20 years of leadership experience in the mining industry, mostly in coal, with a track record in delivering large capital projects. Before joining BCI Minerals, Mr. Boshoff served as Chief Operating Officer and then Chief Executive Officer at Bravus Mining and Resources. He led the startup of the Carmichael coal mine taking it through to full production, and managed multiple large capital projects. Earlier in his career, he was General Manager at BHP's Mr Arthur Coal and Daunia mines. BHP's Mt Arthur mine primarily extracts thermal coal for power generation, while the Daunia mine produces semi-hard coking coal and pulverised coal injection (PCI) coal. The Mt Arthur mine is an open-cut operation in New South Wales (still owned by BHP), whereas Daunia is an open-cut mine in Queensland's Bowen Basin which started operations in 2013 and was part of the BHP Mitsubishi Alliance (BMA) joint venture (JV) until it was sold to Whitehaven Coal in 2023.

So he has plenty of mining experience, with the vast majority of that being in coal, and hopefully that coal experience translates into salt and potash, BCI's current focus.

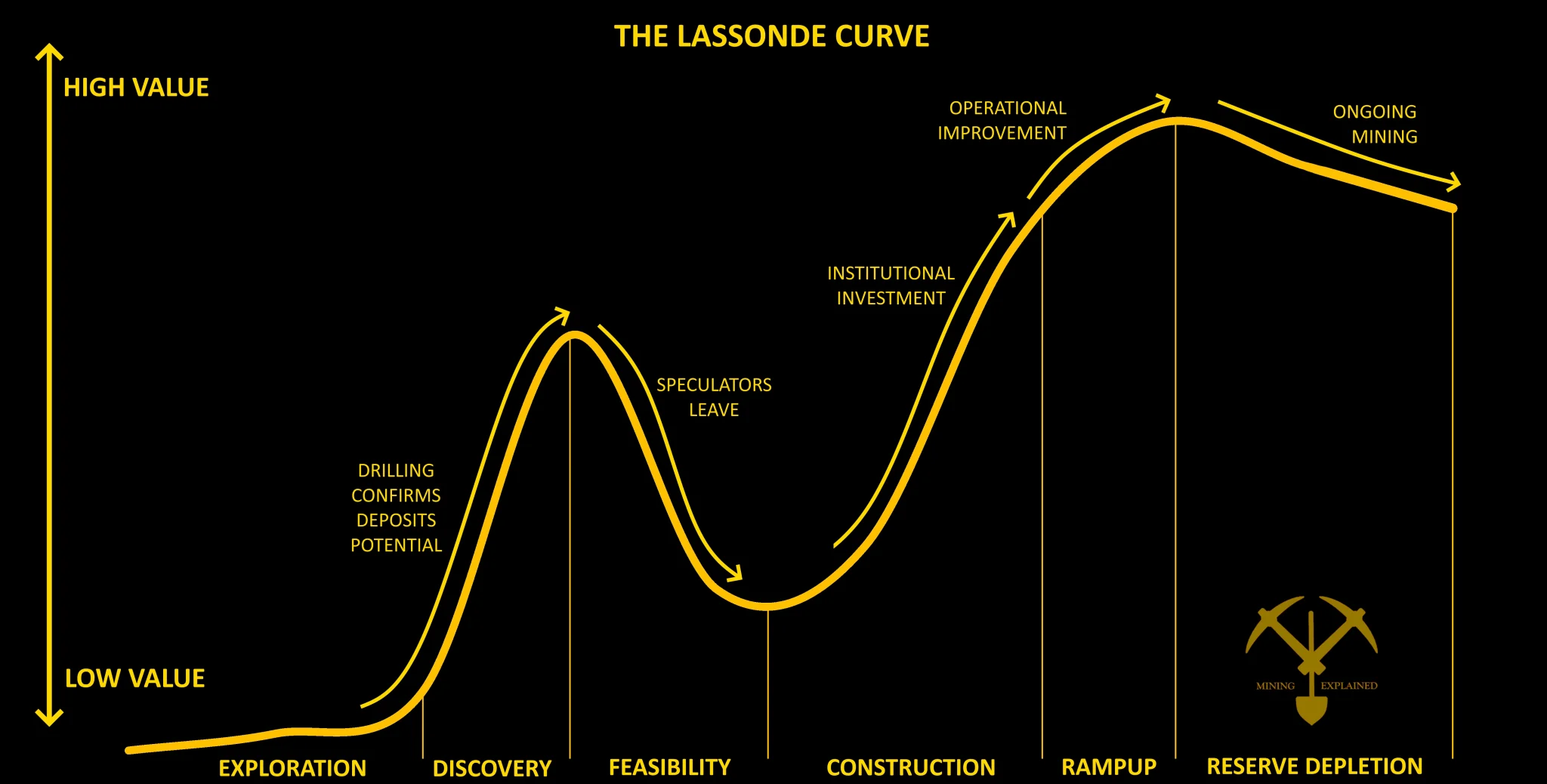

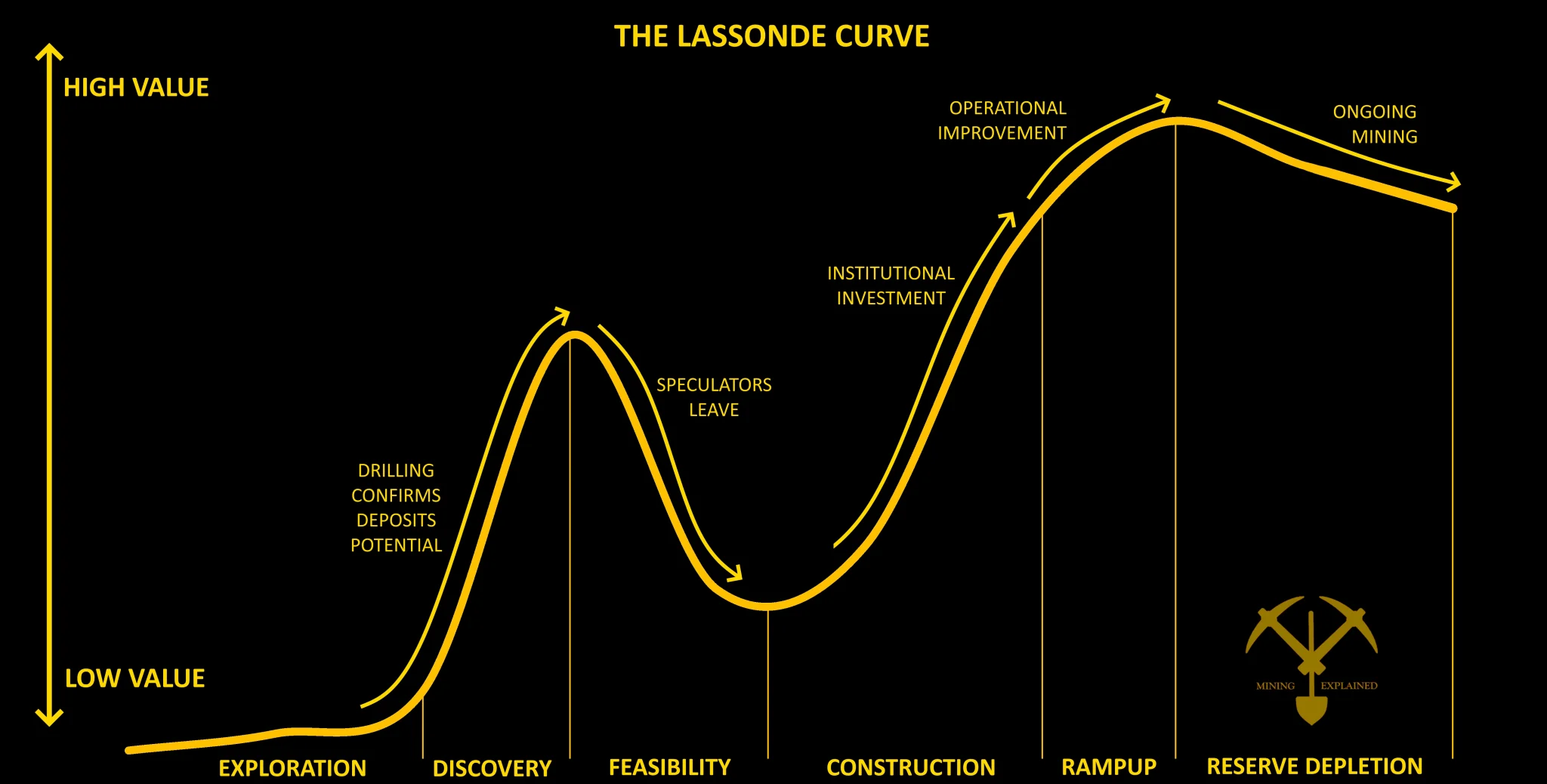

I know bugger all about VRX Silica but what @Chagsy has said makes a lot of sense to me - you certainly have to look out a few years with early stage project developers and be willing to accept multiple capital raisings where you are often going to get diluted with extra share being issued, and often only to a select group (placements). My experience in early stage gold project developers informs me that their share prices only seem to increase if the quality of their project increases, such as if they find substantially more gold, and/or higher grades of gold nearer to surface, that sort of thing, otherwise the share price tends to go lower more than higher as the project progresses and extra CRs are needed to pay the bills and develop the project. Understanding the Lassonde curve is useful here.

Gold is nothing like Silica, however minerals and metals project developers all tend to follow the Lassonde Curve through to production. Once they reach production, the demand of what they are producing is probably going to be the largest determining factor in where their share price goes from there - that and their costs and how efficiently they are producing, whether they are running at nameplate capacity, opportunities for expansion of the plant into a rising demand environment, that sort of thing, but more often than not there is a share price drop off without a further positive catalyst, as shown on the right side of that diagram above.

And China has a way of securing supply for whatever they need, and at the lowest prices most of the time. Take what they did with nickel in Indonesia as a really good example of that - they sunk a shipload of capital into Indonesian nickel and they've completely structurally changed the nickel market in the process, and secured their own supply for the foreseeable future. Now, if you're not operating in Indonesia with Chinese backing, nickel production is usually a loss-making enterprise.

So if China are the main users of high purity silica, their ability to secure their own supply at lower ongoing prices - often after a large initial investment in infrastructure and/or technology - should NOT be underestimated.

I would also note that VRX do not have any high profile backers in terms of Substantial shareholders like BCI Minerals do. VRX only have one Sub, Sparta AG with 14.16% of VRX, and VRX is tiny, with only a $65 million market cap, so VERY early stage, and they have bugger all cash:

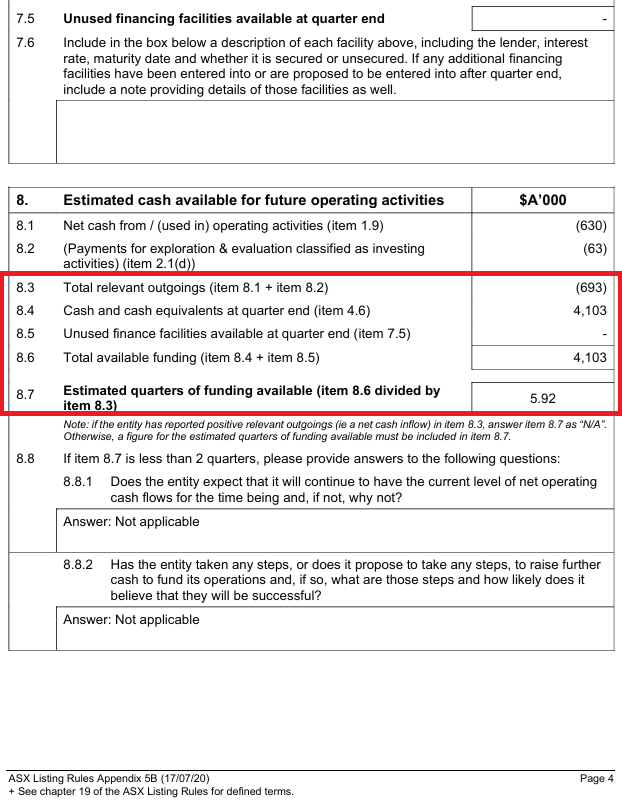

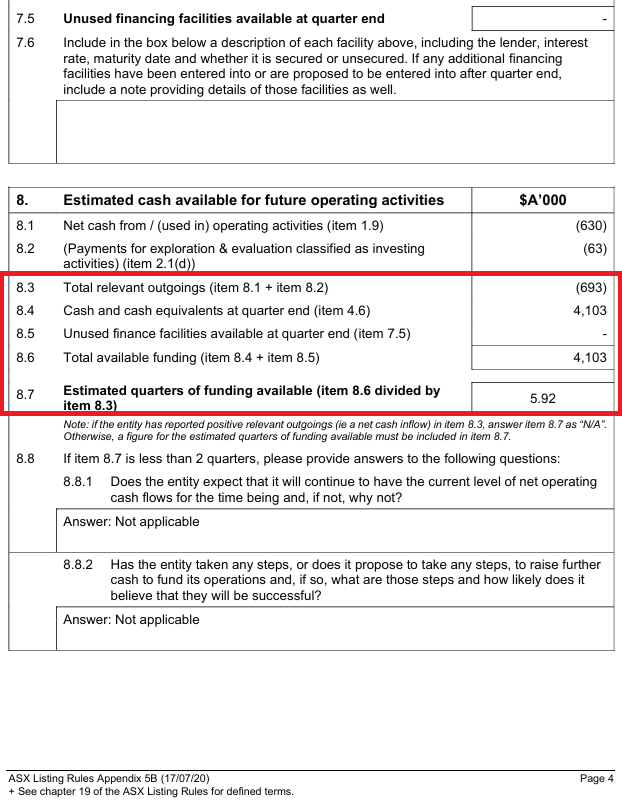

Source: Page 4 of VRX's Quarterly Cash Flow Report (Appendix 5B) for the June 2025 quarter, released on 28th July 2025.

At June 30th they had just $4 million, with zero unused finance facilities, and they had a quarterly cashburn rate of $693 K, meaning that at that cashburn rate they will run out of money within 18 months (6 quarters) - so they are definitely cum-capital-raise.

Two problems there. One is that without any high profile backers - other than Sparta AG - who are willing to hold 5% or more of their shares (Subs), they are likely to have to do cap raises at discounted prices, so not real good for existing shareholders, and the second point is that spending less than $700,000 in three months isn't sustainable if you're serious about developing this silica project. They are going to need to spend a lot MORE cash than that to progress this thing.

So who are Sparta AG?

They are based in Heidelberg, Germany, and in June 2025 Sparta AG fully merged with Beta Systems Software AG, adopting Beta Systems’ name and business going forward. Since October 2024, the SPARTA Invest AG subsidiary has continued the original SPARTA AG value‑investment activities focused on small and mid‑cap companies with Deutsche Balaton AG as its majority shareholder (~92 %).

Who are Deutsche Balaton AG (DBAG)?

The TL;DR summary is:

Summary

- Where do they invest? Small- and mid-cap companies with a focus on undervalued equities, special situations, and distressed assets across technology, industrials, healthcare, and energy sectors.

- Investment Strategy? Active value investing, restructuring, and long-term growth through M&A, corporate turnarounds, and restructuring.

- Geographic Focus? Primarily in Germany, Austria, and Switzerland, but also open to international opportunities if the value proposition is right.

I have come across the name before within the Australian Resources sector, and it doesn't always end well. I'll leave it there, but I recommend: DYOR on that mob.

I'd be particularly worried if DBAG or SPARTA (a.k.a. Beta Systems now apparently) provided finance or a loan to VRX that may result in a change of control (to DBAG or SPARTA) in the event of a default (the loan not being repaid within the required timeframe). That is not currently the case, but at this point SPARTA's investment in VRX is only worth $9 million which is pocket change for them, but with 14%, they have a blocking stake, so nobody else can takeover (acquire) VRX without SPARTA agreeing to it. A third party could build a controlling stake but they'd need 90% of the company to move to compulsory acquisition of the remaining 10% and nobody can get to 90% with SPARTA holding 14%.

I have heard, and this should be taken as alleged behavior rather than fact, that DBAG/SPARTA have form for taking blocking stakes in companies with decent assets but that have other issues such as funding problems, and they often end up controlling those projects themselves at the expense of ordinary retail investors. Whether that is accurate or not, it may or may not apply in this case, and that would all be in the future anyway, if it was to happen at all.

Even without any conspiracy theories, it would make sense for this German mob with billions of dollars of investable capital to take small but meaningful stakes in a number of companies around the world who own assets that may well be considered critical minerals or minerals / materials that may well be in demand in future years. They don't need to make money on every bet they make - they just need to have more wins than losses, or have larger wins than their losses in dollar(/Euro) terms. So I'm not sure we can read too much into their 14% holding in VRX other than that they're the only Subs on the register.

So it's a hard pass for me on VRX, and I'll put BCI on a watchlist, because I've certainly heard that potash demand is going to increase in future years, and I'm intrigued by the 78.6% of BCI that is owned by Stokes' Wroxby, AustraliaSuper and Ryder Capital. That sort of smart money backing is worth taking notice of, IMO.