PINNACLE FY25 RESULT—TOP 10 holding

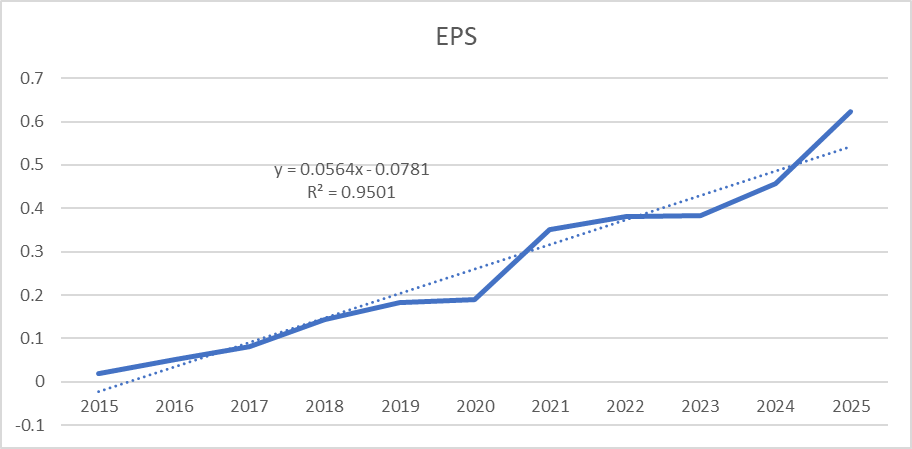

FY25 NPAT was 30% above my numbers, but since I normalise PF and PF had a big year adjusting for that the result was 10% above, still strong. EPS +37% yoy. Note opening FUM is 24% above the average from FY25, positioning PNI for good growth into FY26.

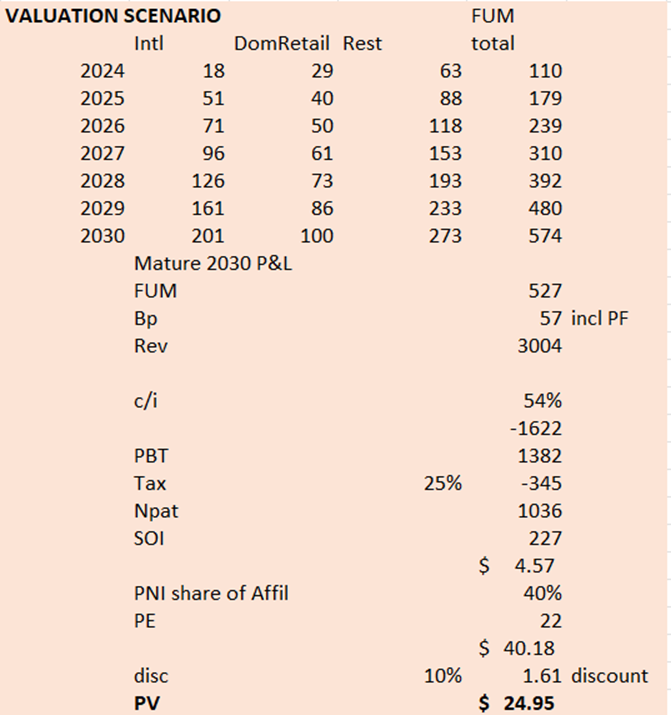

FUM grew from $110B to $179B, growth comprised of $28B acquired, MTM and performance 18B and net flows $23B or 21% in net flows, above my numbers good result. The surprise did not come in retail or international flows which were expected to be good and will likely continue to be strong but in the rest which is domestic insto Australia. That segment dominated by the very competitive public, Insto equities saw large growth started to see the movement in other asset classes and private markets. that could produce another growth leg for PNI. Private markets are now 16% of total FUM and growing strongly.

PNI claim that they aim to be “more relevant to more clients, in more countries, more often” and the strategy is aligning with that desire. The business continues to evolve with consciously increasing exposure to higher margin and higher growth areas while wanting more FUM exposed to PF’s.

International saw outstanding growth and the company brought in new managers with big expectations for global equity manager Life Cycle who increased FUM $16B as the firm reestablished itself under PNI colours.

There have been significant expansions of capabilities in Coolabah (FI) and Metrics (asset based lending) with Metrics developing and expanding origination capabilities and is expected to grow into the huge private credits and other ABL markets. An internal origination capability is expected to give Metrics an competitive edge, allows control of pipeline versus buying through brokers.

The PNI story is coming together better than expected with the firm expanding into growth areas, focus on PF and fees, while strategies that aren’t working as well become insignificant to the total story.

The accounting is complex due to FV accounting, that PNI hold equity (40% average) int eh operating businesses, while the actual 100% owned is largely marketing. Although the accounting is complex the business fundamentals are not, add FUM at good rates and keep you costs under control.

Investing in market sensitive companies can be volatile. My strategy is to pick the winners, that will grow significantly over time and wait for market dislocations to add. That occurred in April when the position was added to. If the SP becomes too frothy I will let some go. No hurry to buy or sell. Basically the same game plan for HUB and MQG. I monitor total market sensitive exposure in the portfolio.

The main risks are a long bear market where FUM growth becomes much more difficult or if one of the major affiliates gets into trouble due to performance or a manner of other things. PNI continues to diversify this risk over time.