I’ve held shares in Soul Patts for a long time and have always seen it as a stabilising force in my portfolio. It’s not a stock that’ll multi-bag, but it keeps doing its thing in a reliable, market-beating way. Those large, and every increasing, full-franked dividends that Uncle Rob sends through twice a year are very nice as well.

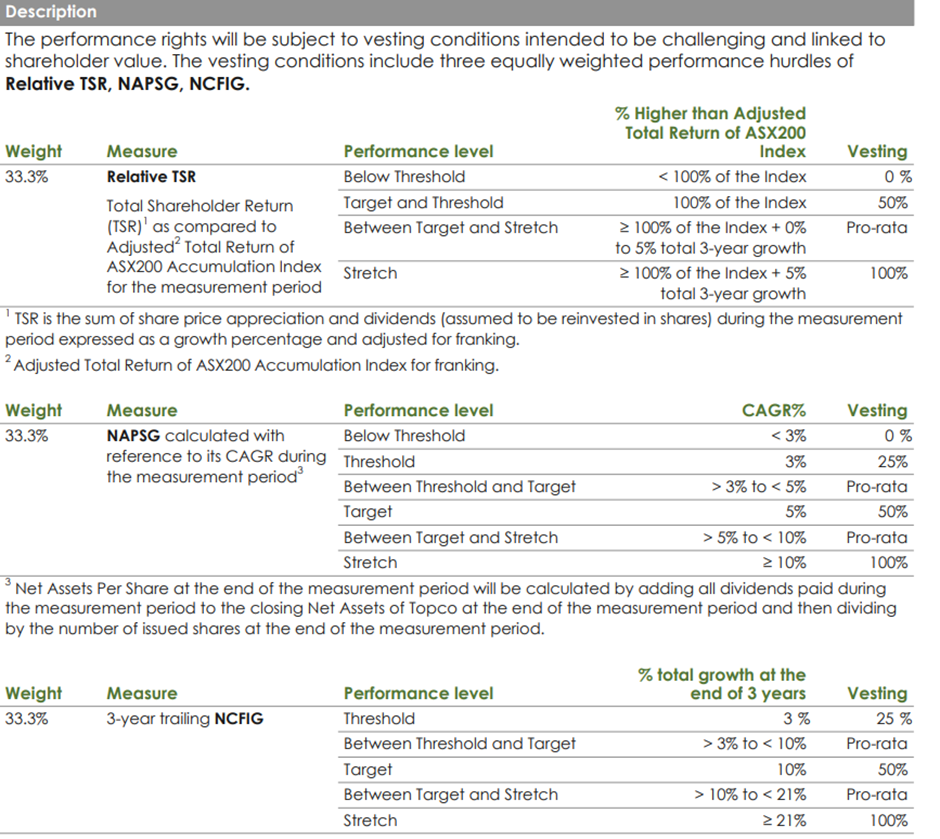

Anyhow, one of the reasons I have this bro-crush is they always seem to get things right, and here’s another example. I understand that as part of the merger with Brickworks, they need to reconfirm the CEO’s incentive scheme, summary copy below. It’s fantastic to see incentives tied not just to immediate results, but trailing performance.

While you could argue the trailing incentive should cover five years instead of three, and other valid tweaks could be suggested, it’s hard to argue against the direction and intent to reward longer-term performance of the company. This approach isn’t as typical as it should be, yet it’s no surprise coming from these folks.

So, what’s my so what? Honestly, I’m not sure I have one, other than to say I wish more of my other companies took a longer-term view when setting CEO incentives, rather than focusing only on the short term.

DISC: Soul Patts is a very large % of my IRL and SM portfolio